Professional Documents

Culture Documents

Accounting Concepts Basic PDF

Uploaded by

d0 ratings0% found this document useful (0 votes)

16 views3 pagesOriginal Title

ACCOUNTING CONCEPTS BASIC.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views3 pagesAccounting Concepts Basic PDF

Uploaded by

dCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

BANAT v COMELEC Total number of seats na pwede

ipamigay sa mga party list minus

Steps in pro-rata allocation of seats in the party-

guaranteed/qualified seats na

list system:

naipamigay sa STEP 3.

STEP 1: Kuhanin ang total number ng members

STEP 5: SECOND ROUND: Tignan kung sino ang

of the House of Representatives (HR), tapos

entitled sa “additional seats”.

kunin ang number of seats ng party-list.

Ano ang additional seats? Seats na binibigay sa

Mahalaga ito para malaman natin ang number

mga party-list (maximum of 2) na nakakuha ng

of seats na ipapamigay natin.

more than 1 na score sa formula na:

Ang party-list seats ay 20% dapat ng total

Vote percentage (kinuha sa STEP 3)

members ng House of representatives.

multiplied by unallocated seats (kinuha

Paano kunin ang seats na ipapamigay sa part- sa STEP 4).

list?

Kapag 2 or more ang sagot, entitled sila sa 2

Kapag ang given ay number ng total additional seats.

members ng HR: divided by 5.

Kapag 1 or more pero less than 2, entitled sila sa

Kapag ang given ay number ng district

1 seat.

representatives: divided by 4.

Kapag less than one, wala silang additional

seat.

STEP 2: Ilista ang mga party-list based on the

number of votes received.

STEP 6: THIRD ROUND: Tignan kung sino ang

entitled sa “remaining seats”.

STEP 3: FIRST ROUND: Tignan kung sino ang

Ano ang remaining seats? Seats na binibigay sa

entitled sa “guaranteed/qualified seats”.

mga party list na hindi nakakuha ng at least 1

Ano ang guaranteed/qualified seat? 1 seat na na score sa STEP 5.

automatic na binibigay sa mga party-list na

Pamula sa unang party-list na di umabot sa

nakakuha ng at least 2% ng total votes (vote

score na 1 sa STEP 5, bigyan ng tig-iisang seats

percentage).

until ma-distribute lahat ng “remaining seats.”

Pano makuha ang vote percentage ng isang

particular party-list?

No. of votes ng particular party list

divided by total number of votes ng

lahat ng party lists.

Kunin lahat ng percentages ng bawat party-list.

Lahat ng nakakuha ng 2% or above, meron na

agad 1 seat.

STEP 4: Kuhanin ang number of seats na di pa

naipapamigay (unallocated seats).

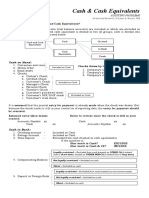

ACCOUNTING, IN GENERAL BALANCE SHEET

Four accounting informations: OFTM Concepts:

1. Operating information 1. Money measurement concept –

2. Financial accounting information balance sheets consist only of

3. Tax accounting information information that can be expressed in

4. Management accounting information monetary terms.

2. Entity concept – accounts are kept for

entities, as opposed to persons

Two sources of accounting principles: associated with those entities.

a. IMPORTANCE: separate ang per-

1. FASB (Financial Accounting Standards sonality ng corporations from the

Board) persons making it.

2. 3. Going-concern concept – assumption of

the continuance of operation for an

indefinitely long period.

Three kinds of financial statements: a. IMPORTANCE: di kailangan

1. Statement of financial position (aka kuhanin constantly ang net worth

balance sheet) ng isang entity at ng kanyang

2. Income statement mga assets.

3. Statement of cash flows 4. Cost concept – all assets are recorded at

their historical cost.

a. IMPORTANCE: Kahit tumaas ang

value ng assets, ang di affected

ang records. ‘Yung acquisition

cost pa rin ang recorded.

5. Dual-Aspect concept – Assets = equities;

Assets = liabilities+ owner’s equity.

a. IMPORTANCE:

i. Bawat dagdag mo sa

assets, may kasabay na

either dagdag sa liabilities,

or bawas sa assets, and

vice-versa.

ii. Bawat dagdag mo sa

liabilities, may kasabay na

dagdag sa assets, or

bawas sa lliabilities, and

vice-versa.

INCOME STATEMENT: character. EXCEPTION: sound reason to

change methods.

6. Materiality concept – the accountant

Difference from BALANCE SHEET: does not attempt to record insignificant

events.

Income statement: flow report; refers to a. IMPORTANCE: no need to record

information over a period of time (e.g. as loss events such as use of a

from year X to year Y). single sheet of yellow paper or loss

Balance sheet: status report; refers to of a ballpen.

information at a certain point in time

(e.g. balance sheet as of MM/DD/YYYY).

Concepts:

1. Accounting Period concept-

accounting measures activities for a

specified interval of time.

2. Conservatism concept:

a. Recognize revenues (increase in

earnings) only when they are

REASONABLY CERTAIN.

b. Recognize expenses (decrease in

earnings) as soon as they are

REASONABLY POSSIBLE.

c. IMPORTANCE:

i. When it comes to items

paid for in 2016 but

delivered in 2017, the

revenue is counted only in

2017 (REASONABLY CER-

TAIN.

ii. When it comes to losses,

when a car is lost in 2016

but it was only in 2017 that

it was certain it will not be

returned, loss is counted in

2016 (REASONABLY POS-

SIBLE).

3. Realization concept – revenue is

recognized only when they are

reasonably certain to be paid.

4. Matching concept – when an event

affects both revenue and expenses, the

effect on each must be recognized in

the same accounting period.

5. Consistency concept – once an entity

has decided on an accounting method,

it should use the same method for all

subsequent events of the same

You might also like

- Formats - Annexures 3.1 and C.5Document6 pagesFormats - Annexures 3.1 and C.5hp4ymrcmvxNo ratings yet

- Accounting For Non Accountants 1Document98 pagesAccounting For Non Accountants 1Sherry Mae Esteleydes100% (1)

- F8/audit and assurance chapter overviewDocument69 pagesF8/audit and assurance chapter overviewMubashirNo ratings yet

- Concept Map RCDocument2 pagesConcept Map RCkat kaleNo ratings yet

- University of Mysore: Accounting TheoryDocument11 pagesUniversity of Mysore: Accounting TheoryKiran A SNo ratings yet

- SHEmbotDocument5 pagesSHEmbotMiles CasidoNo ratings yet

- Understanding Financial StatementsDocument21 pagesUnderstanding Financial StatementsBhargav D.S.No ratings yet

- FIA 141 - Introduction To Financial Accounting-1 - 2Document20 pagesFIA 141 - Introduction To Financial Accounting-1 - 24313256No ratings yet

- Analyzing and Recording TransactionsDocument43 pagesAnalyzing and Recording TransactionshamzaNo ratings yet

- Review On Basic AccountingDocument19 pagesReview On Basic AccountingRegina BengadoNo ratings yet

- Journal EntriesDocument25 pagesJournal EntriesViren DeshpandeNo ratings yet

- Accounts PracticesetDocument91 pagesAccounts PracticesetMouli MandalNo ratings yet

- Attachment 1 - Applicant Organization InfoDocument4 pagesAttachment 1 - Applicant Organization InfoDr. Erwin HandokoNo ratings yet

- CH 2Document20 pagesCH 2ahmedNo ratings yet

- Financial StatementsDocument27 pagesFinancial StatementsIrish Castillo100% (1)

- FinAcc Session 1Document51 pagesFinAcc Session 1Michael TorresNo ratings yet

- Pre-Award Assessment - Self-Assessment To Be Completed by Prospective Subrecipient - Page 1Document2 pagesPre-Award Assessment - Self-Assessment To Be Completed by Prospective Subrecipient - Page 1David EsquivelNo ratings yet

- Intro to Financial Management RatiosDocument6 pagesIntro to Financial Management RatiosChes TalNo ratings yet

- Audit c5Document14 pagesAudit c5t5nhakhobauNo ratings yet

- Financial Management For Non-Finance Manager In-House Training PT Newmont Nusa TenggaraDocument264 pagesFinancial Management For Non-Finance Manager In-House Training PT Newmont Nusa Tenggaralizaaa 123No ratings yet

- Accounting 101Document4 pagesAccounting 101Cheche AmpoanNo ratings yet

- ACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditDocument8 pagesACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditJeffrey Jazz BugashNo ratings yet

- Dellera, Shenna G. - Unit 3 - Intacc3Document23 pagesDellera, Shenna G. - Unit 3 - Intacc3Accounterist ShinangNo ratings yet

- Shares Onwards Notes (AA)Document49 pagesShares Onwards Notes (AA)Raghav GoyalNo ratings yet

- CFAS - MatrixDocument3 pagesCFAS - MatrixFrances Ann CapalonganNo ratings yet

- Account Title Classification/ Presentation Measurement Recognition DerecognitionDocument3 pagesAccount Title Classification/ Presentation Measurement Recognition DerecognitionFrances Ann CapalonganNo ratings yet

- Voting Stock and Nonvoting Stock: Allocating Equity Value: Gift and Estate Tax Valuation InsightsDocument6 pagesVoting Stock and Nonvoting Stock: Allocating Equity Value: Gift and Estate Tax Valuation InsightsGandharw YadavNo ratings yet

- Simplified Notes Unit 1 and 2Document4 pagesSimplified Notes Unit 1 and 2John Paul Gaylan100% (1)

- Forming a Corporation ExplainedDocument7 pagesForming a Corporation ExplainedKhristine Joy CorpuzNo ratings yet

- Accounting Information System Chapter OverviewDocument116 pagesAccounting Information System Chapter OverviewrenandanfNo ratings yet

- BSBA 1 Topic 4 2022 For The StudentsDocument4 pagesBSBA 1 Topic 4 2022 For The StudentsshanehermoginoNo ratings yet

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Lesson 3: Accounting EquationDocument3 pagesLesson 3: Accounting EquationDante SausaNo ratings yet

- Basic Financial Accounting: Unit - 5Document23 pagesBasic Financial Accounting: Unit - 5alok beheraNo ratings yet

- Weakness: Biltrite Case - Chapter 6 Module 2Document11 pagesWeakness: Biltrite Case - Chapter 6 Module 2Miftah FaridNo ratings yet

- AFAR 05 Corporate LiquidationDocument2 pagesAFAR 05 Corporate LiquidationArden LlantoNo ratings yet

- Retained Earnings: Appropriation May Be A Result ofDocument5 pagesRetained Earnings: Appropriation May Be A Result ofLane HerreraNo ratings yet

- Module No. & Title Module No. 3: Intensifying Accounting Knowledge Through The Accounting Equation, Types of Major Accounts, and Books of AccountsDocument15 pagesModule No. & Title Module No. 3: Intensifying Accounting Knowledge Through The Accounting Equation, Types of Major Accounts, and Books of AccountsPonsica RomeoNo ratings yet

- Lesson 2 3 CashflowDocument3 pagesLesson 2 3 CashflowGeraldine MayoNo ratings yet

- Fabm 2 Week 1Document20 pagesFabm 2 Week 1mary rose aragonNo ratings yet

- Bballb Hons Sem 1 Minor I - FM - Unit 3Document29 pagesBballb Hons Sem 1 Minor I - FM - Unit 3MargieNo ratings yet

- Financial Position and Balance Sheet FundamentalsDocument20 pagesFinancial Position and Balance Sheet FundamentalsJust Some Guy without a MustacheNo ratings yet

- Unit 2 Conceptual Framework SlidesDocument18 pagesUnit 2 Conceptual Framework SlidesNandi MliloNo ratings yet

- Chapter 2 ValuationDocument4 pagesChapter 2 ValuationArielle CabritoNo ratings yet

- Accounting Dr. Ashraf Lecture 03 PDFDocument20 pagesAccounting Dr. Ashraf Lecture 03 PDFMahmoud AbdullahNo ratings yet

- Abm 4 Fabm2 Balance SheetDocument8 pagesAbm 4 Fabm2 Balance SheetEarl Christian BonaobraNo ratings yet

- Unit 4 Theory & Prob.Document10 pagesUnit 4 Theory & Prob.dasaritejaswini8No ratings yet

- Poa ReviewerDocument4 pagesPoa Reviewerdevora aveNo ratings yet

- Points To Be Kept in Mind Before Referring: Financial Planning and Analysis (FP&A) ProfileDocument13 pagesPoints To Be Kept in Mind Before Referring: Financial Planning and Analysis (FP&A) Profileanver2679No ratings yet

- Part 2 Financial AnalysisDocument32 pagesPart 2 Financial AnalysisMilad KarimyNo ratings yet

- Accountants Formulae BookDocument47 pagesAccountants Formulae BookVpln SarmaNo ratings yet

- 5# 4 Accounting Equation (UnSolved) PDFDocument4 pages5# 4 Accounting Equation (UnSolved) PDFZaheer SwatiNo ratings yet

- Accounting for Non Accountants: Learn Accounting by Common SenseFrom EverandAccounting for Non Accountants: Learn Accounting by Common SenseNo ratings yet

- Awaken the Accountant in You | Master the Accounting Basics in One HourFrom EverandAwaken the Accountant in You | Master the Accounting Basics in One HourRating: 1 out of 5 stars1/5 (1)

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Trend Following: Learn to Make a Fortune in Both Bull and Bear MarketsFrom EverandTrend Following: Learn to Make a Fortune in Both Bull and Bear MarketsRating: 4.5 out of 5 stars4.5/5 (40)

- The EVA Challenge (Review and Analysis of Stern and Shiely's Book)From EverandThe EVA Challenge (Review and Analysis of Stern and Shiely's Book)No ratings yet

- IHL Facts SummaryDocument6 pagesIHL Facts SummarydNo ratings yet

- Accounting Concepts BasicDocument4 pagesAccounting Concepts BasicdNo ratings yet

- Enrile V SETDocument6 pagesEnrile V SETdNo ratings yet

- Arbit Case Digests 1-20Document13 pagesArbit Case Digests 1-20dNo ratings yet

- ManimtimDocument1 pageManimtimdNo ratings yet

- OJT Request Letter For LeaveDocument1 pageOJT Request Letter For LeavedNo ratings yet

- Orders, Solicits or Induces The Commission of Such A Crime Which in Fact Occurs or Is AttemptedDocument3 pagesOrders, Solicits or Induces The Commission of Such A Crime Which in Fact Occurs or Is AttempteddNo ratings yet

- PRO-RATA ALLOCATION OF PARTY-LIST SEATSDocument3 pagesPRO-RATA ALLOCATION OF PARTY-LIST SEATSdNo ratings yet

- IHL Facts SummaryDocument6 pagesIHL Facts SummarydNo ratings yet

- RequestDocument1 pageRequestdNo ratings yet

- Accounting Concepts BasicDocument4 pagesAccounting Concepts BasicdNo ratings yet

- OJT Request Letter For LeaveDocument5 pagesOJT Request Letter For LeavedNo ratings yet

- 2018 Moot ProblemDocument10 pages2018 Moot ProblemAngela Conejero0% (1)

- Chapter V: Common Anf Private CarriersDocument19 pagesChapter V: Common Anf Private CarriersdNo ratings yet

- Rules of Evidence ExplainedDocument21 pagesRules of Evidence ExplaineddNo ratings yet

- 30 People ExterminationDocument1 page30 People ExterminationdNo ratings yet

- INTERPDocument1 pageINTERPdNo ratings yet

- Insurance 44-71 No CasesDocument5 pagesInsurance 44-71 No CasesdNo ratings yet

- Banking FinalsDocument14 pagesBanking FinalsdNo ratings yet

- Claims, Actions, Payment of DebtsDocument4 pagesClaims, Actions, Payment of DebtsdNo ratings yet

- Al Bashir PDFDocument146 pagesAl Bashir PDFdayneblazeNo ratings yet

- Rights and Regulations for IP TransfersDocument4 pagesRights and Regulations for IP TransfersdNo ratings yet

- Codal SuccessionDocument10 pagesCodal SuccessiondNo ratings yet

- Codal Succession With JuradoDocument15 pagesCodal Succession With Juradod100% (1)

- Economic Planning ReportDocument6 pagesEconomic Planning ReportdNo ratings yet

- SpecPro Rule 75 PDFDocument11 pagesSpecPro Rule 75 PDFdNo ratings yet

- SpecPro Rule 75 PDFDocument11 pagesSpecPro Rule 75 PDFdNo ratings yet

- Spec Pro DigestsDocument7 pagesSpec Pro DigestsdNo ratings yet

- EvidenceDocument14 pagesEvidencedNo ratings yet

- Conceptualizing Wellbeing in The Workplace: Stefania de SimoneDocument5 pagesConceptualizing Wellbeing in The Workplace: Stefania de SimoneMariaP12No ratings yet

- Design and Construction of A Tower Crane: June 2009Document6 pagesDesign and Construction of A Tower Crane: June 2009Beza GetachewNo ratings yet

- ToLiss AirbusA321 V1.0.3 TutorialDocument103 pagesToLiss AirbusA321 V1.0.3 TutorialMarc CerveraNo ratings yet

- Ampling Sing Atlab: BjectivesDocument4 pagesAmpling Sing Atlab: BjectivesMBIEDA NGOMEGNI FRANK GAETANNo ratings yet

- CSC 2209 NotesDocument102 pagesCSC 2209 NotesWilliam manzhi KajjubiNo ratings yet

- Prize List 2017Document6 pagesPrize List 2017magmileNo ratings yet

- Global Yogurt Drink MarketDocument13 pagesGlobal Yogurt Drink MarketjennifermeichangNo ratings yet

- American International University - Bangladesh (AIUB) : Objective Setup DNS, FTP, HTTP and Email Servers in Packet TracerDocument12 pagesAmerican International University - Bangladesh (AIUB) : Objective Setup DNS, FTP, HTTP and Email Servers in Packet TracerS M AkashNo ratings yet

- LTE eNB L1 API DefinitionDocument106 pagesLTE eNB L1 API Definitioneng_alshimaaNo ratings yet

- Incoming Inspection Procedure: Document Part No. Rev 100-0044 007 1 of 11Document11 pagesIncoming Inspection Procedure: Document Part No. Rev 100-0044 007 1 of 11Sandip Jawalkar100% (1)

- Is Islam Compatible With Modernity?Document12 pagesIs Islam Compatible With Modernity?Firasco50% (2)

- 20410A - Module - 00Document12 pages20410A - Module - 00AdewaleNo ratings yet

- 09931017A Clarus SQ8 MS Hardware GuideDocument162 pages09931017A Clarus SQ8 MS Hardware GuidePaola Cardozo100% (2)

- SIEMENS - 1500 based - ET200SP PLC CPU 型錄Document10 pagesSIEMENS - 1500 based - ET200SP PLC CPU 型錄CHIENMAO WUNo ratings yet

- Experiment 2 Post LabDocument7 pagesExperiment 2 Post LabM ReyNo ratings yet

- The Origins of Anglo-Saxon Kingdoms PDFDocument361 pagesThe Origins of Anglo-Saxon Kingdoms PDFEric DubourgNo ratings yet

- The Deer and The CrocodilesDocument4 pagesThe Deer and The CrocodilesM Rifky FauzanNo ratings yet

- Antipsychotic DrugsDocument2 pagesAntipsychotic DrugsDana Mae AfanNo ratings yet

- Key Financial Ratios Checklist: Analyze Performance & SolvencyDocument2 pagesKey Financial Ratios Checklist: Analyze Performance & SolvencyLATIFNo ratings yet

- ART Appropriation FINAL EXAM NOTESDocument3 pagesART Appropriation FINAL EXAM NOTESKate NalanganNo ratings yet

- Pronunciation (Odd One Out) : Choose The Word Whose Underlined Part Is Pronounced DifferentlyDocument2 pagesPronunciation (Odd One Out) : Choose The Word Whose Underlined Part Is Pronounced Differentlyvo kelvin100% (1)

- Illustrator Day3 handout-NEWDocument4 pagesIllustrator Day3 handout-NEWmarkanthonynonescoNo ratings yet

- 21 Day Fat Loss Nutrition Program Book PDFDocument89 pages21 Day Fat Loss Nutrition Program Book PDFJohnDNo ratings yet

- Twilio Best Practices Sample ChapterDocument36 pagesTwilio Best Practices Sample ChapterPackt Publishing100% (1)

- Workplace Etiquettes UneditedDocument23 pagesWorkplace Etiquettes UneditedNikitaNo ratings yet

- 2008 MechDocument80 pages2008 MechRajesh Kumar DasNo ratings yet

- 2 Gas Mixture ExerciseDocument6 pages2 Gas Mixture ExerciseSurenderan LoganNo ratings yet

- Advances in Experimental Social Psychology, Volume 52 PDFDocument349 pagesAdvances in Experimental Social Psychology, Volume 52 PDFJose LuisNo ratings yet

- FDA AssignDocument9 pagesFDA AssignZhainna SilvestreNo ratings yet

- HEC Scholarship DetailsDocument1 pageHEC Scholarship DetailsDr AliNo ratings yet