Professional Documents

Culture Documents

Baidu 1Q08Update 10july2008 1

Uploaded by

ResearchOracleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Baidu 1Q08Update 10july2008 1

Uploaded by

ResearchOracleCopyright:

Available Formats

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

Baidu.com Inc. 10 July 2008

Update Report – 1Q 08 Results

Robust growth in active customer-base to drive online marketing revenues

ADR HOLD Fundamental research indicates a 5% upside in the ADR over the next 6-24 months. We have

Direct access

calculated the targetto the

price fullonreport

based freefactors,

fundamental of charge

using a at

weighted average of target prices

obtained using DCF and comparative valuation methodologies.

Ticker: BIDU http://www.iirgroup.com/researchoracle/viewreport/show/20278

Target price: US$350.00

We reiterate the ADR (1 ADR = 1 common share1) a HOLD with a 6-24 month target price of

Current price: US$332.83 US$350.00 per share.

European BUY The European ADR is expected to appreciate 19% over the next 6-24 months as the 5% fundamental

upside is supported by 14 percentage points upside attributable purely to the anticipated

ADR2 appreciation of the Euro against the US dollar over the same period.

Ticker: BIDUy.F

Target price: €259.26

We upgrade the European ADR from a HOLD to a BUY with a 6-24 month target price of €259.26

Current price: €217.99

Supervisor: Meera Patil

Analyst: Abhay Amlekar Investment horizon - short term actionable trading strategies

Editor: Shem Pennant This report addresses the needs of strategic investors with a long term investment horizon of 6-24 months. If this

report is provided to you by your broker under the Global Settlement, you may now also access (free of charge) the

Global Research Director: short term trading outlook that we publish from time to time for this issuer, looking at the coming 5-30 days for

Satish Betadpur, CFA readers with a shorter trading horizon. These are available online only at www.researchoracle.com

Next news due:

2Q 08 results, July 2008 Report summary

Baidu.com Inc. (Baidu) announced its 1Q 08 results on 24 April 2008. While revenues, operating and

net income witnessed robust growth, margins remained under pressure from increased cost of

revenues mainly related to Traffic Acquisition Costs (TAC). The company witnessed growth in total

marketing customers reflecting the growing demand and acceptance for Baidu and its online web

based search engine. In 1Q 08, Baidu held a search market share of 60.7% in China, compared to

Google Inc.’s (Google) 26.8% and Yahoo! China’s 8.3%. With the existing and new opportunities

available in the market, we believe Baidu is well positioned to capitalize on these. However we believe

that a current levels the company’s fundamental positives are factored into the ADR price and

therefore do not anticipate significant upside potential from current levels.

Currency impact for US investors

The company reports in RMB, which we assume is its major trading currency. Earnings forecasts are

therefore also expressed in RMB. Since the RMB is pegged to the US dollar, we assume that the

impact of currency movements on the price of the ADR is neutral. Where specific currency risks are

identified, they will be highlighted in the report.

Currency impact on European ADR

The impact by itself of the anticipated currency movements on the European ADR (now €217.99),

without considering changes in the share price, is broadly positive and is expected to be:

Over 6 months: €198.11

Over 12 months: €221.89

Over 24 months: €246.54

Page 1 Refer to page 4 for all footnotes

You might also like

- XLCapital NewsAlert 11july2008 1Document1 pageXLCapital NewsAlert 11july2008 1ResearchOracleNo ratings yet

- SMIC 1Q08Update 11july2008 1Document1 pageSMIC 1Q08Update 11july2008 1ResearchOracleNo ratings yet

- WNS NewsAlert 11july2008 1Document1 pageWNS NewsAlert 11july2008 1ResearchOracleNo ratings yet

- Noble 1Q08Update 11jul2008 1Document1 pageNoble 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- O2Micro 1Q08Update 11july2008 1Document1 pageO2Micro 1Q08Update 11july2008 1ResearchOracleNo ratings yet

- SouthernCopper NewsAlert 11jul2008 1Document1 pageSouthernCopper NewsAlert 11jul2008 1ResearchOracleNo ratings yet

- Repsol 1Q08Update 11jul2008 1Document1 pageRepsol 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- Infosys 1Q09Alert 11july2008 1Document1 pageInfosys 1Q09Alert 11july2008 1ResearchOracleNo ratings yet

- UnileverPLC 1Q08Update 10jul08 1Document1 pageUnileverPLC 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- FocusMedia 1Q08Update 11july2008 1Document1 pageFocusMedia 1Q08Update 11july2008 1ResearchOracleNo ratings yet

- Nissan 4QANDFY2008Update 11jul08 1Document1 pageNissan 4QANDFY2008Update 11jul08 1ResearchOracleNo ratings yet

- Roundup 10 July 2008Document2 pagesRoundup 10 July 2008ResearchOracleNo ratings yet

- Covidien 2q08update 11jul08 1Document1 pageCovidien 2q08update 11jul08 1ResearchOracleNo ratings yet

- GrupoAeroCentroNorte NewsAlert 11july2008 1Document1 pageGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOracleNo ratings yet

- Advantest NewsAlert 11july2008 1Document1 pageAdvantest NewsAlert 11july2008 1ResearchOracleNo ratings yet

- NationalGrid FY2008Update 10july2008 1Document1 pageNationalGrid FY2008Update 10july2008 1ResearchOracleNo ratings yet

- ACE 1Q08Update 11jul2008 1Document1 pageACE 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- UnileverNV 1Q08Update 10jul08 1Document1 pageUnileverNV 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- BancoBradesco 1Q08Update 10jul2008 1Document1 pageBancoBradesco 1Q08Update 10jul2008 1ResearchOracleNo ratings yet

- TokioMarine (Formerlymillea) FY2008Update 10july2008 1Document1 pageTokioMarine (Formerlymillea) FY2008Update 10july2008 1ResearchOracleNo ratings yet

- SiliconwarePrecisionIndustries 1Q08Update 10july2008 1Document1 pageSiliconwarePrecisionIndustries 1Q08Update 10july2008 1ResearchOracleNo ratings yet

- XLCapital NewsAlert 09july2008 1Document1 pageXLCapital NewsAlert 09july2008 1ResearchOracleNo ratings yet

- EnduranceSpecialty NewsAlert 10july2008 1Document1 pageEnduranceSpecialty NewsAlert 10july2008 1ResearchOracleNo ratings yet

- NTT FY2008Update 10july2008 1Document1 pageNTT FY2008Update 10july2008 1ResearchOracleNo ratings yet

- Mitsui FY2008Update 10july08 1Document1 pageMitsui FY2008Update 10july08 1ResearchOracleNo ratings yet

- GrupoAeroPacifico NewsAlert 10july2008 1Document1 pageGrupoAeroPacifico NewsAlert 10july2008 1ResearchOracleNo ratings yet

- Companhia de Bebidas Das Americas 1Q08Update 10jul08 1Document1 pageCompanhia de Bebidas Das Americas 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- Votorantim Celolose 1Q08Update 09jul08 1Document1 pageVotorantim Celolose 1Q08Update 09jul08 1ResearchOracleNo ratings yet

- AngiotechPharmaceuticalInc NewsAlert 10jul08 1Document1 pageAngiotechPharmaceuticalInc NewsAlert 10jul08 1ResearchOracleNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 5 - Working Capital ManagementDocument24 pagesChapter 5 - Working Capital ManagementFatimah Rashidi VirtuousNo ratings yet

- Chapter 2 The New Products ProcessDocument7 pagesChapter 2 The New Products ProcessmanoNo ratings yet

- Hitech Security BrochureDocument9 pagesHitech Security BrochureKawalprit BhattNo ratings yet

- Test 1 Ma2Document15 pagesTest 1 Ma2Waseem Ahmad Qurashi63% (8)

- Class XII - Portions For Term I Exam-Commerce 2023-24Document2 pagesClass XII - Portions For Term I Exam-Commerce 2023-24mohammad sidaanNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument8 pagesMobile Services: Your Account Summary This Month'S ChargesVenkatram PailaNo ratings yet

- CiDocument8 pagesCisukrit dobhalNo ratings yet

- Bangladesh Business Structure ReportDocument32 pagesBangladesh Business Structure ReportMd. Tareq AzizNo ratings yet

- KKD Major ProjectDocument22 pagesKKD Major Projectvivek1119No ratings yet

- COBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Document8 pagesCOBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Aulia NisaNo ratings yet

- Merit List Spring 2021Document6 pagesMerit List Spring 2021Rezwan SiamNo ratings yet

- Cfas MidtermDocument21 pagesCfas Midtermabb.reviewersNo ratings yet

- Commercial Contractor Business PlanDocument35 pagesCommercial Contractor Business PlanAMANUEL BABBANo ratings yet

- Analysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Document13 pagesAnalysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Customize essayNo ratings yet

- Allison Faye C. Fernandez FM 1B: 1. LiberalizationDocument2 pagesAllison Faye C. Fernandez FM 1B: 1. LiberalizationKae SvetlanaNo ratings yet

- Real Estate Sector Report BangladeshDocument41 pagesReal Estate Sector Report Bangladeshmars2580No ratings yet

- Deloitte AnalyticsDocument5 pagesDeloitte Analyticsapi-89285443No ratings yet

- Cost Accounting4&Cost ManagementDocument10 pagesCost Accounting4&Cost ManagementJericFuentesNo ratings yet

- URBAN REVITALIZATION AND NEOLIBERALISMDocument50 pagesURBAN REVITALIZATION AND NEOLIBERALISMJoviecca Lawas67% (3)

- PatanjaliDocument52 pagesPatanjaliShilpi KumariNo ratings yet

- Improve Your Business Handbook 1986Document136 pagesImprove Your Business Handbook 1986ZerotheoryNo ratings yet

- An Analysis of Recruitment & Selection Process at Uppcl: A Summer Training Report OnDocument92 pagesAn Analysis of Recruitment & Selection Process at Uppcl: A Summer Training Report OnManjeet SinghNo ratings yet

- Summer ProjectDocument21 pagesSummer ProjectDipesh PrajapatiNo ratings yet

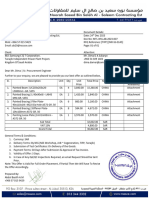

- 007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145Document1 page007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145abasithamNo ratings yet

- Dmgt505 Management Information SystemDocument272 pagesDmgt505 Management Information SystemJitendra SinghNo ratings yet

- Bluescope Steel 2016Document48 pagesBluescope Steel 2016Romulo AlvesNo ratings yet

- MSR 40000 Gid 20009265 403 20220627 1 008Document5 pagesMSR 40000 Gid 20009265 403 20220627 1 008Burn4 YouNo ratings yet

- Kebede Kassa First Draft CommentedDocument73 pagesKebede Kassa First Draft CommentedBereketNo ratings yet

- Brand Audit CoeDocument10 pagesBrand Audit CoeMohammad ZubairNo ratings yet

- 8 13Document5 pages8 13Konrad Lorenz Madriaga UychocoNo ratings yet