Professional Documents

Culture Documents

Financial Liberalization

Uploaded by

damsana3Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Liberalization

Uploaded by

damsana3Copyright:

Available Formats

Government intervention in the financial system, including the setting of interest rates, the imposition

of high reserve requirements and quantitative restrictions on credit allocation, was a fairly common

practice in the 1960s and 1970s, especially in developing countries. That practice was challenged

initially by Goldsmith [19691 and later by McKinnon [1973] and Shaw [1973], who saw it as being

responsible for low savings, credit rationing and low investment. They dubbed it 'financial repression.'

As an antidote the authors proposed the financial liberalization thesis, which essentially involved

freeing financial markets from government intervention and letting the market determine the price

and allocation of credit. The policy implications of this analysis are quite straightforward: remove

interest rate ceilings, reduce reserve requirements and abolish directed credit programs.

Financial liberalisation can be defined as a set of reforms and policy measures

designed to deregulate and transform the financial system and its structure

with a view to achieving a liberalised market-oriented system within an

appropriate regulatory framework. The success of

financial sector reform throughout the world has seen the introduction of

market-based procedures for monetary control, the promotion of competition

in the financial sector, and the relaxation of restrictions on capital flows.

Specifically, the move away from a tightly controlled financial sector to a

deregulated one results in greater flexibility in interest rates, enhancement of

the role of markets in credit and foreign exchange allocation, increased

autonomy for commercial banks, greater depth of money, securities, and

foreign exchange markets, and a significant increase in cross-border capital

flows.

The objective of bringing about these changes to the financial system is to

create more efficient and stable systems, which will facilitate better

performance in the economy. This means providing a foundation for

implementing effective stabilization policies and successfully mobilizing

capital and putting it to efficient use, which leads to achieving higher rates

of economic growth.1

You might also like

- Essence of Financial LiberalizationDocument8 pagesEssence of Financial Liberalizationdamsana3No ratings yet

- Essence of Financial LiberalizationDocument11 pagesEssence of Financial Liberalizationdamsana3No ratings yet

- Interest Rate and Exchange RateDocument3 pagesInterest Rate and Exchange Ratedamsana3No ratings yet

- Lecture 8-Financial Crisis-E (Halan)Document33 pagesLecture 8-Financial Crisis-E (Halan)damsana3100% (1)

- Lecture 05-Commercial Banks (E)Document36 pagesLecture 05-Commercial Banks (E)damsana3100% (1)

- Lecture 7-Financial Liberalization-E (Halan)Document22 pagesLecture 7-Financial Liberalization-E (Halan)damsana3No ratings yet

- The Central Bank Vu Thanh Tu AnhDocument52 pagesThe Central Bank Vu Thanh Tu Anhdamsana3100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MEP Guidebook 2Document2 pagesMEP Guidebook 2Christopher LimNo ratings yet

- Competition and Market Structure in The Plastics CDocument42 pagesCompetition and Market Structure in The Plastics CSariephine Grace ArasNo ratings yet

- UiPath Certified Advanced RPA Developer v1.0 - EXAM DescriptionDocument7 pagesUiPath Certified Advanced RPA Developer v1.0 - EXAM DescriptionabhaysisodiyaNo ratings yet

- Acct 3211 #1Document17 pagesAcct 3211 #1yahye ahmedNo ratings yet

- SWIFTDocument15 pagesSWIFTArushi Gupta100% (2)

- Intermediate CH 1Document15 pagesIntermediate CH 1Abdi MohamedNo ratings yet

- Countervailing MeasuresDocument7 pagesCountervailing MeasuresMd. Atif KhanNo ratings yet

- CHFDDocument16 pagesCHFDPhuong HoNo ratings yet

- Mechanized Methods of Work Transport in Material HandlingDocument3 pagesMechanized Methods of Work Transport in Material Handlingolyad ahmedinNo ratings yet

- GlossaryDocument3 pagesGlossaryYug KhatanaNo ratings yet

- CEG SET - 30 MBA - III Sem Assignment QuestionsDocument11 pagesCEG SET - 30 MBA - III Sem Assignment QuestionsKathiresan NarayananNo ratings yet

- BPE - MIC1 Microeconomics 1 - Fall Semester 2010: Midterm Exam - 01.11.2010, 9:30-10:30 Test Version: ADocument10 pagesBPE - MIC1 Microeconomics 1 - Fall Semester 2010: Midterm Exam - 01.11.2010, 9:30-10:30 Test Version: ANA DO NINo ratings yet

- Accounting Cycles and Documentation TechniquesDocument3 pagesAccounting Cycles and Documentation TechniquesCheesy MacNo ratings yet

- PM Implementation Checklist and PM OverviewDocument36 pagesPM Implementation Checklist and PM OverviewPuneet GobindaNo ratings yet

- Nebosh IG2 Risk Assessment Rigging Site PDFDocument16 pagesNebosh IG2 Risk Assessment Rigging Site PDFNishanthNo ratings yet

- Application Form M3M IFCDocument38 pagesApplication Form M3M IFCDashmesh LandbaseNo ratings yet

- Business Plan 0Document15 pagesBusiness Plan 0Olsen Soqueña100% (3)

- FinanceDocument7 pagesFinanceMahabbat DzhenbekovaNo ratings yet

- Quiz (Modules 1 To 6) - Project PlanningDocument7 pagesQuiz (Modules 1 To 6) - Project Planninganiket.ubhad999wNo ratings yet

- Colour Chronicle: TLP DivisionDocument24 pagesColour Chronicle: TLP Division950 911No ratings yet

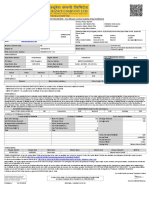

- MOTOR INSURANCE - Two Wheeler Limited Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Limited Liability Only SCHEDULEdreamz lodgeNo ratings yet

- Market Basket Analysis For Data Mining Concepts and TechniquesDocument4 pagesMarket Basket Analysis For Data Mining Concepts and TechniquesEduardo TorresNo ratings yet

- Delta Life Insurance Company LimitedDocument79 pagesDelta Life Insurance Company LimitedKS BiplobNo ratings yet

- Plaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987Document3 pagesPlaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987AaradhyNo ratings yet

- Problem Set 3Document4 pagesProblem Set 3ka ming lamNo ratings yet

- The Concept of Packaging LogisticsDocument31 pagesThe Concept of Packaging LogisticsvenkatryedullaNo ratings yet

- Valuation of Fixed Income Securities Aims and ObjectivesDocument20 pagesValuation of Fixed Income Securities Aims and ObjectivesAyalew Taye100% (1)

- Essential IT controls for risk managementDocument196 pagesEssential IT controls for risk managementvishal jalanNo ratings yet

- Asia Lighterage and Shipping, Inc. vs. CaDocument1 pageAsia Lighterage and Shipping, Inc. vs. CaVian O.No ratings yet

- Marketting Concept AnswerDocument18 pagesMarketting Concept AnswerManjaleeNo ratings yet