Professional Documents

Culture Documents

Dogfight: Comcast vs. AT&T

Uploaded by

PipelinePublishingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dogfight: Comcast vs. AT&T

Uploaded by

PipelinePublishingCopyright:

Available Formats

www.pipelinepub.

com Volume 7, Issue 12

Dogfight: Comcast vs. AT&T

By Tim Young For a number of years now, Pipeline has taken the time to dedicate at least one annual issue to the ongoing competition between cablecos and telcos for various segments of the market. This is a battle thats most furiously pitched in the home. The struggle between these access technologies is taking place all over the world these days. In Europe, cable powerhouse Liberty Global just announced that it will buy Kabel-Baden Wrttemberg, Germanys third largest cableco, further consolidating its position as the largest owner of Non-US cablecos. Meanwhile, according to a recent report from In-Stat, Western Europe leads the world in IPTV customers, with 17.5 million. (11 million of those are in France, alone.) In the CALA region, the cableco/telco struggle is a bit more convoluted, as the largest cableco in the region (NET Servicos de Comunicacao) is actually a subsidiary of telco Embratel. Meanwhile, in parts of AsiaPac, hundreds of millions of pay-tv consumers are distributed

Not for distribution or reproduction.

between scores of carriers, each carrying a part of the worlds largest market (the region is home to 57% of the worlds pay-tv subscribers, according to the Asia-Pacific Broadcasting Union) while rarely surpassing 5 million subs, individually (according to In-Stat). However, one way to characterize the struggle between cablecos and telcos is to select the biggest heavyweight from each category in the US market and see how they stack up against one another. Two aces, up close and personal. Aware of one-anothers presence and attempting to out-maneuver the other. In aviation, its called a dogfight. The Aces Of course, in this head-to-head, the combatants arent a P-51 Mustang and a Messerschmitt Bf 109. In one corner, we have AT&T. Its a big company. Big in a way that planets are big. Its number 7 on the Fortune 500 list, a ranking topped only by 3 oil companies, Bank of America, GE, and WalMart. In the Forbes Global rankings, AT&Ts still #13, worldwide, and thats after sliding six spots from the previous years list. $125billion in revenue.$20billion in income. Thats wicked big. In the other corner is Comcast, which sports a scant $38billion in revenue and $6billion in operating income. And that Fortune 500 list? Comcast clocks in at number 57. So while smaller than the largest telco, the largest US cableco is hardly diminutive. So, lets just take a brief walk through how these companies stack up against one another in a number of important areas:

Two aces, up close and personal. In aviation, its called a dogfight.

2011, All information contained herein is the sole property of Pipeline Publishing, LLC. Pipeline Publishing LLC reserves all rights and privileges regarding the use of this information. Any unauthorized use, such as distributing, copying, modifying, or reprinting, is not permitted. This document is not intended for reproduction or distribution outside of www.pipelinepub.com. To obtain permission to reproduce or distribute this document contact sales@pipelinepub.com for information about Reprint Services.

Pay-TV This one goes the way you might expect. At least for now, its Comcast in a walk, in terms of market dominance. As of September 2010, Comcast had some 23 million subscribers to their pay TV service, at least at a basic level, according to the NCTA. AT&T, meanwhile, clocked in at 2.7 million, making it the number nine video provider in the country, behind even its wireline rival, Verizon, which came in at number seven with its 3.3million subs. However, that massive gap is narrowing, if slightly. Comcast dropped 135,000 video subs in Q42010, while AT&T U-verse is the fastest growing TV provider in the country, said Mari Melguizo, spokesperson for AT&T, with more TV subscribers added than any of the major TV providers reported in 2009 and 2010. Furthermore, while Comcasts xfinity rebranding didnt win it any popularity contests in the mainstream media, the triple-play options that xfinity has brought about really have helped its positioning in the market. The app that Comcast offers iPad/iPhone/Android users came before AT&Ts much less robust U-Verse app offering, and has garnered a lot of positive press for the cableco, as well as generated a perception of being able to meet subscriber needs and wants in an agile and perceptive manner. However, AT&Ts press contacts tell me that their latest value-adds for subscribers include U-verse Mobile, which lets customers manage recordings remotely and watch TV shows on more than 14 devices, U-verse Online, where online users can watch some 100,000 titles of TV shows, movies and video clips, as well as take advantage

Comcast added 1 million net broadband customers in 2010. AT&T did just over half that.

of remote DVR management, the ability to pay bills, and other user features. Its a step in the right direction. Voice Meanwhile, AT&T continues to bleed wireline customers. Wireline voice revenue was down 12.5% between Q1 2010 and Q1 2011. On the other hand, Q42010 numbers (the most recent available at press time) for Comcast show that it added 257,000 voice customers, up about 6 percent over the year previous. VoIP, then, continues to march against the phone systems of old. Data Broadband service is growing among most carriers, but AT&Ts growth has been anemic compared to Comcasts explosion. According to research firm Strategy Analytics, Comcast led the US market in broadband subscriber growth in 2010, adding 1 million net customers over the course of the year. Second place in broadband growth went to none other than AT&T, but with a rate just over half of that demonstrated by Comcast. I asked representatives from each company what made their data offerings stand out. Three things, said

Not for distribution or reproduction.

2011, All information contained herein is the sole property of Pipeline Publishing, LLC. Pipeline Publishing LLC reserves all rights and privileges regarding the use of this information. Any unauthorized use, such as distributing, copying, modifying, or reprinting, is not permitted. This document is not intended for reproduction or distribution outside of www.pipelinepub.com. To obtain permission to reproduce or distribute this document contact sales@pipelinepub.com for information about Reprint Services.

Comcasts Peter Dobrow, Executive Director of Corporate Communications at Comcast. Speed, price and security. The speeds range from 1.5 to 105 Mbps and are offered to 40 million homes. Our prices for all these services are very competitive with what telcos offer, Dobrow said. We also offer the most comprehensive security suite of services to our Internet customers for no additional charge. With U-verse High Speed Internet, said AT&Ts Melguzio, were focusing on your entire surfing experience. Its about speed, value and mobility. That last point is of particular salience. Wireless home networking capability and access to the nations largest Wi-Fi network is included for all U-verse Internet. Aha. The mobile angle. Which leads us to The Rest of the Story I said at the outset of this piece that the battle between cablecos and telcos is fiercest in the residential market. Its the home where these titans spar most vehemently. However, during a roundtable discussion I chaired a few years ago, several cableco execs pointed out something interesting. They noted that as more and more consumers start to carry more complex and data-hungry devices, and as they want to be able to access many of the same things on the go as they would be able to at home, the definition of the home, itself, is changing. It is no longer a building. Its an experience. Its a place where one can be found, and where valuables can be stored, and communications with friends and family take place. Increasingly, consumers desire that home experience anywhere. With that in mind, its clear that the numbers Ive thrown around above only tell part of the story. After all, AT&T isnt sitting on its hands while subs and revenue head for the exits. What about the wireless revenue? Its true: AT&T is a juggernaut in the wireless space, and if the T-Mobile USA acquisition does make it through

Its true: AT&T is a juggernaut in the wireless space

all the proper regulatory hoops, itll only get bigger. Meanwhile, Comcast has a keen understanding of how to integrate elements of the wireless experience (as evidenced by its iPad app prowess), but lacks a meaningful wireless presence. Therefore, if we had to call it (and AT&T would contend that U-Verse is far too young to do a thing like that), we could say that Comcast has won the home and AT&T has won the wireless space. However, lets continue to assume that the changing definition of the home I mentioned before holds true. Lets also recognize that its primarily the home networks that are constantly besieged by over-thetop data accessed by customers who dont expect massive overage charges in the same way that wireless customers might. Furthermore, wireline calling, VoIP or traditional, has lost so much luster that the triple-play scenario may lack some of the punch it once had. In short, might there be a chance that Comcast has captured the home just as the home has started to do what those roundtable members I mentioned said it would do? And if consumers are taking the show on the road, how easy is it to follow them? Whats the point of being king of the mountain if it happens to be Mt. Vesuvius? Still, even as Comcast seems to have the home market well in hand, AT&T insists that they are not to be counted out. The most recent strategy coming from AT&T is to use extant wireless enthusiasm to draw in lucrative U-Verse customers (and at an ARPU of $168, what company couldnt afford a few of those?) Regardless of the outcome, however, its fascinating to watch these two massive companies do battle. One seems to hug the ground, tethered and secure, protecting the ground below. The other seems to be climbing into the mist, free from terrestrial constraint, but perhaps leaving its underside exposed. And in this way, the dogfight rages on.

Not for distribution or reproduction.

Even as Comcast seems to have the home market well in hand, AT&T insists that they are not to be counted out.

2011, All information contained herein is the sole property of Pipeline Publishing, LLC. Pipeline Publishing LLC reserves all rights and privileges regarding the use of this information. Any unauthorized use, such as distributing, copying, modifying, or reprinting, is not permitted. This document is not intended for reproduction or distribution outside of www.pipelinepub.com. To obtain permission to reproduce or distribute this document contact sales@pipelinepub.com for information about Reprint Services.

You might also like

- Data Analysis Cases With Real Data Case 3.1Document5 pagesData Analysis Cases With Real Data Case 3.1nikhiltiwari12389No ratings yet

- McCaw AT&T MergerDocument5 pagesMcCaw AT&T MergerDavid LeviNo ratings yet

- Let There Be Bandwidth - 03.07.06 - by Bret SwansonDocument1 pageLet There Be Bandwidth - 03.07.06 - by Bret SwansonBret SwansonNo ratings yet

- Charter - Time WarnerDocument3 pagesCharter - Time WarnerAndrea SalazarNo ratings yet

- Tech Tuesday Data To Get 1-800' Service: AT&T Pricing Tactics Good For CustomersDocument1 pageTech Tuesday Data To Get 1-800' Service: AT&T Pricing Tactics Good For CustomersPrice LangNo ratings yet

- Economides Net Neutrality FT - Com 11052009Document2 pagesEconomides Net Neutrality FT - Com 11052009Niki NestoraNo ratings yet

- Comcast - AT&TDocument4 pagesComcast - AT&TNayma Tasnim IslamNo ratings yet

- ATT TMobile Merger USDocument25 pagesATT TMobile Merger USguzman87No ratings yet

- Access To The Internet - Regulation or MarketsDocument4 pagesAccess To The Internet - Regulation or MarketsIndependence InstituteNo ratings yet

- Case Merger of AOL and TimeDocument4 pagesCase Merger of AOL and TimeSaakshi1211No ratings yet

- FTTX - FinalBookDocument164 pagesFTTX - FinalBookEvenso Ndlovu100% (2)

- Comcast, AT&T Broadband Close MergerDocument29 pagesComcast, AT&T Broadband Close MergerMahmud Iqbal HalimNo ratings yet

- 2011 Att Tmo Merger CommunitiesDocument20 pages2011 Att Tmo Merger Communitiescoop1287No ratings yet

- The Industry HandbookDocument7 pagesThe Industry HandbookknnoknnoNo ratings yet

- The Industry HandbookDocument13 pagesThe Industry HandbookRenu NerlekarNo ratings yet

- Prof. Christopher Yoo Oral Testimony - "Examining The Comcast-Time Warner Cable Merger and The Impact On Consumers"Document3 pagesProf. Christopher Yoo Oral Testimony - "Examining The Comcast-Time Warner Cable Merger and The Impact On Consumers"Penn LawNo ratings yet

- Time Warner Cable Merger Creates Growth OpportunityDocument41 pagesTime Warner Cable Merger Creates Growth OpportunityPapa King100% (1)

- The Telecom Industry HandbookDocument3 pagesThe Telecom Industry HandbookAman DeepNo ratings yet

- The Wireless ISP Industry & Cellular Wi-Fi Offloading Analysis and ForecastDocument40 pagesThe Wireless ISP Industry & Cellular Wi-Fi Offloading Analysis and ForecastAbel Robles100% (2)

- In 1034Document3 pagesIn 1034SteveGreavesNo ratings yet

- Individual Company Analysis - ComcastDocument6 pagesIndividual Company Analysis - ComcastAkshay RamNo ratings yet

- Sprint Rebuts AT&T and T-Mobile MergerDocument299 pagesSprint Rebuts AT&T and T-Mobile MergerJonathan Fingas100% (1)

- Statement of Chairman Ajit PaiDocument2 pagesStatement of Chairman Ajit PaisffNo ratings yet

- Summary History and Analysis: What Have Been The Business Markets For Time Warner?Document4 pagesSummary History and Analysis: What Have Been The Business Markets For Time Warner?Carol FuenmayorNo ratings yet

- Broadband Scandal FreeDocument408 pagesBroadband Scandal FreeSean TomlinsonNo ratings yet

- Comcast Company Profile: Comcast Corporation (Formerly Holdings) IsDocument6 pagesComcast Company Profile: Comcast Corporation (Formerly Holdings) IsNiya.MV1820 MBANo ratings yet

- Porter Five Forces WordDocument11 pagesPorter Five Forces WordvinodvahoraNo ratings yet

- Justice 2011b - Suing AT&TDocument3 pagesJustice 2011b - Suing AT&Tsam_f3rencNo ratings yet

- Open Access Private Interests and The Emerging Broadband Market, Cato Policy Analysis No. 379Document31 pagesOpen Access Private Interests and The Emerging Broadband Market, Cato Policy Analysis No. 379Cato InstituteNo ratings yet

- Comcast Cable Swot AnalysisDocument7 pagesComcast Cable Swot AnalysisinechicoNo ratings yet

- Swot AnalysisDocument9 pagesSwot Analysisapi-251927329No ratings yet

- Chapter 4 ImranDocument2 pagesChapter 4 ImranImran KhanNo ratings yet

- Evolution of Set Top Box DataDocument27 pagesEvolution of Set Top Box DataSanjay BhoirNo ratings yet

- At and TDocument18 pagesAt and TReeshmaVariyathNo ratings yet

- Nureye ASSIGNMENTDocument24 pagesNureye ASSIGNMENTZeyinA MohammedNo ratings yet

- TV Competition Nowhere:: How The Cable Industry Is Colluding To Kill Online TVDocument40 pagesTV Competition Nowhere:: How The Cable Industry Is Colluding To Kill Online TVsyudenfrNo ratings yet

- Swot At&tDocument3 pagesSwot At&tBianca Ioana CarageaNo ratings yet

- Little Italy DHS MB Cell Site Launch FINAL 4-17-12Document3 pagesLittle Italy DHS MB Cell Site Launch FINAL 4-17-12elyssaraeNo ratings yet

- 1654702914download Cat Sample Papers EbookDocument200 pages1654702914download Cat Sample Papers EbookdeepamjyotiroutrayNo ratings yet

- E13 - IEB - Pre-Class - 1 - Comcast SanitizedDocument3 pagesE13 - IEB - Pre-Class - 1 - Comcast SanitizedAyush AcharyaNo ratings yet

- Mobile Content Going SlowDocument3 pagesMobile Content Going Slowapi-3709961No ratings yet

- Final Wireless Telecommunications Industry PaperDocument19 pagesFinal Wireless Telecommunications Industry Papervp_zarateNo ratings yet

- Noteworthy Trends in IT Services: A N A L Y S T I N T E R V I E WDocument5 pagesNoteworthy Trends in IT Services: A N A L Y S T I N T E R V I E WArrow RootNo ratings yet

- Senate Hearing, 109TH Congress - The At&t and Bellsouth Merger: What Does It Mean For Consumers?Document102 pagesSenate Hearing, 109TH Congress - The At&t and Bellsouth Merger: What Does It Mean For Consumers?Scribd Government DocsNo ratings yet

- Comcast TW CommentsDocument8 pagesComcast TW CommentsalbrighthannaNo ratings yet

- Oppositionto ILHB1500Document5 pagesOppositionto ILHB1500robb-broomeNo ratings yet

- More For Less: Telcos Will Continue To Stretch The Life of Copper NetworksDocument17 pagesMore For Less: Telcos Will Continue To Stretch The Life of Copper Networksvignesh_velappanNo ratings yet

- Verizon and MciDocument31 pagesVerizon and Mciscorpio_17No ratings yet

- Profs Re Comcast MergerDocument16 pagesProfs Re Comcast Mergerjeff_roberts881No ratings yet

- 10 Trends in Wireless MobilityDocument11 pages10 Trends in Wireless MobilityElabo A. ElaboNo ratings yet

- The Sofa Wars in The Living Room, Hooked On Pay TV: Matt Richtel Brian StelterDocument5 pagesThe Sofa Wars in The Living Room, Hooked On Pay TV: Matt Richtel Brian StelterShyam RamlalNo ratings yet

- PORTER 5 ForcesDocument4 pagesPORTER 5 ForcesMiley MartinNo ratings yet

- ECON 3404 Final Paper - Eric ConwayDocument7 pagesECON 3404 Final Paper - Eric ConwayEric ConwayNo ratings yet

- Telecommunications Final PaperDocument41 pagesTelecommunications Final PaperJessieHaNo ratings yet

- Verizon Communications ReportDocument35 pagesVerizon Communications ReportLi ZhouNo ratings yet

- Service Unavailable: America’s Telecommunications Infrastructure CrisisFrom EverandService Unavailable: America’s Telecommunications Infrastructure CrisisNo ratings yet

- Where Does IMS Stand?Document3 pagesWhere Does IMS Stand?PipelinePublishingNo ratings yet

- Machines Rule The FutureDocument4 pagesMachines Rule The FuturePipelinePublishingNo ratings yet

- A Brave New (Connected) WorldDocument3 pagesA Brave New (Connected) WorldPipelinePublishingNo ratings yet

- In E-Billing, Which Comes First? Lean or Green?Document3 pagesIn E-Billing, Which Comes First? Lean or Green?PipelinePublishingNo ratings yet

- Easing The Shift To LTE With Advanced TestingDocument3 pagesEasing The Shift To LTE With Advanced TestingPipelinePublishingNo ratings yet

- Helping Data Centers Run LeanDocument3 pagesHelping Data Centers Run LeanPipelinePublishingNo ratings yet

- Broadband World Forum 2011Document3 pagesBroadband World Forum 2011PipelinePublishingNo ratings yet

- Is Uncertainty Resulting in Bad Backhaul Choices?Document4 pagesIs Uncertainty Resulting in Bad Backhaul Choices?PipelinePublishingNo ratings yet

- Building A Network Integrity PracticeDocument5 pagesBuilding A Network Integrity PracticePipelinePublishingNo ratings yet

- Billing For BillionsDocument3 pagesBilling For BillionsPipelinePublishingNo ratings yet

- Power Consumption and How Carriers Can Use LessDocument3 pagesPower Consumption and How Carriers Can Use LessPipelinePublishingNo ratings yet

- What About The Trucks? Workforce and Fleet ManagementDocument3 pagesWhat About The Trucks? Workforce and Fleet ManagementPipelinePublishingNo ratings yet

- Carriers Embrace The Smart Grid RevolutionDocument4 pagesCarriers Embrace The Smart Grid RevolutionPipelinePublishingNo ratings yet

- Does Green Make Cents? The Business Case, or Lack Thereof, For Going GreenDocument3 pagesDoes Green Make Cents? The Business Case, or Lack Thereof, For Going GreenPipelinePublishingNo ratings yet

- Finding Friends On Sept. 11Document3 pagesFinding Friends On Sept. 11PipelinePublishingNo ratings yet

- Lessons After The Quake: Japan's Remarkable Communications RecoveryDocument3 pagesLessons After The Quake: Japan's Remarkable Communications RecoveryPipelinePublishingNo ratings yet

- Disaster Preparedness To The RescueDocument4 pagesDisaster Preparedness To The RescuePipelinePublishingNo ratings yet

- Text-To-Donate in The Post-Paid WorldDocument3 pagesText-To-Donate in The Post-Paid WorldPipelinePublishingNo ratings yet

- Deadliest OSS: Managing Subsea Networks in A Dangerous WorldDocument4 pagesDeadliest OSS: Managing Subsea Networks in A Dangerous WorldPipelinePublishingNo ratings yet

- An Answer in The Stars: The Case For SatelliteDocument4 pagesAn Answer in The Stars: The Case For SatellitePipelinePublishingNo ratings yet

- The Battle For Solutions Heats Up As CSPs and MSOs Compete To Win Enterprise BusinessDocument4 pagesThe Battle For Solutions Heats Up As CSPs and MSOs Compete To Win Enterprise BusinessPipelinePublishingNo ratings yet

- The WiFi Front Telco V Cable in Fixed WirelessDocument5 pagesThe WiFi Front Telco V Cable in Fixed WirelessPipelinePublishingNo ratings yet

- Cablecos As Unified Communications ProvidersDocument5 pagesCablecos As Unified Communications ProvidersPipelinePublishingNo ratings yet

- The Battle of The Brands: Is CableCo The New Telco?Document4 pagesThe Battle of The Brands: Is CableCo The New Telco?PipelinePublishingNo ratings yet

- Pipeline's Guide To The Cable ShowDocument3 pagesPipeline's Guide To The Cable ShowPipelinePublishingNo ratings yet

- Value Innovation: Monetizing Networks For The FutureDocument3 pagesValue Innovation: Monetizing Networks For The FuturePipelinePublishingNo ratings yet

- The Battle For VideoDocument5 pagesThe Battle For VideoPipelinePublishingNo ratings yet

- Cablecos and Telcos Share Challenging Network FutureDocument3 pagesCablecos and Telcos Share Challenging Network FuturePipelinePublishingNo ratings yet

- What's Really Innovative in Communications IT?Document4 pagesWhat's Really Innovative in Communications IT?PipelinePublishingNo ratings yet

- Learning Activity 3 / Actividad de Aprendizaje 3 Evidence: Cell Phones For Sale / Evidencia: Celulares A La VentaDocument3 pagesLearning Activity 3 / Actividad de Aprendizaje 3 Evidence: Cell Phones For Sale / Evidencia: Celulares A La VentaKaventinas SASNo ratings yet

- SBM Project ReportDocument10 pagesSBM Project ReportPrashant SinghNo ratings yet

- Android Phone Hardware Tester AppDocument7 pagesAndroid Phone Hardware Tester AppVrundanNo ratings yet

- Avi Elster CRT Flat Screen MonitorsDocument6 pagesAvi Elster CRT Flat Screen Monitorsapi-554056851No ratings yet

- TW06 IMEI LayoutDocument2 pagesTW06 IMEI LayoutPhilip GaddiNo ratings yet

- Apple HomePod-User Guide-ENDocument24 pagesApple HomePod-User Guide-ENIman Teguh PNo ratings yet

- Digital Scheme Chart Dec'21Document153 pagesDigital Scheme Chart Dec'21Abhishek SoodNo ratings yet

- A New OEM Manufacturer: Bomare CompanyDocument7 pagesA New OEM Manufacturer: Bomare CompanyAlexander WieseNo ratings yet

- Apple Iphone SE TeardownDocument15 pagesApple Iphone SE Teardowndorian451No ratings yet

- Denon DBP-1611UD Universal Blu-Ray/DVD/CD Player, BlackDocument2 pagesDenon DBP-1611UD Universal Blu-Ray/DVD/CD Player, BlackIBJSC.com100% (1)

- IP Addresses, Login Credentials and Device DetailsDocument11 pagesIP Addresses, Login Credentials and Device Detailsandres gaitanNo ratings yet

- Blu Ray2Document25 pagesBlu Ray2inaayatsNo ratings yet

- Nokia feature phone comparison tableDocument16 pagesNokia feature phone comparison tableArun PrakashNo ratings yet

- Ejercicio de Registro Ventas Usando VBADocument8 pagesEjercicio de Registro Ventas Usando VBAMayra Alexandra CardenasNo ratings yet

- LK315T3LA31 SharpDocument25 pagesLK315T3LA31 SharpJayanti MaratheNo ratings yet

- mrhf1065179 Productsheet MR HF Blue Beat Touch sp50 GB HR PDFDocument1 pagemrhf1065179 Productsheet MR HF Blue Beat Touch sp50 GB HR PDFAnonymous uXWDrbF0rWNo ratings yet

- LG BP40NB30 Technical Specifications - LG USADocument5 pagesLG BP40NB30 Technical Specifications - LG USASecutronNo ratings yet

- Lenovo ThinkPad X250Document3 pagesLenovo ThinkPad X250Mashudi HsNo ratings yet

- Laptop Specification For BuyDocument2 pagesLaptop Specification For BuyAshagre MekuriaNo ratings yet

- Motorola Moto X Style XT1572 - BoardView PDFDocument2 pagesMotorola Moto X Style XT1572 - BoardView PDFPoligraph PoligraphoffNo ratings yet

- Libby Trifold CorrectedDocument2 pagesLibby Trifold CorrectedJonathan CookNo ratings yet

- MacBook Pro (17-Inch Mid 2010, Early 2011, and Late 2011) Service Manual PDFDocument285 pagesMacBook Pro (17-Inch Mid 2010, Early 2011, and Late 2011) Service Manual PDFtech974974100% (1)

- Apple Ipad-6th Generation 9.7inch Wifi 32GB GoldDocument1 pageApple Ipad-6th Generation 9.7inch Wifi 32GB GoldMohammed Abdul SayeedNo ratings yet

- GSM Inter MSC Handover Call FlowDocument63 pagesGSM Inter MSC Handover Call FlowvietdvNo ratings yet

- Icar3 User's Manual-OkDocument7 pagesIcar3 User's Manual-OkahhlNo ratings yet

- It's Your World. Your Phone. Your CallDocument2 pagesIt's Your World. Your Phone. Your CalllaaguidnetNo ratings yet

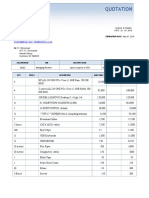

- Quotation: Techsols EnterpriseDocument2 pagesQuotation: Techsols EnterpriseJeffMuiaNo ratings yet

- Globe Business Mobile Plans June 15, 2021Document14 pagesGlobe Business Mobile Plans June 15, 2021Mark Vincent Jayson BaliñaNo ratings yet

- SNDB AVR Inventory 2009-2010Document5 pagesSNDB AVR Inventory 2009-2010GinoSDBNo ratings yet

- Point Mobile PM85 User ManualDocument130 pagesPoint Mobile PM85 User ManualLau CeriseNo ratings yet