Professional Documents

Culture Documents

GuruFocus Report FL

Uploaded by

AY6061Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GuruFocus Report FL

Uploaded by

AY6061Copyright:

Available Formats

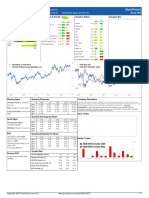

Foot Locker Inc (NYSE:FL) 06/21/2017 1:08AM EST GuruFocus

Price: $ 50.33 (0.00%) Market Cap: $ 6.61 B Enterprise Value: $5.69 B Stock PDF

Financial Strength : 8/10 Profitability & Growth : 8/10 Valuation Ratios Valuation Box

vs vs

vs vs vs vs industry history

industry history industry history

P/E(ttm) 10.31

Cash to Debt 8.26 Operating margin (%) 12.57

Forward P/E N/A

Equity to Asset 0.73 Net-margin (%) 8.39

PE(NRI) 10.31

Interest Coverage 88.91 ROE (%) 24.33

F-Score:

P/B 2.34

ROA (%) 17.25

8

P/S 0.87

Z-Score: ROC (Joel Greenblatt) (%) 56.26

8.11 PFCF 14.15

Revenue Growth (3Y)(%) 10.00

M-Score: POCF 8.96

-2.53 EBITDA Growth (3Y)(%) 17.40

EV-to-EBIT 5.77

WACC vs 4.11% EPS Growth (3Y)(%) 19.90

ROIC 36.03% PEG 0.57

WACC

ROIC Shiller P/E 21.53

Current Ratio 4.90

Quick Ratio 2.51

Days Inventory 92.61

Days Sales Outstanding 4.79

Good Signs Quarterly Revenues Company Description

Piotroski F-Score: High Mar Jun Sep Dec Full Year Foot Locker operates thousands of retail stores throughout the United States, Canada, Europe, Australia, and New

Zealand. It also has one franchisee in the Middle East and one in South Korea, each of which operates multiple

2013 1,713 1,638 1,454 1,622 6,427 stores in those regions. The company mainly sells athletically inspired shoes and apparel. Foot Locker's merchandise

Interest Coverage:

2014 1,791 1,868 1,641 1,731 7,031 comes from only a few suppliers, with Nike providing the majority. Store names include Foot Locker, Champs, and

Comfortable Runners Point. The company also has an e-commerce business selling through Footlocker.com, Eastbay, and Final-

2015 1,911 1,916 1,695 1,794 7,316 Score.... (Read More)

Operating Margin %: 2016 2,007 1,987 1,780 1,886 7,660 Competitors: OTCPK:BELLY, OTCPK:YUEIF, OTCPK:PMMAF, OTCPK:SMSEY, NYSE:SKX, NYSE:WWW,

Expansion 2017 2,113 2,001 NAS:SHOO, NYSE:DECK, NYSE:CAL, OTCPK:MLBGF, OTCPK:GXSBY, NAS:CROX, NAS:FOSL, NAS:VRA,

NAS:WEYS, OTCPK:KMSWF, OTCPK:LESAF, NAS:RCKY, NAS:TLF, OTCPK:JCLY

Dividend Yield %: Close to 5- Quarterly Earnings per Share

year high Guru Trades

Mar Jun Sep Dec Full Year

PE Ratio: Close to 5-year low 2013 0.68 0.90 0.44 0.70 2.72

2014 0.81 1.10 0.63 0.82 3.36

PB Ratio: Close to 3-year low

2015 1.01 1.29 0.84 0.57 3.71

PS Ratio: Close to 3-year low 2016 1.13 1.39 0.94 1.17 4.63

2017 1.41 1.36

DCF Quarterly Dividends Per Share

GuruFocus does not Mar Jun Sep Dec Full Year

calculate intrinsic value: DCF 2013 0.18 0.20 0.20 0.20 0.78

(Earnings Based) for 2014 0.20 0.22 0.22 0.22 0.86

companies with one star 2015 0.22 0.25 0.25 0.25 0.97 Insider Trades

predictability or not rated. But 2016 0.25 0.28 0.28 0.28 1.08

you can go to each stock's 2017 0.28 0.31

DCF page to calculate

Growth Rate

yourself.

Annual Rates(per share) 10-Y 5-Y 12-M

Reverse DCF Revenue Growth (%) 5.50 9.60 8.50

EBITDA Growth (%) 26.60 18.00 18.50

GuruFocus does not

calculate reverse DCF growth Free Cash Flow Growth (%) 28.30 18.40 -5.50

rate for companies with one Book Value Growth (%) 4.10 7.70 9.30

star predictability or not rated.

EPS Growth (%) 0.00 20.20 24.20

But you can go to each

stock's DCF page to calculate

yourself.

Copyright 2015 GuruFocus.com LLC www.gurufocus.com/stock/FL 1/7

Per Share Data

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 TTM Fiscal Period

29.81 30.94 32.09 34.09 35.87 36.65 35.04 34.01 31.06 32.22 36.42 40.14 43.22 48.98 52.64 57.48 58.15 Revenue per Share

2.40 2.89 3.28 3.46 3.72 3.63 0.88 0.27 1.20 2.41 3.58 4.81 5.36 6.57 7.07 8.68 8.57 EBITDA per Share

1.36 1.87 2.30 2.48 2.63 2.52 -0.19 -0.58 0.49 1.73 2.86 4.04 4.48 5.62 6.02 7.51 7.37 EBIT per Share

0.64 1.05 1.39 1.88 1.68 1.60 0.29 -0.52 0.30 1.07 1.80 2.58 2.85 3.56 3.84 4.91 4.88 Earnings per Share (diluted)

0.77 1.10 1.40 1.64 1.67 1.58 0.28 -0.52 0.30 1.07 1.80 2.58 2.85 3.56 3.84 4.91 4.88 eps without NRI

-1.02 0.97 1.02 1.20 1.46 0.15 1.01 0.25 1.78 0.90 2.40 1.88 2.56 3.83 4.35 4.99 4.47 Owner Earnings per Share (TTM)

0.60 1.28 0.85 0.75 1.23 0.10 0.87 1.54 1.64 1.46 2.23 1.64 2.15 3.58 3.67 4.07 3.56 Free Cashflow per Share

-- 0.03 0.15 0.26 0.32 0.40 0.50 0.60 0.60 0.60 0.66 0.72 0.80 0.88 1.00 1.10 1.14 Dividends per Share

7.09 7.86 9.55 11.72 13.04 14.74 14.70 12.42 12.44 13.10 13.92 15.44 16.59 17.72 18.64 20.61 21.50 Book Value per Share

5.73 6.33 7.94 9.12 10.59 12.37 12.36 10.76 10.89 11.69 12.61 14.23 15.06 16.26 17.17 19.11 19.99 Tangible Book per Share

2.85 2.53 2.33 2.34 2.10 1.50 1.43 0.92 0.88 0.89 0.89 0.86 0.92 0.95 0.95 0.97 0.97 Total Debt per Share

15.50 10.10 24.74 26.92 22.72 22.44 13.69 7.36 11.29 17.86 26.24 34.35 38.60 53.22 67.56 68.54 50.33 Month End Stock Price

Ratios

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 TTM Fiscal Period

9.18 14.56 16.66 18.28 13.69 11.61 1.97 -3.81 2.48 8.51 13.45 17.70 17.61 20.83 21.43 25.23 24.33 Return on Equity %

4.05 6.39 7.96 9.85 8.06 7.65 1.39 -2.61 1.69 5.92 9.35 12.37 12.52 14.72 14.72 17.44 17.25 Return on Assets %

19.63 26.97 31.29 30.12 29.38 25.18 -1.76 -6.01 6.06 23.86 39.43 51.92 49.22 57.24 57.26 61.76 56.26 Return on Capital %

10.44 15.50 18.60 17.89 15.31 13.16 -3.32 -4.45 3.26 11.63 19.75 27.34 25.73 30.31 36.63 38.54 36.03 Return on Invested Capital %

9.27 9.23 9.03 11.38 12.13 8.17 4.53 8.62 8.56 10.37 7.38 9.33 8.21 8.95 5.17 4.52 4.11 Weighted Average Cost Of Capital (WACC) %

6.74 6.88 5.20 4.29 2.89 1.07 9.23 6.06 2.14 10.18 5.15 8.21 8.09 8.06 8.33 8.56 8.59 Effective Interest Rate on Debt %

29.87 29.81 30.91 30.49 30.23 30.19 26.12 27.88 27.44 30.03 31.94 32.90 32.79 33.20 33.80 33.94 33.68 Gross Margin %

4.50 5.97 7.16 7.26 7.24 6.92 1.43 -1.97 1.65 5.19 7.86 10.06 10.24 11.31 12.71 12.95 12.57 Operating Margin %

2.10 3.39 4.33 5.47 4.67 4.37 0.83 -1.53 0.99 3.35 4.94 6.42 6.59 7.27 7.30 8.55 8.39 Net Margin %

2.01 4.15 2.66 2.18 3.43 0.28 2.48 4.53 5.29 4.54 6.14 4.09 4.98 7.30 6.98 7.08 6.11 FCF Margin %

0.40 0.32 0.24 0.20 0.16 0.10 0.10 0.07 0.07 0.07 0.06 0.06 0.06 0.05 0.05 0.05 0.05 Debt to Equity

0.43 0.45 0.51 0.57 0.61 0.71 0.70 0.67 0.69 0.70 0.69 0.71 0.72 0.70 0.68 0.71 0.73 Total Equity to Total Asset

0.17 0.14 0.12 0.11 0.10 0.07 0.07 0.05 0.05 0.05 0.04 0.04 0.04 0.04 0.03 0.03 0.03 Total Debt to Total Asset

57.62 56.16 56.82 54.89 52.19 52.92 43.71 47.67 46.79 53.08 60.41 63.39 62.24 67.21 68.14 69.23 69.20 Gross Profit to Total Asset %

1.93 1.88 1.84 1.80 1.73 1.75 1.67 1.71 1.71 1.77 1.89 1.93 1.90 2.03 2.02 2.04 2.05 Asset Turnover

-- 0.03 0.11 0.16 0.19 0.25 1.79 -- 2.00 0.56 0.37 0.28 0.28 0.25 0.26 0.22 0.23 Dividend Payout Ratio

-- -- 3.13 -- -- 3.75 3.36 3.69 -- -- 3.25 4.01 5.55 4.03 4.68 4.79 4.79 Days Sales Outstanding

32.33 28.95 25.87 37.36 33.41 23.28 21.17 18.07 22.28 23.04 22.89 26.22 21.96 23.00 20.75 17.72 14.71 Days Accounts Payable

90.51 93.87 97.00 102 111 116 117 116 112 108 101 98.38 99.64 94.36 94.28 92.21 92.61 Days Inventory

58.18 64.92 74.26 64.19 77.88 96.73 99.59 102 89.49 85.23 81.84 76.17 83.23 75.39 78.21 79.28 82.69 Cash Conversion Cycle

4.03 3.89 3.76 3.59 3.28 3.14 3.11 3.15 3.27 3.37 3.60 3.71 3.66 3.87 3.87 3.96 3.94 Inventory Turnover

0.70 0.70 0.69 0.70 0.70 0.70 0.74 0.72 0.73 0.70 0.68 0.67 0.67 0.67 0.66 0.66 0.66 COGS to Revenue

0.17 0.18 0.18 0.19 0.21 0.22 0.24 0.23 0.22 0.21 0.19 0.18 0.18 0.17 0.17 0.17 0.17 Inventory to Revenue

Copyright 2015 GuruFocus.com LLC www.gurufocus.com/stock/FL 2/7

Income Statement

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 TTM Fiscal Period

4,379 4,509 4,779 5,355 5,653 5,750 5,437 5,237 4,854 5,049 5,623 6,182 6,505 7,151 7,412 7,766 7,780 Revenue

3,071 3,165 3,302 3,722 3,944 4,014 4,017 3,777 3,522 3,533 3,827 4,148 4,372 4,777 4,907 5,130 5,160 Cost of Goods Sold

1,308 1,344 1,477 1,633 1,709 1,736 1,420 1,460 1,332 1,516 1,796 2,034 2,133 2,374 2,505 2,636 2,620 Gross Profit

29.87 29.81 30.91 30.49 30.23 30.19 26.12 27.88 27.44 30.03 31.94 32.90 32.79 33.20 33.80 33.94 33.68 Gross Margin %

923 928 987 1,088 1,129 1,163 1,176 1,174 1,099 1,138 1,244 1,294 1,334 1,426 1,415 1,472 1,482 Selling, General, & Admin. Expense

188 147 148 156 171 175 166 389 153 116 110 118 133 139 148 158 160 Other Operating Expense

197 269 342 389 409 398 78.00 -103 80.00 262 442 622 666 809 942 1,006 978 Operating Income

4.50 5.97 7.16 7.26 7.24 6.92 1.43 -1.97 1.65 5.19 7.86 10.06 10.24 11.31 12.71 12.95 12.57 Operating Margin %

-- -- -- -- -- -- 20.00 16.00 13.00 5.00 13.00 6.00 6.00 6.00 7.00 9.00 9.00 Interest Income

-24.00 -26.00 -18.00 -15.00 -10.00 -3.00 -21.00 -11.00 -3.00 -14.00 -7.00 -11.00 -11.00 -11.00 -11.00 -11.00 -11.00 Interest Expense

-24.00 -26.00 -18.00 -15.00 -10.00 -3.00 -1.00 5.00 10.00 -9.00 -6.00 -5.00 -5.00 -5.00 -4.00 -2.00 -2.00 Net Interest Income

2.00 3.00 -- -- 6.00 -3.00 -127 -2.00 -17.00 4.00 -1.00 -10.00 2.00 5.00 -101 -- -1.00 Other Income (Expense)

175 246 324 374 405 392 -50.00 -100.00 73.00 257 435 607 663 809 837 1,004 975 Pre-Tax Income

-64.00 -84.00 -115 -119 -142 -145 93.00 21.00 -26.00 -88.00 -157 -210 -234 -289 -296 -340 -322 Tax Provision

36.57 34.15 35.49 31.82 35.06 36.99 186 21.00 35.62 34.24 36.09 34.60 35.29 35.72 35.36 33.86 33.03 Tax Rate %

111 162 209 255 263 247 43.00 -79.00 47.00 169 278 397 429 520 541 664 653 Net Income (Continuing Operations)

-19.00 -9.00 -1.00 38.00 1.00 3.00 2.00 -1.00 1.00 -- -- -- -- -- -- -- -- Net Income (Discontinued Operations)

92.00 153 207 293 264 251 45.00 -80.00 48.00 169 278 397 429 520 541 664 653 Net Income

2.10 3.39 4.33 5.47 4.67 4.37 0.83 -1.53 0.99 3.35 4.94 6.42 6.59 7.27 7.30 8.55 8.39 Net Margin %

0.66 1.09 1.46 1.94 1.71 1.62 0.30 -0.52 0.30 1.08 1.81 2.62 2.89 3.61 3.89 4.95 4.91 EPS (Basic)

0.64 1.05 1.39 1.88 1.68 1.60 0.29 -0.52 0.30 1.07 1.80 2.58 2.85 3.56 3.84 4.91 4.88 EPS (Diluted)

147 146 149 157 158 157 155 154 156 157 154 154 151 146 141 135 133 Shares Outstanding (Diluted

Average)

154 149 147 154 171 175 166 130 112 106 110 118 133 139 148 158 160 Depreciation, Depletion and

Amortization

353 421 489 543 586 570 137 41.00 188 377 552 740 807 959 996 1,173 1,146 EBITDA

Copyright 2015 GuruFocus.com LLC www.gurufocus.com/stock/FL 3/7

Balance Sheet

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 TTM Fiscal Period

215 357 190 225 289 221 488 385 582 696 851 880 858 967 1,021 1,046 1,049 Cash And Cash Equivalents

-- -- 258 267 298 263 5.00 23.00 7.00 -- -- 48.00 9.00 -- -- -- -- Marketable Securities

215 357 448 492 587 484 493 408 589 696 851 928 867 967 1,021 1,046 1,049 Cash, Cash Equivalents, Marketable

Securities

-- -- 41.00 -- -- 59.00 50.00 53.00 -- -- 50.00 68.00 99.00 79.00 95.00 102 102 Accounts Receivable

-- -- -- -- -- -- -- -- -- -- -- -- -- 1,250 1,285 1,307 1,279 Inventories, Finished Goods

793 835 920 1,151 1,254 1,303 1,281 1,120 1,037 1,059 1,069 1,167 1,220 -- -- -- -- Inventories, Other

793 835 920 1,151 1,254 1,303 1,281 1,120 1,037 1,059 1,069 1,167 1,220 1,250 1,285 1,307 1,279 Total Inventories

107 92.00 110 189 173 188 240 183 146 179 109 200 164 160 205 178 294 Other Current Assets

1,115 1,284 1,519 1,832 2,014 2,034 2,064 1,764 1,772 1,934 2,079 2,363 2,350 2,456 2,606 2,633 2,622 Total Current Assets

-- -- -- -- -- -- -- -- -- -- 5.00 -- -- -- -- -- -- Investments And Advances

3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 6.00 6.00 4.00 4.00 4.00 4.00 Land And Improvements

36.00 33.00 342 381 31.00 368 304 240 31.00 31.00 31.00 41.00 44.00 44.00 43.00 43.00 43.00 Buildings And Improvements

963 1,012 1,029 1,086 1,441 1,153 1,117 1,018 792 778 799 832 888 909 962 1,031 1,031 Machinery, Furniture, Equipment

1,234 1,311 1,374 1,470 1,475 1,524 1,424 1,261 1,527 1,525 1,562 1,651 1,752 1,736 1,813 1,927 1,927 Gross Property, Plant and Equipment

-597 -675 -706 -755 -800 -870 -903 -829 -1,140 -1,139 -1,135 -1,161 -1,162 -1,116 -1,152 -1,162 -1,162 Accumulated Depreciation

637 636 668 715 675 654 521 432 387 386 427 490 590 620 661 765 792 Property, Plant and Equipment

191 216 232 406 380 369 362 257 244 217 198 185 230 206 201 197 199 Intangible Assets

-- -- -- -- -- 264 266 144 145 145 144 145 163 157 156 155 156 Goodwill

357 350 294 284 243 192 301 424 413 359 341 329 317 295 307 245 264 Other Long Term Assets

2,300 2,486 2,713 3,237 3,312 3,249 3,248 2,877 2,816 2,896 3,050 3,367 3,487 3,577 3,775 3,840 3,877 Total Assets

272 251 234 381 361 256 233 187 215 223 240 298 263 301 279 249 208 Accounts Payable

-- -- -- -- -- -- -- -- -- -- 48.00 45.00 61.00 66.00 95.00 71.00 71.00 Total Tax Payable

211 296 300 285 305 108 105 117 218 266 65.00 108 134 235 217 243 327 Other Accrued Expense

483 547 534 666 666 364 338 304 433 489 353 451 458 602 591 563 535 Accounts Payable & Accrued

Expense

34.00 1.00 -- 18.00 51.00 14.00 -- -- -- -- -- -- 3.00 2.00 1.00 -- -- Current Portion of Long-Term Debt

-- -- -- -- -- -- -- -- -- -- 30.00 34.00 38.00 44.00 46.00 49.00 49.00 Current Deferred Revenue

-- -- -- -- -- 4.00 13.00 10.00 -- -- 24.00 31.00 46.00 48.00 62.00 -- -- Current Deferred Taxes Liabilities

-- -- -- -- -- 4.00 13.00 10.00 -- -- 54.00 65.00 84.00 92.00 108 49.00 49.00 DeferredTaxAndRevenue

29.00 24.00 11.00 -- -- 134 150 104 -- -- 141 120 81.00 -- -- -- -- Other Current Liabilities

546 572 545 684 717 516 501 418 433 489 548 636 626 696 700 612 535 Total Current Liabilities

365 356 335 347 275 220 221 142 138 137 135 -- -- -- -- -- -- Long-Term Debt

365 356 335 347 275 220 221 142 138 137 135 133 136 132 129 127 127 Long-Term Debt & Capital Lease

Obligation

0.40 0.32 0.24 0.20 0.16 0.10 0.10 0.07 0.07 0.07 0.06 0.06 0.06 0.05 0.05 0.05 0.05 Debt to Equity

-- -- -- -- -- -- -- -- -- -- 95.00 61.00 48.00 73.00 90.00 48.00 48.00 PensionAndRetirementBenefit

-- -- -- -- -- -- 15.00 12.00 -- -- 5.00 5.00 18.00 14.00 13.00 3.00 3.00 NonCurrent Deferred Liabilities

397 448 458 376 293 218 240 381 297 245 157 155 163 166 290 340 393 Other Long-Term Liabilities

1,308 1,376 1,338 1,407 1,285 954 977 953 868 871 940 990 991 1,081 1,222 1,130 1,055 Total Liabilities

363 378 411 608 635 -- -- -- 709 735 779 856 921 979 1,108 900 914 Common Stock

797 946 1,132 1,386 1,601 1,785 1,760 1,581 1,535 1,611 1,788 2,076 2,387 2,780 3,182 2,254 2,393 Retained Earnings

-168 -213 -167 -162 -171 -96.00 -66.00 -246 -193 -169 -204 -171 -186 -319 -366 -363 -357 Accumulated other comprehensive

income (loss)

-- -- -- -- -- 653 676 691 -- -- -- -- -- -- -- -- -- Additional Paid-In Capital

-- -1.00 -1.00 -2.00 -38.00 -47.00 -99.00 -102 -103 -152 -253 -384 -626 -944 -1,371 -81.00 -128 Treasury Stock

992 1,110 1,375 1,830 2,027 2,295 2,271 1,924 1,948 2,025 2,110 2,377 2,496 2,496 2,553 2,710 2,822 Total Equity

0.43 0.45 0.51 0.57 0.61 0.71 0.70 0.67 0.69 0.70 0.69 0.71 0.72 0.70 0.68 0.71 0.73 Total Equity to Total Asset

Copyright 2015 GuruFocus.com LLC www.gurufocus.com/stock/FL 4/7

Cashflow Statement

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 TTM Fiscal Period

92.00 153 207 293 264 251 45.00 -80.00 48.00 169 278 397 429 520 541 664 653 Net Income

92.00 153 207 293 264 251 45.00 -79.00 47.00 169 278 397 429 520 541 664 653 Net Income From Continuing

Operations

154 149 147 154 171 175 166 130 112 106 110 118 133 139 148 158 160 Depreciation, Depletion and

Amortization

-69.00 -22.00 -63.00 -183 -111 -38.00 55.00 128 111 -19.00 -17.00 -91.00 -20.00 -81.00 -49.00 -25.00 -33.00 Change In Inventory

9.00 -22.00 -17.00 157 14.00 -103 -36.00 -50.00 2.00 42.00 57.00 53.00 -58.00 84.00 -17.00 -4.00 -3.00 Change In Payables And Accrued

Expense

-137 -8.00 -94.00 -195 -115 -281 69.00 114 237 -25.00 90.00 -116 -66.00 27.00 74.00 23.00 -33.00 Change In Working Capital

38.00 38.00 -5.00 50.00 24.00 21.00 -129 -44.00 2.00 84.00 29.00 20.00 19.00 20.00 -6.00 -1.00 -- Change In DeferredTax

-- -- -- -- -- -- -- 9.00 12.00 13.00 18.00 20.00 25.00 24.00 22.00 22.00 22.00 Stock Based Compensation

-- -- -- -- -- -- -- -- -1.00 -- -- -- -- -- -- -- -- Cash Flow from Discontinued

Operations

57.00 5.00 16.00 -29.00 5.00 15.00 132 253 -63.00 -21.00 -28.00 -23.00 -10.00 -18.00 -34.00 -50.00 -51.00 Cash Flow from Others

204 337 271 273 349 181 283 383 346 326 497 416 530 712 745 816 751 Cash Flow from Operations

-116 -150 -144 -156 -155 -165 -148 -146 -89.00 -97.00 -152 -163 -206 -190 -228 -266 -276 Purchase Of Property, Plant,

Equipment

1.00 6.00 -- -- -- -- -- -- -- -- -- -- -- 5.00 -- -- -- Sale Of Property, Plant, Equipment

-- -- -- -- -- -- -- -106 -- -- -- -- -81.00 -- -2.00 -- -- Purchase Of Business

-- -536 -1,546 -2,884 -2,798 -1,992 -1,378 -23.00 -- -- -- -88.00 -23.00 -- -- -- -- Purchase Of Investment

19.00 384 1,440 2,875 2,767 2,041 1,641 -- 16.00 9.00 -- 39.00 60.00 9.00 -- -- -- Sale Of Investment

-- -- -- -- -- -- -- -- 1.00 -- -- -- -- -- -- -- -- Net Intangibles Purchase And Sale

-20.00 -18.00 -15.00 -242 4.00 8.00 2.00 3.00 -- 1.00 3.00 -- 2.00 -- -- -- -- Cash From Other Investing Activities

-116 -314 -265 -407 -182 -108 117 -272 -72.00 -87.00 -149 -212 -248 -176 -230 -266 -276 Cash Flow from Investing

9.00 10.00 27.00 33.00 14.00 12.00 9.00 2.00 3.00 13.00 22.00 48.00 30.00 22.00 69.00 33.00 -- Issuance of Stock

-- -- -- -- -35.00 -8.00 -50.00 -- -- -50.00 -104 -129 -229 -305 -419 -432 -382 Repurchase of Stock

88.00 -42.00 -19.00 175 -35.00 -87.00 -21.00 -94.00 -3.00 -- -- -2.00 -1.00 -3.00 -2.00 -3.00 -- Net Issuance of Debt

-- -4.00 -21.00 -39.00 -49.00 -61.00 -77.00 -93.00 -94.00 -93.00 -101 -109 -118 -127 -139 -147 -151 Cash Flow for Dividends

-83.00 -- -- -2.00 -- 2.00 1.00 -- -- 3.00 5.00 11.00 9.00 12.00 35.00 20.00 17.00 Other Financing

14.00 -36.00 -13.00 167 -105 -142 -138 -185 -94.00 -127 -178 -181 -309 -401 -456 -529 -484 Cash Flow from Financing

106 -10.00 -15.00 35.00 64.00 -68.00 267 -103 197 114 155 29.00 -22.00 109 54.00 25.00 -13.00 Net Change in Cash

-116 -150 -144 -156 -155 -165 -148 -146 -89.00 -97.00 -152 -163 -206 -190 -228 -266 -276 Capital Expenditure

88.00 187 127 117 194 16.00 135 237 257 229 345 253 324 522 517 550 475 Free Cash Flow

Copyright 2015 GuruFocus.com LLC www.gurufocus.com/stock/FL 5/7

Valuation Ratios

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 TTM Fiscal Period

24.22 9.62 17.93 14.32 13.52 13.94 48.89 -- 37.63 16.69 14.58 13.26 13.54 14.95 17.64 13.96 10.31 PE Ratio(TTM)

-- 10.39 24.30 22.45 15.55 148 13.57 29.92 6.36 19.76 10.92 18.30 15.08 13.90 15.55 13.73 11.27 Price to Owner Earnings

(TTM)

2.19 1.28 2.59 2.30 1.74 1.52 0.93 0.59 0.91 1.36 1.89 2.23 2.33 3.00 3.62 3.33 2.34 Price to Book

2.71 1.60 3.12 2.95 2.15 1.81 1.11 0.68 1.04 1.53 2.08 2.41 2.56 3.27 3.93 3.59 2.52 Price to Tangible Book

27.24 7.51 27.77 36.43 18.29 264 16.22 4.80 6.88 12.22 11.70 20.93 17.94 14.87 18.33 16.81 14.15 Price-to-Free-Cash-Flow

Ratio

11.41 4.23 13.32 15.54 10.21 19.79 7.62 2.97 5.11 8.58 8.13 12.72 10.96 10.91 12.74 11.34 8.96 Price-to-Operating-Cash-Flow

Ratio

0.51 0.32 0.77 0.79 0.63 0.61 0.39 0.22 0.36 0.55 0.72 0.86 0.89 1.09 1.28 1.19 0.87 PS Ratio

9.77 0.75 1.08 2.41 1.42 1.71 -- -- -- -- -- -- -- 0.41 0.79 0.82 0.57 PEG Ratio

0.54 0.32 0.72 0.76 0.58 0.56 0.34 0.17 0.27 0.44 0.58 0.71 0.75 0.93 1.13 1.04 0.73 EV-to-Revenue

6.66 3.39 7.05 7.49 5.58 5.69 13.45 21.33 7.00 5.84 5.91 5.91 6.05 6.95 8.40 6.90 4.96 EV-to-EBITDA

11.82 5.24 10.08 10.48 7.88 8.21 -63.54 -9.83 17.32 8.13 7.38 7.03 7.25 8.13 9.86 7.97 5.77 EV-to-EBIT

8.46 19.08 9.92 9.54 12.69 12.18 -1.57 -10.17 5.77 12.30 13.55 14.22 13.79 12.30 10.14 12.55 17.33 Return on Capital %

3.05 15.64 20.02 11.48 15.57 12.94 0.42 -15.55 9.48 6.20 5.88 4.95 4.74 41.25 26.37 21.65 22.18 Forward Rate of Return

-- -- 98.01 67.03 30.49 29.37 21.13 10.17 15.13 16.32 21.40 24.92 25.64 32.67 36.59 30.99 21.53 Shiller PE Ratio

-- 0.30 0.61 0.95 1.39 1.76 3.65 8.15 5.31 3.36 2.52 2.10 2.07 1.65 1.48 1.60 2.27 Dividend Yield %

Valuation and Quality

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Jan16 Jan17 TTM Fiscal Period

2,169 1,426 3,561 4,202 3,533 3,494 2,115 1,140 1,767 2,762 3,979 5,290 5,809 7,497 9,254 9,013 6,608 Market Cap

2,353 1,426 3,448 4,075 3,272 3,244 1,843 874 1,316 2,203 3,263 4,495 5,081 6,664 8,363 8,094 5,686 Enterprise Value

15.50 10.10 24.74 26.92 22.72 22.44 13.69 7.36 11.29 17.86 26.24 34.35 38.60 53.22 67.56 68.54 50.33 Month End Stock Price

-7.81 -7.22 -6.18 -5.86 -4.49 -3.02 -3.13 -3.52 -1.78 -1.13 -0.59 -0.40 -0.82 -0.81 -1.47 -0.64 -0.05 Net Cash (per share)

-1.38 -0.65 1.26 2.72 4.69 6.94 7.04 5.23 5.77 6.87 7.51 8.92 9.03 9.76 10.10 11.43 11.94 Net Current Asset Value (per

share)

-4.98 -4.26 -2.77 -2.18 -0.46 1.45 1.26 0.35 1.53 2.29 3.19 3.72 3.72 4.05 3.74 4.91 4.83 Net-Net Working Capital (per

share)

6.70 7.73 11.53 18.79 21.71 20.05 19.24 18.51 19.60 21.19 23.64 27.35 31.91 47.00 53.72 62.93 63.17 Projected FCF (per share)

21.98 22.72 23.34 24.88 26.19 26.69 25.50 24.67 22.69 23.52 26.59 29.30 31.57 35.77 38.43 41.96 42.45 Median PS (per share)

4.91 13.41 22.82 11.17 16.02 13.15 -- -- -- -- 9.37 64.63 -- 89.00 85.37 83.96 79.10 Peter Lynch Fair Value (per

share)

9.96 12.52 15.81 18.35 19.95 20.97 8.82 -- 8.57 16.78 22.60 28.75 31.07 36.09 38.52 45.95 46.85 Graham Number (per share)

-5.92 -1.58 14.97 18.65 22.24 23.31 35.08 28.90 24.90 24.63 27.17 22.40 30.36 39.86 48.00 55.97 56.60 Earnings Power Value (EPV)

3.97 3.67 4.79 4.87 4.92 5.70 4.26 3.77 4.37 5.33 6.28 7.04 7.45 8.60 9.03 9.13 8.11 Altman Z-Score

6.00 8.00 7.00 5.00 6.00 4.00 6.00 6.00 5.00 7.00 8.00 7.00 6.00 8.00 9.00 8.00 8.00 Piotroski F-Score

-2.71 -2.80 -2.57 -3.21 -2.59 -2.32 -2.65 -3.10 -3.94 -2.83 -2.79 -2.25 -2.18 -2.97 -2.43 -2.61 -2.53 Beneish M-Score

0.53 0.48 0.51 0.63 0.55 0.62 0.62 0.51 0.52 0.52 0.48 0.52 0.53 0.48 0.47 0.47 0.50 Scaled Net Operating Assets

0.17 5.23 7.41 13.19 2.93 5.48 -10.93 -6.64 -8.03 -2.42 -2.30 5.73 4.22 -0.45 0.69 2.97 4.59 Sloan Ratio (%)

2.04 2.24 2.79 2.68 2.81 3.94 4.12 4.22 4.09 3.96 3.79 3.72 3.75 3.53 3.72 4.30 4.90 Current Ratio

0.59 0.78 1.10 1.00 1.06 1.42 1.56 1.54 1.70 1.79 1.84 1.88 1.81 1.73 1.89 2.17 2.51 Quick Ratio

16.72 13.40 25.64 27.17 23.66 24.47 15.04 14.71 12.43 19.81 26.67 35.84 41.44 57.88 69.19 79.20 79.43 Highest Stock Price

10.60 8.49 9.52 20.07 19.00 21.27 9.84 5.49 7.28 11.61 16.77 26.53 31.79 36.73 52.43 51.79 50.22 Lowest Stock Price

-1.03 -0.91 -1.96 -8.43 0.38 -0.13 0.79 -0.31 -1.03 1.23 1.94 -1.57 2.27 6.41 2.75 4.00 3.50 Shares Buyback Ratio (%)

-4.81 3.81 3.71 6.22 5.23 2.19 -4.40 -2.95 -8.67 3.75 13.03 10.23 7.67 13.32 7.48 9.20 8.52 YoY Rev. per Sh. Growth (%)

137 64.06 32.38 35.25 -10.64 -4.76 -81.88 -279 158 257 68.22 43.33 10.47 24.91 7.87 27.86 24.17 YoY EPS Growth (%)

-4.22 20.22 13.67 5.24 7.58 -2.29 -75.70 -69.88 352 100.00 48.59 34.41 11.59 22.49 7.70 22.73 18.50 YoY EBITDA Growth (%)

2.06 12.19 16.30 6.81 9.59 8.32 -5.96 -29.50 -- -- -- -- -- 36.86 22.29 17.10 18.00 EBITDA 5-Y Growth (%)

139 140 142 151 155 155 150 154 156 156 153 151 148 144 139 134 131 Shares Outstanding (Basic

Average)

140 141 144 156 156 156 154 155 157 155 152 154 151 141 137 132 131 Shares Outstanding (EOP)

0.87 1.09 0.91 1.33 1.44 0.66 0.23 0.96 0.92 1.19 0.95 1.24 0.94 1.22 0.54 0.34 0.32 Beta

04/29/02 05/19/03 04/05/04 03/29/05 04/02/07 03/31/08 03/30/09 03/29/10 03/28/11 03/26/12 04/01/13 03/31/14 03/30/15 03/24/16 03/23/17 Filing Date

05/19/03 04/05/04 03/29/05 03/29/05 04/02/07 03/31/08 03/30/09 03/28/11 03/28/11 04/01/13 03/31/14 03/30/15 03/24/16 03/23/17 03/23/17 03/23/17 Restated Filing Date

Copyright 2015 GuruFocus.com LLC www.gurufocus.com/stock/FL 6/7

About GuruFocus.com

GuruFocus.com is owned by GuruFocus.com LLC, a Texas Limited Liability Company located in Plano, Texas. GuruFocus.com is engaged in the business of financial news, commentaries, research and publishing. GuruFocus.com, LLC is proud to

be a Better Business Bureau (BBB) accredited company with an A+ rating.

GuruFocus.com was founded in 2004 by Charlie Tian, Ph. D. on the philosophy that investors would make a lot fewer mistakes investing if they were to select stocks from the ones that have been researched by the best investors in the world.

GuruFocus tracks the stock picks and portfolio changes of the best investors in the world.

GuruFocus.com is dedicated to value investing. As employed by Warren Buffett, the greatest investor of all time, value investing is the only winning strategy for the long term. GuruFocus hosts numerous value screeners and research tools, and

regularly publishes articles about value investing strategies and ideas.

Disclaimer

GuruFocus.com is not operated by a broker, a dealer, or a registered investment adviser. Under no circumstances does any information posted on GuruFocus.com represent a recommendation to buy or sell a security. The information on this site,

and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The gurus may buy and sell securities before and after any particular article and report and information herein is published, with

respect to the securities discussed in any article and report posted herein. In no event shall GuruFocus.com be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published

or available on GuruFocus.com, or relating to the use of, or inability to use, GuruFocus.com or any content, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive

damages. Past performance is a poor indicator of future performance. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. The information on this site is in no

way guaranteed for completeness, accuracy or in any other way. The gurus listed in this website are not affiliated with GuruFocus.com, LLC. Stock quotes provided by InterActive Data. Fundamental company data provided by Morningstar, updated

daily.

Copyright 2015 GuruFocus.com LLC www.gurufocus.com/stock/FL 7/7

You might also like

- Global Wealth Databook 2018Document167 pagesGlobal Wealth Databook 2018José DíazNo ratings yet

- FinAnalyticsSolutions1236 PDFDocument37 pagesFinAnalyticsSolutions1236 PDFAY6061No ratings yet

- Abu Dhabi List SingaporeDocument6 pagesAbu Dhabi List SingaporeAY6061No ratings yet

- Spec ListDocument1 pageSpec ListAY6061No ratings yet

- Two Simple Proofs For Cramer's Rule: Frank The Giant Bunny April 9, 2016Document1 pageTwo Simple Proofs For Cramer's Rule: Frank The Giant Bunny April 9, 2016AY6061No ratings yet

- Top Glove - 1QFY20 ResultDocument4 pagesTop Glove - 1QFY20 ResultAY6061No ratings yet

- BT Pro Rating ReportDocument13 pagesBT Pro Rating ReportAY6061No ratings yet

- GuruFocus Report NAS-InTCDocument7 pagesGuruFocus Report NAS-InTCAY6061No ratings yet

- Measuring Portfolio Factor Exposures A Practical GuideDocument3 pagesMeasuring Portfolio Factor Exposures A Practical GuideAY6061No ratings yet

- Finance Analytics in R ErrataDocument1 pageFinance Analytics in R ErrataAY6061No ratings yet

- Bloomberg 22 SPLC SupplyChain 2063026Document5 pagesBloomberg 22 SPLC SupplyChain 2063026AY6061No ratings yet

- Imperial College PHD Scholarship Scheme Self-Nomination FormDocument1 pageImperial College PHD Scholarship Scheme Self-Nomination FormAY6061No ratings yet

- Imont PRBDocument19 pagesImont PRBAY6061No ratings yet

- Factors Influencing Economic GrowthDocument2 pagesFactors Influencing Economic GrowthAY6061No ratings yet

- Cengel Thermodynamics Heat Transfer 2nd TXTBKDocument865 pagesCengel Thermodynamics Heat Transfer 2nd TXTBKicething91% (22)

- Cost of UnemploymentDocument2 pagesCost of UnemploymentAY6061No ratings yet

- 8 June 2007 AnswersDocument9 pages8 June 2007 AnswersAY6061No ratings yet

- Edexcel Economics NotesDocument6 pagesEdexcel Economics NotesAY606150% (4)

- Aid On Social & Economic DevelopmentDocument1 pageAid On Social & Economic DevelopmentAY6061No ratings yet

- Economic Effects of Debt ForgivenessDocument2 pagesEconomic Effects of Debt ForgivenessAY6061No ratings yet

- Fair TradeDocument1 pageFair TradeAY6061No ratings yet

- Edexcel Economics NotesDocument6 pagesEdexcel Economics NotesAY606150% (4)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Trading ViewDocument13 pagesTrading ViewfendyNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Fuaad DodooNo ratings yet

- Ministry of Corporate Affairs - MCA ServicesDocument2 pagesMinistry of Corporate Affairs - MCA ServicesMeiyappan MNo ratings yet

- Ra 3135Document3 pagesRa 3135Donna Cel IsubolNo ratings yet

- LAW 327-Strategic International Commercial Transactions-Khyzar HussainDocument12 pagesLAW 327-Strategic International Commercial Transactions-Khyzar HussainMuhammad Irfan RiazNo ratings yet

- In Re:) : Debtors.)Document44 pagesIn Re:) : Debtors.)Chapter 11 DocketsNo ratings yet

- Audit Legal LiabilitiesDocument40 pagesAudit Legal LiabilitiesUmmu Aiman AyubNo ratings yet

- SEBI (ICDR) Regulations ChecklistDocument18 pagesSEBI (ICDR) Regulations ChecklistbkpforgauravNo ratings yet

- Matematik ForexDocument3 pagesMatematik Forexarvin4d100% (1)

- Secured Credit CardsDocument4 pagesSecured Credit Cardsjeremyyu2003No ratings yet

- Lecture On Shareholders' EquityDocument3 pagesLecture On Shareholders' EquityevaNo ratings yet

- 51b Practice Final SolutionDocument27 pages51b Practice Final SolutionJess FernandezNo ratings yet

- Samsung India LTD.: Non Transferable Interview Call LetterDocument1 pageSamsung India LTD.: Non Transferable Interview Call LetterRooneymanuNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementSiraj Siddiqui100% (1)

- Managerial Accounting Multiple Choice AnswersDocument21 pagesManagerial Accounting Multiple Choice Answersmobinil1No ratings yet

- FN3092 - Corporate Finance - 2015 Exam - Zone-ADocument9 pagesFN3092 - Corporate Finance - 2015 Exam - Zone-AAishwarya PotdarNo ratings yet

- Clarification (Company Update)Document6 pagesClarification (Company Update)Shyam SunderNo ratings yet

- Mock Exam 1Document12 pagesMock Exam 1Federico BenzoNo ratings yet

- Ansbacher Cayman Report Appendix Volume 7Document699 pagesAnsbacher Cayman Report Appendix Volume 7thestorydotieNo ratings yet

- Asman Investments vs. K.L. SunejaDocument40 pagesAsman Investments vs. K.L. Sunejaronil18No ratings yet

- 1.financial Services-An Overview-FinalDocument26 pages1.financial Services-An Overview-FinalSaurabh SinghNo ratings yet

- AHOLD CaseDocument20 pagesAHOLD Caseakashh200875% (4)

- Iron Condor - Dan HarveyDocument7 pagesIron Condor - Dan HarveyHernan DiazNo ratings yet

- WM Retirment SumsDocument8 pagesWM Retirment SumsTarun SukhijaNo ratings yet

- Ind As 109Document26 pagesInd As 109Sandya Gupta100% (1)

- Formula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NDocument5 pagesFormula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NrohansahniNo ratings yet

- E-Marketing of Financial Product & Services: Summer Training Project ReportDocument112 pagesE-Marketing of Financial Product & Services: Summer Training Project Reportsanjay kumarNo ratings yet

- Fa Ii. ObjDocument5 pagesFa Ii. ObjSonia ShamsNo ratings yet

- Gotesco Properties v. Go G.R. No. 201167 February 27 2013Document2 pagesGotesco Properties v. Go G.R. No. 201167 February 27 2013Hurjae Soriano Lubag100% (2)

- Supreme Court: Custom SearchDocument4 pagesSupreme Court: Custom SearchZainne Sarip BandingNo ratings yet