Professional Documents

Culture Documents

Schedule 1 Price Schedule PDF

Uploaded by

vishnumdu22Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule 1 Price Schedule PDF

Uploaded by

vishnumdu22Copyright:

Available Formats

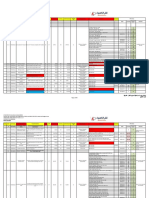

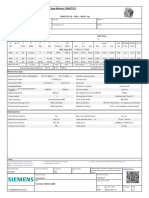

220KV D/C SHAPAR - BABARA LINE- 70.200 KM WITH AL-59 (61/3.

50) CONDUCTOR

Schedule No. 1 - Plant and Mandatory Spare Parts Supplied from Abroad

Item Description Country of HSN Code for Quantity Unit of Unit Price Total Price Custom Duty Taxes & Duties

Origin identification Measurement (Excluding

only GST)

Foreign CIF Foreign Local Local Currency

Curreny Curreny Currency

1 2 3 4 5 6 7 8=5 x7 9 10

1 Tower materials

a) Steel part(MS) 1570 MT

b) Bolt nuts 49 MT

2 AL-59 (61/3.50 mm) conductor 424 KM

3 Silicone Rubber insulators

a) 220KV,90kN-Suspension 1137 Nos.

b) 220KV,120kN- Tension 1134 Nos.

4 Insulator hardware for AL-59 conductor

a) Single suspension 1089 Nos.

b) Double suspension 18 Nos.

c) Single tension 762 Nos.

d) Double tension 180 Nos.

e) P.A rod 1080 Nos.

f) Mid span joint 311 Nos.

g) Vibration damper 4008 Nos.

h) Repair sleeve 42 Nos.

5 OPGW

a) 24 Fibre (DWSM) OPGW fibre Optic cable 70.200 KM

b) Installation Hardware set * & accessories for above OPGW i.e. all 70.200 KM

cable fittings & accessories like suspension clamps, tension

clamps, vibration dampers, earthing clamps, down lead clamps, in-

line splice enclosures etc. including; Pigtails FC-PC type )

a) Fibre Optic Approach Cable -

400 Mtrs - For 220KV S/S &

500 Mtrs - For 400KV S/S

(with installation hardware like ties/ clips / cleats, conduits, ducts,

supports, fittings, accessories etc).

(Any variation in quantities shall be absorbed by contractor)

TOTAL of Column 8 and Column 9 & 10 to be carried forward to Schedule No. 5. Grand

Summary

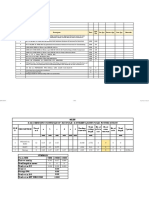

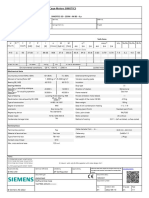

NOTE:-

(1) Separation of the Contract into Supply of Goods, Services and Civil Work, is only for convenience and better economic management and for the ease of

Accountancy but the entire Contract, is to be assessed under GST Law, as the Works Contract Service, which is, as per the provisions of Section 2(30), read with,

Section 2(119), further read with, Paragraph 6(a) of the Schedule II to the CGST Act, 2017 or SGST Act, 2017 and similar provisions, applicable under the UTGST Act,

2017and the IGST Act, 2017 and the entire activity, would be subjected to levy of Tax, at the rate of 9% CGST + 9% SGST or 18% IGST, under the GST Law. However,

Classification Codes for different segments or portions of the Works Contract, may be specified separately, in the Supplies, with a final common Classification Code

of Works Contract Service.

(2) The Bidder is hereby conveyed that only SAC Code and Tax rate for supply of Service Works Contract i.e. 18% is relevant for the purpose of contract since the

contract is works contract and any separation in the works is for better management and convenience purpose.

It is to state that bidders are however requested to fill the HSN code item by item for the knowledge and transparency purpose which shall have no bearing on price or

taxation payment.

(3) Bidder shall quote for all the items as per BoQ

(4) The currency that shall be used for bid evaluation and comparison purposes to convert all bid prices expressed in various currencies into a single currency is:

Indian Rupees

(5) The source of exchange rate shall be: Telegraphic Transfer Selling Rate of State Bank of India in India.

(6) The date for the exchange rate shall be: Opening date of Technical Bid.

Name of Bidder

Signature of Bidder

1

Specify currencies in accordance with ITB 32. Create additional columns for foreign currencies up to a maximum number of 3 foreign currencies if so required.

Country of Origin Declaration Form

Item Description Country

You might also like

- BPS Arp - Ss-01aDocument9 pagesBPS Arp - Ss-01asparkCENo ratings yet

- Red Spot Offset Bolted Tags Fuse Links: SeriesDocument12 pagesRed Spot Offset Bolted Tags Fuse Links: SeriesStephen HustingsNo ratings yet

- PURCHASE ORDER FOR 3 SUBCONTRACTORSDocument2 pagesPURCHASE ORDER FOR 3 SUBCONTRACTORSMBI TABENo ratings yet

- Assitant Engineer Executive Engineer Superintending Engineer 220KV GSS Tinwari 220KV GSS Tinwari RVPNL, JodhpurDocument3 pagesAssitant Engineer Executive Engineer Superintending Engineer 220KV GSS Tinwari 220KV GSS Tinwari RVPNL, Jodhpuraryan vyasNo ratings yet

- A) Power Transformers 1.0 Transformer 1.1 1.2Document16 pagesA) Power Transformers 1.0 Transformer 1.1 1.2Saptarshi ChatterjeeNo ratings yet

- ETABS 2016 Concrete Frame Design: ACI 318-14 Beam Section DesignDocument2 pagesETABS 2016 Concrete Frame Design: ACI 318-14 Beam Section DesignkennysawegNo ratings yet

- LT - Power - Cable Schedule For Garret Line (Danieli)Document3 pagesLT - Power - Cable Schedule For Garret Line (Danieli)zibraltan1No ratings yet

- Split Type Air Conditioner: Models Indoor Unit Outdoor UnitDocument15 pagesSplit Type Air Conditioner: Models Indoor Unit Outdoor Unitbigor2No ratings yet

- 6117 SAF Package-RevA MDocument4 pages6117 SAF Package-RevA MIbrahim Sabry RehabNo ratings yet

- Summary of Capital Cost: DWSS (Gravity Flow)Document5 pagesSummary of Capital Cost: DWSS (Gravity Flow)Mohsin ShahzadNo ratings yet

- Otdr 1Document2 pagesOtdr 1csc EXPERTISENo ratings yet

- ETABS 2016 Concrete Frame Design: ACI 318-11 Beam Section DesignDocument2 pagesETABS 2016 Concrete Frame Design: ACI 318-11 Beam Section DesignRey GonzalesNo ratings yet

- ETABS 17.0.1 Concrete Column DesignDocument2 pagesETABS 17.0.1 Concrete Column DesignRODRIGO FREDDY TICONIPA QUISPENo ratings yet

- Nantong Tiema Metal Products ISO 9001 certificateDocument6 pagesNantong Tiema Metal Products ISO 9001 certificateAsdrubal Fredy GutierrezNo ratings yet

- Annexure B BoqDocument27 pagesAnnexure B BoqHossam AlzubairyNo ratings yet

- Beam DetailsDocument2 pagesBeam DetailsBevelyn Ginhawa ManaloNo ratings yet

- Concrete Frame Design ReportDocument1 pageConcrete Frame Design ReportMin KhantNo ratings yet

- ETABS 2016 Concrete Frame Design: ETABS 2016 16.2.1 License # 18YKGXQNC843LKLDocument2 pagesETABS 2016 Concrete Frame Design: ETABS 2016 16.2.1 License # 18YKGXQNC843LKLSES DESIGNNo ratings yet

- Ce Const2 Al 59 Conductor 2011 PDFDocument3 pagesCe Const2 Al 59 Conductor 2011 PDFPRAGATHI REDDYNo ratings yet

- ETABS 2016 Concrete Frame Design: ACI 318-14 Beam Section DesignDocument2 pagesETABS 2016 Concrete Frame Design: ACI 318-14 Beam Section DesignLulu Danur MayasinNo ratings yet

- Hassa MSD Format Operational Spare For 4400003961Document40 pagesHassa MSD Format Operational Spare For 4400003961Prabhakar SvNo ratings yet

- Lift Cylinder - Staad AnalysistDocument132 pagesLift Cylinder - Staad AnalysistRiyan EsapermanaNo ratings yet

- Earthing Deatils For DumadDocument9 pagesEarthing Deatils For DumadNisith SahooNo ratings yet

- 1LE1601-1AB53-4FB4-Z F01+F11+F50+L05 Datasheet enDocument2 pages1LE1601-1AB53-4FB4-Z F01+F11+F50+L05 Datasheet enTien NguyenNo ratings yet

- BSPTCL SOR For 2018-19 Dt. 08.10.2018-FinalDocument41 pagesBSPTCL SOR For 2018-19 Dt. 08.10.2018-FinalChief Engineer TransOMNo ratings yet

- ETABS 2016 Concrete Frame Design: ACI 318-14 Beam Section DesignDocument2 pagesETABS 2016 Concrete Frame Design: ACI 318-14 Beam Section DesignkennysawegNo ratings yet

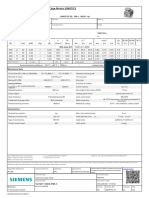

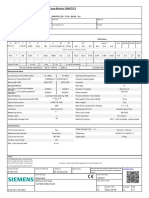

- Data Sheet For Three-Phase Squirrel-Cage-Motors SIMOTICS: Motor Type: 7CV3282B Simotics SD - 280M - Im B3 - 4 PDocument3 pagesData Sheet For Three-Phase Squirrel-Cage-Motors SIMOTICS: Motor Type: 7CV3282B Simotics SD - 280M - Im B3 - 4 Pravi kumarNo ratings yet

- Barden - 107Document1 pageBarden - 107Linh LạiNo ratings yet

- 1le1523 1eb43 4FB4Document2 pages1le1523 1eb43 4FB4pmf engineering limitedNo ratings yet

- ETABS Concrete Frame Design: ACI 318-19 Beam Section Design (Summary)Document2 pagesETABS Concrete Frame Design: ACI 318-19 Beam Section Design (Summary)dubai eyeNo ratings yet

- ColoApp JAW-WJV-0377-I-B INDOSAT 2 03CKR786Document1 pageColoApp JAW-WJV-0377-I-B INDOSAT 2 03CKR786Alhabi RezaNo ratings yet

- ETABS 2016 Concrete Frame Design: ETABS 2016 16.2.0 License # 16CFC3WZUH3FPQ6Document1 pageETABS 2016 Concrete Frame Design: ETABS 2016 16.2.0 License # 16CFC3WZUH3FPQ6CleverRamirezNo ratings yet

- MS Data Sheet TanqueDocument2 pagesMS Data Sheet TanqueLION_FIRENo ratings yet

- 1LE7501-1BB23-5AA4 Datasheet enDocument1 page1LE7501-1BB23-5AA4 Datasheet enVinit ShrivastavaNo ratings yet

- SGS 5319 (M) Q1 - R0Document6 pagesSGS 5319 (M) Q1 - R0myo lwinNo ratings yet

- 1 VB Connection 2lto HL Beam One G.PL NSFDocument32 pages1 VB Connection 2lto HL Beam One G.PL NSFWintun73No ratings yet

- Data Sheet For Three-Phase Squirrel-Cage-Motors SIMOTICS: Motor Type: 7CV3073B Simotics SD - 71M - Im B3 - 4 PDocument1 pageData Sheet For Three-Phase Squirrel-Cage-Motors SIMOTICS: Motor Type: 7CV3073B Simotics SD - 71M - Im B3 - 4 PSHYAM SHARMANo ratings yet

- 1LE7503-0CB32-3AA4 Datasheet enDocument1 page1LE7503-0CB32-3AA4 Datasheet enLuis RomeroNo ratings yet

- 01 Boq 220KV - Gis - Karanjde - Price Schedule (Consolidated)Document4 pages01 Boq 220KV - Gis - Karanjde - Price Schedule (Consolidated)Akd DeshmukhNo ratings yet

- ETABS 2016 Concrete Frame Design: ETABS 2016 16.0.3 Gilang Ramadhan Andaluna License # 1S5LLY67BDQYHLRDocument2 pagesETABS 2016 Concrete Frame Design: ETABS 2016 16.0.3 Gilang Ramadhan Andaluna License # 1S5LLY67BDQYHLRbudifreadnoNo ratings yet

- 1le1523 1eb43 4ab4Document2 pages1le1523 1eb43 4ab4pmf engineering limitedNo ratings yet

- 1LE7501-1CB23-5FA4 Datasheet enDocument1 page1LE7501-1CB23-5FA4 Datasheet enMUKESH VERMANo ratings yet

- 1LE1503-1CB21-7AB4-Z B02+D22+L22+Y82 Datasheet enDocument2 pages1LE1503-1CB21-7AB4-Z B02+D22+L22+Y82 Datasheet enMostafaElrakhawyNo ratings yet

- CDL - 33 - TECH - SPECIFICAITON Tower Erection PDFDocument22 pagesCDL - 33 - TECH - SPECIFICAITON Tower Erection PDFDony RamdhaniNo ratings yet

- ETABS 2016 steel frame design summaryDocument2 pagesETABS 2016 steel frame design summaryRaul Torres AlvarezNo ratings yet

- Data Sheet For Three-Phase Squirrel-Cage-Motors SIMOTICS: Motor Type: 7CV3252C Simotics SD - 250M - Im B3 - 6 PDocument2 pagesData Sheet For Three-Phase Squirrel-Cage-Motors SIMOTICS: Motor Type: 7CV3252C Simotics SD - 250M - Im B3 - 6 Pravi kumarNo ratings yet

- 1LE7501 0DB22 3AA4 Datasheet enDocument1 page1LE7501 0DB22 3AA4 Datasheet enDNo ratings yet

- 20.) GTP EPR High Mast Cables (5 C X 4 SQ MM & 5 C X 2.5 SQ MM)Document1 page20.) GTP EPR High Mast Cables (5 C X 4 SQ MM & 5 C X 2.5 SQ MM)Subrata dubeyNo ratings yet

- 1LE1503-1DB21-7AB4-Z B02+D22+L22+Y82 Datasheet enDocument2 pages1LE1503-1DB21-7AB4-Z B02+D22+L22+Y82 Datasheet enMostafaElrakhawyNo ratings yet

- 6 RR FR LSHDocument1 page6 RR FR LSHGaurav MittalNo ratings yet

- Schedule-4(I) 220/20kV Charikar Substation Package Price BreakupDocument17 pagesSchedule-4(I) 220/20kV Charikar Substation Package Price BreakupSaptarshi ChatterjeeNo ratings yet

- Ferrite in Stainless Steel Weld MetalDocument1 pageFerrite in Stainless Steel Weld MetalElizabeth SpenceNo ratings yet

- ETABS 2016 Concrete Frame Design: ETABS 2016 16.2.1 License # 1PNLDAGBZ3D64CFDocument1 pageETABS 2016 Concrete Frame Design: ETABS 2016 16.2.1 License # 1PNLDAGBZ3D64CFNsan Wilfredo Neyra CisnerosNo ratings yet

- 1LE1503-1EB21-7AB4-Z B02+D22+L22+Y82 Datasheet enDocument2 pages1LE1503-1EB21-7AB4-Z B02+D22+L22+Y82 Datasheet enMostafaElrakhawyNo ratings yet

- ETABS 2016 Concrete Frame Design: ACI 318-11 Beam Section DesignDocument2 pagesETABS 2016 Concrete Frame Design: ACI 318-11 Beam Section DesignRey GonzalesNo ratings yet

- 132kV TBC CRPDocument46 pages132kV TBC CRPMeera DeviNo ratings yet

- Ancillary Work Sublet RatesDocument2 pagesAncillary Work Sublet RatesLaiqueShahNo ratings yet

- Beam Section Design DetailsDocument2 pagesBeam Section Design DetailsSanjeev SanjeevNo ratings yet

- Millimetre Wave Antennas for Gigabit Wireless Communications: A Practical Guide to Design and Analysis in a System ContextFrom EverandMillimetre Wave Antennas for Gigabit Wireless Communications: A Practical Guide to Design and Analysis in a System ContextNo ratings yet

- Token Ring Technology ReportFrom EverandToken Ring Technology ReportNo ratings yet

- Clause No.: BID DOC. NO:RE-CS-5759-004-9Document2 pagesClause No.: BID DOC. NO:RE-CS-5759-004-9vishnumdu22No ratings yet

- Annex A Credit Facility CertificateDocument1 pageAnnex A Credit Facility Certificatevishnumdu22No ratings yet

- Instructions To Bidders: 1. GeneralDocument17 pagesInstructions To Bidders: 1. Generalvishnumdu22No ratings yet

- Transmission LinesDocument25 pagesTransmission LinesEricoVale100% (1)

- MCQ m14Document3 pagesMCQ m14gnanendra_eeeNo ratings yet

- Gulbarga Electricity Supply Company Limited: Invitation For Bidders. (E-Procurement MODE ONLY)Document6 pagesGulbarga Electricity Supply Company Limited: Invitation For Bidders. (E-Procurement MODE ONLY)vishnumdu22No ratings yet

- 1345329511328384370Document3 pages1345329511328384370vishnumdu22No ratings yet

- Transmission Line XDocument21 pagesTransmission Line XKifaru Micro-electronicsNo ratings yet

- Invitation For BidsDocument1 pageInvitation For Bidsvishnumdu22No ratings yet

- 97em MasterDocument15 pages97em MasterJoey MclaughlinNo ratings yet

- IMPORTANT QUESTION IN ELECTRICAL ENGG FOR ASSISTANT ENGINEER EXAMS OF UPRVUNL, UPPCL, MPPKVVNL, HPPSC, IES, GATE and Other State Psus.Document223 pagesIMPORTANT QUESTION IN ELECTRICAL ENGG FOR ASSISTANT ENGINEER EXAMS OF UPRVUNL, UPPCL, MPPKVVNL, HPPSC, IES, GATE and Other State Psus.Rishi Kant Sharma100% (1)

- Stretching Transmission Line Capabilities - A Transpower InvestigationDocument8 pagesStretching Transmission Line Capabilities - A Transpower Investigationvishnumdu22No ratings yet

- INTERNET STANDARDSDocument18 pagesINTERNET STANDARDSDawn HaneyNo ratings yet

- Home Buying GuideDocument27 pagesHome Buying GuideNidhi Rathi Mantri0% (1)

- Home Buying GuideDocument27 pagesHome Buying GuideNidhi Rathi Mantri0% (1)

- Kerala State Electricity Board Tender Extension for Supply of 350kms ACSR DOG ConductorDocument1 pageKerala State Electricity Board Tender Extension for Supply of 350kms ACSR DOG Conductorvishnumdu22No ratings yet

- JK - IDY Common Yoga Protocol - BookDocument40 pagesJK - IDY Common Yoga Protocol - BookKannan.sNo ratings yet

- Sag-Tension Calculation of GAP ConductorDocument1 pageSag-Tension Calculation of GAP Conductorvishnumdu22No ratings yet

- Complete Bid Document - VerifiedDocument42 pagesComplete Bid Document - Verifiedvishnumdu22100% (1)

- Disclosure To Promote The Right To InformationDocument10 pagesDisclosure To Promote The Right To Informationvishnumdu22No ratings yet

- WWW - Pudutenders.gov - In: Electricity Department, Govt. of PuducherryDocument3 pagesWWW - Pudutenders.gov - In: Electricity Department, Govt. of Puducherryvishnumdu22No ratings yet

- Is.1573.1986 ED Coating StandardDocument24 pagesIs.1573.1986 ED Coating StandardUlhas Kavathekar100% (1)

- Is 398 (3) (3-Aluminium Conductors, Aluminized Steel Reinforced)Document17 pagesIs 398 (3) (3-Aluminium Conductors, Aluminized Steel Reinforced)REDDYGAARI ABBAYINo ratings yet

- Bare Overhead TransDocument174 pagesBare Overhead TransVICTORMARCENo ratings yet

- Is 398 (Part-2) (ACSR Below 400 KV)Document10 pagesIs 398 (Part-2) (ACSR Below 400 KV)vishnumdu22No ratings yet

- Conductor DetailsDocument12 pagesConductor DetailsmanohargudNo ratings yet

- MPA 344(a)/2017 Corrosion Protection TendersDocument2 pagesMPA 344(a)/2017 Corrosion Protection TendersVeenoyNo ratings yet

- EPCM TheMisunderstoodContractDocument6 pagesEPCM TheMisunderstoodContractmonikatickoo4412100% (2)

- Apple Macintosh 12-83Document18 pagesApple Macintosh 12-83heliosnineNo ratings yet

- HDK® H30: Product DescriptionDocument2 pagesHDK® H30: Product DescriptionjaviomoteroNo ratings yet

- India's Growing Packaging IndustryDocument10 pagesIndia's Growing Packaging IndustryAdhip Pal ChaudhuriNo ratings yet

- Ogunranti Abiodun Rasaq: Career SummaryDocument4 pagesOgunranti Abiodun Rasaq: Career SummaryOgunranti RasaqNo ratings yet

- Rounding Into Shape: SPECIAL REPORT: Global Automation and Manufacturing Summit PreviewDocument100 pagesRounding Into Shape: SPECIAL REPORT: Global Automation and Manufacturing Summit PreviewHứa Thông TriệuNo ratings yet

- Handtool PliersDocument132 pagesHandtool PliersArk VaderNo ratings yet

- Industry-Company MatrixDocument66 pagesIndustry-Company Matrixanon_981731217No ratings yet

- Software Testing Uharc LicenseDocument1 pageSoftware Testing Uharc Licenseaanur1gNo ratings yet

- P.Arivalagan: Mobile: +91 9360429742Document3 pagesP.Arivalagan: Mobile: +91 9360429742Arivalagan AnNo ratings yet

- Chap1 2Document23 pagesChap1 2Neeraj SharmaNo ratings yet

- Financial Monitoring SystemDocument13 pagesFinancial Monitoring SystemSachie Delizo Gabad100% (1)

- Operations Management: July 2019Document3 pagesOperations Management: July 2019Aman KumarNo ratings yet

- Exam 70 461 Microsoft SQL ServerDocument10 pagesExam 70 461 Microsoft SQL Serverjimmy_sam001No ratings yet

- Index - Foundation of Software TestingDocument3 pagesIndex - Foundation of Software TestingJItendra KNo ratings yet

- AutoCAD1 Land Development Desktop Release 2iDocument2 pagesAutoCAD1 Land Development Desktop Release 2iRajo Ameh100% (1)

- Approval Form For Material Gate Pass 内部出门证: COD Muhammed Thanzeel 8424503 0580281560Document1 pageApproval Form For Material Gate Pass 内部出门证: COD Muhammed Thanzeel 8424503 0580281560Muhammed ThanzeelNo ratings yet

- Global Network - Hitachi Construction MachineryDocument19 pagesGlobal Network - Hitachi Construction MachineryluliyangzyNo ratings yet

- Hub and Spoke System PresentationDocument13 pagesHub and Spoke System PresentationShreyasNo ratings yet

- bd135 954513Document10 pagesbd135 954513cjtrybiecNo ratings yet

- Carlson Hotel WorldwideDocument2 pagesCarlson Hotel WorldwidechrstNo ratings yet

- Lean Manufacturing Transformation for ShipyardsDocument12 pagesLean Manufacturing Transformation for ShipyardsLukman Tarigan SumatraNo ratings yet

- Ganesh Bharadwaj H S-Resume-2023Document6 pagesGanesh Bharadwaj H S-Resume-2023Bharadwaj's ArohanaNo ratings yet

- PM 372 Roto Packer RVTDocument20 pagesPM 372 Roto Packer RVTLiuel GirmaNo ratings yet

- Basement Shop Drawing & CSD: by KhoonDocument4 pagesBasement Shop Drawing & CSD: by KhoonWunNaNo ratings yet

- MM Master DataDocument29 pagesMM Master DatanidhiNo ratings yet

- Solidworks Composer: Add A New Dimension To Your Technical CommunicationsDocument4 pagesSolidworks Composer: Add A New Dimension To Your Technical CommunicationsNatarajan RamamoorthyNo ratings yet

- Comax 1000Document2 pagesComax 1000hitendra_gkNo ratings yet