Professional Documents

Culture Documents

Us Consulting Asset Intelligence Debate 101110

Uploaded by

Kelvin CheongOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Us Consulting Asset Intelligence Debate 101110

Uploaded by

Kelvin CheongCopyright:

Available Formats

Deloitte Debates

Asset Intelligence: A Tactical Tool or a Strategic Opportunity?

Whats the right way to approach new sources of information generated by an organizations assets? More and more companies are using signals and sensors to drive operational performance and shorten the cycle between information and day-to-day business decisions. Theyre also driving productivity improvements by squeezing costs out of many kinds of transactions. Is this just another technology fad or can organizations achieve higher-level strategic advantages by redefining assets as engines for intelligence? Heres the debate. Point Stay focused on tactical applications The jurys still out on asset intelligence The most you can expect from asset intelligence is a reduction of latency which is a significant benefit for driving productivity and quality improvements. Sounds like another IT dream? Dont we have to walk before we run? Counterpoint Productivity and quality improvements are great, but why not go beyond that and use asset intelligence to drive strategic innovation and competitive advantage?

That may be true, but you dont have to walk before you fly. Transforming your organization into a predictive and automated enterprise isnt about incremental improvements with sensors, its a whole new way of doing business. Early adopters are already making the shift using existing technologies. Thats the easy part. The hard part is making the mental shift of redefining assets and using them as strategic weapons in your drive for innovation.

The technology needed to upgrade from tactical applications to full asset intelligence is complicated and unproven.

Point Step up to strategy Labor arbitrage and traditional process improvements are important for reducing costs, but asset intelligence goes far beyond those levers to drive whole new ways of doing business. The demand economy is real, with old businesses now being displaced by demand-design companies. Asset intelligence is an essential capability for thriving in this new environment.

Counterpoint We have a proven and mature business model and innovation isnt our strong suit. Better to let pioneers work out the kinks. Besides, we dont even have a CTO.

The ability to capitalize on asset intelligence is essential for high performing companies

Thats nothing but business jargon. There has always been a demand economy. We develop a forecast and build the inventory. This is nothing new.

Early adopter advantages are significant and sustainable. Not only do you get cost and profitability benefits, you get real opportunities for business model transformation.

No advantage is ever sustainable. A fast follower strategy works well for our business. We can accelerate from there.

My take

Doug Standley, Principal, Deloitte Consulting LLP, Technology Innovation Service Line Leader Information today is flooding into organizations, presenting new opportunities to take faster, smarter actions using real-time signals that produce real-time alerts and real-time responses from real-time organizations. But until you create capabilities for asset intelligence, you wont be able to take advantage of those opportunities. Without asset intelligence, information can pile up into mountains that people decide whether or not to opt-in. In many cases, they simply cant manage or process the ever-increasing volumes. Assets dont add intelligence simply by creating more raw data. Intelligence hinges on interpretation and insight taking context and relationships into account. Its the signals that assets produce, not the sensors, which can drive value. When you establish trust in those signals, you can empower a fundamental shift that changes the customer value proposition, the competitive landscape and perhaps even your business model. Asset intelligence thrives on early signals woven together into systems that can anticipate and act. Instead of waiting for people to conduct physical inspections of a distribution center, asset intelligence taps into the things themselves that fill that facility, enabling machine-to-machine interactions that bypass human intervention. Some call this the predictive enterprise, but whatever you call it, the benefits are compelling. Being able to detect signals earlier and extract more value from them faster is a new front in the battle for customer intimacy and competitive advantage. Companies that sit and wait while others exploit the benefits of asset intelligence run the risk of getting left behind. To get a sense of where asset intelligence might apply in your business, focus on these eight questions: What is an asset? It need not be on the balance sheet or within a depreciation schedule. Which assets play a significant role in business processes youve targeted for improvement? What information would be valuable to extract from each asset? What signals do you already capture and how? What actions can each asset potentially undertake?

Deloitte Debate 2

What are the critical interactions or relationships between assets? What improvements or innovations could occur with better visibility or automation? Where is the latency in your value chain? The analysis should be done across a companys operations from receiving dock to shipping dock to customer delivery, from shop floor to accounting to the CEOs office. Some scenarios will be obvious like the importance of understanding location, movement, temperature and contents of an item in transit. But others could be more subtle. Take your time to think through the possibilities. Explore the intangibles to the fullest. Once opportunities are identified, advancements in sensor hardware, networking and automated data capture can make the next step signal generation relatively easy. Building in the intelligence is where the complexity lies: That means allowing proprietary technologies to work together, defining the business rules and implementing workflow and security to allow trusted, automated decision-making. While many IT organizations have already begun investing in these disciplines, its important to fit asset intelligence into an overarching information strategy tied directly to the business strategy. If you approach asset intelligence focused on cost, infrastructure and sensors, the real potential will not likely be realized.

A view from the consumer products sector

David Rader, Executive Vice President, Frito-Lay (Retired) Any debate around the tactical versus strategic benefits of asset intelligence has to be framed within an organizations expectations for return on investment. Short term that means understanding the potential costs of the investment, as well as opportunities to generate quick returns from speeding up decisions, reducing down time and recognizing problems faster. These benefits should be distinguished from longer-term strategic advantages, such as the ability to see consumer shifts prior to demand changes, to provide insights into Lean Six Sigma analysis, or to enable management to dissect the business and costs at new and deeper levels. Many executives hope these strategic advantages will come from their enterprise information systems, a promise worth pursuing, but hard to realize. Asset Intelligence has the power to leverage enterprise technology, bringing the capabilities of business intelligence to bear in most decisions and areas of opportunity. A good Asset Intelligence system can give views of the business that allow both executive leadership and front-line management to make more effective choices. And while it wont alleviate the ever-increasing pressures for speed, Asset Intelligence does give leaders the ability to leverage speed with the strategic focus needed in todays business environment. Executives want more information and more analysis faster. Asset Intelligence is a smart way to do that. When it comes to adoption of new technologies, I have always been a believer in being early, but not first. Watch and learn from first movers, but dont wait so long that you have to play catch up. While you sort this out, prepare your assets and your organization for the inevitable. Make sure the technology you do develop supports an Asset Intelligence future. Think through which assets are critical to the business and be ready to move quickly when the time is right for your company and your team.

A view from the public sector

Peter Cuviello, Director, Deloitte Consulting LLP When it comes to government, defense and security, Asset Intelligence has determined to be highly strategic and will soon be indispensable. The only question is whether policy makers can refine our procurement processes and contracting requirements to align with the strategic vision most people in government intuitively understand. Today, most of the energy and angst around things in government involves design, development and production. Matters of sustainment things like inventory management, maintenance and supply chain integration are largely an afterthought. That has to change and some improvements are already underway.

Deloitte Debate

For example, a new aircraft has been designed with an autonomic logistics system on board. That means the plane has the ability to communicate its unique systems status requirements to central command without the need for human intervention. Machines talking to machines. Unfortunately, however, the back end systems to support those requirements arent nearly as advanced as the technology on the aircraft itself. To make matters even more challenging, the systems for different aircraft are independent and dont talk to one another. Whats needed is a strategic solution for managing all critical assets in our defense environment from weapons systems to maintenance personnel to spare parts integrated across a flexible, neutral integrated operating platform. Thats the holy grail, and until it happens, the benefits of Asset Intelligence in defense and security will likely be sub-optimized.

A view on global adoption

Glen Allmendinger, President of Harbor Research Virtually all products that use electricity from toys and coffee makers to cars and medical diagnostics possess inherent data-processing capability. These electronic and electro-mechanical products contain a potential wealth of information about their status, usage and performance. If a machine, a consumer product, or a building is not presently monitoring every detail that its creator might wish to extract, it can be modified to do so. With more and more microcontrollers and sensors embedded, everyday objects have the ability to create unique information signatures. Seen this way, a printed bar code, a DVD disc, a house key, or even the pages of a book can have the status of an information signature on a network. This is already the case for many products on the supermarket shelf, cars on a dealers lot, pallets on loading docks and more. In many cases, these information signatures are linked with their real world analogs by unique identifiers: an ISBN or ASIN, or a part number. Until recently, this kind of information has gone largely un-leveraged, even though it can offer extraordinary business advantage. As I see it, networked asset intelligence will bend the traditional linear value chain into a feedback loop through which the heartbeats of assets and devices will continually flow back through complex business alliances that create, distribute, service and use those objects. As it evolves, this infrastructure for living intelligence will cause organizations to re-think the whole relationship of people and assets to business systems. In a true asset-intelligent infrastructure, reliable and blindingly fast microprocessors do what they are very good at doing and what people are very bad at doing: digesting billions of data points, talking to each other about the data, controlling each other based upon the state of the data all in a matter of nanoseconds. Human beings cannot do this, nor should they; this incessant stream of ongoing business information should be invisible to people. At the same time, all this invisible machine activity makes information about a businesss assets, costs and liabilities vastly more visible to managers and to the decision-making process. Asset intelligence implies a total paradigm-shift in IT. The depth of this shift has begun to suggest itself, but it is by no means accomplished. Its a shift from knowing what happened to knowing what is happening and then automatically controlling systems with that knowledge. Obviously, this is not what IT is today. To accomplish genuine enterprise automation and asset intelligence, new technologies must create a living digital nervous system for business intelligence of all kinds. That means nothing less than turning the enterprise into a living information organism a self-aware, self-regulating, self-optimizing creature.

For further information, please visit: http://www.deloitte.com/us/debates/intelligencetooloropportunity.

Deloitte Debate

For further information about this debate, please contact: Doug Standley Principal Deloitte Consulting LLP Technology Innovation Service Line Leader dstandley@deloitte.com David Rader Executive Vice President Frito-Lay (Retired) Peter Cuviello Director Deloitte Consulting LLP pcuviello@deloitte.com

Glen Allmendinger President of Harbor Research

Related Insight: Signal Strength Deloitte Review article about the rise and promise of asset intelligence. Asset Intelligence: Wake-Up Your Value Chain On Your Terms Listen to the Dbriefs Webcast replay. Depth Percetion: Asset Intelligence Do you have depth perception? Get our take on Asset Intelligence, 1 of 12 technology trends shaping business and IT today. Technology Innovation: Top Down or Bottom Up? Explore the Debate.

Related Content: Library: Deloitte Debates Services: Consulting Industries: Consumer Products and Oil and Gas

This publication contains general information only and is based on the experiences and research of Deloitte practitioners. Deloitte is not, by means of this publication, rendering business, financial, investment, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte, its affiliates, and related entities shall not be responsible for any loss sustained by any person who relies on this publication. As used in this document, Deloitte means Deloitte LLP and its subsidiaries. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Copyright 2010 Deloitte Development LLC. All rights reserved. Member of Deloitte Touche Tohmatsu Limited

You might also like

- The Way To Sell: Powered byDocument25 pagesThe Way To Sell: Powered bysagarsononiNo ratings yet

- Turning Big Data Into Useful InformationDocument14 pagesTurning Big Data Into Useful InformationElioBolañosNo ratings yet

- Information Systems For Managers Revised DEC 2022Document11 pagesInformation Systems For Managers Revised DEC 2022Rajni KumariNo ratings yet

- AI in Banking Setting Up For & Continuing Down A Path of SuccessDocument39 pagesAI in Banking Setting Up For & Continuing Down A Path of SuccessNguyenNo ratings yet

- Harvard Business Review on Aligning Technology with StrategyFrom EverandHarvard Business Review on Aligning Technology with StrategyRating: 3.5 out of 5 stars3.5/5 (4)

- Hem Tiwari Vs Nidhi Tiwari Mutual Divorce - Revised VersionDocument33 pagesHem Tiwari Vs Nidhi Tiwari Mutual Divorce - Revised VersionKesar Singh SawhneyNo ratings yet

- Accenture Getting Serious About AnalyticsDocument12 pagesAccenture Getting Serious About AnalyticsChristopher Stevens DíezNo ratings yet

- ITAM Organisational Approach by HPDocument20 pagesITAM Organisational Approach by HPnebonline100% (2)

- Advanced Analytics Nine Insights From The C Suite PDFDocument8 pagesAdvanced Analytics Nine Insights From The C Suite PDFJenniffer Sidney Guerrero PradoNo ratings yet

- JJ Itil FinalDocument10 pagesJJ Itil FinalsfsfNo ratings yet

- BAIN BRIEF Big Data The Organizational ChallengeDocument8 pagesBAIN BRIEF Big Data The Organizational ChallengeCharles A WilsonNo ratings yet

- 12 New Trends in ManagementDocument18 pages12 New Trends in ManagementSaqib IqbalNo ratings yet

- George F Kennan and The Birth of Containment The Greek Test CaseDocument17 pagesGeorge F Kennan and The Birth of Containment The Greek Test CaseEllinikos Emfilios100% (1)

- Deloitte Cio 2 0 EngDocument32 pagesDeloitte Cio 2 0 EngLuis Armando VázquezNo ratings yet

- Germ TheoryDocument15 pagesGerm TheoryjackjugNo ratings yet

- Business @ the Speed of Thought (Review and Analysis of Gates' Book)From EverandBusiness @ the Speed of Thought (Review and Analysis of Gates' Book)Rating: 5 out of 5 stars5/5 (2)

- The Fusion of Business and ITDocument167 pagesThe Fusion of Business and ITMichaelNo ratings yet

- Whitepaper: Insurance Business AnalyticsDocument7 pagesWhitepaper: Insurance Business AnalyticsSanjay GuptaNo ratings yet

- The CIO's Guide To Data and Analytics InnovationDocument19 pagesThe CIO's Guide To Data and Analytics InnovationEnrique Amarilla100% (1)

- The Data and Analytics Leader: Your Competitive AdvantageDocument8 pagesThe Data and Analytics Leader: Your Competitive AdvantagekaushimNo ratings yet

- Big Data Analytics PDFDocument6 pagesBig Data Analytics PDFcontactsm100% (1)

- 4 Pillars For Creating A Winning Enterprise AI StrategyDocument21 pages4 Pillars For Creating A Winning Enterprise AI StrategyKartik ChoudharyNo ratings yet

- What Are The Key Barriers in Digitising Organisations' Procurement Function and How To Overcome ThemDocument6 pagesWhat Are The Key Barriers in Digitising Organisations' Procurement Function and How To Overcome ThemAy KNo ratings yet

- Revolute-Input Delta Robot DescriptionDocument43 pagesRevolute-Input Delta Robot DescriptionIbrahim EssamNo ratings yet

- 15Document74 pages15physicsdocs60% (25)

- Business Analytics: Just Another Passing Fad?Document5 pagesBusiness Analytics: Just Another Passing Fad?Deloitte Analytics100% (1)

- Predictive AnalyticsDocument28 pagesPredictive Analyticssami ghazouaniNo ratings yet

- IT Strategic GridDocument7 pagesIT Strategic GridIti Si100% (1)

- Business @ The Speed Of Thought - Bill Gates (Using a Digital Nervous System)From EverandBusiness @ The Speed Of Thought - Bill Gates (Using a Digital Nervous System)No ratings yet

- The ADDIE Instructional Design ModelDocument2 pagesThe ADDIE Instructional Design ModelChristopher Pappas100% (1)

- 10 Steps To Creating A Data-Driven CultureDocument5 pages10 Steps To Creating A Data-Driven CultureAditi KathinNo ratings yet

- Idc Analyst Connection: Analytics For Driving Business Process ImprovementDocument3 pagesIdc Analyst Connection: Analytics For Driving Business Process ImprovementWebster CarrollNo ratings yet

- Manage Information for Strategic SuccessDocument87 pagesManage Information for Strategic Successyedu84No ratings yet

- ConclusionsPaper IMA India TechRupt Workshop March 2022Document21 pagesConclusionsPaper IMA India TechRupt Workshop March 2022aaNo ratings yet

- Sustaining Analytics: Deliver Hindsight, Insight, and ForesightDocument9 pagesSustaining Analytics: Deliver Hindsight, Insight, and Foresightapi-89285443No ratings yet

- Operational Intelligence: What It Is and Why You Need It NowDocument15 pagesOperational Intelligence: What It Is and Why You Need It NowMutia DiarNo ratings yet

- StrategyThe Blueprint in BriefDocument19 pagesStrategyThe Blueprint in BriefxsdeniedNo ratings yet

- The Digitalization JourneyDocument6 pagesThe Digitalization JourneyMaheswararaj JNo ratings yet

- Ey Reporting Big Data Transform AuditDocument5 pagesEy Reporting Big Data Transform AuditTHUY NGUYEN THANHNo ratings yet

- What Are Some of The Challenges in Developing IT Solution To Solve Business Problem and Meet New Business Opportunities?Document7 pagesWhat Are Some of The Challenges in Developing IT Solution To Solve Business Problem and Meet New Business Opportunities?umairu89No ratings yet

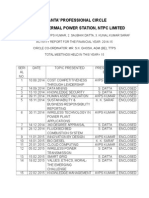

- Quanta Professional CircleDocument22 pagesQuanta Professional Circleron1234567890No ratings yet

- Accenture Technology Vision 2013: Executive SummaryDocument8 pagesAccenture Technology Vision 2013: Executive SummaryDwi Prayoga PutraNo ratings yet

- BBC - Analytics and Decision MakingDocument3 pagesBBC - Analytics and Decision MakingmarinomNo ratings yet

- Data Pirates - Case Prep Sheet 1 Dell CaseDocument5 pagesData Pirates - Case Prep Sheet 1 Dell CaseAditi KathinNo ratings yet

- Are You Ready Tobea: Tech-Savvy CFO?Document8 pagesAre You Ready Tobea: Tech-Savvy CFO?Federico RabinoNo ratings yet

- What Do You Think The Future of Accounting Looks LikeDocument6 pagesWhat Do You Think The Future of Accounting Looks LikeDucanh TranNo ratings yet

- BAIN BRIEF Building IT CapabilitiesDocument4 pagesBAIN BRIEF Building IT Capabilitiesjohnwoo1hotmailcomNo ratings yet

- Implementing A Successful Digital Transformation StrategyDocument3 pagesImplementing A Successful Digital Transformation Strategyvalocity.marketingNo ratings yet

- Assessing The True Value of Business Analytics: White PaperDocument13 pagesAssessing The True Value of Business Analytics: White PaperAbhishiktha VangaNo ratings yet

- mgt186 9Document4 pagesmgt186 9Raihan Vincent CardenasNo ratings yet

- Two Mark Question & Answers Subject Name: Enterprise Resource Planning Degree/ Branch Unit - IDocument11 pagesTwo Mark Question & Answers Subject Name: Enterprise Resource Planning Degree/ Branch Unit - IDivya RaviprakashNo ratings yet

- Big Data and Predictive Analytics: What's New?Document3 pagesBig Data and Predictive Analytics: What's New?John MarvelleNo ratings yet

- Tech Trends 2015Document136 pagesTech Trends 2015api-283646684No ratings yet

- Digital Success Requires Breaking RulesDocument8 pagesDigital Success Requires Breaking RulesAthina TsarmpouNo ratings yet

- Chapter 13 Emerging TechnologiesDocument6 pagesChapter 13 Emerging Technologiesqwira analyticsNo ratings yet

- What To Expect From Workplace Digital Transformation in 2022Document10 pagesWhat To Expect From Workplace Digital Transformation in 2022SaraTurkiNo ratings yet

- Gap AnalysisDocument5 pagesGap AnalysisSulav RijalNo ratings yet

- Essay About Information ManagementDocument3 pagesEssay About Information ManagementGabriel DuranNo ratings yet

- Information System For ManagersDocument10 pagesInformation System For ManagersAditya Raj DuttaNo ratings yet

- Business AnalyticsDocument4 pagesBusiness AnalyticsYan Myo ZawNo ratings yet

- Role of Information Technology in ReengineeringDocument7 pagesRole of Information Technology in Reengineeringvicky20008No ratings yet

- Empower Your Organization with Self-Service Cloud AnalyticsDocument11 pagesEmpower Your Organization with Self-Service Cloud AnalyticsLeonardo PaixãoNo ratings yet

- HBRN. DEHORATIUS A. MUSALEM R. ROODERKERK - Digital Transformation - Why Retailers Fail To Adopt Advanced Data Analytics (27feb2023)Document8 pagesHBRN. DEHORATIUS A. MUSALEM R. ROODERKERK - Digital Transformation - Why Retailers Fail To Adopt Advanced Data Analytics (27feb2023)Rina NovitaNo ratings yet

- Key Features of Machine LearningDocument7 pagesKey Features of Machine LearningOana Maria EneNo ratings yet

- Co-Pilot of The Business: Finance Is The New Guidance SystemDocument9 pagesCo-Pilot of The Business: Finance Is The New Guidance SystemRobertoCLindoSanchezNo ratings yet

- 5-Stage Strategic Plan Implement New TechDocument7 pages5-Stage Strategic Plan Implement New TechJaved YousafNo ratings yet

- Case StudyDocument7 pagesCase StudyKamauWafulaWanyamaNo ratings yet

- Unit 11 LeadershipDocument4 pagesUnit 11 LeadershipMarijana DragašNo ratings yet

- People v. De Joya dying declaration incompleteDocument1 pagePeople v. De Joya dying declaration incompletelividNo ratings yet

- CvSU Vision and MissionDocument2 pagesCvSU Vision and MissionJoshua LagonoyNo ratings yet

- Bunga Refira - 1830104008 - Allophonic RulesDocument6 pagesBunga Refira - 1830104008 - Allophonic RulesBunga RefiraNo ratings yet

- Asian Paints Research ProposalDocument1 pageAsian Paints Research ProposalYASH JOHRI-DM 21DM222No ratings yet

- So Neither or NorDocument2 pagesSo Neither or NorMita KusniasariNo ratings yet

- Chapter 7 Project Cost ManagementDocument48 pagesChapter 7 Project Cost Managementafifah suyadiNo ratings yet

- Second Periodic Test - 2018-2019Document21 pagesSecond Periodic Test - 2018-2019JUVELYN BELLITANo ratings yet

- Movie Recommendation System-1Document25 pagesMovie Recommendation System-1Singi TejaswiniNo ratings yet

- Opinions and ThoughtsDocument2 pagesOpinions and Thoughtsfikri alfaroqNo ratings yet

- ATS - Contextual Theology SyllabusDocument4 pagesATS - Contextual Theology SyllabusAts ConnectNo ratings yet

- Solutions To Basic Economic Problems - AllDocument27 pagesSolutions To Basic Economic Problems - AllAsha GeorgeNo ratings yet

- Overview of Isopanisad, Text, Anvaya and TranslationDocument7 pagesOverview of Isopanisad, Text, Anvaya and TranslationVidvan Gauranga DasaNo ratings yet

- Modul Kls XI Sem IDocument6 pagesModul Kls XI Sem IAnonymous WgvOpI0CNo ratings yet

- Wave Optics Part-1Document14 pagesWave Optics Part-1Acoustic GuyNo ratings yet

- Chapter 1 Notes and ReiewDocument6 pagesChapter 1 Notes and ReiewTricia Mae Comia AtienzaNo ratings yet

- Listening LP1Document6 pagesListening LP1Zee KimNo ratings yet

- Course Outline IST110Document4 pagesCourse Outline IST110zaotrNo ratings yet

- Essay A Level Drama and Theatee Studies A LevelDocument2 pagesEssay A Level Drama and Theatee Studies A LevelSofia NietoNo ratings yet

- Sta. Ignacia High School: Philosophy 101Document1 pageSta. Ignacia High School: Philosophy 101Mira VeranoNo ratings yet

- SLE On TeamworkDocument9 pagesSLE On TeamworkAquino Samuel Jr.No ratings yet

- Influence of Contours On ArchitectureDocument68 pagesInfluence of Contours On Architecture蘇蘇No ratings yet

- Case DurexDocument3 pagesCase DurexGia ChuongNo ratings yet