Professional Documents

Culture Documents

Mortland v. Aughney Bankruptcy Appeal

Uploaded by

Northern District of California BlogCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortland v. Aughney Bankruptcy Appeal

Uploaded by

Northern District of California BlogCopyright:

Available Formats

Case3:11-cv-00744-WHA Document8

Filed07/06/11 Page1 of 5

1 2 3 4 5 6 FOR THE NORTHERN DISTRICT OF CALIFORNIA 7 8 9 10 JAMES ROBERT MORTLAND III, JOHN CURRY, MONROE TIMOTHY SONNENBERG, ROBERT SONNENBERG, TYLER JENSEN, RYAN WALKER, and SEA WALKER, Appellants, v. PATRICK J. AUGHNEY and SORAYA AUGHNEY, Appellees. / INTRODUCTION In this Chapter 13 action, appellants appeal the bankruptcy courts expungement of their class claim and confirmation of the Chapter 13 plan. For the reasons below, the bankruptcy courts decision is AFFIRMED. STATEMENT Plaintiffs filed a putative class action in Superior Court in 2009. James Robert Mortland III, John Curry, Monroe Timothy Sonnenberg, Sean Walker, Ryan Walker, Robert Sonnenberg, Jr., and Tyler Jensen are the named and opt-in plaintiffs in the class action against Certified Parking Attendants, LLC, and its owners, Patrick Aughney, Soraya Aughney, and Elizabeth Van Lohuizen. CPA and its owners ran a valet parking business. The class action concerned unpaid wages and other state and federal labor law violations. No. C 11-00743 WHA IN THE UNITED STATES DISTRICT COURT

United States District Court

11

For the Northern District of California

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

ORDER AFFIRMING RULINGS OF BANKRUPTCY COURT

Case3:11-cv-00744-WHA Document8

Filed07/06/11 Page2 of 5

1 2 3 4 5 6 7 8 9 10

In July 2010, CPA filed a Chapter 11 bankruptcy claim. Soon thereafter the Aughneys filed for Chapter 13 bankruptcy. In the process of filing for bankruptcy, the debtors listed all their current and former employees from 2005 to the date of their filing. The Bankruptcy Notification Center mailed those listed employees notice of the Chapter 13 claim, how to make claims, and the claims-bar date. The bankruptcy notification did not contain information about the pending class action. Mortland, Curry, and Sonnenberg filed a proof of claim for a priority claim on behalf of themselves and the uncertified class. No other current or former employees filed a proof of claim for the Chapter 13 process. On January 14, the court heard appellees motion to expunge the class claims and, as a similar decision had been made regarding the Chapter 11 class claim, all objections were withdrawn and the motion was granted. Later, to memorialize its decision, the court issued a memorandum explaining its reasons for expunging the class claim. A couple weeks after the hearing on the motion to expunge, the court confirmed the Chapter 13 plan, which did not include the class claim. Without a claim in the Chapter 13 plan, the putative class will not benefit from its distribution. So, the appellants timely appealed both decisions (Appellees Br. 57, Appellants Br. 15). ANALYSIS The appeal raises two issues. First, did the bankruptcy court err in expunging the class claim? And if so, second, did the court err in confirming the Chapter 13 plan because the plan did not take into account the claims of the absent putative class? 1. STANDARD OF REVIEW.

United States District Court

11

For the Northern District of California

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

In deciding an appeal from a bankruptcy court, a district court reviews questions of fact for clear error while conclusions of law are reviewed de novo. A bankruptcy courts findings of fact are accepted unless the reviewing court has a definite and firm conviction that a mistake has been committed. Mixed questions of law and fact are reviewed de novo. In re JTS Corp., 617 F.3d 1102, 1109 (9th Cir. 2010) (internal citations omitted).

Case3:11-cv-00744-WHA Document8

Filed07/06/11 Page3 of 5

1 2 3 4 5 6 7 8 9 10

2.

CREDITORS RIGHTS IN THE CHAPTER 13 PROCESS.

Individuals, rather than corporations, file for Chapter 13 bankruptcy. 11 U.S.C. 109(e). When a debtor files, he must list all his creditors. Then, his creditors have the opportunity to optin by showing a proof of claim. 11 U.S.C. 501. From these claims, the debtor creates a Chapter 13 plan to payback his creditors. Once the bankruptcy court confirms the plan, the distribution process can begin. FED. R. BANKR. P. 3015. There are multiple tiers of creditors. Priority creditors get full payment before any distribution is made to other non-prioritized creditors. Even the priorities are prioritized. Employees who claim wage and benefit payments fall into the fourth and fifth priority groups, respectively. In order for an employee to recoup lost wages under a priority claim, he must have earned those wages within 90 days before the filing for bankruptcy or cessation of the debtors business. In order for an employee to recoup from an employment-benefit plan under a priority claim, the claims must have arisen from his work within 180 days before the date of filing the petition or cessation of the business. 11 U.S.C. 507. 3. CLASS ACTION IN THE BANKRUPTCY FORUM.

United States District Court

11

For the Northern District of California

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Our court of appeals has held that FRCP 23 is available to bankruptcy claims. In re Birting Fisheries, Inc., 92 F.3d 939, 93940 (9th Cir. 1996). It is not, however, applied often. Many of the policy factors supporting class actions are absent in bankruptcy proceedings. As proof-of-claim forms are free, accessible, and easy to fill out, the costly barriers to litigation which deter many small claims are reduced. Furthermore, the bankruptcy process is already efficient; it consolidates claims just as a class action does. Here, appellants claim that many putative class members did not know they were entitled to or feared retaliation from speaking out about lack of overtime pay and compensation for workrelated activities and purchases. So, they argue that a class claim would be substantively appropriate in the bankruptcy forum. In re Birting Fisheries, 92 F.3d at 940, our court of appeals concurred with the other circuits and held that Bankruptcy Rule 7023 allows Rule 23 to be applied in adversary proceedings. See, e.g., In re American Reserve Corp., 840 F.2d 487, 488 (7th Cir. 1988); Reid v. 3

Case3:11-cv-00744-WHA Document8

Filed07/06/11 Page4 of 5

1 2 3 4 5 6 7 8 9 10

White Motor Corp., 886 F.2d 1462, 147071 (6th Cir. 1989). Bankruptcy Rule 9014 allows a court to apply bankruptcy rules to a contested matter not otherwise governed by these rules. Thus, a bankruptcy court has discretion to apply Rule 23 via Rule 7023 via Rule 9014. In re American Reserve Corp., 840 F.2d at 488. Here, the bankruptcy court exercised its discretion in not applying Rule 7023. The court held that a prerequisite for application of Rule 7023 is that the proponent seeks a determination of whether Rule 7023 should apply. Indeed, Rule 9014 states that relief shall be requested upon motion. FED. R. BANKR. P. 9014. Appellants never moved the bankruptcy court for application of Rule 23. That is dispositive. 4. CLASS ACTION REQUIREMENTS.

United States District Court

11

For the Northern District of California

Even if plaintiffs had filed a motion to apply Rule 7023 to the claims process, or if the court had, sua sponte, entertained the notion of class certification via Rule 7023, it could not have granted class certification because the putative class representatives did not meet the criteria for a class. In order for a class to pursue a class claim, it must meet all four requirements of Rule 23(a): numerosity, commonality, typicality, and adequacy of representation. FRCP 23(a). The bankruptcy court found that the named class representatives did not meet the commonality requirement. Commonality requires that a representative share questions of law or fact common to the class. FRCP 23(a)(2). Appellants purport to represent employees with a priority claim who deserve a prioritized share of the Chapter 13 plan. As explained above, an employee filing a priority claim would have to have earned that claim within at most 180 days before the debtor filed a Chapter 13 claim. The debtors filed for Chapter 13 in July 2010. The bankruptcy court found that none of the named plaintiffs representing the putative class were employed within the previous 180 days. James Mortland IIIs last day of employment was in September 2009; John Curry, May 2007; Timothy Sonnenberg, October 2009 (Appellees Opening Brief 67). The record provides no information concerning the timing of employment for plaintiffs Robert Sonnenberg, Tyler Jensen, Ryan Walker, and Sea Walker who are now named in this appeal. Relying on the bankruptcy courts determination of the representatives time of 4

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Case3:11-cv-00744-WHA Document8

Filed07/06/11 Page5 of 5

1 2 3 4 5 6 7 8 9 10

employment, which have not been shown to be clearly erroneous, the named plaintiffs fail to meet the commonality requirement. Appellants assert that the putative class did not receive adequate notice regarding their potential claims. See FRCP 23(c). The class, however, was never certified. FRCP 23(c)(2)(B) only requires notice to certified classes. No notice violation occurred. The bankruptcy court did not err in expunging the uncertified class claim. If the absent class members neglected to file their own individual claims in the bankruptcy proceedings, then it is a regrettable but unavailing outcome. CONCLUSION For the above-stated reasons, the bankruptcy court rulings expunging the class claim and confirming the Chapter 13 plan are AFFIRMED.

United States District Court

11

For the Northern District of California

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 5 Dated: July 6, 2010. IT IS SO ORDERED.

WILLIAM ALSUP UNITED STATES DISTRICT JUDGE

You might also like

- Petition for Certiorari: Denied Without Opinion Patent Case 93-1413From EverandPetition for Certiorari: Denied Without Opinion Patent Case 93-1413No ratings yet

- JAT v. JNC - Rule 11 MotionDocument227 pagesJAT v. JNC - Rule 11 MotionSarah BursteinNo ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Reversal Ninth CircuitDocument9 pagesReversal Ninth Circuitrick siegelNo ratings yet

- Eyaktek Opposition To MotionDocument19 pagesEyaktek Opposition To Motionndc_exposedNo ratings yet

- Steven Mouse Appellant v. The Hoes in GA Court of AppealsDocument20 pagesSteven Mouse Appellant v. The Hoes in GA Court of AppealsJanet and JamesNo ratings yet

- 2:04-cv-08425 #180Document297 pages2:04-cv-08425 #180Equality Case FilesNo ratings yet

- Puente - Arizona - Et - Al - v. - Arpai RESPONSE To Motion Re MOTION For Summary Judgment County Defendants' Joint Response in Opposition To Plaintiffs' Motion For Partial Summary JudgmentDocument36 pagesPuente - Arizona - Et - Al - v. - Arpai RESPONSE To Motion Re MOTION For Summary Judgment County Defendants' Joint Response in Opposition To Plaintiffs' Motion For Partial Summary JudgmentChelle CalderonNo ratings yet

- Randy Sengel Motion For Sanctions 1.18Document6 pagesRandy Sengel Motion For Sanctions 1.18Virginia LawNo ratings yet

- Discussion Board#1-Beckworth v. BeckworthDocument4 pagesDiscussion Board#1-Beckworth v. BeckworthMuhammad Qasim Sajid0% (1)

- Judge Dan Jordan III Rules That MDHS May Not Prohibit Same Sex AdoptionDocument28 pagesJudge Dan Jordan III Rules That MDHS May Not Prohibit Same Sex AdoptionRuss Latino100% (1)

- REPLY To Opposition To Motion Re MOTION To Compel Defendants To Produce The Administrative Record MOTION To Hold in Abeyance Re MOTION To DismissDocument11 pagesREPLY To Opposition To Motion Re MOTION To Compel Defendants To Produce The Administrative Record MOTION To Hold in Abeyance Re MOTION To DismissBasseemNo ratings yet

- Order and Judgment - FINALDocument2 pagesOrder and Judgment - FINALKRCG 13No ratings yet

- DeVore Summary Judgment Reply BriefDocument19 pagesDeVore Summary Judgment Reply BriefBen SheffnerNo ratings yet

- Order - Set Aside Default&JTDocument2 pagesOrder - Set Aside Default&JTBiloxiMarxNo ratings yet

- 10-03-23 Richard Fine: Requesting Ronald George, Chair of The Judicial Council To Take Corrective Actions in Re: Conduct of Attorney Kevin MccormickDocument16 pages10-03-23 Richard Fine: Requesting Ronald George, Chair of The Judicial Council To Take Corrective Actions in Re: Conduct of Attorney Kevin MccormickHuman Rights Alert - NGO (RA)100% (1)

- Lancaster County Court of Common Pleas Criminal Division - Clerk of CourtDocument8 pagesLancaster County Court of Common Pleas Criminal Division - Clerk of CourtStan J. CaterboneNo ratings yet

- ORDER Transfer Venue SDCADocument11 pagesORDER Transfer Venue SDCApauloverhauser100% (1)

- Courdy Forfeiture SettlementDocument15 pagesCourdy Forfeiture SettlementcitypaperNo ratings yet

- Washington State vs. Comcast - Motion To DismissDocument29 pagesWashington State vs. Comcast - Motion To DismissTodd BishopNo ratings yet

- Motion To Set Aside Ruling With Levy Family For Failure To Disclose Material InformationDocument7 pagesMotion To Set Aside Ruling With Levy Family For Failure To Disclose Material InformationIlene KentNo ratings yet

- Glaski - Appellant's Opening BriefDocument50 pagesGlaski - Appellant's Opening Brief83jjmackNo ratings yet

- Davies Opening Appeal Brief - California Bankruptcy Court - Ninth - June 2011Document42 pagesDavies Opening Appeal Brief - California Bankruptcy Court - Ninth - June 201183jjmackNo ratings yet

- Motion For Summary JudgmentDocument4 pagesMotion For Summary JudgmentJoe DonahueNo ratings yet

- Hhse - Uptone Motion For Def Judgement Vs MedallionDocument3 pagesHhse - Uptone Motion For Def Judgement Vs MedallionYTOLeaderNo ratings yet

- Motion For en Banc ReviewDocument22 pagesMotion For en Banc ReviewThe ForumNo ratings yet

- H037663 Appellant's Opening BriefDocument28 pagesH037663 Appellant's Opening BriefThomas GribovszkiNo ratings yet

- ComplaintDocument58 pagesComplaintSusan Svrluga100% (2)

- Motion to Dismiss Untimely State Bar Disciplinary ChargesDocument41 pagesMotion to Dismiss Untimely State Bar Disciplinary ChargesRebeca MinguraNo ratings yet

- Plaintiff Lisa Wagner Files For Summary Judgment in Her Whistleblower Case Against Lee CountyDocument26 pagesPlaintiff Lisa Wagner Files For Summary Judgment in Her Whistleblower Case Against Lee CountyNews-PressNo ratings yet

- Caner vs. Autry Et Al. Motion To Sever Case Into TwoDocument12 pagesCaner vs. Autry Et Al. Motion To Sever Case Into TwoJason SmathersNo ratings yet

- Northern Assurance Company of America, As Subrogee of Michael and Carole Morrell v. Square D Company, 201 F.3d 84, 2d Cir. (2000)Document9 pagesNorthern Assurance Company of America, As Subrogee of Michael and Carole Morrell v. Square D Company, 201 F.3d 84, 2d Cir. (2000)Scribd Government DocsNo ratings yet

- YaVaughnie Wilkins BankruptcyDocument8 pagesYaVaughnie Wilkins BankruptcyCalifornia Public Access100% (1)

- United States Court of Appeals For The Tenth CircuitDocument7 pagesUnited States Court of Appeals For The Tenth Circuitdillon-richardsNo ratings yet

- 1 Notice of Removal - Move To Federal CourtDocument10 pages1 Notice of Removal - Move To Federal CourtDentist The MenaceNo ratings yet

- UntitledDocument24 pagesUntitledlesliebrodieNo ratings yet

- Proposed Order Granting Permanent Injunction1Document5 pagesProposed Order Granting Permanent Injunction1News 6 WKMG-TVNo ratings yet

- 8 18 2014 Order On Motion For SanctionsDocument14 pages8 18 2014 Order On Motion For SanctionsDaniel FisherNo ratings yet

- JetSmarter v. BensonDocument227 pagesJetSmarter v. BensonJetsmarter LitNo ratings yet

- Cockerham Kimberly V. Dr. Kelledy Patrick MDDocument19 pagesCockerham Kimberly V. Dr. Kelledy Patrick MDTami2020100% (1)

- Leg Med 9Document28 pagesLeg Med 9Bianca BeltranNo ratings yet

- Answer To Adversary ComplaintDocument8 pagesAnswer To Adversary ComplaintOCEANA_HOANo ratings yet

- Civil Fax CoverDocument1 pageCivil Fax CovertmccandNo ratings yet

- UnpublishedDocument11 pagesUnpublishedScribd Government DocsNo ratings yet

- Attorneys For PlaintiffsDocument16 pagesAttorneys For PlaintiffsEquality Case FilesNo ratings yet

- NOTICE OF APPEAL To The 9th Circuit As To 149 Order by Xavier Becerra.Document3 pagesNOTICE OF APPEAL To The 9th Circuit As To 149 Order by Xavier Becerra.AmmoLand Shooting Sports NewsNo ratings yet

- Laborers Health and Welfare Trust Fund for Northern California Laborers Vacation-Holiday Trust Fund for Northern California Laborers Pension Trust Fund for Northern California Laborers Training and Retraining Trust Fund for Northern California v. Westlake Development, a Corporation First Doe Second Doe Third Doe Black Corporation White Corporation Blue Co. And Grey Company, a Corporation, Westlake Development Company, Inc., Petitioner-Counter-Respondent-Appellee v. Local 389 Laborers Union Northern California District Council of Laborers, Respondents-Counter-Petitioners-Appellants, 53 F.3d 979, 1st Cir. (1995)Document9 pagesLaborers Health and Welfare Trust Fund for Northern California Laborers Vacation-Holiday Trust Fund for Northern California Laborers Pension Trust Fund for Northern California Laborers Training and Retraining Trust Fund for Northern California v. Westlake Development, a Corporation First Doe Second Doe Third Doe Black Corporation White Corporation Blue Co. And Grey Company, a Corporation, Westlake Development Company, Inc., Petitioner-Counter-Respondent-Appellee v. Local 389 Laborers Union Northern California District Council of Laborers, Respondents-Counter-Petitioners-Appellants, 53 F.3d 979, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- FPFCQ Motion To Convert To Chapter 7Document7 pagesFPFCQ Motion To Convert To Chapter 7jaxxstraw100% (1)

- Riverside County LRDocument195 pagesRiverside County LRerisaworkNo ratings yet

- Glaski - Appellant's Reply Brief-1Document22 pagesGlaski - Appellant's Reply Brief-183jjmackNo ratings yet

- ECF 240 RedactedDocument33 pagesECF 240 Redactedhimself2462No ratings yet

- Retaliation in Violation of California Labor Code 1102.5: Los Angeles County Metropolitan Transportation Authority ("Mta") Special Verdict No. OneDocument3 pagesRetaliation in Violation of California Labor Code 1102.5: Los Angeles County Metropolitan Transportation Authority ("Mta") Special Verdict No. Onerich chastNo ratings yet

- Stump v. City of San Diego - First Amended ComplaintDocument19 pagesStump v. City of San Diego - First Amended ComplaintRob NikolewskiNo ratings yet

- Edward Lamar Bloodworth v. United States, 11th Cir. (2015)Document9 pagesEdward Lamar Bloodworth v. United States, 11th Cir. (2015)Scribd Government DocsNo ratings yet

- Middlesex Mutual Insurance Company v. Stuart Levine, 675 F.2d 1197, 11th Cir. (1982)Document11 pagesMiddlesex Mutual Insurance Company v. Stuart Levine, 675 F.2d 1197, 11th Cir. (1982)Scribd Government DocsNo ratings yet

- Motion For Sanctions Against Dorothy HolmesDocument5 pagesMotion For Sanctions Against Dorothy HolmesBill RuminskiNo ratings yet

- Motion To VacateDocument26 pagesMotion To VacatenomdocsNo ratings yet

- Anderson v. Kitchen, 10th Cir. (2010)Document8 pagesAnderson v. Kitchen, 10th Cir. (2010)Scribd Government DocsNo ratings yet

- Lift-U v. Ricon Patent MSJDocument11 pagesLift-U v. Ricon Patent MSJNorthern District of California BlogNo ratings yet

- Golinsky v. OPM 2ACDocument18 pagesGolinsky v. OPM 2ACNorthern District of California BlogNo ratings yet

- Settlement Agreement in Leiterman v. JohnsonDocument11 pagesSettlement Agreement in Leiterman v. JohnsonNorthern District of California Blog0% (1)

- San Francisco v. Postal Service Constitutional MSJDocument22 pagesSan Francisco v. Postal Service Constitutional MSJNorthern District of California BlogNo ratings yet

- Yoshimoto v. O'Reilly Automotive Title VII MSJDocument16 pagesYoshimoto v. O'Reilly Automotive Title VII MSJNorthern District of California BlogNo ratings yet

- Golinsky v. OPM Video3Document1 pageGolinsky v. OPM Video3Northern District of California BlogNo ratings yet

- Van Upp v. Wendell Rosen Black and Dean LLP Bankruptcy AppealDocument16 pagesVan Upp v. Wendell Rosen Black and Dean LLP Bankruptcy AppealNorthern District of California BlogNo ratings yet

- Levi Strass and Co v. Papikan Enterprises Trademark MSJDocument12 pagesLevi Strass and Co v. Papikan Enterprises Trademark MSJNorthern District of California BlogNo ratings yet

- Enyhart v. Ncbe Title III MSJDocument27 pagesEnyhart v. Ncbe Title III MSJNorthern District of California BlogNo ratings yet

- Golinsky v. OPM Video2Document2 pagesGolinsky v. OPM Video2Northern District of California BlogNo ratings yet

- Sony v. Trans Video Patent MSJDocument13 pagesSony v. Trans Video Patent MSJNorthern District of California BlogNo ratings yet

- Williams v. San Francisco Title VII MSJDocument14 pagesWilliams v. San Francisco Title VII MSJNorthern District of California BlogNo ratings yet

- Shahani v. United Commercial Bank Bankruptcy AppealDocument18 pagesShahani v. United Commercial Bank Bankruptcy AppealNorthern District of California BlogNo ratings yet

- Golinsky v. OPM MSJDocument28 pagesGolinsky v. OPM MSJNorthern District of California BlogNo ratings yet

- Golinsky v. OPM Video1Document2 pagesGolinsky v. OPM Video1Northern District of California BlogNo ratings yet

- Golinsky v. OPM MTD1Document12 pagesGolinsky v. OPM MTD1Northern District of California BlogNo ratings yet

- Washington v. Duncan 1983 MSJDocument8 pagesWashington v. Duncan 1983 MSJNorthern District of California BlogNo ratings yet

- Yadira v. Fernandez Labor MSJDocument1 pageYadira v. Fernandez Labor MSJNorthern District of California BlogNo ratings yet

- Water House v. American Canyon FHA MSJDocument14 pagesWater House v. American Canyon FHA MSJNorthern District of California BlogNo ratings yet

- Vaughn v. Donahoe Title VII MSJDocument18 pagesVaughn v. Donahoe Title VII MSJNorthern District of California Blog100% (1)

- Zucrum Foods v. Marquez Bros Intl Trademark MSJDocument12 pagesZucrum Foods v. Marquez Bros Intl Trademark MSJNorthern District of California BlogNo ratings yet

- Wells Fargo Bank v. Renz CERCLA MSJDocument44 pagesWells Fargo Bank v. Renz CERCLA MSJNorthern District of California BlogNo ratings yet

- SF Baykeeper v. West Bay Sanitary Dist Environment MSJDocument74 pagesSF Baykeeper v. West Bay Sanitary Dist Environment MSJNorthern District of California BlogNo ratings yet

- Selvitella v. San Francisco 1983 MSJDocument3 pagesSelvitella v. San Francisco 1983 MSJNorthern District of California BlogNo ratings yet

- Sanford v. Landmark Protection Title VII MSJDocument15 pagesSanford v. Landmark Protection Title VII MSJNorthern District of California BlogNo ratings yet

- Rodriguez v. Adams PHCDocument40 pagesRodriguez v. Adams PHCNorthern District of California BlogNo ratings yet

- Reiffin v. Microsoft MTW PatentDocument6 pagesReiffin v. Microsoft MTW PatentNorthern District of California BlogNo ratings yet

- Openwave Systems v. Myriad France SAS Patent MSJDocument13 pagesOpenwave Systems v. Myriad France SAS Patent MSJNorthern District of California BlogNo ratings yet

- Page v. Cate Habeas MTDDocument6 pagesPage v. Cate Habeas MTDNorthern District of California BlogNo ratings yet

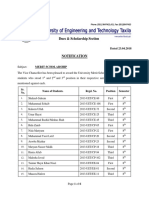

- Dues & Scholarship Section: NotificationDocument6 pagesDues & Scholarship Section: NotificationMUNEEB WAHEEDNo ratings yet

- Price and Volume Effects of Devaluation of CurrencyDocument3 pagesPrice and Volume Effects of Devaluation of Currencymutale besaNo ratings yet

- The Best Chess BooksDocument3 pagesThe Best Chess BooksJames Warren100% (1)

- Sterilization and DisinfectionDocument100 pagesSterilization and DisinfectionReenaChauhanNo ratings yet

- Derivatives 17 Session1to4Document209 pagesDerivatives 17 Session1to4anon_297958811No ratings yet

- Forouzan MCQ in Error Detection and CorrectionDocument14 pagesForouzan MCQ in Error Detection and CorrectionFroyd WessNo ratings yet

- Network Profiling Using FlowDocument75 pagesNetwork Profiling Using FlowSoftware Engineering Institute PublicationsNo ratings yet

- Safety Moment Manual LiftingDocument1 pageSafety Moment Manual LiftingEvert W. VanderBerg100% (1)

- License Key Windows 8Document7 pagesLicense Key Windows 8Juned FahriNo ratings yet

- Gcu On Wiki PediaDocument10 pagesGcu On Wiki Pediawajid474No ratings yet

- A1. Coordinates System A2. Command Categories: (Exit)Document62 pagesA1. Coordinates System A2. Command Categories: (Exit)Adriano P.PrattiNo ratings yet

- Written Test Unit 7 & 8 - Set ADocument4 pagesWritten Test Unit 7 & 8 - Set ALaura FarinaNo ratings yet

- FIITJEE Talent Reward Exam 2020: Proctored Online Test - Guidelines For StudentsDocument3 pagesFIITJEE Talent Reward Exam 2020: Proctored Online Test - Guidelines For StudentsShivesh PANDEYNo ratings yet

- Prosen Sir PDFDocument30 pagesProsen Sir PDFBlue Eye'sNo ratings yet

- Solar Presentation – University of Texas Chem. EngineeringDocument67 pagesSolar Presentation – University of Texas Chem. EngineeringMardi RahardjoNo ratings yet

- Cover Letter IkhwanDocument2 pagesCover Letter IkhwanIkhwan MazlanNo ratings yet

- Global Supplier Quality Manual SummaryDocument23 pagesGlobal Supplier Quality Manual SummarydywonNo ratings yet

- Dreams FinallDocument2 pagesDreams FinalldeeznutsNo ratings yet

- 1803 Hector Berlioz - Compositions - AllMusicDocument6 pages1803 Hector Berlioz - Compositions - AllMusicYannisVarthisNo ratings yet

- Lucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Document5 pagesLucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Daca KloseNo ratings yet

- Criteria For RESEARCHDocument8 pagesCriteria For RESEARCHRalph Anthony ApostolNo ratings yet

- Elliptic FunctionsDocument66 pagesElliptic FunctionsNshuti Rene FabriceNo ratings yet

- FOL Predicate LogicDocument23 pagesFOL Predicate LogicDaniel Bido RasaNo ratings yet

- SCIENCE 5 PPT Q3 W6 - Parts of An Electric CircuitDocument24 pagesSCIENCE 5 PPT Q3 W6 - Parts of An Electric CircuitDexter Sagarino100% (1)

- Category Theory For Programmers by Bartosz MilewskiDocument565 pagesCategory Theory For Programmers by Bartosz MilewskiJohn DowNo ratings yet

- Week 4-LS1 Eng. LAS (Types of Verbals)Document14 pagesWeek 4-LS1 Eng. LAS (Types of Verbals)DONALYN VERGARA100% (1)

- Marikina Polytechnic College Graduate School Scientific Discourse AnalysisDocument3 pagesMarikina Polytechnic College Graduate School Scientific Discourse AnalysisMaestro Motovlog100% (1)

- MAS-06 WORKING CAPITAL OPTIMIZATIONDocument9 pagesMAS-06 WORKING CAPITAL OPTIMIZATIONEinstein Salcedo100% (1)

- History of Philippine Sports PDFDocument48 pagesHistory of Philippine Sports PDFGerlie SaripaNo ratings yet

- De Minimis and Fringe BenefitsDocument14 pagesDe Minimis and Fringe BenefitsCza PeñaNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Export & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesFrom EverandExport & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesRating: 5 out of 5 stars5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Richardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesFrom EverandRichardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Litigation Story: How to Survive and Thrive Through the Litigation ProcessFrom EverandLitigation Story: How to Survive and Thrive Through the Litigation ProcessRating: 5 out of 5 stars5/5 (1)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceFrom EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNo ratings yet

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- The HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsFrom EverandThe HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsRating: 3.5 out of 5 stars3.5/5 (3)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- The Motley Fool's Rule Makers, Rule Breakers: The Foolish Guide to Picking StocksFrom EverandThe Motley Fool's Rule Makers, Rule Breakers: The Foolish Guide to Picking StocksRating: 4 out of 5 stars4/5 (3)