Professional Documents

Culture Documents

Mobile Banking Brochure English

Uploaded by

Foez LeonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mobile Banking Brochure English

Uploaded by

Foez LeonCopyright:

Available Formats

DBBL Mobile Banking at a glance

Banking for the unbanked

What is Mobile Banking? Mobile Banking is a Banking process without bank branch which provides financial services to unbanked communities efficiently and at affordable cost. To provide banking and financial services, such as cash-in, cash out, merchant payment, utility payment, salary disbursement, foreign remittance, government allowance disbursement, ATM money withdrawal through mobile technology devices, i.e. Mobile Phone, is called Mobile Banking. Benefits of Mobile Banking By providing electronic access to money, it is possible to ultimately alleviate poverty, because of the following reasons. Real time on-line banking Available anytime, anywhere throughout the country It is convenient, affordable and secure It is much more effective in developing savings habits It will make access to banking and advanced payment transactions at affordable cost It is much safer, speedy and safeguard against fraudulent transactions

What does DBBL Mobile banking offer? Customer Registration Cash-in (cash deposit) Cash-out (cash withdrawal) Merchant Payment Utility Payment Salary Disbursement Foreign Remittance Air-time Top-up Fund Transfer

Where to register? Customer can register at any authorized agent point of DBBL - at present these are the retailers of Citycell & Banglalink throughout the country who can display DBBL Agent Certificate and DBBL Mobile Banking Banner. How does it work? Customer fills up the KYC Form and submit to agent along with his photograph & National ID (NID) Agent checks the Application Form, photograph & NID Agent goes to Customer Registration Menu in his/her mobile and insert customers mobile number Customer receives a call through IVR or USSD prompt and in reply, s/he gives a 4-digit PIN number of his/her choice (please remember your PIN) A Mobile Account is created in the DBBL system which is his/her mobile number + one check digit Customer receives an SMS which contains his/her Mobile Account number (please remember your check digit) Why PIN is required? PIN is required to be inputted during cash withdrawal from an Agent or DBBL ATM. PIN ensures security of your money and protect fraudulent transactions. Why PIN is strictly confidential? PIN is the of PIN & needed to respective carefully. key for transaction of Mobile Banking. Only correct match Mobile Number can access the Mobile Account. PIN is verify the A/C owner by the system. If a PIN is disclosed, account is at risk; therefore, PIN should be handled very

Why Check digit ? Mobile number is public and known to many people. Without knowing your check digit, none will be able to deposit money at your account, thus it helps to keep your mobile account confidential. On the other hand, a check digit eliminates typing error, thus protects sending or depositing money to a wrong account.

Which Telcos Mobile can be registered? Customer having any mobile from any Mobile Operator can be registered for DBBL Mobile Banking at any agent point of Banglalink and Citycell. All these Mobile Account holders will be able to deposit and withdraw money from the Agents. However the customers having mobile from operators other than Banglalink and Citycell will not be able to initiate many self-initiated services like Balance checking, fund transfer, utility payment, Air-time top up, PIN Change etc. Customers having mobile from Banglalink and Citycell will be able to enjoy all the services agent-initiated as well as self-initiated. What type of Mobile set is required? Any type of mobile set can be used for DBBL mobile banking. How much initial deposit is required? Customers can open a DBBL Mobile Account with an initial deposit of Taka 10/- (taka ten) only. Can I deposit and withdraw money immediately after registration? You can deposit money immediately after registration. However, you can withdraw after your account is fully registered. Bank officer verifies the information on the registration form (KYC form) and authorizes the account for full registration. Normally 1-2 working days are required for full registration. After your account is fully registered, you will get an SMS notification. How is DBBL Mobile Banking secured? DBBL Mobile Banking is highly secured as it uses either USSD or SMS+IVR as its communication channel. In case of USSD, both the instructions and PIN are communicated using USSD while in case of SMS+IVR, instructions are sent via SMS and PIN via IVR (voice channel) both the USSD and IVR are secured for transmission of PIN

Customers money is safe as none can withdraw his/her money without taking possession of Mobile set, PIN and Check digit togrther. None will be able to deposit unwanted money into a Mobile Banking Account without knowing the check digit (although the mobile number is publicly known).

Where to cash-out (cash withdrawal)? Customer can cash-out (withdraw) at any authorized agent of DBBL (at present Citycell & Banglalink agents), DBBL ATMs and DBBL Branch. How does it work? Customer asks the Agent for withdrawal of an amount from his/her mobile account Agent initiates the transaction from his/her mobile Agent gets prompt menu and in reply agent enters customers mobile account number (including check digit) and amount to withdraw DBBL system sends prompt menu to the customers mobile (or IVR Call): You are going to withdraw Tk. XXXX from your mobile account with DBBL. If you want to continue, please enter your 4-digit PIN Customer enters his/her PIN System debits customers account and send an SMS to the customers mobile Agent hands over money to the customer Where to cash-in (cash deposit)? Customer can cash-in (deposit) at any authorized agent of DBBL (at present Citycell & Banglalink agents) or DBBL Branch. How does it work? Customer hands over cash to the Agent Agent initiates the transaction from his/her mobile Agent gets prompt menu and in reply agent enters customers mobile account number (including check digit) and amount Agent enters his/her PIN System credits customers account for the same amount Agent issues a receipt to the customer System sends an SMS to the customers mobile For security reason, customer needs to check the sending number of SMS and the amount. SMS will be sent from 16216

What is transaction limit ? There may be scarcity of cash at agent points. We want to serve as many customers as possible from each agent points. On the other hand, it is required to minimize fraudulent loss, if any. To arrest all the above, a transaction limit in terms of frequency and amount have been set in the system. Current limit for the customers are as under: Cash-in frequency per day = 5 times Cash-out frequency per day = 5 times Cash-in / cash-out amount per transaction = 5,000/Cash-in frequency per month = 20 times Cash-out frequency per month = 20 times

How to check your account balance? Customer initiates the transaction from his/her own mobile DBBL system sends prompt menu to the customers mobile (or IVR Call): Please enter your 4-digit PIN to know your balance or press Cancel button to cancel the request Customer enters his/her PIN System sends the balance into his/her mobile

How to change PIN? Customer initiates the process from his/her own mobile. DBBL system sends prompt menu to the customers mobile (or IVR Call): Please enter your existing 4-digit PIN to proceed or press Cancel button to cancel the request Customer enters his/her existing PIN DBBL system asks for new 4-digit PIN Customer enters his/her new PIN The PIN is changed

What is Salary/Allowance Disbursement? It is a process by which Corporate Office can disburse the salary of their employees and Government can disburse different allowances like elderly allowance, freedom fighter allowance to the people within a few moment in a hassle free way. How it works? Corporate Office/ Government will send the list of mobile account numbers (including check digit) and monthly salary/allowance to DBBL DBBL will credit all the individual accounts by debiting corporate account centrally by a batch process system The employee/beneficiary will get an SMS regarding the transaction The employee/beneficiary can go to any agent or DBBL ATM or DBBL Branch for withdrawal of money

Benefits of Corporate Office/Government? Time savings Cost savings No need of extra manpower Probability of error is very low Instant service is ensured

Benefits of employee/beneficiary? Instant credit to the account No hassle to collect salary/allowance No queue Money can be withdrawn from any agent or DBBL ATM or DBBL Branch

How foreign remittance can be sent to Mobile Account? Exchange houses at abroad receive remittance against beneficiarys mobile account number Exchange houses send the mobile account number and the amount to DBBL DBBL will centrally credit the amount against respective mobile account The beneficiary will get an SMS regarding such transaction. The beneficiary can go to any agent or DBBL ATM or DBBL Branch for withdrawal of money

Fees & Service Charges

Registration Fee Cash-in Charges

: Free : 1% of the transaction amount or Tk.5/-, whichever is higher : 2% of the transaction amount or Tk.10/-, whichever is higher. : Free for customer : Free for customer : Free : Free : Free

Cash-out Charges

Merchant Payment Mobile Top-up Salary Disbursement Allowance Disbursement Remittance Disbursement

To know more, please dial our call centre at: 16216.

Dutch-Bangla Bank Limited

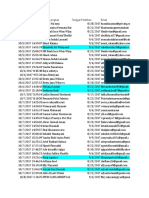

You might also like

- Statement For Account No 60258865747 From 01/11/2019 To 31/01/2020Document8 pagesStatement For Account No 60258865747 From 01/11/2019 To 31/01/2020Hargur BediNo ratings yet

- Engagement Letter ExampleDocument3 pagesEngagement Letter ExamplemerrillvanNo ratings yet

- ECOBANK - Payment Method (En)Document3 pagesECOBANK - Payment Method (En)University of East London OnlineNo ratings yet

- RBC Royal Bank Credit Card AgreementDocument8 pagesRBC Royal Bank Credit Card Agreementmani12390% (1)

- Barclays ChapsguideDocument1 pageBarclays Chapsguidetulips26No ratings yet

- Hotel Invoice: Bill To: Company: Name: Address Line 1: Address Line 2: City, State ZIP Tel: FaxDocument1 pageHotel Invoice: Bill To: Company: Name: Address Line 1: Address Line 2: City, State ZIP Tel: FaxBhargav ChavdiaNo ratings yet

- Direct Deposit InfoDocument1 pageDirect Deposit InfoJose Ramiro gomezNo ratings yet

- Systematic Investment Plan - SIP Project ReportDocument109 pagesSystematic Investment Plan - SIP Project ReportCarmen Alvarado64% (11)

- SMS Internet Banking FormDocument4 pagesSMS Internet Banking FormSayed InsanNo ratings yet

- Features of All Types of AccountsDocument113 pagesFeatures of All Types of AccountsNahid HossainNo ratings yet

- Review of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsFrom EverandReview of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsNo ratings yet

- Ned Bank Pay U AccountDocument4 pagesNed Bank Pay U AccountavarnNo ratings yet

- Banco de Oro Online Banking PDFDocument2 pagesBanco de Oro Online Banking PDFalexander o,verdidaNo ratings yet

- General: (Except Maybank2u & M2U Mobile App Maintenance Time From 9:30pm - 10:15pm and 12:00am - 12:30am Daily)Document8 pagesGeneral: (Except Maybank2u & M2U Mobile App Maintenance Time From 9:30pm - 10:15pm and 12:00am - 12:30am Daily)Careema ChoongNo ratings yet

- What Is A Bank Identification Number (BIN), and HDocument1 pageWhat Is A Bank Identification Number (BIN), and HYogeshwaran.sNo ratings yet

- DocumentDocument7 pagesDocumentajarnmichaelNo ratings yet

- International Bank Account Numbers: Sending and Receiving Payments To or From Europe in EurosDocument2 pagesInternational Bank Account Numbers: Sending and Receiving Payments To or From Europe in EurosBibi LavenderNo ratings yet

- Supplier Bank DetailsDocument2 pagesSupplier Bank DetailsJoaquina BeloNo ratings yet

- Statement of Account - 1705148243908Document4 pagesStatement of Account - 1705148243908kandhasubramanian3No ratings yet

- Ymrtc LogDocument62 pagesYmrtc LogOctavi Ikat100% (3)

- EG-ACH Direct Credit Payment Advice ReportDocument1 pageEG-ACH Direct Credit Payment Advice ReportAlbert FaragNo ratings yet

- Clearing House Lectureupdated - June11 2013Document35 pagesClearing House Lectureupdated - June11 2013dushakilNo ratings yet

- Dragonpay APIDocument31 pagesDragonpay APIhaizea obreinNo ratings yet

- Giraffe Credit Card ACH Authorization Form - 2023 - 02 - 12NNDocument2 pagesGiraffe Credit Card ACH Authorization Form - 2023 - 02 - 12NNShujaRehmanNo ratings yet

- User Init RegistrationDocument10 pagesUser Init RegistrationMashfiq SohrabNo ratings yet

- Estmt - 2024 02 29Document5 pagesEstmt - 2024 02 29sayedsajid653100% (1)

- Pay PalDocument18 pagesPay PalYogesh YadavNo ratings yet

- Course StudyDocument4 pagesCourse Studyapi-479446289No ratings yet

- Building An E Commerce Site A Systematic ApproachDocument31 pagesBuilding An E Commerce Site A Systematic ApproachAlliah Fe Kyreh SegoviaNo ratings yet

- Iswa General Secretariat: Invoice NumberDocument2 pagesIswa General Secretariat: Invoice Numberrudy yoga lesmanaNo ratings yet

- Uncashed Benefit Payment Check or Unclaimed Electronic Benefit Payment Claim FormDocument2 pagesUncashed Benefit Payment Check or Unclaimed Electronic Benefit Payment Claim Formemily ambrosinoNo ratings yet

- E SimDocument2 pagesE SimpanaxxiNo ratings yet

- BDO Credit Card Online Application Form - Home PDFDocument2 pagesBDO Credit Card Online Application Form - Home PDFalexander o,verdidaNo ratings yet

- Ach StreamlineDocument47 pagesAch Streamlineaugustorcastros5081No ratings yet

- Latasha Palmer: Rohan SketcherDocument1 pageLatasha Palmer: Rohan Sketchershafiqrehman7No ratings yet

- Business Account Wells FargoDocument3 pagesBusiness Account Wells FargoRafael FerrerNo ratings yet

- Paypal Integration ResearchDocument10 pagesPaypal Integration ResearchAsadullahKhanRindNo ratings yet

- Multiple Bank Account Registration FormDocument2 pagesMultiple Bank Account Registration FormprasadkarkareNo ratings yet

- Swift Gpi Transaction Management Services Overview July2018Document28 pagesSwift Gpi Transaction Management Services Overview July2018E KaraNo ratings yet

- (Alert) There Was A New Login To Your Chime AccountDocument2 pages(Alert) There Was A New Login To Your Chime AccountVictor CarbajalNo ratings yet

- Absa RecoverDocument1 pageAbsa RecoverEbenéNo ratings yet

- Mobile BankingDocument66 pagesMobile BankingNalini SharmaNo ratings yet

- Account - Statement 222Document1 pageAccount - Statement 222Fikile EemNo ratings yet

- Merchant Account ChangeDocument1 pageMerchant Account Changeaglenn788934No ratings yet

- Creditcard Payment Internetbanking PDFDocument8 pagesCreditcard Payment Internetbanking PDFbagavan10No ratings yet

- Credit CardDocument6 pagesCredit Cardredwanur_rahman2002No ratings yet

- 82989Document3 pages82989Abhishek JaiswalNo ratings yet

- Qashout Quick Start Guide PDFDocument82 pagesQashout Quick Start Guide PDFRifkyc'RyderNyalindunxNo ratings yet

- !!credit Card Authorization Form RCGDocument1 page!!credit Card Authorization Form RCGDavid RojasNo ratings yet

- Plastic MoneyDocument24 pagesPlastic MoneySeema ManghnaniNo ratings yet

- Netspend All-Access AccountDocument35 pagesNetspend All-Access Accountchristopherhowell269100% (1)

- Student Payment OptionsDocument2 pagesStudent Payment OptionsOsayemi GbemisolaNo ratings yet

- Oakland14chipandskim PDFDocument16 pagesOakland14chipandskim PDFAm RaiNo ratings yet

- Blitz-Logs 20230624132400Document48 pagesBlitz-Logs 20230624132400marekpetrekNo ratings yet

- Wise, Formerly TransferWise Online Money Transfers International Banking Features 2Document1 pageWise, Formerly TransferWise Online Money Transfers International Banking Features 2Rene PatrickNo ratings yet

- Credit CardsDocument15 pagesCredit CardsAmit AdesharaNo ratings yet

- Monica Montiel-WUMT - Dept: Rom: Sent: Wednesday, November 16, 2011 7:52 AM To: Subject: RE: Dear Valued CustomerDocument4 pagesMonica Montiel-WUMT - Dept: Rom: Sent: Wednesday, November 16, 2011 7:52 AM To: Subject: RE: Dear Valued CustomerMarcos Paulo Do NascimentoNo ratings yet

- Terms and Conditions For Online-Payments: Privacy PolicyDocument5 pagesTerms and Conditions For Online-Payments: Privacy PolicyKhush TaterNo ratings yet

- Tracking, Track Parcels, Packages, Shipments DHL Express Tracking 2Document1 pageTracking, Track Parcels, Packages, Shipments DHL Express Tracking 2RAGHAV GOEL100% (1)

- Fixed Deposit SampleDocument21 pagesFixed Deposit SampleSuriyachakArchwichaiNo ratings yet

- Invoice Order 8158488368921799Document2 pagesInvoice Order 8158488368921799Ricardo HesseNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Kalviseithi - 6,7,8 Lesson Plan Term 2 - All Subject PDFDocument220 pagesKalviseithi - 6,7,8 Lesson Plan Term 2 - All Subject PDFJalagandeeswaran KalimuthuNo ratings yet

- RSMRR Fans1Document49 pagesRSMRR Fans1ansonchongNo ratings yet

- Credit Card Error CodesDocument4 pagesCredit Card Error Codescurbstone Security ServicesNo ratings yet

- HdbfsDocument34 pagesHdbfsMounicaNo ratings yet

- Murabaha - Application (Trade Finance)Document72 pagesMurabaha - Application (Trade Finance)Riz Khan100% (2)

- Appendices To Substantive Defenses To Consumer Debt Collection Suits TDocument59 pagesAppendices To Substantive Defenses To Consumer Debt Collection Suits Tdbush2778No ratings yet

- Financial Performance of DCC Bank With Special Reference To Vijayapur DistrictDocument4 pagesFinancial Performance of DCC Bank With Special Reference To Vijayapur DistrictAnjum Ansh KhanNo ratings yet

- Foreign Exchange MathDocument6 pagesForeign Exchange MathJoyanta Sarkar100% (1)

- Form Rekening & ID Tentor (Jogja)Document14 pagesForm Rekening & ID Tentor (Jogja)Cut Ummu FathimahNo ratings yet

- Auditing Icwai Group I Objective Type Questions and Answers: Narayan@icwahelpn - Co.inDocument11 pagesAuditing Icwai Group I Objective Type Questions and Answers: Narayan@icwahelpn - Co.inHaider ShoaibNo ratings yet

- Claims Against Fund Managers On The RiseDocument2 pagesClaims Against Fund Managers On The RiseTheng RogerNo ratings yet

- Cross Rates - August 23 2018Document1 pageCross Rates - August 23 2018Tiso Blackstar GroupNo ratings yet

- Comprehension Questions: 1. What Are Minimum Lease Payments'?Document13 pagesComprehension Questions: 1. What Are Minimum Lease Payments'?Amit ShuklaNo ratings yet

- ReportDocument1 pageReportumaganNo ratings yet

- HDFC Life InsuranceDocument12 pagesHDFC Life Insurancesaswat mohantyNo ratings yet

- Qatar Quarterly Equity HandbookDocument60 pagesQatar Quarterly Equity Handbook123bingoNo ratings yet

- Research Proposal by Pragya Jaiswal - Edited VersionDocument8 pagesResearch Proposal by Pragya Jaiswal - Edited Versionpragya jaiswalNo ratings yet

- Personal Accident Insurance - POLMBKBA82EFIJBDocument3 pagesPersonal Accident Insurance - POLMBKBA82EFIJBGiridharan VenkateshNo ratings yet

- Technology in BankingDocument92 pagesTechnology in BankingJason Amaral100% (2)

- Consensus Letter FillingDocument3 pagesConsensus Letter FillingNurnadia SalizaNo ratings yet

- Account Opening-Board ResolutionDocument3 pagesAccount Opening-Board ResolutionAbubakar ShabbirNo ratings yet

- Someone Elses Pay Off I Put The Link Here N A TexDocument3 pagesSomeone Elses Pay Off I Put The Link Here N A Texjulianthacker100% (1)

- S. 604 Federal Reserve Sunshine Act - Senate Contact InfoDocument5 pagesS. 604 Federal Reserve Sunshine Act - Senate Contact InfojofortruthNo ratings yet

- Lakshmi Vilas BankDocument16 pagesLakshmi Vilas Bankvinss420No ratings yet

- Firm Infrastructure Risk Management Human Resources Technologic Al Developme NTDocument3 pagesFirm Infrastructure Risk Management Human Resources Technologic Al Developme NTPrincessNo ratings yet

- Slips Edu 06-2021Document9,468 pagesSlips Edu 06-2021Umar AzanNo ratings yet

- Govacctg New PDFDocument190 pagesGovacctg New PDFJasmine Lim100% (1)