Professional Documents

Culture Documents

GUIDE TO DRAFTING A BILL OF EXCHANGE

Uploaded by

David Oloo StoneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GUIDE TO DRAFTING A BILL OF EXCHANGE

Uploaded by

David Oloo StoneCopyright:

Available Formats

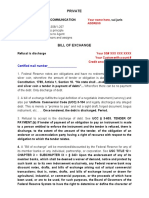

GUIDE TO PREPARING A BILL OF EXCHANGE / DRAFT

The following wording is intended as a guide and may vary according to: Tenor (eg: Sight, 30/60/90/ days from date of, Fixed Maturity Date) Whether Bill of Exchange is drawn under a Letter of Credit (will be referred to as draft)

Date. Amount .. (in figures) At (tenor see above) of this First* Bill of Exchange (second* of same date and tenor being unpaid), please pay to the order of ourselves the sum of ........................................(amount in words) for value received.

To: (Drawee Name & Address)

For and on behalf of: (Company Name) . (Capacity of signatory)

)

Notes *Duplicate Bill of Exchange to be drawn: At....... of this SECOND Bill of Exchange (FIRST of same date and tenor being unpaid)....... It is common for only one Bill of Exchange to be required, in which case drawn: At....... of this SOLE Bill of Exchange............ Ensure that Bill of Exchange is signed on its face and endorsed on reverse, ie: signed for and on behalf of....(your company name) Is Drawee name & address correct? If Bill of Exchange is presented direct for acceptance (eg: documentary / clean collection), Bill should be drawn on buyer. If Bill (or draft) is to be drawn under a Letter of Credit, check requirements of L/C as to which bank is named as the drawee. If Bill / draft is drawn under L/C ensure Bill is clearly marked as per L/C requirements, eg: Drawn under irrevocable L/C no .. of .. (bank) dated . (or as required under the L/C

This specimen Bill of Exchange and supporting notes have been prepared by MJ Hayward Associates Ltd to assist exporters prepare basic Bills of Exchange, without any liability or responsibility on our part. Exporters should take appropriate advice and base their own Bills of Exchange on the particular circumstances of the underlying transaction. www.mjhayward.co.uk

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- How Does A Bill of Exchange Work?: Signed by The Person Giving It (Drawer)Document3 pagesHow Does A Bill of Exchange Work?: Signed by The Person Giving It (Drawer)asif abdullah78% (9)

- Bill of Exchange TemplateDocument2 pagesBill of Exchange TemplateSwank96% (25)

- Invoice for Non-Negotiable Bill of ExchangeDocument2 pagesInvoice for Non-Negotiable Bill of ExchangeBlak Lib86% (7)

- 2 Bill of Exchange TemplateDocument1 page2 Bill of Exchange Templatepoppadoc19594% (17)

- Ion of Bill of ExchangeDocument11 pagesIon of Bill of Exchangeshami00992100% (1)

- Bills of Exchange (Drafts) : Sample L/CDocument4 pagesBills of Exchange (Drafts) : Sample L/Cjuan andres praxedes mateo100% (3)

- Promissory Note vs Bill ExchangeDocument4 pagesPromissory Note vs Bill ExchangeEloiza Evans80% (5)

- International Bill of Exchange and Promissory NotesDocument41 pagesInternational Bill of Exchange and Promissory NotesW897% (36)

- International Bill of Exchange TemplateDocument1 pageInternational Bill of Exchange Templatejj85% (88)

- Bill of ExchangeDocument1 pageBill of ExchangeFreeman Lawyer100% (9)

- Bill of Exchange Act 34 of 1964Document31 pagesBill of Exchange Act 34 of 1964lifeisgrand100% (7)

- Bill of Exchange FAQDocument5 pagesBill of Exchange FAQMonica Popovici100% (4)

- Bill of Exchange (Careful... )Document12 pagesBill of Exchange (Careful... )Jayanth Kumar93% (61)

- BOE Bonded TemplateDocument2 pagesBOE Bonded TemplateSuzanne Cristantiello100% (6)

- Jans Bonded Promissory NoteDocument1 pageJans Bonded Promissory Noteexousiallc100% (1)

- Bill of Exchange (Credit Instruments)Document12 pagesBill of Exchange (Credit Instruments)Aziz ShaikhNo ratings yet

- Bill of Exchange GuideDocument0 pagesBill of Exchange Guidemy hoangNo ratings yet

- Private Document Tender of PaymentDocument2 pagesPrivate Document Tender of PaymentPennyDoll94% (17)

- How to correctly complete a bill of exchangeDocument2 pagesHow to correctly complete a bill of exchangeVũ Nguyễn100% (1)

- Promissory Note PaymentDocument4 pagesPromissory Note Paymentjoe100% (7)

- Bill of Exchange TemplateDocument1 pageBill of Exchange Templatec mesker100% (3)

- Regstered Bonded Promissory NoteDocument2 pagesRegstered Bonded Promissory NoteAnonymous nYwWYS3ntV94% (17)

- Bills of ExchangeDocument5 pagesBills of Exchangesara24391100% (3)

- IBOE LanguageDocument1 pageIBOE Languageexousiallc100% (6)

- Bill of ExchangeDocument3 pagesBill of Exchangegenaro201091% (11)

- Bill of ExchangeDocument3 pagesBill of Exchangemlo356100% (8)

- Bill of ExchangeDocument14 pagesBill of ExchangeMa Angelica Micah Labitag100% (8)

- Financing Foreign Trade and International Trade DocumentsDocument9 pagesFinancing Foreign Trade and International Trade DocumentsStaidCasper100% (1)

- Charge Back Order 10-03-08Document1 pageCharge Back Order 10-03-08John Downs100% (3)

- B - Private Registered Bond For Setoff - Birth Certificate Bond 1MLWDocument1 pageB - Private Registered Bond For Setoff - Birth Certificate Bond 1MLWmas100% (2)

- Latest Formats:: "Accepted For Value"Document10 pagesLatest Formats:: "Accepted For Value"Stephen L. SmithNo ratings yet

- Letter of Credit TemplateDocument3 pagesLetter of Credit TemplateAnis InayahNo ratings yet

- Certificate of Ownership-Auth-TDA Account PDFDocument1 pageCertificate of Ownership-Auth-TDA Account PDFrisovi100% (6)

- 4 Bonded Promissory Note 2Document1 page4 Bonded Promissory Note 2Erick J. Valentine100% (1)

- Notice of TenderDocument2 pagesNotice of Tendertony100% (22)

- Bill of ExchangeDocument4 pagesBill of ExchangeSara SanamNo ratings yet

- 4 Bonded Promissory Note 2Document1 page4 Bonded Promissory Note 2Michael Kovach86% (7)

- PS-bill of Exchange ActDocument35 pagesPS-bill of Exchange ActPhani Kiran MangipudiNo ratings yet

- Bill of ExchangeDocument12 pagesBill of ExchangeSandesh Jadhav89% (18)

- Secured Party Indemnity Bond and Discharging Debts................... UnderstandDocument3 pagesSecured Party Indemnity Bond and Discharging Debts................... Understandamenelbey96% (24)

- Bill of ExchangeDocument19 pagesBill of ExchangeKNOWLEDGE CREATORS100% (3)

- BC Bond (Power Bond)Document2 pagesBC Bond (Power Bond)Alberto94% (17)

- Bankers AcceptanceDocument3 pagesBankers AcceptanceGilner PomarNo ratings yet

- Letter of AdviceDocument2 pagesLetter of AdviceAndrew100% (6)

- Secretary of the Treasury Chargeback for Personal UCC Contract Trust AccrualDocument1 pageSecretary of the Treasury Chargeback for Personal UCC Contract Trust AccrualRichard LucianoNo ratings yet

- The Bill of ExchangeDocument11 pagesThe Bill of ExchangeInter_vivos56% (9)

- Notice of Memorandum of Law Points and Authorities in Support of International Bill of ExchangeDocument15 pagesNotice of Memorandum of Law Points and Authorities in Support of International Bill of ExchangeJason Henry100% (10)

- Hold Harmless AgreementDocument3 pagesHold Harmless Agreementdaisy tolliver100% (5)

- Promissory NoteDocument1 pagePromissory NoteTasha Johnson100% (2)

- Accepted For Value Example LetterDocument4 pagesAccepted For Value Example LetterGalina Novahova100% (22)

- Ronald Promissory Note To IRS CA Franchis Tax BoardDocument1 pageRonald Promissory Note To IRS CA Franchis Tax BoardConnie Lynn Hilton100% (1)

- PRVT Reg Indemnity BondDocument5 pagesPRVT Reg Indemnity BondWayne Lund100% (4)

- I GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRFrom EverandI GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRNo ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Stop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsFrom EverandStop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsRating: 5 out of 5 stars5/5 (1)

- Eprs Bri (2022) 739204 enDocument9 pagesEprs Bri (2022) 739204 enDavid Oloo StoneNo ratings yet

- GGSC Happiness Calendar November 2022Document1 pageGGSC Happiness Calendar November 2022David Oloo StoneNo ratings yet

- 000044Document92 pages000044David Oloo StoneNo ratings yet

- 14 A 6Document265 pages14 A 6David Oloo StoneNo ratings yet

- Right To FoodDocument40 pagesRight To FoodkrishanNo ratings yet

- 000044Document92 pages000044David Oloo StoneNo ratings yet

- Biomdo - Judicial Enforcement of The Right To A Fair Trial 0of KenyaDocument84 pagesBiomdo - Judicial Enforcement of The Right To A Fair Trial 0of KenyaDavid Oloo StoneNo ratings yet

- Chidimp2014 PDFDocument125 pagesChidimp2014 PDFDavid Oloo StoneNo ratings yet

- Analysis of The ContributionDocument64 pagesAnalysis of The Contributionmulabbi brianNo ratings yet

- Administration of Justice-Uganda-March-05Document5 pagesAdministration of Justice-Uganda-March-05David Oloo StoneNo ratings yet

- 14 A 6Document265 pages14 A 6David Oloo StoneNo ratings yet

- Right To FoodDocument40 pagesRight To FoodkrishanNo ratings yet

- Legal Pluralism Contributes to Mau Forest ConflictsDocument30 pagesLegal Pluralism Contributes to Mau Forest ConflictsDavid Oloo Stone100% (1)

- Children's Rights Course ReportDocument112 pagesChildren's Rights Course ReportDavid Oloo StoneNo ratings yet

- Faulty Logic and Reasoning ExplainedDocument42 pagesFaulty Logic and Reasoning ExplainedDavid Oloo Stone100% (1)

- Epr Cudi C PaperDocument29 pagesEpr Cudi C PaperDavid Oloo StoneNo ratings yet

- Ohide ThesisDocument105 pagesOhide ThesisDavid Oloo StoneNo ratings yet

- Formation of ContractDocument59 pagesFormation of ContractDavid Oloo StoneNo ratings yet

- Banking Cw2Document32 pagesBanking Cw2David Oloo StoneNo ratings yet

- Negligence Law by OkiyaDocument195 pagesNegligence Law by OkiyaDavid Oloo Stone100% (2)

- Module Descriptor International Trade Law RevisedDocument4 pagesModule Descriptor International Trade Law RevisedDavid Oloo StoneNo ratings yet

- Internally Displaced PersonsDocument30 pagesInternally Displaced PersonsDavid Oloo StoneNo ratings yet