Professional Documents

Culture Documents

Key Learnings On Gas Price & It's Mechanism For India With Regulatory Aspects

Uploaded by

Anand aashishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Key Learnings On Gas Price & It's Mechanism For India With Regulatory Aspects

Uploaded by

Anand aashishCopyright:

Available Formats

Key Learnings on Gas Price & it’s

Mechanism for India with

Regulatory Aspects

join the Future now

Project on Gas Pricing in India

Market Price Regulation in India Query: Which consuming sectors do have regulated prices

(power generation, industry , residential and commercial ,

Coverage is Inclusive of Wellhead , Wholesale and / or Retail feedstock, others?)

Prices

Response:

Query: Which market prices are regulated (wellhead ,

wholesale and/ or retail)

All the consuming sectors in India have regulated gas prices

which are being supplied through APM mechanism. This was

Response:

done keeping in view of scarcity of natural gas in the country,

priority for the commercial utilization of domestic gas was

All the market prices for gas in India are regulated i.e.

decided by Government of India, to make its most optimal

wellhead, wholesale and retail. It is pertinent to note that the

use. The priority for utilization of gas produced from fields

proposed formula by Rangarajan Committee has not been

under APM i.e. gas produced by NOCs- ONGC and Oil India,

implemented as the rationale behind same is not very well

for the fields awarded on nomination basis prior to the PSC

accepted by the stake holders. The gas pricing mechanism in

regime and for the natural gas produced by NELP contractors

India which still is under implementation follows typically two

including RIL's KG D6 field was decided by GoI. The guidelines

regimes namely:

for the gas sold from NELP fields were issued by Empowered

Group of Ministers (EGoM) in May 2008. APM gas is mainly

• Administered Pricing Mechanism (APM)

allocated to existing power and fertilizer plants. The order of

• Non-APM or Free market gas

priority has been laid down to give first priority to the existing

plants to ensure utilization of capacities already created and

The price of APM gas is set by the Government principally on

to obtain faster monetization of natural gas.

a cost-plus basis. As regards non-APM/free-market gas, this

The second preference is given to substitute liquid fuels in

could also be broadly divided into two categories, namely, (i)

The second preference is given to energy-intensive industries

imported Liquefied Natural Gas (LNG), and (ii) domestically

and the third preference to plants in easing bottlenecks and

produced gas from New Exploration Licensing Policy (NELP)

expansion. The order of priority is shown in Exhibit 01 for

and pre-NELP fields.

existing units and in Exhibit 02 for green-field units.

© ENINCON LLP 2016 I 01

Exhibit 01: Order of Priority Consumers with Existing Exhibit 02: Order of Priority Consumers with Green Field

Units Units

TABULAR TABULAR

Order of Priority Consuming Sectors Order of Priority Consuming Sectors

First A First A

Second B Second B

Third Power Plants Third C

Fourth C Fourth D

Fifth D Fifth Power Plants

Source: enincon research Source: enincon research

Exhibit 03: Allocation of Gas from Krishna Godavari (KG)-D6 Basin in MMSCMD to Different Consuming Sectors

ILLUSTRATIVE

Earlier Allocation from KG - D6 Basin in MMSCMD Current Allocation from KG - D6 Basin in MMSCMD

Fertilizer

Fertilizer

LPG

LPG

Power Power

Others Others

Source: enincon research

© ENINCON LLP 2016 I 02

Gas Regulatory Structure & Pricing Response:

in India There are broadly two pricing regimes for gas in the country

currently – one for the gas priced under the Administered

Coverage is Inclusive of Basis of Regulation and Structure in

Pricing Mechanism (APM), and the other for the non-APM or

India

free-market gas. The price of APM gas is set by the

Query: Who is the regulator (Ministry, Local Government, Government principally on a cost-plus basis. As regards non-

Government Agency, Independent Energy Regulator, APM/free-market gas, this could also be broadly divided into

Competition Regulator, Courts or others)? two categories, namely, (i) imported Liquefied Natural Gas

(LNG), and (ii) domestically produced gas from New

Response: Exploration Licensing Policy (NELP) and pre-NELP fields.

Further, the basis of regulation on gas pricing in India can be

Ministry of Petroleum and Natural Gas (MoPNG) is the apex understood from below explanation:-

regulatory body representing Government of India that

regulates and oversees exploration, exploitation and Cost Recovery: The contractor bids the Cost Recovery Factor

utilization of petroleum resources, including natural gas. Also, – i.e. the percentage of revenues which he is entitled to take

there are other two regulatory bodies under MoPNG namely: in a year to recover his exploration, development and

production costs. This percentage can be up to 100 percent.

• Directorate General of Hydrocarbons (DGH) – Regulates The higher the cost recovery factor that the contractor bids,

Upstream Hydrocarbon Sector the earlier the costs can be recovered; however, in such a

• Petroleum and Natural Gas Regulatory Board (PNGRB) – situation, his fiscal package will be relatively unattractive as

Regulates Downstream Hydrocarbon Sector part of the bid evaluation.

Query: What is the basis for regulation (Cost of service, Local Market Price: The sale price must at all times be on the

including production, transportation, distribution storage basis of similar arms - length sales in the market.

etc; local or international market price; price of competing

fuels, social affordability, including for electricity that is Social Affordability: The fertilizer and power plants are

generated from natural gas; and others) heavily subsidized by the Government and, if the same is not

done then that will be the direct pass through to the end

consumers.

© ENINCON LLP 2016 I 03

Also, Gas pricing mechanism in India is presently driven by

sectoral prioritization, administered gas allocation and Exhibit 04: Sector Wise Demand of Gas During 12th FYP

pricing, apart from huge supply-side constraints. While short- (From 2012-17) in India in MMSCMD

term demand changes in international demand due to

weather-related causes are quite frequent, the Indian gas 250 ILLUSTRATIVE

market has not seen such volatility in demand in the short-

term. This is mainly due to the fact that gas consumption is 200

concentrated in the fertilizer, power and LPG sectors. Other

Gas in MMSCMD

factors resulting in short-term volatility, like business cycles 150

2012-13

and supply interruptions are also not relevant here. However, 2013-14

all these factors impact international gas price in the spot 2014-15

100 2015-16

market and may impact profitability of Indian industry

2016-17

substantially.

50

The latest natural gas pricing guidelines which was

supposedly applicable from April 01, 2014 but was deferred 0

by firstly the Election commission of India in the event of Petrochemicals Sponge Iron

Power Fertilizer CGD Industrial

/ Refineries/ / Steel

General elections in the country and secondly by the new Internal

Government to find a judicious way of pricing of gas against Consumption

the universal opposition of Rangarajan Committee

Source: enincon research

recommendations for pricing is depicted as below:

The Government has issued the Notification regarding

Domestic Natural Gas Pricing Guidelines, 2014 on

10.01.2014. These Guidelines are hosted on website of the These guidelines will be applicable to all natural gas

Ministry and would have been published in the Gazette of produced domestically, irrespective of the source, whether

India. Salient features of the Domestic Natural Gas Pricing conventional, shale, CBM etc. These guidelines shall apply

Guidelines, 2014 are: from 1st April 2014.

© ENINCON LLP 2016 I 04

These guidelines shall not be applicable where prices have Finally, the simple average of the prices arrived at through the

been fixed contractually for a certain period of time, till aforementioned two methods will be determined as the price

the end of such period. These guidelines shall also not be for domestically produced natural gas in India.

applicable where the production sharing contract provides

a specific formula for natural gas price indexation / Domestic Gas prices shall be notified in advance on a quarterly

fixation. Further, the pricing of natural gas from small / basis using the data for four quarters, with a lag of one quarter.

isolated fields in the nomination blocks of NOCs will be In respect of D1 and D3 gas discoveries of Block KG-DWN-98/3,

governed by the extant policy in respect of these blocks these guidelines shall be applicable subject to submission of

issued on 8th July, 2013. bank guarantees in the manner to be notified separately.

The prices determined under these guidelines shall be

applicable to all consuming sectors uniformly. These

guidelines shall also be applicable for natural gas produced Query: Please indicate the latest available price level for the

by ONGC/OIL from their nominated fields. main large consumers ( power generation , feed stock , local

, distributors etc ) and specify date of the quote.

The pricing of natural gas produced domestically shall be

based on the following methodology: Response:

First, the netback price of all Indian imports at the wellhead In India, as mentioned in previous section also, the gas pricing

of the exporting countries will be estimated. Since there may is done under four major pricing regimes for domestic gas in

be several sources of gas imports, the weighted average of the country – gas priced under Administrative Pricing

such netback of import prices at the wellheads would Mechanism (APM), Pre-NELP, non-APM and NELP (New

represent the average global price for Indian LNG imports. Exploration Licensing Policy). The price of APM & non-APM

gas is fixed by the Government. As regards NELP & pre-NELP

Secondly, weighted average of prices prevailing at trading gas, its pricing is governed in terms of the Production Sharing

points of transactions – i.e., the hubs or balancing points of Contract (PSC) signed between the Government & the

the major global markets will be estimated. For this, (a) the Contractor. As far as imported gas is concerned, the price of

hub price (at the Henry Hub) in the US (for North America), LNG imported under term contracts is governed by the Sale &

(b) the price at the National Balancing Point of the UK (for Purchase Agreement (SPA) between the LNG seller and the

Europe) and (c) the netback wellhead price at the sources of buyer; the spot cargoes are purchased on mutually agreeable

supply for Japan will be taken as the average price for commercial terms. Government of India.

producers at their supply points across continents.

© ENINCON LLP 2016 I 05

Exhibit 05: Price Applicable to Customers Not Entitled All the consuming sectors have to bear the prices under

for APM Gas which is Market Driven and Applicable these mechanisms only as per the priority for allocations as

from 1.7.2010 (In $/ mmbtu) set by Government of India.

Also, the gas produced from existing fields of the nominated

ILLUSTRATIVE

blocks of NOCs, viz., OIL & ONGC, is being supplied

Identified onshore fields in Gujarat & predominantly to fertilizer plants, power plants, court-

Rajasthan mandated customers, and customers having a requirement of

less than 50,000 standard cubic metres per day at APM rates.

North-East

Southern Zone -- Cauvery Basin The Government fixed APM gas price in the country, with

effect from 1.6.2010, is $ 4.2/mmbtu (inclusive of royalty),

Southern Zone -- KG Basin excepting in the Northeast, where the APM price is $

2.52/mmbtu, which is X% of the APM price elsewhere, the

Western & Northern Zones (covering

Maharashtra, Gujarat and other… balance Y% being paid to NOCs as subsidy from the

Government Budget.

0 2 4 6

$/mmbtu Exhibit 06: Price Applicable to Customers as Sold by

Source: enincon research NoCs for Non-APM Gas and Applicable from 1.7.2010

( in $/ mmbtu)

The prices are indicated in the set of following figures along ILLUSTRATIVE

5.5

with the dates from which they are applicable:

5

$/mmbtu

Western & North Zones

4.5

Southern Zone -- KG Basin

4 Southern Zone -- Cauvery Basin

North-East

3.5

Source: enincon research

© ENINCON LLP 2016 I 06

Query: With reference to the upstream part of the value Response:

chain (production and/or import), please outline the main

criteria that are used for regulation, including as available: The criteria used for regulation for the upstream part of the Gas

value chain in India can be classified under two important heads:-

Criteria for Capital Valuation For Domestic Gas Production

Rates of return and their main component For Gas Imports

Depreciation rates We would cover the domestic and gas imports section separately

Operational Expenditures indicating the main criteria used for regulation. Considering the

Use of benchmarking techniques domestic gas production section first we would detail out the

Exploration cost and their evaluation criteria major criteria which are utilized to regulate the upstream sector.

Depletion fees, royalties or user costs

Social or environmental fees and subsidies Domestic Gas Production Sector of India:

Reference to Competing Fuels The domestic gas upstream value chain’s applicable criteria as per

Reference to International Gas Prices the listed pointers are depicted in Exhibit 07.

© ENINCON LLP 2016 I 07

Exhibit 07: Main Criteria Used for Regulation in Case of Domestic Gas in India

TABULAR

Main Criteria Used for Regulation of Domestic Criteria’s Remarks

Gas Applicability

Criteria for Capital Valuation A

Rates of Return & their Main Components Not applicable in India

Depreciation Rates B

Operational Expenditures Yes , it is applicable and forms the part of cost of production

Use of Benchmarking Techniques C

Exploration Cost & Their Evaluation Criteria D

Depletion Fees, Royalties or User Costs E

Social or Environmental Fees & Subsidies

F

G

Reference to Competing Fuel

Reference to International Gas Prices H

Applicable Partially Applicable Partially Applicable

Source: enincon research

© ENINCON LLP 2016 I 08

Exhibit 08: Main Criteria Used for Regulation in Case of Imported Gas in India

TABULAR

Main Criteria Used for Regulation of Criteria’s Remarks

Domestic Gas Applicability

Criteria for Capital Valuation A

Rates of Return & their Main Components B

Depreciation Rates Yes , it is applicable and forms the part of cost of production

Operational Expenditures C

Use of Benchmarking Techniques D

Exploration Cost & Their Evaluation Criteria E

Depletion Fees, Royalties or User Costs F

Social or Environmental Fees & Subsidies G

Reference to Competing Fuel

H

Reference to International Gas Prices I

Applicable Partially Applicable Partially Applicable

Source: enincon research

© ENINCON LLP 2016 I 09

You might also like

- Revised Analyst's Dilemma Analysis Pallab MishraDocument2 pagesRevised Analyst's Dilemma Analysis Pallab Mishrapalros100% (1)

- Spe 173255 MSDocument19 pagesSpe 173255 MSAnand aashishNo ratings yet

- COA Resolution Number 2015-031Document3 pagesCOA Resolution Number 2015-031gutierrez.dorie100% (7)

- Managerial Economics - Concepts and ToolsDocument20 pagesManagerial Economics - Concepts and ToolsBopzilla0911100% (1)

- Yemen Gas CompanyDocument38 pagesYemen Gas CompanyPratik PatelNo ratings yet

- City Gas Distribution: Indian Gas Chain (Source: GGCL Investors Meet, Marchv27, 2008)Document18 pagesCity Gas Distribution: Indian Gas Chain (Source: GGCL Investors Meet, Marchv27, 2008)Snehil TripathiNo ratings yet

- ICWAI Gas PriceDocument3 pagesICWAI Gas PriceA Prabu DasNo ratings yet

- CGD - PWCDocument7 pagesCGD - PWCasbel jsajanNo ratings yet

- Summer Internship Project PresentationDocument18 pagesSummer Internship Project PresentationamartyadasNo ratings yet

- Nagarjuna Fertilizers & Chemicals LimitedDocument5 pagesNagarjuna Fertilizers & Chemicals Limitedpooh8888No ratings yet

- Siemens Technical Paper Gas Turbine ModernizationDocument14 pagesSiemens Technical Paper Gas Turbine ModernizationAldiarso UtomoNo ratings yet

- Spe Distinguished Lecturer Series Spe FoundationDocument37 pagesSpe Distinguished Lecturer Series Spe FoundationaidanNo ratings yet

- Gas Pricing: Out of APM, FinallyDocument5 pagesGas Pricing: Out of APM, Finallyvishi.segalNo ratings yet

- Presentation 2Document19 pagesPresentation 2Muhammad NaeemNo ratings yet

- 21VAND Coal GasDocument13 pages21VAND Coal GasgancanNo ratings yet

- Infraline Round Table On "Gas Availability For The Power Sector" Power SectorDocument26 pagesInfraline Round Table On "Gas Availability For The Power Sector" Power SectorsaileashNo ratings yet

- Natural Gas Liquid Hydrocarbons LPG Transmission Petrochemicals City Gas Distribution E&PDocument3 pagesNatural Gas Liquid Hydrocarbons LPG Transmission Petrochemicals City Gas Distribution E&PLakshay SharmaNo ratings yet

- OIL & GAS World: OIL, ONGC Get Freedom To Price Natural GasDocument6 pagesOIL & GAS World: OIL, ONGC Get Freedom To Price Natural GasAnkur KatariaNo ratings yet

- City Gas Distribution Projects: 8 Petro IndiaDocument22 pagesCity Gas Distribution Projects: 8 Petro Indiavijay240483No ratings yet

- Natr GasDocument57 pagesNatr GasMohd Muzammil Mohd AltafNo ratings yet

- 6th City Gas Stakeholders PPT - GK Sharma - MGLDocument23 pages6th City Gas Stakeholders PPT - GK Sharma - MGLSHOBHIT KUMARNo ratings yet

- Brief Note On Stranded Gas Based Power PlantDocument3 pagesBrief Note On Stranded Gas Based Power PlantRahul MathurNo ratings yet

- Carbon Footprint Reduction Strategies Select-Specialist Front-End Division of WorleyparsonsDocument25 pagesCarbon Footprint Reduction Strategies Select-Specialist Front-End Division of WorleyparsonsLuisAnggaSC chaniagoNo ratings yet

- Indra 04 RiskDocument15 pagesIndra 04 RisksangitaNo ratings yet

- Gas PricingDocument53 pagesGas Pricingsudhanshu shekharNo ratings yet

- Coal-Based Power Generation in India 2019: Trends, Developments, Future Role and Market OutlookDocument5 pagesCoal-Based Power Generation in India 2019: Trends, Developments, Future Role and Market OutlookNaman SinghNo ratings yet

- Research Methodology: TH NDDocument6 pagesResearch Methodology: TH NDJaydeep MulchandaniNo ratings yet

- Basics of CGD For MBA Oil - Gas StudentsDocument53 pagesBasics of CGD For MBA Oil - Gas StudentsUJJWALNo ratings yet

- Herbsttagung 2012 Vortrag 04 MosserDocument17 pagesHerbsttagung 2012 Vortrag 04 MosserChrisNo ratings yet

- Fertilizer 86 120 16 35 PDFDocument20 pagesFertilizer 86 120 16 35 PDFSATHISHNo ratings yet

- Haryana City Gas Distribution LTD.: - A Summer Internship Project Presentation (June - July 2011)Document19 pagesHaryana City Gas Distribution LTD.: - A Summer Internship Project Presentation (June - July 2011)manish pantNo ratings yet

- Override Control of Fuel Gas PDFDocument4 pagesOverride Control of Fuel Gas PDFNimeshKamatNo ratings yet

- Gas Utilization PolicyDocument2 pagesGas Utilization Policyaravind_k104No ratings yet

- TendernoticeDocument18 pagesTendernoticemmeskalkaji2No ratings yet

- Pakistan'S Gas Shortage - Is A Moratorium On Gas Supply To Captive Power Plants (CPPS) The Solution? An Article by Mr. Shahid Sattar and Mr. Saad Umar, AptmaDocument4 pagesPakistan'S Gas Shortage - Is A Moratorium On Gas Supply To Captive Power Plants (CPPS) The Solution? An Article by Mr. Shahid Sattar and Mr. Saad Umar, AptmaArslan RashidNo ratings yet

- Ec Overview December 2012 UpdatedDocument18 pagesEc Overview December 2012 UpdatedBrunoPanutoNo ratings yet

- APC Utilized at IGCC Plant (ABB)Document16 pagesAPC Utilized at IGCC Plant (ABB)Yang Gul LeeNo ratings yet

- Overview LNG Central Java V.1.2.REV1Document10 pagesOverview LNG Central Java V.1.2.REV1sigit l.prabowoNo ratings yet

- DR David IgeDocument20 pagesDR David IgesegunoyesNo ratings yet

- Prereforming: Based On High Activity Catalyst To Meet Market DemandsDocument8 pagesPrereforming: Based On High Activity Catalyst To Meet Market Demandsvaratharajan g rNo ratings yet

- Draft PPT On Carbon Market Compliance MechanismDocument41 pagesDraft PPT On Carbon Market Compliance MechanismSYED ABRAR AHMEDNo ratings yet

- Oil & Gas News: Governmental and Regulatory UpdatesDocument6 pagesOil & Gas News: Governmental and Regulatory UpdatesChaItanya KrIshnaNo ratings yet

- Air Pollution Market - FinalDocument310 pagesAir Pollution Market - FinalS V RAJAGOPALAN100% (1)

- 12 Clarification-02 PDFDocument248 pages12 Clarification-02 PDFMohamed MabroukNo ratings yet

- Abb 13e2 GT24 1997Document11 pagesAbb 13e2 GT24 1997atfrost4638No ratings yet

- Dabhol Power Project: Group 3Document7 pagesDabhol Power Project: Group 3Nischal Singhal ce18b045No ratings yet

- 03 - Andianto - Bayu PERTAMINA BIOGAS FORUMDocument12 pages03 - Andianto - Bayu PERTAMINA BIOGAS FORUMwangintanNo ratings yet

- 2018 ICIS Africa Presentation PDFDocument17 pages2018 ICIS Africa Presentation PDFSanogo YayaNo ratings yet

- Annual Report 2008 2009 PDFDocument118 pagesAnnual Report 2008 2009 PDFMuhammad AzeemNo ratings yet

- Power With LPG Fuel Flexible SolutionDocument24 pagesPower With LPG Fuel Flexible SolutionPablo M Ugalde100% (1)

- Feasibility Report On Diesel Hydro-Treater (DHT) Unit and Associated FacilitiesDocument29 pagesFeasibility Report On Diesel Hydro-Treater (DHT) Unit and Associated FacilitiesDivyansh Singh ChauhanNo ratings yet

- Determination of Swap Ratio in Merger: Case of Reliance Natural Resources Ltd. and Reliance Power Ltd. MergerDocument14 pagesDetermination of Swap Ratio in Merger: Case of Reliance Natural Resources Ltd. and Reliance Power Ltd. MergerAswani B RajNo ratings yet

- Ghana Ministry - Gas Options-PresentationDocument19 pagesGhana Ministry - Gas Options-PresentationCheikh75No ratings yet

- Energy Scan 43rd IssueDocument12 pagesEnergy Scan 43rd IssueABHIMANYU kumarNo ratings yet

- Point Wise Compliance of Terms of Reference (Tor)Document14 pagesPoint Wise Compliance of Terms of Reference (Tor)OMSAINATH MPONLINENo ratings yet

- 5510 0210 00ppr Man B W Me Lgip Dual Fuel Engines WebDocument29 pages5510 0210 00ppr Man B W Me Lgip Dual Fuel Engines WebΜερκουρηςκαπαNo ratings yet

- Aeroderivative Gas Turbines For LNG Liquefaction PlantsDocument19 pagesAeroderivative Gas Turbines For LNG Liquefaction PlantsAnibal Rios100% (2)

- Applied Energy 2006 - Analysis of The Vehicle Mix in The Passenger-Car Sector in JapanDocument15 pagesApplied Energy 2006 - Analysis of The Vehicle Mix in The Passenger-Car Sector in JapanNojus DekerisNo ratings yet

- Green Power Market Development Initiative - India: An Initiative Supported byDocument20 pagesGreen Power Market Development Initiative - India: An Initiative Supported by2742481No ratings yet

- PerusahaanDocument3 pagesPerusahaanFaza InsanNo ratings yet

- Industry Manual On Acceptance of Product by Marketing CompanDocument39 pagesIndustry Manual On Acceptance of Product by Marketing CompanGate PadipaliNo ratings yet

- Predicting the Price of Carbon Supplement 1: Hinkley Point C Nuclear Power Station Enhanced Carbon Audit LCA Case StudyFrom EverandPredicting the Price of Carbon Supplement 1: Hinkley Point C Nuclear Power Station Enhanced Carbon Audit LCA Case StudyNo ratings yet

- Financing Solutions to Reduce Natural Gas Flaring and Methane EmissionsFrom EverandFinancing Solutions to Reduce Natural Gas Flaring and Methane EmissionsRating: 5 out of 5 stars5/5 (1)

- Density Log 1Document18 pagesDensity Log 1Anand aashishNo ratings yet

- Resistivityloglab 161015225941Document20 pagesResistivityloglab 161015225941Anand aashishNo ratings yet

- Workshop On Application of Data Science in Petroleum EngineeringDocument2 pagesWorkshop On Application of Data Science in Petroleum EngineeringAnand aashishNo ratings yet

- Topic 1: Well Equipment: Prof. Ajay Suri Dept. of Petroleum Engineering IIT (ISM) DhanbadDocument126 pagesTopic 1: Well Equipment: Prof. Ajay Suri Dept. of Petroleum Engineering IIT (ISM) DhanbadAnand aashishNo ratings yet

- Petroleum Reservoir Engineering AND Field Developement: 4., - , Decline Curve AnalysisDocument1 pagePetroleum Reservoir Engineering AND Field Developement: 4., - , Decline Curve AnalysisAnand aashishNo ratings yet

- Foam Generation by Capillary Snap-Off in Flow Across A Sharp Permeability TransitionDocument13 pagesFoam Generation by Capillary Snap-Off in Flow Across A Sharp Permeability TransitionAnand aashishNo ratings yet

- Polymer Stability After Successive Mechanical-Degradation EventsDocument16 pagesPolymer Stability After Successive Mechanical-Degradation EventsAnand aashishNo ratings yet

- Economic Feasibility of Carbon Sequestration With Enhanced Gas Recovery (Csegr)Document20 pagesEconomic Feasibility of Carbon Sequestration With Enhanced Gas Recovery (Csegr)Anand aashishNo ratings yet

- Novel Application of Cationic Surfactants For Foams With Wettability Alteration in Oil-Wet Low-Permeability Carbonate RocksDocument14 pagesNovel Application of Cationic Surfactants For Foams With Wettability Alteration in Oil-Wet Low-Permeability Carbonate RocksAnand aashishNo ratings yet

- New Method To Reduce Residual Oil Saturation by Polymer FloodingDocument13 pagesNew Method To Reduce Residual Oil Saturation by Polymer FloodingAnand aashishNo ratings yet

- Geothermal Well Logging: Temperature and Pressure Logs: Benedikt SteingrímssonDocument16 pagesGeothermal Well Logging: Temperature and Pressure Logs: Benedikt SteingrímssonAnand aashishNo ratings yet

- Top World Oil ProducersDocument1 pageTop World Oil ProducersAnand aashishNo ratings yet

- Oil and Gas IndustryDocument50 pagesOil and Gas IndustryAnand aashishNo ratings yet

- Saeed Jafari Daghlian So A, Lesley Anne James, Yahui ZhangDocument13 pagesSaeed Jafari Daghlian So A, Lesley Anne James, Yahui ZhangAnand aashishNo ratings yet

- Experimental Study of Enhanced-Heavy-Oil Recovery in Berea Sandstone Cores by Use of Nanofluids ApplicationsDocument13 pagesExperimental Study of Enhanced-Heavy-Oil Recovery in Berea Sandstone Cores by Use of Nanofluids ApplicationsAnand aashishNo ratings yet

- The Pricing of Crude Oil: Stephanie Dunn and James HollowayDocument10 pagesThe Pricing of Crude Oil: Stephanie Dunn and James HollowayAnand aashishNo ratings yet

- Back To Forward / Inder Malhotra: Rising Oil Prices and Indian Energy CrunchDocument3 pagesBack To Forward / Inder Malhotra: Rising Oil Prices and Indian Energy CrunchAnand aashishNo ratings yet

- Itinerario Cosco ShippingDocument2 pagesItinerario Cosco ShippingRelly CarrascoNo ratings yet

- Anand Vihar Railway Stn. RedevelopementDocument14 pagesAnand Vihar Railway Stn. RedevelopementPratyush Daju0% (1)

- BH-7 Inspector'S Test W/On-Off Unit With Brass Sight Class: ASTM B16 C36000Document1 pageBH-7 Inspector'S Test W/On-Off Unit With Brass Sight Class: ASTM B16 C36000saus sambalNo ratings yet

- CV Santosh KulkarniDocument2 pagesCV Santosh KulkarniMandar GanbavaleNo ratings yet

- Dornbusch Overshooting ModelDocument17 pagesDornbusch Overshooting Modelka2010cheungNo ratings yet

- 64 Development of Power Operated WeederDocument128 pages64 Development of Power Operated Weedervinay muleyNo ratings yet

- Module 1 GE 4 (Contemporary World)Document84 pagesModule 1 GE 4 (Contemporary World)MARY MAXENE CAMELON BITARANo ratings yet

- Radisson BluDocument4 pagesRadisson BluDhruv BansalNo ratings yet

- Errors, Correction, Control and Recon, ProvisionDocument11 pagesErrors, Correction, Control and Recon, ProvisionOwen Bawlor ManozNo ratings yet

- MCX MarginDocument2 pagesMCX MarginKUMAR RNo ratings yet

- Draft LA Ghana Country Study, En-1Document35 pagesDraft LA Ghana Country Study, En-1agyenimboatNo ratings yet

- Scitech Prelim HandoutsDocument12 pagesScitech Prelim Handoutsms.cloudyNo ratings yet

- Feu LQ #1 Answer Key Income Taxation Feu Makati Dec.4, 2012Document23 pagesFeu LQ #1 Answer Key Income Taxation Feu Makati Dec.4, 2012anggandakonohNo ratings yet

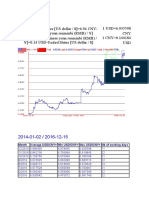

- Month Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysDocument3 pagesMonth Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysZahid RizvyNo ratings yet

- Pub Rethinking Development GeographiesDocument286 pagesPub Rethinking Development Geographiesxochilt mendozaNo ratings yet

- Deloitte With World Economic Forum Future of Food - Partnership-GuideDocument40 pagesDeloitte With World Economic Forum Future of Food - Partnership-GuideFred NijlandNo ratings yet

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarDocument14 pagesAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misNo ratings yet

- Delegation of Powers As Per DPE GuidelinesDocument23 pagesDelegation of Powers As Per DPE GuidelinesVIJAYAKUMARMPLNo ratings yet

- In Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Document126 pagesIn Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Chapter 11 DocketsNo ratings yet

- Internal Audit Checklist Sample PDFDocument3 pagesInternal Audit Checklist Sample PDFFernando AguilarNo ratings yet

- Rec Max VS Opt AltDocument4 pagesRec Max VS Opt AltAloka RanasingheNo ratings yet

- Latitudes Not AttitudesDocument7 pagesLatitudes Not Attitudesikonoclast13456No ratings yet

- The Making of A Smart City - Best Practices Across EuropeDocument256 pagesThe Making of A Smart City - Best Practices Across Europefionarml4419No ratings yet

- Credit CreationDocument17 pagesCredit Creationaman100% (1)

- Sustainability in The Built Environment Factors AnDocument7 pagesSustainability in The Built Environment Factors AnGeorges DoungalaNo ratings yet

- MKT 465 ch2 SehDocument51 pagesMKT 465 ch2 SehNaimul KaderNo ratings yet

- Jose C. Guico For Petitioner. Wilfredo Cortez For Private RespondentsDocument5 pagesJose C. Guico For Petitioner. Wilfredo Cortez For Private Respondentsmichelle m. templadoNo ratings yet