Professional Documents

Culture Documents

Assignment 1 Week 2 Accounting Summary Report Class 4 BUS 599 GM DR Rahul D Parikh

Uploaded by

Rishi PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1 Week 2 Accounting Summary Report Class 4 BUS 599 GM DR Rahul D Parikh

Uploaded by

Rishi PatelCopyright:

Available Formats

Accounting Summary Report of Gurudev Lemonade Stand: Season One

Accounting Summary Report of Gurudev Lemonade Stand: Season One Rahul Parikh BUS599: Introduction to Quantitative Principles (MWF1133A) Dr Zhimin Huang August 20, 2011

Accounting Summary Report Accounting Summary Report

Gurudev Lemonade stand is a partnership firm established by me, and my friend, by investing initial capital of $20.00 each, to sale refreshing lemonade drinks. Business was started from scratch during season one, when weather was partly cloudy, and partly sunny, targeting the thirst aspect of peoples physiological need. This report is the study of six days business of the firm, during season one, creating general journal of its transactions in chronological order, an income statement, and balance sheet for the business operation. General Journal:

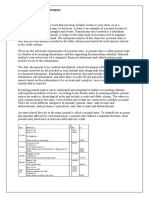

Appendix-1: General Journal of Gurudev Lemonade Stand, For Season One:

Accounting Summary Report

General journal is prepared in this business (Appendix-1: Page 2), to record each transactions in chronological order, showing debits, and credits, for each transaction during season one (Brownfield, 2007, p.55). All transactions were recorded starting from owners capital of $40.00, to total debits or credits of $404.85, in chronological order that occurred date wise. For example it includes all revenue earned, by selling lemonade, during each day of season one, which was credited in the journal, but at the same time it was debited as cash account in journal on same day. Similarly all supplies purchased, which are inventories, were debited, and also were credited as account payable on the same day in the journal. Transactions in the journal makes us know, whether it is income statement or balance sheet account. For example equipment or inventories purchased, and cash earned by selling lemonades are reflected as total assets, in balance sheet account, and revenue earned deducting the expenses incurred, is reflected as earning in income statement of season one. Income statement:

Appendix-2: Income Statement of Gurudev Lemonade Stand, For Season One: The income statement reflects total revenue earned, and expenses incurred, with resulting net income over the six days business activities of season one. Income statement of this lemonade business (Appendix-2) mentions that they have generated revenue of $185.90 by selling lemonade over span of six days in season one, and have incurred total expenses of $59.95 by using supplies, while earning this revenue. Subtracting the expenses from

Accounting Summary Report revenues, gave net earnings/income of $125.95 in income statement of six day business activity of season one. Balance Sheet:

Appendix-3: Balance Sheet of Gurudev Lemonade Stand, For Season One: Balance sheet describes financial position of lemonade business with respect to type, and amounts of assets, liabilities, and equity, over six day business during season one (Brownfield, 2007, p.17). It reveals (Appendix-3) that Gurudev lemonade started as partnership business with owners capital of $40.00, made investment of $10.05 in inventories, and $9.00 in equipments, during six days business of season one. Company generated $185.90 in cash as revenue, thus it has total assets of $204.95 during season one. On liability aspect, company has $39.00 as account payable. In equity, company has retained earnings of $125.95, plus owners capital of $40.00, thus total equity in balance sheet is $165.95 for six days operation. The balance sheet shows that company has total liabilities of

Accounting Summary Report $39.00, total equity of $165.95, thus total equity and liabilities of $ 204.95, which balances the total assets of $204.95 during six days of business operation in season one. Financial Ratios:

Appendix-4: Financial Ratios of Gurudev Lemonade Stand, For Season One: Financial Ratio (Appendix-4) gives actual condition of current status of business compared to balance sheet or income statement. Following are significant ratios, used to comment on operation of Gurudev lemonade stand business. Profit margin or return on sales is a ratio of net income to net sales, and it is a useful measure of companys operating result, as it reflects the percent of profit corresponding to each dollar of sales (Brownfield, 2007, p.108). It is a measure of profitability, and indicates what portion of sales contributes to the income of the company. In season one; Profit margin was 67.8%, which means company has roughly net income of $0.67 for each dollar of sales. This is a terrific profitable operation; indicating strong financial return. Inventory turnover is 5.97, which is a function of total sales over net income ($185.90), and represents number of times, the inventories has turned over into sales. This means that

Accounting Summary Report business operation has short shelf life, signifying restocking planning for the company. Also such high turnover signifies high demand of product, which in turn signifies strong, and potential, financial status of the Company.

Cash ratio is a function of total cash to its current liabilities. It is 4.77 which suggests strong companys liquidity, and serves as measure of how quickly company can repay its short-term debt, thus it is a good indicator of the solvency of the company, and also indicates strong condition of the company as far as cash on hand is concerned. Return on earning (ROE) of 75.9% calculates the return generated by owners of the company. It is one of the most important indicators of a firms profitability, and potential growth, as it is a ratio of net profit divided by equity. Company showing such high ROE is able to grow without large expenditure. Return on assets (ROA) of 61.5% illustrates how profitable company is relative to its assets. It indicates that company is generating strong return on owners investment, and owner has strong efficiency of using current assets to generate revenue. Recommendations: Lemonade stand has excellent financial performance, but few recommendations regarding its operation can be applied to have better business effectiveness. 1) To achieve better growth, company needs to increase its equipments to increase its revenue, which will help to increase its assets. 2) Based on current inventory turnover, company has generated significant amount of cash, but still company should increase its inventory to create more sales, and increase its revenue, and cash on hand. 3) Company should increase its assets, which will increase its leverage ratio, which will make company attractive to potential investors. Conclusion: Operation of Gurudev Lemonade Stand Company over six days of season one was very successful. The income statement shows revenue of $185.90 compared to expenses of $59.95,

Accounting Summary Report thus making a net income of $125.95. The balance sheet shows total assets of $204.95, with total liabilities of $39.00, and total equity of $165.95. This figures states that company

generated significant revenue, with minimal expenses, and minimal liabilities, thus generated significant assets, retain earning, and generous profit, in a short duration of six days business operation. Based on such success, it is recommended that company must plan for best use of its profit, and significant cash flow, to make effective better run, and growth, of the business.

Accounting Summary Report References: Brownfield, David L. (Ed.). (2007). MBA essentials. New York: McGraw-Hill Learning Solutions. ISBN: 978-0-697-77527-6. Season One Sample, Retrieved on August 15, 2011 from http://threadcontent.next.ecollege.com/pub/content/fab89beb-0b4f-42fa-9a4f30c5bb68e87c/BUS599_Season_1_Sample.pdf Season Two Sample, Retrieved on August 15, 2011 from http://vizedhtmlcontent.next.ecollege.com/pub/content/2ab7e0d8-c328-4bf2-867982e34a53a936/BUS599_Season_2_Sample.pdf .

You might also like

- Work # 1 Financial Analysis - World of Games 2015 (2500 Words) April 28, 2016Document13 pagesWork # 1 Financial Analysis - World of Games 2015 (2500 Words) April 28, 2016Assignment HelperNo ratings yet

- Profit and Loss (P&L) : Definition - What Does Mean?Document2 pagesProfit and Loss (P&L) : Definition - What Does Mean?Divyang BhattNo ratings yet

- Auditors Report and Financial Analysis of ITCDocument28 pagesAuditors Report and Financial Analysis of ITCNeeraj BhartiNo ratings yet

- Principles of Finance Chapter07 BlackDocument115 pagesPrinciples of Finance Chapter07 BlackLim Mei Suok100% (1)

- Practical 4 Preparation of Balance Sheet of Broiler in Chitwan District ObjectivesDocument16 pagesPractical 4 Preparation of Balance Sheet of Broiler in Chitwan District ObjectivesPurna DhanukNo ratings yet

- Financial Statement Analysis in 40 CharactersDocument11 pagesFinancial Statement Analysis in 40 CharactersGurneet Singh7113No ratings yet

- Amaysim Australia LimitedDocument9 pagesAmaysim Australia LimitedMahnoor NooriNo ratings yet

- APLK - Earnings Quality - Arsyan AdimasDocument6 pagesAPLK - Earnings Quality - Arsyan AdimasAdimas Hanindika100% (1)

- Financial Statement AnalysisDocument9 pagesFinancial Statement AnalysisQaisar BasheerNo ratings yet

- Ch03 - Financial Statements and Ratio AnalysisDocument26 pagesCh03 - Financial Statements and Ratio Analysisaccswc21No ratings yet

- A Study On Profitability Analysis atDocument13 pagesA Study On Profitability Analysis atAsishNo ratings yet

- Faa U2Document10 pagesFaa U2kztrmfbc8wNo ratings yet

- Ratio Analysis and Interpretation of Accounts: Performance Evaluation For The Month of July 2013Document8 pagesRatio Analysis and Interpretation of Accounts: Performance Evaluation For The Month of July 2013shakeitoNo ratings yet

- What Is The Statement of Comprehensive Income?: EquityDocument4 pagesWhat Is The Statement of Comprehensive Income?: EquityKatherine Canisguin AlvarecoNo ratings yet

- Prepare Basic Financial StatementsDocument6 pagesPrepare Basic Financial StatementsMujieh NkengNo ratings yet

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatNo ratings yet

- Masan Group CorporationDocument31 pagesMasan Group Corporationhồ nam longNo ratings yet

- Financial Statements GuideDocument25 pagesFinancial Statements GuideRegie SudoyNo ratings yet

- Reporting Comprehensive Income, Equity Changes, and Key Financial StatementsDocument9 pagesReporting Comprehensive Income, Equity Changes, and Key Financial StatementsAbigail Elsa Samita Sitakar 1902113687No ratings yet

- PRESENTATION ON Finincial Statement FinalDocument28 pagesPRESENTATION ON Finincial Statement FinalNollecy Takudzwa Bere100% (2)

- Chapter 2 Review of Financial Statement Preparation Analysis InterpretationDocument46 pagesChapter 2 Review of Financial Statement Preparation Analysis InterpretationMark DavidNo ratings yet

- Week 6 Learning Summary Financial RatiosDocument10 pagesWeek 6 Learning Summary Financial RatiosRajeev ShahdadpuriNo ratings yet

- CAT Business AcumenDocument13 pagesCAT Business AcumenAftab AhmadNo ratings yet

- Financial Performance MeasuresDocument5 pagesFinancial Performance Measurescattiger123No ratings yet

- Unit 4 - Ratio AnalysisDocument13 pagesUnit 4 - Ratio AnalysisEthan Manuel Del ValleNo ratings yet

- Accountancy Project TopicDocument14 pagesAccountancy Project TopicIsha BhattacharjeeNo ratings yet

- Comparing Financial Performance of Tata Motors and Bajaj AutoDocument27 pagesComparing Financial Performance of Tata Motors and Bajaj AutoPatel RuchitaNo ratings yet

- Analyze Financial Statements (39Document8 pagesAnalyze Financial Statements (39Stephany PolinarNo ratings yet

- Finance Chapter 4 Online PDFDocument43 pagesFinance Chapter 4 Online PDFJoseph TanNo ratings yet

- Fs AnalysisDocument34 pagesFs Analysisbawangb21No ratings yet

- Basic Accounting LectureDocument56 pagesBasic Accounting LectureJun Guerzon PaneloNo ratings yet

- Key Financial Performance IndicatorsDocument19 pagesKey Financial Performance Indicatorsmariana.zamudio7aNo ratings yet

- Alekya - Profit AnaDocument17 pagesAlekya - Profit AnaMOHAMMED KHAYYUMNo ratings yet

- Understanding Financial Statement FM 1Document5 pagesUnderstanding Financial Statement FM 1ashleyNo ratings yet

- Lec 14 Fin Perf ManagementDocument21 pagesLec 14 Fin Perf ManagementHaroon RashidNo ratings yet

- Evaluating Financial RatiosDocument2 pagesEvaluating Financial RatioseightNo ratings yet

- Assessing Financial Health (Part-A)Document17 pagesAssessing Financial Health (Part-A)kohacNo ratings yet

- Single Entry System and Incomplete Records NotesDocument5 pagesSingle Entry System and Incomplete Records NotesKristen Shaw100% (5)

- Report in Business Finance: Group 2 - Review of Financial Statement Preparation, Analysis, and InterpretationDocument14 pagesReport in Business Finance: Group 2 - Review of Financial Statement Preparation, Analysis, and InterpretationKOUJI N. MARQUEZNo ratings yet

- Local Media3038223883012324361Document77 pagesLocal Media3038223883012324361Bria Charmaine CutinNo ratings yet

- ROEDocument7 pagesROEfrancis willie m.ferangco100% (1)

- Interpretation On RatiosDocument3 pagesInterpretation On RatiosLorraine CalderonNo ratings yet

- Accounting Basics ExplainedDocument5 pagesAccounting Basics ExplainedRooban BalachandranNo ratings yet

- Accounting ReportDocument23 pagesAccounting ReportAreeba FatimaNo ratings yet

- Kimmel, Weygandt, Kieso, Trenholm Financial Accounting: Tools For Business Decision-Making, Canadian EditionDocument6 pagesKimmel, Weygandt, Kieso, Trenholm Financial Accounting: Tools For Business Decision-Making, Canadian EditionPrameswari NaNo ratings yet

- Final AcountsDocument20 pagesFinal Acountskarthikeyan01No ratings yet

- Finman ScriptDocument3 pagesFinman ScriptREA ANGELINE BARDOSNo ratings yet

- Midterm Departmental Examination Multiple Choice. Identify The Choice That Completes The Statement or Answers The QuestionDocument5 pagesMidterm Departmental Examination Multiple Choice. Identify The Choice That Completes The Statement or Answers The QuestionRandy ManzanoNo ratings yet

- Meaning of Financial StatementsDocument44 pagesMeaning of Financial Statementsparth100% (1)

- Financial Statement AnalysisDocument59 pagesFinancial Statement AnalysisJeymar YraNo ratings yet

- Fabm ReviewerDocument3 pagesFabm ReviewerReyman Andrade LosanoNo ratings yet

- 15 - 16 Accounting Concepts and PrinciplesDocument39 pages15 - 16 Accounting Concepts and PrinciplesKyeien100% (1)

- Audit of Financial StatementDocument23 pagesAudit of Financial StatementGurpreet KaurNo ratings yet

- Econ 303Document5 pagesEcon 303ali abou aliNo ratings yet

- Financial Statement Analysis (Nov-20)Document51 pagesFinancial Statement Analysis (Nov-20)Aminul Islam AmuNo ratings yet

- Financial Analysis Report Shell Cluster 7531Document4 pagesFinancial Analysis Report Shell Cluster 7531Darren MavadyNo ratings yet

- AssesmentDocument14 pagesAssesmentbhumi shuklaNo ratings yet

- 8 Financial StatementDocument11 pages8 Financial StatementLin Latt Wai AlexaNo ratings yet

- Financial Accounting: Sir Syed Adeel Ali BukhariDocument25 pagesFinancial Accounting: Sir Syed Adeel Ali Bukhariadeelali849714No ratings yet

- 1 Business Correspondence - For STUDENTSDocument7 pages1 Business Correspondence - For STUDENTSHanna SianturiNo ratings yet

- GST Presentation - Place of Supply of GoodsDocument15 pagesGST Presentation - Place of Supply of GoodsAditi AgarwalNo ratings yet

- Balaji WafersDocument37 pagesBalaji Wafersmaishavi panchal100% (2)

- Service Berry Define Service As Act, Deeds, & Performance. AMA Define Service As Activities, Benefits or Satisfaction That AreDocument4 pagesService Berry Define Service As Act, Deeds, & Performance. AMA Define Service As Activities, Benefits or Satisfaction That AretansifNo ratings yet

- Address Change RequestDocument2 pagesAddress Change Requestapi-257956839No ratings yet

- Kerin StudyCards CH07Document2 pagesKerin StudyCards CH07avinash_1229No ratings yet

- Comparing Honda's Success in the US Motorcycle MarketDocument3 pagesComparing Honda's Success in the US Motorcycle MarketRiya3No ratings yet

- Store Brands vs. Manufacturer Brands ConDocument22 pagesStore Brands vs. Manufacturer Brands ConRandy RosalNo ratings yet

- Buying and Selling: and Net Profit/LossDocument19 pagesBuying and Selling: and Net Profit/LossMarc Graham NacuaNo ratings yet

- Retail PricingDocument14 pagesRetail PricingSouvik Roy ChowdhuryNo ratings yet

- Tax ReportDocument5 pagesTax ReportHanna Lyn BaliscoNo ratings yet

- Nilesh Deshmukh's SEO-Optimized Resume TitleDocument5 pagesNilesh Deshmukh's SEO-Optimized Resume TitleJustine JoseNo ratings yet

- Indian Beer Industry: Social Media &Document29 pagesIndian Beer Industry: Social Media &Shashank BurdeNo ratings yet

- JHNBDocument13 pagesJHNBChakradhar DNo ratings yet

- Oracle Order Management Cloud 2018 Implementation Essentials Exam Questions & AnswersDocument38 pagesOracle Order Management Cloud 2018 Implementation Essentials Exam Questions & AnswersNittin BaruNo ratings yet

- Accounts Receivable, Notes Receivable, and Revenue Audit ProceduresDocument28 pagesAccounts Receivable, Notes Receivable, and Revenue Audit ProceduresjuanNo ratings yet

- SRF C1821 - Request Split OcDocument1 pageSRF C1821 - Request Split OcSheryl PanuncilloNo ratings yet

- VAL Added Logistics Forms and CostsDocument58 pagesVAL Added Logistics Forms and CostsHiếu NguyễnNo ratings yet

- Arun.r. (Mba Ib) Report of Intern SailDocument60 pagesArun.r. (Mba Ib) Report of Intern Sailnitishbhardwaj123No ratings yet

- Ms6402 Case Study1 EnergyDocument20 pagesMs6402 Case Study1 EnergySamJabryNo ratings yet

- Agarbatti Manufacturing22Document14 pagesAgarbatti Manufacturing22Avinash SahooNo ratings yet

- Cost Accounting Qualifying Exam Reviewer 2017Document12 pagesCost Accounting Qualifying Exam Reviewer 2017Adrian Francis100% (1)

- Accounting For Leases and Hire Purchase Contract Final - DocxmaryDocument41 pagesAccounting For Leases and Hire Purchase Contract Final - DocxmarySoledad Perez100% (1)

- Cool Mats Restaurant Placemats Advertising Business OpportunityDocument23 pagesCool Mats Restaurant Placemats Advertising Business OpportunitycoolmatsNo ratings yet

- Variation Proforma Journal EntriesDocument11 pagesVariation Proforma Journal EntriesZaheer Ahmed SwatiNo ratings yet

- FM AssignmentDocument62 pagesFM AssignmentJacquelyn Vanessa TeeNo ratings yet

- Sample 1Document1 pageSample 1Lheo Sanchez CayabasNo ratings yet

- Chapter 6Document10 pagesChapter 6iazeem241No ratings yet

- Internship Report On Labaid PropertiesDocument114 pagesInternship Report On Labaid PropertiesAbanti Binte Farook100% (2)

- Monthly Sales Report TemplateDocument1 pageMonthly Sales Report TemplateShady R. NicolasNo ratings yet