Professional Documents

Culture Documents

The New Era of Risk Management

Uploaded by

jtahirah07Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The New Era of Risk Management

Uploaded by

jtahirah07Copyright:

Available Formats

Knowledge Leadership

THE NEW ERA OF RISK MANAGEMENT

T he recent financial market meltdown

has highlighted the importance of risk

management in protecting and creating

el of integration across heretofore siloed

functions. By integrating risk-management

silos through a consolidated technology

mandate. This fragmented approach limits

an organization’s ability to streamline com-

pliance processes and reduce costs. It may

shareholder value. It is widely acknowl- infrastructure and shared processes, com- also obscure the opportunity to integrate

edged that the current crisis has been panies can benefit from improved efficien- compliance with other initiatives including

driven by failures in risk management and cies, reduced costs, and improved trans- operational risk management and technol-

oversight that led many organizations to parency in the interdependencies of risks ogy risk management.

rethink their risk-management strategies. in the business. Business managers are realizing that

While clearly there were management In addition, companies are increasingly while complying with regulatory mandates

mistakes that led to the current crisis, it’s adopting a risk-based approach to manag- and mitigating risks to a certain business

also true that executive management and ing their business. A risk-based approach process certainly have different objectives,

boards of directors need a better under- identifies the key business processes and a single loss event can affect the outcome

standing of how risk is being managed in associated risks and then allocates re- of each. For instance, data loss and securi-

their businesses to drive shareholder val- sources accordingly. All companies are un- ty breach from a lost laptop can be viewed

ue. Unfortunately, the ability to accurately der pressure to reduce costs, so focusing both as a realized operational risk and as

assess, monitor, and manage the key risks on the right risks in the business is more regulatory non-compliance.

to the business has proven to be very dif- critical than ever. The rising cost of capital will lead to

ficult. Now is a defining moment in our in- tighter control environments. Investors

Compounding this risk-management dustry. Executives are under pressure and lenders will reward those companies

challenge, regulators around the world to improve their risk-management capa- with a lower inherent operating risk, and

will likely be enacting stronger regulation bilities and to be responsive to additional they will demand a premium for the un-

and pursuing a stricter line of regulatory regulatory oversight. At the same time, the certainty associated with weak control en-

oversight with regard to risk management. economic climate dictates that companies vironments. Many institutions today have

As U.S. Secretary of the Treasury Timo- must squeeze out additional efficiencies limited visibility into the state of their con-

thy Geithner recently declared, “We need across their business. To meet these chal- trol environments. As companies rethink

much stronger standards for openness, lenges, companies are turning to a strategy their risk-management strategies mov-

transparency, and plain, common sense of integrated risk management—the “New ing forward, many are hoping to leverage

language throughout the financial system.” Era of Risk Management.” operational risk management to improve

One of the main challenges is that risk- performance in other risk-management

management functions frequently operate Integrated Risk Management disciplines. For instance, in the case of

in silos. For instance, in some banks leading Many organizations today, from financial market and credit risk, strong controls can

up to the crisis, there were serious opera- services to manufacturing, are rethinking support the trading and lending processes

tional risks (e.g. mortgage fraud) as part of their approach to risk management with for better business outcomes. A well-man-

the lending process that when realized led a particular eye toward integrating across aged controls environment will benefit all

to these banks holding large positions in different risk-management functions. Tra- risk disciplines.

toxic assets. A better integration across ditionally, compliance has been a separate Integrating risk and compliance across

the operational and credit risk functions function, but is increasingly converging the enterprise and adopting a risk-based

could have mitigated these risks. In addi- with operational risk–especially in the fi- approach to the business will enable ex-

tion to delivering poor outcomes, a siloed nancial services industry. Further, within ecutives to focus on those risks that could

approach to risk management is expensive, the compliance function itself, companies have the greatest impact on the organiza-

the result of its multiple, redundant data have found that managing compliance in tion. Business managers can spend less

collection processes and duplicative tech- silos is both cumbersome and costly. For time on assessments and more time on

nology infrastructures. Going forward, ex- each new regulation, organizations typi- proactively managing risk and capitalizing

ecutives will rethink their risk-management cally implement a new technology point- on opportunities to meet company objec-

infrastructures and design them with a lev- solution aimed at the specific regulatory tives.

48 WWW.COMPLIANCEWEEK.COM » 888.519.9200 JUNE 2009

OpenPages

The Role of Technology » A converged risk-management meth- kets, higher credit ratings, and lower costs

Meeting the increasing demands of inte- odology that delivers efficiencies of capital. Providing enhanced visibility

grated risk management in a large organiza- into the risk landscape, an integrated risk-

tion requires effective technology support » One assessment serving multiple pur- management approach empowers business

to manage risk in a rigorous and systematic poses—Risk and Compliance managers to make smarter decisions that

way across the entire business. Technology maximize value, reduce costs, and balance

should be an enabler—supporting the risk » Dashboard reporting for real-time ac- risk with returns. When embedded into

and compliance management process and cess to business unit risk exposure everyday processes at all levels of the orga-

methodology—not defining the process nization, better risk management will drive

and methodology. Key objectives include: » A single technology infrastructure business performance. ■

» Providing real-time data management Summary

and decision support to ensure that Certainly, one of the keys to successful risk ABOUT OPENPAGES

senior management and boards of di- management is establishing an integrated OpenPages is the leading provider of inte-

rectors receive accurate information risk-management framework that spans grated risk management solutions for global

on the causes, financial impact, and risk and compliance programs and provides companies. OpenPages solutions enable

potential mitigating actions to control the ability to identify, manage, and monitor companies to eliminate risk and compliance

issues the key risks across the enterprise. Those silos, manage risk across the business, sustain

companies that don’t rationalize the over- compliance across multiple regulations, and

» Automating and streamlining risk and lap between risk and compliance activities embed these activities into their core business

compliance processes (e.g. Risk Self- must conduct and manage separate as- practices. OpenPages is working closely with

Assessment, Control Self-Assess- sessment, documentation, and reporting its customers as they make the transition to

ment, Loss Events, Scenario Analysis, processes, which may actually hinder the a risk-based approach to managing their busi-

and KRIs) ability to effectively assess enterprise-wide ness, and many of its customers are integrat-

risk and the adequacy of internal control ing disparate risk management activities into

» Supporting enterprise-wide risk as- systems. a common set of processes supported by a

sessment, measurement, and report- Firms that successfully identify, mea- single technology platform, OpenPages 5.5.

ing through a central repository of sure, and mitigate risk should be rewarded These companies are prepared for the New

policies, procedures, risks, and con- with higher valuations from financial mar- Era of Risk Management.

trols

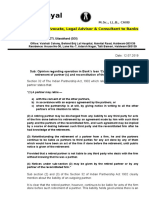

Figure One

Business Unit Process Owners

» Integrating with other applications to

leverage data that exists elsewhere in

the organization (e.g. loss events)

As shown in Figure One, an integrated

risk-management solution can help com-

panies meet the increasing burden from

regulatory compliance requirements and

Shared

risk management, while gaining tangible Risk and

Compliance

benefits through: Framework

» A single point of accountability for Internal Risk Regulatory IT

oversight of compliance and opera- Audit Management Compliance Operations

tional risks

JUNE 2009 WWW.COMPLIANCEWEEK.COM » 888.519.9200 49

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Macro Tut 5: Monetary SystemDocument6 pagesMacro Tut 5: Monetary SystemAnna Nguyen100% (1)

- Opinion Reg Reconstitution OfpartnershipDocument3 pagesOpinion Reg Reconstitution OfpartnershipNarayan ChanyalNo ratings yet

- CdoDocument4 pagesCdoVinayak Musalekar100% (1)

- Chapter 6 CVP AnalysisDocument27 pagesChapter 6 CVP AnalysisMariel Angeli Chan100% (1)

- Hedge Fund Fees and Performance Charges ExplainedDocument19 pagesHedge Fund Fees and Performance Charges ExplainedRussell MckayNo ratings yet

- Currency Competition and Foreign Exchange Markets - Hartmann, P (1998)Document211 pagesCurrency Competition and Foreign Exchange Markets - Hartmann, P (1998)ererereretrterNo ratings yet

- Part Two 2015Document140 pagesPart Two 2015vatsonwizzluvNo ratings yet

- Short-Term Profit Hunter: Stochastics, Moving AveragesDocument35 pagesShort-Term Profit Hunter: Stochastics, Moving Averagesdodona7772494100% (1)

- CVP Analysis & Absorption CostingDocument17 pagesCVP Analysis & Absorption CostingvijaykoratNo ratings yet

- Arch Pharmalabs API Manufacturing SitesDocument6 pagesArch Pharmalabs API Manufacturing SitesChandan VirmaniNo ratings yet

- The Cost of Trigger Happy InvestingDocument4 pagesThe Cost of Trigger Happy InvestingBrazil offshore jobsNo ratings yet

- Derivatives Analytics With Python Numpy PDFDocument34 pagesDerivatives Analytics With Python Numpy PDFAndre AmorimNo ratings yet

- Behavioral Finance JAFFW2008Document146 pagesBehavioral Finance JAFFW2008lesszarkaNo ratings yet

- 'Foreclosure - Simulation - Report' LXW-M05619-200138877 PDFDocument1 page'Foreclosure - Simulation - Report' LXW-M05619-200138877 PDFshree dev kenal100% (1)

- Hex AwareDocument37 pagesHex Awaretarun slowNo ratings yet

- Options strategies and spreads guideDocument9 pagesOptions strategies and spreads guideSatya Kumar100% (1)

- Financing - Vs - Forgiving A Debt OverhangDocument16 pagesFinancing - Vs - Forgiving A Debt OverhangDImiskoNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument19 pagesCost-Volume-Profit (CVP) AnalysisMohammad SaadmanNo ratings yet

- Financial Institutions Management - Chap016Document13 pagesFinancial Institutions Management - Chap016Mohamed MedNo ratings yet

- Brigham-Financial Management Chapter2Document32 pagesBrigham-Financial Management Chapter2Dian Adi NugrahaNo ratings yet

- Yield Curve Analysis Project Documents 2009 Financial CrisisDocument50 pagesYield Curve Analysis Project Documents 2009 Financial CrisisSrijan SaxenaNo ratings yet

- Annex ThesisDocument29 pagesAnnex ThesisrahulNo ratings yet

- Derivatives MarketsDocument9 pagesDerivatives Marketsdebaditya_mohantiNo ratings yet

- 14 Various Topics in Management ServicesDocument6 pages14 Various Topics in Management Servicesrandomlungs121223No ratings yet

- Economic Calendar Economic CalendarDocument6 pagesEconomic Calendar Economic CalendarAtulNo ratings yet

- Presentation On PPP Seminar - Dr. Mustafa K. MujeriDocument21 pagesPresentation On PPP Seminar - Dr. Mustafa K. MujeriAnim InmolNo ratings yet

- American Securitization Forum - Streamlined ForeclosureDocument43 pagesAmerican Securitization Forum - Streamlined ForeclosureMaster ChiefNo ratings yet

- One Shot One Kill Price ActionDocument35 pagesOne Shot One Kill Price Actionrerer100% (3)

- Camels RatingDocument63 pagesCamels RatingAminul Haque RusselNo ratings yet

- IFM Exchange Rate Arrangements POINT Format Eun ResnickDocument3 pagesIFM Exchange Rate Arrangements POINT Format Eun Resnickshreya chapagainNo ratings yet