Professional Documents

Culture Documents

Farooq Haque Classes: Exclusions From Syllabus of IDT of CA Final

Uploaded by

Nikhil0 ratings0% found this document useful (0 votes)

30 views1 pagegst

Original Title

Gst Exclusions

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgst

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views1 pageFarooq Haque Classes: Exclusions From Syllabus of IDT of CA Final

Uploaded by

Nikhilgst

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

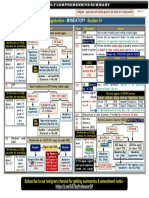

Exclusions from syllabus of IDT of CA Final Farooq Haque Classes

Exclusions from syllabus of Indirect Tax Laws of CA Final

ICAI Notification dt. 09/02/2018

(1) (2) (3) (4)

S. No. in Topics of Exclusions Corresponding

the the (Provisions which are excluded page no. of notes

syllabus syllabus from the corresponding topic of

the syllabus)

1(ii) Levy and collection of CGST and CGST Act, 2017 & IGST Act, 2017

IGST – Application of CGST/IGST (i) Rate of tax prescribed for supply of (i) Pg 76 (Module I)

law; Concept of supply including goods

composite and mixed supplies, inter- (ii) Rate of tax prescribed for supply of (ii) Pg 76 (Module I)

State supply, intra-State supply, services

supplies in territorial waters; Charge (iii) Exemptions for supply of goods

of tax; Exemption (iii) Pg 80 (Module I)

from tax; Composition levy

1(vii) Procedures under GST – All CGST Act, 2017 and CGST Rules, 2017

procedures including registration, tax (i) Tax deduction at source except the (i) Pg 72 (Module II)

invoice, credit and debit notes, provisions made effective vide (Sec 51)

electronic way bill, accounts and Notification No. 33/2017 CT dated

records, returns, payment of tax 15.09.2017

including reverse charge, refund, job (ii) Pg 74 (Module II)

(ii) Collection of tax at source

work (Sec 52)

(iii) Registration of persons required to

(iii) Pg 12 (Module II)

collect tax at source

(Rule 12)

(iv) Filing of return by a person required

(iv) Pg 50 (Module II)

to deduct tax at source

(Rule 66)

(v) Submission of statement of supplies

through an e-commerce operator (v) Pg 50 (Module II)

(vi) Categories of supply of goods, tax on (Rule 67)

which is payable on reverse charge (vi) Pg 204 (Module I)

basis under section 9(3) & Pg 58 (Sec 9(3))

(vii) Chapter XVI: E-Way Rules [Rules (vii) Not Covered

138- 138D] of CGST Rules, 2017

IGST Act, 2017

Categories of supply of goods, tax on which Pg 270 (Module I)

is payable on reverse charge basis under (Sec 5(3))

section 5(3)

You might also like

- GST Scanner by DG SirDocument41 pagesGST Scanner by DG SirvishnuvermaNo ratings yet

- All India GST JurisdictionDocument2 pagesAll India GST JurisdictionNitish AggarwalNo ratings yet

- Study guidelines for May 2019 indirect tax examDocument2 pagesStudy guidelines for May 2019 indirect tax examUrvi MishraNo ratings yet

- CA Final AmendmentsDocument2 pagesCA Final AmendmentsMalvika RaoNo ratings yet

- Study Guidelines For May 2023 Examination: Intermediate Course - Paper 4: Taxation - Section B: Indirect TaxesDocument2 pagesStudy Guidelines For May 2023 Examination: Intermediate Course - Paper 4: Taxation - Section B: Indirect TaxesHema LathaNo ratings yet

- Study Guidelines For November 2021 Examination: Intermediate New Course Paper 4: Taxation Section B: Indirect TaxesDocument2 pagesStudy Guidelines For November 2021 Examination: Intermediate New Course Paper 4: Taxation Section B: Indirect TaxesPrachi KarkhanisNo ratings yet

- CA InterDocument7 pagesCA InterKrrish KelwaniNo ratings yet

- CA Inter Applicability Amendments For Nov22Document7 pagesCA Inter Applicability Amendments For Nov22311903736No ratings yet

- Ca FoundationDocument7 pagesCa FoundationSantosh ThakurNo ratings yet

- Study Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax Lawsparam.ginniNo ratings yet

- Study Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax Lawsruhi MalviyaNo ratings yet

- GST Scanner v1 PDFDocument566 pagesGST Scanner v1 PDFsrivani vemula100% (1)

- Paper 6D Question Wise Sheet For May 2021Document109 pagesPaper 6D Question Wise Sheet For May 2021Meet DalalNo ratings yet

- Bos 60629Document6 pagesBos 60629ROCKSPYNo ratings yet

- Ca Final NotesDocument2 pagesCa Final NotesShantanuNo ratings yet

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperDocument8 pagesNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saNo ratings yet

- Finance Act 2022Document43 pagesFinance Act 2022Mark GechureNo ratings yet

- Applicability of Standards/Guidance Notes/Legislative Amendments Etc. For May, 2021 Examination Intermediate Level (New Course) Paper 1: AccountingDocument8 pagesApplicability of Standards/Guidance Notes/Legislative Amendments Etc. For May, 2021 Examination Intermediate Level (New Course) Paper 1: AccountingsoniNo ratings yet

- 16 - PartB - G C VANAJA (1) - 2023-24Document2 pages16 - PartB - G C VANAJA (1) - 2023-24fininfinity ctaNo ratings yet

- Harsh Shah - Input Tax Credit - 27!4!17-Ilovepdf-CompressedDocument63 pagesHarsh Shah - Input Tax Credit - 27!4!17-Ilovepdf-Compresseddinesh kasnNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- Advanced Tax Laws and Practice: NoteDocument7 pagesAdvanced Tax Laws and Practice: Notesheena2saNo ratings yet

- The Tax Laws Amendment Act 2020Document23 pagesThe Tax Laws Amendment Act 2020PatrtickNo ratings yet

- Instructions ITR7 AY2021 22Document125 pagesInstructions ITR7 AY2021 22BhaviNo ratings yet

- TheFinanceAct 2022Document43 pagesTheFinanceAct 2022Kenneth NgureNo ratings yet

- Advanced Tax Laws and PracticeDocument8 pagesAdvanced Tax Laws and Practicesheena2saNo ratings yet

- Finance Act - No. 8 of 2020Document17 pagesFinance Act - No. 8 of 2020Jos NyangletNo ratings yet

- 4B MergedDocument50 pages4B MergednaqiNo ratings yet

- CBDT Issued New Guidelines For Compounding of Income Tax Offences - Taxguru - inDocument22 pagesCBDT Issued New Guidelines For Compounding of Income Tax Offences - Taxguru - inveer_bcaNo ratings yet

- Calculate Income Tax in Old Tax RegimeDocument1 pageCalculate Income Tax in Old Tax RegimeSRINIVAS MNo ratings yet

- Accountancy Paper II 2014Document2 pagesAccountancy Paper II 2014Qasim IbrarNo ratings yet

- Changes in ITC Reporting in GSTR - 3BDocument6 pagesChanges in ITC Reporting in GSTR - 3BKirtan Ramesh JethvaNo ratings yet

- BC 604, Income Tax Law & Practice, 2022Document12 pagesBC 604, Income Tax Law & Practice, 2022davusingh786No ratings yet

- Appendix I: Revenue Receipts of States and Union Territories With Legislature Andhra Pradesh 2016-17 (Accounts) 2017-18 (Budget Estimates)Document8 pagesAppendix I: Revenue Receipts of States and Union Territories With Legislature Andhra Pradesh 2016-17 (Accounts) 2017-18 (Budget Estimates)Jyothish JbNo ratings yet

- List of Statutory Returns, Registers & Forms Under Labour Laws - Taxguru - inDocument4 pagesList of Statutory Returns, Registers & Forms Under Labour Laws - Taxguru - inketan mahajanNo ratings yet

- Gujarat Authority Advance Ruling on Electroplating ServicesDocument13 pagesGujarat Authority Advance Ruling on Electroplating ServicesPratik ParmarNo ratings yet

- Section - 24 GST REGDocument1 pageSection - 24 GST REGraj pandeyNo ratings yet

- 1w1212notification 54 2020Document4 pages1w1212notification 54 2020Adrian ŠainaNo ratings yet

- Economics WorksheetDocument2 pagesEconomics Worksheetdennis greenNo ratings yet

- Itc (Incl. Transitional Provisions), Isd, Cross Utilization of Igst & Fund TransferDocument51 pagesItc (Incl. Transitional Provisions), Isd, Cross Utilization of Igst & Fund Transfershivam beniwalNo ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Direct Tax or Indirect TaxDocument8 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- TAXO Union Budget 2022Document27 pagesTAXO Union Budget 2022sanjayNo ratings yet

- Refund in GSTDocument6 pagesRefund in GSTNilesh SoniNo ratings yet

- GST MCQS - 2 Without AnswerDocument9 pagesGST MCQS - 2 Without AnswerSpidy MacNo ratings yet

- Chapter 2 Charge of TaxDocument6 pagesChapter 2 Charge of Taxkatta sumanthNo ratings yet

- CSR Schedule 20-21 Final VersionDocument2 pagesCSR Schedule 20-21 Final VersionAcs Kailash TyagiNo ratings yet

- 10 Duty DrawbackDocument11 pages10 Duty DrawbacksrinivasNo ratings yet

- CA Final DT A MTP 1 May 23Document14 pagesCA Final DT A MTP 1 May 23Mayur JoshiNo ratings yet

- Advanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToDocument18 pagesAdvanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToMurugesh Kasivel EnjoyNo ratings yet

- Compounding Guidelines Dated 16.09.2022Document29 pagesCompounding Guidelines Dated 16.09.2022Mane TVNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAida AmalNo ratings yet

- FinancialStatementAnalysesofTata-shortDocument46 pagesFinancialStatementAnalysesofTata-shortyashutank46No ratings yet

- Annual Report 2023Document4 pagesAnnual Report 2023shubham vNo ratings yet

- Latest GST Updates in 2022Document6 pagesLatest GST Updates in 2022prathNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument5 pagesForm 16 Part A: WWW - Taxguru.inDarshan PatelNo ratings yet

- GST - V2 - May 2023Document326 pagesGST - V2 - May 2023FhfhhNo ratings yet

- Guide to Saudi Arabia Imports and Exports VAT ComplianceDocument44 pagesGuide to Saudi Arabia Imports and Exports VAT Compliancechinese hansNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- MCQs For Accounting Principles and ProceduresDocument10 pagesMCQs For Accounting Principles and ProceduresAshfaq Afridi73% (11)

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- Divisible Profits Factors and PrinciplesDocument14 pagesDivisible Profits Factors and PrinciplesVeeresh SharmaNo ratings yet

- B.Com Corporate Laws MCQ and Q&A BankDocument3 pagesB.Com Corporate Laws MCQ and Q&A BankNikhil100% (1)

- Audit and AuditorsDocument22 pagesAudit and Auditorsharshsasuke96No ratings yet

- Audit Mcqs 150Document23 pagesAudit Mcqs 150Nikhil62% (26)

- Emerging Technologies 19Document23 pagesEmerging Technologies 19NikhilNo ratings yet

- Accounting Equation MCQDocument10 pagesAccounting Equation MCQiisjaffer100% (1)

- Accounting MCQ On BasicDocument7 pagesAccounting MCQ On BasicSiji Varghese100% (1)

- Audit Mcqs 3Document8 pagesAudit Mcqs 3NikhilNo ratings yet

- ReconstructionDocument26 pagesReconstructionNikhilNo ratings yet

- Protection of Is PDFDocument31 pagesProtection of Is PDFNikhilNo ratings yet

- Accounting MCQ On BasicDocument7 pagesAccounting MCQ On BasicSiji Varghese100% (1)

- Master Minds - Quality Education Beyond Your ImaginationDocument22 pagesMaster Minds - Quality Education Beyond Your Imaginationpriyeshrjain1100% (1)

- Salary NikkyDocument1 pageSalary NikkyNikhilNo ratings yet

- Farooq Haque Classes: Exclusions From Syllabus of IDT of CA FinalDocument1 pageFarooq Haque Classes: Exclusions From Syllabus of IDT of CA FinalNikhilNo ratings yet

- Business Accounting EssentialsDocument48 pagesBusiness Accounting EssentialsßläcklìsètèdTȜèNo ratings yet

- AnswerKey Financial Accounting IDocument5 pagesAnswerKey Financial Accounting INikhilNo ratings yet

- Kids Abacus PDFDocument8 pagesKids Abacus PDFBala RanganathNo ratings yet

- Republic v. Evangelista, 466 SCRA 544 (2005)Document2 pagesRepublic v. Evangelista, 466 SCRA 544 (2005)Carie LawyerrNo ratings yet

- HW 4Document9 pagesHW 4piya67kNo ratings yet

- Criminal Law 1 Midterm ExamDocument6 pagesCriminal Law 1 Midterm ExamJovie MendozaNo ratings yet

- Government AccountingDocument32 pagesGovernment AccountingLaika Mae D. CariñoNo ratings yet

- BISQUE v. ASPLUNDH TREE EXPERT COMPANY - Document No. 5Document2 pagesBISQUE v. ASPLUNDH TREE EXPERT COMPANY - Document No. 5Justia.comNo ratings yet

- Ty vs. NBIDocument10 pagesTy vs. NBIAnna BautistaNo ratings yet

- Regulating Act, 1773, Constitutional HistoryDocument3 pagesRegulating Act, 1773, Constitutional HistoryKaran SinghNo ratings yet

- 6 23 2010 - 1 50Document50 pages6 23 2010 - 1 50reapertradesNo ratings yet

- Press Release 28 March 2024Document1 pagePress Release 28 March 2024akkashirNo ratings yet

- Katrina Pierce IndictmentDocument29 pagesKatrina Pierce IndictmentTodd FeurerNo ratings yet

- Port of Entry Visa Application GuideDocument10 pagesPort of Entry Visa Application Guiderana604No ratings yet

- Chapter 3 Criminal Law EssentialsDocument20 pagesChapter 3 Criminal Law EssentialsMike EffingRocksNo ratings yet

- Domasig vs. NLRCDocument3 pagesDomasig vs. NLRCTinersNo ratings yet

- Right Issue and Private PlacementDocument6 pagesRight Issue and Private PlacementMudit SinghNo ratings yet

- Crim1 Case DigestsDocument50 pagesCrim1 Case DigestsJanneil Monica Morales78% (9)

- 2 ABS CBN Broadcasting Corp v. NazarenoDocument16 pages2 ABS CBN Broadcasting Corp v. NazarenoPatricia Anne GonzalesNo ratings yet

- Hilao vs. Marcos, 25 F. Ed 1467Document2 pagesHilao vs. Marcos, 25 F. Ed 1467Janine Castro100% (1)

- Jollibee Foods Corporation's Contractualization Issue in The PhilippinesDocument2 pagesJollibee Foods Corporation's Contractualization Issue in The PhilippinesLoida Gigi AbanadorNo ratings yet

- Search Warrant Face PageDocument2 pagesSearch Warrant Face PageShawn FreemanNo ratings yet

- Walang Pamagat Na DokumentoDocument9 pagesWalang Pamagat Na Dokumentomosay denNo ratings yet

- Docshare - Tips - Persons and Family Relations Case Digestspdf PDFDocument100 pagesDocshare - Tips - Persons and Family Relations Case Digestspdf PDFMarielle Joyce G. AristonNo ratings yet

- Section 377Document32 pagesSection 377Pritam SahaNo ratings yet

- CrimLaw2 CasesDocument78 pagesCrimLaw2 CasesJillen SuanNo ratings yet

- Beeck V Aquaslide 'N' Dive Corp.Document2 pagesBeeck V Aquaslide 'N' Dive Corp.crlstinaaaNo ratings yet

- Royal Homes Marketing Corporation v. Alcantara, G. R. No. 195190, July 28, 2014Document6 pagesRoyal Homes Marketing Corporation v. Alcantara, G. R. No. 195190, July 28, 2014Tin LicoNo ratings yet

- Contracts Act 1950: Ir. Dr. Mas Sahidayana Mohktar Mas - Dayana@um - Edu.myDocument31 pagesContracts Act 1950: Ir. Dr. Mas Sahidayana Mohktar Mas - Dayana@um - Edu.myTbyTanNo ratings yet

- 003-Revidad, Et Al. v. NLRCDocument14 pages003-Revidad, Et Al. v. NLRCwewNo ratings yet

- Supreme Court Severely Censures Lawyer for Entering Appearance in Terminated CaseDocument4 pagesSupreme Court Severely Censures Lawyer for Entering Appearance in Terminated CaseEmma Ruby Aguilar-ApradoNo ratings yet

- Sample PlaintDocument2 pagesSample Plaintshweta76% (17)

- General Provisions of the Philippine Penal CodeDocument11 pagesGeneral Provisions of the Philippine Penal CodeJeremiah ReynaldoNo ratings yet