Professional Documents

Culture Documents

S.No Particulars Old Machine Rs New Machine Rs

Uploaded by

narunsankar0 ratings0% found this document useful (0 votes)

27 views2 pageswcm

Original Title

ABC Ltd

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentwcm

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views2 pagesS.No Particulars Old Machine Rs New Machine Rs

Uploaded by

narunsankarwcm

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

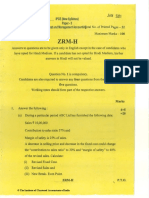

MARIAN INTERNATIONAL INSTITUTE OF MANAGEMENT

FINANCIAL MANAGEMENT –Batch:”B”

SEMESTER II/INTERNAL TEST II

Marks: 2x10=20 Batch 2017-2019 Time: 1hour

Answer Any Two Questions

1. Iswarya ltd has a machine which has been in operation for six years. The management is

considering a proposal to purchase an improved model of a similar machine which gives an

increased output. Give your opinion as Manager in regard to the proposal from the following

data:

S.No Particulars Old Machine New Machine

Rs Rs

1 Purchase price of machine 60,000 1,20,000

2 Expenditure per annum on a/c of :

(a) Power Consumption 7,000 8,000

(b)Consumable stores 4,000 5,000

(c)Repairs and Maintenance 5,000 4,000

3 Labour cost per running hour 2 2.25

4 Units of output, 40 60

per machine hour

5 Machine running hours per annum 2000 2000

6 Material cost per unit 40 paisa 40 paisa

7 Selling price of output per unit Rs.1 Rs.1

8 Estimated life in years 10 10

To Determine the Accounting Rate of Return as well as Average Rate of Return.

2. Iswarya company is planning to purchase a machine which has the following cash flows:

Year 1(CFAT) Probability Year2(CFAT) Probability

Rs.9,00,000 0.5 Rs.9,00,000 0.5

Rs.15,00,000 0.5

Rs.18,00,000 0.6

Rs.13,00,000 0.5 Rs.15,00,000 0.4

The machine costs Rs.12, 00,000 with an estimated life of 2 years. The cost of capital of the firm

is 12%.make your recommendation through the Decision Tree method.

3. Outline the financial management technique of capital investment in fixed assets.

4. What are the steps in the capital budgeting process of a firm explain?

You might also like

- Workbook Group TheoryDocument62 pagesWorkbook Group TheoryLi NguyenNo ratings yet

- WarringFleets Complete PDFDocument26 pagesWarringFleets Complete PDFlingshu8100% (1)

- DeliciousDoughnuts Eguide PDFDocument35 pagesDeliciousDoughnuts Eguide PDFSofi Cherny83% (6)

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Quarter 1 - Module 1Document31 pagesQuarter 1 - Module 1Roger Santos Peña75% (4)

- Strategic Cost ManagementDocument54 pagesStrategic Cost ManagementnarunsankarNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Tea IndustryDocument100 pagesTea IndustrynarunsankarNo ratings yet

- 2 Break-Even Analysis - AssignmentDocument2 pages2 Break-Even Analysis - AssignmentNamanNo ratings yet

- Cost ManagementDocument7 pagesCost ManagementSakshi VermaNo ratings yet

- Synthesis, Analysis and Simulation of A Four-Bar Mechanism Using Matlab ProgrammingDocument12 pagesSynthesis, Analysis and Simulation of A Four-Bar Mechanism Using Matlab ProgrammingPedroAugustoNo ratings yet

- Cash Management 11012018Document41 pagesCash Management 11012018narunsankarNo ratings yet

- Impact of Pantawid Pamilyang Pilipino Program On EducationDocument10 pagesImpact of Pantawid Pamilyang Pilipino Program On EducationEllyssa Erika MabayagNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Design of Penstock: Reference Code:IS 11639 (Part 2)Document4 pagesDesign of Penstock: Reference Code:IS 11639 (Part 2)sunchitk100% (3)

- ARM - CMA Mock March 2024 With SolutionDocument17 pagesARM - CMA Mock March 2024 With SolutionTooba MaqboolNo ratings yet

- CA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesDocument17 pagesCA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesAyush ThÃkkarNo ratings yet

- FM TestDocument5 pagesFM TestSamir JainNo ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument3 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- Cost Sheet: Particulars Job 101 Job 102Document12 pagesCost Sheet: Particulars Job 101 Job 102vishal soniNo ratings yet

- Perunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiDocument4 pagesPerunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiAlbert JulieNo ratings yet

- Cost and Management Accounting Mid Term Exam: Date: 2 Total Marks: 100 Marks Instructio NsDocument4 pagesCost and Management Accounting Mid Term Exam: Date: 2 Total Marks: 100 Marks Instructio NsmaryNo ratings yet

- Cost and Management Accounting Mid Term Exam: July, 2020 Time Allowed: 3 Hours & 15 MinutesDocument10 pagesCost and Management Accounting Mid Term Exam: July, 2020 Time Allowed: 3 Hours & 15 MinutesmaryNo ratings yet

- 3 Decision MakingDocument6 pages3 Decision MakingAnushka DharangaonkarNo ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- Cost Sheet - Pages 16Document16 pagesCost Sheet - Pages 16omikron omNo ratings yet

- BBA-VI 562 Subjective Dec 2016Document2 pagesBBA-VI 562 Subjective Dec 2016Saif ali KhanNo ratings yet

- 820001-Cost and Management AccountingDocument4 pages820001-Cost and Management AccountingsuchjazzNo ratings yet

- CH 3 - ProblemsDocument7 pagesCH 3 - ProblemsEspace NuvemNo ratings yet

- Unit IVDocument14 pagesUnit IVkuselvNo ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingKhushi RaniNo ratings yet

- 4 2 Sma 2018Document5 pages4 2 Sma 2018Nawoda SamarasingheNo ratings yet

- Test Series: October, 2018 Mock Test Paper - 2 Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingDocument8 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingAnkitaNo ratings yet

- GIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyDocument36 pagesGIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyShehrozSTNo ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Mid Term (March 2023)Document6 pagesMid Term (March 2023)Nadir IshaqNo ratings yet

- DM Various SceneriousDocument15 pagesDM Various SceneriousSyed FaizanNo ratings yet

- Managerial Accounting (Acct 321) 3rd Trimester 2016Document5 pagesManagerial Accounting (Acct 321) 3rd Trimester 2016Nodeh Deh SpartaNo ratings yet

- Significance in Planning A Firm? (5x6 Marks 30 Marks)Document3 pagesSignificance in Planning A Firm? (5x6 Marks 30 Marks)N ArunsankarNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- 3) CostingDocument19 pages3) CostingKrushna MateNo ratings yet

- 51624bos41275inter QDocument5 pages51624bos41275inter QvarunNo ratings yet

- Capital Expenditure DecisionsDocument2 pagesCapital Expenditure DecisionsSundarNo ratings yet

- Final Advanced Management AccountingDocument11 pagesFinal Advanced Management AccountingSon DonNo ratings yet

- BSC (Hons) Banking and International Finance Cohort: Bbif/07/Pt - Year 2 Examinations For 2008 - 2009 / Semester IiDocument10 pagesBSC (Hons) Banking and International Finance Cohort: Bbif/07/Pt - Year 2 Examinations For 2008 - 2009 / Semester IiMuse ManiaNo ratings yet

- MS 4Document3 pagesMS 4jaskiranNo ratings yet

- Winter Exam-2012: Management AccountingDocument4 pagesWinter Exam-2012: Management AccountingSamina IrshadNo ratings yet

- Caf-03 Cma Artt Mock QP With SolDocument16 pagesCaf-03 Cma Artt Mock QP With Solkulhaq29No ratings yet

- (Ext.) 2013 PatternDocument111 pages(Ext.) 2013 PatternThe HinduNo ratings yet

- 1122 Assignment Fin301Document6 pages1122 Assignment Fin301carazamanNo ratings yet

- MC1Document3 pagesMC1deepalish88No ratings yet

- Cost Accounting and Financial Management: All Questions Are CompulsoryDocument4 pagesCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNo ratings yet

- MA Test 1Document2 pagesMA Test 1test twotestNo ratings yet

- Paper - 5: Advanced Management Accounting QuestionsDocument38 pagesPaper - 5: Advanced Management Accounting Questionsshubham singhNo ratings yet

- Overheads & ABC - Questions Test 1Document4 pagesOverheads & ABC - Questions Test 1jj4223062003No ratings yet

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaDocument14 pagesChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatNo ratings yet

- Ma&FADocument40 pagesMa&FAmadhu_bhowmickNo ratings yet

- Costing FM Mock Test May 2019Document20 pagesCosting FM Mock Test May 2019Roshinisai VuppalaNo ratings yet

- 54543bos43717ipcc p3q PDFDocument6 pages54543bos43717ipcc p3q PDFPuneet VyasNo ratings yet

- A-3 Capital BudgetingDocument4 pagesA-3 Capital BudgetingUTkarsh DOgraNo ratings yet

- MA End TermDocument11 pagesMA End TermShashank AgarwalaNo ratings yet

- CostingDocument494 pagesCostingbagi alekhyaNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument33 pagesPaper - 3: Cost and Management Accounting Questions Material CostEFRETNo ratings yet

- Problem-42: RequiredDocument7 pagesProblem-42: RequiredRADHIKA V HNo ratings yet

- Standard Costing Ex QuestionsDocument20 pagesStandard Costing Ex QuestionsKaruna ChakinalaNo ratings yet

- Tea WorkerDocument55 pagesTea WorkernarunsankarNo ratings yet

- Case Study Goli - Making of A Crorepati by Selling Vada PavDocument9 pagesCase Study Goli - Making of A Crorepati by Selling Vada PavnarunsankarNo ratings yet

- S.N o Name of The Company Industry Area/Domain Campus/Off CampusDocument2 pagesS.N o Name of The Company Industry Area/Domain Campus/Off CampusnarunsankarNo ratings yet

- Lock Box SystemsDocument2 pagesLock Box SystemsnarunsankarNo ratings yet

- Marian International Institute of Management Working Capital Management UNIT TEST IV (2x10 20)Document1 pageMarian International Institute of Management Working Capital Management UNIT TEST IV (2x10 20)narunsankarNo ratings yet

- Example - From The Following Forecasts of Income and Expenditure, Prepare A Cash Budget For The Months Jan. To April 2011Document1 pageExample - From The Following Forecasts of Income and Expenditure, Prepare A Cash Budget For The Months Jan. To April 2011narunsankarNo ratings yet

- Capacity Building For Sustainable Rural Communities To Be SubmittedDocument13 pagesCapacity Building For Sustainable Rural Communities To Be SubmittednarunsankarNo ratings yet

- Objectives of Financial ManagementDocument23 pagesObjectives of Financial ManagementnarunsankarNo ratings yet

- Clearing and Settlement: Financial DerivativesDocument28 pagesClearing and Settlement: Financial DerivativesnarunsankarNo ratings yet

- Activity-Based Costing (ABC) Is A Costing Methodology ThatDocument14 pagesActivity-Based Costing (ABC) Is A Costing Methodology ThatnarunsankarNo ratings yet

- Present Value: The Present Value of A Single Cash Flow Can Be Written As FollowsDocument4 pagesPresent Value: The Present Value of A Single Cash Flow Can Be Written As FollowsnarunsankarNo ratings yet

- Management Accounting and Control SystemsDocument6 pagesManagement Accounting and Control SystemsnarunsankarNo ratings yet

- Cisco BGP ASPATH FilterDocument115 pagesCisco BGP ASPATH FilterHalison SantosNo ratings yet

- Nadee 3Document1 pageNadee 3api-595436597No ratings yet

- Pidsdps 2106Document174 pagesPidsdps 2106Steven Claude TanangunanNo ratings yet

- How To Block HTTP DDoS Attack With Cisco ASA FirewallDocument4 pagesHow To Block HTTP DDoS Attack With Cisco ASA Firewallabdel taibNo ratings yet

- Caspar Hirschi - The Origins of Nationalism - An Alternative History From Ancient Rome To Early Modern Germany-Cambridge University Press (2012)Document255 pagesCaspar Hirschi - The Origins of Nationalism - An Alternative History From Ancient Rome To Early Modern Germany-Cambridge University Press (2012)Roc SolàNo ratings yet

- SweetenersDocument23 pagesSweetenersNur AfifahNo ratings yet

- Government College of Nursing Jodhpur: Practice Teaching On-Probability Sampling TechniqueDocument11 pagesGovernment College of Nursing Jodhpur: Practice Teaching On-Probability Sampling TechniquepriyankaNo ratings yet

- Algoritm BackTracking EnglezaDocument6 pagesAlgoritm BackTracking Englezaionutz_67No ratings yet

- Gas Dynamics and Jet Propulsion 2marksDocument15 pagesGas Dynamics and Jet Propulsion 2marksAbdul rahumanNo ratings yet

- What's New in CAESAR II: Piping and Equipment CodesDocument1 pageWhat's New in CAESAR II: Piping and Equipment CodeslnacerNo ratings yet

- (Jones) GoodwinDocument164 pages(Jones) Goodwinmount2011No ratings yet

- World Insurance Report 2017Document36 pagesWorld Insurance Report 2017deolah06No ratings yet

- Miguel Augusto Ixpec-Chitay, A097 535 400 (BIA Sept. 16, 2013)Document22 pagesMiguel Augusto Ixpec-Chitay, A097 535 400 (BIA Sept. 16, 2013)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Out PDFDocument211 pagesOut PDFAbraham RojasNo ratings yet

- Pathology of LiverDocument15 pagesPathology of Liverערין גבאריןNo ratings yet

- ML Ass 2Document6 pagesML Ass 2Santhosh Kumar PNo ratings yet

- Tutorial 5 SolvedDocument3 pagesTutorial 5 SolvedAshutoshKumarNo ratings yet

- Durex 'S Marketing Strategy in VietnamDocument45 pagesDurex 'S Marketing Strategy in VietnamPham Nguyen KhoiNo ratings yet

- Eggermont 2019 ABRDocument15 pagesEggermont 2019 ABRSujeet PathakNo ratings yet

- Julia Dito ResumeDocument3 pagesJulia Dito Resumeapi-253713289No ratings yet

- AMULDocument11 pagesAMULkeshav956No ratings yet

- PDF Chapter 5 The Expenditure Cycle Part I Summary - CompressDocument5 pagesPDF Chapter 5 The Expenditure Cycle Part I Summary - CompressCassiopeia Cashmere GodheidNo ratings yet

- Listen and Arrange The Sentences Based On What You Have Heard!Document3 pagesListen and Arrange The Sentences Based On What You Have Heard!Dewi Hauri Naura HaufanhazzaNo ratings yet