Professional Documents

Culture Documents

SAP - Asset Pricing & Taxation

Uploaded by

bharatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAP - Asset Pricing & Taxation

Uploaded by

bharatCopyright:

Available Formats

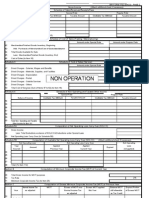

Business Blueprint

Asset Pricing & Taxation

1 BUSINESS

PROCESS

OVERVIEW..............................................................................................2

2 BUSINESS

FLOW3

2.1

PRICING AND

TAXATION

PROCESS FLOW

EXPLANATION...............................................................................................................................................4

2.1.1

Tax 4

2.1.2

Pricing..........................................................................................................4

3 SYSTEM PROCESS FLOW...........................................................................6

3.1 REQUIREMENT...............................................................................................................................7

4 BUSINESS DECISIONS AND CASE SCENARIOS.........................................................7

4.1 Legal obligations, Promotions, tax audits.....................................................................................7

1 Business Process Overview

Pricing and Taxes are triggered whenever a Material / Article PO is created,

received at any of the locations.

The following reasons can trigger pricing and taxes-

Asset Pricing & Taxation Page 1 of 7

Article creation (including nature of Material and locations)

P.O Creation

Pricing and Taxation

Stock transfers

Goods receipts

Inter state / same state different location movement of goods

Invoice matching and verifications

Imports / Exports of goods

Additional costs to be loaded on non-merchandise like BOM, Octroi,

Freight, etc.

2 Business Flow

Asset Pricing & Taxation Page 2 of 7

TAXATION

START

Create a tax master based

on the type of article being

purchased and locations of

purchase.

System to identify the type of

article being purchased.

Category/Account

Tax rate to be defaulted to

article being purchased based

on the conditions

System to select the type of tax applicable

(VAT/LST) based on location.

END

Asset Pricing & Taxation Page 3 of 7

2.1 Pricing and Taxation Process Flow explanation

2.1.1 Tax

SAP will capture the tax master records (condition table, condition records),

which will be used for the procurement process.

All articles will be by default “1” taxable where the exact tax rate from 0% to

X% will be derived from the condition tables.

Comment:

The Corporate Planning Dept will maintain the tax master for the relevant

article.

2.1.2 Pricing

Pricing consist of following elements:

Discount

Excise Duty

Vat

Service Tax

Packing Charges

Freight

Octroi

Transportation Charges

Installation Charges will be pricing elements for purchasing.

2.1.2.1 Pricing Structure for Imports

Particulars

ZPB0 Net Purchase Price Value

P&FO Packing & Forwarding Value

Sub Total (FOB) Value

ZFR2 Frt Forgn -II (Val) Value

Sub Total (C&F) Value

ZIN1 Insurance Value Value

Sub Total (CIF) Value

LD00 Landing charge* %

Sub Total (Assessable Value) Value

JCDB Basic customs Duty %

JCV1 Counter Vailing Duty %

JECV Ecess on CVD 2% %

JECA Add Ecess on CVD 1% %

(BCD + CVD + ECess CVD + Add Ecess)

Asset Pricing & Taxation Page 4 of 7

Copy Ass

ECEO Ecess overall 2% %

AECO Add Ecess overall 1% %

Sub Total Except Addl Duty

JADC Addit. Custom Duty %

ZFR1 Freight Local Value

ZC&F Local C & F Charges Value

ZDET Detention Charges Value

ZDEM Demurrage Charges Value

ZOTH Other Sundry exp. Value

Total Value

* We do not pay landing charges, we just calculate landing charges to calculate

the custom duty payable. It does not get added to the stock.

2.1.2.2 Pricing Structure for Local Purchase

Particulars

P001 Gross Price Value

P000 Gross Price Value

Gross Value Value

R000 Discount % on Gross %

R001 Discount/Quantity v

Net incl. disc. Value

ZBED Basic Excise Duty %

ZECS Basic Excise Duty %

Net Incl BED &Cess Value

ZTXP Tax Exempt Portion % %

ZTXX Deduct Exemption % %

NAVS Non-Deductible Tax Value

Value w/o Deductible

Tax Value

JEXS Taxes on the PO Value

Val w/o any tax Value

Total Tax Value

ZPAC Packing Value

FRA1 Freight % %

FRB1 Freight (Value) Value

ZOCA Asset Octroi %

Total for printing Value

Sub-Total Value

Total Value Value

Asset Pricing & Taxation Page 5 of 7

3 System Process Flow

Purchase:

Four different conditions will exist for keeping tax rates where different GL

posting can be achieved (Transaction FV11):

JVCD (VAT Deductible)

JVCN (VAT non Deductible)

JVCS (CST)

JSRT (Service Tax)

JEC3 (E Cess on Service Tax)

The tax codes and the corresponding rates for the four different condition

types are listed in the hyperlink below.

Tax Rates for different Condition Types.xls

A simplified example of deriving the condition value:

Region Supplier Number Region Article Master (for Tax Code Tax

Supplier (for exceptions Receiving exceptions) (Always rate

additional to Site “1”)

the region)

In Purchasing, parts of the purchase price can be tax exempt. E.g. Purchase

Price is 100 INR where 80 INR are free of tax and 20 INR are taxable where the

standard rate as explained above is applicable.

In purchase pricing, tax will therefore always be calculated for the taxable

amount. A new statistical condition needs to be maintained optional for

articles, which have a tax exemption amount beside the purchase price.

PP net 100 INR

PP exempts 80 INR

= Taxable PP 20 INR

Integration with other modules

Article master

Invoice Verification

Goods Receipts

Stock Transfers

Purchase order

Asset Pricing & Taxation Page 6 of 7

3.1 Requirement

Identify products coming from different vendors (and therefore

locations) uniquely

Comment

Scrapping will not create automated tax posting. Manual tax handling

will be required.

4 Business Decisions and case scenarios

Responsibility to define the tax masters will lie with Corporate Planning.

This will have an impact on the pricing and taxes, article master, GL

postings and recording.

Tax accounting is done at P.O level or P.O article level combination.

Also specify the GL postings

4.1 Legal obligations, Promotions, tax audits

The tax returns, reporting of business overheads are all based on the pricing

and taxation.

Asset Pricing & Taxation Page 7 of 7

You might also like

- CIN Governor and MastersDocument103 pagesCIN Governor and MastersJeongsoo LeeNo ratings yet

- Articles On SAP Import ProcurementDocument4 pagesArticles On SAP Import Procurementnoor ahmed100% (1)

- HowTo Landed Costs 2007A B1 PDFDocument18 pagesHowTo Landed Costs 2007A B1 PDFVictor BitarNo ratings yet

- At A GlanceDocument22 pagesAt A GlanceThakur RinkiNo ratings yet

- Business PlanDocument14 pagesBusiness PlanghadaNo ratings yet

- Remission of Duties & Taxes On Exported Products (Rodtep) SchemeDocument21 pagesRemission of Duties & Taxes On Exported Products (Rodtep) SchemeAnupam BaliNo ratings yet

- Export - Duty CalculationDocument2 pagesExport - Duty CalculationSunil MateNo ratings yet

- Project Class Day 7Document10 pagesProject Class Day 7y421997No ratings yet

- An Insight Into GST in IndiaDocument26 pagesAn Insight Into GST in IndiaSrikantNo ratings yet

- Cheat Sheet of The GODS.v2.0 PDFDocument8 pagesCheat Sheet of The GODS.v2.0 PDFCorina Ioana BurceaNo ratings yet

- Goods and Services Tax (GST) : Simplified byDocument14 pagesGoods and Services Tax (GST) : Simplified bypushpendra singh sodhaNo ratings yet

- MGT Accts HW2Document4 pagesMGT Accts HW2V KaulNo ratings yet

- SM CHDocument53 pagesSM CHInderjeet JeedNo ratings yet

- Ind As 12Document74 pagesInd As 12Akhil AkhyNo ratings yet

- Salient Features of Income Tax Act 2023Document79 pagesSalient Features of Income Tax Act 2023Md. Abdullah Al ImranNo ratings yet

- How To Setup A Group Tax in R12 E-Business Tax (EBTax) (Doc ID 1604480.1)Document18 pagesHow To Setup A Group Tax in R12 E-Business Tax (EBTax) (Doc ID 1604480.1)Lo JenniferNo ratings yet

- ATO STP Phase 2 Income Types-Country Codes Position Paper v1.0Document30 pagesATO STP Phase 2 Income Types-Country Codes Position Paper v1.0Ray WeiNo ratings yet

- Ind As On Items Impacting The Financial Statements: Unit 1: Indian Accounting Standard 12: Income TaxesDocument61 pagesInd As On Items Impacting The Financial Statements: Unit 1: Indian Accounting Standard 12: Income Taxesjigar BrahmbhattNo ratings yet

- Income TaxesDocument17 pagesIncome TaxesThomas HutahaeanNo ratings yet

- 1 GST-OverviewDocument60 pages1 GST-OverviewAccounts - ParallaxNo ratings yet

- FIN-573 - Lecture 2 - Jan 28 2021Document33 pagesFIN-573 - Lecture 2 - Jan 28 2021Abdul BaigNo ratings yet

- Creditable Tax Withheld: Goods ManufacturedDocument12 pagesCreditable Tax Withheld: Goods ManufacturedNino FrondozoNo ratings yet

- EBS Group Tax1604480.1Document19 pagesEBS Group Tax1604480.1sreenivasNo ratings yet

- TTM 4 - Income Tax Article 22, 23 and 26Document61 pagesTTM 4 - Income Tax Article 22, 23 and 26Ramdonidoni doniNo ratings yet

- Accounting Valuation and TaxationDocument20 pagesAccounting Valuation and TaxationSweta SinhaNo ratings yet

- Calculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageDocument3 pagesCalculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageAccounts Pivot Engg0% (1)

- Robert Conrad Mozambique GW2012Document12 pagesRobert Conrad Mozambique GW2012Mochammad AdamNo ratings yet

- Chowdhury Nafis Nusrat Asha Mid 2 Answer ScriptDocument6 pagesChowdhury Nafis Nusrat Asha Mid 2 Answer ScriptChowdhury Nafis Nusrat Asha 2135471660No ratings yet

- UCC overheadDocument7 pagesUCC overheadSaqib KazmiNo ratings yet

- Customizingwhtaccumulationforcbt 150727190419 Lva1 App6892Document18 pagesCustomizingwhtaccumulationforcbt 150727190419 Lva1 App6892Marcos MunizNo ratings yet

- Customizing WHT Accumulation For CBT Ref. Nota 916003Document18 pagesCustomizing WHT Accumulation For CBT Ref. Nota 916003evandroscNo ratings yet

- IFRS Study Notes-Day 2Document46 pagesIFRS Study Notes-Day 2Obisike EmeziNo ratings yet

- CIN Country Version India Full StepsDocument173 pagesCIN Country Version India Full Stepssuresh goudNo ratings yet

- PST Small Business GuideDocument18 pagesPST Small Business GuideNizar AhamedNo ratings yet

- 19147gg0787 Sap Cin DocsDocument56 pages19147gg0787 Sap Cin DocsLokesh ModemzNo ratings yet

- LPP Customer DocuDocument4 pagesLPP Customer DocucmocattoNo ratings yet

- Help instructions for GST filingDocument26 pagesHelp instructions for GST filingnikhil javeriNo ratings yet

- UGG ValuationDocument7 pagesUGG ValuationPritam KarmakarNo ratings yet

- Public Finance Meaning of VATDocument6 pagesPublic Finance Meaning of VATadnaharNo ratings yet

- Tax Determination in Sales and Distribution: SymptomDocument8 pagesTax Determination in Sales and Distribution: SymptomRaviNo ratings yet

- What Are The Registers in CINDocument8 pagesWhat Are The Registers in CINpraveerNo ratings yet

- Taxation Sap Explain With An ExampleDocument18 pagesTaxation Sap Explain With An Examplejitendraverma8No ratings yet

- Creditable Tax Withheld: Goods ManufacturedDocument3 pagesCreditable Tax Withheld: Goods ManufacturedJanua_Luca_as__4392No ratings yet

- JWM - The Value of Tax EffInvestmentsDocument8 pagesJWM - The Value of Tax EffInvestmentsbrettpevenNo ratings yet

- Value Added TaxDocument7 pagesValue Added TaxCassian RukashaNo ratings yet

- Introduction To Goods and Services Tax Compliance in Oracle ERP Cloud Internal Ref GSTDocument37 pagesIntroduction To Goods and Services Tax Compliance in Oracle ERP Cloud Internal Ref GSTdchussain17No ratings yet

- Audit Report PART-3 Schedule-IDocument6 pagesAudit Report PART-3 Schedule-IsuniljaithwarNo ratings yet

- Document From Adhu-6 PDFDocument19 pagesDocument From Adhu-6 PDFBasavaraj S PNo ratings yet

- Petroleum Fiscal System, The Trends and The ChallengesDocument44 pagesPetroleum Fiscal System, The Trends and The ChallengesBenny Lubiantara100% (4)

- P15.MK. Cost of Capital-1Document52 pagesP15.MK. Cost of Capital-1ZahraNo ratings yet

- Petroleum Fiscal Systems: Trends & ChallengesDocument44 pagesPetroleum Fiscal Systems: Trends & ChallengesLulav BarwaryNo ratings yet

- GSTDocument10 pagesGSTmpsing1133No ratings yet

- Tata-Motors-Group-Investor-Presentation-Q3 FY23Document51 pagesTata-Motors-Group-Investor-Presentation-Q3 FY23Sai Biplab BeheraNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Aircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandAircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- The Startup of You - Executive SummaryDocument9 pagesThe Startup of You - Executive SummaryYohanes LiebertoNo ratings yet

- How To Make An Origami Flower: What You Will NeedDocument4 pagesHow To Make An Origami Flower: What You Will NeedbharatNo ratings yet

- Top Indian ad agencies by billings and clientsDocument9 pagesTop Indian ad agencies by billings and clientsArun SachuNo ratings yet

- Matrimonial Bio DataDocument1 pageMatrimonial Bio DatabharatNo ratings yet

- 2012 Social Security ChangesDocument3 pages2012 Social Security ChangesbharatNo ratings yet

- Useful Guidelines of RBIDocument68 pagesUseful Guidelines of RBIbharatNo ratings yet

- What Is Section 498a of The Indian Penal CodeDocument3 pagesWhat Is Section 498a of The Indian Penal CodebharatNo ratings yet

- FI GL Closing Operations Part2Document161 pagesFI GL Closing Operations Part2bharatNo ratings yet

- Sarbanes Oxley PresentationDocument16 pagesSarbanes Oxley PresentationAdil ZerozerosevenNo ratings yet

- Economic Enviornment of BusinessDocument33 pagesEconomic Enviornment of BusinessbharatNo ratings yet

- The World's Most Innovative CompaniesDocument10 pagesThe World's Most Innovative CompaniesbharatNo ratings yet

- World's Top Leading Public Companies ListDocument20 pagesWorld's Top Leading Public Companies ListbharatNo ratings yet

- Private Equity InvestmentsDocument1 pagePrivate Equity InvestmentsbharatNo ratings yet

- GIFT Corporate Presentation NewDocument53 pagesGIFT Corporate Presentation NewbharatNo ratings yet

- 09-11 Jobs & ProfilesDocument27 pages09-11 Jobs & ProfilesbharatNo ratings yet

- 10 Most Corrupt Indian PoliticiansDocument4 pages10 Most Corrupt Indian PoliticiansbharatNo ratings yet

- Essential Intelligence On Complex Business Sectors, Made SimpleDocument20 pagesEssential Intelligence On Complex Business Sectors, Made SimplebharatNo ratings yet

- Stevejobs StandfordconvocationspeechDocument6 pagesStevejobs Standfordconvocationspeechapi-272667476No ratings yet

- Bharat PicDocument1 pageBharat PicbharatNo ratings yet

- Leveraged BuyoutDocument9 pagesLeveraged Buyoutbharat100% (1)

- Lokpal Bill 1.9Document29 pagesLokpal Bill 1.9harish_afriendforeverNo ratings yet

- Capital Adequacy RatioDocument4 pagesCapital Adequacy RatiobharatNo ratings yet

- Justice N.santosh HegdeDocument1 pageJustice N.santosh HegdebharatNo ratings yet

- Lokpal Bill: ... Understanding The Drafts of and Civil SocietyDocument28 pagesLokpal Bill: ... Understanding The Drafts of and Civil SocietyAbhishek GourNo ratings yet

- Lokpal BillDocument2 pagesLokpal BillManasa VedulaNo ratings yet

- Anna HazareDocument20 pagesAnna HazarebharatNo ratings yet

- Jan Lokpal Big OffsetDocument16 pagesJan Lokpal Big OffseteklakshNo ratings yet

- Draft Lokpal Bill 2011Document28 pagesDraft Lokpal Bill 2011FirstpostNo ratings yet

- Civil Society S Lokpal BilDocument27 pagesCivil Society S Lokpal Bilmuthoot2009No ratings yet

- Anna HazareDocument11 pagesAnna HazarebharatNo ratings yet

- Notes FMDocument42 pagesNotes FMSneha JayalNo ratings yet

- Gs Control Offer of Extension BoardDocument4 pagesGs Control Offer of Extension BoardGautam MishraNo ratings yet

- Internship ReportDocument62 pagesInternship ReportSejal TutejaNo ratings yet

- PUNE - Hotel StayDocument2 pagesPUNE - Hotel StaySantosh DeshpandeNo ratings yet

- EpaymentPrintCommonAction DoDocument1 pageEpaymentPrintCommonAction DoDHANU DANGINo ratings yet

- Tax Evasion Through SharesDocument5 pagesTax Evasion Through SharesPrashant Thakur100% (1)

- Fleet Status Report OdfjellDocument2 pagesFleet Status Report OdfjellAgungNo ratings yet

- DGPS SurveyDocument21 pagesDGPS SurveyHitesh JangidNo ratings yet

- Assignment # 01Document6 pagesAssignment # 01HammadNo ratings yet

- List of Purpose Codes 1: (For Use in Forms P/R Only)Document25 pagesList of Purpose Codes 1: (For Use in Forms P/R Only)Siti CleaningNo ratings yet

- Donors Tax Handout 3Document5 pagesDonors Tax Handout 3Xerez SingsonNo ratings yet

- The Role of Tax Checks in The Determination of Taxes Owed (Case Study at Pt. Indonesian Railways)Document9 pagesThe Role of Tax Checks in The Determination of Taxes Owed (Case Study at Pt. Indonesian Railways)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Demand AnalysisDocument25 pagesDemand AnalysisSharanya RameshNo ratings yet

- NISM-Series V-A MFD CPE Material-Nov-2019Document202 pagesNISM-Series V-A MFD CPE Material-Nov-2019sushilalewa1No ratings yet

- Buisness Plan CafeDocument25 pagesBuisness Plan CafeIsrael Elias100% (1)

- Understanding MacroeconomicsDocument36 pagesUnderstanding Macroeconomicsrahul191991No ratings yet

- Strict or Liberal Construction of StatutesDocument32 pagesStrict or Liberal Construction of StatutesGreg BaldoveNo ratings yet

- Test 1: in ChargeDocument9 pagesTest 1: in ChargeT. JHONNo ratings yet

- PILMICO v. CIRDocument2 pagesPILMICO v. CIRPat EspinozaNo ratings yet

- IGNTU EContent 456503968929 B.com 6 Prof - shailendraSinghBhadouriaDean& FINANCIALSERVICES AllDocument4 pagesIGNTU EContent 456503968929 B.com 6 Prof - shailendraSinghBhadouriaDean& FINANCIALSERVICES AllDinesh PKNo ratings yet

- 269-Republic v. Patanao G.R. No. L-22356 July 21, 1967Document3 pages269-Republic v. Patanao G.R. No. L-22356 July 21, 1967Jopan SJNo ratings yet

- Tax Invoice for Electrical PartsDocument1 pageTax Invoice for Electrical PartsShilpa GuptaNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentAnonymous e9EIwbUY9No ratings yet

- 11th BPS Arrears Income Tax Relief 89 1 RajManglamDocument8 pages11th BPS Arrears Income Tax Relief 89 1 RajManglamShubhamGuptaNo ratings yet

- AP Microeconomics TestDocument13 pagesAP Microeconomics TestGriffin Greco100% (1)

- City of Davao v. Intestate Estate of Amado Dalisay Case DigestDocument3 pagesCity of Davao v. Intestate Estate of Amado Dalisay Case DigestKian FajardoNo ratings yet

- Income Tax Book by CA Suraj Agrawal - May & Nov 2020 Exam - CompressedDocument590 pagesIncome Tax Book by CA Suraj Agrawal - May & Nov 2020 Exam - CompressedSonali Dixit100% (1)

- Smietanka v. First Trust & Savings Bank: 257 U.S. 602 (1922) : Justia US Supreme Court CenterDocument1 pageSmietanka v. First Trust & Savings Bank: 257 U.S. 602 (1922) : Justia US Supreme Court CenterChou TakahiroNo ratings yet

- CIR v. MINDANO II (G.R. No. 191498. January 15, 2014.)Document2 pagesCIR v. MINDANO II (G.R. No. 191498. January 15, 2014.)Emmanuel YrreverreNo ratings yet

- Ultimate Guide To SIP in Pakistan Ebook FinalDocument39 pagesUltimate Guide To SIP in Pakistan Ebook FinalbisaxNo ratings yet