Professional Documents

Culture Documents

Financial Accounting Punjab University: Question Paper 2018

Uploaded by

aneebaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting Punjab University: Question Paper 2018

Uploaded by

aneebaCopyright:

Available Formats

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

Question Paper 2018

Paper Code BC 304

Time : 3 Hours Marks: 100

Note: Attempt any five questions. All questions carry equal marks.

Q.1 On 1st January, 2017 Abdullah drew and Hassan accepted a bill at 3 months for Rs. 10,000. On

4th January,2017. Abdullah discounted the bill at his bank at 8 percent per annum and remitted half

the proceeds to Hassan. On 1st February 2017, Hassan drew and Abdullah accepted a bill at 3

months for Rs.10,000. On 4th February, 2017, Hassan discounted the bill at 8 percent per annum

and remitted half the proceeds to Abdullah. Abdullah and Hassan agreed to share the discount

equally.

At maturity Abdullah met his acceptance, but Hassan failed to meet his and Abdullah therefore,

had to pay it. Abdullah drew and Hassan accepted a new bill of 3 months for the amount of the

original bill plus interest 8 % per annum. On 1st August, 2017, Hassan became insolvent and only

50 paisa in rupees received from him.

Record the above transactions in Abdullah’s Journal and write up Hassan’s Account.

Q.2 The December 2017 Bank Statement received by Ghazi Associates from HBL Model

Town Branch shows credit balance Rs. 500,000 while Ghazi Associates records shows a debit

balance of Rs. 561,000 on December 31, 2017. The accountant while doing bank reconciliation

found out the following reconciliation items.

(1) Two cheques issued in December have not yet cleared by bank and not included in paid

cheques returned by bank along with bank statement,

Cheque No Date Amount

056789 15-12-2017 Rs.8000

056799 20-12-2017 Rs.7000

(2) A deposit of Rs. 70,000 was not credited by bank in Ghazi Associate account as it was

deposited in late hours.

(3) December 22, Rs. 7,000 dividend incomes on investment in the shares of National Bank

were collected by HBL Bank and credited in Ghazi Associates account but not yet recorded

in cash book.

(4) December 31, Rs. 7,000 interest computed on average balance during December was

credited by bank in Ghazi Associate account but not yet debited in cash book by

accountant.

(5) December 25, Rs. 1,000 was debited as collections charges by bank for handling various

collections from accounts receivable but not appeared on the credit side of cash book.

(6) December 30 a cheque of Rs. 10,000 marked NSF was returned by bank.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 40

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

(7) A cheque No. 875890 dated 20-12-2017 of Rs. 32,000 issued in favour of PTCL to pay

telephone bill was erroneously recorded as Rs. 23,000 in cash book by accountant.

Required:

Prepare bank reconciliation statement and determine the balance at bank to be reported in the

balance sheet in December 31, 2017.

Q.3 The trial balance of Zee Ltd shows a difference of Rs. 127,000 which is debited to

Suspense Account. Subsequently the following errors are discovered. You are required to

correct the errors and prepare suspense account.

a) The total of the returns outwards book Rs. 21,000 has not been posted in the ledger.

b) A purchase of Rs. 40,000 from Majid has been entered in the Sales Book. However,

Majid’s account has been correctly credited.

c) A sales of Rs. 43,000 to Rahman has been credited in his account as Rs. 34,000.

d) A sale of Rs. 29,600 to Kareem has been entered in the Sales book at Rs. 26,900

e) Old furniture sold for Rs. 54,000 has been entered in the sale account as Rs. 45,000

f) Goods taken by proprietor, Rs. 10,000 have not been entered in the books at all.

Q.4 From the following information prepare Trading & Profit and Loss Account of Pak

Flour Mill for the year ended 30th September, 2017 and the Balance Sheet as on that date:

Accounts Title Rs. Accounts Title Rs.

Capital 120,000 Audit Fee 2,000

Trade Creditors 15,200 Office Expenses 2000

Bills Payable 1,000 Interest Paid 1,700

Unexpired commission 2,300 Bad Debts 1,400

Sales 624,000 Salaries 13,000

Discount Received 2,100 Repair & Renewals 1,800

Stock 101,000 Printing & Stationary 1,400

Purchases 518,000 Plant & Machinery 53,000

Carriage Inwards 8,900 Buildings 35,000

Discount Allowed 750 Tools 8,650

Trade Creditors 16,000

Stock as on 30th September 2017 was valued at Rs. 109,900. Plant and machinery is to be

depreciated at 10 percent, buildings at 5 percent and tools at 15 percent.

Reserve against bad debts is to be created at 5 percent of the trade debtors.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 41

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

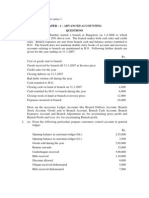

Q.5. The following is receipts and payments account of the Lahore Club for the year ended

31st December.

Receipts Dr. Rs Payments Cr. Rs

To balance 1st Jan. 2017 3,000 By Rent 52,000

To Entrance Fee 5,500 By Stationary etc 30,680

To Subscription, 2016 2,000 By Wages 53,330

To Subscription, 2017 169,000 By Billiards Table 39,000

To Subscription, 2018 3,000 By Repairs and Renewals 8,060

To Lockers Rent 5,000 By Interest 15,000

To special subscription for Governors Party 34,500 By balance 31st December 23,960

Total 222,000 Total 222,000

Locker rent, Rs. 600 referred to 2016 and Rs. 900 is still owing: Rent Rs. 13,000 pertained to 2016

and Rs. 13,000 is still due: Stationary Rs. 3,120 related to 2016, still owing Rs. 3,640;

Subscription unpaid for 2017 Rs. 4,680; Special subscription for Governor’s Party outstanding

RS.5,500.

Q.6 The Balance sheet of Noor and Associates was as under on 1st July, 2017

Liabilities & Capital Rs Assets Rs

Sundry Creditors 90,000 Cash 10,000

Reserve 50,000 Debtors 100,000

Noor’s Capital 150,000 Stock 120,000

Nazirs Capital 120,000 Furniture 20,000

Buildings 160,000

Total 410,000 Total 410,000

Munir was admitted as a partner and was given 1/4th share on the following terms

(a) He should bring Rs. 150,00 as his capital

(b) His share of goodwill was valued at Rs. 50,000 but he was unable to bring it in cash and,

therefore it was to be raised.

(c) Stock and furniture be depreciated by 10 percent.

(d) A provision of 6 percent on debtors be created

(e) An amounts of Rs. 10,000 included in creditors not to be treated as a liability.

(f) A provision of Rs. 5,000 be created against bill discounted

(g) The buildings be treated as worth Rs. 200,000

It was agreed that except cash, other assets and liabilities were to be shown at same old figure in

the balance sheet.

Required: Give Journal entries to record the transaction on the admission of Munir and Show the

balance sheet after his admission.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 42

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

Q.7 Zain is not writing his books properly. From the following information prepare a statement

showing profit or loss and statement of affairs for the year ending 30th June 2017.

01-07-2016 30-06-2016

Cash in hand 9,000 28,000

Debtors 228,000 214,000

Creditors 312,000 284,000

Stock 334,000 374,000

Bills Receivable 305,000 288,000

Bank overdraft 408,000 392,000

Motor van 42,000 42,000

Furniture 34,000 34,000

Drawings Rs. 48,000: Depreciate furniture at 10% Write off Rs. 8,000 on motor van. Provide RS.

10,000 as bad debts 5% as reserve on debtors. Provide reserve of Rs. 16,000 on Bill Receivable

Q.8 Al-Hadi Transporter purchase a truck for Rs. 500,000 on 1st January, 2014, Depreciation is

written off 20% p.a on the reducing balance. On July 1, 2016, Al-Hadi spent Rs. 1,00,000 on

overhauling of truck. On July 1, 2017, Al-Hadi exchanged its old truck with new one. The purchase

price of new truck was Rs. 850,000 and the vendor allowed trade in allowance Rs. 250,000 for the

old truck. Depreciation rate for new truck is 15% p.a on the reducing balance.

Required:

Prepare the Truck Account from 2014 to 2017 assuming that accounts are closed on 31st December

ever year.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 43

You might also like

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Financial Accounting exam questionsDocument3 pagesFinancial Accounting exam questionsVishwas Srivastava 371No ratings yet

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- Financial Accounting DocumentsDocument104 pagesFinancial Accounting DocumentsHarsh 21COM1555No ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Document3 pagesTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- 5627Document8 pages5627MS 7No ratings yet

- ACCOUNTANCY+2 B0ardDocument12 pagesACCOUNTANCY+2 B0ardlakshmanan2838No ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Accountancy QP 1 (A) 2023Document5 pagesAccountancy QP 1 (A) 2023mohammedsubhan6651No ratings yet

- Financial Accounting Past Paper BCom Part 1 PU 2019Document3 pagesFinancial Accounting Past Paper BCom Part 1 PU 2019Rana Hanzila TahirNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- AFH Important questionDocument6 pagesAFH Important questionmanassadashiv013No ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Accountancy Question Bank for Class XIDocument9 pagesAccountancy Question Bank for Class XIlasyaNo ratings yet

- 11 April Account Subjective Question'Document3 pages11 April Account Subjective Question'Nishant NepalNo ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- Financial Accounting Punjab University: Question Paper 2009Document5 pagesFinancial Accounting Punjab University: Question Paper 2009Abrar AliNo ratings yet

- Accounting: Page 1 of 3Document3 pagesAccounting: Page 1 of 3Laskar REAZNo ratings yet

- ACC101Document8 pagesACC101Rizwana MehwishNo ratings yet

- Home Assinment 2021-22new Microsoft Office Word DocumentDocument4 pagesHome Assinment 2021-22new Microsoft Office Word DocumentGanesh AdhalraoNo ratings yet

- Single EntryDocument18 pagesSingle EntryFizzazubair rana50% (2)

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Sy DissolutionDocument7 pagesSy Dissolutionsmit9993No ratings yet

- Financial Accounting 2019Document8 pagesFinancial Accounting 2019Ivy NinjaNo ratings yet

- XI Commerce Accounting Practice - Paper: TIME: 1 Hour, 10 MinutesDocument4 pagesXI Commerce Accounting Practice - Paper: TIME: 1 Hour, 10 MinutesSYED HAIDER ALI ZAIDINo ratings yet

- Introduction To Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesIntroduction To Financial Accounting: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument47 pagesAttempt Any Four Questions. All Questions Carry Equal MarksAbhishek GwalNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- PaperDocument4 pagesPaperamirNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- Faculty of Commerce & Business Management 6234/11Document28 pagesFaculty of Commerce & Business Management 6234/11Vishu DcpNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Partnership - I: Change in Profit Sharing RatioDocument33 pagesPartnership - I: Change in Profit Sharing RatioUjjwal BeriwalNo ratings yet

- XDocument5 pagesXSAI KISHORENo ratings yet

- Prelim Examination 2018 With Answers PDFDocument6 pagesPrelim Examination 2018 With Answers PDFjudel ArielNo ratings yet

- B.Com Financial Accounting Single Entry ConversionDocument91 pagesB.Com Financial Accounting Single Entry ConversionJ RajputNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- B.Com Past Papers Solved Punjab UniversityDocument12 pagesB.Com Past Papers Solved Punjab UniversityaneebaNo ratings yet

- B.Com Past Papers Solved Punjab UniversityDocument12 pagesB.Com Past Papers Solved Punjab UniversityaneebaNo ratings yet

- Financial Accounting Punjab University B.com Part 1 Solved Past Papers 2012 PDFDocument11 pagesFinancial Accounting Punjab University B.com Part 1 Solved Past Papers 2012 PDFaneebaNo ratings yet

- Ethical Behaviour: Attempt All QuestionsDocument1 pageEthical Behaviour: Attempt All QuestionsaneebaNo ratings yet

- 7-Business Stats & Maths A-13Document2 pages7-Business Stats & Maths A-13aneebaNo ratings yet

- Multi Topic EssayDocument7 pagesMulti Topic Essayaneeba100% (1)

- Financial Accounting Punjab University B.com Part 1 Solved Past Papers 2014Document13 pagesFinancial Accounting Punjab University B.com Part 1 Solved Past Papers 2014aneeba50% (2)

- 8 - Financial Accounting A-13Document2 pages8 - Financial Accounting A-13aneebaNo ratings yet

- 4 - Bussines Law A-13Document1 page4 - Bussines Law A-13aneebaNo ratings yet

- 2 - Auditing A-13Document1 page2 - Auditing A-13aneebaNo ratings yet

- Islamic Education: (New Syllabus)Document1 pageIslamic Education: (New Syllabus)aneebaNo ratings yet

- 3 - B.C.R.W A 13Document1 page3 - B.C.R.W A 13aneebaNo ratings yet

- 5 - Business Taxation A 13Document1 page5 - Business Taxation A 13aneebaNo ratings yet

- Islamic Education (Old Syllabus)Document1 pageIslamic Education (Old Syllabus)aneebaNo ratings yet

- 1 - Advanced Financial Accounting A-13Document2 pages1 - Advanced Financial Accounting A-13aneebaNo ratings yet

- 6 - Cost Accounting A-13Document2 pages6 - Cost Accounting A-13aneebaNo ratings yet

- Botany Paper I 13Document1 pageBotany Paper I 13aneebaNo ratings yet

- 6 - Computer Application 14Document1 page6 - Computer Application 14aneebaNo ratings yet

- Zoology (Theory) Paper-III Set IDocument1 pageZoology (Theory) Paper-III Set IaneebaNo ratings yet

- Pakistan Studies A 13Document1 pagePakistan Studies A 13aneebaNo ratings yet

- Twaif by Hamna Tanveer PDFDocument1,436 pagesTwaif by Hamna Tanveer PDFaneebaNo ratings yet

- Mathematics B Course Paper IIIDocument1 pageMathematics B Course Paper IIIaneebaNo ratings yet

- Financial Accounting Punjab University: Question Paper 2018Document4 pagesFinancial Accounting Punjab University: Question Paper 2018aneebaNo ratings yet

- 7 - Economics of Pakistan A-13Document1 page7 - Economics of Pakistan A-13aneebaNo ratings yet

- Mathematics A IV Set IDocument1 pageMathematics A IV Set IaneebaNo ratings yet

- Botany Paper II 13Document1 pageBotany Paper II 13aneebaNo ratings yet

- Education (New Syllabus)Document2 pagesEducation (New Syllabus)aneebaNo ratings yet

- (B.A/B.Sc. Part-II) (Old & New Syllabus-2016)Document1 page(B.A/B.Sc. Part-II) (Old & New Syllabus-2016)aneebaNo ratings yet

- Ethical Behaviour (B.com) 14Document1 pageEthical Behaviour (B.com) 14aneebaNo ratings yet

- January 2018Document112 pagesJanuary 2018Pumper Magazine100% (1)

- Hul Subsidirary Annual Report 2018 19Document284 pagesHul Subsidirary Annual Report 2018 19dhananjay1504No ratings yet

- Business Law ReviewerDocument16 pagesBusiness Law ReviewerTerence Jeff TamondongNo ratings yet

- Farrukh Mushtaq ResumeDocument2 pagesFarrukh Mushtaq ResumeFarrukh M. MirzaNo ratings yet

- Group Directory: Commercial BankingDocument2 pagesGroup Directory: Commercial BankingMou WanNo ratings yet

- National Occupational Safety and Health Profile of OmanDocument105 pagesNational Occupational Safety and Health Profile of OmanKhizer ArifNo ratings yet

- N12 - Atulya AhujaDocument3 pagesN12 - Atulya Ahujaanushka kashyapNo ratings yet

- Imt Ghaziabad - The A-TeamDocument6 pagesImt Ghaziabad - The A-TeamAbhishek GuptaNo ratings yet

- Chapter 12Document31 pagesChapter 12KookieNo ratings yet

- 1.1 Purpose: Intended Audience and Reading SuggestionsDocument11 pages1.1 Purpose: Intended Audience and Reading SuggestionsSwapneel JadhavNo ratings yet

- Business Plan For Fashion&YouDocument40 pagesBusiness Plan For Fashion&YouAnoop Kular100% (1)

- BA2 PT Unit Test - 01 QuestionsDocument2 pagesBA2 PT Unit Test - 01 QuestionsSanjeev JayaratnaNo ratings yet

- Analyst SkillsDocument2 pagesAnalyst SkillsGarvit HarisinghaniNo ratings yet

- Engineering Dept ScopeDocument3 pagesEngineering Dept ScopeSehrishNo ratings yet

- Consumer Buying BehaviourDocument2 pagesConsumer Buying BehavioursmjegaNo ratings yet

- Pro Services in Dubai - Pro Services in Abu DhabiDocument23 pagesPro Services in Dubai - Pro Services in Abu DhabiShiva kumarNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- Netvault Backup Compatibility Guide For Hardware and Software TechnicalDocument71 pagesNetvault Backup Compatibility Guide For Hardware and Software TechnicalArunmurNo ratings yet

- Market Research of FevicolDocument12 pagesMarket Research of FevicolShraddha TiwariNo ratings yet

- Operational Effectiveness + StrategyDocument7 pagesOperational Effectiveness + StrategyPaulo GarcezNo ratings yet

- Bill Ackman's Letter On General GrowthDocument8 pagesBill Ackman's Letter On General GrowthZoe GallandNo ratings yet

- Obstfeld, Taylor - Global Capital Markets PDFDocument374 pagesObstfeld, Taylor - Global Capital Markets PDFkterink00767% (3)

- Emerging OD Approaches and Techniques for Organizational LearningDocument16 pagesEmerging OD Approaches and Techniques for Organizational LearningDinoop Rajan100% (1)

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- CH 2 Business EnviromentDocument36 pagesCH 2 Business EnviromentSeema TanwarNo ratings yet

- Financial Ratio Analysis of Dabur India LimitedDocument44 pagesFinancial Ratio Analysis of Dabur India LimitedRajesh Kumar roulNo ratings yet

- Exposing the Financial Core of the Transnational Capitalist ClassDocument26 pagesExposing the Financial Core of the Transnational Capitalist ClassMichinito05No ratings yet

- Trading Setup EbookDocument34 pagesTrading Setup EbookJohn JosephNo ratings yet

- Engineering Management 5 - ControllingDocument46 pagesEngineering Management 5 - ControllingCraig PeriNo ratings yet

- About ATA CarnetDocument4 pagesAbout ATA CarnetRohan NakasheNo ratings yet