Professional Documents

Culture Documents

Duke V HSBC W

Uploaded by

DinSFLAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Duke V HSBC W

Uploaded by

DinSFLACopyright:

Available Formats

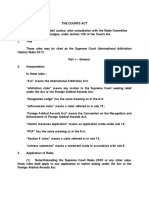

DISTRICT COURT OF APPEAL OF THE STATE OF FLORIDA

FOURTH DISTRICT

July Term 2011

RODGER and LINA DUKE, Appellants, v. HSBC MORTGAGE SERVICES, LLC, Appellee. No. 4D09-5183 [November 23, 2011] POLEN, J. Appellants, Rodger and Lina Duke (the Dukes), appeal the trial courts order granting final summary judgment of foreclosure in favor of appellee, HSBC Mortgage Services, Inc. (HSBC). We reverse the trial courts order a n d hold that the record reflected genuine issues of material fact, making summary judgment improper.

www.StopForeclosureFraud.com

In May 2009, appellee, HSBC, brought an action against appellants, the Dukes, to foreclose on a mortgage on real property in Palm Beach County, Florida. The mortgage, as attached to the complaint, showed that the borrower was the Dukes and the lender was First NLC Financial Services, LLC (First NLC). The mortgage further showed that Mortgage Electronic Registration Systems, Inc. (MERS) is a separate corporation that is acting solely as a nominee for Lender and Lenders successors and assigns. HSBCs complaint indicated that the mortgage was assigned to it, and that it was the rightful owner and holder of the note and mortgage. The Dukes alleged that HSBC did not attach an assignment of mortgage to their complaint; however, a notice of assignment was filed with the court on August 26, 2009, with a copy of the assignment dated June 1, 2009, attached. HSBC alleged that the original note and mortgage had been lost and were not in HSBCs custody or control. On July 10, 2009, and July 17, 2009, the Dukes were served by publication in the Palm Beach Daily Business Review. When the Dukes failed to respond to the service by publication, HSBC moved for default. On the same date as the motion for default, HSBC also moved for

summary judgment as to the existence of a valid mortgage and promissory note and [HSBCs] right to a Judgment of Foreclosure. On September 11, 2009, the Dukes filed a motion for additional time to file a response to the foreclosure complaint. Shortly thereafter, on September 30, 2009, default was entered against the Dukes. In November of 2009, a n agreed order on motion for additional time to file response was entered, allowing the Dukes to file their response to the foreclosure complaint on or before November 12, 2009. On November 18, 2009, a hearing was held on HSBCs motion for summary judgment. At the hearing, the original note was unable to be located. The Dukes argued that the original note did not contain any endorsements proving that the note and mortgage were assigned to HSBC, thus summary judgment should not be granted because of an issue of material fact precluding such a determination. However, the trial court entered final summary judgment of foreclosure on November 18, 2009, and set a sale date of December 21, 2009. This appeal followed. The standard of review on an order granting summary judgment is de novo. McLeod v. Bankier, 63 So. 3d 858, 860 (Fla. 4th DCA 2011). Summary judgment is granted only when no genuine issues of material fact exist and the party moving for summary judgment is, as a matter of law, entitled to judgment. Id. Florida Rule of Civil Procedure 1.510(c) governs summary judgment motions and proceedings. The rule states, in relevant part: The motion shall state with particularity the grounds upon which it is based and the substantial matters of law to be argued and shall specifically identify any affidavits, answers to interrogatories, admissions, depositions, a n d other materials as would be admissible in evidence (summary judgment evidence) on which the movant relies. The movant shall serve the motion at least 20 days before the time fixed for the hearing, and shall also serve at that time a copy of any summary judgment evidence on which the movant relies that has not already been filed with the court. . . . The judgment sought shall be rendered forthwith if the pleadings and summary judgment evidence on file show that there is no genuine issue as to any material fact and that the moving party is entitled to a judgment as a matter of law. Fla. R. Civ. P. 1.510(c).

www.StopForeclosureFraud.com

-2-

The Dukes argued that at the time the foreclosure complaint was filed, the mortgage was held by First NLC, not appellee, HSBC. In its complaint, HSBC alleged it owned and held the note and mortgage at the time the complaint was filed. When exhibits are attached to a complaint, the contents of the exhibits control over the allegations of the complaint. BAC Funding Consortium Inc. v. Jean-Jacques, 28 So. 3d 936, 938 (Fla. 2d DCA 2010). Here, HSBC alleged in its complaint that it now owns and holds the Note and Mortgage, but an assignment was not attached to the complaint, supporting HSBCs position. Instead, the mortgage attached to the complaint showed First NLC as the lender, creating discrepancies between the complaint and the attached exhibit. Thus, at the time of the argument on the summary judgment motion, genuine issues of material fact existed as to whether HSBC was the proper owner and holder of the note and mortgage where First NLC was named on the mortgage and evidence of an assignment was not included. We therefore reverse the trial courts order granting summary judgment because genuine issues of material fact remain in dispute regarding the owner and holder of the note and mortgage at the time the complaint was filed.

www.StopForeclosureFraud.com

Reversed. GROSS and CONNER, JJ., concur. * * * Appeal from the Circuit Court for the Fifteenth Judicial Circuit, Palm Beach County; Meenu T. Sasser, Judge; L.T. Case No. 502009CA018957 XXXXMB. Elsa M. Figueras of E. Figueras & Associates, P.A., Davie, and Peter J. Snyder of Peter J. Snyder, P.A., Boca Raton, for appellants. Enrico G. Gonzalez, Temple Terrace, for appellee. Not final until disposition of timely filed motion for rehearing.

-3-

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Richard Welch Criminal Complaint For Child PornographyDocument8 pagesRichard Welch Criminal Complaint For Child PornographyVictor FiorilloNo ratings yet

- Califorina ForeclosuresDocument48 pagesCaliforina ForeclosuresCelebguard100% (1)

- Califorina ForeclosuresDocument48 pagesCaliforina ForeclosuresCelebguard100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Civil Law 1 Review Succession - Reserva Troncal, Vacancies of Shares, Accretion, Representation, Instetate Succession, Barrier RuleDocument14 pagesCivil Law 1 Review Succession - Reserva Troncal, Vacancies of Shares, Accretion, Representation, Instetate Succession, Barrier Ruleruby0% (1)

- Caltex (Phil) Inc., V. CA (212 Scra 448)Document11 pagesCaltex (Phil) Inc., V. CA (212 Scra 448)Eric Villa100% (1)

- Course Outline Syllabus 2019 Legal CounselingDocument9 pagesCourse Outline Syllabus 2019 Legal CounselingAGilda Lasaca QuinaNo ratings yet

- D C O A O T S O F: Merlande Richard and Elie RichardDocument5 pagesD C O A O T S O F: Merlande Richard and Elie RichardDinSFLANo ratings yet

- Sample Contract - Patent Transfer AgreementDocument13 pagesSample Contract - Patent Transfer AgreementYicheng Qin100% (1)

- Republic V Pilipinas ShellDocument2 pagesRepublic V Pilipinas ShellGenesis Leal100% (1)

- Lasoy V ZenarosaDocument1 pageLasoy V ZenarosaRealyn AustriaNo ratings yet

- CAAP 17 0000553sdoDocument5 pagesCAAP 17 0000553sdoDinSFLANo ratings yet

- CAAP 14 0001115mopDocument21 pagesCAAP 14 0001115mopDinSFLANo ratings yet

- CAAP 18 0000477sdoDocument15 pagesCAAP 18 0000477sdoDinSFLA100% (1)

- Case: 14-14544 Date Filed: 05/03/2019 Page: 1 of 76Document76 pagesCase: 14-14544 Date Filed: 05/03/2019 Page: 1 of 76DinSFLANo ratings yet

- Electronically Filed Intermediate Court of Appeals CAAP-15-0000734 13-MAY-2019 08:14 AMDocument15 pagesElectronically Filed Intermediate Court of Appeals CAAP-15-0000734 13-MAY-2019 08:14 AMDinSFLANo ratings yet

- Supreme CourtDocument15 pagesSupreme CourtDinSFLA100% (1)

- Electronically Filed Intermediate Court of Appeals CAAP-17-0000402 22-MAY-2019 08:23 AMDocument7 pagesElectronically Filed Intermediate Court of Appeals CAAP-17-0000402 22-MAY-2019 08:23 AMDinSFLANo ratings yet

- SCWC 16 0000319Document29 pagesSCWC 16 0000319DinSFLANo ratings yet

- Electronically Filed Intermediate Court of Appeals CAAP-15-0000442 28-FEB-2019 08:04 AMDocument6 pagesElectronically Filed Intermediate Court of Appeals CAAP-15-0000442 28-FEB-2019 08:04 AMDinSFLANo ratings yet

- Filed 4/2/19 On Transfer: Enner LockDocument39 pagesFiled 4/2/19 On Transfer: Enner LockDinSFLANo ratings yet

- Buckley InfoBytes - Edmonson, Et Al v. Eagle National Bank - 4th Circuit Opinion 2019.04.26Document40 pagesBuckley InfoBytes - Edmonson, Et Al v. Eagle National Bank - 4th Circuit Opinion 2019.04.26DinSFLANo ratings yet

- Supreme Court of The State of New York Appellate Division: Second Judicial DepartmentDocument6 pagesSupreme Court of The State of New York Appellate Division: Second Judicial DepartmentDinSFLA100% (1)

- Electronically Filed Intermediate Court of Appeals CAAP-15-0000316 21-MAR-2019 07:51 AMDocument3 pagesElectronically Filed Intermediate Court of Appeals CAAP-15-0000316 21-MAR-2019 07:51 AMDinSFLANo ratings yet

- Certified For Publication: Filed 4/30/19 Reposted With Page NumbersDocument10 pagesCertified For Publication: Filed 4/30/19 Reposted With Page NumbersDinSFLANo ratings yet

- Electronically Filed Intermediate Court of Appeals CAAP-18-0000298 19-MAR-2019 08:43 AMDocument7 pagesElectronically Filed Intermediate Court of Appeals CAAP-18-0000298 19-MAR-2019 08:43 AMDinSFLA100% (1)

- Electronically Filed Intermediate Court of Appeals CAAP-17-0000848 28-DEC-2018 07:54 AMDocument7 pagesElectronically Filed Intermediate Court of Appeals CAAP-17-0000848 28-DEC-2018 07:54 AMDinSFLANo ratings yet

- (J-67-2018) in The Supreme Court of Pennsylvania Eastern District Saylor, C.J., Baer, Todd, Donohue, Dougherty, Wecht, Mundy, JJDocument18 pages(J-67-2018) in The Supreme Court of Pennsylvania Eastern District Saylor, C.J., Baer, Todd, Donohue, Dougherty, Wecht, Mundy, JJDinSFLANo ratings yet

- Not To Be Published in Official Reports: Filed 2/14/19 The Bank of New York Mellon v. Horner CA4/3Document10 pagesNot To Be Published in Official Reports: Filed 2/14/19 The Bank of New York Mellon v. Horner CA4/3DinSFLA100% (1)

- 16 17197Document39 pages16 17197DinSFLA100% (1)

- Electronically Filed Intermediate Court of Appeals CAAP-17-0000884 29-JAN-2019 08:15 AMDocument7 pagesElectronically Filed Intermediate Court of Appeals CAAP-17-0000884 29-JAN-2019 08:15 AMDinSFLA50% (2)

- Electronically Filed Intermediate Court of Appeals CAAP-14-0001093 28-JAN-2019 07:52 AMDocument13 pagesElectronically Filed Intermediate Court of Appeals CAAP-14-0001093 28-JAN-2019 07:52 AMDinSFLANo ratings yet

- CAAP 16 0000806sdoDocument5 pagesCAAP 16 0000806sdoDinSFLANo ratings yet

- Supreme Court of Florida: Marie Ann GlassDocument15 pagesSupreme Court of Florida: Marie Ann GlassDinSFLANo ratings yet

- Electronically Filed Intermediate Court of Appeals CAAP-16-0000178 27-DEC-2018 07:55 AMDocument13 pagesElectronically Filed Intermediate Court of Appeals CAAP-16-0000178 27-DEC-2018 07:55 AMDinSFLANo ratings yet

- Electronically Filed Intermediate Court of Appeals CAAP-16-0000042 21-DEC-2018 08:02 AMDocument4 pagesElectronically Filed Intermediate Court of Appeals CAAP-16-0000042 21-DEC-2018 08:02 AMDinSFLA100% (1)

- United States Court of Appeals For The Ninth CircuitDocument17 pagesUnited States Court of Appeals For The Ninth CircuitDinSFLANo ratings yet

- Renaldo Vs Deutsche Bank National TrustDocument4 pagesRenaldo Vs Deutsche Bank National TrustDinSFLANo ratings yet

- International Trade Law: Objectives of The CourseDocument13 pagesInternational Trade Law: Objectives of The CourseUMANG COMPUTERSNo ratings yet

- Of To: To The To The LC The Act The of The LLDocument3 pagesOf To: To The To The LC The Act The of The LLRoselle Perez-BariuanNo ratings yet

- The Corporation Code of The Philippines BP BLG 68Document62 pagesThe Corporation Code of The Philippines BP BLG 68ATTY. R.A.L.C.No ratings yet

- The 1987 Philippine ConstitutionDocument105 pagesThe 1987 Philippine ConstitutionATTY. R.A.L.C.0% (1)

- Injunction Ia FormatDocument7 pagesInjunction Ia FormatIpkshita SinghNo ratings yet

- Inclusive SocietyDocument1 pageInclusive SocietyJohnNo ratings yet

- M. Jones V Thomas, Dep Commissioner Spiezio & Building Commissioner Jones and The City PF Mount Vernon United States District CourtDocument15 pagesM. Jones V Thomas, Dep Commissioner Spiezio & Building Commissioner Jones and The City PF Mount Vernon United States District CourtDamon K JonesNo ratings yet

- More Transparency in International Commercial Arbitration: To Have or Not To Have?Document24 pagesMore Transparency in International Commercial Arbitration: To Have or Not To Have?Anurag ranaNo ratings yet

- Estores Vs SupanganDocument14 pagesEstores Vs SupanganDarren Joseph del PradoNo ratings yet

- TenancyDocument3 pagesTenancyEunice Panopio LopezNo ratings yet

- G.R. No. 70493 May 18, 1989Document52 pagesG.R. No. 70493 May 18, 1989beth_afan0% (1)

- Last Will and Testament - Carmelita C. RoblesDocument2 pagesLast Will and Testament - Carmelita C. Roblesric releNo ratings yet

- Functions & Power - Suruhanjaya Syarikat Malaysia (SSM)Document1 pageFunctions & Power - Suruhanjaya Syarikat Malaysia (SSM)Khairun NisyaNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Sssea vs. Ca - . July 28, 1989 Cortes, J:: G.R No 85279Document35 pagesSssea vs. Ca - . July 28, 1989 Cortes, J:: G.R No 85279Julie AnnNo ratings yet

- TORTS - 30. Anonuevo v. CADocument10 pagesTORTS - 30. Anonuevo v. CAMark Gabriel B. MarangaNo ratings yet

- Fermin Vs PeopleDocument25 pagesFermin Vs PeopleheymissrubyNo ratings yet

- Supreme Court International Arbitration Claims Rules 2013Document25 pagesSupreme Court International Arbitration Claims Rules 2013Milazar NigelNo ratings yet

- A Time To KillDocument148 pagesA Time To KillMA IZ0% (2)

- 4-4-11 Divinagracia vs. PanugalingDocument4 pages4-4-11 Divinagracia vs. PanugalingNicNo ratings yet

- Sanshuinu: Smart Contract Security AuditDocument7 pagesSanshuinu: Smart Contract Security AuditCristian GherghiţăNo ratings yet

- Constitution of The Philippines (1973) : PreambleDocument28 pagesConstitution of The Philippines (1973) : PreambleRosemarie BeltranNo ratings yet