Professional Documents

Culture Documents

Delta Health Alliance 2017

Uploaded by

the kingfish0 ratings0% found this document useful (0 votes)

3K views37 pagesDelta Health Alliance

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDelta Health Alliance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

3K views37 pagesDelta Health Alliance 2017

Uploaded by

the kingfishDelta Health Alliance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 37

SCANNED MAY 0 2 2018

2949309700507 8

re 990 Return of Organization Exempt From Income Tax | 2% S00"

Under scton 0, 52,0494) tthe nara Revenue Gade cet prt funds —

ccseingtsttgtman |» Donatenier scl secur eunbes on is om sma be made pl pea

cence > iormaon spout Fem 00 an is nsiylons sat ware gov/onn090 \J Iliieeasated

2016, and ending jupe30 20

[© encioreiceniteain naar

DD sasesscxnge [Sarg asm 470915576,

TO Name cnange” [Birr and ses (2 FO Tox Tosi nt Gedo sess | Roos ETamphom novo

DD innaeetm — |2.0.80x277 652.696.7004

Di rrareumnenina) hyo on, is & BON Cay AEE oT wa oe

D snansesraun 1530778 Covoesrcopes 10,806,918

Tralee gan mumteretacranr] vos

J Website: > www deltahealthalhance.org { Hic) Group exemation number

FR I

‘Summary

Hi Wt stort tse Yer CIN

T1No- attach a ee cn)

MS.

1 Briely describe the organzalion’s mission or most sgniicant action! in altance wah Misseippi Unveraties and other

| relatednonprotennes, Dea Heal Aliance, in

5 dane nadia underserved regions of

§] 2 Checktnis box Lin the organization ciscontined is operations or disposed of more than 25% of ne asl,

| 3 Number of voung members of the governing body (Part VI line 1a) ee ta 5

| 4 Number of independent voting members ofthe governing body Part Vi,ine 1b) |). | a 5

B) 5 Tatiranec cen ena e200 Phe 25) Dl Zs

3 | 6 Total numberof voluters estimate il necessary) 2) Ee

&] 7a Total unrelated business revenue trom Part Vil, column (C).ne 12...) Te 0

bb_ Net unrelated business taxable income from Form 990-7 line 34 eeeelae °

Fr vowr Sarat

| 8 Contnbutions and grants (Part Vil ine th) Fee 16.155,065 1.56676

2 | 9 Program sence revenue (art Vil, ine 29) pit 2718202] 1193629

| 10 Investment income (Part Vill, columa (A) ines 3, 4, and 7) + s 7.293] 2148

lt Otherrevenue (Part Vil, column (A), bnes 5, 6,8, Se, 10¢, and 116) 35,93 esse

42__Totalrevenue—add ines 8 through 11 must equal Part Vl, column (4 ne 12) waar 7aan6 915

18 Grants and similar amounis parc (Part x, column (A), nes 1-3) 3,505,202

14 Benefits pald to or for members (Pat IX, column (A, tne 4)

4g [15 Salanes other compensation, employee benetits (Part IX, cok wess19 “anezay 7,400,384

# | 189 Professional fundrasng fees (Part IX, column (A), line 176)

i 1b Total fundraising expenses (Part IX, column (O}, dine. 25) De

17 Other expenses (Part IX, column (A, tines 112-1 fo RECENED 270.68] 3940 203

18 Total expenses. Add ines 13-17 (must equal Pdrt KreolumnAl- ine. 25)—, 77399,156 79,40.337

19 _Rlevenve less expenses. Subtract ine 18 from uhgt2 I 1,578,097 (533422)

FF | HAR LE ZOTE | opera of Curent ox] tad owr

$B)20Totlassas Pan x tno 16 30958,30] 13,683 18

Sq]21 Total iabites (Par x, ine 26) | 445431 21809

He Tee re eee cuit idaxsBDEN, UT | 5.50459 sania

FEMHN Sianature Block

Under penis of pry, | dice Dat rave Srarined satan, nding seconpanyng seheddey and waterloo te eat fy rowedGe Bd US TE

tre. corel | Decora of peor chr tan eco sane on lors wh reper has 7s

) LH Lileiaiaely

Sign

Type or pram ane

eae

Here YP Fyanace o Norte STRATTON

oa b sei Prepare sara oagel™

Preparer

Use Only | sane Ease

fay the IS ciscuss ths return with the preparer shown above? (eos instructions). ~~ Lives Dine

For Paperwork Reduction Act Notice, see the separate instructions. ‘oat No 182" Ferm 990 0

$

om 50 16 age

Statement of Program Service Accomplishments

Checkil Schedule O conta a response or note Yo any tne ints Pat

7 Baty describe the organization's mesion

ce wih Msiip ivr and oe clted no-pofit nies Daa rsson ate advo,

‘velop, and plement programs to morove the healthcare and ducaioal needs fe most depressed and under served

Did the organization undertake any significant program services Guring The year which were not Usted on the

prior Form 990 or 990-£27 a . eee Clea

\tYes" deserve these new services on Schedule O.

3 Bid the crganation cease conducting, or make sgnicant changes fn How Ht conduct, any program

senices?.. eta ee 228 yes)

i "Yes," descr these changes on Schedule.

4 Describe the organization's program service accomplishments for each ofits three largest program services, as measured by

expenses. Section 501(c\3) and 501(c\(¢) organizations are required to report the amount of grants and allocations to others,

the total expenses, and revenue, if any, for each program sarvce reported

a

_) Expenses $____ 3264875 ncuding granls 183284675) Pevenue § Tags)

iianola Promise Communty,

“a (Code) @xpenses $___

alivon - Early Headstar

“4a Other program sewices (Describe in Schedule 0.)

(Expenses $___ 6.515.721 Including grants of $ __ 6,615,721) (Revenue $ 15721)

Ze Total program senice expenses Ta a8,

Fom 890 0076)

pOMoe

‘Form 390 ote) Page 3

Chachist of Required Schedules

11 te crcantzaton desobed in section 501(X8) or 49471) (ther than a pate foundation? “Yes,

complete Schedule A ily

2 _Isthe organization required to complete Schedule 8, Schedule of Contnbutos (see instructions?» . 2 Le

3 isthe ergaizaton engage in director ndrect pliical campaign aches on behalf of on oppostion to

candidates for pub office? I "Yes," complete Schedule ©, Part! a| |v

44 Section 501(c) organizations. Did the organization engage in lobbying ates, or havea section S01)

fection in ffect during tho tax year? I "Yes," complet Schedule C, Pat «| |v

§ Is the organization a section §01(c)4), 501(ci5), or 501(c)\6) organization that receives membership dues,

assessments, or similar amounts a8 defined In Revenue Procedure 98-197 If "Yes," complete Schedule.

Parti : s|_|v

6 id the organization malntaln any donor acvised funds or any similar funds or accounts for which donors

have the right to provide advice onthe distnutlon or investment of amounts In such funds or accounts? It

“Yes,” complete Schedule D, Part | o| |v

7 Did the organization receive or hold & conservation easement, ichcing easements to preserva open space,

the environment, histor land areas, or strc structures? "Yes," completo Schedule. Pat I 7

8 ee omntzaten man colacone of wrk of a Hore estes, esr 8871s,

complete Schedule, Part I! e| |v

8 id the organization report an arnount in Part X, ine 2, for escrow or custodial account abit, serve as @

gated or arr not aa Fat Xo oe et cour, Set manga et 58 oF

debt negotiation serces? Yes," complete Schade D, Part V o| |v

10 Did the organization, tect or though a related organzaton, hold assets im tomporaly resicted

endowments, permanent endowments or quasiendowments I "Yes,"complete Schedule D, Part 10

41.1 the organization's answer to any ofthe folowing questions i “Yes,” then complete Schedule D, Parts

VIL Vil Bor Xasapphicte.

19 Did the organization report an amount for land, builsings, and equipment in Part X; line 10? If “Yes,”

complete Schedule D, Part sal v

bb 01d the organization report an amount for vestments othr secures in Part X, ne 12 that is 596 of more

of ts total asets reported n Pan, 16? IVs,” complete Sched D, Pat Vl so] dv

«© Did the ganization report an amount for vestments program related In Part X, line 12 that Is 5% or more

ofits total asets reported in Part % line 167 “Yes,” complete Schedule D, Part Vl se} |v

4 Did the organization report an amount for other asset Pat X ne 15 thaws 6% oF more ofits toa asets

reported in Prt X. line 162 "Yes," complete Schedule D, Pat ra] lv

«© De the organization report an amount for other bits in Part X, ne 25? if-Yes," complete Scheauie D, Pat x [Ate Z

ath exganiato's separate or consotteg tania statement fr the tx year include afotnote tat seses

the crgarzaton' tality for ucetan tax postions under FIN 48 ASC 1407 "Ye“compete Schad, Par X= [axe |v

12a id the organization obtain separate, Independent aucted far stterents forthe tax year? IY," complete

SehediteB, Parts Mand X tly

Was the organzation inched in consolidated, independent aucted fancial statement fr the tax year? If

"Yes," andthe orpanzation answored "No" fo ine 12a, then completing Schedule D, Pats and ws optional | a6] |v

13 Is the organization a school described in section 170(b){1)(A)iil? If "Yes," complete Schedule E 13, vo

‘44a. the organzation mantain an office, employees, o agents ouside ofthe United States? . ia] —}¥

Did the erganizalon have aggregate revenues or expenses of more than $10,000 from grantmaking,

fundraising, business, investment. and program series actitles ouside the United States, or aggregate

foreign vestments valved at $100,000 or more? I "¥es,"complet Schedule F, Pars and. |xgp| | ¥

415 Did he organtationreprt on Part IX, cola Ine 3, mere than $5,000 of grants o other assistance to or

for any foreign organization? I "Yes," complate Schedule , Parts and ss|_|v

16 Did the organization report on Part 1X, column (A, ne 3, more than $5,000 of aggregate grants or other

assistance too or freign Inchaauals? "es," complete Schedule F, Parts Il and WV we| |v

17 Did the organization epoca total of more than $16,000 of expenses fr professional fundraising services on

Part, column (A ines € and 116? if "Yes," compete Sehedue G Part I(oee instructions) Lz lv

18 Did the organization report more than $15,000 total of fundratsing event gross Income and contributions on

Parl nese and 852 “Ye,” complote Schedule G, Pat epee iat

19 04d he organization report more than $16,000 of goss income fom gaming actives on Part Vil ine 9a?

ites" complete Schedule G, Part il sol |v

Fem 880 (2076

You might also like

- Mabil WM TRO RequestDocument3 pagesMabil WM TRO Requestthe kingfish100% (1)

- WANTED 4-9-24Document2 pagesWANTED 4-9-24the kingfishNo ratings yet

- Peoples CompllaintDocument33 pagesPeoples Compllaintthe kingfishNo ratings yet

- Bennett Charles Polic ReportDocument6 pagesBennett Charles Polic Reportthe kingfishNo ratings yet

- Ivana Fis File - RedactedDocument14 pagesIvana Fis File - Redactedthe kingfishNo ratings yet

- Wilson - Shaken Baby AbuseDocument2 pagesWilson - Shaken Baby Abusethe kingfishNo ratings yet

- Press Release Update NAME CORRECTION Ridgecrest HomicideDocument3 pagesPress Release Update NAME CORRECTION Ridgecrest Homicidethe kingfishNo ratings yet

- Dak Complaint WMDocument15 pagesDak Complaint WMthe kingfish100% (1)

- BlackRock Inc., Et Al.Document33 pagesBlackRock Inc., Et Al.the kingfishNo ratings yet

- RDI Contract, 2024.03.12Document40 pagesRDI Contract, 2024.03.12the kingfish100% (1)

- Dak Complaint WMDocument15 pagesDak Complaint WMthe kingfish100% (1)

- Where Is All The Money Going - An Analysis of Inside and Outside The Classroom Education SpendingDocument6 pagesWhere Is All The Money Going - An Analysis of Inside and Outside The Classroom Education Spendingthe kingfishNo ratings yet

- 828 Sports Ventures Overview - Gluckstadt WMDocument9 pages828 Sports Ventures Overview - Gluckstadt WMthe kingfishNo ratings yet

- Angelique Arrest Report RecordDocument2 pagesAngelique Arrest Report Recordthe kingfishNo ratings yet

- Ivana Fis File RedactedDocument14 pagesIvana Fis File Redactedthe kingfishNo ratings yet

- Briarwood 1 Kohan OrderDocument14 pagesBriarwood 1 Kohan Orderthe kingfishNo ratings yet

- Rapid Edited 1Document8 pagesRapid Edited 1the kingfishNo ratings yet

- Most WantedDocument2 pagesMost Wantedthe kingfishNo ratings yet

- NAACP Reeves Denial OrderDocument12 pagesNAACP Reeves Denial Orderthe kingfish100% (2)

- Floyd Jacobs FileDocument23 pagesFloyd Jacobs Filethe kingfishNo ratings yet

- Floyd Jacobs FileDocument23 pagesFloyd Jacobs Filethe kingfishNo ratings yet

- Answer and CounterclaimDocument86 pagesAnswer and Counterclaimthe kingfishNo ratings yet

- Committee Chairs Announcement 1.12.2024Document2 pagesCommittee Chairs Announcement 1.12.2024the kingfish100% (1)

- Rankn Deputies Memo - Redacted2Document27 pagesRankn Deputies Memo - Redacted2the kingfish100% (1)

- Interim OrderDocument6 pagesInterim Orderthe kingfishNo ratings yet

- Stamps PetitionDocument7 pagesStamps Petitionthe kingfishNo ratings yet

- NAACP Reeves OpinionDocument3 pagesNAACP Reeves Opinionthe kingfishNo ratings yet

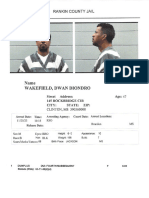

- Wakefield DUIDocument1 pageWakefield DUIthe kingfish100% (1)

- RD Notice of AppealDocument12 pagesRD Notice of Appealthe kingfishNo ratings yet

- Solid Waste RFPDocument81 pagesSolid Waste RFPAnthony WarrenNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)