Professional Documents

Culture Documents

Kingsley Sheteh Newuh,: TLCM Will Be Used Hereafter To Stand For Trade Liberalisation and Competitive Markets

Uploaded by

Kingsley Sheteh NewuhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kingsley Sheteh Newuh,: TLCM Will Be Used Hereafter To Stand For Trade Liberalisation and Competitive Markets

Uploaded by

Kingsley Sheteh NewuhCopyright:

Available Formats

Kingsley Sheteh Newuh,

Introduction:

The World Bank on 12th January 2011 made the pronouncement that “Developing

countries face three main short-term risks—tensions in financial markets, large and

volatile capital flows, and a rise in high food prices” (World Bank, 2011) and as the

UNESCAP (2011) plan to meet in Bangkok on the 25-26 of January, 2011, the main

objectives of the consultation will be to analyse constraints for Trade Facilitation for

agricultural products, exchange and introduce best practices on Trade Facilitation

and identify recommended actions to implement Trade Facilitation for Agricultural

products in the Asia-Pacific. Following these trends which clearly highlight the risks

facing developing nations and the importance being placed by the international

community on trade facilitation, it will be difficult not to conclude that the situation of

poor countries in the world today is of prime importance even though it is one that

has precluded any other remedy out of poverty but continued trade liberalisation and

the building of competitive markets. (TLCM)1

This essay evaluates the veracity of this position while drawing on the experience of

third world countries with some special attention given to Thailand. First will be an

understanding of trade liberalisation, which will be followed by a section which

argues against the dogmatic position that trade liberalisation is the only way out of

poverty. This begins with a brief overview of Thailand’s participation in international

trade, followed by arguments to show that trade liberalisation has not and cannot be

the only way out of poverty. This will then be followed by a conclusion.

1

TLCM will be used hereafter to stand for Trade liberalisation and Competitive markets.

1

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

Trade Liberalisation and Competitive Markets: An Understanding

Underlying the whole notion of TLCM is the Economic ideas of Adam Smith and

David Ricardo. Smith saw the collective interest as being best served by the free

exercise of individual self interest, (‘The Invisible Hand’). For Ricardo an important

element to the happiness of mankind would be an increased and better distribution

of labour which can be achieved, “by each country producing those commodities for

which by its situation, its climate and its natural or artificial advantages, it is adapted,

and by their exchanging them for the commodities of other countries, as that they

should be augmented by a rise in the rate of profit.” (Sraffa, 1962, p.132)

These ideas of comparative advantage have been the main ideology of the

Washington Consensus who according to Galbraith base their argument on the idea

that “markets are efficient, that states are unnecessary, that poor and the rich have

no conflicting interests, that markets perform at the highest level when left alone…

that privatisation and deregulation and open capital markets promote economic

development, that government should balance budgets and fight inflation and do

almost nothing else”. (Galbraith, 1999, p.1)

If these policies were as simple as they are presented and do produce the results

that they are claimed to be able to produce, the many-layered question that still

remains to be answered is: why is there still so much widespread poverty in the

world and why is the balance of payments of most poor countries always negative

even when they follow deregulations and privatisation policies and open up their

markets to foreign trade. Why is there still growing poverty when as a matter of fact,

today, for the first time, developing countries are said to have made the most

impressive breakthrough into global markets for goods and services other than just

2

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

primary products, (Collier, 2007) The answer to these is simple; while TLCM have

been very crucial to the growth of certain poor economies, available evidence shows

that they have not and will not any time soon be the only way to lead the poor out of

poverty because “the mere fact that free trade agreements between countries

increase the flow of trade between them does not necessarily mean that it will

enhance the welfare of the trading partners.” (Pholphirul, 2010. P. 52).

Continued Trade Liberalisation and Market Competition: The

Panacea to Poverty?

Before going to general analysis, it will be expedient to present the case of Thailand

as a country that is supposedly doing well and is getting out of poverty. Thailand has

a long history of international trade and is a member of several international trade

organizations including the ASEAN Free Trade Area (AFTA), the Asia Pacific

Economic Cooperation (APEC), and the World Trade Organization (WTO). All these

notwithstanding, Thai balance of trade was consistently negative until 1998. In an

astonishing turn of events, imports in 1997 (just two years after joining the WTO)

exceeded exports by US$5.319 billion but the following year, exports exceeded

imports by US$11.485 billion. Despite the uneven balance of trade, the Thai

economy continued to grow by an average of 6.8 percent in the 1970s, 7.5 percent in

the 1980s, and 8 percent in the early 1990s before the Asian financial crisis. With the

onslaught of the crises, they accepted bailout packages from the IMF although these

were tied to a series of drastic economic reforms. The Thai government immediately

adopted the ‘Sufficiency Economy Philosophy’ which together with the aid received

got the economy back on its feet within a very short space of time and by 2001,

Thailand's economy had recovered. The increasing tax revenues, free-enterprise

economy, generally pro-investment policies, and strong export industries allowed the

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

country to balance its budget and repay its debts to the IMF in 2003, four years

ahead of schedule. It is however, a held view that both trade and financial

liberalisation are the catalysts to this and also will be the source of the long-run

economic growth of all the East Asian economies (Dowling and Ray, 2000).

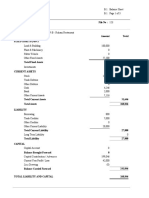

Trade (expressed in billions of US$): Thailand

Exports Imports

1975 2.208 3.280

1980 6.505 9.214

1985 7.121 9.242

1990 23.070 33.379

1995 56.439 70.776

1998 54.456 42.971

SOURCE: International Monetary Fund. International Financial Statistics Yearbook

1999.

It is the prevailing thought of this discourse that increasing TLCM will lead to

improvements to the lot of the poor. Unfortunately although rapid economic growth

has in general, increased the material wealth of the Thai population, the distribution

of economic growth has been extremely biased and unbalanced. In terms of

geographical distribution, inequalities have been growing. The inhabitants of the

Bangkok Metropolitan Area have an average income of 340% of the national

average, while the figures for the North and Northeast regions are 48% and 31%

respectively. (See MDG Report 2004, p.13, Bangkok Post, 2009).

This happens to be just one case in a world in which Collier says has over a billion

people locked at the bottom of the poverty pit. Hence, although “…the growth of

global trade has been good for Asia…don’t count on it to help the bottom billion…

Based on present trends, it seems more likely to lock yet more of the bottom-billion

countries.” (Collier, 2007 p.87) This is likely going to be the case because there is

always this ready-made-solution-attitude towards poor countries which is

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

compounded by the fallacies of composition and hasty generalisations. A statement

like “…development as economic growth via the classical free market has been

successful to date and that what is required now are minor reforms to dampen the

worst excesses of globalisation,” says it all. (Thomas, 2001, p. 578)

There is absolutely no doubt that greater integration in to the international economy

through trade should be able to stimulate growth, diffuse new technologies, and

generate investments which should invariably lead to economic growth and facilitate

the move out of poverty. The fact that this is failing to bring about the desired result

may be because many advocates of TLCM easily forget the paradox pointed out by

Lenin that

Monopoly is exactly the opposite of free competition; but we have seen the

latter being transformed into monopoly before our very eyes, creating large-

scale industry and eliminating small industry, replacing large-scale industry by

still larger scale industry, finally leading to such a concentration of production

and capital that monopoly has been and is the result (Lenin, 1939, p.236)

This has clearly been the case with the increasing growth in the number of

Multinational Corporations (MNC) who have monopolised world trade to the

detriment of infant industries and agricultural sectors of poor countries. From the

1960s there has been a proliferation of MNCs which grew from 3,500 in 1960 to

60,000 in 1999. The aggregate stock of FDI worldwide increased in tandem from $66

billion in 1960 to over $4,000 billion in 1999, as compared with only $14 billion in

1914. (UNCTAD, 1996, 1999) Little wonder McCormick2 (2002) argues that

“multinationals are a powerful force for good in the world. They spread wealth, work,

technologies that raise living standards and better ways of doing business. That's

why so many developing countries are competing fiercely to attract their investment.”

What McCormick fails to realise is that the natural tendency for foreign investors in

2

President of the International Chamber of Commerce, at the 2002 World Economic Forum (WEF)

5

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

poor countries has been only to invest in the high profit sectors of the economies,

with the level of interest and profit remittance being extremely high in relation to

capital invested to the value of production by foreign firms, and to the taxes paid.

(Green & Seidman, 1968) Also, the lucrative profits which are made from these

sectors are immediately sent back to metropolitan banks, and/or home offices. This

practice hampers domestic capital formation, and results in a net overflow of capital

from the poor economies to the developed capitalist economies in the form of

repatriated profits and royalties. These forms of investments are incompatible with

both the attainment of sustainable economic development and any significant

improvement in the standards of living of poor nations.

The most disturbing aspect of the argument for TLCM is the hypocrisy of the rich

nation, for “…despite progress in the post-war era, advanced-economy trade barriers

remain stubbornly high against clothing, textiles, and agricultural goods, the very

products in which LDCs have a natural comparative advantage.” (Griswold, 2000)

This and other external economic interests make the balanced development of poor

economies extremely difficult. The chronic trade deficits of many African countries in

the recent past can be attributed to this structural imbalance, and the dependence on

exports. This is made worse by the rising prices of imports and the declining prices

of exports a situation compounded by the structural adjustment policies of the World

Bank and the IMF whose deregulation and privatisation policies implemented in over

90 countries have left the world with a bitter legacy of “…growing poverty in all

regions of the developing world, except China.” (Coates3, 2002) At this period of

increasing imports of manufactured goods for developmental purposes, this decline

in export prices relative to import prices is nothing but catastrophic.

3

Director of World Development Movement at World Economic Forum (WEF)2002

6

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

According to Green and Seidman (1968), the unfavourable incorporation of the

underdeveloped world into the world economy is like a ‘giant price scissors’ that

have led to the growing deficits in the balance of trade faced by poor countries. As a

result of these balance of trade deficits, poor countries have been forced to finance

imports as well as their development programs through borrowing from foreign

sources. This has led to their increased dependence on foreign capital and ‘foreign

aid’ from Western governments and donor agencies. These circumstances therefore

make it practically impossible for these economies to pursue policies designed to

achieve economic independence and hence, economic growth.

To make bad matters worse, the membership of these poor nations in international

trade organisations is not helping matters. The WTO for example fails to take the

specific concerns of the developing world seriously, it is said to be consistently

allowing the US and the EU to dominate a reform agenda that allows continuing

protectionism in the wealthy world while simultaneously forcing open markets and

imposing new regulatory regimes in Africa Asia and Latin America. (Khor, 2001) This

could be one of the reasons why progress in the world is so farfetched. The fact that

convergence is failing to help the poor countries is largely due to the unwillingness of

International bodies like the IMF, World Bank, the WTO to admit that they are failing.

On the contrary, as their prescribed policies keep failing, they keep defending

themselves and present every unwelcome case as an unfortunate exception.

(Galbraith, 1999) It is not surprising that there has been this massive call for an end

to the WTO, with 10 good reasons given to support the call. (Albert, 2000)

From the forgoing it becomes clear that while TLCM may help in some cases as it

did minimally in the case of Thailand, the international political economic terrain is

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

becoming more and more an arena where only the fittest survive. Since most of the

rich nations are still maintaining protective policies, poor nations may benefit from a

certain degree of openness but this will vary from country to country. It is therefore

without an iota of doubt going from the evidence just presented that continued TLCM

will rather result in a widening of the gulf between rich and poor nations unless a

level playing ground is sought.

Conclusion:

It has been the objective of this essay to show that continued trade liberalisation and

competitive markets have not and will not be the solution to poverty. It therefore did

this while pointing to some of the negative effects of openness such as the hypocrisy

of rich nations, the biased investment policies of MNCs and the fact that the

international arbiters have been failing and cannot be relied on 4. In the final analysis,

it will be advisable for all poor countries to seek strategies from within as Thailand

did; a philosophy that can weather the bad effects of ruthless competition in the open

world market.

References:

Albert, M. 2000. “A Questions and Answers on the WTO, IMF, World Bank, and

Activism,” Z Magazine, January 2000, pp. 24-29.

Bangkok post, (26/11/2009) Country's in for it in a very bad way, Available at:

http://www.bangkokpost.com/print/28103/ Accessed 11/01/2011

4

The failure of the international community in Copenhagen and Cancun to arrive at a binding treaty to

resolve matters of extreme concern to the whole world such as Global Warming and Climate Change

makes one to wonder if they can even be relied on in matters that affect only poor countries

8

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

Coates, B. 2002. Debate: Globalisation: Good or Bad? Online at

http://news.bbc.co.uk/1/hi/business/1790941.stm. Accessed 07/01/2011

Collier, P. 2007. The Bottom Billion: Why the Poorest Countries are Failing and

What Can Be Done About It. Oxford: Oxford University Press.

Dowling, J.M. & Ray, D. 2000. “The structure and composition of international trade

in Asia: historical trends and future prospects.” Journal of Asian Economics 11(3):

301-318.

Galbraith, J.K. 1999. “The Crisis of Globalization,” Dissent Magazine, Summer

1999, pp. 12-16

Green, R.H & Seidman, A. 1968: Unity or Poverty? The Economics of Pan-

Africanism Baltimore: Penguin

Griswold, D.T. 2000. “The Blessings and Challenges of Globalization” The World and

I, September 2000, pp. 267-283.

Khor, M. 2001 ‘Whe World Trade Organisation and the south: implications of the

emerging global economic governance for development’ in Jomo, K.S. & Nagaraj, S.

(eds.) Globalisation versus Development. Basingstoke: Palgrave, pp. 59-84

Lenin, V.I. 1939. Imperialism: The Highest Stage of Capitalism. In Christman, H.

(ed) 1966. Essential works of Lenin “What Is to Be Done?” and Other Writings,

Bantam Books Inc.

McCormick, R.D Debate: Globalisation: Good or Bad? Online at

http://news.bbc.co.uk/1/hi/business/1790941.stm. Accessed 07/01/2011

International Development Department, University of Birmingham

Kingsley Sheteh Newuh,

Thailand Millennium Development Goals Report (2004).Office of the National

Economic and Social Development Board, United Nations Country Team in Thailand

Pholphirul, P. 2010. "Does AFTA Create More Trade for Thailand? An Investigation

of Some Key Trade Indicators," Journal of Current Southeast Asian Affairs, Institute

of Asian Studies, GIGA German Institute of Global and Area Studies, Hamburg, vol.

29(1), pages 51-78.

Sraffa, P. (ed.) 1962. “On the Principles of Political Economy and Taxation” in Works

and Correspondence of David Ricardo, Vol. 1 Cambridge,

Thomas, C. 2001. “Poverty, Development, and Hunger,” in The Globalization of

World Politics: An Introduction to International Relations, Baylis, J. & Smith, S. New

York: Oxford University Press,

UNCTAD, 1996, 1999. United Nations Conference on Trade and Development

UNESCAP 2011. High Level Consultation on Facilitating Agricultural Trade in Asia

and the Pacific, 25-26 January 2011, Bangkok http://www.unescap.org/

World Bank, 2011. Developing Countries Are Driving Global Growth, but Risks

Remain http://go.worldbank.org/A9P6JDP6N0 [Accessed 13/01/2011]

10

International Development Department, University of Birmingham

You might also like

- Lesson 3 Module Market IntegrationDocument10 pagesLesson 3 Module Market IntegrationTon TonNo ratings yet

- Globalisation EssayDocument21 pagesGlobalisation EssayMengmeng WuNo ratings yet

- Global Integration in Pursuit of Sustainable Human Development: Analytical PerspectivesDocument25 pagesGlobal Integration in Pursuit of Sustainable Human Development: Analytical PerspectivesCarmel PuertollanoNo ratings yet

- TH e Heavy Price of Globalization: Globalization and Sustainable DevelopmentDocument19 pagesTH e Heavy Price of Globalization: Globalization and Sustainable DevelopmentRajiv KhokherNo ratings yet

- Ge 3 Chapter IiDocument27 pagesGe 3 Chapter IiRyan SalipsipNo ratings yet

- Lesson 2 The Global EconomyDocument31 pagesLesson 2 The Global EconomyAaron Manuel MunarNo ratings yet

- CHAPTER 2: The Structures of GlobalizationDocument14 pagesCHAPTER 2: The Structures of GlobalizationRanz Denzel Isaac SolatorioNo ratings yet

- Submitted BY Submitted To:: Name: Amarjeet Kaur Mrs. Geetu Miglani Class: Mba (Fyic) 6Document21 pagesSubmitted BY Submitted To:: Name: Amarjeet Kaur Mrs. Geetu Miglani Class: Mba (Fyic) 6Rakesh SandhalNo ratings yet

- Name: Gonzales Angelica Course: Bse-Socialstudies3 Subject: CepDocument5 pagesName: Gonzales Angelica Course: Bse-Socialstudies3 Subject: Cepjade GonzalesNo ratings yet

- Mr. Jovic B. Lim, LPT, MAED Mr. Arnold P. Santos, LPT. Mr. Adrian D. Estudillo, LPTDocument24 pagesMr. Jovic B. Lim, LPT, MAED Mr. Arnold P. Santos, LPT. Mr. Adrian D. Estudillo, LPTLodicakeNo ratings yet

- Chapter 2 Global Marketing EnvironmentDocument41 pagesChapter 2 Global Marketing EnvironmentaimannawwarNo ratings yet

- Globalization Trade and Commerce Allover The World by Creating A Border Less MarketDocument28 pagesGlobalization Trade and Commerce Allover The World by Creating A Border Less MarketMd.Najmul HasanNo ratings yet

- Module 3 Global EconomyDocument28 pagesModule 3 Global EconomyJeprox Martinez100% (1)

- Module 1 Module in International EconomicsDocument18 pagesModule 1 Module in International EconomicsMar Armand RabalNo ratings yet

- Global Business Environment Strategy D2Document10 pagesGlobal Business Environment Strategy D2DAVIDNo ratings yet

- Critics of Globalization: How International Institutions Failed in Their MissionsDocument4 pagesCritics of Globalization: How International Institutions Failed in Their MissionsfizaAhaiderNo ratings yet

- Global Economy Actors & StructuresDocument9 pagesGlobal Economy Actors & StructuresJuNo ratings yet

- Module 3 Global EconomyDocument9 pagesModule 3 Global EconomyCamela GinNo ratings yet

- Nwssu - Mod in Contemporary World - Module2Document34 pagesNwssu - Mod in Contemporary World - Module2raymundo canizaresNo ratings yet

- II. The Global EconomyDocument37 pagesII. The Global EconomyJenny PeraltaNo ratings yet

- BvjyfiyutghnvnhgfDocument18 pagesBvjyfiyutghnvnhgfKimberly SilveroNo ratings yet

- Ge 3 Module 3Document7 pagesGe 3 Module 3eugene taleNo ratings yet

- Journal of FInance Vol 21Document44 pagesJournal of FInance Vol 21ANKIT_XXNo ratings yet

- Orca Share Media1670151187797 7005121807582248302Document4 pagesOrca Share Media1670151187797 7005121807582248302Dan Christian VillacoNo ratings yet

- Chapter 3 Market IntegrationDocument12 pagesChapter 3 Market IntegrationMikey CabenianNo ratings yet

- Lecture 1: International Business & Globalizatio NDocument11 pagesLecture 1: International Business & Globalizatio NTariqul IslamNo ratings yet

- Global Economy: Actors and IntegrationDocument64 pagesGlobal Economy: Actors and IntegrationSansuri Zet Su100% (1)

- MB0037Document8 pagesMB0037Venu GopalNo ratings yet

- ECO 615 Unit 1 LectureDocument11 pagesECO 615 Unit 1 LecturebuhleymapNo ratings yet

- GLOBALIZATION AND DEVELOPMENT EXPERIENCESDocument12 pagesGLOBALIZATION AND DEVELOPMENT EXPERIENCESRakesh Sandhal100% (1)

- Trade by PatrickDocument17 pagesTrade by PatrickMokwe Bea Patrick juniorNo ratings yet

- WTO, IMF and World BankDocument4 pagesWTO, IMF and World BanktallalbasahelNo ratings yet

- Financial Challenges For The New MillennDocument8 pagesFinancial Challenges For The New MillennUmair RanaNo ratings yet

- F585 Globalisation Essay NotesDocument10 pagesF585 Globalisation Essay NotesLauren ChuaNo ratings yet

- Market IntegrationDocument5 pagesMarket IntegrationJanee JaneNo ratings yet

- Module 3 - GlobalizationDocument3 pagesModule 3 - GlobalizationjessafesalazarNo ratings yet

- CNTMP 1Document16 pagesCNTMP 1Andrei OroNo ratings yet

- UNCTAD conference paper on incentives, capabilities and developing countriesDocument18 pagesUNCTAD conference paper on incentives, capabilities and developing countriesfmaxvicenteNo ratings yet

- Global Economy LessonDocument8 pagesGlobal Economy LessonEric Daniel LopezNo ratings yet

- Globalization's impact on economic systemsDocument4 pagesGlobalization's impact on economic systemsharrrypotter20No ratings yet

- 4.2 The Responsibility of WTODocument7 pages4.2 The Responsibility of WTOpanay1otisNo ratings yet

- Issues in Development TheoryDocument18 pagesIssues in Development TheoryAboubaker S.A. BADINo ratings yet

- The Importance of International Trade All Over The WorldDocument18 pagesThe Importance of International Trade All Over The WorldEhesanulHaqueSaifNo ratings yet

- Global Economic Reform - PEAC373Document11 pagesGlobal Economic Reform - PEAC373Matthew RyanNo ratings yet

- Implications For and Imperatives of Responsible Leadership: Global Crises and The Collapse of The Doha RoundDocument4 pagesImplications For and Imperatives of Responsible Leadership: Global Crises and The Collapse of The Doha RoundDung TruongNo ratings yet

- Lesson 1-International TradeDocument12 pagesLesson 1-International TradeJerry Len TapdasanNo ratings yet

- Globalization and The Role of The State: Challenges and PerspectivesDocument26 pagesGlobalization and The Role of The State: Challenges and PerspectivesRizalNo ratings yet

- Role of Economics in Global Business Management: Submitted byDocument34 pagesRole of Economics in Global Business Management: Submitted byNitin JainNo ratings yet

- Globalization ReflectionDocument3 pagesGlobalization ReflectionlapNo ratings yet

- Globalization and The New Sustainability FrameworkDocument9 pagesGlobalization and The New Sustainability FrameworkMirza ŠrndićNo ratings yet

- Globalization Needs Ethics and SolidarityDocument3 pagesGlobalization Needs Ethics and SolidarityRenz N. GuzmanNo ratings yet

- GlobalizationDocument3 pagesGlobalizationTuliao, Merarie Y.No ratings yet

- Globalization: Economic Challenges and The Political ResponseDocument5 pagesGlobalization: Economic Challenges and The Political Responseruthanne022No ratings yet

- IMF Issues Brief examines benefits and risks of globalizationDocument8 pagesIMF Issues Brief examines benefits and risks of globalizationfbonciuNo ratings yet

- Week 1 - Topic OverviewDocument20 pagesWeek 1 - Topic Overviewsibzz08No ratings yet

- Vietnam's Economic Growth: A Contestation for China's Emerging PowerDocument10 pagesVietnam's Economic Growth: A Contestation for China's Emerging PowerYanuar PriambodoNo ratings yet

- MB0037 International Business ManagementDocument23 pagesMB0037 International Business ManagementsasyamNo ratings yet

- LESSON 2 The Global EconomyDocument13 pagesLESSON 2 The Global EconomyoykemsNo ratings yet

- Jimmy Truong Mod2Document8 pagesJimmy Truong Mod2jimmyytruongNo ratings yet

- EY Portfolio Management in Oil and GasDocument24 pagesEY Portfolio Management in Oil and GaswegrNo ratings yet

- CAH FlashcardsDocument22 pagesCAH FlashcardsChristian VladNo ratings yet

- Balance Shit!!Document3 pagesBalance Shit!!Irfan izhamNo ratings yet

- Alivira To Acquire Majority Stake in Karizoo Group Spain (Company Update)Document6 pagesAlivira To Acquire Majority Stake in Karizoo Group Spain (Company Update)Shyam SunderNo ratings yet

- The Dividend PolicyDocument10 pagesThe Dividend PolicyTimothy Nshimbi100% (1)

- 20 Accounting Changes and Error CorrectionsDocument17 pages20 Accounting Changes and Error CorrectionsKyll MarcosNo ratings yet

- Measuring and Controlling Assets Employed + DELL Case StudyDocument34 pagesMeasuring and Controlling Assets Employed + DELL Case Studykid.hahn100% (1)

- What is ASEAN and its purposeDocument12 pagesWhat is ASEAN and its purposem3r0k050% (2)

- Solution Set 1: 2. (5 Points)Document9 pagesSolution Set 1: 2. (5 Points)c406400No ratings yet

- 82170665Document23 pages82170665LuisMendiolaNo ratings yet

- Hargreaves Lansdown Fund Account - Transfer FormDocument2 pagesHargreaves Lansdown Fund Account - Transfer Formcolin_14No ratings yet

- High Returns from Cultivation of Agro Cash Crops Using Advanced TechniquesDocument23 pagesHigh Returns from Cultivation of Agro Cash Crops Using Advanced TechniquesSonam KhatriNo ratings yet

- Auditing Chap 12 - Audit of Cash & Other Liquid AssetsDocument20 pagesAuditing Chap 12 - Audit of Cash & Other Liquid AssetsAira Cruz0% (1)

- Brochure Sampoorna Suraksha EE0813 PDFDocument11 pagesBrochure Sampoorna Suraksha EE0813 PDFkamleshNo ratings yet

- Conventional Subrogation Requires ConsentDocument2 pagesConventional Subrogation Requires ConsentLiaa Aquino100% (2)

- Financial Management I - Chapter 1Document17 pagesFinancial Management I - Chapter 1Mardi UmarNo ratings yet

- Reinsurance Industry in IndiaDocument18 pagesReinsurance Industry in Indiapriyank2380804621100% (12)

- Bank of PunjabDocument52 pagesBank of Punjabmuhammadtaimoorkhan87% (15)

- Dispersion Trading: Many ApplicationsDocument6 pagesDispersion Trading: Many Applicationsjulienmessias2100% (2)

- Chapter 2+3-MCQDocument2 pagesChapter 2+3-MCQNguyễn Việt LêNo ratings yet

- Cash BookDocument18 pagesCash BookDr. Mohammad Noor AlamNo ratings yet

- WCM QuizzerDocument8 pagesWCM QuizzerkimNo ratings yet

- Marriott Case AnalysisDocument3 pagesMarriott Case AnalysisNikhil ThaparNo ratings yet

- Korea Infrastructure PPP SupportDocument10 pagesKorea Infrastructure PPP SupportLuna JNo ratings yet

- International Finance and Banking Conference FI BA 2015 XIIIth Ed PDFDocument391 pagesInternational Finance and Banking Conference FI BA 2015 XIIIth Ed PDFrodica_limbutuNo ratings yet

- Blecic&Partners Law Firm ProfileDocument6 pagesBlecic&Partners Law Firm ProfileBlecic&PartnersNo ratings yet

- Rosewood Hotels and Resorts: Branding To Increase Customer Profitability and Lifetime ValueDocument26 pagesRosewood Hotels and Resorts: Branding To Increase Customer Profitability and Lifetime ValueAshishNo ratings yet

- Economic indicators and policy instrumentsDocument1 pageEconomic indicators and policy instrumentsThaminah ThassimNo ratings yet

- Infineeti SIMSREE AchillesDocument10 pagesInfineeti SIMSREE AchillesVinay DeshmukhNo ratings yet

- Tax Revenue Performance in KenyaDocument47 pagesTax Revenue Performance in KenyaMwangi MburuNo ratings yet