Professional Documents

Culture Documents

Income Statement - 10 Year Summary (In Millions)

Uploaded by

yakapmOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Statement - 10 Year Summary (In Millions)

Uploaded by

yakapmCopyright:

Available Formats

Income Statement - 10 Year Summary (in Millions)

12/10

12/09

12/08

12/07

SALES

135,423.0

104,116.0

147,732.0

177,594.0

EBIT

5,737.0

102,493.0

-29,471.0

-6,346.0

DEPRECIATION

6,923.0

11,384.0

18,724.0

9,513.0

TOTAL NET INCOME

6,172.0

104,821.0

-30,943.0

-43,091.0

EPS

2.87

113.24

-53.44

-76.13

TAX RATE (%)

11.71

-2.11

0.0

0.0

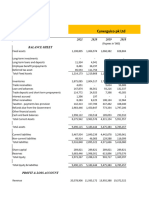

Balance Sheet - 10 Year Summary (in Millions)

12/10

12/09

12/08

12/07

CURRENT ASSETS

138,898.0

136,295.0

91,039.0

0.0

CURRENT LIABILITIES

102,718.0

108,048.0

176,599.0

0.0

LONG TERM DEBT

9,974.0

5,562.0

29,018.0

0.0

SHARES OUTSTANDING

1.5 Bil

1.5 Bil

610.5 Mil

0.0 Mil

Financial data in U.S. Dollars

Values in Millions (Except for per share items)

Business Type: Industry

Financial statements are prepared in this standard format to allow direct comparisons of all companies and industries

across multiple time frames.

See 10K and 10Q SEC Filings for as reported statements

INCOME STATEMENT

2010

Period End Date

Period Length

Stmt Source

2009

2008

2007

Stmt Source Date

Stmt Update Type

12/31/2010 12/31/2009 12/31/2008 12/31/2007

12 Months 12 Months 12 Months 12 Months

10-K PROSPECTU PROSPECTU PROSPECTU

S

S

S

03/01/2011 08/18/2010 08/18/2010 08/18/2010

Updated

Updated

Updated

Updated

Revenue

Other Revenue, Total

Total Revenue

135,423.0 104,116.0 147,732.0 177,594.0

169.0

473.0

1,247.0

2,390.0

135,592.0 104,589.0 148,979.0 179,984.0

Cost of Revenue, Total

Gross Profit

Selling/General/Administrative

Expenses, Total

Research & Development

Depreciation/Amortization

Interest Expense (Income), Net

Operating

Unusual Expense (Income)

118,944.0

16,479.0

112,195.0

-8,079.0

149,257.0

-1,525.0

165,573.0

12,021.0

11,446.0

12,359.0

19,050.0

15,959.0

0.0

125.0

0.0

0.0

190.0

0.0

0.0

749.0

0.0

0.0

1,259.0

0.0

-196.0 -126,878.0

567.0

552.0

Other Operating Expenses, Total

Operating Income

-7.0

751.0

409.0

5,280.0 105,943.0 -21,187.0

Interest Income (Expense), Net NonOperating

Gain (Loss) on Sale of Assets

Other, Net

Income Before Tax

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

5,737.0 102,493.0 -29,471.0

0.0

0.0

-6,346.0

Income Tax - Total

Income After Tax

672.0

-2,166.0

1,766.0

36,863.0

5,065.0 104,659.0 -31,237.0 -43,209.0

Minority Interest

Equity In Affiliates

U.S. GAAP Adjustment

Net Income Before Extra. Items

-331.0

-396.0

108.0

-406.0

1,438.0

558.0

186.0

524.0

0.0

0.0

0.0

0.0

6,172.0 104,821.0 -30,943.0 -43,091.0

Total Extraordinary Items

Net Income

0.0

0.0

0.0

545.0

-4,309.0

0.0

0.0

4,549.0

6,172.0 104,821.0 -30,943.0 -38,542.0

-1,504.0

-131.0

0.0

0.0

Basic Weighted Average Shares

Basic EPS Excluding Extraordinary Items

Basic EPS Including Extraordinary Items

1,500.0

3.11

3.11

924.5

113.24

113.24

579.0

-53.44

-53.44

566.0

-76.13

-68.1

Diluted Weighted Average Shares

Diluted EPS Excluding Extrordinary

Items

Diluted EPS Including Extraordinary

Items

1,624.0

2.87

924.5

113.24

579.0

-53.44

566.0

-76.13

2.87

113.24

-53.44

-68.1

0.0

0.0

0.5

1.0

0.0

1,098.0

4,363.0

0.0

6,151.0

9,756.0

0.0

2,659.0

18,641.0

0.0

3,399.0

9,439.0

-9,522.0

-1,762.0

-20,906.0 -20,486.0

-24,385.0 -28,904.0

22,188.3 -30,868.45

22,219.3 -30,574.45

6,161.0

-3,352.0

-5,794.0

-42,850.2

-42,732.2

Total Adjustments to Net Income

Dividends per Share - Common Stock

Primary Issue

Gross Dividends - Common Stock

Interest Expense, Supplemental

Depreciation, Supplemental

Normalized

Normalized

Normalized

Normalized

Normalized

Common

EBITDA

EBIT

Income Before Tax

Income After Taxes

Income Available to

Basic Normalized EPS

Diluted Normalized EPS

Amortization of Intangibles

Financial data in U.S. Dollars

Values in Millions (Except for per share items)

12,007.0

5,084.0

5,541.0

4,891.96

4,494.96

3.0

2.77

2,560.0

24.03

24.03

1,628.0

-52.81

-52.81

83.0

-75.5

-75.5

74.0

Business Type: Industry

Financial statements are prepared in this standard format to allow direct comparisons of all companies and industries

across multiple time frames.

See 10K and 10Q SEC Filings for as reported statements

BALANCE SHEET

2009

2008

2007

2010

Period End Date

Stmt Source

Stmt Source Date

Stmt Update Type

Assets

Cash and Short Term Investments

Total Receivables, Net

Total Inventory

Prepaid Expenses

Other Current Assets, Total

Total Current Assets

Property/Plant/Equipment, Total - Net

Goodwill, Net

Intangibles, Net

Long Term Investments

Note Receivable - Long Term

Other Long Term Assets, Total

Other Assets, Total

Total Assets

Liabilities and Shareholders' Equity

Accounts Payable

Payable/Accrued

Accrued Expenses

Notes Payable/Short Term Debt

Current Port. of LT Debt/Capital Leases

Other Current Liabilities, Total

Total Current Liabilities

Total Long Term Debt

12/31/2010 12/31/2009 12/31/2008 12/31/2007

10-K

10-K PROSPECTU

S

03/01/2011 03/01/2011 08/18/2010

Updated Reclassified

Updated

N/A

N/A

N/A

26,616.0

22,813.0

14,194.0

N/A

8,699.0

7,518.0

7,918.0

0.0

12,125.0

0.0

5,613.0

53,053.0

10,107.0

0.0

18,809.0

59,247.0

13,195.0

0.0

8,960.0

44,267.0

0.0

0.0

0.0

0.0

19,235.0

18,687.0

31,778.0

30,672.0

11,882.0

14,547.0

10,158.0

9,571.0

8,662.0

149.0

4,130.0

3,422.0

0.0

0.0

138,898.0 136,295.0

40,107.0

0.0

265.0

2,189.0

0.0

4,211.0

0.0

91,039.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

21,497.0

0.0

21,590.0

1,123.0

493.0

2,454.0

47,157.0

18,725.0

0.0

21,120.0

9,497.0

724.0

2,369.0

52,435.0

22,259.0

0.0

30,661.0

8,470.0

8,450.0

5,768.0

75,608.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

9,974.0

5,562.0

29,018.0

0.0

Deferred Income Tax

Minority Interest

Other Liabilities, Total

Total Liabilities

Redeemable Preferred Stock

Preferred Stock - Non Redeemable, Net

Common Stock

Additional Paid-In Capital

Retained Earnings (Accumulated

Deficit)

Other Equity, Total

Total Equity

Total Liabilities & Shareholders

Equity

1,207.0

807.0

563.0

979.0

708.0

484.0

43,401.0

48,536.0

70,926.0

102,718.0 108,048.0 176,599.0

0.0

10,391.0

15.0

24,257.0

266.0

1,251.0

36,180.0

0.0

6,998.0

15.0

24,040.0

-4,394.0

0.0

0.0

1,017.0

16,489.0

-70,727.0

0.0

0.0

0.0

0.0

0.0

1,588.0 -32,339.0

28,247.0 -85,560.0

0.0

0.0

138,898.0 136,295.0

Total Common Shares Outstanding

Total Preferred Shares Outstanding

1,500.14

376.1

0.0

0.0

0.0

0.0

1,500.0

360.0

91,039.0

0.0

610.48

0.0

0.0

0.0

Financial data in U.S. Dollars

Values in Millions (Except for per share items)

Business Type: Industry

Financial statements are prepared in this standard format to allow direct comparisons of all companies and industries

across multiple time frames.

See 10K and 10Q SEC Filings for as reported statements

CASH FLOW

2010

Period End Date

Period Length

Stmt Source

Stmt Source Date

Stmt Update Type

Net Income/Starting Line

Depreciation/Depletion

Amortization

Deferred Taxes

Non-Cash Items

Changes in Working Capital

2009

2008

2007

12/31/2010 12/31/2009 12/31/2008 12/31/2007

12 Months 12 Months 12 Months 12 Months

10-K

10-K

10-K PROSPECTU

S

03/01/2011 03/01/2011 03/01/2011 08/18/2010

Updated Reclassified Reclassified

Updated

6,413.0 105,217.0

6,923.0

11,384.0

0.0

0.0

0.0

0.0

-5,676.0 -126,983.0

-489.0

-7,248.0

-31,051.0

18,724.0

0.0

0.0

168.0

-38,136.0

9,513.0

0.0

36,717.0

3,049.0

94.0

-3,412.0

Cash from Operating Activities

Capital Expenditures

Other Investing Cash Flow Items,

Total

Cash from Investing Activities

7,171.0 -17,630.0 -12,065.0

7,731.0

-4,200.0

-5,379.0

-7,530.0

-7,542.0

5,433.0

-13,599.0

5,766.0

5,782.0

1,233.0 -18,978.0

-1,764.0

-1,760.0

-1,421.0

-1,384.0

0.0

-5.0

Total Cash Dividends Paid

Issuance (Retirement) of Stock, Net

Issuance (Retirement) of Debt, Net

Cash from Financing Activities

-1,572.0

4,857.0

-11,634.0

-9,770.0

-97.0

0.0

46,055.0

44,574.0

-283.0

0.0

4,126.0

3,843.0

-567.0

0.0

-5,021.0

-5,593.0

Foreign Exchange Effects

Net Change in Cash

-57.0

-1,423.0

660.0

-778.0

8,626.0 -10,764.0

316.0

694.0

Net Cash - Beginning Balance

Net Cash - Ending Balance

22,679.0

21,256.0

14,053.0

22,679.0

Financing Cash Flow Items

24,817.0

14,053.0

24,123.0

24,817.0

Financial data in U.S. Dollars

Values in Millions (Except for per share items)

Business Type: Industry

Financial statements are prepared in this standard format to allow direct comparisons of all companies and industries

across multiple time frames.

See 10K and 10Q SEC Filings for as reported statements

SOURCE: http://moneycentral.msn.com/investor/invsub/results/statemnt.aspx?

symbol=US%3aGM&stmtView=Ann

You might also like

- Excel FunctionsDocument13 pagesExcel Functionsfhlim2069No ratings yet

- Introduction to Corporate GovernanceDocument16 pagesIntroduction to Corporate GovernanceSourav SenNo ratings yet

- Teuer Furniture A Case Solution PPT (Group-04)Document13 pagesTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- FIN5FMA Tutorial 9 SolutionsDocument4 pagesFIN5FMA Tutorial 9 Solutionsmitul tamakuwalaNo ratings yet

- Company Law MCQ For CA Inter PDFDocument57 pagesCompany Law MCQ For CA Inter PDFArun ManojNo ratings yet

- Summer Internship PresentationDocument16 pagesSummer Internship PresentationGunjan KumarNo ratings yet

- Implied Volatility Step by Step GuideDocument22 pagesImplied Volatility Step by Step GuideAriol ZereNo ratings yet

- Historical Release Dates Non Farm PayrollsDocument10 pagesHistorical Release Dates Non Farm PayrollsMessageDanceNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- India's Growing Edible Oil Imports and Business OpportunitiesDocument19 pagesIndia's Growing Edible Oil Imports and Business Opportunitiessreeramchellappa100% (1)

- Schwartz R.a., Byrne J.a., Colaninno A. - A Trading Desk View of Market Quality (2005)Document206 pagesSchwartz R.a., Byrne J.a., Colaninno A. - A Trading Desk View of Market Quality (2005)TimoNo ratings yet

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- Shell Financial Data BloombergDocument48 pagesShell Financial Data BloombergShardul MudeNo ratings yet

- E. Sensitivities and ScenariosDocument3 pagesE. Sensitivities and ScenariosDadangNo ratings yet

- Submitted By: Name: R.Akash PRN: 16020841177 Finance 2016-18 Submitted To: Prof. Pooja GuptaDocument44 pagesSubmitted By: Name: R.Akash PRN: 16020841177 Finance 2016-18 Submitted To: Prof. Pooja Guptaranjana kashyapNo ratings yet

- PepsiCo Inc (PEP US) Financial Highlights and Key Metrics 2013-2022Document22 pagesPepsiCo Inc (PEP US) Financial Highlights and Key Metrics 2013-2022Jasneet BaidNo ratings yet

- Group 2 - VNM - Ver1Document11 pagesGroup 2 - VNM - Ver1Ánh Lê QuỳnhNo ratings yet

- Bajaj Auto Financial Analysis: Presented byDocument20 pagesBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995No ratings yet

- TotalEnergies Financial Data BloombergDocument48 pagesTotalEnergies Financial Data BloombergShardul MudeNo ratings yet

- Nike Inc Nyse Nke FinancialsDocument10 pagesNike Inc Nyse Nke FinancialsvipinNo ratings yet

- Charter Communication - DATADocument4 pagesCharter Communication - DATARahil VermaNo ratings yet

- Charter Communication - DATADocument4 pagesCharter Communication - DATARahil VermaNo ratings yet

- Charter Communication - DATADocument4 pagesCharter Communication - DATARahil VermaNo ratings yet

- Charter Communication - DATADocument4 pagesCharter Communication - DATARahil VermaNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- Budgetary Control as a Tool for Cost ManagementDocument8 pagesBudgetary Control as a Tool for Cost ManagementDileepkumar K DiliNo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Walt Disney Co/The (DIS US) - ADVERTDocument4 pagesWalt Disney Co/The (DIS US) - ADVERTRahil VermaNo ratings yet

- Analisis de AmazonDocument6 pagesAnalisis de AmazonFrancisco MuñozNo ratings yet

- Reliance Industries LimitedDocument12 pagesReliance Industries LimitedKunal SalunkeNo ratings yet

- Starwood Hotels Resorts Worldwide Inc FinancialsDocument48 pagesStarwood Hotels Resorts Worldwide Inc FinancialsAgarwal SaranshNo ratings yet

- Financial Statistical Summary: Attock Refinery LimitedDocument2 pagesFinancial Statistical Summary: Attock Refinery Limitedabrofab123No ratings yet

- Oil India LTD (OINL IN) - BBG AdjustedDocument16 pagesOil India LTD (OINL IN) - BBG AdjustedBhawna YadavNo ratings yet

- AnalysispdfDocument15 pagesAnalysispdfMalevolent IncineratorNo ratings yet

- Medical Shop Business PlanDocument16 pagesMedical Shop Business PlanPrajwal Vemala JagadeeshwaraNo ratings yet

- Redco Textiles LimitedDocument18 pagesRedco Textiles LimitedUmer FarooqNo ratings yet

- Pronatural Food Corp. Financial Statement AnalysisDocument29 pagesPronatural Food Corp. Financial Statement AnalysisZejkeara ImperialNo ratings yet

- Economic Rate of Return Using Multiple RegressionDocument12 pagesEconomic Rate of Return Using Multiple RegressionBalu AmithNo ratings yet

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Document11 pagesProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNo ratings yet

- Cielo S.A. and SubsidiariesDocument81 pagesCielo S.A. and Subsidiariesb21t3chNo ratings yet

- Investment ExcelDocument78 pagesInvestment ExcelByezid LimonNo ratings yet

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDocument19 pagesKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNo ratings yet

- JFHFFDocument18 pagesJFHFFUjjwal SharmaNo ratings yet

- BUS 635 Project On BD LampsDocument24 pagesBUS 635 Project On BD LampsNazmus Sakib PlabonNo ratings yet

- Lecture Common Size and Comparative AnalysisDocument28 pagesLecture Common Size and Comparative AnalysissumitsgagreelNo ratings yet

- Balance SheetDocument6 pagesBalance SheetMohammad Abid MiahNo ratings yet

- Tata Steel's Balance Sheet and Financial Ratios AnalysisDocument12 pagesTata Steel's Balance Sheet and Financial Ratios AnalysisDhwani ShahNo ratings yet

- Axis Bank Limited Group - Consolidated Profit & Loss AccountDocument66 pagesAxis Bank Limited Group - Consolidated Profit & Loss Accountshreyjain88No ratings yet

- BSBFIM601___Task_1.docxDocument10 pagesBSBFIM601___Task_1.docxKitpipoj PornnongsaenNo ratings yet

- Analysis of financial ratios for multiple companies over 8 yearsDocument82 pagesAnalysis of financial ratios for multiple companies over 8 yearssamuel safoNo ratings yet

- Assignment Brief - Accounting and Finance For Managers - ACC3015Document16 pagesAssignment Brief - Accounting and Finance For Managers - ACC3015AtiqEyashirKanakNo ratings yet

- Acc105 CaDocument12 pagesAcc105 CaAaryan DwivediNo ratings yet

- PLDT's financial performance over 5 yearsDocument12 pagesPLDT's financial performance over 5 yearsStephene MaynopasNo ratings yet

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaNo ratings yet

- Axis BankDocument14 pagesAxis BankAswini Kumar BhuyanNo ratings yet

- LDG - Financial TemplateDocument20 pagesLDG - Financial TemplateQuan LeNo ratings yet

- BSBFIM601 Assessment 1: Sales and Profit BudgetsDocument8 pagesBSBFIM601 Assessment 1: Sales and Profit Budgetsprasannareddy9989100% (1)

- Example of Financial TemplateDocument2 pagesExample of Financial Templatezeus33No ratings yet

- Valuation Model 1Document71 pagesValuation Model 1Tuan NguyenNo ratings yet

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamareNo ratings yet

- Business & Finance Homework HelpDocument9 pagesBusiness & Finance Homework HelpAustine OtienoNo ratings yet

- FM 1-1Document25 pagesFM 1-1Utkarsh BalamwarNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- General Electric Co (GE US) - AdjustedDocument4 pagesGeneral Electric Co (GE US) - AdjustedAswini Kumar BhuyanNo ratings yet

- Day 1 To Day 4Document186 pagesDay 1 To Day 4Sameer PadhyNo ratings yet

- CAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - StudentsDocument4 pagesCAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - StudentsWaqas RashidNo ratings yet

- Accounting For Fixed Assets (As-10)Document18 pagesAccounting For Fixed Assets (As-10)Jalaj ShahNo ratings yet

- Sample Midterm PDFDocument4 pagesSample Midterm PDFVaibhav MittalNo ratings yet

- Haim LevyDocument17 pagesHaim LevyHakan AslanNo ratings yet

- Ankita's Project On IPO.Document81 pagesAnkita's Project On IPO.takhu0% (1)

- Financial Deepening TurkeyDocument111 pagesFinancial Deepening TurkeyFajrul Syam ArzaniNo ratings yet

- ING - FX TalkingDocument18 pagesING - FX TalkingCiocoiu Vlad AndreiNo ratings yet

- Copy (2) of Futures Market Trading Mechanism-1Document14 pagesCopy (2) of Futures Market Trading Mechanism-1Pradipta Sahoo100% (1)

- FRA and SWAPSDocument49 pagesFRA and SWAPSBluesinhaNo ratings yet

- Risk Management in SharekhanDocument60 pagesRisk Management in SharekhanSilvi Khurana0% (1)

- Financial Markets and Their Role in EconomyDocument6 pagesFinancial Markets and Their Role in EconomyMuzammil ShahzadNo ratings yet

- MaximDocument31 pagesMaximForexProNo ratings yet

- Silver OutlookDocument14 pagesSilver OutlookkapilhituNo ratings yet

- India Cements - Annual - Report - 2019 PDFDocument180 pagesIndia Cements - Annual - Report - 2019 PDFPrajwalNo ratings yet

- The 3 Common and Costly Mistakes With Candle ChartsDocument17 pagesThe 3 Common and Costly Mistakes With Candle ChartsA ZNo ratings yet

- About DematDocument28 pagesAbout DematShaila TibeliNo ratings yet

- Alpari UK Bank Deposit DetailsDocument3 pagesAlpari UK Bank Deposit DetailsTSXfx01No ratings yet

- SummaryDocument24 pagesSummaryankit yadavNo ratings yet

- Coffey V Ripple Labs ComplaintDocument32 pagesCoffey V Ripple Labs ComplaintShaurya MalwaNo ratings yet

- Ban Iko Pilipinas: SentralDocument3 pagesBan Iko Pilipinas: SentralMaya Julieta Catacutan-EstabilloNo ratings yet

- Sebi Mergers & Acquisitions: Eira KochharDocument26 pagesSebi Mergers & Acquisitions: Eira Kochhareira kNo ratings yet