Professional Documents

Culture Documents

Finance Formula

Uploaded by

Ranin, Manilac Melissa SOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Formula

Uploaded by

Ranin, Manilac Melissa SCopyright:

Available Formats

AC509: Financial Markets and Institutions

MMM

Guide on the Computation of Expected Rate of Return, Realized Rate of Return and Yield to Maturity

Basic Formula:

~ ~ ~ ~

P = CF1 + (1 + r)1

CF2 + CF3 + + CFn (1 + r)2 (1 + r)3 (1 + r)n

However, what may be asked for is not the present value of the bond but rather the expected rate of return or the realized rate of return or even the yield to maturity. So how exactly is the interest rate computed? There are two methods which may help you come up with the interest rate being asked for. 1. 60-40 Formula (commonly used to compute for YTM). 2. Interpolation 60-40 FORMULA Let us first discuss the easier formula using the example found in the book (by Saunders). You are considering the purchase of a $1,000 face value bond that pays 11 percent coupon interest per year, paid semiannually. The bond matures in 15 years and has a face value of $1,000. If the current market price of the bond is $931.176, the yield to maturity is? YTM= Annual interest + Par Price n 40%( par) + 60% (price) YTM = 1000(.11) + 1000- 931.176 15 (.40)(1000) + (.60)(931.176) YTM= 11.95% or 12% Or this formula can also be used to compute for err and rr. Such as this example. A bond you purchased 2 years ago for $890 is now selling for $925. The bond paid $100 per year in coupon interest on the last day of each year (the last payment made today). You intend to hold the bond for 4 more years and project that you will be able to sell it at the end of year 4 for $960. You also project that the bond will continue paying $100 in interest per year. Given the risk associated with the bond, its required rate of return (rrr) over the next four years is 11.25 percent. Let us simplify the problem: 2 years ago (year 2009)- $890 Selling Price NOW 2011- $925 Current Selling Price 4 years after (year 2015) - $ 960 Selling Price Interest- $100 on the last day of each year There are no limitations to the mind except those we acknowledge. -Napoleon Hill

AC509: Financial Markets and Institutions $890 2009 rr? $100 2010 $925 $100 2011 err?

MMM $960 $100 2015

$100 2012

$100 2013

$100 2014

rr= 100 + 925-890 2 (.40)(925) + (.60)(890) rr= 12.99% or 13% err= 100 + 960-925 4 (.40)(960) + (.60)(925) err= 11.58% As you may have noticed, there are very slight differences between the answers computed using the 6040 formula and the answers using the financial calculator (or the answers found in the book). That is why it would be helpful if you also learn how to interpolate to be able to compute for err, rr and YTM. INTERPOLATION ALWAYS KEEP THIS IN MIND: THE HIGHER THE INTEREST RATE, THE LOWER IS THE BOND VALUE. Thisll be handy to make your learning on interpolation easier. Still remember our discussion on this? We will use again the latter example found in the book. A bond you purchased 2 years ago for $890 is now selling for $925. The bond paid $100 per year in coupon interest on the last day of each year (the last payment made today). You intend to hold the bond for 4 more years and project that you will be able to sell it at the end of year 4 for $960. You also project that the bond will continue paying $100 in interest per year. Given the risk associated with the bond, its required rate of return (rrr) over the next four years is 11.25 percent. Let us simplify the problem: 2 years ago (year 2009)- $890 Selling Price NOW 2011- $925 Current Selling Price 4 years after (year 2015) - $ 960 Selling Price Interest- $100 on the last day of each year $890 2009 rr? $100 2010 $925 $100 2011 err? $960 $100 2015

$100 2012

$100 2013

$100 2014

There are no limitations to the mind except those we acknowledge. -Napoleon Hill

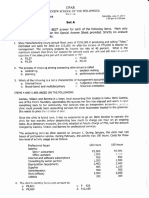

AC509: Financial Markets and Institutions Problem: WHAT IS THE EXPECTED RATE OF RETURN ON THIS INVESTMENT? Step 1: Plot the Low, Med and High interest rates with their respective bond value. LOW MED HIGH 11.25% err? 12% * $935.31 $925 $913.832*

MMM

Where did we get 12% and $913.832??? 12% is an assumption. Remember THE HIGHER THE INTEREST RATE, THE LOWER IS THE BOND VALUE? Since the given bond values are in descending order, it is but reasonable to assume that the bond value of the HIGHEST interest rate is LOWER than the bond value of the LOWEST interest rate. With this, we assume that the interest rate for the HIGH point is 12% based on the principle that THE HIGHER THE INTEREST RATE, THE LOWER IS THE BOND VALUE. You may ask, Miss, can we use any interest rate higher than 11.25%? Sure. You can even use 13% and still get the same answer. How was $913.832 computed? This is the bond value at 12% interest. Bond value= 100(3.0373) + 960(.6355) = 913.832 * Step 2: Get the difference between the bond value of the LOW and MED points, and the MED and HIGH points. Finally, add both differences. LOW MED HIGH 11.25% err? 12% * $935.31 $925 $913.832* 10.31 X 21.478 Z 11.168 Y

To avoid confusion in our computation later, let us assume: X= 10.31 Y= 11.168 Z= 21.478 Step 3: Now, we can interpolate using these formulae: err= L% + [( X / Z) x (H% - L%)] or err= H% - [( Y / Z) x (H% - L%)] Hence, using the LOW point info err= 11.25% + [( 10.31 / 21.478) x (12% - 11.25%)] err= 11.61% or using the HIGH point info err= 12% - [( 11.168 / 21.478) x (12% - 11.25%)] err= 11.61% Either way, youll get the same answer. There are no limitations to the mind except those we acknowledge. -Napoleon Hill

AC509: Financial Markets and Institutions How about if what is being asked is the REALIZED RATE OF RETURN?? Step 1: Plot the Low, Med and High interest rates with their respective bond value. LOW MED HIGH 12% * rr? 14% ** $906.41* $890 $876.45**

MMM

Where did we get 12%, $906.41, 14% and $876.4236??? 12% and 14% are assumptions. Remember THE HIGHER THE INTEREST RATE, THE LOWER IS THE BOND VALUE? The focal point in deriving such values is the $890 purchase price (of 2 years ago). To get the LOW point, we should be reminded that if the interest rate is low, the bond value should be high or in this case, higher than $890. Conversely, to get the HIGH point, if the interest rate is HIGH, the bond value should be low or specifically lower than $890. Therefore, make sure that when you come up with your assumed interest rates, the bond values are lower than the bond value or purchase price of the realized rate of return. How was $906.41 computed? This is the bond value at 12% interest. Also, use 2 years since this was purchased 2 years ago. Bond value= 100(1.69) + 925(.7972) = 906.41 * How was $876.45 computed? This is the bond value at 14% interest. Also, use 2 years since this was purchased 2 years ago. Bond value= 100(1.6467) + 925(.7695) = 876.45 ** Step 2: Get the difference between the bond value of the LOW and MED points, and the MED and HIGH points. Finally, add both differences. LOW MED HIGH 12% * rr? 14% ** $906.41* $890 $876.45** 16.91 X 30.46 Z 13.55 Y

To avoid confusion in our computation later, let us assume: X= 16.91 Y= 13.55 Z= 30.46 Step 3: Now, we can interpolate using these formulae: rr= L% + [( X / Z) x (H% - L%)] or rr= H% - [( Y / Z) x (H% - L%)] Hence, using the LOW point info rr= 12% + [( 16.91 / 30.46) x (14% - 12%)] rr= 13.11%

There are no limitations to the mind except those we acknowledge. -Napoleon Hill

AC509: Financial Markets and Institutions or using the HIGH point info rr= 14% - [( 13.55 / 30.46) x (14% - 12%)] rr= 13.11%

MMM

END

There are no limitations to the mind except those we acknowledge. -Napoleon Hill

You might also like

- CMPC312 QuizDocument19 pagesCMPC312 QuizNicole ViernesNo ratings yet

- Management Advisory Services Solution to ProblemDocument13 pagesManagement Advisory Services Solution to ProblemMIKKONo ratings yet

- Quiz 3Document6 pagesQuiz 3BibliophilioManiac100% (1)

- Week 5 Problem 15Document2 pagesWeek 5 Problem 15Rachelle RodriguezNo ratings yet

- MULTIPLE CHOICE - Capital BudgetingDocument9 pagesMULTIPLE CHOICE - Capital BudgetingMarcuz AizenNo ratings yet

- Capital BudgetingDocument41 pagesCapital Budgetingalum jacobNo ratings yet

- Chapter 8 Franchise AccountingDocument11 pagesChapter 8 Franchise AccountingFaithful FighterNo ratings yet

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimNo ratings yet

- Chap 006Document68 pagesChap 006Koki KatoNo ratings yet

- CASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONDocument2 pagesCASH MANAGEMENT AND WORKING CAPITAL OPTIMIZATIONR100% (1)

- HO FS AnalsisDocument15 pagesHO FS AnalsisGva Umayam0% (2)

- Differential Analysis:: The Key To Decision MakingDocument32 pagesDifferential Analysis:: The Key To Decision MakingkimmyNo ratings yet

- Chapter 4-Decision Analysis: Multiple ChoiceDocument19 pagesChapter 4-Decision Analysis: Multiple ChoiceRashaNo ratings yet

- Prelim Exam PDFDocument6 pagesPrelim Exam PDFPaw VerdilloNo ratings yet

- Learning Objective 11-1: Chapter 11 Considering The Risk of FraudDocument25 pagesLearning Objective 11-1: Chapter 11 Considering The Risk of Fraudlo0302100% (1)

- tb301 PDFDocument60 pagestb301 PDFDarmin Kaye PalayNo ratings yet

- Bond Price Elasticity and DurationDocument29 pagesBond Price Elasticity and DurationKim Nora0% (1)

- This Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesDocument2 pagesThis Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesArjay Dela PenaNo ratings yet

- 2.lesson 3 (Cost Behavior - Solution)Document5 pages2.lesson 3 (Cost Behavior - Solution)Aamir DossaniNo ratings yet

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizAshNor RandyNo ratings yet

- Measures of Central TendencyDocument21 pagesMeasures of Central TendencyRanier Factor AguilarNo ratings yet

- Dr.G.R.Damodaran College of Science Financial Management Multiple Choice QuestionsDocument20 pagesDr.G.R.Damodaran College of Science Financial Management Multiple Choice Questionsshuhal AhmedNo ratings yet

- Chapter 16Document36 pagesChapter 16manjunk25No ratings yet

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFDanica PelenioNo ratings yet

- Sol Man - MC PTXDocument5 pagesSol Man - MC PTXiamjan_101No ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Midterms - 2 - Capital - Budgeting - Techniques - PDF Filename UTF-8''Midterms 2 CapiDocument17 pagesMidterms - 2 - Capital - Budgeting - Techniques - PDF Filename UTF-8''Midterms 2 CapiAirille CarlosNo ratings yet

- Practice Problem SetDocument22 pagesPractice Problem SetJanielle NaveNo ratings yet

- "How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/eDocument51 pages"How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/eMARY JUSTINE PAQUIBOTNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasscreebeedNo ratings yet

- Interactive Model of An EconomyDocument142 pagesInteractive Model of An Economyrajraj999No ratings yet

- Acct 3Document25 pagesAcct 3Diego Salazar100% (1)

- 272 M S Q MDocument2 pages272 M S Q MAdnan AzizNo ratings yet

- Cvp-Analysis AbsvarcostingDocument13 pagesCvp-Analysis AbsvarcostingGwy PagdilaoNo ratings yet

- Business Law MidtermsDocument16 pagesBusiness Law MidtermsLory McmorryNo ratings yet

- Personal Online Banking - BDO Network Bank, Inc.Document2 pagesPersonal Online Banking - BDO Network Bank, Inc.Kenneth Dumdum HermanocheNo ratings yet

- Chapter 3 Liquidation ValueDocument11 pagesChapter 3 Liquidation ValueJIL Masapang Victoria ChapterNo ratings yet

- ABMF3174 TUTORIAL 5-8v2Document18 pagesABMF3174 TUTORIAL 5-8v2Ray100% (1)

- Study ProbesDocument48 pagesStudy ProbesRose VeeNo ratings yet

- Part I: Installment Part I: Installment Sales (1-140) Sales (1-140)Document77 pagesPart I: Installment Part I: Installment Sales (1-140) Sales (1-140)Gale RasNo ratings yet

- NPO Accounting Activity May 26 2021Document5 pagesNPO Accounting Activity May 26 2021Cassie PeiaNo ratings yet

- 4 Responsibility and Transfer Pricing Part 1Document10 pages4 Responsibility and Transfer Pricing Part 1Riz CanoyNo ratings yet

- Bond Valuation and Yield CalculationsDocument12 pagesBond Valuation and Yield CalculationsSeri DiyanaNo ratings yet

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- Cma/Cfm: Preparatory ProgramDocument42 pagesCma/Cfm: Preparatory Programpaperdollsx0% (2)

- 2011-02-03 230149 ClarkupholsteryDocument5 pages2011-02-03 230149 ClarkupholsteryJesus Cardenas100% (1)

- Top 5 Accounting Firms in The PhilippinesDocument8 pagesTop 5 Accounting Firms in The PhilippinesRoselle Hernandez100% (3)

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Cost of Capital: By: Judy Ann G. Silva, MBADocument21 pagesCost of Capital: By: Judy Ann G. Silva, MBAAnastasha GreyNo ratings yet

- Ac2102 TPDocument6 pagesAc2102 TPNors PataytayNo ratings yet

- Financial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareDocument11 pagesFinancial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareairaNo ratings yet

- Fundamentals of Assurance Services - Docx'Document8 pagesFundamentals of Assurance Services - Docx'jhell dela cruzNo ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- AFAR - Corporate LiquidationDocument1 pageAFAR - Corporate LiquidationKent Raysil PamaongNo ratings yet

- STRATEGIC COST MANAGEMENT: RELEVANT COSTING DECISIONSDocument6 pagesSTRATEGIC COST MANAGEMENT: RELEVANT COSTING DECISIONSMon Ram0% (1)

- Final 2 2Document3 pagesFinal 2 2RonieOlarteNo ratings yet

- Solution To Chapter 21Document25 pagesSolution To Chapter 21Sy Him100% (5)

- Raising profit margin, maintaining asset turnover and increasing return on equityDocument7 pagesRaising profit margin, maintaining asset turnover and increasing return on equityedrick LouiseNo ratings yet

- Interest Rates and Bond Valuation: Solutions To Questions and ProblemsDocument7 pagesInterest Rates and Bond Valuation: Solutions To Questions and ProblemsFelipeNo ratings yet

- Realized Rate of ReturnDocument13 pagesRealized Rate of ReturnBrithney ButalidNo ratings yet

- SEC 109 Exempt Transactions VATDocument3 pagesSEC 109 Exempt Transactions VATRanin, Manilac Melissa SNo ratings yet

- Contract of Sale and Contract To SellDocument2 pagesContract of Sale and Contract To SellRanin, Manilac Melissa SNo ratings yet

- PSRS-4410 Engagement To Compile Fin InfoDocument14 pagesPSRS-4410 Engagement To Compile Fin InfocolleenyuNo ratings yet

- PSA 560 RedraftedDocument14 pagesPSA 560 RedraftedMan DiNo ratings yet

- Psa 200 PDFDocument7 pagesPsa 200 PDFDanzen Bueno ImusNo ratings yet

- Philippine Auditing Standards on Agreed-Upon Procedures EngagementsDocument14 pagesPhilippine Auditing Standards on Agreed-Upon Procedures EngagementsTeresa RevilalaNo ratings yet

- PSRE-2400 Engagement To Review FSsDocument26 pagesPSRE-2400 Engagement To Review FSscolleenyuNo ratings yet

- PSA 700 RedraftedDocument34 pagesPSA 700 RedraftedRanin, Manilac Melissa SNo ratings yet

- PSAE 3400 (Previously PSA 810)Document15 pagesPSAE 3400 (Previously PSA 810)Gon FreecsNo ratings yet

- Lang - Ac516 r01Document16 pagesLang - Ac516 r01Ranin, Manilac Melissa SNo ratings yet

- PSAE-3000 Assurance Engagements Other Than Audits and Review of Historical Fin InfoDocument23 pagesPSAE-3000 Assurance Engagements Other Than Audits and Review of Historical Fin InfocolleenyuNo ratings yet

- Psa 250Document14 pagesPsa 250Ranin, Manilac Melissa SNo ratings yet

- BAZERMAN ET AL Why Good Accountants Do Bad AuditsDocument10 pagesBAZERMAN ET AL Why Good Accountants Do Bad AuditsFrancisco EstradaNo ratings yet

- Topic 7 - Absorption & Marginal CostingDocument8 pagesTopic 7 - Absorption & Marginal CostingMuhammad Alif100% (5)

- Philippine Standards On Auditing 220 RedraftedDocument20 pagesPhilippine Standards On Auditing 220 RedraftedJayNo ratings yet

- Bonds and Their ValuationDocument41 pagesBonds and Their ValuationRenz Ian DeeNo ratings yet

- PSA 120 Framework of Philippine Standards on AuditingDocument9 pagesPSA 120 Framework of Philippine Standards on AuditingMichael Vincent Buan SuicoNo ratings yet

- 01 Glossary of Terms December 2002Document20 pages01 Glossary of Terms December 2002Tracy KayeNo ratings yet

- Risk and Return LectureDocument67 pagesRisk and Return LectureRanin, Manilac Melissa S100% (3)

- Audited Financial Statements: San Miguel CorporationDocument1 pageAudited Financial Statements: San Miguel CorporationRanin, Manilac Melissa SNo ratings yet

- Time Value of Money LectureDocument54 pagesTime Value of Money LectureRanin, Manilac Melissa SNo ratings yet

- EnronDocument7 pagesEnronRanin, Manilac Melissa SNo ratings yet

- The Cost of Capital Lecture (Revised)Document50 pagesThe Cost of Capital Lecture (Revised)Ranin, Manilac Melissa S50% (4)

- Oblicon Questions and AnswersDocument2 pagesOblicon Questions and AnswersRanin, Manilac Melissa SNo ratings yet

- The Basics of Capital BudgetingDocument56 pagesThe Basics of Capital BudgetingRanin, Manilac Melissa SNo ratings yet

- Wall ClimbingDocument4 pagesWall ClimbingRanin, Manilac Melissa SNo ratings yet

- Stocks and Their Valuation LectureDocument54 pagesStocks and Their Valuation LectureRanin, Manilac Melissa SNo ratings yet

- Sun CellularDocument4 pagesSun CellularRanin, Manilac Melissa SNo ratings yet

- AC 512 Comprehensive ExamDocument5 pagesAC 512 Comprehensive ExamRanin, Manilac Melissa S100% (1)

- Stupid CupidDocument2 pagesStupid CupidRanin, Manilac Melissa SNo ratings yet

- UNIT 1 - Foundations of Finance - Ver 19.0Document161 pagesUNIT 1 - Foundations of Finance - Ver 19.0Vasudevan R DNo ratings yet

- Project Selection Models GuideDocument45 pagesProject Selection Models GuideCminh TrNo ratings yet

- P&G Cost of Capital AnalysisDocument64 pagesP&G Cost of Capital Analysiskuch bhi75% (4)

- Apj Abdul Kalam Technological University Eight Semester B.Tech Degree Examination, August 2020Document2 pagesApj Abdul Kalam Technological University Eight Semester B.Tech Degree Examination, August 2020harithaNo ratings yet

- Fidelity Personalized Planning & Advice at Work Terms and ConditionsDocument54 pagesFidelity Personalized Planning & Advice at Work Terms and ConditionsRCNo ratings yet

- Financial Analysis Ratios for Profitability & LiquidityDocument11 pagesFinancial Analysis Ratios for Profitability & LiquidityWILSON KosheyNo ratings yet

- Shareholder Value MaximizationDocument41 pagesShareholder Value MaximizationPrashant Karpe100% (1)

- Chapter 19Document42 pagesChapter 19Karissa GaviolaNo ratings yet

- CH 13 Working Capital OverviewDocument12 pagesCH 13 Working Capital OverviewIlyas SadvokassovNo ratings yet

- Non-Financial Performance MeasuresDocument6 pagesNon-Financial Performance MeasuresAparnaBoddapatiNo ratings yet

- Syllabus 3310 MasterDocument39 pagesSyllabus 3310 MasterRaju SharmaNo ratings yet

- Mutual Fund AnalysisDocument53 pagesMutual Fund AnalysisVijetha EdduNo ratings yet

- Analysis of Profitability of Fish Farming Among Women in Osun State, NigeriaDocument10 pagesAnalysis of Profitability of Fish Farming Among Women in Osun State, NigeriaiisteNo ratings yet

- The RaceDocument183 pagesThe RaceJ.h. WangNo ratings yet

- The Capital Asset Pricing Model (CAPM) ImpDocument126 pagesThe Capital Asset Pricing Model (CAPM) Impasifanis33% (3)

- Business Valuation Models: Two Methods: 1. Discounted Cash Flow 2. Relative ValuesDocument24 pagesBusiness Valuation Models: Two Methods: 1. Discounted Cash Flow 2. Relative ValuesIndra S ChaidrataNo ratings yet

- Chapter 13 Finance LL - Additional Problems - BBDocument6 pagesChapter 13 Finance LL - Additional Problems - BBThuy Tien NguyenNo ratings yet

- University of California PE and VC IRR ReturnsDocument5 pagesUniversity of California PE and VC IRR Returnsdavidsun1988No ratings yet

- Jyotsna Sem - 2Document90 pagesJyotsna Sem - 2Anonymous NhOj4N100% (1)

- Balanced Scorecard and Responsibility AccountingDocument7 pagesBalanced Scorecard and Responsibility AccountingMonica GarciaNo ratings yet

- MCB-ARIF HABIB RISK PROFILES OF FUNDS AND PLANSDocument12 pagesMCB-ARIF HABIB RISK PROFILES OF FUNDS AND PLANSSaad TanvirNo ratings yet

- Fund PerformanceDocument13 pagesFund PerformanceHilal MilmoNo ratings yet

- SSRN Id256754Document9 pagesSSRN Id256754RabmeetNo ratings yet

- XDepartmental Examination - Pricing DecisionsDocument2 pagesXDepartmental Examination - Pricing DecisionsxorelliNo ratings yet

- 12 Appliedmath4Document22 pages12 Appliedmath4manojboaNo ratings yet

- VK - Swot Analysis of Investment OptionsDocument3 pagesVK - Swot Analysis of Investment OptionsThajas100% (1)

- A Study On Financial Planning and Portfolio ManagementDocument8 pagesA Study On Financial Planning and Portfolio ManagementManish JhaNo ratings yet

- Investment Management Unit 1Document12 pagesInvestment Management Unit 1Fahadhtm MoosanNo ratings yet

- Financial Statement AnalysisDocument62 pagesFinancial Statement AnalysisCECILLE ALBAO100% (1)

- Evaluating A Firms Financial Performance by Keown3Document36 pagesEvaluating A Firms Financial Performance by Keown3talupurum100% (1)