Professional Documents

Culture Documents

Form 13 PDF

Uploaded by

Asmatullah KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 13 PDF

Uploaded by

Asmatullah KhanCopyright:

Available Formats

INCOME-TAX RULES, 1962

Form No.13

[See rules 28 and 37G]

Application by a person for a certificate under sections 197

and/or 206C(9) of the Income-tax Act, 1961, for no

*deduction/collection of tax or *deduction/

collection of tax at a lower rate

To

The Assessing Officer,

1.*I, ……………..of……………… do, hereby, request that a ce rtificate m ay be issued to the

person responsible for paying to me the incomes/sum by way of salary/interest on securities/interest

other than "interest on securi ties"/insurance commission/comm ission (not being insurance

commission) or brokerage/comm ission, etc., on the sale of lottery ti ckets/fees for professional or

technical services/any sum by way of paym ent to contractors and sub-

contractors/dividends/rent/income in respec t of units/sum by way of payment of compensation on

acquisition of immovable p roperty (strike out whiche ver is not applic able) authorising him not to

deduct income-tax at the time of payment to me of such income/sum. The particulars of my income

and other details are as per para 2.

and/or

*I, …………………of …………………do, hereby, request that a certificate m ay be issued to m e

for receiving the incomes/sum by way of salary/interest on securities/interest other than "interest on

securities"/insurance comm ission/commission (not being insurance comm ission) or

brokerage/commission, etc., on the sale of lottery tickets/fees for profe ssional or technical

services/any sum by way of paym ent to contractors and sub-contr actors/dividends/rent/income in

respect of units/sum by way of paym ent of co mpensation on acquisition of i mmovable property

(strike out whichever is not a pplicable) after deduction of inco me-tax at the rate of………….. per

cent. The particulars of my income and other details are as per para 2.

and/or

*I, of do, hereby, request th at a certificate m ay be issued to th e seller, being the person responsible

for collecting the tax from m e in respect of the amount payable by m e as the buyer of [specify the

nature of goods referred to in th e T able in sub-section (1) of section 206C] /lessee or licensee of

[specify the natu re of contract o r licence o r leas e r eferred to in the Ta ble in sub -section (1C) of

section 206C] (Strike out whichever is not applicable) auth orizing him to collec t income-tax at the

rate of per cent at the time of debit of such amount to my account or receipt thereof from me, as the

case may be. The particulars of my income and other details are as per para 2.

2. The particulars of my income and other details are as under :

(i) Status

(State whether individual, Hindu undivided family,

firm, body of individuals, Company, etc.)

(ii) Residential status

Printed from www.incometaxindia.gov.in Page 1 of 8

(Whether resident / resident but not ordinarily resident/

non-resident)

(iii) Permanent Account No. (PAN)

(iv) Tax Deduction and Collection Account No. (TAN)

(v) Details of returns/statements which have become due but have not been filed :

Section under which Assessment Due date for filing Reason for not filing

return/statement has year/ quarter

become due

(1) (2) (3) (4)

Section 139

Section 200

Section 206C

(vi) Details of returned income/ assessed income for the last three assessment years:

(enclose copies of returns of incom e f iled alongwith their enclos ures and copies of

assessment orders, if assessed, for the last three assessment years.)

Assessment Total inco me as Total income as Total tax including Total tax including

year per retu rn of per latest interest payable on interest payable on

income assessment returned income assessed income

(1) (2) (3) (4) (5)

(vii) Details of tax payment for the last three assessment years:

Assessment Total Tax paid Credit Credit Tax paid Tax paid in

year payment by way of claimed for claimed for by way of response to

of tax Advance tax tax collection self notice of

including tax deduction at source assessment demand

interest at source tax under

section 156

(1) (2) (3) (4) (5) (6) (7)

(viii) Details of sales, profit, etc. for the last three previous years in the case of assessee whose

income include incom e under the head "Pro fits and gains of business or profession":

Printed from www.incometaxindia.gov.in Page 2 of 8

(enclose copies of prof it and loss account and balance sheet along w ith audit report, if

audited, for the last three previous years)

Previous Gross sales, Gross profit Net profit

year turnover

receipt of In rupees In percentage to In rupees In percentage to

business or amount stated in amount stated in

profession column (1) column (1)

(1) (2) (3) (4) (5) (6)

(ix) Details of existing liability under Income-tax Act, 1961 and Wealth-tax Act, 1957:

Liability under the Income-tax Act, 1961

Amount Amount Amount for Amount Amount

Assessment payable in payable for which notice of payable as payable

Year/ period respect of self- demand under deductor or under the

advance-tax assessment section 156 has collector which Wealth-tax

tax been served but had become due Act, 1957

not paid but not paid

(1) (2) (3) (4) (5) (6)

(x) Assessment year to which the payments relate

(xi) Estimated total income of the previous year relevant to the assessment year referred to

in(x) above (give detailed computation and basis thereof)

(xii) Total tax including interest payable on the income at (xi)

(xiii) How the liability mentioned in col. (ix) and col. (xii) is proposed to be discharged?

(xiv) Details of paym ent of advance-tax an d tax already deducted/collected for the

assessment year relevant to the current previous year till date.

Nature of prepaid tax Date of payment/deduction/collection

Advance tax

TDS

TCS

(xv) Details of income claimed to be exempt and not included in the total income in col.

(xi) (Please append a note giving reason for claiming such exemption).

(xvi) Please furnish the particulars in Annexure- I in respect of no deduction of tax under

section 197 where it is requested that certifi cate is to be issued under sub-rule (4) of

rule 28AA; or in Annexure –I-A in respect of deduction of tax at a lower rate under

section 197 where it is requested that the certificate is to be issued under sub-rule (6) of

rule 28AAand/or in Annexure-II for collection of tax at lower rate under section 206C(9) of the

Income-tax Act, as the case may be.

*I, _____________ the trustee/co-trustee of ________________ do hereby declare that the

securities/sums/shares, particulars of which are given in the Annexure, are properly held under trust

Printed from www.incometaxindia.gov.in Page 3 of 8

wholly for charitable or religi ous purposes and that th e income therefrom qualifies for exem ption

under sections 11 and 13 of the Income-tax Act, 1961.

*I declare that th e secu rities/sums/shares, p articulars of which are given in the Schedules above,

stand in my name and are beneficially owned by m e, and the incom e therefrom is not includ ible in

the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961.

I further declare that what is stated in this application is correct.

Date ………….. ……………………………………

Signature

Place ………….

……………………………………..

……………………………………..

Address

*Strike out whichever is not applicable.

ANNEXURE I

[For the purpose of tax deduction at source]

Please furnish the particulars in th e Schedules be low in respect of th e paym ents f or which the

certificate is sought, —

SCHEDULE I

Description Number of Date of Amount of Estimated amount of

of securities securities securities interest to be received

securities

(1) (2) (3) (4) (5)

SCHEDULE II

Sl. Name and Amount of The date Period for which Rate of Estimated amount

No. address of the such sums on which such sums were interest ofinterest to

person to such sums given on Interest be received

whom thesum s were given

are given on

on Interest interest

(1) (2) (3) (4) (5) (6) (7)

SCHEDULE III

Sl. Name and address of person Estimated amount of insurance commission

No responsible for paying insurance

Printed from www.incometaxindia.gov.in Page 4 of 8

commission

(1) (2) (3)

SCHEDULE IV

Sl. Name and No. Class of Total Distinctive Estimated amount

No. address of the of shares shares and face value numbers of dividend to be

company face value of of shares received

of each shares

share

(1) (2) (3) (4) (5) (6) (7)

SCHEDULE V

Sl Name and Period of Amount Income Income from Estimated total

No. address of the employment of from sources other income

employer salary house than sa lary

received property and

income from

house

property

(1) (2) (3) (4) (5) (6) (7)

SCHEDULE VI

Sl. Name and address of person responsible for Estimated amount of rent to be

No. paying rent received

(1) (2) (3)

SCHEDULE VII

Sl. Name and No. of Classes of Total face Distinctive Estimated amount

Printed from www.incometaxindia.gov.in Page 5 of 8

No. address of the units units value of numbers of income to be

mutual fund and face units of units received

value of

each unit

(1) (2) (3) (4) (5) (6) (7)

SCHEDULE VIII

Sl. Name and address of person responsible for Estimated amount of comm ission (not

No. paying commission (not being insurance being insurance comm ission referred to

commission referred to in section194D) or in section194D) or brokerage to be

brokerage. received

(1) (2) (3)

SCHEDULE IX

Sl. Full nam e and Date of Nature of Date by which Sums expected to be

No. address of the the the contract work on the credited / paid in

authority/person contract contract would pursuance of the contract

with whom the be completed during the current

contract previous year and each of

was made the three immediately

succeeding years

(1) (2) (3) (4) (5) (6)

SCHEDULE X

Sl. Name and address of person(s) responsible Estimated amount

No. for payingcomm ission, rem uneration or of commission/remuneration/prize to be

prize (by w hatever name called)on the sale received(strike out whichever is not

of lottery tickets applicable)

(1) (2) (3)

Printed from www.incometaxindia.gov.in Page 6 of 8

SCHEDULE XI

Sl. Name and address of person(s) Estimated amount of fees for

No. responsible forpaying fees for professional/technicalservices to be received

professional/technical services (strike out whichever is notapplicable)

(1) (2) (3)

SCHEDULE XII

Sl. Name and address of person responsible for Estimated amount of com pensation

No. paying compensation or enhanced compensation or the enhanced compensation

or the consideration or enhanced consideration or consideration or the enhanced

on account of compulsory acquisition of consideration

immovable property

(1) (2) (3)

………………………..

(Signature)

Date……………

………………………..

Place ………………. ………………………..

………………………..

(Address)

ANNEXURE I-A

[For the purpose of tax deduction at source]

Please furnish the particulars in th e Schedule below in respect of the paym ents for which th e

certificate is sought, —

SCHEDULE

Sl. No. Nature of payment Estimated amount of incomes/sum to be received

(1) (2) (3)

………………………..

(Signature)

Date……………

………………………..

Place ………………. ………………………..

………………………..

(Address)

Printed from www.incometaxindia.gov.in Page 7 of 8

ANNEXURE II

[For the purpose of tax collection at source]

Please furnish particulars of the am ounts payable in respect of whic h the certificate is sought in the

schedules below:-

SCHEDULE I

Sl.No. Full name and Date of sale Nature and Amounts expected to be

address of the seller with reference description of debited/ paid in pursuance

number of the goods sold of the sale during the

such sale and details current financial year and

of sale each of the three

immediately succeeding

years

(1) (2) (3) (4) (5)

SCHEDULE II

Sl. Full name and Date of grant of Nature of contract Amounts expected to be

No. address of the leaseor licence orlicence or lease debited/ paid in pursuance

person granting or contractor anddescription of the contract during the

lease or licence transfer of right and details ofthe current financial year and

with reference contract each of the three

number immediately succeeding

years

(1) (2) (3) (4) (5)

Date …………

…………………………………

Signature of the buyer

Full Name……………………...

Designation ………………….

Printed from www.incometaxindia.gov.in Page 8 of 8

You might also like

- Unit 4 - Java Basics & Usage of Classes, Objects & InheritanceDocument149 pagesUnit 4 - Java Basics & Usage of Classes, Objects & InheritanceAsmatullah KhanNo ratings yet

- Java I/O Streams and Applets GuideDocument52 pagesJava I/O Streams and Applets GuideAsmatullah KhanNo ratings yet

- Unit 1 - Understand The Principles of Web DesigningDocument263 pagesUnit 1 - Understand The Principles of Web DesigningAsmatullah KhanNo ratings yet

- Unit 9 - Understand Java Servlets and JDBCDocument33 pagesUnit 9 - Understand Java Servlets and JDBCAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 04 - Data Models - Relational ModelDocument4 pagesUnit 1 Understanding Database System - Part 04 - Data Models - Relational ModelAsmatullah KhanNo ratings yet

- Introduction To RDBMS - Unit 1 TopicsDocument8 pagesIntroduction To RDBMS - Unit 1 TopicsAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 08 - Data Model - Design ApproachDocument6 pagesUnit 1 Understanding Database System - Part 08 - Data Model - Design ApproachAsmatullah KhanNo ratings yet

- Unit 3 - Internet Technologies and Java ProgrammingDocument47 pagesUnit 3 - Internet Technologies and Java ProgrammingAsmatullah KhanNo ratings yet

- AWT and Event Handling in JavaDocument60 pagesAWT and Event Handling in JavaAsmatullah KhanNo ratings yet

- Unit 4:understand PL / SQL: By, Asmatullah Khan, CL/CP, Gioe, SecunderabadDocument93 pagesUnit 4:understand PL / SQL: By, Asmatullah Khan, CL/CP, Gioe, SecunderabadAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 03 - Data Models - ER ModelDocument6 pagesUnit 1 Understanding Database System - Part 03 - Data Models - ER ModelAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 10 - DB Users - ArchitectureDocument6 pagesUnit 1 Understanding Database System - Part 10 - DB Users - ArchitectureAsmatullah KhanNo ratings yet

- Unit 5 Understand Advanced PL SQLDocument27 pagesUnit 5 Understand Advanced PL SQLAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 07 - Data Model - Object Relational Model and Semi Structured ModelDocument5 pagesUnit 1 Understanding Database System - Part 07 - Data Model - Object Relational Model and Semi Structured ModelAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 05 - Data Models - Relational Model LanguagesDocument6 pagesUnit 1 Understanding Database System - Part 05 - Data Models - Relational Model LanguagesAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 06 - Data Models - Relational Model - SQL QueryDocument6 pagesUnit 1 Understanding Database System - Part 06 - Data Models - Relational Model - SQL QueryAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 01 - Database System and Its AdvantagesDocument6 pagesUnit 1 Understanding Database System - Part 01 - Database System and Its AdvantagesAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 09 - Database Manager or EngineDocument8 pagesUnit 1 Understanding Database System - Part 09 - Database Manager or EngineAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 02 - Data Abstraction Instances and SchemasDocument5 pagesUnit 1 Understanding Database System - Part 02 - Data Abstraction Instances and SchemasAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 18 - E. F. Codd Rules For RDBMSDocument9 pagesUnit 1 Understanding Database System - Part 18 - E. F. Codd Rules For RDBMSAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 14 - Reducing ER Diagrams To Tables - Multivalue Attributs - Class HeirarchyDocument10 pagesUnit 1 Understanding Database System - Part 14 - Reducing ER Diagrams To Tables - Multivalue Attributs - Class HeirarchyAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 16 - Normalization - 2 NF - 3 NFDocument10 pagesUnit 1 Understanding Database System - Part 16 - Normalization - 2 NF - 3 NFAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 13 - Reducing ER Diagrams To Tables - Relationship SetDocument12 pagesUnit 1 Understanding Database System - Part 13 - Reducing ER Diagrams To Tables - Relationship SetAsmatullah KhanNo ratings yet

- DBMS Concepts and Normalization FormsDocument12 pagesDBMS Concepts and Normalization FormsAsmatullah KhanNo ratings yet

- Parallel Programming Using MPI: David Porter & Mark NelsonDocument81 pagesParallel Programming Using MPI: David Porter & Mark NelsonAsmatullah KhanNo ratings yet

- Telangana Technical Education Department Document on Relational Database Management SystemsDocument15 pagesTelangana Technical Education Department Document on Relational Database Management SystemsAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 15 - Normalization - 1 NF and Functional DependencyDocument12 pagesUnit 1 Understanding Database System - Part 15 - Normalization - 1 NF and Functional DependencyAsmatullah KhanNo ratings yet

- Unit 1 Understanding Database System - Part 12 - Reducing ER Diagrams To Tables - Entity SetDocument9 pagesUnit 1 Understanding Database System - Part 12 - Reducing ER Diagrams To Tables - Entity SetAsmatullah KhanNo ratings yet

- Introduction To Parallel ProgrammingDocument46 pagesIntroduction To Parallel ProgrammingAsmatullah KhanNo ratings yet

- Parallel Programming Using MPI: David Porter & Mark NelsonDocument81 pagesParallel Programming Using MPI: David Porter & Mark NelsonAsmatullah KhanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ordinance Covered CourtDocument4 pagesOrdinance Covered CourtBarangay Onse Malaybalay100% (6)

- Structured Programming Approach NotesDocument278 pagesStructured Programming Approach NotesJohn Downey Jr.100% (2)

- MFM Assignment 2Document14 pagesMFM Assignment 2Satadeep DattaNo ratings yet

- Interpreting Words and Phrases in StatutesDocument24 pagesInterpreting Words and Phrases in StatutesPaul Arman MurilloNo ratings yet

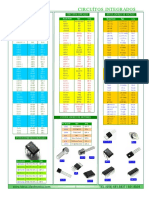

- Circuítos Integrados: Reguladores de Voltaje: Amplificadores Operacionales: Circuitos LinealesDocument4 pagesCircuítos Integrados: Reguladores de Voltaje: Amplificadores Operacionales: Circuitos LinealesAlejandro BalladaresNo ratings yet

- Curriculum Map in Tle 7Document17 pagesCurriculum Map in Tle 7MikkoNo ratings yet

- AEP Contract v1Document3 pagesAEP Contract v1Rafly AndrianzaNo ratings yet

- EquinoxZ2 FirmwareUpdate Instructions 022321 WebDocument4 pagesEquinoxZ2 FirmwareUpdate Instructions 022321 WebNowy NowyNo ratings yet

- InBev's Acquisition of Anheuser - BuschDocument11 pagesInBev's Acquisition of Anheuser - BuschЛюся БогачукNo ratings yet

- Make Homemade Soda in SecondsDocument32 pagesMake Homemade Soda in SecondsalizzeadNo ratings yet

- OppositionDocument2 pagesOppositionbrancronNo ratings yet

- ResumeprdesignDocument1 pageResumeprdesignapi-279371261No ratings yet

- Ap4498 Flight 2nd Stage Maint ManxDocument20 pagesAp4498 Flight 2nd Stage Maint ManxdaviddealbaNo ratings yet

- FANUC-16,18-C Operation & Maintenance HandbookDocument456 pagesFANUC-16,18-C Operation & Maintenance HandbookPeter Skiadaresis100% (2)

- Quiz 8 Six Standard Phases of A Construction ProjectDocument2 pagesQuiz 8 Six Standard Phases of A Construction ProjectJomarie AlcanoNo ratings yet

- Tips Industries LTD V. Wynk Music LTD (Airtel) An Analysis of The Position of Online Music Streaming and Digital DownloadsDocument6 pagesTips Industries LTD V. Wynk Music LTD (Airtel) An Analysis of The Position of Online Music Streaming and Digital DownloadsNishantNo ratings yet

- Temperature Gauge Calibration ReportDocument2 pagesTemperature Gauge Calibration Reportansar aliNo ratings yet

- 132 KVDocument32 pages132 KVWan Zamani Wan AbdullahNo ratings yet

- Energy Saving Reader DatasheetDocument2 pagesEnergy Saving Reader Datasheetarechor1605No ratings yet

- Five Key Strategies of Formative AssessmentDocument1 pageFive Key Strategies of Formative Assessmentapi-349574245No ratings yet

- KGW's Motion For Summary JudgementDocument15 pagesKGW's Motion For Summary JudgementKGW NewsNo ratings yet

- Chapter 12Document7 pagesChapter 12Xynith Nicole RamosNo ratings yet

- Pentagon Channel FTPDocument2 pagesPentagon Channel FTPHazaed AsrofNo ratings yet

- Nollet 2015 - Handbook of Food Analysis PDFDocument1,531 pagesNollet 2015 - Handbook of Food Analysis PDFემილი ონოფრე100% (3)

- AssignmentDocument3 pagesAssignmentSoyeb MohammedNo ratings yet

- Boiler Performance Test CalcDocument53 pagesBoiler Performance Test CalcdgmprabhakarNo ratings yet

- UTSA 15-17 GraduateCatalogDocument336 pagesUTSA 15-17 GraduateCatalogSandeep AyyagariNo ratings yet

- Defense Mechanism Against Hostile TakeoversDocument7 pagesDefense Mechanism Against Hostile Takeoversyoungarien100% (1)

- Kinetika Kimia: Bambang WidionoDocument77 pagesKinetika Kimia: Bambang WidionoFardaawNo ratings yet

- TERRAZO - Specifications and Design GuideDocument50 pagesTERRAZO - Specifications and Design GuidejuanNo ratings yet