Professional Documents

Culture Documents

Travis County Appraisal Review Board Suit

Uploaded by

Anonymous Pb39klJCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Travis County Appraisal Review Board Suit

Uploaded by

Anonymous Pb39klJCopyright:

Available Formats

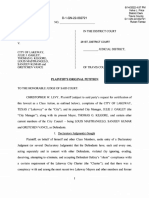

10/8/2018 12:59 PM

Velva L. Price

District Clerk

Travis County

CAUSE NO. D-1-GN-18-006098

____________________ D-1-GN-18-006098

Carrisa Escalante

TEXAS PROTAX-AUSTIN, INC.; § IN THE DISTRICT COURT

FIVE STONE TAX ADVISERS, LLC; §

46 COMMERCIAL PROPERTY OWNERS §

113 RESIDENTIAL PROPERTY OWNERS §

Plaintiffs, §

vs. §

§ OF TRAVIS COUNTY, TX

TRAVIS APPRAISAL REVIEW BOARD; §

MARYA CRIGLER, CHIEF APPRAISER, §

(In her Official Capacity) §

Defendants § 201ST

_______ JUDICIAL DISTRICT

PLAINTIFFS’ ORIGINAL PETITION

AND DISCOVERY REQUESTS

TO THE HONORABLE JUDGE OF THIS COURT:

Plaintiffs, Texas Protax-Austin, Inc. (Protax) and 46 of Protax’s Commercial Property

customers; Five Stone Tax Advisers, LLC (Five Stone) and 113 of Five Stone’s Residential

Property customers, file this Original Petition against Defendants Travis Appraisal Review Board

and Marya Crigler, in her official capacity as Travis County Chief Appraiser.

A. SUMMARY AND DISCOVERY CONTROL PLAN

1. a. Plaintiff taxpayers and their tax agents challenge the Defendants’ unlawful

manipulation and corruption of the 2018 tax appraisal protest process in Travis County that leaves

property owners without the Appraisal Review Board (ARB) hearing to which they are entitled by

law. The Defendants, particularly Chief Appraiser Marya Crigler, also use tactics—including the

manipulation of protest hearing schedules—to try to prevent taxpayers from getting representation

from the tax agent the taxpayers officially designate to represent them, as they are entitled by law

to do. Plaintiffs seek appropriate court orders (a) requiring that their 2018 appraisal protests

Plaintiffs’ Original Petition

Page 1 of 24

receive an ARB hearing; (b) that any dismissal of their 2018 protest that may have occurred by the

ARB violated the Texas Open Meetings Act and should be declared void; (c) and that the Chief

Appraiser, Marya Crigler, Chief Deputy Lonnie Hendry, and the rest of her staff should be enjoined

from exceeding her authority and destroying the independence of the ARB by such tactics as her

and her Chief Deputy, Lonnie Hendry’s prejudicial control in scheduling ARB hearings; assigning

protests for hearing to certain ARB panels in a non-random method; and in causing the unlawful

dismissal of appraisal protests without a hearing.

b. In recent press reports, Chief Appraiser Crigler says there were a record number of

tax appraisal protests filed in 2018. The reason so many protests are filed is because the appraised

value the Chief Appraiser puts on the property is inflated, unequitable, and erroneous and can only

be corrected by filing a protest. If the Chief Appraiser’s value was correct and equitable, there

would not be so many appraisal protests. Tax agents, such as Plaintiffs, have the resources and

expertise to prove the Chief Appraiser’s excessive and unequal appraisal for their clients. For

example, Protax’s tax agent, Dave Brown (who represented the 46 Commercial Property Plaintiffs

in this case), obtained a reduced value for his other commercial clients in over 76% of the ARB

Hearings held, achieving over 12% reduction in value. Five Stones’ agents (who represented the

113 Residential Property Plaintiffs in this case) obtained value reductions for their other residential

clients in over 85% of the ARB Hearings held, achieving over 7% reduction in value. No wonder

Crigler and Hendry tried to keep these agents from getting fair ARB hearings for their clients. This

year, Crigler and her Chief Deputy essentially declared “war” on tax agents and tried to interfere

in them obtaining corrections and equity for their clients. Together with the ARB Chair Betty

Thompson and the ARB Board’s complicity, Crigler and Hendry denied any ARB hearing at all

Plaintiffs’ Original Petition

Page 2 of 24

to the plaintiffs.

c. Discovery in this case is intended to be conducted under Level 2 pursuant to Texas

Rules of Civil Procedure 190.3.

B. RELIEF

2. Plaintiffs seek monetary relief of $100,000 or less and nonmonetary relief. Tex. R. Civ. P.

47(c)(2).

C. PARTIES

3. Plaintiffs are:

a. Texas Protax-Austin, Inc. is a Texas corporation employing property tax agents and

may be served through their attorney of record in this case.

b. Five Stone Tax Advisers, LLC is a Texas limited liability company employing

property tax agents and may be served through their attorney of record in this case.

c. 46 Commercial Property Owners who are customers of Texas Protax-Austin and

are listed by name and the TCAD Property ID (PID) of their property in the list on the last pages

of this petition. These plaintiffs may be served through their attorney of record in this case.

d. 113 Residential Property Owners who are customers of Five Stone Tax Advisers

and are listed by name and the TCAD Property ID (PID) of their property in the list on the last

pages of this petition. These plaintiffs may be served through their attorney of record in this case.

4. Defendants are:

a. The Travis Appraisal Review Board who may be served via its Chair, Betty

Thompson, at the Travis Central Appraisal District offices at 8314 Cross Park Drive, Austin,

Plaintiffs’ Original Petition

Page 3 of 24

Texas.

b. Marya Crigler, in her official capacity as Travis County Chief Appraiser, who may

be served at the Travis Central Appraisal District offices at 8314 Cross Park Drive, Austin, Texas.

D. JURISDICTION & VENUE

5. The District Courts of Travis County, Texas have jurisdiction over this case pursuant to

Texas Tax Code section 41.45(f); Texas Government Code (Texas Open Meetings Act), section

551.142; and the Court’s jurisdiction for equitable relief, such as the injunctive relief requested

herein. The amount in controversy exceeds the minimal jurisdictional limits of this Court, and the

exercise of this Court’s jurisdiction over the Defendants is proper. Venue is mandatory in the

District Courts of Travis County, Texas pursuant to Texas Civil Practices & Remedies Code §

15.002.

E. FACTS

6. The facts stated in Paragraph 1 above are incorporated herein.

a. A valid and timely protest for 2018 was filed, pursuant to Texas Tax Code section

41.44, for each Plaintiff property owner for the property identified in the list included in this

Petition.

b. Licensed tax agents with Plaintiffs Texas Protax and Five Stone were validly

appointed as tax agents for each of the Plaintiff property owners as shown in the list included in

this Petition.

c. Plaintiffs made one or more written requests, pursuant to Texas Tax Code section

41.45 to ARB Chair Betty Thompson to postpone hearings on Plaintiffs’ protests that could not be

Plaintiffs’ Original Petition

Page 4 of 24

feasibly heard on the date scheduled. Chair Thompson either ignored the requests or failed to

respond or rule in writing to the requests. Orally, ARB Chair Thompson told both Protax and Five

Stone that hearings that were not reached under the schedule, would be rolled over to be heard

later, but after Ms. Thompson spoke to Marya Crigler and Lonnie Hendry, she changed her mind

and orally indicated that any protest hearings not reached as scheduled (by Marya Crigler) would

be dismissed.

d. After the scheduled hearing date for Plaintiffs’ appraisal protests when the protests

were not heard (due to Crigler’s and Hendry’s over-scheduling tactic), Plaintiffs made timely

requests, pursuant to Texas Tax Code section 41.45, for a new hearing. Chair Thompson either

ignored the requests or failed to respond or rule on the requests in writing.

e. Plaintiffs never received any written notice that their protests were dismissed.

f. Based on the Appraisal District’s response to public information requests by Texas

Protax and Five Stone, there is no record that a hearing on each Plaintiff’s protest was ever opened

or started.

g. No meeting notice of any meeting of the Travis Appraisal Review Board, held after

the originally scheduled hearing dates for Plaintiffs’ appraisal protests, contained an agenda

subject that gave notice the Board was going to consider dismissing appraisal protests.

7. The Chief Appraiser and her Chief Deputy, Lonnie Hendry, exercise their power in

prejudicial and grossly unfair ways. For example, Protax agent Dave Brown was representing a

homeowner (PID 548494) in arbitration to correct the over-appraisal of the owner’s home as a

commercial property and denial of his homestead exemption. On May 15, 2017, the deadline for

submission of evidence to support the arbitration hearing, Lonnie Hendry demanded that Dave

Plaintiffs’ Original Petition

Page 5 of 24

Brown meet with him in person (with other witnesses) regarding the case. In a visibly angry and

shouting way, Hendry demanded that Dave Brown withdraw the arbitration appeal. Based on Mr.

Brown’s recollection, Chief Deputy Hendry threatened with the words, “If you don’t withdraw,

I’ll use every means at my disposal to make your life as miserable as possible every time you walk

through the Appraisal District’s door.” 1

Brown did not withdraw the arbitration and was

successful in the arbitration appeal.

8. Chief Deputy Appraiser Hendry made good on his threat in the 2018 appraisal protest

season by interfering in Mr. Brown’s opportunity to settle appraisal protests informally and by

deliberately over-scheduling Mr. Brown to be in protest hearings, for accounts he was the assigned

agent for, in such a way as to make it impossible him to attend the hearings.

a. Even though ARB protest hearings were scheduled for 17 days (June 25th – July

14th), Hendry, with Marya Crigler’s agreement, scheduled all of David Brown’s hearings, 517 of

them, on just 3 days in 5 ARB panels simultaneously! Hendry scheduled Brown on July 3rd for

185 hearings in 4 ARB panels simultaneously; on July 5th for 170 hearings in 5 ARB panels

simultaneously; and on July 6th for 162 hearings in 5 ARB panels simultaneously. Hendry knew

that Brown could not be in 2 (or more) places at once and that it would be impossible to conduct

that many hearings per day anyway. Hendry had adopted a rule that informal settlement

discussions were not available on commercial properties valued below $950,000. Thus Dave

1

While it cannot be brought as a civil action, Plaintiffs note that the Texas Penal Code

§39.03 defines Official Oppression as “a public servant acting under color of his office or

employment ... (1) intentionally subjects another to mistreatment ... (2) intentionally denies or

impedes another in the exercise or enjoyment of any right, privilege, power, or immunity, knowing

his conduct is unlawful....”

Plaintiffs’ Original Petition

Page 6 of 24

Brown, who had hundreds of commercial protests in that category, had even more protests pushed

into formal hearings because Hendry outlawed informal settlements in that category. But Hendry

allowed other agents of commercial property with such lower values to settle the protests

informally.

b. Consistent with his previous threat, Hendry scheduled Brown for more hearings,

before more ARB panels, in fewer days than any other commercial tax agent operating in Travis

County. When Mr. Brown tried to get the unreached hearings reset, Hendry and Crigler refused,

and 46 of those protests were dismissed without a hearing (now the subject of this lawsuit). The

evidence will show that other tax agents who had hearings that were not reached on the day

originally scheduled were allowed to “rollover” those hearings to have them heard at subsequent

times.

9. Once protests are settled for lower values or the ARB orders changes in value, it affects

the benchmark for equal-and-uniform values for comparable properties. So, Protax has always

requested updated appraisal information during the appraisal protest process so it has fresh

appraisal decisions included in its ARB hearing evidence. Defendant Crigler and her staff

attempted to block this evidence from being presented to ARB panels.

a. Since 1986, Protax has routinely requested a “full load” set of the District’s

appraisal information, which the District has provided usually within one day or so. But this year

when Protax made this routine data request in June, the District responded that the updated

appraisal information would not be available until July 11, 2018—virtually after all the ARB

protest hearings were concluded! Protax viewed this ridiculous delay as part of Crigler’s “war”

on tax agents and a deliberate attempt to keep tax agents from being able to show the ARB panels

Plaintiffs’ Original Petition

Page 7 of 24

updated appraisal evidence for “equity” hearings.

b. That this tactic was deliberate, is further supported by a written statement district

appraisers began reading at the beginning of ARB equity hearings—for the first time—that

denounced the practice of tax agents asking the panels to consider the updated appraisal

information and giving panels incorrect interpretations of the Tax Code provision on unequal

appraisal protests. The district labeled the statement “’Me Too’ (Equity) Grids.” So, upon hearing

from Crigler’s staff that the updated appraisal information would not be provided until the ARB

hearings were over, Protax filed a formal request with ARB Chair Thompson to postpone the

hearings until the Chief Appraiser would provide the updated appraisal data. Ms. Thompson

denied that request indicating that she did not have to postpone hearings just because the District

was refusing to provide appraisal information the tax agents needed to put on their protest before

the ARB panels. This is consistent with ARB Chair Thompson’s attitude that the Tax Code only

provides that taxpayers get a hearing, not necessarily a fair hearing. After being threatened with

a lawsuit for violating the Texas Public Information Act’s requirement to “promptly” provide this

public information, Ms. Crigler relinquished and provided the data—proving that it was feasible

to do so all along and had deliberately been withheld.

10. When, on July 3rd, David Brown asked District appraiser Jared Bates if he could try

to settle the unreached hearings informally, Mr. Bates reported that Chief Deputy Hendry refused,

saying the deadline for informal settlement had passed. Public records show that District Appraiser

Plaintiffs’ Original Petition

Page 8 of 24

Jared Bates also works, privately, for Chief Deputy Hendry’s real estate firm. 2

But after this

supposed deadline, Hendry let other commercial tax agents settle 129 cases informally with

taxable value reductions of $161,493,406! The bulk of these value reductions were included in 43

by Morrison & Head on a couple of days around July 9th, that reduced the taxable value of those

commercial properties by $102,856,592! 3 Hendry permitted a value reduction on the 43 Morrison

& Head accounts that exceeds the total assessed value of all the 46 Protax/Dave Brown accounts

($88,026,102) on which protests were dismissed and are at issue in this lawsuit.

11. The Chief Appraiser’s tactic of deliberately over-scheduling tax agents for hearings and

then dismissing the unreached protests was used on residential protests as well. But the Chief

Appraiser (as an opposing party in the ARB hearings) is not authorized by law to do the ARB

scheduling or ARB panel assignments which are, by Comptroller rule, supposed to be randomly

assigned. For example, John P. Krueger, of Five Stone Tax Advisers, complained that his

residential accounts were over-scheduled (July 3rd and 5th, 80 hearings per day for each of 5 ARB

2

Chief Deputy Appraiser Lonnie Hendry, Jr. also has an active real estate brokerage with 8

sales agents, supposedly operating outside Travis County. But the TREC website for “Team

Hendry Realty” shows that TCAD’s Manager of Commercial Property, Matt Markert, and TCAD

commercial appraiser, Jared Bates, are also sales agents for Hendry’s brokerage.

https://www.trec.texas.gov/apps/license-holder-search/?detail_id=1000039924 On LinkedIn,

Hendry says, “If any of my LinkedIn connections refers a client to my brokerage – Team Henley

Realty LLC—and we are able to help them I will pay a referral fee for the lead.” (emphasis added)

https://www.linkedin.com/feed/update/urn:li:activity:6406644187789344768

3

Agent companies receiving settlements after the deadline Hendry imposed on David Brown

included BRECK BOSTWICK & ASSOC.; CANTRELL MCCULLOCH INC.; COMMERCIAL

TAX GROUP LLC; HARDING & CARBONE INC.; PARADIGM TAX GROUP LLC; POPP

HUTCHESON PLLC; PROPERTY TAX PARTNERS LLP – HOUSTON; RYAN LLC; and

MORRISON & HEAD LP. The appearance of favoritism by Hendry to Morrison & Head is raised

by the fact that in the Fall of 2016, Morrison & Head offered Hendry a lucrative job which, because

he would have to relocate to Dallas, Hendry declined.

Plaintiffs’ Original Petition

Page 9 of 24

panels, or an average of one hearing every 6 minutes). On July 3rd at approximately 1pm, Mr.

Krueger spoke to ARB Chair Betty Thompson about the unfairness of the panel scheduling and

non-random assignment, to which Ms. Thompson replied, “The [Tax] Code doesn’t say anything

about a fair hearing.”

12. About mid-day on July 6th, Krueger argued with Chief Appraiser Marya Crigler (with other

witnesses present) about the unfairness of the hearing schedule, and Krueger asked, “Who set my

hearing schedule this way?” As Krueger recalls, Crigler admitted, “I set all of your hearings.”

(emphasis added). During the hearings, Crigler refused to let Five Stone’s agents plug their laptops

in electrical outlets in the ARB hearing rooms (which were held at the Exposition Center) so, the

agents’ laptops ran down, making it impossible to continue the hearings. On June 28th, TCAD

staff told Protax they could not use any of vacant tables or electrical plugs for their computers

either. This was another element of the Chief Appraiser’s “war” on tax agents.

13. In an email on June 26, 2018, Krueger proposed that, for efficient use of personnel, his

agents be able to work informally at the Exposition Center with Crigler’s appraisers on 145

residential cases when the TCAD appraisers’ time was not occupied with owner-filed protests or

while not appearing in formal hearings. Crigler refused, even though there were many hours of

downtime (residential owners not showing up at the Expo Center) for her appraisers and plenty of

availability of ARB panels during the hearings period. Because of the deliberate over-scheduling

and stubborn refusal to provide any kind of hearing, formal or informal, 113 of Five Stone’s

residential property owners had their protests dismissed without a hearing, resulting in this lawsuit.

14. While Crigler and Hendry refused tax agents’ requests to support rescheduling of protest

hearings instead of dismissing the protests, when Crigler’s staff were not ready for hearings, the

Plaintiffs’ Original Petition

Page 10 of 24

hearings were magically postponed. For example, on the morning of July 3rd, Protax residential

tax agent Debra Bawcom was signing in for 102 ARB hearings she was prepared for, when TCAD

Assistant Director for Residential, Monica Chacon, approached her and said the TCAD was not

ready and those hearings would be rescheduled or settled informally. This is further evidence that

Crigler and her staff are scheduling the ARB panel hearings, not the ARB Chair.

15. Crigler and Hendry, with complicity by ARB Chair Thompson, used tactics that denied fair

hearings to taxpayers, and, in the case of the Plaintiffs in this lawsuit, any hearing at all. They put

an extra-legal time limit of only 15 minutes on any ARB protest hearing. Crigler and Hendry

controlled the informal settlement process in prejudicial fashion and used denial of access to

“Informals” to punish agents they disfavored, forcing even more formal ARB hearings, the

schedules for which Crigler and Hendry also controlled. ARB Chair Thompson arbitrarily ignored

formal requests for hearing postponements and rehearing pursuant to Tax Code section 41.45.

Even in the ARB hearing process, Crigler’s staff, including Chief Deputy Hendry, used improper

“training” discussions with ARB members, ex parte, to misinform ARB panel members about the

Tax Code and appraisal issues, and comments intended to prejudice the panel members against tax

agents and deny fair hearings to taxpayers and their agents. District staff did not follow hearing

evidentiary rules, and one tax agent, Jason Nassour, reports that he observed TCAD appraiser

Jason Ruley having online access to highly confidential mortgage information on the Fannie Mae

West website of taxpayers’ private mortgage information!

16. Throughout the hearing process this year, ARB Chair Thompson and Chief

Appraiser Crigler claimed the restrictions and scheduling, including the dismissal of the cases at

issue in this lawsuit, were necessary to certify the appraisal roll by their self-chosen target date of

Plaintiffs’ Original Petition

Page 11 of 24

July 14th, while the Tax Code gives them until July 20th to do so. With those extra days—in

addition to the days when ARB panel and district appraisers were sitting idle—there was plenty of

time available to complete the Plaintiffs’ protest hearings and still meet the certification deadline.

Yet, the total value of the Plaintiffs’ property in this lawsuit, $159 million, is less than 7/100ths of

1% percent of the approximately $236 Billion in value they needed to achieve certification. The

excuse that over-scheduling and dismissing the appraisal protests on Plaintiffs’ property was

necessary to timely achieve certification is a sham. No one—not the Chief Appraiser, the ARB

Chair, nor the ARB Board—ever sent Plaintiffs notice that their valid and timely filed appraisal

protests had been dismissed. With or without notice, the protest dismissals were unlawful.

17. Ominously, it appears that Crigler intends to ramp up her “war” on tax agents even more

in 2019 and rig the system so even more taxpayers are denied hearings and fair treatment. In a

meeting with Crigler and Hendry on August 28, 2018, Hendry told Protax agent Debra Bawcom

that certain tax agents, including Jason Nassour and Dave Brown—whom Hendry doesn’t like—

will not be allowed to have informal settlement discussions on arbitration appeals from 2018. And

Crigler announced that, for 2019, she is dramatically reducing the opportunity for taxpayers using

tax agents to get informal settlement conferences and that even more formal ARB panel hearings

would be required. This means that if hearing schedules are manipulated in 2019 the way they

were in 2018, even more protests will be dismissed without hearings.

F. CLAIMS

Denial of ARB Hearing

17. Texas Tax Code section 41.45(f) says:

(f) A property owner who has been denied a hearing to which the property owner

is entitled under this chapter may bring suit against the appraisal review board by

Plaintiffs’ Original Petition

Page 12 of 24

filing a petition or application in district court to compel the board to provide the

hearing. If the property owner is entitled to the hearing, the court shall order the

hearing to be held and may award court costs and reasonable attorney fees to the

property owner.

Plaintiffs were entitled to a hearing. Plaintiffs are also entitled to be represented at that

hearing by a tax agent of their choosing. Tex. Tax Code section 1.111. Neither the Chief

Appraiser, the ARB Chair, nor the ARB Board has authority to pressure or punish a taxpayer for

the choice the taxpayer makes in choosing the tax agent. The Defendants are without authority to

so schedule the Plaintiffs’ hearing(s) that it was impossible for their designated tax agent to appear

at the scheduled hearing. No hearing was actually commenced for the Plaintiffs’ appraisal protests.

The ARB Chair improperly and unlawfully ignored or implicitly denied Plaintiffs’ request for

postponement or rehearing.

18. Therefore, Plaintiffs seek a court order compelling the Defendant Travis Appraisal Review

Board to grant Plaintiffs hearings on their appraisal protest for 2018.

Violation of the Texas Open Meetings Act

19. Defendant Travis Appraisal Review Board is a “governmental body” subject to Tex. Gov’t

Code Chapter 551, the Texas Open Meetings Act. No meeting notice in 2018 of the Travis

Appraisal Review Board contained an agenda subject item to dismiss appraisal protests. The Texas

Open Meetings Act requires such notice:

Sec. 551.041. NOTICE OF MEETING REQUIRED. A governmental body shall

give written notice of the date, hour, place, and subject of each meeting held by the

governmental body.

On information and belief, the Defendant dismissed thousands of appraisal protests, ostensibly

because the taxpayers or their agents were not in attendance at the scheduled time for the protest

hearing. Dismissing a validly and timely filed appraisal protest is not the same thing as approving

Plaintiffs’ Original Petition

Page 13 of 24

the appraised value after a contested appraisal review board panel hearing. Dismissing a protest

is a distinct subject from deciding to approve appraisal records. For example, at the July 14, 2018

ARB meeting (at which Plaintiffs believe the Board dismissed their protests), the agenda subject

items were:

1. Call to Order

2. Establish Quorum Present

3. Approval of Records

4. Order Approving 2018 Appraisal Records

5. Administrative Matters and Any Action Resulting from

6. Adjournment of Quorum Meeting

Not one of those agenda items would be sufficient notice under Open Meetings Act section

551.041 to dismiss appraisal protests. In fact, the agenda items are so vague and general, they may

not even be sufficient notice for other actions the Board took.

20. Plaintiffs Texas Protax-Austin, Inc., Five Stone Tax Advisers, and each of the property

owners are interested persons for purposes of this Open Meetings Act claim. The Open Meetings

Act says:

Sec. 551.142. MANDAMUS; INJUNCTION. (a) An interested person, including

a member of the news media, may bring an action by mandamus or injunction to

stop, prevent, or reverse a violation or threatened violation of this chapter by

members of a governmental body.

(b) The court may assess costs of litigation and reasonable attorney fees incurred

by a plaintiff or defendant who substantially prevails in an action under Subsection

(a). In exercising its discretion, the court shall consider whether the action was

brought in good faith and whether the conduct of the governmental body had a

reasonable basis in law.

The Open Meetings Act also says: “Sec. 551.141. ACTION VOIDABLE. An action taken by a

governmental body in violation of this chapter is voidable.”

21. Therefore, pursuant to the Open Meetings Act, Plaintiffs ask the Court to reverse and

Plaintiffs’ Original Petition

Page 14 of 24

declare void the action taken by Defendant Travis Appraisal Review Board in dismissing

Plaintiffs’ valid and timely filed protests under Texas Tax Code section 41.44 and order the

Defendant to provide a hearing to each Plaintiff on its 2018 appraisal protest. In addition, Plaintiffs

ask the Court to reverse and declare void any action taken in 2018 by the Defendant Appraisal

Review Board to dismiss any property owner’s appraisal protest at a meeting of the TARB for

which no agenda subject appeared in the meeting notice to dismiss appraisal protests.

Injunction to Stop Chief Appraiser’s Ultra Vires Scheduling and Selection of ARB Panels

22. Plaintiffs are all adversely and uniquely affected by the effective denial of their right to an

ARB appraisal protest hearing by Chief Appraiser Marya Crigler’s (and her Chief Deputy Lonnie

Hendry’s) tactic of over-scheduling hearings to get the protests dismissed when the ARB panel

runs out of time to conduct the hearing as Crigler and her staff scheduled. The Chief Appraiser

does not have authority to schedule ARB panel hearings or to select with protests are heard by

which ARB panel (which are supposed to be assigned randomly). The Texas Tax Code, section

41.45(a) says that upon a taxpayer filing notice of protest of the appraisal, “the appraisal review

board shall schedule a hearing on the protest.” (emphasis added). Section 41.66(o) says, “The

chairman of an appraisal review board or a member designated by the chairman may make

decisions with regard to the scheduling or postponement of a hearing....”

23. While Tex. Tax Code section 6.43(f) allows the ARB to get “clerical assistance” from the

Chief Appraiser’s staff including “with scheduling and arranging of hearings,” that section does

not permit what has now occurred in Travis County: The complete abdication of any independence

by the ARB in establishing a fair schedule of hearings and total delegation of that function to the

Chief Appraiser. The Chief Appraiser herself has admitted that “she” is scheduling the hearings

Plaintiffs’ Original Petition

Page 15 of 24

and selecting the panels (in a non-random way, in violation of the Texas Comptroller’s rules).

Injunction is appropriate to stop a government official from exercising authority she does not

possess.

24. Plaintiffs seek an injunction to permanently enjoin Marya Crigler, in her capacity as Chief

Appraiser, her staff and her successors in office, from scheduling appraisal protest hearings or

selecting the ARB panel that will hear the protest. The requested injunctive relief is authorized by

Tex. Civ. Prac. & Rem. Code section 65.011(1), (2), and (3). It is probable that Plaintiffs will

recover from Defendant after a trial on the merits regarding Defendant Crigler’s ultra vires acts.

If Plaintiffs’ application for injunctive relief is not granted, harm is imminent because Crigler’s

ultra vires exercise of authority to schedule ARB hearings, particularly in the prejudicial fashion

she did in 2018, will cause Plaintiffs to be without the appraisal protest hearings to which they

entitled by law. Even if the Court grants the requested Order for hearings under Tax Code section

41.45(f), Plaintiffs should not again be subjected to a prejudicial and unlawful hearing schedule

instituted by Defendant Crigler. The harm of being denied a hearing by Defendant Crigler’s

unlawful exercise of authority to set the hearing schedule and choose the ARB panels to hear

Plaintiffs’ protest is irreparable. Plaintiffs have no adequate remedy at law because there is no

other procedure available, than injunctive relief, to prevent Defendant Crigler from continuing her

unlawful and harmful tactics to effectively deny Plaintiffs appraisal protest hearings now and in

the future.

F. CONDITIONS PRECEDENT

25. All conditions precedent have been performed or have occurred.

Plaintiffs’ Original Petition

Page 16 of 24

G. ATTORNEY FEES

26. Plaintiffs have been required to retain the legal services of the attorney signing this

pleading. Plaintiffs ask the Court to award Plaintiffs reasonable and necessary attorney fees

pursuant to Tex. Tax Code section 41.45(f) and Tex. Gov’t Code section 551.142(b) (Texas Open

Meetings Act).

PRAYER

For these reasons, Plaintiffs pray that—

a. Defendants be cited to appear and answer;

b. Plaintiffs be granted judgment as follows:

1. Pursuant to Tex. Tax Code 41.45(f), an order compelling the Defendant Travis

ARB to promptly grant hearings to each Plaintiff on their 2018 appraisal protest, and after such

hearing, to correct the 2018 appraisal records of Travis County;

2. Pursuant to Tex. Gov’t Code sections 551.141 and 551.142, reverse and declare

void (a) the action of the Travis Appraisal Review Board to dismiss Plaintiffs’ 2018 appraisal

protests, and (b) the action of the Travis Appraisal Review Board to dismiss any property owners’

2018 appraisal protests, and to order the Board to set hearings on those unlawfully dismissed

protests.

3. To grant an injunction against Marya Crigler, in her capacity as Chief Appraiser of

Travis County and against her staff and successors in office, from determining the schedule or

ARB panel selection by which appraisal protests in Travis County will be heard.

e. Plaintiffs be granted judgment for all costs of court and reasonable and necessary attorney

fees.

Plaintiffs’ Original Petition

Page 17 of 24

f. Plaintiffs be granted all further relief to which Plaintiffs may be entitled.

Respectfully submitted,

_____________________________

Bill Aleshire

Bar No. 24031810

AleshireLAW, P.C.

700 Lavaca, Suite 1400

Austin, Texas 78701

Telephone: (512) 320-9155

Cell: (512) 750-5854

Facsimile: (512) 320-9156

Bill@AleshireLaw.com

ATTORNEY FOR PLAINTIFFS

Attached:

Discovery Requests Served With Petition

Plaintiffs’ Original Petition

Page 18 of 24

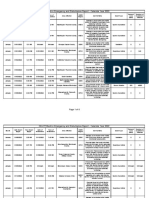

PARTY PLAINTIFFS’ LIST:

Petition Paragraph 3(c): 46 Commercial Property Owners, Customers of Protax:

PID OWNERSHIP/PLAINTIFF’S NAME

350573 EDWARD LAWRENCE BRACKIN

211180 JAME CECIL PICKENS ET AL

194641 J B BRANTON JR

194311 MARK D BRAINARD

105405 STANLEY F KORNFUEHRER

194459 BENARD LAVES & HAROLD P LAVES

208315 JOHN CALHOUN MILLER

327549 KENNETH D PRUE

194520 HAL B ARMSTRONG III

282700 STEPHEN WERTHEIMER

194454 201 EAST 6TH STREET LLC

194535 418 EAST 6TH STREET LLC & ET AL

105391 715 WEST SIXTH STREET LP

190889 BANGERS RAINEY STREET

194497 SMITH-HAGE BUILDING LP

194566 GSD ENTERPRISES LP

105500 BROADDUS PROPERTIES LTD

107247 BRIDGES REAL ESTATE LLC

105390 BULL CREEK EXPLORER LLC

194312 ANKO LLC

194589 PECAN-500 LLC

249932 PCD PROPERTIES LTD

105367 600-2313-2305 MJM LLC & RICHARD G HARDIN

807119 SIX-TEN-TWELVE-SIXTEEN NUECES LLC

424204 LAKEWAY CAR WASH LLC

194540 408 SIXTH EAST LC

194569 505-507 SIXTH LLC

194631 SIXTH RED RIVER LC

194597 MCDANIEL COMMERCIAL LLC

194343 MILLER 120 W 5TH PROPERTY LLC

194186 520 WEST 6TH STREET LLC

194634 CABOT-CHASE LTD

194640 CABOT-CHASE LTD

Plaintiffs’ Original Petition

Page 20 of 24

107155 OGDEN RENTALS LP

243374 3AQ INC

194526 RATR INC

291961 2002 RE LP

194467 REWBOW LLC

192857 M M REYNOLDS 67 M O M TRUST

194493 SILBERSTEIN JONAS & JUANITA LIVING TRUST

249915 SILBERSTEIN JONAS & JUANITA LIVING TRUST

194283 SIMMS & STEIN FAMILY TRUST

233436 AUSTIN TRUST COMPANY TRUSTEE & LAURA N ROBERTS & ROBERT

NICHOLAS

194284 THREE D PROPERTIES LIMITED

208428 TWIN OAKS ASSOCIATES LTD

196567 WATERLOO II LTD

Petition Paragraph 3(d): 113 Residential Property Owners, Customers of Five Stone Tax Advisers:

PID OWNERSHIP/PLAINTIFF’S NAME

100425 1719 Bluebonnet Ln LLC

795972 210 Lee Barton LLC

204135 Amy Schweiss

302703 Andre Beskrowni & Meghal Mehta

321345 Arjun Mishra

163256 Baci Series #2 of Clasi Series LLC

495244 Beatty Barts Family Trust

460747 Ben Le

159402 Beverly Ogier Wood Trustee

333253 Brandye Tambunga

231699 Brian Christensen

831426 Butler Cove Partners LLC

709177 Caitlin Sulley & Ryan Bamford

303391 Carey Howard & Sarah Howard

101151 Catherine Morgan

129581 Charles & Hanna Byrd

117585 Charles Gordon Watson

758857 Charles John Marriot

191816 Christina Di Pierro & Kevin Fagan

Plaintiffs’ Original Petition

Page 21 of 24

557421 Chrys Hightower

113228 Dana Golemi

356270 Daniel & Cheryl Seay

121101 David Macdonald

366634 Eldho Varkey

306096 Elizabeth Sowell & Clark Mente

101225 Emil Jimez & Christina Iron

423033 Gabriel Rodriguez & Rory Mcneill

165254 Gary and Linda Vopat

200281 Gaston Family Trust

207219 Gautum Mekala & Chalasani Lokaranjtt

204402 Gretchen Robbins

117401 Heidi & Vincent Restivo

752729 Henry & Georgia Smith

107780 Hweilu Chen & Kellie Pai

455820 Invigor Property Management LLC

325509 Israel & Chris Trevino

540766 James Martino

312538 Jean Kim

709119 Jeffery & Hannah Hamilton

355545 Jett Virginia Revocable Trust

323384 Joel & Jillian Farris

359665 John M Scott

134858 Joseph & Mary Jo Sheehan

239885 Joseph Schuepbach

128119 Josh & Leila Behjat

193348 Justin Thomas Stewart

102556 Katelyn & Clayton Boone

323405 Kathleen Godwin

521260 Kevin & Cathy Zou

200415 Kimberly Griffin

475209 Laura Perez & Joseph Corso

117404 Lillian Kathleen Montana

508890 Lisa & Bryan Oneil

323526 Lynn Cash & Alison Proctor

177749 Margaret Butler

108202 Mark & Dawn Hooper

501082 Marvin & Lucille Duncan

204350 Matthew & Sarah Shaw

Plaintiffs’ Original Petition

Page 22 of 24

324118 Melisa Santillano

121902 Michele Seghers

121914 Michele Seghers

794488 Miles Anderson

311894 Monica Flores & Dusty Burcham

129585 Murray Martin & Peggy Broo

207635 MWS Capital LLC

310963 Nathan Kennedy

129582 Patricia Anderson

108420 Patrick Eitel & Natasha Beaugh

121876 Patrick Fear

786629 Paul & Linda Spurgeon

267323 Pavel & Darya Karoukin

438443 Pintek Family Trust

219065 Rebecca Abdallah

464650 Richard & Kerri Slobodnik

534703 Rick Clay & Alice Bingham

356099 Robert & Tracy King

356144 Ronald & Linnea Spitzack

189220 Ross Blagg

122539 Ryan & Elizabeth Coleman

303358 Ryan & Kristin Chandler

548869 Ryan & Ruth Firth

329451 Sandra Sancen

222654 Santaka Investment Group

148146 Scott & Ronnie Kruger

557268 Seung Hun Lee & Kim Yeonjin

100734 Shirin Khosropour

197596 Simon Wallace

522127 Soledad Wilson

825601 Srinivas Neshangi

540687 Stan & Parker Rice

161982 Stanley Craig

772839 Steven & Geanneita Butler

157240 Steven & Sharon Rudkin

125010 Susan Klein & Shil Govino

100699 Sylvia Deily & William Tucker

330883 Tarin Lewis

121016 Teresa Vannoy

Plaintiffs’ Original Petition

Page 23 of 24

157210 Teri Hewitt

709196 Tiffany & Crystal Murray

129584 Timothy & Beth Jones

366268 Tommy & Meghan Lueders

355856 Toni & Jason Hammond

484290 Trudy & David Hasan

775177 Tung Chung

125011 Velayudhan & Deepthi Venugopal

349258 Vincent & Angie Whitney

100673 Virginia Wilkinson & Christopher

126785 William & Barbara Shepherd

103346 William Ogilvie

187662 William Pittman & Eric Webb

891396 Yesenia Woodall

431303 Tony & Brenda Alvardo

741044 Haynes Family Investments LTD

Plaintiffs’ Original Petition

Page 24 of 24

You might also like

- CJS On SignaturesDocument47 pagesCJS On Signaturesgoldilucks100% (2)

- Court of Criminal Appeals of Tennessee On State of Tennessee v. Frankie E. CasteelDocument29 pagesCourt of Criminal Appeals of Tennessee On State of Tennessee v. Frankie E. CasteelNewsChannel 9 Staff100% (1)

- 2023 SCB 0083Document25 pages2023 SCB 0083Trevor DrewNo ratings yet

- 2023.01.20 Hagelman Et Al v. CornwellDocument14 pages2023.01.20 Hagelman Et Al v. CornwellAnonymous Pb39klJ100% (1)

- 2023.01.20 Hagelman Et Al v. CornwellDocument14 pages2023.01.20 Hagelman Et Al v. CornwellAnonymous Pb39klJ100% (1)

- Jodrell News, Issue 2Document4 pagesJodrell News, Issue 2RobertSauntNo ratings yet

- Texas Month-to-Month Lease Agreement GuideDocument5 pagesTexas Month-to-Month Lease Agreement GuideThi NgoNo ratings yet

- Robb Elementary Investigative Committee ReportDocument82 pagesRobb Elementary Investigative Committee ReportAnonymous Pb39klJNo ratings yet

- Sflores@ci - Fillmore.ca - Us: Sonja Flores 525-1500 x113Document3 pagesSflores@ci - Fillmore.ca - Us: Sonja Flores 525-1500 x113VanessaNo ratings yet

- Army of One Training Manual # 01Document175 pagesArmy of One Training Manual # 01ED CurtisNo ratings yet

- Addendums To The 7elucidationsDocument84 pagesAddendums To The 7elucidationswolf gangNo ratings yet

- Marsy's Law Florida Supreme Court OpinionDocument27 pagesMarsy's Law Florida Supreme Court OpinionPeter BurkeNo ratings yet

- Strong & Powerful Love Spells To Win Your Ex Lover Back in 12hours +256779317397Document1 pageStrong & Powerful Love Spells To Win Your Ex Lover Back in 12hours +256779317397Prof MuuzaNo ratings yet

- Action of EjectmentDocument10 pagesAction of EjectmentRomeo BahNo ratings yet

- 60-Second Brain Teasers Crime Puzzles Short Forensic Mysteries To Challenge Your Inner Amateur DetectiveDocument157 pages60-Second Brain Teasers Crime Puzzles Short Forensic Mysteries To Challenge Your Inner Amateur DetectiveTan Yan TingNo ratings yet

- In The Realm of Hacking: by Chaelynne M. Wolak Wolakcha@scsi - Nova.eduDocument8 pagesIn The Realm of Hacking: by Chaelynne M. Wolak Wolakcha@scsi - Nova.edukarmaNo ratings yet

- 50-114 Residence Homestead Exemption Application PDFDocument3 pages50-114 Residence Homestead Exemption Application PDFAnonymous Pb39klJNo ratings yet

- Book Club Vol. 11Document36 pagesBook Club Vol. 11PRHLibrary100% (2)

- Ohio Human Trafficking Taskforce Report 0117Document36 pagesOhio Human Trafficking Taskforce Report 0117Ashton VogelhuberNo ratings yet

- CHEM 397 Experiment QDocument20 pagesCHEM 397 Experiment QazinthepantsNo ratings yet

- 1963 Criminal Procedure Code of Somalia - English VersionDocument105 pages1963 Criminal Procedure Code of Somalia - English Versionصقر قريشNo ratings yet

- QTBrochure InsideDocument1 pageQTBrochure InsidelighthandsNo ratings yet

- DoD Law Enforcement Role in Combating Human TraffickingDocument54 pagesDoD Law Enforcement Role in Combating Human Traffickingbaguio7pulisya7syeteNo ratings yet

- Your Rights When Interacting with Law EnforcementDocument18 pagesYour Rights When Interacting with Law EnforcementYaco Jessa Mae JavierNo ratings yet

- Former Bhs Students' Federal Lawsuit Against AisdDocument38 pagesFormer Bhs Students' Federal Lawsuit Against AisdAnonymous Pb39klJNo ratings yet

- Texas Parole GuidelinesDocument15 pagesTexas Parole GuidelinesBrian MartinNo ratings yet

- DePuy Appeals Verdict in California CasesDocument98 pagesDePuy Appeals Verdict in California CasesLisa BartleyNo ratings yet

- Ohio's Concealed Carry Laws and License Application (June 2022)Document34 pagesOhio's Concealed Carry Laws and License Application (June 2022)Cassie NistNo ratings yet

- Johnny Delshaw Lawsuit Against The Seattle TimesDocument176 pagesJohnny Delshaw Lawsuit Against The Seattle TimesNeal McNamaraNo ratings yet

- Conflicts OutlineDocument35 pagesConflicts Outlineksmit125No ratings yet

- FACDL-Miami's Demand For ReformDocument2 pagesFACDL-Miami's Demand For ReformAnonymous PbHV4HNo ratings yet

- Chapter 12 VehiclesDocument49 pagesChapter 12 VehiclesAndrew Charles HendricksNo ratings yet

- Legal Issues TOCDocument3 pagesLegal Issues TOC9wfuepoNo ratings yet

- 2023.02.15 (1) Original ComplaintDocument8 pages2023.02.15 (1) Original ComplaintAnonymous Pb39klJNo ratings yet

- Travis Co Lawsuit Against Vrbo, Rental Owners in ComfortDocument12 pagesTravis Co Lawsuit Against Vrbo, Rental Owners in ComfortAnonymous Pb39klJNo ratings yet

- Revised Idaho Marijuana Legalization Ballot MeasureDocument23 pagesRevised Idaho Marijuana Legalization Ballot MeasureMarijuana MomentNo ratings yet

- Labor 2 Digests 1 - 13Document18 pagesLabor 2 Digests 1 - 13Ben Dover McDuffinsNo ratings yet

- 2022 Austin Energy Emergency Operations Plan FilingDocument189 pages2022 Austin Energy Emergency Operations Plan FilingAnonymous Pb39klJNo ratings yet

- 2019 Public Service CorporationsDocument7 pages2019 Public Service CorporationsActivate VirginiaNo ratings yet

- FletcDocument208 pagesFletcTim PipanNo ratings yet

- E ReceiptDocument1 pageE Receiptrodolfo laranjaNo ratings yet

- Lying Cheating Breaking Promises Stealing v1Document13 pagesLying Cheating Breaking Promises Stealing v1ngziyeeNo ratings yet

- Crystal Vs Bpi DigestDocument5 pagesCrystal Vs Bpi DigestAmelyn Albitos-Ylagan MoteNo ratings yet

- Balane - Spanish Antecedents of Civil LawDocument45 pagesBalane - Spanish Antecedents of Civil LawChimney sweep100% (1)

- W1 Ayer Hitam V Tin DredgingDocument22 pagesW1 Ayer Hitam V Tin Dredginghaziqah100% (1)

- General Santos Coca Cola Plant Free Workers Union - Tupas Vs Coca Cola Bottlers Et AlDocument2 pagesGeneral Santos Coca Cola Plant Free Workers Union - Tupas Vs Coca Cola Bottlers Et AlAlvin HalconNo ratings yet

- CRIMPRO Madeja V Hon CaroDocument2 pagesCRIMPRO Madeja V Hon CarojmNo ratings yet

- Psi WashingtonDocument9 pagesPsi WashingtonVanessaNo ratings yet

- HRDC - SwvrjaDocument28 pagesHRDC - SwvrjaWCYB DigitalNo ratings yet

- CA15of2010 Life ImprisonmentDocument58 pagesCA15of2010 Life ImprisonmentManjare Hassin RaadNo ratings yet

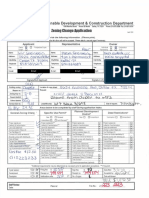

- Z223-223 Application KeydocsDocument5 pagesZ223-223 Application KeydocsAvi S. AdelmanNo ratings yet

- Piis0025619616308254 PDFDocument23 pagesPiis0025619616308254 PDFdrunkpunchloveNo ratings yet

- Disability Benefits and Application File July 7, 2015 No Compression by HackersDocument66 pagesDisability Benefits and Application File July 7, 2015 No Compression by HackersStan J. CaterboneNo ratings yet

- Most Corrupt 2011: Rep. Hal Rogers (R-KY)Document8 pagesMost Corrupt 2011: Rep. Hal Rogers (R-KY)CREWNo ratings yet

- The Myth Behind Long Prison SentencesDocument4 pagesThe Myth Behind Long Prison SentencesNguyễn Phương LinhNo ratings yet

- The Feds Say They Shut Down Nine Massage-Parlor Brothels in Massive Prostitution BustDocument19 pagesThe Feds Say They Shut Down Nine Massage-Parlor Brothels in Massive Prostitution BustDallasObserverNo ratings yet

- WCDP Stolen Checks IssueDocument2 pagesWCDP Stolen Checks IssueprecinctchairNo ratings yet

- Wahington Small ClaimsDocument27 pagesWahington Small ClaimslawatusiNo ratings yet

- Magnetic Electricity Generator DesignDocument14 pagesMagnetic Electricity Generator DesignMladen MuskinjaNo ratings yet

- Brown v. Kendall (1850) : The Triumph of The Negligence Rule (Almost SL But Still NEG)Document13 pagesBrown v. Kendall (1850) : The Triumph of The Negligence Rule (Almost SL But Still NEG)Myung100% (1)

- PropertyDocument26 pagesPropertycari2718100% (1)

- SC BowersDocument25 pagesSC BowersWIS Digital News StaffNo ratings yet

- OIG FOIA Closed InvestigationsDocument712 pagesOIG FOIA Closed InvestigationsWhatYou HaventSeenNo ratings yet

- Wall of Moms, Et Al. v. DHS, Et Al.Document48 pagesWall of Moms, Et Al. v. DHS, Et Al.Law&CrimeNo ratings yet

- State Organizational DirectoryDocument52 pagesState Organizational DirectoryДрагослав БјелицаNo ratings yet

- Spousal Collection - Part 1Document97 pagesSpousal Collection - Part 1Queer OntarioNo ratings yet

- Psychic Intuitive Management For Our Modern AgeDocument20 pagesPsychic Intuitive Management For Our Modern AgeCommercial ScoutsNo ratings yet

- DHS Had Authority To Deploy Federal Law Enforcement Officers To Protect Federal Facilities in Portland, Oregon, But Should Ensure Better Planning and Execution in Future Cross-Component ActivitiesDocument32 pagesDHS Had Authority To Deploy Federal Law Enforcement Officers To Protect Federal Facilities in Portland, Oregon, But Should Ensure Better Planning and Execution in Future Cross-Component ActivitiesABC News PoliticsNo ratings yet

- Targeted Human Development Programs - Investing in The Next GenerationDocument30 pagesTargeted Human Development Programs - Investing in The Next GenerationSara ValentinNo ratings yet

- Rialto's 2015 California Public Records RequestsDocument12 pagesRialto's 2015 California Public Records RequestsBeau YarbroughNo ratings yet

- Jane Doe vs. Scientology: RTC's Motion To DismissDocument47 pagesJane Doe vs. Scientology: RTC's Motion To DismissTony Ortega100% (1)

- Vet State Benefits - FL 2020Document18 pagesVet State Benefits - FL 2020DonnieNo ratings yet

- Expungment PacketDocument6 pagesExpungment PacketNick Elkins100% (1)

- Devide and ConquerDocument54 pagesDevide and ConquerSteffen PlachetkaNo ratings yet

- Regulatory Reform Task Force Progress Report 2Document99 pagesRegulatory Reform Task Force Progress Report 2Valerie StraussNo ratings yet

- Tcad LawsuitDocument47 pagesTcad LawsuitAnonymous Pb39klJNo ratings yet

- Lawrence Two Years Probated SuspensionDocument5 pagesLawrence Two Years Probated SuspensionAnonymous Pb39klJNo ratings yet

- Drought Response Watering Restrictions For Firm Water Customers Pres 2024-02-21Document7 pagesDrought Response Watering Restrictions For Firm Water Customers Pres 2024-02-21Anonymous Pb39klJNo ratings yet

- Basin Conditions Update Presentation 2024-02-21Document11 pagesBasin Conditions Update Presentation 2024-02-21Anonymous Pb39klJNo ratings yet

- Policy May 2023 - DRAFTDocument4 pagesPolicy May 2023 - DRAFTAnonymous Pb39klJNo ratings yet

- Lcra Drought Contingency Plan For Firm Water Customers Update Pres 2024-02-21Document10 pagesLcra Drought Contingency Plan For Firm Water Customers Update Pres 2024-02-21Anonymous Pb39klJNo ratings yet

- Lcra Drought Contingency Plan For Firm Water Customers Update Pres 2024-02-21Document10 pagesLcra Drought Contingency Plan For Firm Water Customers Update Pres 2024-02-21Anonymous Pb39klJNo ratings yet

- Basin Conditions Update Presentation 2024-02-21Document11 pagesBasin Conditions Update Presentation 2024-02-21Anonymous Pb39klJNo ratings yet

- Lcra Water Conservation Plan Update Pres 2024-02-21Document11 pagesLcra Water Conservation Plan Update Pres 2024-02-21Anonymous Pb39klJNo ratings yet

- Drought Response Watering Restrictions For Firm Water Customers Pres 2024-02-21Document7 pagesDrought Response Watering Restrictions For Firm Water Customers Pres 2024-02-21Anonymous Pb39klJNo ratings yet

- RequiresDocument11 pagesRequiresAnonymous Pb39klJNo ratings yet

- Sign Bar InventoryDocument3 pagesSign Bar InventoryAnonymous Pb39klJNo ratings yet

- State Rep. Bryan Slaton Expulsion ReportDocument1 pageState Rep. Bryan Slaton Expulsion ReportAnonymous Pb39klJNo ratings yet

- KVUE RAW 2022 Annual Summary DOE Power OutagesDocument6 pagesKVUE RAW 2022 Annual Summary DOE Power OutagesAnonymous Pb39klJNo ratings yet

- KVUE RAW 2021 Annual Summary DOE Power OutagesDocument41 pagesKVUE RAW 2021 Annual Summary DOE Power OutagesAnonymous Pb39klJNo ratings yet

- KVUE RAW Climate Central US Power Outages 2000-2021Document82 pagesKVUE RAW Climate Central US Power Outages 2000-2021Anonymous Pb39klJNo ratings yet

- KVUE/Texas Hispanic Policy Foundation "Texas Decides" Poll - Part 2Document32 pagesKVUE/Texas Hispanic Policy Foundation "Texas Decides" Poll - Part 2Anonymous Pb39klJNo ratings yet

- House Letter July 30 - Raptor - FINALDocument1 pageHouse Letter July 30 - Raptor - FINALAnonymous Pb39klJNo ratings yet

- Public Utility Commission of Texas Weather Emergency Preparedness Report 2022Document98 pagesPublic Utility Commission of Texas Weather Emergency Preparedness Report 2022Anonymous Pb39klJNo ratings yet

- Lakeway City Manager Julie Oakley LawsuitDocument30 pagesLakeway City Manager Julie Oakley LawsuitAnonymous Pb39klJNo ratings yet

- (DAILY CALLER OBTAINED) - Rom 22451Document2 pages(DAILY CALLER OBTAINED) - Rom 22451Henry RodgersNo ratings yet

- Austin ISD FY2023 Staff Budget ReductionsDocument3 pagesAustin ISD FY2023 Staff Budget ReductionsAnonymous Pb39klJNo ratings yet

- Plaintiffs' AdvisoryDocument15 pagesPlaintiffs' AdvisoryAnonymous Pb39klJNo ratings yet

- Media Coalition Letter To Mayor McLaughlinDocument3 pagesMedia Coalition Letter To Mayor McLaughlinKCEN-TV 6 NewsNo ratings yet

- Benguet Corporation Tailings Dam Tax Assessment CaseDocument8 pagesBenguet Corporation Tailings Dam Tax Assessment CaseEmma Ruby Aguilar-ApradoNo ratings yet

- New York State Board of Law ExaminersDocument22 pagesNew York State Board of Law ExaminersAsif ParviNo ratings yet

- 7K Corp Vs AlbaricoDocument12 pages7K Corp Vs AlbaricoMay RMNo ratings yet

- Supreme Court upholds moratorium laws interrupted prescription periodDocument2 pagesSupreme Court upholds moratorium laws interrupted prescription periodDani LynneNo ratings yet

- Counter Claims in Civil Suits-Prof - DR - Mukund SardaDocument7 pagesCounter Claims in Civil Suits-Prof - DR - Mukund SardaGirivel Thirugnanam100% (1)

- Prescription 1106 PDFDocument11 pagesPrescription 1106 PDFMichelle Gay Abenes PalasanNo ratings yet

- Trillanes v. PimentelDocument7 pagesTrillanes v. PimentelAnonymous ow97IGY9e6No ratings yet

- Importance of Committees for Effective Corporate GovernanceDocument22 pagesImportance of Committees for Effective Corporate GovernanceshankarinadarNo ratings yet

- Agency Answer GuideDocument12 pagesAgency Answer GuideCassie L GraysonNo ratings yet

- Mechanics Bank of Alexandria v. Lynn, 26 U.S. 376 (1828)Document11 pagesMechanics Bank of Alexandria v. Lynn, 26 U.S. 376 (1828)Scribd Government DocsNo ratings yet

- CrimPro Cases (Rule 116)Document45 pagesCrimPro Cases (Rule 116)elvinperiaNo ratings yet

- Resolution 2001 03Document139 pagesResolution 2001 03Brian DaviesNo ratings yet

- Negligence elements and the Caparo testDocument2 pagesNegligence elements and the Caparo testSyed Fazal HussainNo ratings yet

- Jasco RulingDocument7 pagesJasco RulingAnthony WarrenNo ratings yet

- People vs. Baustista FULLDocument4 pagesPeople vs. Baustista FULLDPNo ratings yet

- Supreme Court Rules Against Citizenship Bid Due to Omitted ChildrenDocument3 pagesSupreme Court Rules Against Citizenship Bid Due to Omitted ChildrenDebbie YrreverreNo ratings yet

- G.R. No. 93891 (Resolution) - Pollution Adjudication Board v. Court ofDocument19 pagesG.R. No. 93891 (Resolution) - Pollution Adjudication Board v. Court ofJaana AlbanoNo ratings yet

- Charlotte Keeley Misconduct Sacramento Superior Court: Unlawful Proof of Service - Sacramento County Judge Robert Hight - Judge James Mize - US District Court Eastern District of California - 3rd District Court of Appeal Judge Vance Raye - California Supreme Court Tani Cantil SakauyeDocument10 pagesCharlotte Keeley Misconduct Sacramento Superior Court: Unlawful Proof of Service - Sacramento County Judge Robert Hight - Judge James Mize - US District Court Eastern District of California - 3rd District Court of Appeal Judge Vance Raye - California Supreme Court Tani Cantil SakauyeCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Ralph C. Hamm, III v. Paul Murphy, Superintendent, 53 F.3d 327, 1st Cir. (1995)Document6 pagesRalph C. Hamm, III v. Paul Murphy, Superintendent, 53 F.3d 327, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- Conflicts For Digest - J3 and K3Document40 pagesConflicts For Digest - J3 and K3Kyle BollozosNo ratings yet

- Conciliation & MediationDocument21 pagesConciliation & MediationreadefinedNo ratings yet