Professional Documents

Culture Documents

Impact of IFRS139 On Sectors

Uploaded by

darionxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of IFRS139 On Sectors

Uploaded by

darionxCopyright:

Available Formats

Malaysia

Market Focus

DBS Group Research . Equity 14 May 2010

KLCI: 1,346.92

ANALYST Goh Yin Foo, CFA, CMT +603 2711 0950 yinfoo@hwangdbsvickers.com.my Malaysia Research Team general@hwangdbsvickers.com.my

FRS in action now

Sneak preview on FRS effects in the Jan Mar quarter

financial reporting season. On show now is FRS 139 with mixed implications chiefly for banks, airlines and exporters. More new accounting standards on the way, which could twist reported earnings by listed companies in sectors like property developers, concessionaires and plantation companies.

Now playing. FRS 139 Financial Instruments: Recognition and Measurement is one new accounting standard (effective on 1 Jan 10) that would be heard more often when Malaysia corporate announce their Jan Mar quarterly financial results between now and end-May. In essence, under FRS 139, the recognition and measurement of financial assets, financial liabilities and derivative contracts based on fair value accounting could distort the earnings profiles either way for companies such as banks, airlines and exporters. Next change. More changes from new accounting treatments are in the pipeline. IFRIC 12 Service Concession Arrangements may alter the earnings stream of toll concessionaires while IFRIC 15 Agreement for the Construction of Real Estate will lead to lumpy profit recognitions by property development companies. Both standards are slated for implementation commencing from 1 Jul 10 onwards. Earnings on the swing. Expect to read increasingly volatile earnings to be reported by Malaysian entities going forward. Against this backdrop, investors should focus on core profit patterns in their valuation analysis of listed companies. In terms of best stock picks in the Malaysian market, our top two choices for large caps are Maybank and RHB Capital while we like IJM Corporation and MRCB in the small-mid cap category.

Recipients of this report, received from DBS Vickers Research (Singapore) Pte Ltd (DBSVR), are to contact DBSVR at +65 6398 7954 in respect of any matters arising from or in connection with this report.

Key Indices FBMKLCI FBMEmas FBM100 Daily Volume (m shrs) Daily Turnover (RMm) Daily Turnover (US$m) Current 1,347 9,055 8,817 906 1,006 315 % Chng 0.2 0.3 0.3

Market Key Data (%) 2008A 2009F 2010F (x) 2008A 2009F 2010F Stock Picks Large Cap Maybank RHB Capital

EPS Gth -4.8 17.5 12.6 PER 19.1 16.2 14.4 Price (RM) 13/5 7.72 6.12

Div Yield 3.0 2.7 2.9 EV/EBITDA 9.6 8.5 7.8 Target Price 9.10 7.30

Stock Picks Small-mid Cap IJM Corp MRCB Jobstreet Price (RM) 13/5 4.90 1.55 2.01 Target Price 6.00 2.25 3.20

In Singapore, this research report or research analyses may only be distributed to Institutional Investors, Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore. www.dbsvickers.com Refer to important disclosures at the end of this report ed-MY/ sa- WMT

Market Focus FRS in action now

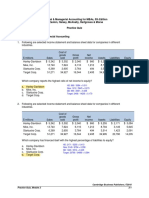

Highlights FRS background. Malaysia which started adopting the Financial Reporting Standards (FRS) in Jan 06 is on track to be in full convergence with the International Financial Reporting Standards (IFRS) by the 1 Jan 2012 deadline. Under a gradual implementation approach, 19 FRS has come into effect since 1 Jan 10 while 19 more would be adopted within the next 1 years. Appendix 1 shows an updated timeline of FRS adoption by Malaysian listed companies. Briefly, the overriding purpose of the FRS is to offer users a set of financial statements that are comparable and consistent with international common practice. The new standards essentially call for a greater application of fair value accounting with a Figure 1: Major FRS effects

Standard Sector(s) potentially affected

bigger scope of coverage, while enhancing disclosure levels at the same time. A deeper and wider research on the FRS implications was first presented in our report Raising the accounting bar dated 27 Aug 09. For easy reference, the highlights of the major FRS have been summarized and reproduced in Appendix 2 at the back of this write-up. Watch out for 8 standards. In our previous report, we picked eight FRS that could be of interest to investors, in terms of their potential impact on income statement and balance sheet of listed companies. A summary of the probable accounting implications on the individual sectors is captured in Figure 1.

Probable accounting implications

FRS 139 IFRIC 12 IFRIC 15 FRS 141 IFRIC 4 IFRIC 13 FRS 7 FRS 8

Banks Airlines, exporters, plantation companies, conglomerates Concessionaries like toll road operators Property developers Plantation companies Power utilities (including IPPs) Retail consumer operators All companies All companies

(Slight) positive earnings impact for banks upon initial adoption. Greater volatility in reported earnings for the rest. NTA could see a big bang. Earnings stream could be distorted. Profit recognition will be lumpy. Greater volatility in reported earnings. Balance sheet items may be reshuffled. Marginally lower revenue recognition initially. Better transparency. Better transparency.

Source: MASB website, HDBSVR

Page 2

Market Focus FRS in action now

I. FRS139 Financial Instruments: Recognition and Measurement (effective on 1 Jan 10)

came into effect on 1 Jan 10 despite initial skepticism that it could be deferred. In essence, FRS 139 spells out the accounting principles for: (a) recognizing and measuring financial instruments; and (b) the application of hedge accounting.

FRS 139 kicks off. A central and complex standard in the FRS

series with linkages to many other standards and interpretations encompassing virtually all companies, FRS 139

Figure 2: Categories of financial instruments under FRS 139

Financial Assets Financial Liabilities

- Financial assets at fair value through profit & loss (include derivatives) - Held-to-maturity investments (amortised cost) - Loans and receivables (amortised cost) - Available-for-sale financial assets (fair value through equity)

- Financial liabilities at fair value through profit & loss (include derivatives) - Other financial liabilities (amortised cost) - Financial guarantee contracts - Commitments to provide loans at below-market interest rates

Source: MASB website, HDBSVR

Impact on banks. Malaysian banks have already been

recognizing and measuring their financial assets and financial liabilities (according to the classifications in Figure 2 above) under Bank Negara Malaysia (BNM)s guidelines. However, there would be potential implications arising from two additional rules under FRS 139.

micro financing services is expected to see slightly lower interest income recognition in the initial years on account of the methodology change (see our Company Focus report dated 12 Apr 10 for more details); and

(ii) The assessment of loan impairment loss. In assessing

impairment of financial assets (such as loans, receivables and advances), the banks would evaluate at the end of each balance sheet date whether there is any objective evidence that a loan (or group of loans) is impaired. Impairment allowances would be made on loans/receivables/advances when there is objective evidence of impairment as a result of the occurrence of certain loss events after the initial recognition of the loans/receivables/advances, and these loss events would have an impact on the estimated future cash flows. (This also means that general provisioning would eventually not be allowed). Impairment test would first be carried out individually for loans/receivables/advances which are individually significant and collectively for loans/receivables/ advances which are not individually significant. In the case that no objective evidence of impairment exists for an individually assessed loan, it would then be included in a group of loans with similar credit risk characteristics and collectively assessed for impairment. In the event that an impairment loss has been incurred, the amount of loss which is measured as the difference between the carrying amount of the loans/receivables/advances and the present value of the estimated cash flows is to be recognized in the income statement.

The use of effective interest method to compute interest income and interest expense. It involves calculating the

(i) amortised cost of a financial asset or liability, and allocating the interest income or interest expense over the relevant period. The effective interest rate (EIR) would be the rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial instrument. This effective interest rate would be applied to measure the amount of interest income to be recognized, as opposed to the existing accounting practice of recognizing interest income based on contractual interest rates or sum-of-digit (SOD) method. Adoption of this standard would result in an accounting adjustment in the balance sheet. Like in the case of Public Bank, the Group restated the opening balance of its retained profits by adding RM274.1m as at 1 Jan 10. In addition, there was a write-back of interest-in-suspense of RM68.7m to the opening retained profits following the FRS 139 implementation (as interest on a loan written down for impairment loss is to be recognized using the EIR instead of on a cash basis). One other example is AEON Credit Services Malaysia. After the switchover from the SOD to EIR method, this provider of

Page 3

Market Focus FRS in action now

Additionally, as a transitional arrangement, Bank Negara Malaysia (BNM) has prescribed an alternative basis for collective assessment of impairment by banking institutions, whereby banks are required to maintain collective assessment impairment allowances of at least 1.5% of total outstanding loans/financing, net of individual impairment allowances. (A lower collective assessment impairment allowance is allowed subject to BNMs approval). The actual impact on banks upon the adoption of the loans impairment basis under FRS 139 and BNMs transitional arrangements whereby adjustments to the carrying values of financial assets would be made to opening retained profits would depend on factors like the historical profiles of loans portfolios in the individual banks. For example, given the healthy asset quality in its books, Public Bank disclosed in its Jan Mar 10 quarter announcement that it had: (a) written back general allowance of RM2.1b and specific allowance of RM223.0m against opening retained profits as at 1 Jan 10; and (b) recognized opening collective assessment allowance of RM2.0b and opening individual assessment allowance of RM233.7m against opening retained profits as at 1 Jan 10.

measure derivative contracts. These would be captured and marked-to-market at each balance sheet date, with their fair value changes reflected either in the income statement or equity in the balance sheet, instead of being treated as off balance sheet items like in the past. Derivatives are carried as assets when fair value is positive and as liabilities when fair value is negative. To qualify for hedge accounting, the hedge must relate to a specific, identifiable and designated risk, and must ultimately affect the entity's profit or loss. Hedge accounting will recognize the offsetting effects on profit or loss of changes in the fair values of the hedging instrument and the hedged item. (Derivatives that do not qualify for hedge accounting are classified at fair value through profit and loss with any gains or losses arising from changes in fair value being recognized in the income statement). In particular, the impact of hedge accounting will hinge on the type of hedging relationships and how effective the hedge is, which will in turn determine the eventual accounting treatments to be applied in recognizing gains or losses either in the income statement or in equity. A summary of the accounting rules is found in Figure 3.

Wide implications from hedge accounting. FRS 139 would

also require all companies (including banks) to recognize and Figure 3: Accounting treatment for hedge accounting

Type of hedging relationship Treatment

- Fair value hedge - Cash flow hedge

Gain or loss from remeasuring the hedging instrument at fair value to be recognised in profit or loss. Gain or loss on the hedged item attributable to the hedged risk to be recognised in profit or loss. The portion of the gain or loss on the hedging instrument that is determined to be an effective hedge to be recognised directly in equity. Amounts taken to equity are transferred to income statement when the hedged transaction affects profit or loss. The ineffective portion of the gain or loss on the hedging instrument to be recognised in profit or loss. The portion of the gain or loss on the hedging instrument that is determined to be an effective hedge shall be recognised directly in equity. The ineffective portion to be recognised in profit or loss.

- Hedge of a net investment in a foreign operation

Source: MASB website, HDBSVR

For companies that use derivatives like fuel hedging contracts, foreign currency hedging contracts, interest rate hedging contracts as a risk management tool to mitigate and manage their operating and financial risks, hedge accounting (under the cash flow hedge relationship in Figure 3) would apply. This could then result in these entities announcing distorted reported earnings from quarter to quarter. Consider Malaysian Airline System (MAS). The airline company booked in a derivative gain of RM581.7m in the Oct Dec 09 quarter (a reversal from a derivative loss of RM202.1m in the

preceding quarter). In the notes to accounts, it disclosed that it made: (a) a net gain from fuel hedging contracts (consist of realized gain/loss on settlement of hedging contracts and fair value changes due to movement in mark-to-market position on outstanding hedging contracts) amounting to RM587.0m; (b) a loss from foreign currency hedging contracts of RM7.4m; and (c) a gain from interest rate hedging contracts of RM2.1m. Hedge accounting effects should also be felt by exporters such as semiconductor manufacturers and glove makers. However, our feedback suggests that the actual impact on

Page 4

Market Focus FRS in action now

their bottomline would probably be minimal given the relatively small exposure and short lifespan of their derivative contracts at any given point in time. In a nutshell, the adoption of FRS 139 would generally lead to greater earnings volatility going forward. II. IFRIC 12 Service Concession Arrangements (effective 1 July 2010)

that it constructs or upgrades. This is because a right to charge users of the public service is not an unconditional right to receive cash since the amounts depend on the extent that the public uses the service. If so, then this right will be treated as an intangible asset and amortised in accordance with FRS 138 Intangible Assets; or (b) A financial asset, if it represents an unconditional contractual right to receive cash or other financial asset from the government (the grantor). In which case, this right will be treated as a receivable (or another category of financial asset) under FRS 139; or (c) A combination of both provided the consideration amount is separately identifiable. If so, then concessionaires would have to reclassify the infrastructure asset from PPE to either intangible asset or financial asset. From an accounting perspective, the effect could eat into or even wipe out the net tangible assets (NTA) of the concessionaires, depending on the value of the infrastructure assets. For example, based on the latest accounts of the two toll operators under our coverage, the carrying value of concession assets (RM12.4b for Plus and RM1.5b for Litrak) are actually more than their NTA (of RM6.1b for Plus and RM0.4b for Litrak). Nevertheless, as investors increasingly focus more on net assets (rather than NTA) in the balance sheet, any reclassification effect may be of academic interest only.

Work in progress. When we published our previous write-up

back in Aug last year, we said that private operators that have signed service concession agreements with the public sector being the entities that would see accounting changes under IFRIC 12 were still in discussion with the relevant authorities on this accounting standard. Since then, we have seen little progress, while the effective date for its implementation has been delayed from 1 Jan 10 initially to 1 Jul 10 now. To recap, IFRIC 12 would cover service providers with concession arrangements where the grantor (i.e. the government) sets and controls the regulations (the service to be provided, to whom, at what price) and controls / owns the infrastructure at the end of the period. These concessionaires who would initially construct or upgrade the infrastructure to provide a public service and thereafter operates / maintains the infrastructure for a specified period of time could see two effects from this accounting standard. Likely listed companies that would fall inside the scope of this standard include Plus and Litrak.

Amortization effect. Second, there could be a change on how

the operators would account for amortization costs relating to the concession rights. Under IFRIC 12, the present practice of amortization using revenue method (with adjustments for inflation) would be disallowed. Instead, only the straight line amortization or volume method would be permitted. The accounting policy change could force concessionaires to book in lower profits (or even losses) in the initial periods because of higher amortization charge (see illustration in Figure 4 for calculation and Figure 5 for potential earnings impact for Plus and Litrak). Yet, a worthy consideration to keep in mind is that there would be no impact on their cash flow streams.

Reclassification effect. First, the concessionaires should not

recognize the infrastructure as property, plant and equipment (PPE) in their books (which is the current accounting practice). This is because the contractual service arrangement does not convey the right to control the use of the public service infrastructure to the operator. Instead, the nature of the consideration received or receivable in return for constructing or upgrading the public sector asset will determine the appropriate accounting treatment. IFRIC 12 says that the infrastructure shall be recognized as: (a) An intangible asset, if the arrangement is no more than a right (a licence) to charge for the use of the public sector asset

Page 5

Market Focus FRS in action now

Figure 4: Illustration of earnings impact due to a change in amortisation method

Assume a 7-year concession and constant volume.

Yr1 Volume Rev (incl. rate increases) Expenses Finance cost Profits Rev (incl. rate increases) Expenses Finance cost Profits 3 30 (21) (7) 2 30 (43) (7) (20) Yr2 3 40 (28) (6) 6 40 (43) (6) (9) Yr3 3 50 (36) (5) 9 50 (43) (5) 2 Yr4 3 60 (43) (4) 13 60 (43) (4) 13 Yr5 3 70 (50) (3) 17 70 (43) (3) 24 Yr6 3 80 (57) (2) 21 80 (43) (2) 35 Yr7 3 90 (65) (1) 24 90 (42) (1) 47 Total 21 420 (300) (28) 92 420 (300) (28) 92

Amortisation using revenue (with inflationary increases)

Amortisation using revenue (without inflationary increases)

Source: PricewaterhouseCoopers

Figure 5: Potential impact on concessionaires arising from IFRIC 12

Company Impact on first full-year earnings (RMm) If amortise using revenue (with inflationary increases) method If amortise using revenue (without inflationary increases) method % chg from base case earnings forecast

Plus Litrak

RM1,481m RM82m

RM1,379m RM69m

(7%) (16%)

Source: Company financial statements, HDBSVR

III. IFRIC 15 Agreements for the Construction of Real Estate (effective 1 Jul 2010)

In view of the volatile profit streams, investors will employ the P/RNAV method (rather than the P/E way) as a valuation tool for listed property companies ahead. IV. FRS 141 Agriculture (implementation date not fixed yet)

Property earnings will take a ride. We understand from

industry sources that although talks are still going on, property development companies could be adopting IFRIC 15 with effect from 1 Jul 10. Recall that under this standard, property developers should recognize revenue only when the real estate is completed and delivered to the buyer (versus the percentage of completion method currently). Prior to completion, they will account for costs incurred and progress billings received that had been accumulated during the construction period as asset and liability on the balance sheet, respectively. This will be the accounting treatment if a buyer has limited influence on the design of the property (which means it does not meet the definition of a construction contract) and the developer who has a contractual obligation to provide services (together with construction materials) to hand over the property will only transfer to the buyer control and the significant risks and rewards of ownership of the real estate in its entirety upon completion or delivery.

Pending implementation. No effective date has been set yet since our last report on the adoption of FRS 141. This standard essentially requires an entity to recognize and measure biological growth using current fair values by reporting changes in fair value throughout the period from planting to harvest. Its application covering biological assets, agricultural produce at the point of harvest and government grants will be adopted by entities in the plantation, timber, livestock and aquaculture sectors. Expect volatility. By capturing the change in fair value less

estimated point-of-sale costs of a biological asset and agriculture produce in the profit or loss account for the period in which it arises, reported earnings for these companies can be more volatile. As a consequence, investors may also increasingly use valuation methodologies such as discounted cash flows or adjusted P/E ratio (based on core earnings rather than reported profits) when analyzing plantation companies.

A shift in valuation approach. As a majority of the Malaysian

property developers practice the sell-and-build business model, their earnings pattern could be lumpy and bumpy upon the implementation of IFRIC 15, with the actual impact depending on the timing of completion of their portfolio of property projects.

Page 6

Market Focus FRS in action now

V.

IFRIC 4 Determining whether an Arrangement Contains a Lease (effective 1 Jan 2011)

VII. FRS 7 Financial Instruments: Disclosures (effective on 1 Jan 2010)

IFRIC 4 on the way. Pending implementation too is IFRIC 4, which seeks to provide guidance on whether an arrangement between businesses (that does not take the legal form of a lease) contains a lease. It will be considered so if the arrangement depends on the use of a specific asset and conveys a right to control the use of that asset. That being the case, the arrangement should then be accounted for in accordance with FRS 117 Leases.

An interesting insight. It will be interesting to check out the

financial statements to be released by listed companies with Dec financial year-end as they would have adopted FRS 7. Promising to show more transparency with enhanced disclosure requirements, the new standard would offer insights into the financial risk and capital management of a company. Essentially, entities will be required to reveal the extent of risk exposures in various financial instruments and how they manage these risk factors, by providing qualitative and quantitative information (such as aging and sensitivity analysis) on liquidity, credit, exchange rates and other price risks. With more information made available for a deeper analysis, investors hopefully would be in a better position to detect early signs of companies slipping into financial troubles or gauge their exposures to currency / interest rate movements. VIII. FRS 8 Operating Segments (effective 1 Jul 2009)

Will IPPs fall under the scope of IFRIC 4? Based on the above broad guidelines, entities that are required to adopt IFRIC 4 could include the independent power producers (IPPs). Under the power purchase agreements or PPAs, the arrangement is such that the IPPs would depend on the use of a specific fixed asset (i.e. the power generation plant) to service a particular customer (in this case Tenaga), which has a right to control the use of that asset.

If so, then the IPPs as the lessors may be asked to reclassify their power generation assets from PPE to lease receivables (at an amount equal to the present value of the minimum lease payment). As for Tenaga, the Group would be required to carry the IPPs power assets as PPE in their books (if it is considered a finance lease). The reshuffling of accounting items will, in turn, alter the computation of financial ratios like return on assets. VI. IFRIC 13 Customer Loyalty Programmes (effective 1 Jan 2010)

Analyzing FRS 8. Still, it remains to be seen how much

additional disclosures under FRS 7 that would come out in the open. This is based on our experience after scrutinizing a sample of listed companies accounts that are supposed to be in compliance with FRS 8, which came into effect on 1 Jul 09. Briefly, FRS 8 requires entities to prepare and present financial statements using segment reporting from the managements perspective. Yet, there are still companies that continue to show no breakdown in the segmental performance analysis, even after stating that they have adopted FRS 8 already. On the positive side, among the companies that made more disclosures include Parkson Holdings. Beginning from the Jul Sep 09 quarter, the retail group started to provide a geographical split of revenue and operating profit by country, showing the contributions from Malaysia, China and Vietnam. Focus remains on underlying financials. It will naturally take time for investors to get used to the slew of changes in accounting treatments under the FRS regime. While financial projections would be harder to make in view of the presence of lumpy accounting items, investors are expected to focus on the trend of core operating earnings and cash flow streams (as well as their implications on valuation models). Our best bets for Malaysian equities exposure are: (a) big caps, namely Maybank (TP RM9.10) and RHB Capital (TP RM7.30); and (b) small-mid caps like IJM Corporation (TP RM6.00) and MRCB (TP RM2.25)

Accounting for incentive plans. For businesses with customer

loyalty programmes, IFRIC 13 which took effect on 1 Jan 10 dictates that they would not be allowed to book the entire amount of sales transacted as per the existing accounting practice (and treat the award credits as marketing cost). Under this standard, they must segregate revenue into current sales transactions and future sales. Future sales will be classified as deferred revenue, which will then be reversed out and recognized as revenue when those loyalty points are redeemed eventually. Many companies across the sectors would be required to adjust to this new accounting treatment, although the actual impact is not likely to be significant. One case example is MAS, which stated in its Oct Dec 09 quarter results that the impact from the adoption of IFRIC 13 which was applied retrospectively was an estimated decrease of RM60m to retained earnings.

Page 7

Market Focus FRS in action now

Appendix 1: Proposed calendar of adoption of IFRS (as at 6 May 2010)

Standards/Interpretations IASB effective date Proposed effective date in Malaysia Status

1 January 2010 / 1 March 2010

1 2 3 4 5 6 7 8 9 10 IAS 39 Financial Instruments: Recognition and Measurement IFRS 7 Financial Instruments: Disclosures IFRS 4 Insurance Contracts IFRIC Interpretation 9 Reassessment of Embedded Derivatives IFRIC Interpretation 10 Interim Financial Reporting and Impairment IAS 23 Borrowing Costs (revised) Amendment to IFRS 2 Share-based PaymentVesting Conditions and Cancellations IFRIC Interpretation 11 IFRS 2 - Group and Treasury Share Transactions IFRIC Interpretation 13 Customer Loyalty Programmes IFRIC Interpretation 14 FRS 119 - The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction 11 12 IAS 1 Presentation of Financial Statements (revised) Amendments to IFRS 1 and IAS 27 Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate 13 14 Improvements to IFRSs (2008) Amendments to IAS 32 and IAS 1: Puttable Financial Instruments and Obligations arising on Liquidation 15 16 17 18 19 Amendments to IAS 39: Eligible Hedged Items Amendments to IAS 39 and IFRS 7: Reclassification of Financial Assets Amendments to IFRIC 9 and IAS 39 Embedded Derivatives Improvements to IFRS (2009) Amendment to IAS 32: Classification of Rights Issue 1 July 2009 / 1 January 2010 1 February 2010 1 March 2010 1 January 2010 30 June 2009 1 January 2010 1 July 2009 1 July 2008 1 January 2010 1 January 2010 Issued as Amendments to FRS 139, FRS 7 and IC Interpretation 9 in September 2009 Issued as Amendments to FRS 139, FRS 7 and IC Interpretation 9 in September 2009 Issued as Amendments to FRS 139, FRS 7 and IC Interpretation 9 in September 2009 Issued as Improvements to FRSs (2009) In September 2009 Issued as Amendments to FRS 132 in March 2010 1 January 2009 1 January 2009 1 January 2010 1 January 2010 Issued as Improvements to FRSs (2009) in September 2009 Issued as Amendments to FRS 132 in September 2009 1 January 2009 1 January 2010 1 January 2009 1 January 2010 Issued as FRS 101 (revised) in September 2009 Issued as Amendments to FRS 1 and FRS 127 in May 2009 1 January 2008 1 January 2010 Issued as IC Interpretation 14 in May 2009 1 July 2008 1 January 2010 Issued as IC Interpretation 13 in May 2009 1 March 2007 1 January 2010 1 January 2009 1 January 2009 1 January 2010 1 January 2010 1 November 2006 1 January 2010 1 January 2007 1 January 2005 1 June 2006 1 January 2010 1 January 2010 1 January 2010 Issued as FRS 7 in November 2008 Issued as FRS 4 in November 2008 Issued as IC Interpretation 9 in November 2008 Issued as IC Interpretation 10 in November 2008 Issued as FRS 123 in May 2009 Issued as Amendment to FRS 2 in May 2009 Issued as IC Interpretation 11 in May 2009 1 January 2005 1 January 2010 Issued as FRS 139 in February 2006

1 July 2010

20 21 IFRIC Interpretation 12 Service Concession Arrangements IFRS 3 Business Combinations (revised) 1 July 2009 1 July 2010 1 January 2008 1 July 2010 Issued as IC Interpretation 12 in January 2010 Issued as FRS 3 in January 2010

Page 8

Market Focus FRS in action now

Appendix 1: Proposed calendar of adoption of IFRS (continued)

Standards/Interpretations IASB effective date Proposed effective date in Malaysia Status

1 July 2010

22 23 24 25 26 IAS 27 Consolidated and Separate Financial Statements IFRS 1 First-time Adoption of IFRS (revised) IFRIC Interpretation 15 Agreements for the Construction of Real Estate IFRIC Interpretation 16 Hedges of a Net Investment in a Foreign Operation IFRIC Interpretation 17 Distributions of Noncash Assets to Owners 1 July 2009 1 July 2010 1 October 2008 1 July 2010 1 January 2009 1 January 2009 1 July 2010 1 July 2010 Issued as FRS 1 in January 2010 Issued as IC Interpretation 15 in January 2010 Issued as IC Interpretation 16 in January 2010 Issued as IC Interpretation 17 in January 2010 1 July 2009 1 July 2010 Issued as FRS 127 in January 2010

1 January 2011

27 28 29 30 31 32 Amendments to IFRS 7 Improving Disclosures about Financial Instruments IFRIC Interpretation 4 Determining whether an Arrangement Contains a Lease IFRIC Interpretation 18 Transfers of Assets from Customers Amendments to IFRS 2: Group Cash-settled Share-based Payment Transactions Amendments to IFRS 1: Additional Exemptions For First-time Adopters Limited Exemption from Comparative IFRS 7 Disclosures for First-time Adopters (Amendment to IFRS 1) 1 July 2010 1 January 2011 Issued as Limited Exemption from Comparative FRS 7 Disclosures for First-time Adopters (Amendment to FRS 1) in March 2010 1 January 2010 1 January 2011 Issued as MASB ED 71 in January 2010 1 January 2010 1 January 2011 1 July 2009 1 January 2011 1 January 2006 1 January 2011 1 July 2009 1 January 2011 Issued as Amendments to FRS 7 in March 2010 Issued as [draft] IC Interpretation 4 in October 2009 Issued as [draft] IC Interpretation 18 in October 2009 Issued as MASB ED 68 in November 2009

1 July 2011

33 34 IAS 24 Related Party Disclosures (revised) Amendments to IFRIC 14: Prepayments of a Minimum Funding Requirement 35 IFRIC 19 Extinguishing Financial Liabilities With Equity Instruments 1 July 2010 1 July 2011 1 January 2011 1 January 2011 1 July 2011 1 July 2011 Work in progress. The staff plans to expose IAS 24 (revised) in Q2 of 2010 Work in progress. The staff plans to expose Amendments to IFRIC 14 in Q2 of 2010 Work in progress. The staff plans to expose IFRIC 19 in Q2 of 2010

1 January 2012

36 Improvements to IFRSs (2010) 1 January 2011 1 January 2012 Work in progress. The staff plans to expose Improvements to IFRSs in Q4 of 2010

To Be Announced

37 38 IAS 41 Agriculture IFRS 9 Financial Instruments 1 January 2003 1 January 2013 Issued as MASB ED 50 in January 2006 Issued as MASB ED 69 in December 2009

Note: Some standards still at the exposure draft stage and being revised at the international level are currently known as IFRS and IAS at the moment. In our report, we used FRS as the standard name in Malaysia for consistency. IFRIC, which stands for International Financial Reporting Interpretation Committee, refers to the interpretation of standards (under the FRS framework) in more specific situations. Source: MASB website

Page 9

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted

Highlight(s) FRS 7 Financial Instruments: Disclosures Requires entities to provide disclosures in their financial statements that enable users to evaluate: (a) the significance of financial instruments for the entitys financial position and performance; and (b) the nature and extent of risks arising from financial instruments to which the entity is exposed during the period and at the reporting date, and how the entity manages those risks. These risks typically include, but are not limited to, credit risk, liquidity risk and market risk. Implication(s) on Sector(s) Allows users of financial statements to assess the risk exposure and risk management strategies of companies. The information revealed may trigger early alarm bells if the risk levels are deemed to be excessive.

Applies to all entities, including entities that have few financial instruments (e.g. a manufacturer whose only financial instruments are accounts receivable and accounts payable) and those that have many financial instruments (e.g. a financial institution, most of whose assets and liabilities are financial instruments). The carrying amounts of each of the categories of financial assets and financial liabilities, as defined in FRS 139, shall be disclosed either on the face of the balance sheet or in the notes. An entity shall disclose: (a) the carrying amount of financial assets it has pledged as collateral for liabilities or contingent liabilities; and (b) the terms and conditions relating to its pledge. For loans payable recognised at the reporting date, an entity shall disclose: (a) details of any defaults during the period of principal, interest, sinking fund, or redemption terms of those loans payable; (b) the carrying amount of the loans payable in default at the reporting date; and (c) whether the default was remedied, or the terms of the loans payable were renegotiated, before the financial statements were authorised for issue. If, during the period, there were breaches of loan agreement terms other than those described in the above paragraph, an entity shall disclose the same information as required if those breaches permitted the lender to demand accelerated repayment (unless the breaches were remedied, or the terms of the loan were renegotiated, on or before the reporting date). An entity shall disclose the following items of income, expense, gains or losses either on the face of the financial statements or in the notes: (a) net gains or net losses on: (i) financial assets or financial liabilities at fair value through profit or loss, showing separately those on financial assets or financial liabilities designated as such upon initial recognition, and those on financial assets or financial liabilities that are classified as held for trading in accordance with FRS 139; (ii) available-for-sale financial assets, showing separately the amount of gain or loss recognised directly in equity during the period and the amount removed from equity and recognised in profit or loss for the period; (iii) held-to-maturity investments; (iv) loans and receivables; and (v) financial liabilities measured at amortised cost; (b) total interest income and total interest expense (calculated using the effective interest method) for financial assets or financial liabilities that are not at fair value through profit or loss; (c) fee income and expense (other than amounts included in determining the effective interest rate) arising from: (i) financial assets or financial liabilities that are not at fair value through profit or loss; and (ii) trust and other fiduciary activities that result in the holding or investing of assets on behalf of individuals, trusts, retirement benefit plans, and other institutions; (d) interest income on impaired financial assets accrued in accordance with FRS 139; and (e) the amount of any impairment loss for each class of financial asset. An entity shall disclose the following separately for each type of hedge described in FRS 139 (i.e. fair value hedges, cash flow hedges, and hedges of net investments in foreign operations). An entity shall disclose separately: (a) in fair value hedges, gains or losses: (i) on the hedging instrument and (ii) on the hedged item attributable to the hedged risk; (b) the ineffectiveness recognised in profit or loss that arises from cash flow hedges; and (c) the ineffectiveness recognised in profit or loss that arises from hedges of net investments in foreign operations. For each class of financial assets and financial liabilities, an entity shall disclose the fair value of that class of assets and liabilities in a way that permits it to be compared with its carrying amount. Disclosures of fair value are not required: (a) when the carrying amount is a reasonable approximation of fair value, for example, for financial instruments such as short-term trade receivables and payables; (b) for an investment in equity instruments that do not have a quoted market price in an active market, or derivatives linked to such equity instruments, that is measured at cost in accordance with FRS 139 because its fair value cannot be measured reliably; or (c) for a contract containing a discretionary participation feature (as described in FRS 4) if the fair value of that feature cannot be measured reliably. As FRS 7 is closely linked to FRS 139, an entity shall not apply this Standard for annual periods beginning before 1 January 2010 unless it also applies FRS 139. FRS 7 is to be viewed together with FRS 139. More transparency in the accounts.

Page 10

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted (continued)

Highlight(s) FRS 8 Operating Segments An entity shall disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates. Sets out requirements for disclosure of information about an entitys operating segments and also about the entitys products and services, the geographical areas in which it operates, and its major customers. Specifies how an entity should report information about its operating segments in annual financial statements and requires an entity to report selected information about its operating segments in interim financial reports. An operating segment is a component of an entity: (a) that engages in business activities from which it may earn revenues and incur expenses; (b) whose operating results are regularly reviewed by the entitys chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance; and (c) for which discrete financial information is available. Requires an entity to report a measure of operating segment profit or loss and of segment assets. It also requires an entity to report a measure of segment liabilities and particular income and expense items if such measures are regularly provided to the chief operating decision maker. It requires reconciliations of total reportable segment revenues, total profit or loss, total assets, liabilities and other amounts disclosed for reportable segments to corresponding amounts in the entitys financial statements. An entity shall report separately information about an operating segment that meets any of the following quantitative thresholds: (a) Its reported revenue, including both sales to external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments; (b) The absolute amount of its reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss; and (c) Its assets are 10 per cent or more of the combined assets of all operating segments. If the total external revenue reported by operating segments constitutes less than 75 per cent of the entitys revenue, additional operating segments shall be identified as reportable segments until at least 75 per cent of the entitys revenue is included in reportable segments. Information about other business activities and operating segments that are not reportable shall be combined and disclosed in an all other segments category separately from other reconciling items. An entity shall provide information about the extent of its reliance on its major customers. If revenues from transactions with a single external customer amount to 10 per cent or more of an entitys revenues, the entity shall disclose that fact, the total amount of revenues from each such customer, and the identity of the segment or segments reporting the revenues. FRS 101 Presentation of Financial Statements (revised) Sets overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. The changes made are to require information in financial statements to be aggregated on the basis of shared characteristics and to introduce a statement of comprehensive income. The revisions include changes in the titles of some of the financial statements to reflect their function more clearly. A complete set of financial statements comprises: (a) statement of financial position (previously balance sheet); (b) statement of comprehensive income; (c) statement of changes in equity; and (d) statement of cash flows (previously cash flow statement). The new titles will be used in accounting standards, but are not mandatory for use in financial statements. Requires an entity to present a statement of financial position as at the beginning of the earliest comparative period in a complete set of financial statements when the entity applies an accounting policy retrospectively or makes a retrospective restatement, or when the entity reclassifies items in the financial statements. Therefore, in addition to notes, an entity would be required to present three statements of financial position and two of each of the other statements. Requires entities to present all changes in equity arising from transactions with owners in their capacity as owners (i.e. owner changes in equity) such as dividends and share repurchases separately from other changes in equity (i.e. non-owner changes in equity or comprehensive income) such as transactions with third parties. Enhanced comparability. Provides an indication on customer profile. Provides an insight into segment reporting through the eyes of management. Implication(s) on Sector(s) More transparency in the accounts for investors to make better informed decisions. Information is made available for segmental analysis.

Page 11

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted (continued)

Highlight(s) Non-owner changes in equity would be presented in either: (a) a single statement of comprehensive income; or (b) two statements: a statement displaying components of profit or loss (separate income statement) and a second statement beginning with profit or loss and displaying components of other comprehensive income (statement of comprehensive income). Examples of components of other comprehensive income include: (a) changes in revaluation surplus; (b) actuarial gains and losses on defined benefit plans recognised; (c) gains and losses arising from translating the financial statements of a foreign operation; (d) gains and losses on remeasuring available-for-sale financial assets; (e) the effective portion of gains and losses on hedging instruments in a cash flow hedge. Requires an entity to disclose reclassification adjustments and income tax relating to each component of other comprehensive income. Reclassification adjustments are the amounts reclassified to profit or loss in the current period that were previously recognised in other comprehensive income. Requires the presentation of dividends recognised as distributions to owners and related amounts per share in the statement of changes in equity or in the notes. The presentation of such disclosures in the statement of comprehensive income is not permitted anymore. The purpose is to ensure that owner changes in equity (in this case, distributions to owners in the form of dividends) are presented separately from non-owner changes in equity (presented in the statement of comprehensive income). Dividends are distributions to owners in their capacity as owners and the statement of changes in equity presents all owner changes in equity. FRS 139 Financial Instruments: Recognition and Measurement Establishes the principles for recognising and measuring financial assets, financial liabilities and some contracts to buy or sell non-financial items. Shall be applied by all entities to all types of financial instruments except: (a) those interests in subsidiaries, associates and joint ventures that are accounted for under FRS 127, FRS 128 or FRS 131; (b) rights and obligations under leases to which FRS 117 applies. (c) employers rights and obligations under employee benefit plans, to which FRS 119 applies; (d) financial instruments issued by the entity that meet the definition of an equity instrument in FRS 132 (including options and warrants). However, the holder of such equity instruments shall apply this Standard to those instruments, unless they meet the exception in (a) above. (e) rights and obligations arising under (i) an insurance contract in FRS 202 or FRS 203 or insurance contract as defined in FRS 4 Insurance Contracts, other than an issuers rights and obligations arising under an insurance contract that meets the definition of a financial guarantee contract, or (ii) a contract that is within the scope of FRS 202, FRS 203 or FRS 4 because it contains a discretionary participation feature. (f) contracts for contingent consideration in a business combination (see FRS 3). This exemption applies only to the acquirer. (g) contracts between an acquirer and a vendor in a business combination to buy or sell an acquiree at a future date. (h) loan commitments other than those loan commitments that are within the scope of this Standard. (i) financial instruments, contracts and obligations under share-based payment transactions to which FRS 2 applies. (j) rights to payments to reimburse the entity for expenditure it is required to make to settle a liability that it recognises as a provision in accordance with FRS 137. When a financial asset or financial liability is recognised initially, an entity shall measure it at its fair value. Subsequent measurement will depend on the classification of the financial instrument. Financial assets are classified into the following four categories: Reported earnings will fluctuate. For banks, there will be a change in the way they compute interest and loan loss provisions. Almost all companies (including banks) will have to adopt FRS 139. Implication(s) on Sector(s) Users of financial statements will be able to segregate lumpy accounting components from reported income to derive core operating profit.

(1) financial assets at fair value through profit or loss (include derivatives). Subsequent measurement is at fair value, with any gains/losses to be recognised in profit or loss account; (2) held-to-maturity investments. Subsequent measurement is at amortised cost using the effective interest method (with amortisation to be recognised in profit or loss account). Subject to review for impairment: any impairment losses or reversals of impairment losses will be recognised in profit or loss; (3) loans and receivables. Subsequent measurement is at amortised cost using the effective interest method (with amortisation to be recognised in profit or loss account). Subject to review for impairment: any impairment losses or reversals of impairment losses will be recognised in profit or loss; and

Page 12

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted (continued)

Highlight(s) (4) available-for-sale financial assets. Subsequent measurement is at fair value, with any gains/losses to be recognised directly in equity (via the statement of changes in equity). If there is evidence that the asset is impaired, then the cumulative loss that has been recognised directly in equity shall be removed from equity and recognised in profit or loss account. Impairment losses recognised in profit or loss already only can be reversed through: (a) equity for equity instruments; and (b) through profit or loss for debt instruments. Financial liabilities are classified into the following two categories: (1) financial liabilities at fair value through profit or loss (which include instruments held for trading). Subsequent measurement is at fair value, with any gains/losses to be recognised in profit or loss account; and (2) Other financial liabilities that are not in the first category. Subsequent measurement is at amortised cost using the effective interest method (with amortisation to be recognised in profit or loss account). An entity is precluded from reclassifying financial instruments into or out of their category. An embedded derivative is a component of a hybrid (combined) instrument that also includes a non-derivative host contractwith the effect that some of the cash flows of the combined instrument vary in a way similar to a stand-alone derivative. An embedded derivative shall be separated from the host contract and accounted for as a derivative under this Standard if, and only if: (a) the economic characteristics and risks of the embedded derivative are not closely related to the economic characteristics and risks of the host contract; (b) a separate instrument with the same terms as the embedded derivative would meet the definition of a derivative; and (c) the hybrid (combined) instrument is not measured at fair value with changes in fair value recognised in profit or loss (ie a derivative that is embedded in a financial asset or financial liability at fair value through profit or loss is not separated). Derivatives are carried as assets when fair value is positive (and as liabilities when fair value is negative). Derivatives - no longer offbalance sheet items - will appear on the financial statements. Airlines, exporters, conglomerates with overseas operations / extensive treasury dealings will be affected. Reported earnings will fluctuate. Implication(s) on Sector(s)

If there is a designated hedging relationship between a hedging instrument and a hedged item, an entity shall account for the gain or loss on the hedging instrument and the hedged item.

A hedged item can be a recognised asset or liability, an unrecognised firm commitment, a highly probable forecast transaction or a net investment in a foreign operation. For hedge accounting purposes, only assets, liabilities, firm commitments or highly probable forecast transactions that involve a party external to the entity can be designated as hedged items. If the hedged item is a non-financial asset or non-financial liability, it shall be designated as a hedged item (a) for foreign currency risks, or (b) in its entirety for all risks, because of the difficulty of isolating and measuring the appropriate portion of the cash flows or fair value changes attributable to specific risks other than foreign currency risks. Hedge accounting recognises the offsetting effects on profit or loss of changes in the fair values of the hedging instrument and the hedged item. To qualify for hedge accounting, the hedge must relate to a specific identified and designated risk, and must ultimately affect the entity's profit or loss. Hedging relationships are of three types: (1) fair value hedge: a hedge of the exposure to changes in fair value of a recognised asset or liability or an unrecognised firm commitment, or an identified portion of such an asset, liability or firm commitment, that is attributable to a particular risk and could affect profit or loss; (2) cash flow hedge: a hedge of the exposure to variability in cash flows that (i) is attributable to a particular risk associated with a recognised asset or liability or a highly probable forecast transaction and (ii) could affect profit or loss; and (3) hedge of a net investment in a foreign operation. A fair value hedge shall be accounted for as follows: (a) the gain or loss from remeasuring the hedging instrument at fair value (for a derivative hedging instrument) or the foreign currency component of its carrying amount measured in accordance with FRS 121 (for a non-derivative hedging instrument) shall be recognised in profit or loss; and Reported earnings will be volatile.

Page 13

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted (continued)

Highlight(s) (b) the gain or loss on the hedged item attributable to the hedged risk shall adjust the carrying amount of the hedged item and be recognised in profit or loss. A cash flow hedge shall be accounted for as follows: (a) the portion of the gain or loss on the hedging instrument that is determined to be an effective hedge shall be recognised directly in equity through the statement of changes in equity. Amounts taken to equity are transferred to income statement when the hedged transaction affects profit or loss; and (b) the ineffective portion of the gain or loss on the hedging instrument shall be recognised in profit or loss. More specifically, a cash flow hedge is accounted for as follows: (a) the separate component of equity associated with the hedged item is adjusted to the lesser of the following (in absolute amounts): (i) the cumulative gain or loss on the hedging instrument from inception of the hedge; and (ii) the cumulative change in fair value (present value) of the expected future cash flows on the hedged item from inception of the hedge; (b) any remaining gain or loss on the hedging instrument or designated component of it (that is not an effective hedge) is recognised in profit or loss; and (c) if an entitys documented risk management strategy for a particular hedging relationship excludes from the assessment of hedge effectiveness a specific component of the gain or loss or related cash flows on the hedging instrument, that excluded component of gain or loss is recognised in accordance with the accounting treatment for a financial asset / financial liability classified as at fair value through profit and loss or an available-for-sale financial asset. Hedges of a net investment in a foreign operation shall be accounted for similarly to cash flow hedges: (a) the portion of the gain or loss on the hedging instrument that is determined to be an effective hedge shall be recognised directly in equity through the statement of changes in equity; and (b) the ineffective portion shall be recognised in profit or loss. The gain or loss on the hedging instrument relating to the effective portion of the hedge that has been recognised directly in equity shall be recognised in profit or loss on disposal of the foreign operation. Hedges of firm commitments are now treated as fair value hedges rather than cash flow hedges. However, the Standard clarifies that a hedge of the foreign currency risk of a firm commitment can be treated as either a cash flow hedge or a fair value hedge. If a hedge of a forecast transaction subsequently results in the recognition of a financial asset or a financial liability, the associated gains or losses that were recognised directly in equity in accordance with the cash flow hedge accounting treatment shall be reclassified into profit or loss in the same period or periods during which the asset acquired or liability assumed affects profit or loss (such as in the periods that interest income or interest expense is recognised). However, if an entity expects that all or a portion of a loss recognised directly in equity will not be recovered in one or more future periods, it shall reclassify into profit or loss the amount that is not expected to be recovered. If a hedge of a forecast transaction subsequently results in the recognition of a non-financial asset or a nonfinancial liability, or a forecast transaction for a non-financial asset or non-financial liability becomes a firm commitment for which fair value hedge accounting is applied, then the entity shall adopt (a) or (b) below: (a) It reclassifies the associated gains and losses that were recognised directly in equity in accordance with the cash flow hedge accounting treatment into profit or loss in the same period or periods during which the asset acquired or liability assumed affects profit or loss (such as in the periods that depreciation expense or cost of sales is recognised). However, if an entity expects that all or a portion of a loss recognised directly in equity will not be recovered in one or more future periods, it shall reclassify into profit or loss the amount that is not expected to be recovered. (b) It removes the associated gains and losses that were recognised directly in equity in accordance with the cash flow hedge accounting treatment, and includes them in the initial cost or other carrying amount of the asset or liability. Derivatives that do not qualify for hedge accounting are classified at fair value through profit and loss with any gains or losses arising from changes in fair value being recognised in the income statement. Reported earnings will be volatile. Reported earnings will be volatile. Reported earnings will be volatile. Implication(s) on Sector(s)

Page 14

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted (continued)

Highlight(s) FRS 141 Agriculture Prescribes the accounting treatment, financial statement presentation and disclosures related to agricultural activity. It shall be applied to account for: (a) biological assets; (b) agricultural produce at the point of harvest; and (c) government grants. Agricultural activity is the management by an entity of the biological transformation of living animals or plants (biological assets) for sale, into agricultural produce, or into additional biological assets. For example: raising livestock, forestry, annual or perennial cropping, cultivating orchards and plantations, floriculture, and aquaculture (including fish farming). Recognises and measures biological growth using current fair values by reporting changes in fair value throughout the period between planting and harvest. Requires all biological assets be measured at each balance sheet date at their fair value less estimated pointof-sale costs up to the point of harvest, unless the fair value cannot be measured reliably (in which case, the standard requires an entity to measure that biological asset at its cost less any accumulated depreciation and any accumulated impairment losses). Also requires all agricultural produce at the point of harvest be measured at its fair value less estimated point-of-sale costs. Requires the change in fair value less estimated point-of-sale costs of a biological asset and agriculture produce to be included in profit or loss for the period in which it arises. Does not establish any new principles for land related to agricultural activity. Biological assets that are physically attached to land (for example, trees in a plantation forest) are measured at their fair value less estimated pointofsale costs separately from the land. Requires that an unconditional government grant related to a biological asset measured at its fair value less estimated pointofsale costs be recognised as income when, and only when, the government grant becomes receivable. IFRIC Interpretation 4 Determining whether an Arrangement Contains a Lease To be announced IFRIC Interpretation 12 Service Concession Arrangements Prescribes the accounting treatments for operators - arising from the obligations they undertake and rights they receive - in public-to-private service concession arrangements for the delivery of public services. Applies to public-to-private service concession arrangements if: (a) the grantor controls or regulates what services the operator must provide with the infrastructure, to whom it must provide them, and at what price; and (b) the grantor controlsthrough ownership, beneficial entitlement or otherwiseany significant residual interest in the infrastructure at the end of the term of the arrangement. The operator effectively acts as a service provider. The operator constructs or upgrades infrastructure (construction or upgrade services) used to provide a public service and operates and maintains that infrastructure (operation services) for a specified period of time. Infrastructure within the scope of this standard shall not be recognised as property, plant and equipment of the operator because the contractual service arrangement does not convey the right to control the use of the public service infrastructure to the operator. The operator shall account for revenue and costs relating to: (a) construction or upgrade services in accordance with FRS 111 Construction Contracts (based on percentage of completion method); and (b) operation services in accordance with FRS 118 Revenue (based on percentage of completion method). Under FRS 118, in the case of rendering of services, when services are performed by an indeterminate number of acts over a specified period of time, revenue is recognised on a straight-line basis over the specified period unless there is evidence that some other method better represents the stage of completion. If the operator performs more than one service (i.e. construction or upgrade services and operation services) under a single contract or arrangement, consideration received or receivable shall be allocated by reference to the relative fair values of the services delivered, when the amounts are separately identifiable. The nature of the consideration determines its subsequent accounting treatment. The consideration received or receivable by the operator shall be recognised at its fair value. There are two types of service concession arrangement. In return for constructing or upgrading the public sector asset: (a) the operator receives (and shall recognise) a financial asset, ie an unconditional contractual right to receive cash or another financial asset from the government (the grantor). Infrastructure asset will be reclassified and parked outside PPE. Will apply to concessionaires like toll road operators. Reported earnings will be volatile. Impact on plantation companies. Implication(s) on Sector(s)

Page 15

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted (continued)

Highlight(s) In this case, FRSs 132 and 139 and FRS 7 will apply to the financial asset recognised. The amount due from or at the direction of the grantor is accounted for in accordance with FRS 139 as: (a) a loan or receivable; (b) an available-for-sale financial asset; or (c) if so designated upon initial recognition, a financial asset at fair value through profit or loss, if the conditions for that classification are met. If the amount due from the grantor is accounted for either as a loan or receivable or as an available-for-sale financial asset, FRS 139 requires interest calculated using the effective interest method to be recognised in profit or loss. (b) the operator receives (and shall recognise) an intangible asset, i.e. no more than a right (a licence) to charge for use of the public sector asset that it constructs or upgrades. A right to charge users of the public service is not an unconditional right to receive cash because the amounts depend on the extent that the public uses the service. In this case, FRS 138 applies to the intangible asset recognised. If the operator is paid for the construction services partly by a financial asset and partly by an intangible asset it is necessary to account separately for each component of the operators consideration. The operator may have contractual obligations it must fulfil as a condition of its licence: (a) to maintain the infrastructure to a specified level of serviceability; or (b) to restore the infrastructure to a specified condition before it is handed over to the grantor at the end of the service arrangement. These contractual obligations to maintain or restore infrastructure, except for any upgrade element, shall be recognised and measured in accordance with FRS 137, ie at the best estimate of the expenditure that would be required to settle the present obligation at the balance sheet date. In accordance with FRS 123, borrowing costs attributable to the arrangement shall be recognised as an expense in the period in which they are incurred unless the operator has a contractual right to receive an intangible asset (a right to charge users of the public service). In this case borrowing costs attributable to the arrangement may be capitalised during the construction phase of the arrangement in accordance with the allowed alternative treatment under that standard. Changes in accounting policies are accounted for in accordance with FRS 108, i.e. retrospectively. If, for any particular service arrangement, it is impracticable for an operator to apply this standard retrospectively at the start of the earliest period presented, it shall: (a) recognise financial assets and intangible assets that existed at the start of the earliest period presented; (b) use the previous carrying amounts of those financial and intangible assets (however previously classified) as their carrying amounts as at that date; and (c) test financial and intangible assets recognised at that date for impairment, unless this is not practicable, in which case the amounts shall be tested for impairment as at the start of the current period. IFRIC Interpretation 13 Customer Loyalty Programmes An entity shall account for award credits (often described as points) as a separately identifiable component of the sales transaction(s) in which they are granted (the initial sale). The fair value of the consideration received or receivable in respect of the initial sale shall be allocated between the award credits and the other components of the sale. Retrospective effect. Implication(s) on Sector(s) If so, then the right will be treated as a financial asset under FRS 139.

If so, then the right will be treated as an intangible asset and amortised in accordance with FRS 138 Intangible Assets.

Applicable to companies that offer award credits as a marketing tool. Their revenue recognition could be hit (slightly) upfront upon adoption of this standard.

The consideration allocated to the award credits shall be measured by reference to their fair value, ie the amount for which the award credits could be sold separately. If the fair value is not directly observable, it must be estimated. An entity may estimate the fair value of award credits by reference to the fair value of the awards for which they could be redeemed. If the entity supplies the awards itself, it shall recognise the consideration allocated to award credits as revenue when award credits are redeemed and it fulfils its obligations to supply awards. The amount of revenue recognised shall be based on the number of award credits that have been redeemed in exchange for awards, relative to the total number expected to be redeemed. If a third party supplies the awards, the entity shall assess whether it is collecting the consideration allocated to the award credits on its own account (i.e. as the principal in the transaction) or on behalf of the third party (ie as an agent for the third party). (a) If the entity is collecting the consideration on behalf of the third party, it shall: (i) measure its revenue as the net amount retained on its own account, i.e. the difference between the consideration allocated to the award credits and the amount payable to the third party for supplying the awards; and (ii) recognise this net amount as revenue when the third party becomes obliged to supply the awards and entitled to receive consideration for doing so. (b) If the entity is collecting the consideration on its own account, it shall measure its revenue as the gross consideration allocated to the award credits and recognize the revenue when it fulfils its obligations in respect of the awards. Delayed revenue recognition.

Delayed revenue recognition.

Page 16

Market Focus FRS in action now

Appendix 2: Summary of selected new accounting standards* to be adopted (continued)

Highlight(s) IFRIC Interpretation 15 Agreements for the Construction of Real Estate Applies to the accounting for revenue and associated expenses by entities that undertake the construction of real estate directly or through subcontractors. Provides guidance on how to determine whether an agreement for the construction of real estate is within the scope of FRS 111 Construction Contracts or FRS 118 Revenue and when revenue from the construction should be recognised. An agreement for the construction of real estate meets the definition of a construction contract when the buyer is able to specify the major structural elements of the design of the real estate before construction begins and/or specify major structural changes once construction is in progress (whether or not it exercises that ability). In other words, it is a contract specifically negotiated for the construction of an asset or a combination of assets .... In this case, the agreement is within the scope of FRS 111 (and if its outcome can be estimated reliably), it requires a percentage of completion method of revenue recognition for construction contracts, i.e. revenue is recognised progressively as construction progresses. When the agreement does not meet the definition of a construction contract in which buyers have only limited ability to influence the design of the real estate or to specify only limited variations to the basic design it falls within the scope of FRS 118. In this case, the entity shall determine whether the agreement is for: (a) the rendering of services only; or If the entity is not required to acquire and supply construction materials, the agreement may be only an agreement for the rendering of services in accordance with FRS 118. In this case, FRS 118 requires revenue to be recognised by reference to the stage of completion of the transaction using the percentage of completion method. The requirements of FRS 111 are generally applicable to the recognition of revenue and the associated expenses for such a transaction. (b) the sale of goods. If the entity is required to provide services together with construction materials in order to perform its contractual obligation to deliver the real estate to the buyer, the agreement is an agreement for the sale of goods and the criteria for recognition of revenue is set out in FRS 118. This can be in the form of two types of agreements (i) agreements in which the entity transfers to the buyer control and the significant risks and rewards of ownership of the work in progress in its current state as construction progresses; In this case, the entity shall recognise revenue by reference to the stage of completion using the percentage of completion method. The requirements of FRS 111 are generally applicable to the recognition of revenue and the associated expenses for such a transaction. (ii) agreements in which the entity transfers to the buyer control and the significant risks and rewards of ownership of the real estate in its entirety at a single time (eg at completion, upon or after delivery). In this case, the entity shall recognise revenue only when all the criteria in FRS 118 are satisfied, i.e. to recognise revenue only when the completed real estate is delivered to the buyer. Changes in accounting policy shall be accounted for retrospectively in accordance with FRS 108. Implication(s) on Sector(s)

Property developers with selland-build business models will be affected. Will only be able to recognise property development profits upon completion. Retrospective effect.

Note: * Some standards still at the exposure draft stage or being revised at the international level are known as IFRS and IAS at the moment. We used FRS as the standard name in Malaysia for consistency. IFRIC - which stands for International Financial Reporting Interpretation Committee - refers to the interpretation of standards (under the FRS framework) in more specific situations. Source: MASB website, HDBSVR

Page 17

Market Focus FRS in action now

DBSV recommendations are based an Absolute Total Return* Rating system, defined as follows: STRONG BUY (>20% total return over the next 3 months, with identifiable share price catalysts within this time frame) BUY (>15% total return over the next 12 months for small caps, >10% for large caps) HOLD (-10% to +15% total return over the next 12 months for small caps, -10% to +10% for large caps) FULLY VALUED (negative total return i.e. > -10% over the next 12 months) SELL (negative total return of > -20% over the next 3 months, with identifiable catalysts within this time frame)

Share price appreciation + dividends