Professional Documents

Culture Documents

EPF Claim-Withdrawal Provisions

Uploaded by

Imran MohammadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EPF Claim-Withdrawal Provisions

Uploaded by

Imran MohammadCopyright:

Available Formats

PROVISIONS OF THE EMPLOYEES' PROVIDENT FUND SCHEME 1952 ON SETTLEMENT OF EMPLOYEES' PROVIDENT FUND CLAIMS

For reading material refer : Employees' Provident Fund Scheme, '52 - para 69 , 70 , 72(1) , 72(2) , 72(3) , 72(3A) , 72(4). Forms prescribed for claiming the Provident Fund dues : By a member :through Form 19 On death of member by nominee/family member(s)/legal heirs: through Form 20 SETTLEMENT UNDER PARA 69-TO MEMBER: THROUGH FORM No.19 Immediate settlement without waiting Settlement only after a waiting period of 2 months period of two months 69(1)(e)(i) transfer of a non retrenched employee 69(1)(a) Retirement after attaining 55 years of from a closed establishment to uncovered age. establishment. 69(1)(b) Retirement on account of total and 69(1)(e)(ii) Transfer of an employee from a permanent incapacity due to bodily or mental covered establishment to an un-covered infirmity . establishment under the same employer. 69(1)(d) Termination of service on 69(2) Other cases viz. Resignation, Leaving retrenchment. service, etc. Note: For female members leaving service for the 69(1)(dd) Termination on V.R.S purpose of getting married; waiting period not applicable. 69(1)(c) Migration from India for permanent 69(1)(e)(iii) Members discharged & retrenchment settlement abroad or taking compensation paid under I.D. Act 1947. employment abroad. Settlement under para 70: (Accumulation of a deceased member) through Form No. 20 70(i) If a nomination exists, payment is made to the nominee in accordance with Form 2(R) . (Nomination and Declaration Form). 70(ii) If no nomination subsists, payment is to be made to every member of his family (as defined under para-2(g) of Employees' Provident Fund Scheme 1952) in equal share. For the purpose of this paragraph, a member's posthumous child, if born alive , shall be treated as a surviving child, born before the member's death. But the following will not be eligible for any share, if other family members are available to receive the accumulations. 1. Major sons ,

2. Major sons of a deceased son , 3. Married daughters whose husbands are alive , 4. Married daughter of a deceased son whose husbands are alive. 70(iii) In cases where para 70(i), 70(ii) , does not apply, the payment is to be made to the person who is legally entitled to it, vide para 70(iii). In case there is no nominee and also there is no person entitled to receive the amount, if the amount to the credit of the fund does not exceed Rs. 10,000/-, the Commissioner may pay such amount to the claimant after enquiry and after satisfying the title of the claimant. When the payment is to be made to a minor, it is payable to : 1. 2. 3. 4. The Guardian appointed under Guardian and Wards Act 1890 , failing (a), to The Guardian appointed by the member as per para 61(4A), failing (a),(b), to To the natural guardian of the minor, failing (a) (b) (c), to To the person , considered to be the proper person by the commissioner when the amount not exceeding Rs.20,000/- or the person considered to be the proper person , by the Chairman , C.B.T where the amount exceeds Rs. 20,000/- . Para-72(3)

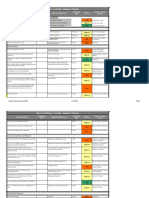

When the payment is to be made to a lunatic person , it is payable to: 1. The Manager appointed for the minor's estate under Indian Lunacy Act ,1912 failing (a), 2. The natural guardian of the lunatic, failing (a)(b), 3. To the person considered by the Commissioner as proper person , amount not exceeding Rs.20,000/- or to person considered by Chairman C.B.T as proper person amount exceeding Rs. 20,000/-. Para-72(3A) Note: Maximum amount payable by money order is Rs.2000/- and beyond that by cheque. If the amount is beyond Rs. 500/-, the M.O. cost will be borne by the claimant. Para 70(A): If a person entitled to received a share in the Provident Fund accumulations of a deceased member is charged with committing the murder of the member or with abetting the crime, the share payable to such person shall be retained till the case is finalised . If, subsequently he/she is exonerated, the share will be paid to him/her. If such a person is found guilty and convicted, the share will be paid equally to other person(s) entitled to receive the accumulations. WITHDRAWALS Types of Benefit Eligibility 5 Years of The purchase of membership of site for the Fund construction of (Minimum house balance in Eligible Amount Form Documentary Support l 24 months wages A declaration from the member (Basic & DA) that, dwelling site or dwelling OR No.31 house/flat or the house under l Members own construction is free from share of encumberances and the same is

members a/c should be Rs. 1000/-) * The purchase should be in favour of member or member spouse. 5 Years of membership of the Fund (Minimum balance in The members a/c Construction of should be Rs. House 1000/-) * The purchase should be in favour of member or member & spouse. The purchase of 5 Year of dwelling flat membership of the Fund (Minimum balance in members a/c should be Rs. 1000/-) * The purchase should be in favour of member or member & spouse. Additions, 5 years from the Alterations or date of improvements to completion of the dwelling dwelling house house

contribution + Companys share of Contribution with interest thereon

under the title of the member or the spouse (notification dated 25.2.2000)

l 36 months wages No.31 (Basic+DA) OR l Members own share of contribution + Companys share of contribution with interest thereon

A declaration from the member that, dwelling site or dwelling house/flat or the house under construction is free from encumberances and the same is under the title of the member or the spouse (notification dated 25.2.2000)

l 36 months wages No.31 (Basic+DA) OR l Members own share of contribution + Companys share of contribution with interest thereon

A declaration from the member that, dwelling site or dwelling house/flat or the house under construction is free from encumberances and the same is under the title of the member or the spouse (notification dated 25.2.2000)

12 months basic or No.31 members own share of contribution with thereon.

68 BB : REPAYMENT OF LOAN

Types of Benefit Advance from the fund for repayment of loan

Eligibility

Eligible Amount

Form Documentary Support

10 years membership 36 month wages (Basic No.31 A certificate from the of the fund & member + DA) lending authority should have taken OR furnishing the details of loan from Govt. Body Members own share of loan and outstanding Contribution + amount. Companys share of Contribution with interest thereon.

68 J : ADVANCE FROM FUND FOR ILLNESS Types of Benefit Advance from the fund for illness viz. hospitalisation for more than a month, major surgical operation or suffering from TB, Leprosy, Paralysis, Cancer, Heart ailment etc. Eligibility Stay in Hospital at least for a month Eligible Amount 6 moths wages (Basic + DA) Form Documentary Support No.31 A certificate from the Medical Practitioner for hospitalisation or operation.

68 K : ADVANCE FROM THE FUND FOR MARRIAGE Eligible Documentary Form Amount Support l Advance from the fund l 7 years membership of l 50% of No.31 Declaration by the for Marriage of the fund & minimum members own member which is self/son/daughter/ balance in members share of attested by the sister/brother etc. account should be Rs. contribution employer. l Advance from the fund 1000/for education of Son/Daughter Types of Benefit Eligibility 68L : ADVANCE IN ABNORMAL CONDITIONS Types of Benefit Grant of advance in abnormal conditions, Natural calamities etc. Eligibility l Certificate of damage from appropriate authority. l State Govt. declaration. Eligible Amount l Rs. 5000/- or 50% of members own share of contribution (To apply within 4 months) Documentary Support No.31 l Certificate from the Appropriate Authority. Form

68 M : ADVANCE TO MEMBER AFFECTED BY CUT IN THE SUPPLY OF ELECTRICITY

Eligible Documentary Form Amount Support Grant of advance l The advance may be granted only l Wages No.31 Certificate from State to members to a member whose total wages for for a Govt. regarding cut in affected by cut in any one month commencing from the month the supply of electricity. the supply of month of January 1973 were 3/4th or OR th electricity less than 3/4 of wages for a month l Rs.300/Types of Benefit Eligibility 68 N : GRANT OF ADVANCE TO MEMBERS WHO ARE PHYSICALLY HANDICAPPED Documentary Types of Benefit Eligibility Eligible Amount Form Support To Physically Production of Basic wages+ DA No.31 Certificate from the Handicapped member medical certificate from a for six months Medical practitioner for purchase of an competent medical or own share of to the effect that the member is physically equipment required to practitioner to the effect contribution with minimize the hardship that he is physically interest or cost of handicapped.. on account of equipment which handicapped handicap. ever is least. Note: For calculation/ computing the period of membership U/P 68B, 68BB, 68K, total service exclusive of periods of break under the same employer before the scheme is applied to him, as well as period of membership of the fund is always included.

You might also like

- Strategic Management GuideDocument64 pagesStrategic Management GuideAlbert Ziwome0% (1)

- Payment of Gratuity Act 1972 ExplainedDocument56 pagesPayment of Gratuity Act 1972 ExplainedprofkalpeshNo ratings yet

- (Davey) Entry and Exit Confessions of A Champion Trader 52 WaysDocument214 pages(Davey) Entry and Exit Confessions of A Champion Trader 52 Wayssim tykes67% (3)

- School Finance Team TORDocument2 pagesSchool Finance Team TORGrace Music100% (1)

- PF SchemeDocument5 pagesPF SchemeVelayudham ThiyagarajanNo ratings yet

- On "Provident Fund & MP Act 1952" of India.Document14 pagesOn "Provident Fund & MP Act 1952" of India.Anshu Shekhar Singh100% (4)

- Approval SheetDocument5 pagesApproval SheetJoseph AlogNo ratings yet

- Epf - Faq What Is EPF?Document13 pagesEpf - Faq What Is EPF?siddhuemailsNo ratings yet

- KomatsuDocument54 pagesKomatsuhaiccdk6No ratings yet

- Project Report On Analysis of Indian BankDocument74 pagesProject Report On Analysis of Indian Banksanthoshni81% (27)

- Adani Bill JADHAVDocument5 pagesAdani Bill JADHAVsupriya thombreNo ratings yet

- 335872Document7 pages335872pradhan13No ratings yet

- Retail ManagementDocument115 pagesRetail Managementarora08sumit71% (7)

- Benefits of PFDocument3 pagesBenefits of PFRaghava NarayanaNo ratings yet

- Withdrawals Types of Benefit Eligibility Eligible Amount Form Documentary SupportDocument4 pagesWithdrawals Types of Benefit Eligibility Eligible Amount Form Documentary SupportSreekanth G RaoNo ratings yet

- Withdrawals Types of Benefit Eligibility Eligible Amount Form Documentary SupportDocument4 pagesWithdrawals Types of Benefit Eligibility Eligible Amount Form Documentary SupportAnonymous BANHtP2No ratings yet

- Bonus Act eligibility and disqualification provisionsDocument12 pagesBonus Act eligibility and disqualification provisionsrashmaNo ratings yet

- Ignacio Soc Leg PowerpointDocument31 pagesIgnacio Soc Leg PowerpointRoentgen Djon Kaiser IgnacioNo ratings yet

- VrsDocument12 pagesVrsRajat MathurNo ratings yet

- Question:-Q Write Note On Deduction U/s 80 C To 80 UDocument15 pagesQuestion:-Q Write Note On Deduction U/s 80 C To 80 UnikhilNo ratings yet

- Contributions/ Fees 1. EE's Contribution: Members Who Can AffordDocument2 pagesContributions/ Fees 1. EE's Contribution: Members Who Can AffordblimjucoNo ratings yet

- Policies Mutual AssistanceDocument4 pagesPolicies Mutual AssistanceDonna Fe Patiluna100% (1)

- Salient Features:: LIC Introduces New Jeevan Nidhi' - Deferred Pension PlanDocument5 pagesSalient Features:: LIC Introduces New Jeevan Nidhi' - Deferred Pension PlanPramod Kumar SaxenaNo ratings yet

- Emploees Provedent FundDocument21 pagesEmploees Provedent FundManoj PandeyNo ratings yet

- Republic Act 9679 Home Development Mutual FundDocument6 pagesRepublic Act 9679 Home Development Mutual Fundmarge carreonNo ratings yet

- The Employees' State Insurance ACT, 1948Document19 pagesThe Employees' State Insurance ACT, 1948Prithviraj MathurNo ratings yet

- Withdrawals Types of Benefit Eligibility Eligible Amount Form Documentary SupportDocument4 pagesWithdrawals Types of Benefit Eligibility Eligible Amount Form Documentary SupportAyaan ShaikhNo ratings yet

- SBI LIFE PMJJBY INSURANCE CERTIFICATEDocument1 pageSBI LIFE PMJJBY INSURANCE CERTIFICATEDoel MajumderNo ratings yet

- Ravi Agrawal Vs Union of India and Anr - 03-01-2019Document17 pagesRavi Agrawal Vs Union of India and Anr - 03-01-2019Latest Laws TeamNo ratings yet

- TM Module IV NotesDocument16 pagesTM Module IV NotesAnkur DubeyNo ratings yet

- EPFO - MiscDocument20 pagesEPFO - MiscJc Duke M EliyasarNo ratings yet

- GPF NotesDocument9 pagesGPF Notesaudit corNo ratings yet

- Application For Provident BenefitDocument2 pagesApplication For Provident BenefitcaesarbaNo ratings yet

- The Aga Khan University Human Resource Policies and Procedures ManualDocument5 pagesThe Aga Khan University Human Resource Policies and Procedures Manualsaniya_surani6960No ratings yet

- Intro Duty To Notify & Register: ST STDocument3 pagesIntro Duty To Notify & Register: ST STAnis AmeeraNo ratings yet

- Essential Act Summary: Employee Benefits under ESI Act 1948Document27 pagesEssential Act Summary: Employee Benefits under ESI Act 1948Abhi RoyNo ratings yet

- GIT - Total Income Exam QP - 18-3-2020Document18 pagesGIT - Total Income Exam QP - 18-3-2020geddadaarunNo ratings yet

- cLUBBING OF iNCOMEDocument18 pagescLUBBING OF iNCOMEDipinderNo ratings yet

- EPF ActDocument10 pagesEPF ActManpreet Kochhar100% (1)

- Sec.80 DDDocument4 pagesSec.80 DDSurbhi PunshiNo ratings yet

- GsisDocument28 pagesGsisKristiana Montenegro GelingNo ratings yet

- Provident FundDocument16 pagesProvident FundSundara KNo ratings yet

- Secti On Nature of Deduction Who Can Claim: Individual/HUFDocument12 pagesSecti On Nature of Deduction Who Can Claim: Individual/HUFyutrfNo ratings yet

- The Employees' State Insurance (ESI) ACT, 1948Document17 pagesThe Employees' State Insurance (ESI) ACT, 1948goldberg13No ratings yet

- Retirement Planning Mock Test: Practical Questions: Section 1: 29 Questions (1 Mark Each)Document17 pagesRetirement Planning Mock Test: Practical Questions: Section 1: 29 Questions (1 Mark Each)Ami ShahNo ratings yet

- EOIBDocument28 pagesEOIBZafar Iqbal100% (1)

- Employee Provident Fund and Public Provident Fund comparedDocument6 pagesEmployee Provident Fund and Public Provident Fund comparedtimtoyNo ratings yet

- Employees' State Insurance Act benefits overviewDocument17 pagesEmployees' State Insurance Act benefits overviewNisar Ahmad SiddiquiNo ratings yet

- Deductions 2021 22Document5 pagesDeductions 2021 22Karan RajakNo ratings yet

- HDMFDocument5 pagesHDMFJett LabillesNo ratings yet

- Provident Fund - A Insight:) Who Will Be Covered by The Pension Scheme?Document7 pagesProvident Fund - A Insight:) Who Will Be Covered by The Pension Scheme?Amit BiswasNo ratings yet

- 1 1 Employees PF ActDocument9 pages1 1 Employees PF ActSudha SatishNo ratings yet

- Form No 03102014 ALIB Life Insurance BenefitsDocument2 pagesForm No 03102014 ALIB Life Insurance BenefitsAndres Kalikasan SaraNo ratings yet

- DeductionsDocument42 pagesDeductionsNithya RajNo ratings yet

- Gmat EnglishDocument2 pagesGmat Englishagangapur0% (1)

- Save The Youth 2Document19 pagesSave The Youth 2Jason SparksNo ratings yet

- IT Assignment 2Document7 pagesIT Assignment 2Srinivasulu Reddy PNo ratings yet

- Social Legislation DummyDocument91 pagesSocial Legislation DummyMylesGernaleNo ratings yet

- Salary, Benefits and Leave for MDT EmployeesDocument10 pagesSalary, Benefits and Leave for MDT EmployeesMiguel Valdivia RosasNo ratings yet

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDocument6 pagesASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201No ratings yet

- Part 2Document2 pagesPart 2blimjucoNo ratings yet

- MF0003 - Taxation ManagementDocument7 pagesMF0003 - Taxation ManagementushasnNo ratings yet

- PF & Miscellaneous Provisions ActDocument19 pagesPF & Miscellaneous Provisions Actpriya_ammuNo ratings yet

- Jeevan - Akshay-Vi Premium VasuDocument24 pagesJeevan - Akshay-Vi Premium VasumbadevilNo ratings yet

- BairdDocument6 pagesBairdShaniel T Hunter100% (1)

- Project Report of Labour Laws On Benefits of The Employees' State Insurance Act, 1948Document10 pagesProject Report of Labour Laws On Benefits of The Employees' State Insurance Act, 1948aggarwalbhaveshNo ratings yet

- Sponsorship: Who's Eligible & How to ApplyFrom EverandSponsorship: Who's Eligible & How to ApplyNo ratings yet

- Guidelines For Withdrawal PDFDocument3 pagesGuidelines For Withdrawal PDFMary LeandaNo ratings yet

- Chapter 13 WorksheetDocument4 pagesChapter 13 WorksheetSy HimNo ratings yet

- Joinpdf PDFDocument1,043 pagesJoinpdf PDFOwen Bawlor ManozNo ratings yet

- Departamento de Matemáticas: Mathematics - 3º E.S.ODocument2 pagesDepartamento de Matemáticas: Mathematics - 3º E.S.OketraNo ratings yet

- Leveraging The Credit Shelter Trust W/Sun Protector VULDocument4 pagesLeveraging The Credit Shelter Trust W/Sun Protector VULBill BlackNo ratings yet

- Fin QnaDocument4 pagesFin QnaMayur AgrawalNo ratings yet

- Help Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFDocument194 pagesHelp Manual For IOs Doing Inspection of Computerized Branches Updated Till 30th September 2008-1 PDFarpannathNo ratings yet

- Master in Finance February Intake: Total Credits 8 Total Credits 8Document3 pagesMaster in Finance February Intake: Total Credits 8 Total Credits 8阿咪老师MissAmyNo ratings yet

- Bank ReconciliationDocument2 pagesBank ReconciliationPatrick BacongalloNo ratings yet

- Trend Analysis Balance SheetDocument4 pagesTrend Analysis Balance Sheetrohit_indiaNo ratings yet

- "Performance Measurement With Reference To Cooperative Bank of Oromia (Master of Business Administration (M.B.A.) Under Esteemed Guidance ofDocument150 pages"Performance Measurement With Reference To Cooperative Bank of Oromia (Master of Business Administration (M.B.A.) Under Esteemed Guidance ofsai100% (1)

- Glossary BAHARDocument372 pagesGlossary BAHARJasmine AishaNo ratings yet

- Lazy Lagoon Sarovar Portico Suites: Hotel Confirmation VoucherDocument2 pagesLazy Lagoon Sarovar Portico Suites: Hotel Confirmation VoucherHimanshu WadaskarNo ratings yet

- Advance Accounting Sample Ch3Document38 pagesAdvance Accounting Sample Ch3MarielyLopezBrigantty83% (6)

- The Sunday Times - UBS Global Warming Index - Ilija Murisic - May 07Document2 pagesThe Sunday Times - UBS Global Warming Index - Ilija Murisic - May 07akasaka99No ratings yet

- COM203 AmalgamationDocument10 pagesCOM203 AmalgamationLogeshNo ratings yet

- DEPOSITSLIP#192792#1Document1 pageDEPOSITSLIP#192792#1AsadNo ratings yet

- IASB Conceptual Framework OverviewDocument28 pagesIASB Conceptual Framework OverviewTinoManhangaNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisShubham BansalNo ratings yet

- For Payments Other Than Imports and Remittances Covering Intermediary TradeDocument3 pagesFor Payments Other Than Imports and Remittances Covering Intermediary TradeBgrj AjitNo ratings yet

- DOF HandoverChecklistDocument4 pagesDOF HandoverChecklistRamy AmirNo ratings yet