Professional Documents

Culture Documents

Risk Assessment and Financial Impact Analysis Model

Uploaded by

DaveOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Assessment and Financial Impact Analysis Model

Uploaded by

DaveCopyright:

Available Formats

[Company Name]

Risk Assessment and Financial Impact Model

[Date]

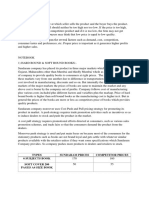

Gray cells are calculated for you. You do not need to enter anything into them.

Number of

Cost per Total annual Probability of Annual

Risk area Potential risk annual Weighted cost Mitigating strategies & controls Cost/benefit Decision summary Owner

incident cost occurrence control cost

incidents

Competitive Contoso, Ltd. might introduce a superior 1.00 $1,850,000 $1,850,000 75.0% $1,387,500 Reduce price by 25% on May 31 to keep the $1,150,000 $237,500 Monitor competitor progress and Kirk

offering on June 30 to compete with our volume stable. implement new strategy if required. DeGrasse

#1 product line.

$0 $0 $0

Economic/political $0 $0 $0

$0 $0 $0

Regulatory/legal Need to meet Sarbanes-Oxley 404 1.00 $15,000,000 $15,000,000 5.0% $750,000 Establish SOX Compliance Office on January $1,200,000 ($450,000) Despite negative cost/benefit, proceed Kim Ralls

(SOX) compliance requirements by 15 to ensure compliance 30 days before with SOX compliance because of the

target date. required date. company's high visibility.

$0 $0 $0

$0 $0 $0

Technological Potential exists for hackers to 5.00 $4,000,000 $20,000,000 10.0% $2,000,000 Upgrade firewall to latest version; install $750,000 $1,250,000 Continue to monitor technology to ensure Carol Philips

compromise internal network and obtain proxy server in Q2. that our company's and our clients'

confidential customer or employee information is protected. Intrusion would

information. have an enormous effect.

$0 $0 $0

$0 $0 $0

Operational If a key parts supplier in Eastern Asia 1.00 $1,250,000 $1,250,000 75.0% $937,500 Partner with alternate suppliers to reduce $937,500 $0 Begin negotiating terms with other key Michiko

suddenly goes out of business, it will risk reliance on dominant supplier. suppliers; take care not to lock into Osada

25% of production. minimum volume agreements.

$0 $0 $0

$0 $0 $0

Financial $0 $0 $0

$0 $0 $0

$0 $0 $0

$0 $0 $0

$0 $0 $0

$0 $0 $0

$0 $0 $0

TOTALS $22,100,000 $38,100,000 $5,075,000 $4,037,500 $1,037,500

Sample—Competitive risk

Scenario: Contoso, Ltd. introduces superior offering in June to compete with our #1 product line.

Units Dollars Annual growth rate

Product X sales—year 1 9 $5,000,000 –

Product X sales—year 2 10 5,500,000 10%

Product X sales—year 3 11 6,000,000 9%

Projected sales—year 4 12 $6,545,455

First half sales weighting 30%

Second half sales weighting 70%

Second half sales at risk $4,581,818

Number of units at risk 8.4

Cost per unit $500,000

Impact with no mitigation

Sales reduction 40% Note: based on market surveys

Reduced number of units sold 5.04

Revised second half product sales $2,749,091

Revenue impact ($1,832,727) Note: round to $1,850,000 for scorecard

Mitigation through price reduction

Unit price reduction required to maintain volume 25% Note: based on market surveys

Number of units at risk 8.40

Revised second half product sales $3,436,364

Revenue impact ($1,145,455) Note: round to $1,150,000 on scorecard

Mitigation of competitive impact with price reduction $687,273

Sample—Operational risk

Scenario: Key materials supplier in East Asia goes out of business, risking 25% of production for Product X.

Expected Product X revenues—2004 $5,000,000

Cost of goods sold

Labor $1,000,000

Materials 2,000,000

Other direct costs 500,000

Total cost of goods sold $3,500,000

Gross margin $1,500,000

Margin contribution percentage 30%

Impact with no mitigation

Reduction in materials availability 25%

Revised product sales $3,750,000

Revenue impact ($1,250,000)

Mitigation through new supplier

Reduction in materials availability 19%

Revised product sales $4,062,500

Revenue impact ($937,500)

Mitigation of impact with other suppliers $312,500

Materials breakdown

% Contribution Amount

At-risk supplier 25% $500,000

All other suppliers 75% 1,500,000

Total materials costs $2,000,000

Ability to mitigate materials loss through other suppliers 25%

You might also like

- Chapter 10 QuestionsDocument5 pagesChapter 10 QuestionsDaveNo ratings yet

- Precious Bible PromisesDocument219 pagesPrecious Bible PromisesDaveNo ratings yet

- Fast Forward MBA - Business CommunicationsDocument175 pagesFast Forward MBA - Business Communicationsapi-27288526100% (1)

- Risk Management-A Balancing ActDocument19 pagesRisk Management-A Balancing ActPillai Sreejith100% (13)

- Operational Risk MGTDocument18 pagesOperational Risk MGTDaveNo ratings yet

- Cost Benefit AnalysisDocument323 pagesCost Benefit AnalysisDave100% (1)

- A Risk Management Standard (AIRMIC IRM 2002)Document17 pagesA Risk Management Standard (AIRMIC IRM 2002)ducuhNo ratings yet

- Risk Management in Commercial BanksDocument43 pagesRisk Management in Commercial BanksDave92% (12)

- Performance MGT OverviewDocument2 pagesPerformance MGT OverviewDaveNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Understanding Forward and Futures MarketsDocument37 pagesUnderstanding Forward and Futures MarketsBenjamin GiustoNo ratings yet

- MANAGING HINDUSTAN UNILEVER STRATEGICALLYDocument8 pagesMANAGING HINDUSTAN UNILEVER STRATEGICALLYSatish Kannaujiya67% (6)

- Barilla SpADocument2 pagesBarilla SpAyyyNo ratings yet

- X Engineering EconomicsDocument39 pagesX Engineering EconomicsMikaellaTeniolaNo ratings yet

- Types Sundaram Prices Competitor Prices 6 Subjects Book Soft Cover 200 Pages A4 Size BookDocument3 pagesTypes Sundaram Prices Competitor Prices 6 Subjects Book Soft Cover 200 Pages A4 Size BookPalak DoshiNo ratings yet

- AFC 2012 Sem 1Document8 pagesAFC 2012 Sem 1Ollie WattsNo ratings yet

- ThroughputDocument15 pagesThroughputVaibhav KocharNo ratings yet

- Chapter 6 - Operations ManagementDocument50 pagesChapter 6 - Operations ManagementDeepak VermaNo ratings yet

- Letters of Credit ExplainedDocument7 pagesLetters of Credit ExplainedGelo MVNo ratings yet

- Neurogym My Exceptional Life BlueprintDocument20 pagesNeurogym My Exceptional Life BlueprintShaun Mayfield100% (2)

- RetailManagerUserGuide PDFDocument322 pagesRetailManagerUserGuide PDFJun Vincent CabangNo ratings yet

- Adidas Term PaperDocument13 pagesAdidas Term PapernadaNo ratings yet

- SMP Respiratory Business Plan AbbottDocument22 pagesSMP Respiratory Business Plan AbbottAgha AliNo ratings yet

- Marketing Strategies of Vishal Mega MartDocument57 pagesMarketing Strategies of Vishal Mega Martsachin1065100% (3)

- Different Types of ChannelsDocument60 pagesDifferent Types of ChannelsSRIRAMA CHANDRANo ratings yet

- Ragan 15e PPT ch03Document20 pagesRagan 15e PPT ch03enigmauNo ratings yet

- Chapter 8 PDFDocument62 pagesChapter 8 PDFgetasewNo ratings yet

- Pivot Reversal: Strategy DescriptionDocument3 pagesPivot Reversal: Strategy Descriptionrahimsajed0% (1)

- Director of Human ResourcesDocument2 pagesDirector of Human Resourcesapi-78760215No ratings yet

- Entrepreneurship Skills: NtroductionDocument28 pagesEntrepreneurship Skills: NtroductionVanshNo ratings yet

- Multiple Choice QuestionsDocument3 pagesMultiple Choice QuestionsAbdii DhufeeraNo ratings yet

- QS09 - Class Exercises SolutionDocument4 pagesQS09 - Class Exercises Solutionlyk0tex100% (1)

- Market Research Assignment 2Document12 pagesMarket Research Assignment 2Vrinda GuptaNo ratings yet

- Supply Chain ManagementDocument21 pagesSupply Chain ManagementMTZANo ratings yet

- B2B Marketing Strategy for IT Solutions ProviderDocument27 pagesB2B Marketing Strategy for IT Solutions ProviderMuneeb Ur-RehmanNo ratings yet

- 5 6208257192076771369 PDFDocument79 pages5 6208257192076771369 PDFsambit kumarNo ratings yet

- CH 05Document68 pagesCH 05Lê JerryNo ratings yet

- PcEx 2Document2 pagesPcEx 2Asad ZamanNo ratings yet

- Case Study Hershey Food CorporationDocument8 pagesCase Study Hershey Food CorporationNimra JawaidNo ratings yet

- Customer Satisfaction On Hyundai CarsDocument49 pagesCustomer Satisfaction On Hyundai CarsVikas BhardwajNo ratings yet