Professional Documents

Culture Documents

Jeremy D Fogel Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jeremy D Fogel Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

AO 10 Rev.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization N. D. California

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S. C. app, ,sq~q 101-111)

I. Person Reporting (last name, first, middle initial) Fogel, Jeremy D.

4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/03/2011 6. Reporting Period 01/01/2010 to 12/31/2010

U. S. District Judge - active

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

United States Courthouse 280 South First Street San Jose, California 95113

IMPORTANT NO TES: The instructions accompanying this form must be followed Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (Ropo.ing individual only; seepp. 9-13 of filing instructions.)

~-~ NONE (No reportable positions.)

POSITION

1. Lecturer in law 2, 3, 4, 5, Trustee

NAME OF ORGANIZATION/ENTITY

Stanford Law School

Trust # I

II. AGREEMENTS. (Reporting individual only; see pp. 14-16 of filing instructions.)

NONE (No reportable agreements.)

DATE

I. 9/30/81

PARTIES AND TERMS

California Judicial Retirement System: entitled to approximately 61% of then-current salary of Superior Court Judge as of my 63rd birthday

Fo_qel, Jeremv D.

FINANCIAL DISCLOSURE REPORT Page 2 of 7

Name of Person Reporting Fogel, Jeremy D.

Date of Report 05/03/2011

III. NON-INVESTMENT INCOME. (nepo.i.g indi,idualandspouse; seepp. 17-24 of filing instructions.)

A. Filers Non-Investment Income D NONE (No reportable non-investment income.) DATE

I. 2010 2. 3. 4.

SOURCE AND TYPE

Stanford Law School (teaching)

INCOME (yours, not spouses) $10350

B. Spouses Non-! nvestment I nco me - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

D

I. 2OlO 2. 3. 4.

NONE (No reportable non-investment income.) DATE

SOURCE AND TYPE

Los Gatos-Saratoga Joint Union High School District

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.)

SOURCE

I. Pepperdine University Law School George Washington University Federal Circuit Bar Association INTERPOL, Unde~vriters Laboratories State Bar of California, Intellectual Property Law Section

DATES

3/I 8/2010-3/19/2010

LOCATION

Malibu, CA

PURPOSE

Speak at conference

ITEMS PAID OR PROVIDED

Transportation, meals and lodging

2.

5/10/2010-5/I 1/2010

Washington, DC

Speak at conference

Transportation, meals and lodging

3.

6/25/2010-6/26/2010

Colorado Springs, CO

Speak at conference

Transportation, meals and lodging

4.

10/16/2010-10/22/201 C, Hong Kong, China

Speak at conference

Transportation, meals and lodging

5.

I0/29/2010-10/30/201C Napa, CA

Speak at conference

Transportation, meals and lodging

FINANCIAL DISCLOSURE REPORT Page 3 of 7

Name of Person Reporting Fogel, Jeremy D.

Date of Report 05/03/201 I

V. GIFTS. anch,d,~ those to spouse,,nd dependen, ehil,~en: ~ee pp. ~s.s~ of filing instructions.)

NONE (No reportable gifts.) SOURCE

I. 2. 3. 4. 5.

DESCRIPTION

VALUE

Vl. LIAB ILITIES. ancludes those of spouse and dependent children; see pp. 32-33 of filing instructions.)

[~] NONE (No reportable liabilities.)

CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 7

Name of Person Reporting Fogel, Jeremy D.

Date of Report 05/03/201 I

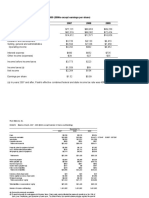

VII. INVESTMENTS and TRUSTS - inco,~e. ,alue. transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trost assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period O) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) Gross value at end of reporting period 0) (2) Value Value Code 2 Method (.I-P) Code 3

(Q-W)

Transactions during reporting period

0) Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I (J-P) (A-H)

Identi~y of buyer/seller (if private

transaction)

I. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17.

First Western Investments (assets below)

Redeemed (part) Redeemed (pan)

O4/01/10 09/09/I 0

K K

-Russell Core Equity Fund CI I (fmr Russell Equity I) -Russell Tax-Managed Lg Cap Fund -Russell lntl Developed Markets Fund I (fmr Russell Intl I) --Russell Emerging Markets -Russell Tax Exempt Bond --Fidelity Cash --Russell Tax-Mgd Mid & Sm Cap Fund Morgan Stanley Dean Witter IRA #1 (assets below) --MSDW Liquid Asset Fund -Pioneer Mid-Cap Fund --Morgan Stanley Bank --John Hancock Regional Bank B --Unit Van Kampen EAFE Select 20 Portfolio 2007- I Morgan Stanley Dean Witter IRA #2 (assets below) --MSDW Liquid Asset Fund

A C

Distribution Distribution None

J K K J L J K

T T T T T T T

A B A C

Distribution Int./Div. Int./Div. Distribution

A A A A A

Int./Div. Dividend Interest Interest Int./Div.

J K K J K

T T T T T

Im./Div.

1. Income Gain Codes: (See Columns BI and D4) 2. Value COd~ (see Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$ 1.0OO or less F =$50.001 - $10~.000 J = $15,000 or less N -$250.0OI - $500,00~ P3 =$25,000.001 - $50.00~.000 Q =Appraisal U =Book Value

B =$1.001 - $2,500 G =$100,001 - $1.000,000 K =$15.001 - $50.000 O=$500.001-$1.000.000 R =Cost (Real Estate Only) V =Other

C =$2.501 - $5.000 Ill =$1,000.001 - $5.00).090 L =$ 50.1)01 - $ 100.00~ PI $ 1.000.001 - $ 5.090,000 P4 =More than $50,000,0~0 S =A,:.ses~,mcnt W =Estintalcd

D =$5.001 - $15,000 H2 =More than $5,0~0.000 M = $ 100.001 - $250,1)00 P2 =$5.000,001 - $25.0~O.0~0 T -Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 7

Name of Person Reporting Fogel, Jeremy D.

Date of Report 05/03/201 I

VII. INVESTMENTS and TRUSTS - income, ralue, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period (1) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.) Gross value at end of reporting period (1) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) Transactions during reporting period

(])

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code2 Code I (J-P) {A-H)

(5)

Identity of buyeNseller (ifprivate tmnsaction)

18.

-Morgan Stanley Bank

A A A A A A A A

Interest Dividend Dividend Interest Dividend Dividend Interest Interest

J J K J J J J J

T T T T T T T T

19. -MSDWGlobalAdvantageB 20. 21. 22. 23. 24. 25. 26. 27. 28. --Pioneer Mid-Cap Fund --John Hancock Regional Bank A --MS Spectrum Tech --MS Spectrum Select World Savings lRA (CD) World Savings IRA (CD) Trust #1 (assets below) --City National Bank Ladder Account LTCQ, Inc. common stock

Interest None

PI K

T U

I. Income Gain Codes: (See Columns B I and I)4 ) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (Sec Column C2)

A =$1,000 or less F =$ 50.001 J =$15.000 or less N -S250.001 - $500.090 P3 =$25.00~.001 - $50.00~.000 Q =Appraisal U =Book Value

B =$1.001 - $2,500 K =$15,001 - $50.000 O =$500.0~1 - $1,0~).000 R -Cosl (Real Estate Only) V Other

C =$2,501 - $5.000 L =$50,001 - $100,000 PI =$1,000,001 - $5,000.090 P4 =More than $50,000,0~0 S =Assessment W =Eslimatcd

=$5,1101 - $15,000 H2 =More than $5,000.000 M =$100,0~1 - $250,000 P2 $5,0~1,001 - $25.000,000 -Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 6 of 7

Name of Person Reporting Fogel, Jeremy D.

Date of Report 05/03/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

FINANCIAL DISCLOSURE REPORT Page 7 of 7

IX. CERTIFICATION.

Name of Person Reporting Fogel, Jeremy D.

Date of Report 05/03/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported ~vas withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S] Jeremy D. Fogel

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

AO 10 Rev. 1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization N. D. California

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Reqtdred by the Ethics in Government Act of 1978 (5 U.S.C. app. ,~" 101-111)

I. Person Reporting (last name, first, middle initial) Vogel, Jercmy D.

4. Title (Article ill judges indicate active or senior status; magistrate judges indicate full- or part-time)

Date of Report 06/09/201 I 6. Reporting Period 01/01/2010 to 12/31/2010

U. S, District Judge - active

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modification~ pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

United States Courthouse 280 South First Street San .lose, California 95113

IMPORTANT NOTES: The instructions accompanying this form must be followe,! Complete all parts,

checking the NONE box for each part where you have no reportable informatiot~ Sign on last page.

I. POSITIONS. CReVo,,ing individual only; seepp. 9-I3 of filing instructions.)

~-~ NONE (No reportable positions.) POSITION

1. Lecturer in law 2. 3. 4. 5. Trustee

NAME OF ORGANIZATION/ENTITY

Stanford Law School

Trust # I

II. AGREEMENTS. (Reporting individual only; see pp. 14-16 of filing instructions.)

[~ NONE (No reportable agreements.) DATE

1.9/30/81

PARTIES AND TERMS

California Judicial Retirement System: entitled to approximately 61% of then-current salary.of Superior Court Judge as of my 63rd birthday

Fo_qel, Jeremv D. A

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting Fogel, Jeremy D.

Date of Report 06/09/201 I

III. NON-INVESTMENT INCOME. (Reporting individual and spouse; see pp. 17-24 of filing instructions.)

A. Filers Non-Investment Income D NONE (No reportable non-investment income.) DATE

I. 2010 2. 3. 4.

SOURCE AND TYPE

Stanford Law School (teaching)

INCOME (yours, not spouses) $10350

B. Spouses Non-lnvestment Income - If you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.) D

NONE (NO reportable non-investment income.)

DATE

SOURCE AND TYPE

Los Gatos-Saratoga Joint Union High School District

I. 2010 2. 3. 4.

IV. REIMBURSEMENTS - transportation, Iodglng, food, entertainment.

(Includes those to spouse and dependent children: see pp. 25-27 of filing instructions.)

D

I.

NONE (No reportable reimbursements.) SOURCE

Pepperdine University Law School George Washington University Federal Circuit Bar Association INTERPOL, Underwriters Laboratories State Bar of California, Intellectual Property Law Section

DATES

3/18/2010-3/19/2010

LOCATION

Malibu, CA

PURPOSE

Speak at conference

ITEMS PAID OR PROVIDED

Transportation, meals and lodging

2.

5/10/2010-5/11/2010

Washington, DC

Speak at conference

Transportation, meals and lodging

3.

6/25/2010-6/26/2010

Colorado Springs, CO

Speak at conference

Transportation, meals and lodging

4.

10/16/2010-10/22/201C Hong Kong, China

Speak at conference

Transportation, meals and lodging

5.

10/29/2010-10/30/201C Napa, CA

Speak at conference

Transportation, meals and lodging

Name of Person Reporting

Da~e of Reporf 06/09/2011

PageFINANCIAL3 of 8 DISCLOSURE REPORT I Fogel, Jeremy D.

~]

NONE (No reportable g~s.)

SOURCE DESCRIPT|ON VALUE

I. 2. 3. 4. 5.

VI. LLAB IL ITIES. aneludes ,hose olspouse a,d dependen, children; see pp. 32-33 of filing instructionsO

NONE (No reportable liabilities.) CREDITOR

I. 2. 3.

4.

DESCRIPTION

VALUE CODE

5.

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting Fogel, Jeremy D.

Date of Report 06/09/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

[~]

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period O) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) Gross value at end of reporling period (D (2) Value Value Code 2 Method

(J-P) Code 3

Transactions during reporting period O) Type (e.g.,

buy, sell, redemption)

(2) (3) Date Value mnddd/yy Code 2

(J-P)

(4) Gain Code 1

(A-H)

(Q-W) Fidelity Investments (assets listed below) 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. --Fidelity Cash --Russell Tax-Mgd Mid & Sm Cap Fund A C Int./Div, Distribution J K T T Sold (part) Sold (part) 04/05/10 09/10/10 J J A A --Russell Tax Exempt Bond B lnt./Div. T --Russell Emerging Markets A Distribution J T --Russell Intl Developed Markets Fund 1 (fmr Russell Intl I) None T --Russell Tax-Managed Lg Cap Fund C Distribution K T -Russell Core Equity Fund CI 1 (fmr Russell Equity 1)

A Distribution J

(5) Identity of buyer/seller (if private transaction)

Sold (part) Sold (part)

04/05/10 09110/10 12/31110 04/05110 09/10/10 12131/10 04/05110 09110/10 04/05110 09/10/10 04/05/I 0 09/10110 12/31110

J J J J J J J J J J J J J

A A A A A A A A A A A A

(part)

Sold (part) Sold (part) Sold (part) Sold (part) Sold (part) Sold (part) Sold (part) Sold (part) Sold (part) Buy (addl)

Sold

I. Income Gain Codes: (See Columns B I and [M) 2. Value Codes (See Colurnns CI and D3) 3. Value Method Codes (see Column C2)

A $1,000 or Icss F =S50,0~1 * $100.009 J $15.000 or less N =$250.001 -$500.000 P3 -525.0~.0~1 - $50.000.0~0 Q =Apprai~l U =Book Value

B=$1,001-$2,500 G -$100.001 * $1,009.00~ K :$15,001 - $50,000 O 5500.0~1 - 51,00~,000 R =Cost (Real Estate Only} V :Other

C =$2,501 - $5,000 HI =$1.0(~.001 - $5,0OO,0~9 L =$50.001 - 5100,000 PI -$1,0OO,001 - $5,000,0~0 P4 =More than $50,000.000 S =Assessment W =Estimated

D=$5,001"$15,0O0 H2 -More than M =$100,001 - $250,000 P2 =$5,000.001 - 525,000.00~ T =Cash Market

E =515,0~1 - 550,00(I

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Fogel, Jeremy D.

Date of Repor~ 06/09/2011

VII. I NVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during rel~rting period Gross value at end of reporting period Transactions during reporling period

(l)

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

(n

Value Code 2 (J-P)

(2)

Value Method Code 3 (Q-W) Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code 1 (J-P) (A-IT)

(5)

Identity of buyer/seller (if private transaction)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. Morgan Stanley Dean Witter IRA #1 (assets belo\v) --MSDW Liquid Asset Fund --Pioneer Mid-Cap Fund --Morgan Stanley Bank --John Hancock Regional Bank B --Unit Van Kampen EAFE Select 20 Porl folio 2007-1 Morgan Stanley Dean Witter IRA #2 (assets below) --MSDW Liquid Asset Fund --Morgan Stanley Bank --MSDW Global Advantage B --Pioneer Mid-Cap Fund --John Hancock Regional Bank A --MS Spectrum Tech --MS Spectrum Select World Savings IRA (CD) World Savings IRA (CD) A A A A A A A A A Int./Div. Interest Dividend Dividend Interest Dividend Dividend Interest Interest J J J K J J J J J

T T T T T T T T T

Sold

12/31/10

(pan)

A A A A A

Int./Div. Dividend Interest Interest IntJDiv.

J K K J K

T T T T T

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns C I and D3) 3. Value ~tcthod Codes tSce Column C2)

A =$1,000 or less F =$50,001 - $100.000 J =$15,000 or less N =$250.0(11 - $50~.000 P3 $25.000,001 - $50.000.000 Q =Appraisal LI =Book Value

B =$1,001 - $2,500 G =$100.001 - $1,000,000 K =$15,001 - $50,009 O =$500,001 - $1,00~,000 R =Cost (Real E.,.tate Only) V -Other

C =$2,501 - $5,000 HI =$1,000,001 - $5.00~.0~0 L =$50,0OI - $100,0~0 PI =$1,000,001 - $5,000,000 P4 =More than $50.000,0~0 S =As:.,cssment W =Esltmalcd

D =$5,001 - $15,000 H2 =More than $5,000,0(~ M =$100,001 - $250,00~ P2 =$5,000,091 - $25,000,000 T =Cash Market

E =$15,001 - $50,0OO

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting Fogel, Jeremy D.

Date of Report 06/09/2011

VII. INVESTMENTS and TRUSTS - inco.,e, ,.l.e, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end of reporting period Transactions during reporting period

(1)

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

(i)

Value Code 2 (.I-P)

(2)

Value Method Code 3 (Q.W)

O)

Type (e.g., buy. sell, redemption)

(2)

Date mnddd/yy

(3)

(4)

(5)

Identily of buyer/seller (if private transaction)

Value Gain Code 2 Code I

35. 36. 37.

Trust #1 (assets below) -City National Bank Ladder Account LTCQ, Inc. common stock

Interest PI T

None

I. Income Gain Codes: (See Columns B I and IM) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (see Column C2)

A :$1,000 or less F =$50.001 - $100.000 J -$15,000 or less N =$250,001 - $500.000 P3 =$25.000.001 - $50.000.000 Q =Appraisal U =Book Value

B =$1.001 - $2.500 G =$100.091 - $1.000.000 K -$15,001 - $50,000 O =$500,001 - $1.000,000 R =Cost (Real Estale Only) V :Other

C =$2.501 - $5.000 H I =$1.009,001 L =$50,001 - $100,000 PI =$1.000.0~1 - $5.000.000 P4 More than $50.0~0.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5.000,000 M =$100,001 - $250,000 P2 =$5.0~0,001 - $25.000.000 T =Cash Market

E =$15.001- $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Fogel, Jeremy D.

Date of Report 06/09/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (Indicate part of report.)

FINANCIAL DISCLOSURE REPORT Page 8 of 8

Name of Person Reporting Fogel, Jeremy D.

Date of Report 06/09/201 l

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure.

I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S] Jeremy D. Fogel

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.No ratings yet

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.No ratings yet

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Schoolboard PowerpointDocument2 pagesSchoolboard PowerpointJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Summer Training Project Report On: Investors Perception Towards Derivatives MarketDocument84 pagesA Summer Training Project Report On: Investors Perception Towards Derivatives MarketVishal SutharNo ratings yet

- Tollbrothersinc10q 20100310Document323 pagesTollbrothersinc10q 20100310matthewphenry1951No ratings yet

- LOccitane en ProvenceDocument16 pagesLOccitane en ProvenceGiga KutkhashviliNo ratings yet

- Motivation and Reward Systems: January 2015Document5 pagesMotivation and Reward Systems: January 2015Rezaul karimNo ratings yet

- Financial Statement Analysis 1Document23 pagesFinancial Statement Analysis 1MedicareMinstun Project100% (1)

- Abbot's Financial AnalysisDocument23 pagesAbbot's Financial AnalysisMonaaa100% (3)

- Structured Products - Info - UBSDocument8 pagesStructured Products - Info - UBSAritraRayNo ratings yet

- Star Appliance Cost of Capital AnalysisDocument8 pagesStar Appliance Cost of Capital AnalysisGiga KutkhashviliNo ratings yet

- CS as a Valuer and Emerging Valuation OpportunitiesDocument42 pagesCS as a Valuer and Emerging Valuation OpportunitiesGAURAVNo ratings yet

- Warren Buffett Stock Picks ValuationDocument11 pagesWarren Buffett Stock Picks ValuationOld School Value75% (4)

- RiskMetrics (Monitor)Document24 pagesRiskMetrics (Monitor)Angel Gutiérrez ChambiNo ratings yet

- A Critical Analysis of APT and CAPMDocument4 pagesA Critical Analysis of APT and CAPManon_2694232370% (2)

- MBA ProfileDocument1 pageMBA Profilecorporate relationNo ratings yet

- The Rediscovered Benjamin Graham-Lectures On Security AnalysisDocument66 pagesThe Rediscovered Benjamin Graham-Lectures On Security AnalysiskenatiguiNo ratings yet

- Preferred Stock Financing Term SheetDocument13 pagesPreferred Stock Financing Term SheetDan MerrittsNo ratings yet

- 111-Associated Bank vs. CA 291 Scra 511Document7 pages111-Associated Bank vs. CA 291 Scra 511Jopan SJNo ratings yet

- Interview With Andrejs LandsmanisDocument2 pagesInterview With Andrejs LandsmanisForsta AP-fondenNo ratings yet

- Introduction to Ratio Analysis and InterpretationDocument92 pagesIntroduction to Ratio Analysis and InterpretationRohit Soni100% (1)

- Unseen Question TemplateDocument2 pagesUnseen Question TemplategeorgeNo ratings yet

- Creating An Automated Stock Trading System in ExcelDocument19 pagesCreating An Automated Stock Trading System in Excelgeorgez111100% (2)

- Lemelson Capital Featured in HFMWeekDocument32 pagesLemelson Capital Featured in HFMWeekamvona100% (1)

- Project Report ON: Investment IN EquitiesDocument63 pagesProject Report ON: Investment IN Equitiesvaishu7896541384No ratings yet

- Flash Memory Income Statements 2007-2009Document10 pagesFlash Memory Income Statements 2007-2009sahilkuNo ratings yet

- Financial goal investment optionsDocument4 pagesFinancial goal investment optionsSai Krishna Dhulipalla50% (2)

- Parle Product FinanciaDocument14 pagesParle Product FinanciaAbinash Behera100% (1)

- 20161223xo6onf PDFDocument57 pages20161223xo6onf PDFThomas Neo AndersonNo ratings yet

- The Primary Market in IndiaDocument34 pagesThe Primary Market in IndiaPINAL100% (1)

- Opportunity CostDocument1 pageOpportunity CostManoj KNo ratings yet

- 511rf Risk Attitude Profiling Questionnaire FactsheetDocument5 pages511rf Risk Attitude Profiling Questionnaire FactsheetJana Rose PaladaNo ratings yet

- Wacc Ecf Apv Eva SvaDocument13 pagesWacc Ecf Apv Eva SvaDHRUV SONAGARANo ratings yet