Professional Documents

Culture Documents

Ptaxation 1 Cases PDF

Uploaded by

Fely DesembranaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ptaxation 1 Cases PDF

Uploaded by

Fely DesembranaCopyright:

Available Formats

CASES IN

TAXATION I

Submitted to:

JUDGE LORETO ALOG

-Professor-

Submitted by:

EVANGELINE O. PESCADOR

UPANG-Phinma

College of Law

TAXATION I CASES Page 1

COMMISSIONER OF INTERNAL REVENUE v. SAN ROQUE POWER CORPORATION,

G.R. No. 196113

Facts

San Roque is a domestic corporation duly organized and existing under and by virtue of the laws of

the Philippines with principal office at Barangay San Roque, San Manuel, Pangasinan. It was

incorporated in October 1997 to design, construct, erect, assemble, own, commission and operate

power-generating plants and related facilities pursuant to and under contract with the Government of

the Republic of the Philippines, or any subdivision, instrumentality or agency thereof, or any

governmentowned or controlled corporation, or other entity engaged in the development, supply, or

distribution of energy.

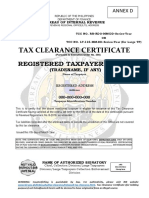

As a seller of services, San Roque is duly registered with the BIR with TIN/VAT No. 005-017-501. It is

likewise registered with the Board of Investments ("BOI") on a preferred pioneer status, to engage in

the design, construction, erection, assembly, as well as to own, commission, and operate electric

power-generating plants and related activities, for which it was issued Certificate of Registration No.

97-356 on February 11, 1998.

On October 11, 1997, San Roque entered into a Power Purchase Agreement ("PPA") with the National

Power Corporation to develop hydro-potential of the Lower Agno River and generate additional power

and energy for the Luzon Power Grid, by building the San Roque Multi-Purpose Project located in San

Manuel, Pangasinan. The PPA provides, among others, that [San Roque] shall be responsible for the

design, construction, installation, completion, testing and commissioning of the Power Station and

shall operate and maintain the same, subject to NPC instructions. During the cooperation period of

twenty-five (25) years commencing from the completion date of the Power Station, NPC will take and

pay for all electricity available from the Power Station.

On the construction and development of the San Roque Multi- Purpose Project which comprises of the

dam, spillway and power plant, San Roque allegedly incurred, excess input VAT in the amount of

?559,709,337.54 for taxable year 2001 which it declared in its Quarterly VAT Returns filed for the

same year. [San Roque] duly filed with the BIR separate claims for refund, in the total amount of

?559,709,337.54, representing unutilized input taxes as declared in its VAT returns for taxable year

2001.

However, on March 28, 2003,San Roque filed amended Quarterly VAT Returns for the year 2001 since

it increased its unutilized input VAT to the amount of ?560,200,283.14. Consequently, [San Roque]

filed with the BIR on even date, separate amended claims for refund in the aggregate amount of

?560,200,283.14.

CIRs inaction on the subject claims led to the filing by San Roque of the Petition for Review with the

Court [of Tax Appeals] in Division on April 10, 2003.

The CTA Second Division initially denied San Roques claim. The CTA Second Division required San

Roque to show that it complied with the requirements of Section 112(B) of Republic Act No. 8424 (RA

8424) to be entitled to a tax refund or credit of input VAT attributable to capital goods imported or

locally purchased. San Roque filed a Motion for New Trial and/or Reconsideration on 7 April 2006. In

its 29 November 2007 Amended Decision, the CTA Second Division found legal basis to partially grant

San Roques claim.

The Commissioner filed a Petition for Review before the CTA EB praying for the denial of San Roques

claim for refund or tax credit in its entirety as well as for the setting aside of the 29 November 2007

Amended Decision and the 11 July 2008 Resolution in CTA Case No. 6647.

TAXATION I CASES Page 2

The CTA EB dismissed the CIRs petition for review and affirmed the challenged decision and

resolution.

ISSUES:

I. Whether or not the Court of Tax Appeals En Banc erred in holding that San Roques claim for refund

was not prematurely filed.

II. Whether or not the Court of Tax Appeals En Banc erred in affirming the amended decision of the

Court of Tax Appeals (Second Division) granting San Roques claim for refund of alleged unutilized

input VAT on its purchases of capital goods and services for the taxable year 2001

RULING:

On 10 April 2003, a mere 13 days after it filed its amended administrative claim with the

Commissioner on 28 March 2003, San Roque filed a Petition for Review with the CTA docketed as CTA

Case No. 6647. From this we gather two crucial facts: first, San Roque did not wait for the 120-day

period to lapse before filing its judicial claim; second, San Roque filed its judicial claim more than four

(4) years before the Atlas doctrine, which was promulgated by the Court on 8 June 2007.

Clearly, San Roque failed to comply with the 120-day waiting period, the time expressly given by law

to the Commissioner to decide whether to grant or deny San Roques application for tax refund or

credit. It is indisputable that compliance with the 120-day waiting period is mandatory and

jurisdictional. The waiting period, originally fixed at 60 days only, was part of the provisions of the

first VAT law, Executive Order No. 273, which took effect on 1 January 1988. The waiting period was

extended to 120 days effective 1 January 1998 under RA 8424 or the Tax Reform Act of 1997. Thus,

the waiting period has been in our statute books for more than fifteen (15)

years before San Roque filed its judicial claim.

Failure to comply with the 120-day waiting period violates a mandatory provision of law. It violates

the doctrine of exhaustion of administrative remedies and renders the petition premature and thus

without a cause of action, with the effect that the CTA does not acquire jurisdiction over the taxpayers

petition. Philippine jurisprudence is replete with cases upholding and reiterating these doctrinal

principles. San Roques failure to comply with the 120-day mandatory period renders its petition for

review with the CTA void. Article 5 of the Civil Code provides, "Acts executed against provisions of

mandatory or prohibitory laws shall be void, except when the law itself authorizes their validity." San

Roques void petition for review cannot be legitimized by the CTA or this Court because Article 5 of the

Civil Code states that such void petition cannot be legitimized "except when the law itself authorizes

validity." There is no law authorizing the petitions validity.

It is hornbook doctrine that a person committing a void act contrary to a mandatory provision of law

cannot claim or acquire any right from his void act. A right cannot spring in favor of a person from his

own void or illegal act. This doctrine is repeated in Article 2254 of the Civil Code, which states, "No

vested or acquired right can arise from acts or omissions which are against the law or which infringe

upon the rights of others." For violating a mandatory provision of law in filing its petition with the CTA,

San Roque cannot claim any right arising from such void petition. Thus, San Roques petition with the

CTA is a mere scrap of paper. Well-settled is the rule that tax refunds or credits, just like tax

exemptions, are strictly construed against the taxpayer. The burden is on the taxpayer to show

that he has strictly complied with the conditions for the grant of the tax refund or credit.

This Court cannot disregard mandatory and jurisdictional conditions mandated by law simply because

conditions.

TAXATION I CASES Page 3

What is important, as far as the present cases are concerned, is that the mere filing by a

taxpayer of a judicial claim with the CTA before the expiration of the 120-day period cannot

operate to divest the Commissioner of his jurisdiction to decide an administrative claim

within the 120-day mandatory period, unless the Commissioner has clearly given cause for

equitable estoppel to apply as expressly recognized in Section 246 of the Tax Code.

A final word. Taxes are the lifeblood of the nation. The Philippines has been struggling to improve its

tax efficiency collection for the longest time with minimal success. Consequently, the Philippines has

suffered the economic adversities arising from poor tax collections, forcing the government to

continue borrowing to fund the budget deficits. This Court cannot turn a blind eye to this economic

malaise by being unduly liberal to taxpayers who do not comply with statutory requirements for tax

refunds or credits. The tax refund claims in the present cases are not a pittance. Many other

companies stand to gain if this Court were to rule otherwise. The dissenting opinions will turn on its

head the well-settled doctrine that tax refunds are strictly construed against the taxpayer.

COMMISSIONER OF INTERNAL REVENUE v. TEAM SUAL CORPORATION (FORMERLY MIRANT

SUAL CORPORATION)

G.R. No. 194105, February 05, 2014

FACTS:

TSC is a corporation that is principally engaged in the business of power generation and the

subsequent sale thereof solely to National Power Corporation (NPC); it is registered with the Bureau of

Internal Revenue (BIR) as a VAT taxpayer.

On November 26, 1999, the CIR granted TSC’s application for zero–rating arising from its sale of

power generation services to NPC for the taxable year 2000. As a VAT–registered entity, TSC filed its

VAT returns for the first, second, third, and fourth quarters of taxable year 2000 on April 24, 2000,

July 25, 2000, October 25, 2000, and January 25, 2001, respectively.

On March 11, 2002, TSC filed with the BIR an administrative claim for refund, claiming that it is

entitled to the unutilized input VAT in the amount of 179,314,926.56 arising from its zero–rated sales

to NPC for the taxable year 2000.

On April 1, 2002, without awa1tmg the CIR’s resolution of its administrative claim for refund/tax

credit, TSC filed a petition for review with the CTA seeking the refund or the issuance of a tax credit

certificate in the amount of 179,314,926.56 for its unutilized input VAT for the taxable year 2000. The

case was subsequently raffled to the CTA First Division.

In his Answer, the CIR claimed that TSC’s claim for refund/tax credit should be denied, asserting that

TSC failed to comply with the conditions precedent for claiming refund/tax credit of unutilized input

VAT. The CIR pointed out that TSC failed to submit complete documents in support of its application

for refund/tax credit contrary to Section 112 (C) of the National Internal Revenue Code (NIRC).

On January 26, 2009, the CTA First Division rendered a Decision, which granted TSC’s claim for

refund/tax credit of input VAT. Nevertheless, the CTA First Division found that, from the total

unutilized input VAT of 179,314,926.56 that it claimed, TSC was only able to substantiate the amount

of 173,265,261.30. Thus, the instant Petition for Review was granted The CIR sought a reconsideration

.

of the CTA First Division Decision dated January 26, 2009 maintaining that TSC is not entitled to a

refund/tax credit of its unutilized input VAT for the taxable year 2000 since it failed to submit all the

necessary and relevant documents in support of its administrative claim.

TAXATION I CASES Page 4

ISSUES

1. Whether or not the CTA en banc erred in holding that TSC’s petition for review with the CTA was

not prematurely filed.

RULING:

The petition is meritorious.

Section 112 of the NIRC provides for the rules to be followed in claiming a refund/tax credit of

unutilized input VAT.

In case of full or partial denial of the claim for tax refund or tax credit, or the failure on the part of the

Commissioner to act on the application within the period prescribed above, the taxpayer affected may,

within thirty (30) days from the receipt of the decision denying the claim or after the expiration of the

one hundred twenty–day period, appeal the decision or the unacted claim with the Court of Tax

Appeals. Any unutilized input VAT attributable to zero–rated or effectively zero–rated sales may be

claimed as a refund/tax credit. Initially, claims for refund/tax credit for unutilized input VAT should be

filed with the BIR, together with the complete documents in support of the claim. Pursuant to Section

112(A) of the NIRC, the administrative claim for refund/tax credit must be filed with the BIR within

two years after the close of the taxable quarter when the sales were made. Under Section 112(C) of

the NIRC, the CIR is given 120 days from the submission of complete documents in support of the

application for refund/tax credit within which to either grant or deny the claim. In case of (1) full or

partial denial of the claim or (2) the failure of the CIR to act on the claim within 120 days from the

submission of complete documents, the taxpayer–claimant may, within 30 days from receipt of the

CIR decision denying the claim or after the lapse of the 120–day period, file a petition for review with

the CTA.

In this case, the administrative and the judicial claims were simultaneously filed on September 30,

2004. Obviously, respondent did not wait for the decision of the CIR or the lapse of the 120–day

period. For this reason, we find the filing of the judicial claim with the CTA premature.

Finally, even if TSC was able to substantiate, through the documents it submitted, that it is indeed

entitled to a refund/tax credit of its unutilized input VAT for the taxable year 2000, its claim would still

have to be denied. “Tax refunds are in the nature of tax exemptions, and are to be

construed strictissimi juris against the entity claiming the same. “The taxpayer is charged with the

heavy burden of proving that he has complied with and satisfied all the statutory and

administrative requirements to be entitled to the tax refund. TSC, in prematurely filing a petition

for review with the CTA, failed to comply with the 120–day mandatory period under Section 112(C) of

the NIRC. Thus, TSC’s claim for refund/tax credit of its unutilized input VAT should be denied.

COMMISSIONER OF INTERNAL REVENUEv. MANILA ELECTRIC COMPANY (MERALCO)

G.R. No. 181459, June 09, 2014

FACTS

On July 6, 1998, respondent Manila Electric Company (MERALCO) obtained a loan from Norddeutsche

Landesbank Girozentrale (NORD/LB) Singapore Branch in the amount of USD120,000,000.00 with ING

Barings South East Asia Limited (ING Barings) as the Arrange On September 4, 2000, respondent

MERALCO executed another loan agreement with NORD/LB Singapore Branch for a loan facility in the

amount of USD100,000,000.00 with Citicorp International Limited as Agent cralawred

Under the foregoing loan agreements, the income received by NORD/LB, by way of respondent

MERALCO’s interest payments, shall be paid in full without deductions, as respondent MERALCO shall

TAXATION I CASES Page 5

bear the obligation of paying/remitting to the BIR the corresponding ten percent (10%) final

withholding tax. Pursuant thereto, respondent MERALCO paid/remitted to the Bureau of Internal

Revenue (BIR) the said withholding tax on its interest payments to NORD/LB Singapore Branch,

covering the period from January 1999 to September 2003.

However, sometime in 2001, respondent MERALCO discovered that NORD/LB Singapore Branch is a

foreign government-owned financing institution of Germany. Thus, on December 20, 2001, respondent

MERALCO filed a request for a BIR Ruling with petitioner Commissioner of Internal Revenue (CIR) with

regard to the tax exempt status of NORD/LB Singapore Branch, in accordance with Section

32(B)(7)(a) of the 1997 National Internal Revenue Code (Tax Code), as amended

On October 7, 2003, the BIR issued Ruling No. DA-342-2003 declaring that the interest payments

made to NORD/LB Singapore Branch are exempt from the ten percent (10%) final withholding tax,

since it is a financing institution owned and controlled by the foreign government of Germany.

On November 5, 2004, respondent MERALCO received a letter from petitioner denying its claim for tax

refund on the basis that the same had already prescribed under Section 204 of the Tax Code, which

gives a taxpayer/claimant a period of two (2) years from the date of payment of tax to file a claim for

refund before the BIR

Aggrieved, respondent MERALCO filed a Petition for Review with the Court of Tax Appeals (CTA) on

December 6, 2004.12 After trial on the merits, the CTA-First Division rendered a Decision partially

granting respondent MERALCO’s Petition for Review . In the same vein, the motions for

reconsideration filed by the respective parties were also denied in a Resolution dated January 9, 2008,

Hence, the instant petition.

ISSUE:

1. Whether or not respondent MERALCO is entitled to a tax refund/credit relative to its payment of

final withholding taxes on interest payments made to NORD/LB from January 1999 to September

2003.

RULING

After a careful scrutiny of the records and evidence presented before us, we find that respondent

MERALCO has discharged the requisite burden of proof in establishing the factual basis for its claim for

tax refund.

Tax refunds are based on the general premise that taxes have either been erroneously or excessively

paid. Though the Tax Code recognizes the right of taxpayers to request the return of such

excess/erroneous payments from the government, they must do so within a prescribed period.

Further, “a taxpayer must prove not only his entitlement to a refund, but also his compliance with the

procedural due process as non-observance of the prescriptive periods within which to file the

administrative and the judicial claims would result in the denial of his claim.”

red

In the case at bar, respondent MERALCO had ample opportunity to verify on the tax-exempt status of

NORD/LB for purposes of claiming tax refund. Even assuming that respondent MERALCO could not

have emphatically known the status of NORD/LB, its supposition of the same was already confirmed

by the BIR Ruling which was issued on October 7, 2003. Nevertheless, it only filed its claim for tax

refund on July 13, 2004, or ten (10) months from the issuance of the aforesaid Ruling. We agree with

the CTA-First Division, therefore, that respondent MERALCO’s claim for refund in the amount of Two

Hundred Twenty-Four Million Seven Hundred Sixty Thousand Nine Hundred Twenty-Six Pesos and

Sixty-Five Centavos (P224,760,926.65) representing erroneously paid and remitted final income taxes

for the period January 1999 to July 2002 should be denied on the ground of prescription.

Finally, we ought to remind petitioner that the arguments it raised in support of its position have

TAXATION I CASES Page 6

already been thoroughly discussed both by the CTA-First Division and the CTA En Banc. Oft-repeated

is the rule that the Court will not lightly set aside the conclusions reached by the CTA which, by the

very nature of its function of being dedicated exclusively to the resolution of tax problems, has

accordingly developed an expertise on the subject, unless there has been an abuse or improvident

exercise of authority. This Court recognizes that the CTA’s findings can only be disturbed on appeal if

they are not supported by substantial evidence, or there is a showing of gross error or abuse on the

part of the Tax Court. In the absence of any clear and convincing proof to the contrary, this Court

must presume that the CTA rendered a decision which is valid in every respect. It has been a long-

standing policy and practice of the Court to respect the conclusions of quasi-judicial agencies such as

the CTA, a highly specialized body specifically created for the purpose of reviewing tax cases.

PHILIPPINE AIRLINES, INC. v. COMMISSIONER OF INTERNAL REVENUE

G.R. No. 198759, July 01, 2013

FACTS

For the period July 24 to 28, 2004, Caltex sold 804,370 liters of imported Jet A-1 fuel to PAL for the

latter’s domestic operations. Consequently, on July 26, 27, 28 and 29, 2004, Caltex electronically

filed with the Bureau of Internal Revenue (BIR) its Excise Tax Returns for Petroleum Products,

declaring the amounts of P1,232,798.80, P686,767.10, P623,422.90 and P433,904.10, respectively,

or a total amount of P2,975,892.90, as excise taxes due thereon

On October 29, 2004, PAL, through a letter-request dated October 15, 2004 addressed to respondent

Commissioner of Internal Revenue (CIR), sought a refund of the excise taxes passed on to it by

Caltex. It hinged its tax refund claim on its operating franchise, i.e., Presidential Decree No.

1590 issued on June 11, 1978 (PAL’s franchise), which conferred upon it certain tax exemption

privileges on its purchase and/or importation of aviation gas, fuel and oil, including those which are

passed on to it by the seller and/or importer thereof. Further, PAL asserted that it had the legal

personality to file the aforesaid tax refund claim.

Due to the CIR’s inaction, PAL filed a Petition for Review with the CTA on July 25, 2006. In its Answer,

the CIR averred that since the excise taxes were paid by Caltex, PAL had no cause of action.

The CTA Second Division denied PAL’s petition on the ground that only a statutory taxpayer (referring

to Caltex in this case) may seek a refund of the excise taxes it paid. It added that even if the tax

burden was shifted to PAL, the latter cannot be deemed a statutory taxpayer.

It further ruled that PAL’s claim for refund should be denied altogether on account of Letter of

Instruction No. 1483 (LOI 1483) which already withdrew the tax exemption privileges previously

granted to PAL on its purchase of domestic petroleum products, of which the transaction between PAL

and Caltex was characterized.

PAL moved for reconsideration, but the same was denied in a Resolution dated January 14, 2010,

prompting it to elevate the matter to the CTA En Banc, which affirmed the ruling of the CTA 2nd

Division. Aggrieved, PAL filed a motion for reconsideration which was, however, denied in a Resolution

dated September 16, 2011, hence, the instant petition.

ISSUES

1. Whether or not PAL has the legal personality to file a claim for refund of the passed on excise

taxes;

2. Whether or not the sale of imported aviation fuel by Caltex to PAL is covered by LOI 1483 which

withdrew the tax exemption privileges of PAL on its purchases of domestic petroleum products for use

in its domestic operations; and

TAXATION I CASES Page 7

3. Whether or not PAL has sufficiently proved its entitlement to refund.

RULING

The court held that the petition is meritorious.

A. PAL’s legal personality to file a claim for refund of excise taxes.

The Court ruled it had the legal personality to file a claim for refund

Section 204(c) of the NIRC states that it is the statutory taxpayer which has the legal personality to

file a claim for refund. Accordingly, in cases involving excise tax exemptions on petroleum products

under Section 135 of the NIRC, the Court has consistently held that it is the statutory taxpayer who is

entitled to claim a tax refund based thereon and not the party who merely bears its economic burden.

B. Coverage of LOI 1483.

LOI 1483 amended PAL’s franchise by withdrawing the tax exemption privilege granted to PAL on its

purchase of domestic petroleum products for use in its domestic operations.

In this case, records disclose that Caltex imported aviation fuel from abroad and merely re-sold the

same to PAL, tacking the amount of excise taxes it paid or would be liable to pay to the government

on to the purchase price. Evidently, the said petroleum products are in the nature of “things imported”

and thus, beyond the coverage of LOI 1483 as previously discussed. As such, considering the

subsistence of PAL’s tax exemption privileges over the imported goods subject of this case, PAL is

allowed to claim a tax refund on the excise taxes imposed and due thereon.

C. PAL’s entitlement to refund.

It is hornbook principle that the Court is not a trier of facts and often, remands cases to the lower

courts for the determination of questions of such character. However, when the trial court had already

received all the evidence of the parties, the Court may resolve the case on the merits instead of

remanding them in the interest of expediency and to better serve the ends of justice.

Applying these principles, the Court finds that the evidence on record shows that PAL was able to

sufficiently prove its entitlement to the subject tax refund. Thus, finding that PAL has sufficiently

proved its entitlement to a tax refund of the excise taxes subject of this case, the Court hereby grants

its petition and consequently, annuls the assailed CTA resolutions.

COMMISSIONER OF INTERNAL REVENUE, PETITIONER, VS. PL MANAGEMENT

INTERNATIONAL PHILIPPINES, INC., RESPONDENT.

G.R. No. 160949, April 04 ,2011

FACTS

The inaction of petitioner Commissioner of Internal Revenue (Commissioner) on the respondent's

written claim for tax refund or tax credit impelled the latter to commence judicial action for that

purpose in the CTA. However, the CTA denied the claim on December 10, 2001 for being brought

beyond two years from the accrual of the claim.

TAXATION I CASES Page 8

On appeal, the Court of Appeals (CA) reversed the CTA's denial through the decision promulgated in

C.A.-G.R. Sp. No. 68461 on November 28, 2002, and directed the petitioner to refund the unutilized

creditable withholding tax to the respondent, hence, the petitioner appeals. It was denied by the CTA

because of prescription. Aggrieved, the respondent appealed to the CA, assailing the correctness of

the CTA's denial of its judicial claim for refund on the ground of bar by prescription. The CA partly

granted the petition. The CA rejected the petitioner's motion for reconsideration

Issues

ISSUES

I. WHETHER OR NOT THE COURT OF APPEALS ERRED IN HOLDING THAT THE TWO-YEAR

PRESCRIPTIVE PERIOD UNDER SECTION 229 OF THE TAX CODE IS NOT JURISDICTIONAL,

THUS THE CLAIM FOR REFUND OF RESPONDENT IS SUSPENDED FOR REASONS OF EQUITY.

II. WHETHER OR NOT THE COURT OF APPEALS ERRED IN HOLDING THAT RESPONDENT'S

JUDICIAL RIGHT TO CLAIM FOR REFUND BROUGHT BEFORE THE COURT OF APPEALS ON

APRIL 14, 2000 WAS ONE DAY LATE ONLY.

RULING

We reverse and set aside the decision of the CA to the extent that it orders the petitioner to refund to

the respondent the P1,200,000.00 representing the unutilized creditable withholding tax in taxable

year 1997, but permit the respondent to apply that amount as tax credit in succeeding taxable years

until fully exhausted.

Section 76 of the NIRC of 1997 provides:

Section 76. Final Adjustment Return. - Every corporation liable to tax under Section 27 shall file a final

adjustment return covering the total taxable income for the preceding calendar or fiscal year. If the

sum of the quarterly tax payments made during the said taxable year is not equal to the total tax due

on the entire taxable income of that year the corporation shall either:

(A) Pay the balance of tax still due; or

(B) Carry over the excess credit; or

(C) Be credited or refunded with the excess amount paid, as the case may be.

The predecessor provision of Section 76 of the NIRC of 1997 is Section 79 of the NIRC of 1985, which

provides:

Section 79. Final Adjustment Return. - Every corporation liable to tax under Section 24 shall file a

final adjustment return covering the total net income for the preceding calendar or fiscal year. If the

sum of the quarterly tax payments made during the said taxable year is not equal to the total tax due

on the entire taxable net income of that year the corporation shall either:

(a) Pay the excess tax still due; or

(b) Be refunded the excess amount paid, as the case may be.

These two options under Section 76 are alternative in nature. The choice of one precludes

the other. One cannot get a tax refund and a tax credit at the same time for the same

excess income taxes paid.

TAXATION I CASES Page 9

Inasmuch as the respondent already opted to carry over its unutilized creditable withholding tax of

P1,200,000.00 to taxable year 1998, the carry-over could no longer be converted into a claim for tax

refund because of the irrevocability rule provided in Section 76 of the NIRC of 1997. Thereby, the

respondent became barred from claiming the refund. However, in view of it irrevocable choice, the

respondent remained entitled to utilize that amount of P1,200,000.00 as tax credit in succeeding

taxable years until fully exhausted. In this regard, prescription did not bar it from applying the amount

as tax credit considering that there was no prescriptive period for the carrying over of the amount as

tax credit in subsequent taxable years.

ALLIED BANKING CORPORATION, VS. COMMISSIONER OF INTERNAL REVENUE

G.R. No. 175097 : February 05, 2010

DEL CASTILLO, J.:

FACTS

On April 30, 2004, the Bureau of Internal Revenue (BIR) issued a Preliminary Assessment Notice

(PAN) to petitioner Allied Banking Corporation for deficiency Documentary Stamp Tax (DST) in the

amount of P12,050,595.60 and Gross Receipts Tax (GRT) in the amount of P38,995,296.76 on

industry issue for the taxable year 2001. Petitioner received the PAN on May 18, 2004 and filed a

protest against it on May 27, 2004.

On July 16, 2004, the BIR wrote a Formal Letter of Demand with Assessment Notices to petitioner,

which partly reads as follows; It is requested that the above deficiency tax be paid immediately upon

receipt hereof, inclusive of penalties incident to delinquency. This is our final decision based on

investigation. If you disagree, you may appeal the final decision within thirty (30) days from receipt

hereof, otherwise said deficiency tax assessment shall become final, executory and demandable.

On September 29, 2004, petitioner filed a Petition for Review with the CTA which was raffled to its

On October 12, 2005, the First Division of the CTA rendered a Resolution granting respondent's Motion

to Dismiss. Aggrieved, petitioner moved for reconsideration but the motion was denied by the First

Division in its Resolution dated February 1, 2006. On February 22, 2006, petitioner appealed the

dismissal to the CTA En Banc. The CTA En Banc declared that it is absolutely necessary for the

taxpayer to file an administrative protest in order for the CTA to acquire jurisdiction. It emphasized

that an administrative protest is an integral part of the remedies given to a taxpayer in challenging

the legality or validity of an assessment. According to the CTA En Banc, although there are exceptions

to the doctrine of exhaustion of administrative remedies, the instant case does not fall in any of the

exceptions.

ISSUE

1. Whether or not the Formal Letter of Demand dated July 16, 2004 can be construed as a final

decision of the CIR appealable to the CTA under RA 9282.

RULING

The court found the petition meritorious

The CTA, being a court of special jurisdiction, can take cognizance only of matters that are clearly

within its jurisdiction. The taxpayers shall be informed in writing of the law and the facts on which the

assessment is made; otherwise, the assessment shall be void. Within a period to be prescribed by

implementing rules and regulations, the taxpayer shall be required to respond to said notice. If the

taxpayer fails to respond, the Commissioner or his duly authorized representative shall issue an

assessment based on his findings. Such assessment may be protested administratively by filing a

request for reconsideration or reinvestigation within thirty (30) days from receipt of the assessment in

such form and manner as may be prescribed by implementing rules and regulations. Within sixty (60)

days from filing of the protest, all relevant supporting documents shall have been submitted;

otherwise, the assessment shall become final.

TAXATION I CASES Page 10

If the protest is denied in whole or in part, or is not acted upon within one hundred eighty (180) days

from submission of documents, the taxpayer adversely affected by the decision or inaction may appeal

to the Court of Tax Appeals within thirty (30) days from receipt of the said decision, or from the lapse

of the one hundred eighty (180)-day period; otherwise, the decision shall become final, executory and

demandable. In the instant case, petitioner timely filed a protest after receiving the PAN. In response

thereto, the BIR issued a Formal Letter of Demand with Assessment Notices. Pursuant to Section 228

of the NIRC, the proper recourse of petitioner was to dispute the assessments by filing an

administrative protest within 30 days from receipt thereof. Petitioner, however, did not protest the

final assessment notices. Instead, it filed a Petition for Review with the CTA. Thus, if we strictly apply

the rules, the dismissal of the Petition for Review by the CTA was proper.The case is an exception to

the rule on exhaustion of administrative remedies. Similarly, in this case, we find the CIR estopped

from claiming that the filing of the Petition for Review was premature because petitioner failed to

exhaust all administrative remedies.

G.R. No. 173854 : March 15, 2010

COMMISSIONER OF INTERNAL REVENUE VS. FAR EAST BANK & TRUST COMPANY (NOW

BANK OF THE PHILIPPINE ISLANDS)

FACTS

On April 10, 1995, respondent filed with the Bureau of Internal Revenue (BIR) two Corporate Annual

Income Tax Returns, one for its Corporate Banking Unit (CBU) and another for its Foreign Currency

Deposit Unit (FCDU) for the taxable year ending December 31, 1994. The return for the CBU

consolidated the respondent's overall income tax liability for 1994, which reflected a refundable

income tax of P12,682,864.00. Petitioner, on the other hand, did not present any evidence.

On October 4, 1999, the CTA rendered a Decision denying respondent's claim for refund on the ground

that respondent failed to show that the income derived from rentals and sale of real property from

which the taxes were withheld were reflected in its 1994 Annual Income Tax Return. On October 20,

1999, respondent filed a Motion for New Trial based on excusable negligence. It prayed that it be

allowed to present additional evidence to support its claim for refund. However, the motion was

denied on December 16, 1999 by the CTA. On appeal, the CA reversed the Decision of the CTA. The

CA found that respondent has duly proven that the income derived from rentals and sale of real

property upon which the taxes were withheld were included in the return as part of the gross income.

Hence, this present recourse.

ISSUE

1. Whether or not the respondent has proven its entitlement to the refund

RULING

The respondent miserably failed to prove its entitlement to the refund. A taxpayer claiming for a tax

credit or refund of creditable withholding tax must comply. The two-year period requirement is based

on Section 229 of the NIRC of 1997. Respondent timely filed its claim for refund. There is no

dispute that respondent complied with the first requirement. The filing of respondent's administrative

claim for refund on May 17, 1996 and judicial claim for refund on April 8, 1997 were well within the

two-year period from the date of the filing of the return on April 10, 1995.Respondent failed to

prove that the income derived from rentals and sale of real property were included

in the gross income as reflected in its return.

TAXATION I CASES Page 11

Based on the foregoing, respondent has failed to comply with two essential requirements for a

valid claim for refund. Consequently, the same cannot be given due course. Incidentally, under Sec.

16 of the NIRC, the Commissioner of the BIR is tasked to make an examination of returns and

assess the correct amount of tax. Respondent failed to present all the Certificates of

Creditable Tax Withheld at Source. The burden is on the taxpayerto prove its entitlement to

the refund.

Hence, for failing to prove its entitlement to a tax refund, respondent's claim must be denied. Since

tax refunds partake of the nature of tax exemptions, which are construed strictissimi juris against the

taxpayer, evidence in support of a claim must likewise be strictissimi scrutinized and duly proven

G.R. No. 178087 : May 05, 2010

COMMISSIONER OF INTERNAL REVENUE VS. KUDOS METAL CORPORATION

DECISION

FACTS

On April 15, 1999, respondent Kudos Metal Corporation filed its Annual Income Tax Return (ITR) for

the taxable year 1998. Pursuant to a Letter of Authority dated September 7, 1999, the Bureau of

Internal Revenue (BIR) served upon respondent three Notices of Presentation of Records. Respondent

failed to comply with these notices, hence, the BIR issued a Subpeona Duces Tecum dated September

21, 2006, receipt of which was acknowledged by respondent's President, Mr. Chan Ching Bio, in a

letter dated October 20, 2000. A review and audit of respondent's records then ensued.

On August 25, 2003, the BIR issued a Preliminary Assessment Notice for the taxable year 1998

against the respondent. This was followed by a Formal Letter of Demand with Assessment Notices for

taxable year 1998, dated September 26, 2003 which was received by respondent on November 12,

2003. Respondent challenged the assessments by filing its "Protest on Various Tax Assessments" on

December 3, 2003 and its "Legal Arguments and Documents in Support of Protests against Various

Assessments" on February 2, 2004. On October 4, 2005, the CTA Second Division issued a Resolution

canceling the assessment notices issued against respondent for having been issued beyond the

prescriptive period. It found the first Waiver of the Statute of Limitations incomplete and defective for

failure to comply with the provisions of Revenue Memorandum Order (RMO) No. 20-90. On appeal, the

CTA En Banc affirmed the cancellation of the assessment notices. Although it ruled that the Assistant

Commissioner was authorized to sign the waiver pursuant to Revenue Delegation Authority Order

(RDAO) No. 05-01, it found that the first waiver was still invalid based on the second and third

grounds stated by the CTA Second Division. Pertinent portions of the Decision read as follows:

In the case at bar, the period agreed upon in the subject first waiver expired on December 31, 2002.

The second waiver in the instant case which was supposed to extend the period to assess to

December 31, 2003 was executed on February 18, 2003 and was notarized on February 19, 2003.

Clearly, the second waiver was executed after the expiration of the first period agreed upon.

Consequently, the same could not have tolled the 3-year prescriptive period to assess. Petitioner

sought reconsideration but the same was unavailing.

ISSUE

1. WHETHER OR NOT THE COURT OF TAX APPEALS EN BANC ERRED IN RULING THAT THE

GOVERNMENT'S RIGHT TO ASSESS UNPAID TAXES OF RESPONDENT PRESCRIBED.

RULING

The petition is bereft of merit.

Section 203 of the National Internal Revenue Code of 1997 (NIRC) mandates the government to

TAXATION I CASES Page 12

assess internal revenue taxes within three years from the last day prescribed by law for the filing of

the tax return or the actual date of filing of such return, whichever comes later. Hence, an assessment

notice issued after the three-year prescriptive period is no longer valid and effective. Exceptions

however are provided under Section 222 of the NIRC. The waivers executed by respondent's

accountant did not extend the period within which the assessment can be made. Estoppel

does not apply in this case

Conversely, in this case, the assessments were issued beyond the prescribed period. Also, there is no

showing that respondent made any request to persuade the BIR to postpone the issuance of the

assessments.

The doctrine of estoppel cannot be applied in this case as an exception to the statute of limitations on

the assessment of taxes considering that there is a detailed procedure for the proper execution of the

waiver, which the BIR must strictly follow. As we have often said, the doctrine of estoppel is

predicated on, and has its origin in, equity which, broadly defined, is justice according to natural law

and right. As such, the doctrine of estoppel cannot give validity to an act that is prohibited by law or

one that is against public policy.It should be resorted to solely as a means of preventing injustice and

should not be permitted to defeat the administration of the law, or to accomplish a wrong or secure an

undue advantage, or to extend beyond them requirements of the transactions in which they

originate.Simply put, the doctrine of estoppel must be sparingly applied.

As to the alleged delay of the respondent to furnish the BIR of the required documents, this cannot be

taken against respondent. Neither can the BIR use this as an excuse for issuing the assessments

beyond the three-year period because with or without the required documents, the CIR has the power

to make assessments based on the best evidence obtainable.

G.R. No. 166829 : April 19, 201

TFS, INCORPORATED VS. COMMISSIONER OF INTERNAL REVENUE

FACTS

Petitioner TFS, Incorporated is a duly organized domestic corporation engaged in the pawnshop

business. On January 15, 2002, petitioner received a Preliminary Assessment Notice (PAN) for

deficiency value added tax (VAT), expanded withholding tax (EWT), and compromise penalty in the

amounts of P11,764,108.74, P183,898.02 and P25,000.00, respectively, for the taxable year 1998.

Insisting that there was no basis for the issuance of PAN, petitioner through a letter dated January 28,

2002 requested the Bureau of Internal Revenue (BIR) to withdraw and set aside the assessments.

During trial, petitioner offered to compromise and to settle the assessment for deficiency EWT with the

BIR. Hence, on September 24, 2003, it filed a Manifestation and Motion withdrawing its appeal on the

deficiency EWT, leaving only the issue of VAT on pawnshops to be threshed out. Since no opposition

was made by the CIR to the Motion, the same was granted by the CTA on November 4, 2003.

On April 29, 2004, the CTA rendered a Decision upholding the assessment issued against petitioner in

the amount of P11,905,696.32, representing deficiency VAT for the year 1998, inclusive of 25%

surcharge and 20% deficiency interest, plus 20% delinquency interest from February 25, 2002 until

full payment, pursuant to Sections 248 and 249(B) of the National Internal Revenue Code of 1997

(NIRC). The CTA ruled that pawnshops are subject to VAT under Section 108(A) of the NIRC as they

are engaged in the sale of services for a fee, remuneration or consideration.

Aggrieved, petitioner moved for reconsideration but the motion was denied by the CTA in its

Resolution dated July 20, 2004,which was received by petitioner on July 30, 2004.

On August 16, 2004, petitioner filed before the Court of Appeals (CA) a Motion for Extension of Time

to File Petition for Review. On August 24, 2004, it filed a Petition for Review but it was dismissed by

the CA in its Resolution dated August 31, 2004, for lack of jurisdiction in view of the enactment of

TAXATION I CASES Page 13

Republic Act No. 9282 (RA 9282). The petition, however, was dismissed for having been filed out of

time per Resolution dated November 18, 2004. Petitioner filed a Motion for Reconsideration but it was

denied in a Resolution dated January 24, 2005. Hence, this petition.

ISSUES

1. WHETHER OR NOT THE HONORABLE COURT OF TAX APPEALS EN BANC SHOULD HAVE GIVEN DUE

COURSE TO THE PETITION FOR REVIEW AND NOT STRICTLY APPLIED THE TECHNICAL RULES OF

PROCEDURE TO THE DETRIMENT OF JUSTICE.

2. WHETHER OR NOT PETITIONER IS SUBJECT TO THE 10% VAT.

RULING

The petition is meritorious.

Jurisdiction to review decisions or resolutions issued by the Divisions of the CTA is no longer with the

CA but with the CTA En Banc. This rule is embodied in Section 11 of RA 9282. A party adversely

affected by a resolution of a Division of the CTA on a motion for reconsideration or new

trial, may file a petition for review with the CTA en banc. Procedural rules may be relaxed in

the interest of substantial justice. It is settled that an appeal must be perfected within the

reglementary period provided by law; otherwise, the decision becomes final and executory. However,

as in all cases, there are exceptions to the strict application of the rules for perfecting an appeal.

Imposition of VAT on pawnshops for the tax years 1996 to 2002 was deferred

In fine, although strict compliance with the rules for perfecting an appeal is indispensable for the

prevention of needless delays and for the orderly and expeditious dispatch of judicial business, strong

compelling reasons such as serving the ends of justice and preventing a grave miscarriage may

nevertheless warrant the suspension of the rules.In the instant case, we are constrained to disregard

procedural rules because we cannot in conscience allow the government to collect deficiency VAT from

petitioner considering that the government has no right at all to collect or to receive the same.

Besides, dismissing this case on a mere technicality would lead to the unjust enrichment of the

government at the expense of petitioner, which we cannot permit. Technicalities should never be used

as a shield to perpetrate or commit an injustice.

COMMISSIONER OF INTERNAL REVENUE v. HON. RAUL M. GONZALEZ, Secretary of Justice,

L. M. CAMUS ENGINEERING CORPORATION (represented by LUIS M. CAMUS and LINO D.

MENDOZA)

G.R. No. 177279 : October 13, 2010

FACTS

Pursuant to Letter of Authority (LA) No. 00009361 dated August 25, 2000 issued by then

Commissioner of Internal Revenue (petitioner) Dakila B. Fonacier, Revenue Officers Remedios C.

Advincula, Jr., Simplicio V. Cabantac, Jr., Ricardo L. Suba, Jr. and Aurelio Agustin T. Zamora

supervised by Section Chief Sixto C. Dy, Jr. of the Tax Fraud Division (TFD), National Office,

conducted a fraud investigation for all internal revenue taxes to ascertain/determine the tax liabilities

of respondent L. M. Camus Engineering Corporation (LMCEC) for the taxable years 1997, 1998 and

1999. The audit and investigation against LMCEC was precipitated by the information provided by an

cr1aw

"informer" that LMCEC had substantial underdeclared income for the said period. For failure to comply

with the subpoena duces tecum issued in connection with the tax fraud investigation, a criminal

complaint was instituted by the Bureau of Internal Revenue (BIR) against LMCEC on January 19, 2001

for violation of Section 266 of the NIRC In view of the above findings, assessment notices together

with a formal letter of demand dated August 7, 2002 were sent to LMCEC through personal service on

October 1, 2002. Since the company and its representatives refused to receive the said notices and

TAXATION I CASES Page 14

demand letter, the revenue officers resorted to constructive service in accordance with Section 3,

cra1aw

Revenue Regulations (RR) No. 12-99

LMCEC argued that petitioner is now estopped from further taking any action against it and its

corporate officers concerning the taxable years 1997 to 1999. With the grant of immunity from audit

from the companys availment of ERAP and VAP, which have a feature of a tax amnesty, the element

of fraud is negated the moment the Bureau accepts the offer of compromise or payment of taxes by

the taxpayer. The act of the revenue officers in finding justification under Section 6(B) of the NIRC

(Best Evidence Obtainable) is misplaced and unavailing because they were not able to open the books

of the company for the second time, after the routine examination, issuance of termination letter and

the availment of ERAP and VAP. LMCEC thus maintained that unless there is a prior determination of

fraud supported by documents not yet incorporated in the docket of the case, petitioner cannot just

issue LAs without first terminating those previously issued. It emphasized the fact that the BIR officers

who filed and signed the Affidavit-Complaint in this case were the same ones who appeared as

complainants in an earlier case filed against Camus for his alleged "failure to obey summons in

violation of Section 5 punishable under Section 266 of the NIRC of 1997" (I.S. No. 00-956 of the

Office of the City Prosecutor of Quezon City). After preliminary investigation, said case was dismissed

for lack of probable cause in a Resolution issued by the Investigating Prosecutor on May 2, 2001.

Petitioner filed a motion for reconsideration which was denied by the Chief State Prosecutor. Petitioner

aw l

appealed to respondent Secretary of Justice but the latter denied its petition for review under

Resolution dated December 13, 2005.

Its motion for reconsideration having been denied, petitioner challenged the ruling of respondent

Secretary via a certiorari petition in the CA. On October 31, 2006, the CA rendered the assailed

decision denying the petition and concurred with the findings and conclusions of respondent

aw

Secretary. Petitioners motion for reconsideration was likewise denied by the appellate

ISSUES

1. Whether or not the Court of Appeals erroneously sustained the findings of the Secretary of Justice

who gravely abused his discretion by dismissing the complaint based on grounds which are not even

elements of the offenses charged.

2. Whether or not the Court of Appeals erroneously sustained the findings of the Secretary of Justice

who gravely abused his discretion by dismissing petitioners evidence, contrary to law.

3. Whether or not the Court of Appeals erroneously sustained the findings of the Secretary of Justice

who gravely abused his discretion by inquiring into the validity of a Final Assessment Notice which has

become final, executory and demandable pursuant to Section 228 of the Tax Code of 1997 for failure

of private respondent to file a protest against the same.37 chanroble svi rtual lawlib rary

RULING

The court granted the petition.

There is no dispute that prior to the filing of the complaint with the DOJ, the report on the tax fraud

investigation conducted on LMCEC disclosed that it made substantial underdeclarations in its income

tax returns for 1997, 1998 and 1999. Pursuant to RR No. 12-99 a PAN was sent to and received by

LMCEC on February 22, 2001 wherein it was notified of the proposed assessment of deficiency taxes

amounting to P430,958,005.90 (income tax - P318,606,380.19 and VAT - P112,351,625.71) covering

taxable years 1997, 1998 and 1999. In response to said PAN, LMCEC sent a letter-protest to the TFD,

ra1aw

which denied the same on April 12, 2001 for lack of legal and factual basis and also for having been

filed beyond the 15-day reglementary period. Private respondents assertions regarding the

allawlibrary

qualifications of the "informer" of the Bureau deserve scant consideration. We have held that the lack

of consent of the taxpayer under investigation does not imply that the BIR obtained the information

from third parties illegally or that the information received is false or malicious. Nor does the lack of

TAXATION I CASES Page 15

consent preclude the BIR from assessing deficiency taxes on the taxpayer based on the documents.

In the same vein, herein private respondents cannot be allowed to escape criminal prosecution under

cra1aw

Sections 254 and 255 of the NIRC by mere imputation of a "fictitious" or disqualified informant under

Section 282 simply because other than disclosure of the official registry number of the third party

"informer," the Bureau insisted on maintaining the confidentiality of the identity and personal

circumstances of said "informer."

The formal letter of demand calling for payment of the taxpayers deficiency tax or taxes shall state

the fact, the law, rules and regulations or jurisprudence on which the assessment is based,

otherwise the formal letter of demand and the notice of assessment shall be void. l

From the documents gathered and the data obtained therein, the substantial underdeclaration as

defined under Section 248(B) of the NIRC of 1997 by your corporation of its income had been

confirmed. Tax amnesty is a general pardon to taxpayers who want to start a clean tax slate. It also

gives the government a chance to collect uncollected tax from tax evaders without having to go

through the tedious process of a tax case. Even assuming arguendo that the issuance of RR No. 2-99

is in the nature of tax amnesty, it bears noting that a tax amnesty, much like a tax exemption, is

never favored nor presumed in law and if granted by statute, the terms of the amnesty like that of a

tax exemption must be construed strictly against the taxpayer and liberally in favor of the taxing

authority.

The determination of probable cause is part of the discretion granted to the investigating prosecutor

and ultimately, the Secretary of Justice. However, this Court and the CA possess the power to review

findings of prosecutors in preliminary investigations. Although policy considerations call for the widest

latitude of deference to the prosecutors findings, courts should never shirk from exercising their

power, when the circumstances warrant, to determine whether the prosecutors findings are supported

by the facts, or by the law. In so doing, courts do not act as prosecutors but as organs of the

judiciary, exercising their mandate under the Constitution, relevant statutes, and remedial rules to

settle cases and controversies. Clearly, the power of the Secretary of Justice to review does not

preclude this Court and the CA from intervening and exercising our own powers of review with respect

to the DOJs findings, such as in the exceptional case in which grave abuse of discretion is committed,

as when a clear sufficiency or insufficiency of evidence to support a finding of probable cause is

ignored.

COMMISSIONER OF INTERNAL REVENUE, v. McGEORGE FOOD INDUSTRIES, INC.

G.R. No. 174157 : October 20, 2010

FACTS

On 15 April 1998, more than three months after Republic Act No. 8424 or the Tax Reform Act of 1997

(1997 NIRC) took effect on 1 January 1998, respondent McGeorge Food Industries, Inc. (respondent)

filed with the Bureau of Internal Revenue (BIR) its final adjustment income tax return for the calendar

year ending 31 December 1997. The return indicated a tax liability of P5,393,988 against a total

payment of P10,130,176 for the first three quarters,3 resulting in a net overpayment of P4,736,188.

cra1aw

Exercising its option to either seek a refund of this amount or carry it over to the succeeding year as

tax credit, respondent chose the latter, indicating in its 1997 final return that it wished the amount "to

be applied as credit to next year.

On 15 April 1999, respondent filed its final adjustment return for the calendar year ending 31

December 1998, indicating a tax liability of P5,799,056. Instead of applying to this amount its unused

tax credit carried over from 1997 (P4,736,188), as it was supposed to do, respondent merely

deducted from its tax liability the taxes withheld at source for 1998 (P217,179) and paid the balance

of P5,581,877.

TAXATION I CASES Page 16

On 14 April 2000, respondent simultaneously filed with the BIR and the Court of Tax Appeals (CTA) a

claim for refund of its overpayment in 1997 of P4,736,188. Petitioner Commissioner of Internal

Revenue (petitioner) opposed the suit at the CTA, alleging that the action preempted his own

resolution of respondents parallel claim for refund, and, at any rate, respondent has to prove its

entitlement to refund. The CTA ruled for respondent and ordered petitioner to refund the reduced

a1aw

amount of P4,598,716.98 to account for two tax payments allegedly withheld at source which

respondent failed to substantiate. The CTA held that refund was proper because respondent complie.d

Petitioner appealed to the Court of Appeals.

The Court of Appeals affirmed the CTA, upholding the applicability of Section 69 of the 1977 NIRC. The

Court of Appeals likewise sustained the CTAs finding on the timeliness and substantiation of

respondents refund claim. Petitioner sought but was denied reconsideration, hence, this petition.

ISSUE

Whether or not respondent is entitled to a tax refund for overpayment in 1997 after it opted, but

failed, to credit such to its tax liability in 1998.

RULING

We hold that respondent is not entitled to a refund under Section 76 of the 1997 NIRC, the law in

effect at the time respondent made known to the BIR its preference to carry over and apply its

overpayment in 1997 to its tax liability in 1998. In lieu of refund, respondents overpayment should be

applied to its tax liability for the taxable years following 1998 until it is fully credited. Section 76 of the

1997 NIRC Controls

As respondent opted to carry-over and credit its overpayment in 1997 to its tax liability in 1998,

Section 76 makes respondents exercise of such option irrevocable, barring it from later switching

options to "[apply] for cash refund." Instead, respondents overpayment in 1997 will be carried over to

the succeeding taxable years until it has been fully applied to respondents tax liabilities.

Section 76 remains clear and unequivocal. Once the carry-over option is taken, actually or

constructively, it becomes irrevocable. Petitioner has chosen that option for its 1998 creditable

withholding taxes. Thus, it is no longer entitled to a tax refund of P459,756.07, which corresponds to

its 1998 excess tax credit. Nonetheless, the amount will not be forfeited in the government’s favor,

because it may be claimed by petitioner as tax credits in the succeeding taxable years. Accordingly,

we hold that under Section 76 of the 1997 NIRC, respondents claim for refund is unavailing. However,

respondent is entitled to apply its unused creditable overpayment in 1997 to its tax liability arising

after 1998 until such has been fully applied.

COMMISSIONER OF INTERNAL REVENUE v. HAMBRECHT & QUIST PHILIPPINES,

INC.,

G.R. No. 169225 : November 17, 2010

FACTS

In a letter dated February 15, 1993, respondent informed the Bureau of Internal Revenue

(BIR), through its West-Makati District Office of its change of business address from the 2nd

Floor Corinthian Plaza, Paseo de Roxas, Makati City to the 22nd Floor PCIB Tower II, Makati

Avenue corner H.V. De la Costa Streets, Makati City. Said letter was duly received by the

TAXATION I CASES Page 17

BIR-West Makati on February 18, 1993. On November 4, 1993, respondent received a tracer

letter or follow-up letter dated October 11, 1993 issued by the Accounts Receivable/Billing

Division of the BIR’s National Office and signed by then Assistant Chief Mr. Manuel B. Mina,

demanding for payment of alleged deficiency income and expanded withholding taxes for

the taxable year 1989 amounting to P2,936,560.87. On December 3, 1993, respondent,

through its external auditors, filed with the same Accounts Receivable/Billing Division of the

BIR’s National Office, its protest letter against the alleged deficiency tax assessments for

1989 as indicated in the said tracer letter dated October 11, 1993.

The alleged deficiency income tax assessment apparently resulted from an adjustment

made to respondent’s taxable income for the year 1989, on account of the disallowance of

certain items of expense, namely, professional fees paid, donations, repairs and

maintenance, salaries and wages, and management fees. The latter item of expense, the

management fees, made up the bulk of the disallowance, the examiner alleging, among

others, that petitioner failed to withhold the appropriate tax thereon. This is also the same

basis for the imposition of the deficiency withholding tax assessment on the management

fees. Revenue Regulations No. 6-85 (EWT Regulations) does not impose or prescribe EWT

on management fees paid to a non-resident.

On November 7, 2001, nearly eight (8) years later, respondent’s external auditors received

a letter from herein petitioner Commissioner of Internal Revenue dated October 27, 2001.

The letter advised the respondent that petitioner had rendered a final decision denying its

protest on the ground that the protest against the disputed tax assessment was allegedly

filed beyond the 30-day reglementary period prescribed in then Section 229 of the National

Internal Revenue Code.

On December 6, 2001, respondent filed a Petition for Review docketed as CTA Case No.

6362 before the then Court of Tax Appeals, pursuant to Section 7 of Republic Act No. 1125,

otherwise known as an ‘Act Creating the Court of Tax Appeals’ and Section 228 of the NIRC,

to appeal the final decision of the Commissioner of Internal Revenue denying its protest

against the deficiency income and withholding tax assessments issued for taxable year

1989.[3] cralaw

In a Decision dated September 24, 2004, the CTA Original Division held that the subject

assessment notice sent by registered mail on January 8, 1993 to respondent’s former place

of business was valid and binding since respondent only gave formal notice of its change of

address on February 18, 1993. Thus, the assessment had become final and unappealable

for failure of respondent to file a protest within the 30-day period provided by law.

However, the CTA (a) held that the CIR failed to collect the assessed taxes within the

prescriptive period; and (b) directed the cancellation and withdrawal of Assessment Notice

No. 001543-89-5668. Petitioner’s Motion for Reconsideration and Supplemental Motion for

Reconsideration of said Decision filed on October 14, 2004 and November 22, 2004,

respectively, were denied for lack of merit.

Hence, the instant Petition

ISSUES

1. WHETHER OR NOT THE COURT OF TAX APPEALS HAS JURISDICTION TO RULE THAT THE

GOVERNMENT’S RIGHT TO COLLECT THE TAX HAS PRESCRIBED.

2. WHETHER OR NOT THE PERIOD TO COLLECT THE ASSESSMENT HAS PRESCRIBED.[5] cra law

TAXATION I CASES Page 18

RULING

The court held that the petition was without merit

The jurisdiction of the CTA is governed by Section 7 of Republic Act No. 1125, as amended,

and the term “other matters” referred to by the CIR in its argument can be found in number

(1) of the aforementioned provision.

Plainly, the assailed CTA En Banc Decision was correct in declaring that there was nothing in

the foregoing provision upon which petitioner’s theory with regard to the parameters of the

term “other matters” can be supported or even deduced. What is rather clearly apparent,

however, is that the term “other matters” is limited only by the qualifying phrase that

follows it.

In the case at bar, the issue at hand is whether or not the BIR’s right to collect taxes had

already prescribed and that is a subject matter falling under Section 223(c) of the 1986

NIRC, the law applicable at the time the disputed assessment was made. Thus, from the

foregoing, the issue of prescription of the BIR’s right to collect taxes may be considered as

covered by the term “other matters” over which the CTA has appellate jurisdiction.

With respect to the second issue, the CIR insists that its right to collect the tax deficiency it

assessed on respondent is not barred by prescription since the prescriptive period thereof

was allegedly suspended by respondent’s request for reinvestigation. Based on the facts of

this case, we find that the CIR’s contention is without basis.

The plain and unambiguous wording of the said provision dictates that two requisites must

concur before the period to enforce collection may be suspended: (a) that the taxpayer

requests for reinvestigation, and (b) that petitioner grants such request. Consequently, the

mere filing of a protest letter which is not granted does not operate to suspend the running

of the period to collect taxes. In the case at bar, the records show that respondent filed a

request for reinvestigation on December 3, 1993, however, there is no indication that

petitioner acted upon respondent’s protest.

Since the CIR failed to disprove the aforementioned findings of fact of the CTA which are

borne by substantial evidence on record, this Court is constrained to uphold them as binding

and true. This is in consonance with our oft-cited ruling that instructs this Court to not

lightly set aside the conclusions reached by the CTA, which, by the very nature of its

functions, is dedicated exclusively to the resolution of tax problems and has accordingly

developed an expertise on the subject unless there has been an abuse or improvident

exercise of authority.

COMMISSIONER OF INTERNAL REVENUE VS. METRO STAR SUPERAMA, INC

G.R. No. 185371 : December 08, 2010

FACTS

Petitioner is a domestic corporation duly organized and existing by virtue of the laws of the Republic of

the Philippines. On January 26, 2001, the Regional Director of Revenue Region No. 10, Legazpi City,

issued Letter of Authority No. 00006561 for Revenue Officer Daisy G. Justiniana to examine

petitioner's books of accounts and other accounting records for income tax and other internal revenue

taxes for the taxable year 1999. Said Letter of Authority was revalidated on August 10, 2001 by

TAXATION I CASES Page 19

Regional Director Leonardo Sacamos. On April 11, 2002, petitioner received a Formal Letter of

Demand dated April 3, 2002 from Revenue District No. 67, Legazpi City, assessing petitioner the

amount of Two Hundred Ninety Two Thousand Eight Hundred Seventy Four Pesos and Sixteen

Centavos (P292,874.16.) for deficiency value-added and withholding taxes for the taxable year 1999,

computed as follows:

Subsequently, Revenue District Office No. 67 sent a copy of the Final Notice of Seizure dated May 12,

2003, which petitioner received on May 15, 2003, giving the latter last opportunity to settle its

deficiency tax liabilities within ten (10) [days] from receipt thereof, otherwise respondent BIR shall be

constrained to serve and execute the Warrants of Distraint and/or Levy and Garnishment to enforce

collection. On February 6, 2004, petitioner received from Revenue District Office No. 67 a Warrant of

Distraint and/or Levy No. 67-0029-23 dated May 12, 2003 demanding payment of deficiency value-

added tax and withholding tax payment in the amount of P292,874.16. On July 30, 2004, petitioner

filed with the Office of respondent Commissioner a Motion for Reconsideration pursuant to Section

3.1.5 of Revenue Regulations No. 12-99. On February 8, 2005, respondent Commissioner, through its

authorized representative, Revenue Regional Director of Revenue Region 10, Legaspi City, issued a

Decision denying petitioner's Motion for Reconsideration. Petitioner, through counsel received said

Decision on February 18, 2005. Denying that it received a Preliminary Assessment

Notice (PAN) and claiming that it was not accorded due process, Metro Star filed a petition for

review with the CTA.

The CTA-Second Division found merit in the petition of Metro Star and, on March 21, 2007. The CIR

sought reconsideration of the decision of the CTA-Second Division, but the motion was denied in the

latter's July 24, 2007 Resolution Aggrieved, the CIR filed a petition for review with the CTA-En Banc,

but the petition was dismissed after a determination that no new matters were raised. The motion for

reconsideration filed by the CIR was likewise denied by the CTA-En Banc in its November 18, 2008

Resolution

ISSUE

WHWTHER OR NOT METROSTAR WAS DENIED DUE PROCESS

RULING

The general rule is that the Court will not lightly set aside the conclusions reached by the CTA which,

by the very nature of its functions, has accordingly developed an exclusive expertise on the resolution

unless there has been an abuse or improvident exercise of authority.

Jurisprudence is replete with cases holding that if the taxpayer denies ever having received an

assessment from the BIR, it is incumbent upon the latter to prove by competent evidence

that such notice was indeed received by the addressee. The Supreme Court has consistently

held that while a mailed letter is deemed received by the addressee in the course of mail, this is

merely a disputable presumption subject to controversion and a direct denial thereof shifts the burden

to the party favored by the presumption to prove that the mailed letter was indeed received by the

addressee.

The failure of the respondent to prove receipt of the assessment by the Petitioner leads to the

conclusion that no assessment was issued. Consequently, the government's right to issue an

assessment for the said period has already prescribed. (Industrial Textile Manufacturing Co. of the

Phils., Inc. vs. CIR CTA Case 4885, August 22, 1996). (Emphases supplied.)

The Court agrees with the CTA that the CIR failed to discharge its duty and present any evidence to

show that Metro Star indeed received the PAN dated January 16, 2002. It could have simply presented

the registry receipt or the certification from the postmaster that it mailed the PAN, but failed. Neither

did it offer any explanation on why it failed to comply with the requirement of service of the PAN. It

merely accepted the letter of Metro Star's chairman dated April 29, 2002, that stated that he had

received the FAN dated April 3, 2002, but not the PAN; that he was willing to pay the tax as computed

TAXATION I CASES Page 20

by the CIR; and that he just wanted to clarify some matters with the hope of lessening its tax liability.

The taxpayers shall be informed in writing of the law and the facts on which the

assessment is made; otherwise, the assessment shall be void. Within a period to be prescribed

by implementing rules and regulations, the taxpayer shall be required to respond to said notice. If the

taxpayer fails to respond, the Commissioner or his duly authorized representative shall issue an

assessment based on his findings. Such assessment may be protested administratively by filing a

request for reconsideration or reinvestigation within thirty (30) days from receipt of the assessment in

such form and manner as may be prescribed by implementing rules and regulations. Within sixty (60)

days from filing of the protest, all relevant supporting documents shall have been submitted;

otherwise, the assessment shall become final. If the protest is denied in whole or in part, or is not

acted upon within one hundred eighty (180) days from submission of documents, the taxpayer

adversely affected by the decision or inaction may appeal to the Court of Tax Appeals within thirty

(30) days from receipt of the said decision, or from the lapse of one hundred eighty (180)-day period;

otherwise, the decision shall become final, executory and demandable.

From the provision quoted above, it is clear that the sending of a PAN to taxpayer to inform him of the

assessment made is but part of the "due process requirement in the issuance of a deficiency tax

assessment," the absence of which renders nugatory any assessment made by the tax authorities. It

is an elementary rule enshrined in the 1987 Constitution that no person shall be deprived of property

without due process of law. In balancing the scales between the power of the State to tax and its

inherent right to prosecute perceived transgressors of the law on one side, and the constitutional

rights of a citizen to due process of law and the equal protection of the laws on the other, the scales

must tilt in favor of the individual, for a citizen's right is amply protected by the Bill of Rights under

the Constitution. Thus, while "taxes are the lifeblood of the government," the power to tax has its

limits, in spite of all its plenitude.

But even as we concede the inevitability and indispensability of taxation, it is a requirement

in all democratic regimes that it be exercised reasonably and in accordance with the

prescribed procedure. If it is not, then the taxpayer has a right to complain and the courts will then

come to his succor.

LASCONA LAND CO., INC. VS. COMMISSIONER OF INTERNAL REVENUE

G.R. No. 171251 : March 05, 2012

FACTS

On March 27, 1998, the Commissioner of Internal Revenue (CIR) issued Assessment Notice No.

0000047-93-407 against Lascona Land Co., Inc. (Lascona) informing the latter of its alleged deficiency

income tax for the year 1993 in the amount of P753,266.56. Consequently, on April 20, 1998, Lascona

filed a letter protest, but was denied by Norberto R. Odulio, Officer-in-Charge (OIC), Regional

Director, Bureau of Internal Revenue, Revenue Region No. 8, Makati City, On April 12, 1999, Lascona

appealed the decision before the CTA and was docketed as C.T.A. Case No. 5777. Lascona alleged that

the Regional Director erred in ruling that the failure to appeal to the CTA within thirty (30) days from

the lapse of the 180-day period rendered the assessment final and executory. The CIR, however,

maintained that Lascona's failure to timely file an appeal with the CTA after the lapse of the 180-day

reglementary period provided under Section 228 of the National Internal Revenue Code (NIRC)

resulted to the finality of the assessment. On January 4, 2000, the CTA, in its Decision nullified the

subject assessment. It held that in cases of inaction by the CIR on the protested assessment, Section

228 of the NIRC provided two options for the taxpayer: (1) appeal to the CTA within thirty (30) days

from the lapse of the one hundred eighty (180)-day period, or (2) wait until the Commissioner decides

on his protest before he elevates the case. The CIR moved for reconsideration. On March 3, 2000, the

CTA denied the CIR's motion for reconsideration for lack of meritDissatisfied, the CIR filed an appeal

before the CA. In the disputed Decision dated October 25, 2005, the Court of Appeals granted the

TAXATION I CASES Page 21

CIR's petition and set aside the Decision dated January 4, 2000 of the CTA and its Resolution dated

March 3, 2000. It further declared that the subject Assessment Notice No. 0000047-93-407 dated

March 27, 1998 as final, executory and demandable. Lascona moved for reconsideration, but was

denied for lack of merit, thus, the instant petition.

ISSUES

1. WHETHER OR NOT THE SUBJECT ASSESSMENT HAS BECOME FINAL, EXECUTORY AND

DEMANDABLE DUE TO THE FAILURE OF THE PETITIONER TO FILE AN APPEAL ON TIME.

RULING

The court found merit in the petition Within a period to be prescribed by implementing rules and

regulations, the taxpayer shall be required to respond to said notice. If the taxpayer fails to respond,

the Commissioner or his duly authorized representative shall issue an assessment based on his