Professional Documents

Culture Documents

Analysis of demand and purchasing behavior of agricultural and veterinary products

Uploaded by

Shaira BugayongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of demand and purchasing behavior of agricultural and veterinary products

Uploaded by

Shaira BugayongCopyright:

Available Formats

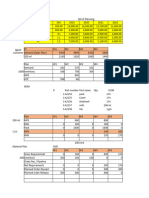

Graph 1.

Analysis on demand of Agricultural and Veterinary Products

What agricultural or veterinary products do you

usually buy?

350 321 310

300 260

250

Frequency

200

200 180 162

150 114 120

90

100

50 13 28

0 5

0

Agricultural

Products

Veterinary

The graph above illustrates the usual agricultural and veterinary products

that are bought by the consumers in agrivet enterprises.

321 out of 400 or 80.25% of the respondents say that the agricultural

products they usually buy are fruits, vegetables, or crops being a part of their daily

consumption. While none of the respondents buy rubber because none of them

are engaged in rubber industry.

Meanwhile, 260 out of 400 total survey respondents or 65% of the total

population attest that the veterinary product they usually buy are feeds for the daily

consumption of their livestock which is widespread in Bukidnon and only 5 of the

respondents buy soap for their dogs.

Graph 2. Analysis of frequency on purchasing Agricultural and Veterinary Products

How often do you buy the products?

200 182

180

160 144

140

Frequency

120

100 87

80 64 60

60

40 28

12 14

20 3 3 3

0

Time

Graph 2 shows how many times respondents purchase agricultural or

veterinary products. This represents that each customer has his or her own buying

behavior patterns. 45.50% or 182 out of 400 surveyed consumers buy agricultural

or veterinary products weekly while only 3 of them buy either every 2 days, every

3 days or once a month.

In analyzing customer buying behavior patterns, it is necessary to ascertain

what products and how much of each product customers purchase.

Graph 3. Analysis of reasons on purchasing Agricultural and Veterinary Products

What are your reasons for buying agricultural or

veterinary products?

250

206

200 180

147

Frequency

150

100 84

50 20 15

3 1

0

Reason

The graph above depicts the different reasons why respondents purchase

agricultural or veterinary products. 206 out of 400 or 51.50% of the surveyed

consumers buy agricultural products for their personal consumption. This

represents what Maslow describes at the bottom of his hierarchy.

Graph 4. Analysis on the location of purchasing the products

Where do you regularly buy these products?

200 184

180

160

140

114

Frequency

120 105

100

80 72

60 48

40

14 10 8 9

20 7 3

0

Place

Graph 4 illustrates the different locations where consumers regularly buy

agricultural or veterinary products. Among the locations, 184 out of 400

respondents or 46% of them buys in Valencia City since it is nearest, most

accessible and wide-ranging agrivet enterprises are located. While only 3

respondents buys in Pangantucan.

Graph 5. Analysis of the reasons for buying at certain locations

Why do you choose to shop at your indicated

location?

450

392

400

350

300

Frequency

250 216

200 176

150

100

44

50 4 4

0

Availability Convenient Customer Prices Quality Work

Location Service

Reason

The graph above shows why respondents usually buy at their ideal location.

98% or 392 out of 400 of the surveyed consumers say that they usually buy at

such location because of it is convenient for them. While only 4 of the respondents

say that they buy at such location because of the availability of products and they

work at the agrivet enterprise.

Graph 6. Analysis on factors that would convince to change of store

What would convince you to change where you

currently shop?

350

292

300

250 228

Frequency

200 183

150

104

100 75 60

50

0

Already Constant Customer Location Price Product

Satisfied with availability of Service Quality

the current stocks

shop

Factor

Graph 6 illustrates the factors that would convince consumers to change

their preferred location of buying agricultural or veterinary products. 73% or 292

out of a total of 400 respondents would be convinced to change their preferred

location when prices are lower or favorable.

Graph 7. Consumer Analysis: Prospect Market of CMU Agrivet Enterprise

Would you choose to buy in CMU if CMU would

have its own agri-vet enterprise?

350 328

300

250

Frequency

200

150

100

49

50 23

0

Yes No Abstain

Answer

Graph 7 illustrates the degree of consumer approval of CMU having an

Agrivet Enterprise as one of its income generating projects.

82% or 328 out of 400 surveyed consumers are in favor of buying in CMU

if it would have its own agrivet enterprise. While only 5.75% or 23 of the 400

respondents are not in favor. This represents the consumers who are already

satisfied in their chosen location of buying agricultural and veterinary products.

On the other hand, 49 or 12.25% of the respondents either buy at CMU or

their preferred location.

You might also like

- Variable No - of Respondents % Male 185 37 Female 315 63 Total 500 100Document11 pagesVariable No - of Respondents % Male 185 37 Female 315 63 Total 500 100manuj pareekNo ratings yet

- Variable No - of Respondents % Male 185 37 Female 315 63 Total 500 100Document11 pagesVariable No - of Respondents % Male 185 37 Female 315 63 Total 500 100manuj pareekNo ratings yet

- Spicer Kendall - FinalDocument25 pagesSpicer Kendall - Finalapi-611386981No ratings yet

- 1 - Information PresentationDocument25 pages1 - Information PresentationEarl HernaneNo ratings yet

- Consumer Behavior - Topic1Document19 pagesConsumer Behavior - Topic1Abhishek PatilNo ratings yet

- Consumer Behavior: Cardinal Utility Theory and Diminishing Marginal UtilityDocument14 pagesConsumer Behavior: Cardinal Utility Theory and Diminishing Marginal Utilitykajal goyalNo ratings yet

- Global Baby Diaper Rash Cream Market Research Report and Forecast 2024Document13 pagesGlobal Baby Diaper Rash Cream Market Research Report and Forecast 2024NassoNacimeNo ratings yet

- Fm203 Casestudy Part 3 OdonnellDocument4 pagesFm203 Casestudy Part 3 OdonnellLUKE O'DONNELLNo ratings yet

- Vishal Seminar PresentationDocument34 pagesVishal Seminar PresentationVishal JasujaNo ratings yet

- Current Assets Non-Current Assets: Statement of Financial PositionDocument22 pagesCurrent Assets Non-Current Assets: Statement of Financial PositionZafar Ibn Kader 2013819030No ratings yet

- Demonstrating Repeatable Sales Model 2Document2 pagesDemonstrating Repeatable Sales Model 2ramblingmanNo ratings yet

- Demonstrating Repeatable Sales ModelDocument2 pagesDemonstrating Repeatable Sales ModelramblingmanNo ratings yet

- Presentation on Dahi Consumption SurveyDocument40 pagesPresentation on Dahi Consumption SurveySnehal PatilNo ratings yet

- Exercise MicroeconomicsDocument3 pagesExercise MicroeconomicsTaufik DanielNo ratings yet

- Submitted By: Namita Dahiya 2009H149194P Supriya Rana2009H149205P Anandi Gupta 2009H149210P Anjum Jain 2009H149218P R.Umang Doshi2009H149220PDocument23 pagesSubmitted By: Namita Dahiya 2009H149194P Supriya Rana2009H149205P Anandi Gupta 2009H149210P Anjum Jain 2009H149218P R.Umang Doshi2009H149220Panandi.g9100% (1)

- Importance and Scope of Commercial Dairy FarmingDocument29 pagesImportance and Scope of Commercial Dairy FarmingVNo ratings yet

- Animal Drug Industry of BangladeshDocument44 pagesAnimal Drug Industry of BangladeshJakirAhmedNo ratings yet

- What Can Buyers DoLMIC ARTmarketDocument9 pagesWhat Can Buyers DoLMIC ARTmarketfranklinjoshuamNo ratings yet

- Dabur India LimitedDocument24 pagesDabur India Limitedshine_star4100% (2)

- Obppc DeckDocument28 pagesObppc Decknishant.mishraNo ratings yet

- Product LaunchPad 2018 OptDocument13 pagesProduct LaunchPad 2018 Optsean7787No ratings yet

- Thermal Spray Powder GuideDocument28 pagesThermal Spray Powder GuideAbdul RafiiNo ratings yet

- Amul 102524Document19 pagesAmul 102524mihirNo ratings yet

- GEA Homogenization Technology: Delivery ProgramDocument6 pagesGEA Homogenization Technology: Delivery Programqiaohongzedingtalk.comNo ratings yet

- WWW Altestore Com Howto Recommended Inverter Cables Sizing and Breakers or Fuses A62Document2 pagesWWW Altestore Com Howto Recommended Inverter Cables Sizing and Breakers or Fuses A62Suhas PatilNo ratings yet

- Polyface: The Farm of Many FacesDocument5 pagesPolyface: The Farm of Many Facesmohit1101933764100% (1)

- Thailand HACCP SituationDocument21 pagesThailand HACCP SituationHenry LauNo ratings yet

- Propagation of Backyard PoultryDocument3 pagesPropagation of Backyard PoultrysalmanNo ratings yet

- SaleschannelFMCGv5-fixedvaluesDocument7 pagesSaleschannelFMCGv5-fixedvaluesThảo NguyễnNo ratings yet

- Book 2Document6 pagesBook 2mslamh981No ratings yet

- Carbon FoodprintDocument11 pagesCarbon Foodprintrahibaparveen200589No ratings yet

- Hammed IITA Conference May1023Document7 pagesHammed IITA Conference May1023yinkaNo ratings yet

- 6.Market Structures, Market Failure, Financial Sector and Labour MarketTrade UnionDocument97 pages6.Market Structures, Market Failure, Financial Sector and Labour MarketTrade UnionGovindra ShippingNo ratings yet

- Commercialization of Vitamin D Enhanced MushroomsDocument21 pagesCommercialization of Vitamin D Enhanced Mushroomsedong boniNo ratings yet

- Dark Web Price Index 2021Document12 pagesDark Web Price Index 2021Una storia d'amoreNo ratings yet

- Every Move I Make I Rely You: Heart RateDocument15 pagesEvery Move I Make I Rely You: Heart RateLihun WongNo ratings yet

- Advertising Revenue Comparison: MagazineDocument7 pagesAdvertising Revenue Comparison: MagazineSUM ONENo ratings yet

- BIO K 211 TDS (EN) Fasciola Hepatica SeroDocument4 pagesBIO K 211 TDS (EN) Fasciola Hepatica SeroPia Loreto Cid TroncosoNo ratings yet

- Potato CooperativeDocument20 pagesPotato Cooperativeashish1684No ratings yet

- Total Male 6 Female 20 Total Students 26Document6 pagesTotal Male 6 Female 20 Total Students 26kessa thea salvatoreNo ratings yet

- Taller Producción y CostosDocument1 pageTaller Producción y CostosSebastian valenciaNo ratings yet

- Introduction To The Business of AgricultureDocument35 pagesIntroduction To The Business of AgricultureAvin PersadNo ratings yet

- Managerial Economics Assignment Regression AnalysisDocument1 pageManagerial Economics Assignment Regression AnalysismersharkNo ratings yet

- Sheet 6Document2 pagesSheet 6Amany SobhyNo ratings yet

- Economics Department Homework 4Document1 pageEconomics Department Homework 4hassah fahadNo ratings yet

- Spring crops and profits from single harvestDocument13 pagesSpring crops and profits from single harvestDanpuricNo ratings yet

- Rivulis E1000 English Metric 20190507 WebDocument4 pagesRivulis E1000 English Metric 20190507 WebMehdi BassouNo ratings yet

- Evaluation of Agro-Morphological Performances of Hybrid Varieties of Chili Pepper (Capsicum Frutescens L.) in Northern BeninDocument9 pagesEvaluation of Agro-Morphological Performances of Hybrid Varieties of Chili Pepper (Capsicum Frutescens L.) in Northern BeninPremier PublishersNo ratings yet

- SolutionDocument6 pagesSolutionmailrahulrajNo ratings yet

- Advertising Revenue Comparison: MagazineDocument6 pagesAdvertising Revenue Comparison: MagazineSUM ONENo ratings yet

- E-Uparjan-Computerization of Food Grain Procurement System in Madhya PradeshDocument37 pagesE-Uparjan-Computerization of Food Grain Procurement System in Madhya PradeshAshishNo ratings yet

- Koko Chocolate ProposalDocument13 pagesKoko Chocolate ProposalAnonymous prHkW2ObkNo ratings yet

- Chap 10Document45 pagesChap 10Sawan AcharyNo ratings yet

- Catfish Aquaculture BP2024Document4 pagesCatfish Aquaculture BP2024Entrepreneurship CornerNo ratings yet

- Presented By: Jenil Patel MEB-I (04) Kunj Sukhadia MEB-I (06) Rahi Raval MEB-IDocument18 pagesPresented By: Jenil Patel MEB-I (04) Kunj Sukhadia MEB-I (06) Rahi Raval MEB-IKavita BishtNo ratings yet

- Polyface The Farm of Many FacesDocument5 pagesPolyface The Farm of Many FacesentranaNo ratings yet

- 30 Veterinary Practices BufDocument40 pages30 Veterinary Practices BufKaKa ManaNo ratings yet

- Daily sales and operations reportDocument13 pagesDaily sales and operations reportWaleed ZafarNo ratings yet

- 27 Total Product Average Product and Marginal ProductDocument103 pages27 Total Product Average Product and Marginal ProductVaibhav SuranaaNo ratings yet

- Physics PDFDocument1 pagePhysics PDFShaira BugayongNo ratings yet

- Grade 10 First Am BotDocument14 pagesGrade 10 First Am BotShaira BugayongNo ratings yet

- Grade 10 First Am BotDocument14 pagesGrade 10 First Am BotShaira BugayongNo ratings yet

- Taxation Material 3Document11 pagesTaxation Material 3Shaira BugayongNo ratings yet

- Table NormalizationDocument1 pageTable NormalizationShaira BugayongNo ratings yet

- Grade10FirstAmbot 1Document15 pagesGrade10FirstAmbot 1Shaira BugayongNo ratings yet

- Radio Wave Infrared Wave Visible Light Ultraviolet Rays X-Ray Wave Gamma Wave Wavelength FrequencyDocument1 pageRadio Wave Infrared Wave Visible Light Ultraviolet Rays X-Ray Wave Gamma Wave Wavelength FrequencyShaira BugayongNo ratings yet

- Philippine Taxation Questions GuideDocument36 pagesPhilippine Taxation Questions GuideShaira BugayongNo ratings yet

- 4 TH Grading IPDocument17 pages4 TH Grading IPShaira BugayongNo ratings yet

- ) Was TreatedDocument3 pages) Was TreatedShaira BugayongNo ratings yet

- After TwoDocument2 pagesAfter TwoShaira BugayongNo ratings yet

- Taxation Material 2Document7 pagesTaxation Material 2Shaira BugayongNo ratings yet

- Manage Appointments and Patient RecordsDocument2 pagesManage Appointments and Patient RecordsShaira BugayongNo ratings yet

- RRLDocument9 pagesRRLShaira BugayongNo ratings yet

- Taxation Material 1Document11 pagesTaxation Material 1Shaira Bugayong100% (1)

- Sec11 23Document1 pageSec11 23Shaira BugayongNo ratings yet

- Central Mindanao University: Cmu Laboratory High SchoolDocument1 pageCentral Mindanao University: Cmu Laboratory High SchoolShaira BugayongNo ratings yet

- Bioplastic Organic Plastic Test 1 6 23 Test 2 4 8 Test 3 3 18 Average 4.33 N 15.33 NDocument3 pagesBioplastic Organic Plastic Test 1 6 23 Test 2 4 8 Test 3 3 18 Average 4.33 N 15.33 NShaira BugayongNo ratings yet

- 4 TH Grading IPDocument17 pages4 TH Grading IPShaira BugayongNo ratings yet

- Negotiable Instruments LawDocument2 pagesNegotiable Instruments LawShang BugayongNo ratings yet

- Grade 10 First Am BotDocument14 pagesGrade 10 First Am BotShaira BugayongNo ratings yet

- Past CPA Board On MASDocument22 pagesPast CPA Board On MASJaime Gomez Sto TomasNo ratings yet

- APCAS 10 11 Phil Ctry ReportDocument24 pagesAPCAS 10 11 Phil Ctry ReportBilly Julius GestiadaNo ratings yet

- ) Was TreatedDocument3 pages) Was TreatedShaira BugayongNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsElena Llasos84% (31)

- Summary of Important EquationsDocument7 pagesSummary of Important EquationsShaira Bugayong100% (1)

- 2009-09-19 061224 UpselwDocument1 page2009-09-19 061224 UpselwMArk Dino AlbielaNo ratings yet

- Supplier Contact NO. Email Address Address 1. B-Meg: Davao OfficeDocument2 pagesSupplier Contact NO. Email Address Address 1. B-Meg: Davao OfficeShang BugayongNo ratings yet

- Statement of Financial Position ClassificationDocument1 pageStatement of Financial Position ClassificationShaira BugayongNo ratings yet

- Tariff and Customs Code-AnswerDocument10 pagesTariff and Customs Code-AnswerShaira BugayongNo ratings yet

- BPSC Test Series 368Document1 pageBPSC Test Series 368vasajamunNo ratings yet

- Service Annotated BibliographyDocument2 pagesService Annotated Bibliographyapi-282306789No ratings yet

- Phase 4 - Team Leadership - Facebook CaseDocument14 pagesPhase 4 - Team Leadership - Facebook CaseMauricio RiveraNo ratings yet

- Future of Slovene Language Between Standards and RealityDocument25 pagesFuture of Slovene Language Between Standards and RealityLeonardo PavanNo ratings yet

- Exam Paper For Edxcel iGCSE Language Pater BDocument28 pagesExam Paper For Edxcel iGCSE Language Pater BDamask RoseNo ratings yet

- Action Plan DRRMDocument2 pagesAction Plan DRRMIrish Diane Zales Barcellano100% (6)

- Art Staff BioDocument3 pagesArt Staff BioJess SauerNo ratings yet

- Patterson, O'Malley & Story PDFDocument14 pagesPatterson, O'Malley & Story PDFSanja JankovićNo ratings yet

- Botha Nepgen - Connecting The Dots PAS 55 ISO 55000 and GFMAMDocument133 pagesBotha Nepgen - Connecting The Dots PAS 55 ISO 55000 and GFMAMrevitaNo ratings yet

- Attention-Deficit Hyperactivity Disorder (ADHD)Document3 pagesAttention-Deficit Hyperactivity Disorder (ADHD)Hazzel Mea OberoNo ratings yet

- Coast Starlight Schedule 010818Document3 pagesCoast Starlight Schedule 010818Robert NogginsNo ratings yet

- Five Forces, SWOT and Internal Analysis of Southwest Airlines and The Airline IndustryDocument9 pagesFive Forces, SWOT and Internal Analysis of Southwest Airlines and The Airline IndustryTravelers EyesNo ratings yet

- Power and PoliticsDocument11 pagesPower and Politicsrahil yasin89% (9)

- Timbuk 2Document4 pagesTimbuk 2Andrea Nelly Leiva Martínez100% (1)

- A Pedagogy of Culture Based On Chinese Storytelling TraditionsDocument549 pagesA Pedagogy of Culture Based On Chinese Storytelling TraditionsAnonymous YykEL4PNo ratings yet

- Reading Rehabilitation Hospital - Group 3 - Section DDocument3 pagesReading Rehabilitation Hospital - Group 3 - Section DBollapragada Sai Sravanthi0% (1)

- PDF A Terrible Matriarchy Sushmita Kashyap CompressDocument1 pagePDF A Terrible Matriarchy Sushmita Kashyap CompressSolomon rajuNo ratings yet

- Phụ Lục 1-Chủ Đề Thi Hbta 2021Document5 pagesPhụ Lục 1-Chủ Đề Thi Hbta 2021Lilies RosyNo ratings yet

- The No Child Left Behind Act of 2001-1Document23 pagesThe No Child Left Behind Act of 2001-1api-503235879No ratings yet

- MSC Container Services GuideDocument4 pagesMSC Container Services Guidedhruv chudgarNo ratings yet

- Vivo v. Montesa DigestDocument2 pagesVivo v. Montesa DigestkathrynmaydevezaNo ratings yet

- Inspection and Testing of Electrical InstallationDocument8 pagesInspection and Testing of Electrical InstallationKamugasha KagonyeraNo ratings yet

- Kanji Dictionary For Foreigners Learning Japanese 2500 Kanjis Isbn9784816366970pdfDocument4 pagesKanji Dictionary For Foreigners Learning Japanese 2500 Kanjis Isbn9784816366970pdfBhavesh MhatreNo ratings yet

- Proposed Enhanced Learners' Work Immersion ProgramDocument26 pagesProposed Enhanced Learners' Work Immersion ProgramClara Belle100% (2)

- André Antoine's Passion for Realism in the Théâtre-LibreDocument31 pagesAndré Antoine's Passion for Realism in the Théâtre-LibretibNo ratings yet

- Coordination AND CIRCUIT TRAININGDocument7 pagesCoordination AND CIRCUIT TRAININGKezia EscarioNo ratings yet

- Cyberactivism and Citizen Journalism in Egypt Digital Dissidence and Political Change by Courtney C. Radsch (Auth.)Document364 pagesCyberactivism and Citizen Journalism in Egypt Digital Dissidence and Political Change by Courtney C. Radsch (Auth.)gregmooooNo ratings yet

- Ethics and professional skills module syllabus overviewDocument12 pagesEthics and professional skills module syllabus overviewShylendra Dookhan0% (1)

- SAMPLE Bar Exam ScheduleDocument4 pagesSAMPLE Bar Exam ScheduleFrances Abigail BubanNo ratings yet

- Doing Business With BelizeDocument21 pagesDoing Business With BelizeOffice of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet