Professional Documents

Culture Documents

Are You Financially Savvy?

Uploaded by

The London Free PressOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Are You Financially Savvy?

Uploaded by

The London Free PressCopyright:

Available Formats

in An illustrative look at news and events

minutes

Are you financially savvy?

According to a recent survey done by Statistics Canada, Canadians scored an

average of 67% on their financial quiz. How well do you think you can do? How well did

Canadians score?

1 If the inflation rate is 5%

and the interest rate you

get on your savings is 3%,

will your savings have at

6

If you had a savings account

at a bank, which of the

following statements would

be correct concerning the

9 Which of the following

types of investment would

best protect the purchas-

ing power of a family’s

12 Which of the following

can hurt your credit

rating?

a) Making late payments

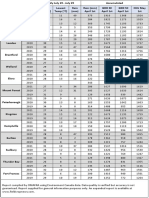

Older people fared better

64.1% 66.0% 67.2% 67.1% 67.5%

least as much buying power savings in the event of a

in a year’s time?

interest that you would earn

on this account? sudden increase in

on loans and debts by age

inflation? b) Staying in one job

a) Yes b) No a) Sales tax may be charged too long

a) A twenty-five year

2

on the interest that you earn c) Living in the same

A credit report is…? corporate bond

-24

-34

-54

4

-4

-6

b) You cannot earn interest location too long

18

25

45

55

35

a) A list of your financial until you pass your 18th b) A house financed with a

assets and liabilities fixed-rate mortgage d) Using your credit card Couples fared better

birthday frequently for purchases

b) A monthly credit card c) Earnings from savings c) A 10-year bond issued 66.6% 67.7% 67.2% 63.6% 64.3%

13

statement account interest may not by a corporation What can affect the

c) A loan and bill payment be taxed d) A certificate of deposit amount of interest

history d) Income tax may be at a bank that you would pay by family status

10

charged on the interest on a loan?

d) A credit line with a Under which of the

financial institution if your income is high a) Your credit rating

enough following circumstances

gle

on ple

ild ith

ren le

r

3

b) How much you borrow

he

would it be financially

pa ing

Co y

ren

t

ch le w

Sin

Ot

l

7

Co

S

Who insures your stocks in beneficial to borrow money

up

Inflation can cause c) How long you take to

the stock market? to buy something now and repay the loan

difficulty in many ways.

a) The National Deposit Which group would have the

repay it with future income?

d) All of the above

68.8% 73.1%

60.0%

Insurance Corporation greatest problem during a) When something is on sale Higher

periods of high inflation educated

by education

14

b) The Securities and b) When the interest on

Exchange Commission that lasts several years? the loan is greater than Which of the following people

a) Young working couples the interest obtained from will help lower the cost fared

c) The Bank of Canada of a house? better

with no children a savings account

d) No one a) Paying off the mortgage

gre y

r le ool

nd st-

b) Young working c) When buying something

de rsit

co po

Un y

ss

e

a o sch

over a long period of time

ar

4

ive

By using unit pricing at couples with children on credit allows someone to

se e m

lom gh

So

dip Hi

the grocery store, you get a much better paying job b) Agreeing to pay the current

c) Older, working couples

can easily compare saving for retirement d) It is always more beneficial rate of interest on the mortgage

the cost of any brand to borrow money to buy for as many years as possible Self-employed people fared better

d) Older people living on

and any package size. fixed retirement income

something now and repay c) Making a larger down

it with future income 67.4% 69.6% 67.9% 62.8%

a) True b) False payment at the time of 60.9%

8

purchase

5

Lindsay has saved $12,000

11

If each of the following for her university expenses Which of the following d) Making a smaller down by labour force

persons had the same by working part-time. Her statements is not payment at the time of

amount of take home pay, plan is to start university correct about most purchase

who would need the greatest next year and she needs all ATM (Automated Teller

amount of life insurance? Machine) cards?

d

ed

ed

r

of the money she saved.

he

The average score

ye

ye

loy

tir

Ot

plo

plo

Re

Which of the following is the

mp

a) A young single woman a) You can get cash anywhere for men taking this

Em

em

lf e

Un

with two young children safest place for her univer- in the world with no fee survey was higher

Se

sity money? than that of women

b) A young single woman b) You must have a bank Albertans are the most financially savvy

without children a) Corporate bonds account to have an ATM card 68.0% 65.1% 69.5% 69.2%

c) An elderly retired man, b) Mutual Funds c) You can generally get cash 64.0% 64.0% 67.1% 67.3%

with a wife who is also retired c) A bank savings account 24 hours-a-day

Male vs.

d) A young married man

without children

d) Locked in a safe at home d) You can generally obtain

information concerning your

female by province

e) Stocks bank balance at an ATM

Answers (% that answered correctly) Male Female Atlantic Que. Ont. Man./Sask. Alta. B.C.

1. b 70% 4. a 76% 7. d 57% 10. c 30% 13. d 75%

2. c 51% 5. a 81% 8. c 68% 11. a 79% 14. c 92%

3. d 38% 6. c 14% 9. b 43% 12. a 94%

Sources: Statistics Canada

d 64% ANTHONY GREEN/QMI AGENCY

You might also like

- Project HobartDocument1 pageProject HobartThe London Free PressNo ratings yet

- Supports During Winter BreakDocument2 pagesSupports During Winter BreakThe London Free PressNo ratings yet

- FINAL Single Pages Student Dress Guidelines 3Document12 pagesFINAL Single Pages Student Dress Guidelines 3The London Free PressNo ratings yet

- Weather ReportDocument1 pageWeather ReportThe London Free PressNo ratings yet

- PAC COVID Vaccine LetterDocument3 pagesPAC COVID Vaccine LetterThe London Free PressNo ratings yet

- Business Leaders Need To Be Climate LeadersDocument3 pagesBusiness Leaders Need To Be Climate LeadersThe London Free PressNo ratings yet

- Statement - Council Delegation June 21 2022Document1 pageStatement - Council Delegation June 21 2022The London Free PressNo ratings yet

- Master Planning Process: Stage 1 Part A Key FindingsDocument7 pagesMaster Planning Process: Stage 1 Part A Key FindingsThe London Free PressNo ratings yet

- A COVID Journal EntryDocument56 pagesA COVID Journal EntryThe London Free PressNo ratings yet

- WISH To BE HOME ProgramDocument2 pagesWISH To BE HOME ProgramThe London Free PressNo ratings yet

- LHSC StatementDocument2 pagesLHSC StatementThe London Free PressNo ratings yet

- Building Climate Resilient CommunitiesDocument57 pagesBuilding Climate Resilient CommunitiesThe London Free PressNo ratings yet

- City's Letter To Housing Affairs Minister Steve Clark April 2020Document3 pagesCity's Letter To Housing Affairs Minister Steve Clark April 2020The London Free PressNo ratings yet

- An Open Letter To The Community From Southwestern Public HealthDocument1 pageAn Open Letter To The Community From Southwestern Public HealthThe London Free PressNo ratings yet

- Wild Babies Do's and Don'tsDocument2 pagesWild Babies Do's and Don'tsThe London Free PressNo ratings yet

- Bishop's LetterDocument2 pagesBishop's LetterThe London Free PressNo ratings yet

- PAC COVID Vaccine LetterDocument3 pagesPAC COVID Vaccine LetterThe London Free PressNo ratings yet

- McKennitt-Parlee - Xinyi Canada Glass Project - For Immediate Attention - DF11 - Nov26-2020 LM PP MMDocument3 pagesMcKennitt-Parlee - Xinyi Canada Glass Project - For Immediate Attention - DF11 - Nov26-2020 LM PP MMThe London Free PressNo ratings yet

- Remembrance Program 2019Document8 pagesRemembrance Program 2019The London Free PressNo ratings yet

- City's Letter To House Affairs Minister Steve Clark March 2020Document2 pagesCity's Letter To House Affairs Minister Steve Clark March 2020The London Free Press100% (1)

- Ontario Farmer - Rural Properties and MarketplaceDocument8 pagesOntario Farmer - Rural Properties and MarketplaceThe London Free PressNo ratings yet

- City's Letter To Housing Affairs Minister Steve Clark November 2018Document2 pagesCity's Letter To Housing Affairs Minister Steve Clark November 2018The London Free Press100% (1)

- Rural Properties and MarketplaceDocument8 pagesRural Properties and MarketplaceThe London Free PressNo ratings yet

- Core Area Action PlanDocument2 pagesCore Area Action PlanThe London Free Press100% (2)

- Walkerton TimelineDocument1 pageWalkerton TimelineThe London Free PressNo ratings yet

- ML Hu BlackRidge Invoice 2Document1 pageML Hu BlackRidge Invoice 2The London Free PressNo ratings yet

- CN Rail Letter From Ontario Agriculture - FinalDocument2 pagesCN Rail Letter From Ontario Agriculture - FinalThe London Free PressNo ratings yet

- ML Hu BlackRidge InvoiceDocument1 pageML Hu BlackRidge InvoiceThe London Free PressNo ratings yet

- TVDSB Employee CodeDocument4 pagesTVDSB Employee CodeThe London Free PressNo ratings yet

- Blackridge Strategy StatementDocument2 pagesBlackridge Strategy StatementThe London Free PressNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Annual Report of Sprayking Agro Equipments LTD F.Y. 2022-23Document105 pagesAnnual Report of Sprayking Agro Equipments LTD F.Y. 2022-23sanjieevNo ratings yet

- WNSDocument3 pagesWNSAnonymous f3AnDlikNo ratings yet

- Polyethylene Technology Mini Project for Master Tec Cable & Wire CoDocument38 pagesPolyethylene Technology Mini Project for Master Tec Cable & Wire CoHatta AimanNo ratings yet

- Presentation - Capital Expenditure and Operating Expenses BudgetsDocument5 pagesPresentation - Capital Expenditure and Operating Expenses BudgetsBVMF_RINo ratings yet

- Bernabe Accounting-FirmDocument33 pagesBernabe Accounting-FirmElla Ramos100% (1)

- Zacks Marijuana Innovators GuideDocument13 pagesZacks Marijuana Innovators GuideEugene GalaktionovNo ratings yet

- Comparative Analysis of Financial Performance of Banks Using Ratio AnalysisDocument46 pagesComparative Analysis of Financial Performance of Banks Using Ratio AnalysisNaushad213No ratings yet

- Property Management Proposal Template FreeDocument12 pagesProperty Management Proposal Template FreeLiz100% (1)

- Difference Between Hire Purchase and LoanDocument6 pagesDifference Between Hire Purchase and LoanSaumya GoelNo ratings yet

- Park Elite Avaliablity Aug-2020Document3 pagesPark Elite Avaliablity Aug-2020Gajendra ChoudharyNo ratings yet

- Sample Qualified Written Request Under Re SpaDocument3 pagesSample Qualified Written Request Under Re SpaPamGrave100% (1)

- Bharat Rasayan - Issues and ConcernsDocument5 pagesBharat Rasayan - Issues and ConcernsJayaprakash Gopala KamathNo ratings yet

- Guide to International Financial Management SystemsDocument22 pagesGuide to International Financial Management Systemsviketa tyagiNo ratings yet

- CFA Level II Mock Exam 2 - Questions (PM)Document36 pagesCFA Level II Mock Exam 2 - Questions (PM)Sardonna Fong100% (1)

- ACCOUNTING FOR BOND REFUNDING AND FAIR VALUE OPTION ENTRIESDocument1 pageACCOUNTING FOR BOND REFUNDING AND FAIR VALUE OPTION ENTRIESJamaica DavidNo ratings yet

- M.phil Register Final1Document53 pagesM.phil Register Final1Anonymous dfy2iDZNo ratings yet

- WS1 Share Acquisition vs. Asset AcquisitionDocument3 pagesWS1 Share Acquisition vs. Asset Acquisitionsheza9No ratings yet

- Orange County Case:: Philippe Jorion'sDocument9 pagesOrange County Case:: Philippe Jorion'sbautheNo ratings yet

- Activity 3Document2 pagesActivity 3Princess CondesNo ratings yet

- Subway SalesDocument5 pagesSubway SalesImad RiazNo ratings yet

- Improving AIM's Performance Through Algorithm ChangesDocument8 pagesImproving AIM's Performance Through Algorithm Changesd1234dNo ratings yet

- Chapte R: Dividend TheoryDocument19 pagesChapte R: Dividend TheoryArunim MehrotraNo ratings yet

- Test Bank Advanced Accounting 3e by Jeter 16 ChapterDocument24 pagesTest Bank Advanced Accounting 3e by Jeter 16 ChapterJaceNo ratings yet

- Ogbonna and Ojeaburu On Impact GIFMIS On Economic DevDocument20 pagesOgbonna and Ojeaburu On Impact GIFMIS On Economic DevAnonymous HcyEQ1Py100% (1)

- Auditing Cy 1Document2 pagesAuditing Cy 1aarvi2473No ratings yet

- Income Sttatement & Balance Sheet Further Consideration: DetailsDocument8 pagesIncome Sttatement & Balance Sheet Further Consideration: DetailsXX OniiSan XXNo ratings yet

- ECSO CFS Romania 2018Document28 pagesECSO CFS Romania 2018Anda AndreeaNo ratings yet

- Paci Fic-Basin Finance Journal: Geng Niu, Yang Zhou, Hongwu Gan TDocument17 pagesPaci Fic-Basin Finance Journal: Geng Niu, Yang Zhou, Hongwu Gan TRetno Puspa RiniNo ratings yet

- Financial Analysis NestleDocument3 pagesFinancial Analysis NestleArjun AnandNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument9 pagesIAS 16 Property, Plant and Equipmentsalman jabbarNo ratings yet