Professional Documents

Culture Documents

Resumen Primer Parcial Pamela

Uploaded by

Arturo HazbunOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Resumen Primer Parcial Pamela

Uploaded by

Arturo HazbunCopyright:

Available Formats

Entrepreneur: Perceive and opportunity to create value, sense, 4 Relying on a team without the CRITICAL

devise a strategy for taking control of necessary expertise. 5 Failing to recognize the threats and potential

resources, inplement a plan of action to make the change problems.

possible, harvest the reward that comes from the

innovation. Start up: an institution designed to create new Strategy – Macro Planning: 1Forecasting

product or service under conditions of extreme (determining Goals): economic objectives, market

uncertainty. Entrepreneurship is management: objectives, operational objectives, social objectives.

Managing uncertainty, discipline/ management needs 2Units Of Measurment: $$$, units sold, tech

measurement. Entrepreneurship: propose creates achievments, social impact.

leadership, leadership requires propose.

Strategic Planning: choosing course of action for a

5 principle drivers for success: 1Timing: is the particular goal (npv), Allowing to plan for several courses

marketing ready and demanding for your solution.2 team of actions and outcomes, Allow to anticipate capital and

building and leadership: multidisciplinary team. 3 resource needs.

“AHA” moment. 4 Business plan: strategy, forecasting,

margin (executing) . 5 financial: resources Deciding on the Objective – Purpose: It needs to be

measurable, Control: How much control over the

Balance Sheet: Assets (current assets {account entrepreneurship, How aligned to your purpose it is,

receivable, cash, inventories}+investment+property, plan Equity vs Debt in decision making.

and equipment+intangible asset+other assets= total

assets) Liabilities & Owners equity (current liabilities Strategic Choices – Interdependency: 1.product-

{account payables, banks loans/debt, preferred stocks}, market strategy: Price, Margin,Quality, Differentiation. 2

Long-term liabilities= total assets) owners equity {stocks operational Strategy: Vertical Boundaries, Horizontal

investment,profits}=TOTAL LIABILITIES & OWNERS. Boundaries. 3 financial strategy: Outside vs

Balance Sheet: Present wealth in preferred than future

Entrepreneur, Debt vs Equit.

wealth, safe assets are preferred than risky assets.

Strategic Planning – Integrated Or Not: 1

Assets: investment decisions (Value comes from the Product-Market: High Margin-Slow Growth vs

ability to generate cash flows: Technology, infraestructure,

equipment, distribution, marketing platforms, knowledge). Low Margin-High Growth. 2 Operational

Financing decision (adventage). Debt financing: Keep Design: Part of Value Chain? (Production-

full ownership, no obligation after paying debt, interest is

tax deductible, short-and long term option, more cash on

Distribution). 3 Financial Decision: Internal

hand. Equity financing: Less risk than debt, no paying Investment vs Outside Investment (Control?)

back funds, gain credibility through investor networks,

investors don’t expect immediate ROI, fixed payments for

better budgeting.

Decision Trees: Focus on most important

choices: Make or buy, Borrow or Issue Equity,

Finance – P&L. Forecasting: strategy – operation – fast or slow growth, Reason forward,

returns: Strategy will determine your sales, Operation will

determine your costs, Returns will measure your success. simultaneous decisions are more branches.

Profits and losses (p&l): Sales - Direct costs {initial • Select the highest expected returned

inventory + goods bought – final inventory} = Gross

Margin. Operating Expenses Rent + Payroll + marketing value (Not only Financial) branch.

+ maintenance + utilities = Total Operating Expenses.

EBITDA{Gross margin – total operating asset}+ Key Questions

depreciation - interest – taxes=Net profit

Making cash flow decision: Negative returns means • Market: What are your market options?

further investment will be needed and there is a need to Level of demand? what is the level of

manage your cash while you can get new investments are

difficulty of their needs? Can you offer a

hang until sales grow. P&L will show you the order you

should spend the money flow you can manage solution to those needs?

Strategy – Operation – Returns Comform The • Operation: What is the level of

Business Plan: Strat-ups have different business plans

than companies, Deviation from results could be due to production needed according to the level

uncertainty, not necessarily from wrong execution, Degree of demand? High cost or low cost? Do

of external reliance of the plan.

you have access to that production, or the

What Make A Business Plan Convincing? Credible or infrastructure?

certified (or with reputation) Evidence

• Financing: Always ask yourself if you

What to avoid in a business plan: 1 Failing to identify

clearly the customer problem that you will address, have the funds available to go into the

2 Failing to identify clearly a narrow target market, 3 next phase of the tree.

Relying on a business model that makes no economic

• Opening a Andy´s Computers • Revise your plan regularly

• Market: Demand - High, VISION

Moderate or Low

THE BIGGEST CHALLENGE OF A START UP

• Infrastructure: Large or Small IS SUPPORTING EXISTING CUSTOMER

WHILE TRYING TO INNOVATE.

• Operation: Type of production

to fill capacity? PURPOSE - MISSION – STRATEGY

• Organization: values vs HYPOTHESIS - BUSINESS PLAN - DECISION

knowledge TREES

• Location: hi traffic vs new area TO CREATE A “BRILLIANT” STRATEGY.

• Competition: new entrants – LEARN - PROVING “BRILLIANT”

actual competitors STRATEGY

• Suppliers: quality vs IMPLEMENTING VS VALIDATED

accessibility LEARNING

Entrepreneurs Game CUSTOMER FIRST

• The business plan: You must decide how THE EFFORT THAT IS NOT NECESSARY

much optimism to put into a business FOR LEARNING WHAT COSTUMERS WANT,

plan. Over-optimism is dangerous. Fail to CAN BE ELIMINATED.

identify real threats.

MEASURING – FINANCE

• Strategic Partnering: Whether to

vertically integrate company, allowing MEASURING VALIDATED LEARNING

new competition from possible allies.

Choose your goals:

• Control: Decide how much control is he

Customer Goals:

willing to exchange for funding

- Identifying Needs

• Information Disclosure: Secret vs

openness - Customer Satisfaction

Flexibility vs Commitment - Customer Loyalty

• Committing to a strategy means giving Financial Goals:

up others.

- Value Perception (Price)

• Keeping enough flexibility for change is

nevertheless is key to limit uncertain - Operational Validation and Cost

negative outcomes. Allow rapid reaction.

- Sales Potential

• Plans help to attain commitment from

TEAM MAKING FAST COMPARISONS AND

DECISIONS

• Having the original benchmark is what

allow the entrepreneur to know failed PRODUCTIVITY IN A START UP SHOULD

assumptions. BE MEASUERD IN HOW MUCH VALIDATED

LEARNING YOU ARE GETTING FROM OUR • EXPERIMENTATION IS A PRODUCT

EFFORTS. YOU HAVE ALREADY STARTED.

BUSINESS PLAN AND GOALS WILL LET FINANCIAL STATEMENT

YOU COMPARE BUSINESS PLAN VS REAL

RESULTS.

START SMALL

• THE AUDACITY OF ZERO IS

IMPORTANT. PARTNERS,

EMPLOYEES, YOURSELF WILL

BENEFIT FROM IT.

THE IMPORTANCE OF VALIDATION

• CREATE STRONG FUNDAMENTALS

• LEARNING COMES FROM THE BASIC ACCOUNTS – P&L

POSIBILITY OF FAILING.

Gross Margin – Gross Profit

EXPERIMENT • Sales

• TEST SISTEMATICATLLY EACH

• Cost of Goods Sold=

COMPONENT OF THE PLAN

EMPIRICALLY • Initial Inventory

• EVERYTHING A START UP DOES IS • + Goods Bought

AN EXPERIMENT DONE TO

ACHIEVE VALIDATED LEARNING. • - Final Inventory

MILESTONES – MINIEXPERIMENTS EBITDA

• MARKET EXPERIMENTS • OPEX (Operating Expenses)

• Price • Payroll

• Need • Utilities

• Package • Rent

• Product Details • Maintenance

• GROWTH EXPERIMENT • OPERATING PROFIT

• Location • Depreciation

• Delivery • NET PROFIT

• Contact Platforms • Interests

FLEXIBLE BUSINESS PLAN • Taxes

BASIC ACOCUNTS – Balance Sheet

• Assets • Organizational

• Cash What type of employees?

• Inventory Characteristics and knowledge they should have.

• Equipment

• Infrastructure

• Accounts Receivables

Debt and Equity

• Debt

• Accounts Payables

• Banks (Loans/Debt)

• Preferred Stocks

• Equity

• Stocks (Equity Investments) • Financial Strategy

• Profits debt vs equity

STRATEGY

Product Market Strategy

• Price

• High Price – Low Volume

• Low Price – High Volume

• Market

• B2B (Business to Business)

• B2C (Business to Consumer)

STRATEGY

OPERATIONAL STRATEGY

• Value Chain

• Production

• Distribution

• Sales and Service

You might also like

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Business Plan Alchemy: Transforming Ideas Into Successful Business VenturesFrom EverandBusiness Plan Alchemy: Transforming Ideas Into Successful Business VenturesNo ratings yet

- Strategic MGTDocument3 pagesStrategic MGTapi-3705268No ratings yet

- Adapt Business Model & Boost SalesDocument47 pagesAdapt Business Model & Boost SalesTshephang MorolongNo ratings yet

- SEFI 4.25.2011 Founders Institute SeelyDocument21 pagesSEFI 4.25.2011 Founders Institute Seelydave_parker129No ratings yet

- Strategy Execution - DiscussionDocument22 pagesStrategy Execution - DiscussionAayushya ChaturvediNo ratings yet

- Session 2-Charting A Company's DirectionDocument34 pagesSession 2-Charting A Company's DirectionJosephine MargarettaNo ratings yet

- 11-1 - Assessment of Entrepreneurial OpportunitiesDocument24 pages11-1 - Assessment of Entrepreneurial OpportunitiesMuhammad Obaid ElahiNo ratings yet

- 11-1 - Assessment of Entrepreneurial OpportunitiesDocument24 pages11-1 - Assessment of Entrepreneurial Opportunitiesmaverik Ad100% (1)

- Crafting A Business Plan and Building A Solid Strategic PlanDocument31 pagesCrafting A Business Plan and Building A Solid Strategic PlanOhona islamNo ratings yet

- Entrepreneurial StrategiesDocument62 pagesEntrepreneurial StrategiesSantosh NepalNo ratings yet

- Taking Your Design Offering To Market: Curriculum Overview Class 1Document23 pagesTaking Your Design Offering To Market: Curriculum Overview Class 1Tarkeshwar SinghNo ratings yet

- Introduction To Strategic ManagementDocument43 pagesIntroduction To Strategic ManagementSHREYANo ratings yet

- 2020 06 01 .2 A Guide To Using The Marketing Plan Template 2016Document5 pages2020 06 01 .2 A Guide To Using The Marketing Plan Template 2016James BluntNo ratings yet

- Improve Business Practice LO 1 2016Document35 pagesImprove Business Practice LO 1 2016John YohansNo ratings yet

- Training Session 3Document42 pagesTraining Session 3Nguyễn Như DuyNo ratings yet

- Refining Business Plans for Specific AudiencesDocument4 pagesRefining Business Plans for Specific Audiencesali haiderNo ratings yet

- 1lecture One SMDocument41 pages1lecture One SMবুঝ বালকNo ratings yet

- Strategic Corporate Finance GuideDocument52 pagesStrategic Corporate Finance GuideSanskriti JainNo ratings yet

- Managerial Accounting & Business EnvironmentDocument80 pagesManagerial Accounting & Business EnvironmentKhinwai HoNo ratings yet

- Selling ROI To The Chief Executive OfficerDocument4 pagesSelling ROI To The Chief Executive OfficerAlejandro CamperoNo ratings yet

- Introduction To Strategic ManagementDocument56 pagesIntroduction To Strategic ManagementAbdu Shukkoor Kaderi100% (1)

- Factors & Methods for Setting an Advertising BudgetDocument13 pagesFactors & Methods for Setting an Advertising BudgetSrinivas KumarNo ratings yet

- BSBMGT617 Task 5Document3 pagesBSBMGT617 Task 5jot jotNo ratings yet

- Advertising Decisions: Half of The Advertising-Expenditure Is Wasted One Doesn't Know Which Half!Document46 pagesAdvertising Decisions: Half of The Advertising-Expenditure Is Wasted One Doesn't Know Which Half!niks24090% (1)

- Crafting A Business Plan and Building A Solid Strategic PlanDocument29 pagesCrafting A Business Plan and Building A Solid Strategic PlanNusrat IslamNo ratings yet

- Merger and Acquisition - SummaryDocument19 pagesMerger and Acquisition - SummaryAna ElbrachtNo ratings yet

- Business Pearson Unit 2Document25 pagesBusiness Pearson Unit 2HasanNo ratings yet

- Engineering and SourcingDocument22 pagesEngineering and SourcingMJ SapiterNo ratings yet

- ED Notes (FM-BEA)Document13 pagesED Notes (FM-BEA)200102018No ratings yet

- Introduction To Strategic Management: DR Bryan MillsDocument56 pagesIntroduction To Strategic Management: DR Bryan MillsJaya IrawanNo ratings yet

- Designing Business Level StrategiesDocument58 pagesDesigning Business Level StrategiesJulie Estopace100% (1)

- Winning in Business Lite Case Study - Read As PreworkDocument3 pagesWinning in Business Lite Case Study - Read As PreworkAgustinNo ratings yet

- Entrep Reviewer Periodic ExamDocument6 pagesEntrep Reviewer Periodic ExamDanna marielle AnaretaNo ratings yet

- 6 2 STM Objectives 2020Document65 pages6 2 STM Objectives 2020MeriDurglishviliNo ratings yet

- Capital Budgeting and Corporate Strategy EssentialsDocument24 pagesCapital Budgeting and Corporate Strategy EssentialseferemNo ratings yet

- 2018 03 10 Screening Jaclyn McclellanDocument52 pages2018 03 10 Screening Jaclyn McclellanYudhi GendutNo ratings yet

- Advertising Decisions: Half of The Advertising-Expenditure Is Wasted One Doesn't Know Which Half!Document45 pagesAdvertising Decisions: Half of The Advertising-Expenditure Is Wasted One Doesn't Know Which Half!Pravah ShuklaNo ratings yet

- Revenue Model: - Assess The Potential Sources of RevenueDocument32 pagesRevenue Model: - Assess The Potential Sources of RevenueChaitali KeluskarNo ratings yet

- MM ZG 523 / QMJ ZG 523 Project ManagementDocument54 pagesMM ZG 523 / QMJ ZG 523 Project ManagementArun PrasadNo ratings yet

- Entrepreneur FinanceDocument30 pagesEntrepreneur FinanceNekoChanNo ratings yet

- CI Session 5Document25 pagesCI Session 5Ben McBeckNo ratings yet

- Chapter 1 (S) What Is Strategy?Document35 pagesChapter 1 (S) What Is Strategy?Abhinav RajNo ratings yet

- Financial Projections Guide Business SuccessDocument9 pagesFinancial Projections Guide Business SuccessIndra Kusuma AdiNo ratings yet

- Entrepreneurship: Sessional ReportDocument9 pagesEntrepreneurship: Sessional Reportcrazy manNo ratings yet

- The Crunch Case & Mythbusting Entrepreneurship: Week 2Document38 pagesThe Crunch Case & Mythbusting Entrepreneurship: Week 2Winston XuNo ratings yet

- Strategy in Entrepreneurial CompaniesDocument22 pagesStrategy in Entrepreneurial CompaniesLaxman GuptaNo ratings yet

- Balance Sheet: Basic Financial StatementsDocument3 pagesBalance Sheet: Basic Financial StatementsAdrienne Erika MANAIGNo ratings yet

- Marketing Strategy For Small BusinessDocument4 pagesMarketing Strategy For Small BusinessChemical.AliNo ratings yet

- Guide Using The Marketing Plan TemplateDocument5 pagesGuide Using The Marketing Plan TemplateAbbad100% (1)

- Ch1 - What Is Strategy - Why Is It ImportantDocument37 pagesCh1 - What Is Strategy - Why Is It ImportantFrancis Jonathan F. PepitoNo ratings yet

- Types of StrategiesDocument27 pagesTypes of StrategiesEbrar AnsiNo ratings yet

- Achievement ClusterDocument1 pageAchievement ClusterlaurenceclydeadarleNo ratings yet

- Session 4 - LeanStartupDocument32 pagesSession 4 - LeanStartupvinay mouryaNo ratings yet

- MBF - BMCDocument44 pagesMBF - BMCnabilaaaNo ratings yet

- PLC Mktstrgy MktplanDocument40 pagesPLC Mktstrgy MktplanDEVASHISHNo ratings yet

- Best Practices in Using A Balanced ScorecardDocument19 pagesBest Practices in Using A Balanced ScorecardPulkit JainNo ratings yet

- Evaluating Your SalesforceDocument16 pagesEvaluating Your SalesforceKhaula AhmedNo ratings yet

- REVIEWER IN STRATEGIC MANAGEMENTDocument7 pagesREVIEWER IN STRATEGIC MANAGEMENTDeborah AquinoNo ratings yet

- ENVC Chapter 4 PDFDocument34 pagesENVC Chapter 4 PDFPotta SusmithaNo ratings yet

- Lgu Naguilian HousingDocument13 pagesLgu Naguilian HousingLhyenmar HipolNo ratings yet

- Kennedy Geographic Consulting Market Outlook 2014 Latin America SummaryDocument8 pagesKennedy Geographic Consulting Market Outlook 2014 Latin America SummaryD50% (2)

- 6 Entrepreneur Networks. Final VerDocument26 pages6 Entrepreneur Networks. Final VerSAURAV SAURAVNo ratings yet

- TQM OverviewDocument125 pagesTQM OverviewSamNo ratings yet

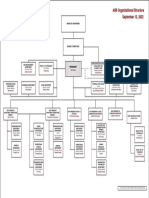

- AIIB Organizational StructureDocument1 pageAIIB Organizational StructureHenintsoa RaNo ratings yet

- SEED Experiment 5 PartaDocument6 pagesSEED Experiment 5 PartaDhaval GamechiNo ratings yet

- Summary of BRC Global Food Safety Standard Issue 6 Changes Landscape 110111Document28 pagesSummary of BRC Global Food Safety Standard Issue 6 Changes Landscape 110111Poulami DeNo ratings yet

- Integration and Responsiveness MatrixDocument9 pagesIntegration and Responsiveness MatrixVishalNo ratings yet

- Chapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesDocument7 pagesChapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesMishalNo ratings yet

- Building Productsspring 2010Document84 pagesBuilding Productsspring 2010Adrian GhabbhalNo ratings yet

- Exam Review: Market Equilibrium and ExternalitiesDocument24 pagesExam Review: Market Equilibrium and ExternalitiesDavid LimNo ratings yet

- Overview - PrintingDocument10 pagesOverview - Printingemman carlNo ratings yet

- Ackoff Systems ThinkingDocument2 pagesAckoff Systems ThinkingLuiz S.No ratings yet

- Customer equity value and lifetime revenue importanceDocument10 pagesCustomer equity value and lifetime revenue importanceSniper ShaikhNo ratings yet

- Solutions To All Assigned Practice Problems (W502)Document27 pagesSolutions To All Assigned Practice Problems (W502)donjazonNo ratings yet

- History and Definition of Eco-EfficiencyDocument6 pagesHistory and Definition of Eco-EfficiencyRodrigo Alejandro Hurtado ValdiviaNo ratings yet

- SupermarketsDocument20 pagesSupermarketsVikram Sean RoseNo ratings yet

- Agile Methodology 2016Document17 pagesAgile Methodology 2016Surya SaysNo ratings yet

- Program Management StudyDocument19 pagesProgram Management Studynavinchopra1986No ratings yet

- Product Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.Document22 pagesProduct Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.R16094101李宜樺No ratings yet

- Ratio Analysis Explained: Key Financial Ratios for Business PerformanceDocument3 pagesRatio Analysis Explained: Key Financial Ratios for Business PerformanceNatalieNo ratings yet

- EMDDocument6 pagesEMDTanpreet SinghNo ratings yet

- FINAL ASEAN Handbook 01 - Engineering ServicesDocument92 pagesFINAL ASEAN Handbook 01 - Engineering ServicesGerry GsrNo ratings yet

- Affidavit of GiftDocument2 pagesAffidavit of GiftAnonymous puqCYDnQNo ratings yet

- Cape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMDocument5 pagesCape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMhan jisungNo ratings yet

- Achieving Strategic Fit Across the Entire Supply ChainDocument28 pagesAchieving Strategic Fit Across the Entire Supply ChainJoann TeyNo ratings yet

- Marketing Strategies of BSNLDocument5 pagesMarketing Strategies of BSNLRanjeet Pandit50% (2)

- Case Study KarimRamziDocument10 pagesCase Study KarimRamziToufik Akhdari0% (1)

- Stock Valuation and Required Rate of Return ConceptsDocument3 pagesStock Valuation and Required Rate of Return ConceptsAntonette YapNo ratings yet

- CH 11Document6 pagesCH 11Saleh RaoufNo ratings yet