Professional Documents

Culture Documents

Problem 3-1

Uploaded by

Omar CirunayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 3-1

Uploaded by

Omar CirunayCopyright:

Available Formats

Problem 3-1

N. Klein & Company had the following transactions in June. Using the matching

concept, decide which of these transactions represented expenses for June.

a. Received orders for goods with prices totaling $25,000.00; Goods to be

delivered in July.

b. Paid Office staff $9,750.00 for work performed in June.

c. Products in Inventory costing $1,725 were found to be obsolete.

d. Sold goods with a cost of $25,000.00 in June.

e. Paid $750.00 for radio and advertising in June.

f. Purchased additional Inventory for $27,000.00.

Answer:

Transactions b, c, d, e

Problem 3-7

QED Electronics Company had the following transactions during April while

conducting its television and stereo repair business.

1. A new repair truck was purchased for $19,000.00

2. Parts with a cost of $1,600.00 were received and used during April.

3. Service Revenue for the month was $33,400.00, but only $20,500.00 was

cash sales. Typically, only 95 percent of sales on account are realized.

4. Interest expense on loans outstanding was $880.00.

5. Wage cost for the month totaled $10,000; however $1,400.00 of this had not

yet been paid to employees.

6. Parts inventory from the beginning of the month was depleted by $2,100.00.

7. Utility bills totaling $1,500.00 were paid. $700.00 of this was associated with

March’s operations.

8. Depreciation expense was $ 2,700.00.

9. Selling Expenses were $1,900.00

10.A provision for income taxes was established at $2,800.00 of which

$2,600.00 had been paid to the federal government.

11.Administrative and miscellaneous expenses were recorded at $4,700.00

Required: Prepare a detailed April Income Statement.

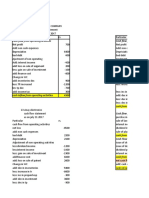

QED Electronic Company

Income Statement

For the Month Ended April, 20XX

33,400.

Total Revenue 00

Less: Expenses

3,700.

Supplies Expense 00

10,000.

Salaries Expense 00

800.

Utility Expense 00

1,900.

Selling Expense 00

Administrative and Miscellaneous 4,700.

Expense 00

2,700.

Depreciation Expense 00

880.

Interest Expense 00

24,680.

Total Expenses 00

8,720.

Income Before Taxes 00

2,800.

Provision for Income Taxes 00

5,920.

Net Income 00

You might also like

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Balance Sheet and Transactions Analysis for Charles CompanyDocument14 pagesBalance Sheet and Transactions Analysis for Charles CompanyArunesh SN100% (1)

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Chapter 6 Cost of Sales and Inventories GuideDocument62 pagesChapter 6 Cost of Sales and Inventories GuideRosedel Rosas100% (2)

- Maynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income StatementDocument2 pagesMaynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income Statementriya lakhotiaNo ratings yet

- Stafford Press SolvedDocument2 pagesStafford Press SolvedMurali DharanNo ratings yet

- Lewis Corporation case study: Analysis of inventory valuation methodsDocument7 pagesLewis Corporation case study: Analysis of inventory valuation methodsSudeep ShahNo ratings yet

- ACCOUNTING STERN CORPORATION (A) AnswerDocument4 pagesACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNo ratings yet

- Lewis Corporation Case 6-2 - Group 5Document8 pagesLewis Corporation Case 6-2 - Group 5Om Prakash100% (1)

- Chap004 SolutionsDocument7 pagesChap004 Solutionsdavegeek100% (1)

- Accounting Case 2Document3 pagesAccounting Case 2ayushishahNo ratings yet

- Lori Crump Accounting Case StudyDocument1 pageLori Crump Accounting Case StudyHarsh Anchalia100% (1)

- Case 2-2 Music Mart Balance Sheet 1 OctDocument5 pagesCase 2-2 Music Mart Balance Sheet 1 OctAnubhav Jha100% (3)

- QED Electronics - Problem 3.7Document1 pageQED Electronics - Problem 3.7ivanyongforexNo ratings yet

- Chemallte FinancialsDocument7 pagesChemallte FinancialsTara AkinteweNo ratings yet

- Lone Pine Cafe Balance Sheets Case StudyDocument13 pagesLone Pine Cafe Balance Sheets Case StudyCynthia Anggi Maulina100% (1)

- Solman 12 Second EdDocument23 pagesSolman 12 Second Edferozesheriff50% (2)

- AHM13e Chapter 05 Solution To Problems and Key To CasesDocument21 pagesAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Income Statements 2010Document10 pagesIncome Statements 2010Shivam GoelNo ratings yet

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- Case 11-2 SolutionDocument2 pagesCase 11-2 SolutionArjun PratapNo ratings yet

- Case Report - Grenell FarmDocument5 pagesCase Report - Grenell Farmajsibal100% (1)

- Lone Pine Café FinancialsDocument5 pagesLone Pine Café FinancialsRitu ChhipaNo ratings yet

- Maynard CompanyDocument5 pagesMaynard CompanyNikitha Andrea SaldanhaNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRavina Singh100% (1)

- Case 3.1Document2 pagesCase 3.1Sandeep Agrawal100% (6)

- Case 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalDocument5 pagesCase 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalCyd Marie VictorianoNo ratings yet

- Maynard Company financial analysisDocument1 pageMaynard Company financial analysisTarry Berry75% (4)

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Lone Pine Cafe Case SolutionDocument5 pagesLone Pine Cafe Case SolutionShammika Krishna75% (4)

- Waltham Oil and Lube CentreDocument5 pagesWaltham Oil and Lube CentreAnirudh Singh0% (2)

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- Balance Sheet BasicsDocument20 pagesBalance Sheet BasicsSarbani Mishra0% (1)

- Grennell Farm Balance Sheet AnalysisDocument6 pagesGrennell Farm Balance Sheet AnalysisMichael TorresNo ratings yet

- Marion Boats Assignment 2 LatestDocument2 pagesMarion Boats Assignment 2 LatestRakesh SkaiNo ratings yet

- Maynard Company (A & B)Document9 pagesMaynard Company (A & B)akashnathgarg0% (1)

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Maria HernandezDocument6 pagesMaria Hernandezchtbox1039No ratings yet

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Case1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9Document20 pagesCase1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9amyth_dude_9090100% (2)

- Case 4 2Document5 pagesCase 4 2Marjorie Morada67% (3)

- Case Analysis Rosemont Hill Health Center V3 PDFDocument8 pagesCase Analysis Rosemont Hill Health Center V3 PDFPoorvi SinghalNo ratings yet

- Waltham Oil Lube Centre Inc - FinalDocument10 pagesWaltham Oil Lube Centre Inc - Finalerarun2267% (3)

- Dispensers of CaliforniaDocument4 pagesDispensers of CaliforniaShweta GautamNo ratings yet

- Lone Pine CafeDocument4 pagesLone Pine CafeRahul TiwariNo ratings yet

- Financial Statement Analysis: Amerbran Company (BDocument37 pagesFinancial Statement Analysis: Amerbran Company (BZati Ga'in100% (1)

- Forest City Tennis Club General Ledger and Financial StatementsDocument9 pagesForest City Tennis Club General Ledger and Financial StatementsAhmedNiaz100% (1)

- CASE SUMMARY Waltham Oil and LubesDocument2 pagesCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNo ratings yet

- Waltham Oil and Lube WorkingsDocument5 pagesWaltham Oil and Lube WorkingsGaurav Sahu100% (1)

- Chapter 3 SolutionsDocument8 pagesChapter 3 SolutionsViren DeshpandeNo ratings yet

- AHM13e - Chapter - 06 Solution To Problems and Key To CasesDocument26 pagesAHM13e - Chapter - 06 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Marion Boat - GroupDocument8 pagesMarion Boat - GroupgvermaravNo ratings yet

- Cost of Merchandise Sold $604,783Document5 pagesCost of Merchandise Sold $604,783Fitz Gerald BalbaNo ratings yet

- Music Mart SolutionDocument6 pagesMusic Mart SolutionStranger Sinha50% (2)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- NtbtlogDocument23 pagesNtbtlogOmar CirunayNo ratings yet

- Sodexo Premium Pass Merchant Directory for Luzon RegionDocument3,483 pagesSodexo Premium Pass Merchant Directory for Luzon RegionOmar CirunayNo ratings yet

- Avon - 2.2.3. CP MatrixDocument3 pagesAvon - 2.2.3. CP MatrixOmar CirunayNo ratings yet

- s45 ReliabvalDocument3 pagess45 ReliabvalOmar CirunayNo ratings yet

- SWDocument3 pagesSWocirunay2003No ratings yet

- Avon - 2.3.1. EFE MatrixDocument3 pagesAvon - 2.3.1. EFE MatrixOmar CirunayNo ratings yet

- Finman Group2 Assignment Glen MountDocument4 pagesFinman Group2 Assignment Glen MountOmar CirunayNo ratings yet

- GROUP 2 Exercise 6-8Document1 pageGROUP 2 Exercise 6-8Omar CirunayNo ratings yet

- Poisson Distribution ExamplesDocument2 pagesPoisson Distribution ExamplesEdward KahwaiNo ratings yet

- 2010 Corporate Citizenship Data ElementsDocument2 pages2010 Corporate Citizenship Data ElementsOmar CirunayNo ratings yet

- Grolier BooksDocument4 pagesGrolier BooksOmar CirunayNo ratings yet

- RankingDocument2 pagesRankingOmar CirunayNo ratings yet

- Chapter 1 HWG13Document4 pagesChapter 1 HWG13Omar CirunayNo ratings yet

- Accenture ReportDocument14 pagesAccenture Reportc_crackyNo ratings yet

- Automobile Marketing StrategiesDocument13 pagesAutomobile Marketing StrategiesOmar CirunayNo ratings yet

- Rockstone InternationalDocument2 pagesRockstone InternationalOmar CirunayNo ratings yet

- The Heart of ChangeDocument99 pagesThe Heart of ChangeOmar Cirunay100% (3)

- Chapter 05 1a EocDocument9 pagesChapter 05 1a EocOmar CirunayNo ratings yet

- Cdccont 0900aecd80450b6bDocument2 pagesCdccont 0900aecd80450b6bOmar CirunayNo ratings yet

- Lecture 4. Banks Performance and Financial RatioDocument7 pagesLecture 4. Banks Performance and Financial RatioAruzhan BekbaevaNo ratings yet

- Search Results: Legal and Taxation Issues Concerning E-Commerce - Gopal SaxenaDocument3 pagesSearch Results: Legal and Taxation Issues Concerning E-Commerce - Gopal SaxenaforallNo ratings yet

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Document3 pagesInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiNo ratings yet

- Sample Investment Club Partnership AgreementDocument8 pagesSample Investment Club Partnership AgreementRahman ZuliantoNo ratings yet

- Doctors Hanson Dominick and Borchard Are Radiologists Living in FargoDocument1 pageDoctors Hanson Dominick and Borchard Are Radiologists Living in FargoAmit PandeyNo ratings yet

- 2019 Report on Gov't Salaries and BenefitsDocument1,225 pages2019 Report on Gov't Salaries and BenefitsMark Joseph BajaNo ratings yet

- Subject: Grant of Ad-Hoc Bonus To The State Government Employees and Some Other Categories of Employees For The Year 2019-2020Document3 pagesSubject: Grant of Ad-Hoc Bonus To The State Government Employees and Some Other Categories of Employees For The Year 2019-2020Satyaki Prasad MaitiNo ratings yet

- 8 - GST-8-EXAMPLES - Email BEFORE The SessionDocument2 pages8 - GST-8-EXAMPLES - Email BEFORE The SessionMighty SinghNo ratings yet

- Income Taxation Unit 2 - PreludeDocument8 pagesIncome Taxation Unit 2 - PreludeEllieNo ratings yet

- Airline Revenue Management and e MarketsDocument26 pagesAirline Revenue Management and e MarketsarabianlightNo ratings yet

- Real Estate Finance Midterm SolutionsDocument7 pagesReal Estate Finance Midterm SolutionsJiayu JinNo ratings yet

- AccountsDocument9 pagesAccountssuheb100% (2)

- Tutti Frutti Production ProcessDocument7 pagesTutti Frutti Production ProcessVijay HemwaniNo ratings yet

- HR Prasana Wipro PDFDocument102 pagesHR Prasana Wipro PDFPranjali SilimkarNo ratings yet

- JournalDocument3 pagesJournalAnonymous RPGElS100% (1)

- Basic Instructions For A Simple Balance SheetDocument3 pagesBasic Instructions For A Simple Balance SheetMary100% (8)

- Positive Accounting Theory, Political Costs and Social Disclosure Analyses: A Critical LookDocument23 pagesPositive Accounting Theory, Political Costs and Social Disclosure Analyses: A Critical LookFridRachmanNo ratings yet

- Pag-IBIG Fund Multi Purpose Loan Application SLF001 V03Document2 pagesPag-IBIG Fund Multi Purpose Loan Application SLF001 V03Jazz Adaza67% (3)

- 2017 AfDocument249 pages2017 AfDaniel KwanNo ratings yet

- Payslip 2022 2023 8 10025116 AISATSDocument1 pagePayslip 2022 2023 8 10025116 AISATSAshok Yadav100% (1)

- Measures of Short and Long Term Solvency for Chevron CorpDocument8 pagesMeasures of Short and Long Term Solvency for Chevron CorpAiman Maimunatullail RahimiNo ratings yet

- BLT 101Document14 pagesBLT 101NIMOTHI LASENo ratings yet

- Group Assignment 1Document5 pagesGroup Assignment 1pushmbaNo ratings yet

- 2015 Saln FormDocument4 pages2015 Saln FormSugar Fructose GalactoseNo ratings yet

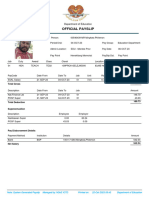

- Official Payslip: Department of EducationDocument1 pageOfficial Payslip: Department of Educationphillmingkwa2017No ratings yet

- Gatchalian vs. Collector 67 Phil 666Document5 pagesGatchalian vs. Collector 67 Phil 666FranzMordenoNo ratings yet

- PEZA PresentationDocument59 pagesPEZA PresentationIsagani DionelaNo ratings yet

- Sfac No 4Document36 pagesSfac No 4Riza Febrian100% (1)

- Chapter 4 Income StatementDocument6 pagesChapter 4 Income StatementRos MiiaaNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)