Professional Documents

Culture Documents

INVESTMENT DECLARATION

Uploaded by

Shishir RoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INVESTMENT DECLARATION

Uploaded by

Shishir RoyCopyright:

Available Formats

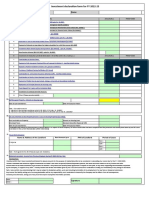

INVESTMENT DECLARATION FOR YEAR 2011-2012 Company : InfoStretch Solutions Pvt Ltd

*E.CODE : *NAME (Mr/Ms.) *DOJ. *PAN NO. *ADDRESS (for the purposes of HRA ) Details of Dependents

I undertake to make the following investments qualifying u/s 88C of the Income Tax Act, 1961 during the financial year 2011-2012 and submit the proof thereof alongwith proof under Chapter VI-A and Rent Receipts (if applicable) before January- 2012.

DESCRIPTION AMOUNT INVESTMENTS U/S 80C capped at Rs 1 Lac Public Provident Fund (PPF) Life Insurance Premium Paid (Like LIC,ICICI Prudential, TATA AIG etc..) National Savings Certificate (NSC) Interest accrued on NSC Approved Superannuation Fund Units purchased from a recognised mutual fund Children Education Expenses / Tuition Fees Housing Loan - Principal Payment Registration / Stamp Duty charges paid for registration of house property NHB Scheme Investment in Mutual Funds / equity shares of Companies engaged in Contribution to Pension Fund Senior Citizen Saving Scheme 2004 Fixed Deposit for 5 Years or more with scheduled bank Post Office Time Deposit Account Total Investments U/S 80C - limited to Rs 1,00,000/- only 0.00 INVESTMENTS U/S 80CCF Infrastructure Bonds (Maximum limit Rs.20,000/-) OTHER PERMITTED DEDUCTIONS 80D - Medical Insurance Premium (up to Rs.15,000/-or Rs 20,000/- as applicable and Additional 1 Deductioon of Rs 15,000/- or Rs.20,000/- allowed in an Individual paying Medical Insurance Premium for His or Her Parent or Parents 2 80DD - Medical Treatment of Dependent suffering from Permanent Disability (up to Rs.50,000/-) 3 80DDB - Expenditure on Medical Treatment for specified disease (up to Rs. 40,000) 4 80E - Repayment of Interest against Educational Loan - no limits on interest paid during the year 5 80U - Permanent Physical Disability (Rs.75000/- ) 6 Total Investments under chapter VI A 0.00 Amount of Bills D. REIMBURSEMENTS 1 Medical (Exemption up to Rs. 15,000/-) 2 Leave Travel Allowance ( 2 journeys in a block of four years exempted) LTA Claimed Current Block is 2010-2013 Yes / No If I do not submit the bills the amount of Medical / LTA paid can be taxed as per the rule. E. INCOME OTHER THAN SALARY- (Attach form 12-C detailing other Income) F. INTEREST PAYMENT ON HOUSING LOAN - (Attach Form 12-C) (up to Rs.1 .5 Lacs if the loan taken after 1-4-99, 30000 if it is prior to 1-4-1999 and there is no limit on let out property) G. RENT PAID PER MONTH ( Please mention the starting and ending month) Rent per month (IF the rent amount changes during the financial year please specify the To Date:amount and the period separately) From Date: To Date: (DD/MM/YYYY format) From Date: The house is located in a Metro / Non Metro H PREVIOUS EMPLOYMENT SALARY (Salary earned from 01/04/11 till date of Joining) If Yes, Form 16 from previous employer or Form 12 B attached If no form 16 or 12B attached, confirm whether the standard deduction and Working Woman Rebate considered by the previous employer or not VERIFICATION I do hereby declare that what is stated above is true to the best of my knowledge and belief. Further, in case of any change in rent and / or occupation of the above premises I would revise the declaration & inform immediately. Note: Please do not attach any proofs to this form. This is only a Declaration .

S.NO. A. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 15 B. 1 C.

Proposed Date of Investment / submission

Rent per month

*Employees' Signature. * Indicated filled is mandatory

Date:

You might also like

- S650 Service - 6987168 enUS SMDocument1,311 pagesS650 Service - 6987168 enUS SMcarlos andres salazar sanchez75% (4)

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Delem: Installation Manual V3Document73 pagesDelem: Installation Manual V3Marcus ChuaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- CEMEX Global Strategy CaseDocument4 pagesCEMEX Global Strategy CaseSaif Ul Islam100% (1)

- Business Plan - Docx 3-Star Hospitality and Tourism Devt Centre in Mbarara - UgandaDocument49 pagesBusiness Plan - Docx 3-Star Hospitality and Tourism Devt Centre in Mbarara - UgandaInfiniteKnowledge100% (9)

- Swift Algorithms GuideDocument50 pagesSwift Algorithms GuideShishir Roy100% (1)

- Cryptography Seminar - Types, Algorithms & AttacksDocument18 pagesCryptography Seminar - Types, Algorithms & AttacksHari HaranNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Income Tax Declaration Form 2012-13Document2 pagesIncome Tax Declaration Form 2012-13asfsadfSNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- HRA, 80C, 80D, 80CCD deductions and landlord detailsDocument9 pagesHRA, 80C, 80D, 80CCD deductions and landlord detailsfaiyaz432No ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Smartivity Labs Employee Tax Form GuideDocument2 pagesSmartivity Labs Employee Tax Form GuideSanjeev Kumar50% (2)

- Zuari Indian Oiltanking Ltd Investment Declaration 2010-11Document2 pagesZuari Indian Oiltanking Ltd Investment Declaration 2010-11shivshenoyNo ratings yet

- HRA, 80C, 80D, 80CCD Investment Declaration GuideDocument10 pagesHRA, 80C, 80D, 80CCD Investment Declaration GuidecutieedivyaNo ratings yet

- For Shalini Investment Declaration-2012-13Document1 pageFor Shalini Investment Declaration-2012-13Poorni GanesanNo ratings yet

- Tax Savings Declaration Form 2010-11Document1 pageTax Savings Declaration Form 2010-11Priyanka KhemkaNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Epsf Form & Guideliness - 2016-17Document8 pagesEpsf Form & Guideliness - 2016-17SumanNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Epsf Form 2011-2012Document2 pagesEpsf Form 2011-2012Chethan KumarNo ratings yet

- Tax Savings Declarations GuidelinesDocument13 pagesTax Savings Declarations GuidelinesAditya DasNo ratings yet

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoNo ratings yet

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Document2 pagesArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050No ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- Guidelines For EPSF FY 2012-13.Document14 pagesGuidelines For EPSF FY 2012-13.80ALLAVINo ratings yet

- Guidelines For Income Tax DeclarationDocument9 pagesGuidelines For Income Tax Declarationapoorva1801No ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- IT Declaration Form 2012-13Document1 pageIT Declaration Form 2012-13Suresh SharmaNo ratings yet

- Hemarus Industries Income Tax Declaration Form SummaryDocument4 pagesHemarus Industries Income Tax Declaration Form SummaryShashi NaganurNo ratings yet

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNo ratings yet

- Income tax filing deadline reminderDocument2 pagesIncome tax filing deadline remindermakamkkumarNo ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- Instruction For Submitting ProofsDocument3 pagesInstruction For Submitting Proofssastrylanka_1980No ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Epsf FormDocument1 pageEpsf Formpawanrai5982No ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Proof Submission GuidelinesDocument5 pagesProof Submission GuidelinesveraristuNo ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- ANNUAL INCOME TAX STATEMENTDocument4 pagesANNUAL INCOME TAX STATEMENTManoj SankaranarayanaNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Covering Sheet For Investment Proof 2011-12Document1 pageCovering Sheet For Investment Proof 2011-12sanyu1208No ratings yet

- Declaration Form For 2014-2015Document3 pagesDeclaration Form For 2014-2015RahulKumbhareNo ratings yet

- Investment Declaration Form For The Financial Year 2014 - 15Document7 pagesInvestment Declaration Form For The Financial Year 2014 - 15devanyaNo ratings yet

- Theorem Tax Plan 2012-13Document1 pageTheorem Tax Plan 2012-13Ashwini PadhyNo ratings yet

- Declaration Form (22-23)Document4 pagesDeclaration Form (22-23)vasavi kNo ratings yet

- IT Declaration 2011-12Document2 pagesIT Declaration 2011-12Vijaya Saradhi PeddiNo ratings yet

- Form IR8A tax return guideDocument1 pageForm IR8A tax return guidegk9f5e6ho1owcldxNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- 2 Employee Proof Submission (EPS) Form-TemplateDocument13 pages2 Employee Proof Submission (EPS) Form-TemplateAnil GanduriNo ratings yet

- 2015 Client Checklist - IndividualDocument9 pages2015 Client Checklist - IndividualMichael JordanNo ratings yet

- Circular Ay 2010 11Document4 pagesCircular Ay 2010 11shaitankhopriNo ratings yet

- IT Declaration Format-05-12-2023Document6 pagesIT Declaration Format-05-12-2023somaNo ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Forms Required For Tax Proofs 1011Document5 pagesForms Required For Tax Proofs 1011Neeraj JosephNo ratings yet

- Income Tax FAQ - Everything You Need to KnowDocument4 pagesIncome Tax FAQ - Everything You Need to KnowRanjan SatapathyNo ratings yet

- PBC - Documents - Forms Required For Tax Proofs FY 23-24Document13 pagesPBC - Documents - Forms Required For Tax Proofs FY 23-24saika tabbasumNo ratings yet

- Taxs Note 2015Document17 pagesTaxs Note 2015Anonymous FQaTclTNNo ratings yet

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDocument4 pagesIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaNo ratings yet

- Guidelines For Submission of Investment Proofs For F Y 13-14Document5 pagesGuidelines For Submission of Investment Proofs For F Y 13-14Harshal PanditNo ratings yet

- SLM Unit 01 MB0048Document18 pagesSLM Unit 01 MB0048saravenkNo ratings yet

- Session 200 - Core OS NetworkingDocument45 pagesSession 200 - Core OS NetworkingShishir RoyNo ratings yet

- Session 512 - Using HTML5 Offline StorageDocument81 pagesSession 512 - Using HTML5 Offline StorageShishir RoyNo ratings yet

- OOP ObjCDocument40 pagesOOP ObjCShishir RoyNo ratings yet

- UIScrollView PGDocument38 pagesUIScrollView PGShishir RoyNo ratings yet

- Table of Forces For TrussDocument7 pagesTable of Forces For TrussSohail KakarNo ratings yet

- Daftar Pustaka Marketing ResearchDocument2 pagesDaftar Pustaka Marketing ResearchRiyan SaputraNo ratings yet

- How To Google Like A Pro-10 Tips For More Effective GooglingDocument10 pagesHow To Google Like A Pro-10 Tips For More Effective GooglingMinh Dang HoangNo ratings yet

- GeM Bidding 2568310Document9 pagesGeM Bidding 2568310SICURO INDIANo ratings yet

- Transmission Line ProtectionDocument111 pagesTransmission Line ProtectioneccabadNo ratings yet

- Readiness of Barangay Masalukot During TyphoonsDocument34 pagesReadiness of Barangay Masalukot During TyphoonsJerome AbrigoNo ratings yet

- M88A2 Recovery VehicleDocument2 pagesM88A2 Recovery VehicleJuan CNo ratings yet

- Fin 464 Chapter-03Document18 pagesFin 464 Chapter-03Shantonu Rahman Shanto 1731521No ratings yet

- PrefaceDocument16 pagesPrefaceNavaneeth RameshNo ratings yet

- Capital Asset Pricing ModelDocument11 pagesCapital Asset Pricing ModelrichaNo ratings yet

- Hydropneumatic Accumulators Pulsation Dampeners: Certified Company ISO 9001 - 14001Document70 pagesHydropneumatic Accumulators Pulsation Dampeners: Certified Company ISO 9001 - 14001Matteo RivaNo ratings yet

- Rubrics For Lab Report For PC1 Lab, PC2 Lab, CIC LabDocument4 pagesRubrics For Lab Report For PC1 Lab, PC2 Lab, CIC LabHunie PopNo ratings yet

- RAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefDocument26 pagesRAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefMardiana MardianaNo ratings yet

- CV of Prof. D.C. PanigrahiDocument21 pagesCV of Prof. D.C. PanigrahiAbhishek MauryaNo ratings yet

- Day / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Document4 pagesDay / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Lhea RecenteNo ratings yet

- BR18 Mechanical Engineering Robotics Semester VIDocument2 pagesBR18 Mechanical Engineering Robotics Semester VIPRAVEeNo ratings yet

- HOS Dials in The Driver App - Samsara SupportDocument3 pagesHOS Dials in The Driver App - Samsara SupportMaryNo ratings yet

- Webpage citation guideDocument4 pagesWebpage citation guiderogelyn samilinNo ratings yet

- Ubaf 1Document6 pagesUbaf 1ivecita27No ratings yet

- Getting Started With DAX Formulas in Power BI, Power Pivot, and SSASDocument19 pagesGetting Started With DAX Formulas in Power BI, Power Pivot, and SSASJohn WickNo ratings yet

- SAPGLDocument130 pagesSAPGL2414566No ratings yet

- Business Law and The Regulation of Business 12th Edition Mann Test BankDocument25 pagesBusiness Law and The Regulation of Business 12th Edition Mann Test BankElizabethRuizrxka100% (60)

- Panameterics GF 868 Flare Gas Meter PDFDocument8 pagesPanameterics GF 868 Flare Gas Meter PDFDaniel DamboNo ratings yet

- Term Paper Mec 208Document20 pagesTerm Paper Mec 208lksingh1987No ratings yet

- CSCI5273 PS3 KiranJojareDocument11 pagesCSCI5273 PS3 KiranJojareSales TeamNo ratings yet