Professional Documents

Culture Documents

PCE Mock Exam (100 Questions) English

Uploaded by

Angelina LiewOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PCE Mock Exam (100 Questions) English

Uploaded by

Angelina LiewCopyright:

Available Formats

MOCK EXAM - 1st Set (Jan 2010)

Q1 A loss adjuster is an independent party appointed by a) An insurer b) An insured c) A claimant d) A policyholder

Q2 Select the best definition for 'grace period' : a) It is the period within which the insurer must pay all bonuses due under the policy. b) It is the period between the premium due date and the maturity date. c) It is the period within which the assured must apply for the policy loans before this benefit is taken away. d) It is the period within which the premium must be paid for the policy continue to be in force. Q3 _________ are NOT categorized under hazardous occupations. a) Quarry workers b) Office cleaners c) Construction labourers d) Race car drivers Q4 Which one of the following best descibes reversionary bonus ? a) The additional units of sum assured given to participating policyholders. b) The cash given to participating policyholders which can be withdrawn at any time. c) The stocks option given to participating policyholders. d) The year end bonus given to agents of insurance companies. Q5 Insurers consider all of the following items as claim proof (proof of loss) EXCEPT: a) The statement of the claimant. b) Bills from the medial provider. c) The report from an inspection company. d) The attending physician`s report. Q6 What do you understand by the term `Proximate Cause`? a) It is the most dominant and most active cause of a loss. b) It is the first cause of which the loss is not the natural consequences. c) It is the uninsured cause of a loss. d) It is the remote cause of a loss. Q7 The type of policy that provide for a lump sum payment upon the claimant being diagnosed as having any one of the specified critical illness are known as a) Critical illness policies. b) Investment linked policies. c) Permanent health insurance policies. d) Permanent disability insurance policies. Q8 Syarikat Takaful Malaysia Berhad,the first takaful company in Malaysia which has started its operation in: a) 1982. b) 1984. c) 1986 d) 1988

Q9 The Malaysian Insurance Institute is formed to a) Promote insurance products in Malaysia. b) Encourage people to buy insurance. c) Promote insurance professionalism and to conduct professional seminars. d) A and B Q10 Which of the following situation is a result from pure risks? a) Loss or gain b) Gain only c) Loss or no loss d) None of the above Q11 When a policy is discontinued, the life office is able to pay surrender value due to a) The operation of the principle of indemnity. b) Interest earned from investment. c) Reduction in the administration expenses. d) Accumulation of reserves from the past premium payments. Q12 Insurance is a) An investment business only. b) A mechanism for transferring risk. c) A mechanism for computing risk. d) A means of providing charity.

Q13 Which one of the following item is NOT required for the settlement of a maturity claim? a) Proof of death b) Proof of ownership c) Proof of survivorship d) Proof of age Q14 Contributory group health insurance plans usually must cover at least _________ of eligible members of the group. a) 55% b) 65% c) 75% d) 85% Q15 A situation where more sub-standard risks are accepted for insurance resulting in a less favourable underwriting results is known as: a) Anti-reation b) Anti-selection c) Contradiction d) Anti rejection Q16 If a life policy is effected with no insurable interest,the policy would be: a) Voidable;depending on the judgement of the High Court. b) Voidable;at the discretion of the life insurer. c) Void;the company is not obliged to pay a claim under the policy. d) Valid;regardless of the absence of insurable interest.

Q17 In Malaysia, the regulation of the general insurance business is achieved through the administration enforcement of the Insurance Act by a) Persatuan Insurans Am Malaysia (PIAM) b) Bank Negara Malaysia c) Life Insurance Association of Malaysia (LIAM) d) Malaysian Insurance and Takaful Brokers Association (MITBA),formerly known as IBAM Q18 Choose one of the following statements which is true about insurable interest ? a) Insurable interest should be present through about the term of the life insurance contract. b) Insurable interest exists between husband and wife. c) A creditor has unlimited insurable interest on the life of a debtor. d) A life insurance policy is voidable if the insurable interest ceases any time during the policy period. Q19 The following are the base underwriting measures often adopted in cases presenting poor physical hazard EXCEPT a) Offering a convertibility option on the policy. b) Imposing suitable policy exclusions on the hazard. c) Charging extra premium. d) Defering the acceptance date. Q20 How does insurance provide protection? a) By spreading the risk b) By spreading the losses of a few over the many who have contributed to the same pool of the fund. c) By controlling the risk d) By preventing the losses from occurring Q21 Which one of the following documents is the evidence of premium payment by the policyholder? a) The signed proposal form b) The letter of acceptance c) The offical receipt d) The premium notice Q22 Which of the following document is normally required by the insurer before a duplicate policy? I. A letter of request II. An undertaking to indemnify the insurer against any eventual loss due to the issuance of the duplicate policy. III. The original policy a) I and II b) I and III c) I only d) I,Iiand III Q23 The earliest begining of insurance was in the field of a) Motor insurance. b) Marine insurance. c) Property insurance. d) Accident insurance.

Q24 As stated in the insurance Act,1996, the two classes of insurance business are a) Life and general business. b) Life and annuity business. c) General and motor business. d) Marine and hull business.

Q25 The following statement about LIAM are true, EXCEPT: a) LIAM is the acronym for Life Insurance Association of Malaysia. b) Membership is open to insurance companies,agents and brokers involved in the life insurance business. c) It promotes the interest of the members of the life insurance industry in Malaysia. d) It collets,collates and publishes statistics and and any relevant information relating to life insurance. Q26 John Tan had overstated his age in his appliation for a life policy. Five years later, he died in a car accident. How much should the company pay to his beneficially ? a) The sum assured b) The sum assured together with excess premium paid. c) The company need not pay anything as John Tan had breached the principle of utmost good faith. d) The surrender value on the date of death. Q27 Insurance deals with fortuitous losses which are: a) Acidental losses. b) All losses. c) Physical hazards. d) Risks, the severity/frequeny of which is within the control of the insured persons. Q28 What types of takaful business are carried on by Malaysian takaful operators? a) Life insurance b) Family takaful business c) General takaful business d) B and C Q29 Which of the following is NOT a method of handling risks in insurance ? a) Risk avoidance b) Risk transfer c) Risk speculation d) Risk retention Q30 The percentage of voluntary cessions for personal accident classes to accepted by Malaysian Re is: a) 4% b) 5% c) 15% d) 20% Q31 Which of the following CANNOT be insured ? a) Protecting one's car from being stolen. b) Protecting one's loss of income in the event of being disabled as a result of an accident. c) Protecting one's house in the event of a fire. d) Protecting one's invesment in the event of an economic depression. Q32 Life insurance can be defined as _____________. a) A contract which provides cover against the losses of individuals in a variety of contingencies. b) A contract which pays an agreed sum of money on the happening of a contingency (event), or a variety of contingencies, dependent on human life. c) A contract which pays an agreed sum of money on the happening of a contingency (event), or of a variety of contingencies, dependent on properties. d) A contract which provides cover against the third parties for damages arising in respect of properties.

Q33 The essential features of insurance are: I. It is economic institution. II. It is based on the principle of mutuality or co-operation. III. Its objective is to accumulate funds to pay for claims that arise as a result of the operation of specific risks. IV. Only certain risks can be insured against, namely those, whose occurrence can be confidently estimated with a certain degree of accuracy. a) b) c) d) I and II II and IV II, III, and IV All of the above

Q34 Risks can be classified into _________. I. Particular risk II. Speculative risk III. Uncertainty risk

IV. Fundamental risk a) b) c) d) I, II, and IV I, II, and III II and III III and IV

Q35 For the principle of contribution to apply, the following conditions have to be fulfilled EXCEPT: a) Two or more policies of indemnity must be in force. b) The loss involves a common subject matter covered by the policy. c) The policy must be a life policy. d) The policies must cover a common peril which gives rise to the loss. Q36 What are the main characteristics of insurable risk? I. It must involve losses that are able to measured financially. II. The loss must be fortuitous. III. It must concern only with pure risks. IV. The premium must be higher in relation to potential risk. a) b) c) d) I, II, and III II, III, and IV I, III, and IV All of the above

Q37 A person has insured his house valued at RM100, 000 against fire and his own life for RM100, 000 against death. What is/are the subject matter of insurance? a) The house and his life. b) The house. c) His life. d) House valued at RM100, 000 and his life. Q38 Contribution will apply in the following conditions: I. The policies must cover a specific peril which gives rise to the loss. II. The policies must cover a specific interest. III. The loss involves a common subject. IV. Two or more policies of indemnity must be in force. a) b) c) d) I and II II and IV III and IV I, II, and IV

Q39 Who has insurable interest? a) In property insurance, a trustee has insurable interest on the property held in trust. b) In liability insurance, anyone who has potential legal liability and legal costs and expenses associated with it has insurable interest. c) In life insurance, a person has unlimited insurable interest in his own life and limbs. d) All of the above. Q40 What are the conditions for the application of the principle of contribution? I. 2 or more policies of indemnity must be in force. II. The policies must cover a common interest. III. The policies must cover a common peril which gives rise to the loss. IV. The loss has to be indemnified first before the application of the principle. a) b) c) d) I, II, and III II, III, and IV I, III, and IV All of the above

Q41 A misrepresentation in a life insurance application is considered to be a material misrepresentation whenever the: a) Insurer discovers the misrepresentation after the policy's contestable period. b) Applicant for insurance intentionally makes a misrepresentation. c) Representation is not literally true, regardless of its significance. d) Misrepresentation is relevant to the insurance's acceptance risk. Q42 Which of the following does NOT constitute a breach of Utmost Good Faith? a) Non-disclosure of material facts. b) Deliberate concealment of facts. c) Fraudulent misrepresentation. d) Claim for an insured item. Q43 "The main objectives of __________ are to establish a sound insurance structure in Malaysia and to make rules, regulations, tariffs and by laws in consultation with the Director General of Insurance (DGI) for implementation by the members." a) Insurance Mediation Bureau (IMB). b) Persatuan Insurance Am Malaysia (PIAM). c) Malaysian Insurance and Takaful Brokers Association (MITBA). d) Association of Malaysia Loss Adjusters (AMLA). Q44 Which of the following is NOT the main objective of the Malaysian Insurance Institute (MII)?

a) To provide and maintain a central organization for promotion of efficiency, progress, and development in the insurance industry. b) To establish a library for the institute. c) To undertake research in the fields of insurance and related subjects. d) To promote and represent the interests of the member companies and the industry. Q45 The following are the principles underlying the guidelines on the Code of Ethics and Conduct EXCEPT: a) To avoid conflict of interest. b) To avoid misuse of position. c) To prevent transmission of information. d) To ensure completeness and accuracy of relevant records.

Q46 Which of the following documents could be accepted as proof of death? I. Death certificate. II. Date of death. III. Coroner's report. IV. Will. a) b) c) d) I and III II and IV II, III, and IV All of the above

Q47 Which of the following association does NOT deal with life insurance? a) NAMLIFA b) LIAM c) ASM d) PIAM Q48 Bank Negara Malaysia was established in year _________. a) 1957 b) 1959 c) 1962 d) 1963 Q49 Malaysian Energy Risk Consortium (MERIC) has a capacity to underwrite up to combined single limit of ________ for upstream risks and ______ for downstream risk. a) RM40 million / RM60 million b) RM20 million / RM40 million c) RM40 million / RM20 million d) RM60 million / RM40 million Q50 The principal piece of legislation, which the insurance companies have to abide by, is __________. a) The Companies Act, 1965. b) The Insurance Act, 1996. c) The Agreement on General Insurance Act, 1988. d) The Insurance Act, 1963. Q51 For life insurance business, the main association is _____________. a) Association of Malaysia Loss Adjusters (AMLA). b) Insurance Brokers Association of Malaysia (IBAM). c) Life Insurance Association of Malaysia (LIAM). d) General Insurance Association Association of Malaysia (PIAM). Q52 Which of the following are the main associations of the General Insurance Business? I. PIAM II. MITBA III. AMLA IV. LIAM a) b) c) d) I and II I and IV I, II, and III All of the above

Q53 In Malaysia, the regulation of insurance business is achieved through the administration and enforcement of The Insurance Act 1996, by the: a) Finance Minister b) Director General of Insurance c) Gavenor Bank Negara d) Prime Minister Q54

In some instances, the insurer may not accept a proposal on its original terms but may offer to provide insurance on different terms. This is called ________. a) Offer and acceptance b) Counter offer from the insurer c) Counter acceptance d) counter offer from the insured Q55 With effect from July 2007, the cash-before-cover ruling includes: a) Personal accident and travel insurance b) Miscellaneous accident insurance c) Personal accident insurance d) Travel insurance Q56 Which of the following plan is not included in the Family Takaful plan? a) Special Accident Takaful Plans. b) Group Takaful Plans. c) Takaful Mortgage plans. d) Takaful plans for education. Q57 Which of the following statement is TRUE about reinsurers? a) Reinsurers prepare a survey report detailing all the necessary information needed by underwriter b) Reinsurers deals with the financial impact of risk and uncertainty. c) Reinsurers share the burden of paying claims for risk underwritten by insurers. d) Reinsurers provide assistance to the companys policy owners and beneficiaries. Q58 Which of the following is the objective of Financial Mediation Bureau (FMB)? a) FMB promotes the standing of actuarial profession in Malaysia. b) FMB helps to settle disputes between policyholders and the financial service providers who are its members. c) FMB provides compensation to victims of motor accidents. d) FMB monitor and regulate the financial stability of insurance industry in Malaysia. Q59 How many member countries does ASEAN have? a) 9 b) 10 c) 11 d) 12 Q60 Which of the following is NOT the function of BNM? a) Promote monetary and financial system stability. b) Fostering a sound and progressive financial sector to achieve sustained economic growth. c) Responsible for the resolution of complaints against insurers. d) Increase the local retention and outflow of the insurance premium.

Q61 Which of the following statement is NOT the objective of LIAM? a) Improve the image of the life insurance industry through self-regulation. b) Liaise with only local organizations towards achieving common objective. c) Promote public understanding and appreciation of life insurance. d) Give support to the regulatory authorities in developing a strong and healthy industry. Q62 Bank Negara Malaysia enforces the Cash-Before-Cover ruling into: I. Motor Insurance. II. Medical Insurance. III. Travel Insurance. IV. Personal Accident. a) b) c) d) I, II, III I, III, IV II, III, IV All of the above

Q63 The insurance contract becomes ________________ when breaches of utmost good faith take place a) Avoidable. b) Illegal. c) Unenforceable. d) Voidable. Q64 The following are TRUE about UItmost Good Faith, except: a) The breached of utmost good faith is termed as non-disclosure or concealment. b) Misrepresentation of a material fact is termed as innocent misrepresentation or fraudulent misrepresentation. c) The breached of utmost good faith is termed as material disclosure or non-concealment. d) Concealment and Fraudulent misrepresentation may further entitle the insurer to sue for damages. Q65 Sihat Malaysia Scheme was officially launched on 18 February 2000 by __________. a) National Insurance Association of Malaysia (NIAM).

b) Persatuan Insurance Am Malaysia (PIAM). c) Life Insurance Association of Malaysia (LIAM). d) Malaysian Insurance And Takaful Brokers Association (MITBA). Q66 Which of the following is TRUE about the need for self-regulation in insurance company? a) Instilling positive attitude among insurance companies staff. b) Providing some elements of protection to the members of Insurance Industries. c) Instilling discipline and promoting healthy competition in the industry. d) To measure various inter-company agreement and guidelines. Q67 Which of the following statement is TRUE about Decentralization? a) Basic functions and decision-making tend to be decided at the head office. b) Some or all of the basic functions carried out at branches. c) It give rise to several advantages including uniformity in practice and economics in administration. d) Underwriting, policy drafting, renewals, claims, and accounting work will be handled at the head office. Q68 Victor has a whole life insurance with Sum Insured of RM20, 000 and a Personal Accident Insurance with Sum Insured of RM20,000. How much Sum Insured will be paid out for Victors death? a) RM40, 000 Personal Accident + Whole Life Insurance. b) RM10, 000 for Personal Accident and RM10, 000 for Whole Life Insurance. c) RM20, 000 for Personal Accident. d) RM20, 000 for Whole Life Insurance.

Q69 ____________ transfer the policy to ______________.

a. Assignor, Assignee.

b. Assignee, Assignor. c. Transferor, Transferee. d. Transferee, Transferor. Q70 An assignment is to transfer of ___________ and _____________ to another person. a) Civil liberties, Constitutional rights. b) Rights, Liabilities. c) Copy rights, Reserved. d) Assets, Liabilities. Q71 _______________ was enacted to regulate the operations of Takaful in Malaysia in compliance with Shariah principles. a) The Shariah Supervisory Council. b) The Takaful Act 1984. c) The Islamic Religious Law. d) The Takaful Operation 1988. Q72 Malaysia regulation on Islamic insurance was started in year: a) 1984. b) 1986. c) 1990. d) 1996. Q73 Which of the following department is involved in risk selection and premium calculation? a) Actuary. b) Agency Development. c) Underwriting. d) Risk Surveyor. Q74 Amy bought a policy which cover a certain amount of sum assured and she gets the payment of a specified amount for every year until death. This is called: a) Single Life Immediate Annuity. b) Annuity Certain. c) Guaranteed Immediate Annuity. d) Deferred Annuity. Q75 Which of the following section of the Policy Contract contain name and the address of the insurer? a) Preamble. b) Attestation. c) Proviso. d) Heading.

Q76

Which of the section under policy contract include the insureds name, address, sum insured, and maturity period? a) The Schedule. b) The Proviso. c) The Preamble. d) Conditions and Privileges. Q77 A death can be proof by submitting the following document, except: a) A death certificate. b) A coroners report. c) Identity card. d) Medical certificate. Q78 Insurance endorsement after issue of a policy can be broadly classified into the following groups relating to changes, except: a) Insured name. b) Address. c) Sum assured. d) Payment method. Q79 Cooling off period consist of _______ days. a) 15 Days. b) 20 Days. c) 25 Days. d) 30 Days. Q80 Major Medical expenses insurance policies provide _____________________________. a) Broad coverage and substantial protection from large and unpredictable healthcare expenses. b) Pay for treatment costs when an insured person is treated as inpatient. c) Provide treatment costs of a disability subject to the limits and conditions stipulated in the policy. d) Large treatment expenses for Critical illnesses and disability will be taken care. Q81 Which of the following statement is TRUE about insurance? a) The emotional trauma can be made good by any conceivable compensatory system. b) Prepare or free oneself for the forthcoming and unexpected financial burden or losses. c) Insurance can help an individual become wealthy through the profit gain from insurance. d) Insurance help to inculcate the discipline of saving amongst the working population. Q82

The primary function of insurance is:

a) b) c) d) Insurance is equitably distributing the financial losses of few who are insured among the many insured. Prepare or free oneself for the forthcoming and unexpected financial burden or losses. Insurance can help an individual become wealthy through the profit gain from insurance. Insurance help to inculcate the discipline of saving amongst the working population.

Q83 What are the 2 main principle used in Takaful Operation? a) Akhlaq and aqidah. b) Contribution and participants. c) Tabarru and Mudharabah. d) Al-Gharar and Al-Maisir.

Q84 What are the types of Takaful Business that available in Malaysian market? a) Individual takaful plan and Takaful mortgage plan. b) Family takaful business and General takaful business. c) Miscellaneous takaful business and Group takaful business. d) Takaful business for Life and takaful business for General. Q85 The following statements are TRUE about duty of Utmost Good Faith, EXCEPT: a) Matters that diminishes the risk to the insured. b) Is of common knowledge. c) The insurer knows or in the ordinary course of his business ought to know. d) In respect of which the insurer has waived any requirement for disclosure. Q86 What is the definition of "risk"? a) Risk is a chance of occurance of certain events. b) Risk is an uncertainty regarding loss which present everywhere. c) Risk is a condition that increases the chance of loss. d) Risk is predictable and can be handle by insurance techniques. Q87 Which of the following section covers Duty of Utmost Good Faith? a) Insurance Act 1996 - Section 150. b) Insurance Act 1963 - Section 150. c) Insurance Act 1963 - Section 163. d) Insurance Act 1996 - Section 163. Q88 Which of the following statement is TRUE about the Universal Agent? a) Appointed to carry out specific act or transaction. b) Appointed to do anything for his principal within the stated limits. c) Appointed to carry out unlimited authority and may do anything for his principal. d) Apponited to act exactly as the principal secretly. Q89 Below are the categories of agents, EXCEPT: a) Secret agent b) Universal agent c) Special agent d) General agent Q90 What are the major 2 key roles of The Malaysian Insurance Institute (MII)? a) Provide training for insurance regulators and insurers. b) Provide industry information for insurer and agents. c) Provide knowledge for agents and develop them. d) Provide training and as an examination centre. Q91 Which of the following factor is NOT required by the underwriter for the risk selection process? a) Medical Factor b) Family Background c) Financial Factor d) Age and sex Q92 The following are the sources of underwriting information, EXCEPT: a) X-ray statement. b) Medical or paramedical examination. c) Attending physician's statement. d) Hospital medical records.

Q93 The following statements are TRUE about principal requirement of Companies Act 1965, EXCEPT: a) Regulation specifies the subsidiary legislation that are repealed. b) Preparation and submission of annual account with statements. c) Method of valuing liabilities. d) Method to value asset and the provision for depreciation. Q94 Which of the following statement is FALSE: a) Pure risk exists when there is the possibility of either loss or no loss. b) Pure risk is more predictable as it is easier to apply in law of large numbers. c) Pure risk exists when there is the possibility of profit, loss, or no loss. d) Pure risk can be handled by insurance techniques.

Q95 What is fundamental risk? a) It affects individuals and bring financial loss to them at the same time. b) It brings accidental and unintentional loss to the whole economic. c) It affects the entire economy or large numbers of groups within the economy. d) It is a type of risk whereby no need to be monitored to ensure that it is achieving the results expected. Q96 If a house burnt down because of fire, it falls under: a) Particular Risk b) Speculative risk c) Fundamental risk d) Pure risk

Q97 A person shall be deemed to have insurable interest in relation to the following relationship, EXCEPT: a) Brothers and sisters b) Spose c) Employees d) A person on whom he is at the time the insurance is affected, wholly or partly, dependent. Q98 What is insurable interest? a) Certain level of emotional and financial interest on the person that we are insuring. b) Financial interest of an insured in the subject matter of insurance. c) Legal rights to insure arising from the legitimate financial interest which an insured has a subject matter of insurance. d) Legal rights to insure arising from an insured subject matter only. Q99 For life insurance, when must the insurable interest exist? a) It must exist at the beginning and at the time of loss. b) Only need insurable interest at the time of loss only. c) It must exist at time of affecting the contract. d) It must exist at the time of affecting the contract, in between to review, and at the time of loss occur. Q100 Which of the following statement is TRUE about ducompany secretary? a) Administration of the organization as a registered company beside ensuring that the company complies with the company and insurance company law. b) Assist each borad of directors and help them out with legal procedures beside preparing minutes. c) Provides and handles services commonly used by many departments head and staff. d) They are the personal advisors to the Board of Directors and help them to carry out certain task and decision while they are away from the office.

Answers: 1. A 2. D 3. B 4. A 5. A 6. A 7. A 8. B 9. C 10.C 11.D 12.B 13.A 14.C 15.B 16.C 17.A 18.B 19.A 20.B 21.C 22.C 23.B 24.A 25.C 26.B 27.A 28.D 29.C 30.A 31.D 32.B 33.D 34.A 35.C 36.A 37.A 38.C 39.D 40.A 41.B 42.D 43.B 44.D 45.C 46.A 47.D 48.B 49.C 50.B 51.C 52.C 53.C 54.B 55.A 56.A 57.C 58.B 59.B 60.D 61.B 62.B 63.D 64.C 65.A 66.C 67.B 68.D 69.A 70.B 71.B 72.A 73.C 74.D 75.D 76.A 77.C 78.B 79.A 80.A 81.B 82.A 83.C 84.B 85.A 86.B 87.A 88.B 89.A 90.D 91.B 92.A 93.A 94.C 95.C 96.D 97.A 98.C 99.C 100.A

You might also like

- Pcea Questions: A Paid-Up PolicyDocument13 pagesPcea Questions: A Paid-Up PolicyUmabaran Murugiah100% (1)

- PCE Sample Questions (Eng) - Set 1Document20 pagesPCE Sample Questions (Eng) - Set 1Thennarasu Don100% (1)

- PCE ENG - Set 6Document17 pagesPCE ENG - Set 6Elansegaran Thangamani100% (2)

- Pce Sample Questions 2016 - EngDocument39 pagesPce Sample Questions 2016 - EngImran Azman100% (1)

- Pre-Contract Agents Exam & Investment-Linked Life Insurance Sample QuestionsDocument9 pagesPre-Contract Agents Exam & Investment-Linked Life Insurance Sample QuestionsKOLEJ ALPHA100% (1)

- PCEIA Sample Questions (E) - Set 1Document20 pagesPCEIA Sample Questions (E) - Set 1VH Boon100% (1)

- PCE Mock Examination - Set 2: Hong Leong Assurance Berhad (94613-X) Financial Services Academy (Jul 2011Document19 pagesPCE Mock Examination - Set 2: Hong Leong Assurance Berhad (94613-X) Financial Services Academy (Jul 2011Zarina GhazaliNo ratings yet

- Internal Insurance Exam Question BankDocument33 pagesInternal Insurance Exam Question BankKishenthi KerisnanNo ratings yet

- PCIL Set 5Document8 pagesPCIL Set 5renugaNo ratings yet

- PCE Sample Questions SET 2 ENG PDFDocument20 pagesPCE Sample Questions SET 2 ENG PDFVivekananthiny Raman100% (2)

- Set 3 - Pce Sample Questions 1. Which Act Is ... - ZurichDocument17 pagesSet 3 - Pce Sample Questions 1. Which Act Is ... - ZurichJasveen KaurNo ratings yet

- PCIL Set 2 Ver 1.0 - 20200816Document9 pagesPCIL Set 2 Ver 1.0 - 20200816KOLEJ ALPHA100% (1)

- 04 12 23 PCE Exam QuestionDocument18 pages04 12 23 PCE Exam QuestionYen Yik Wong82% (11)

- Pce ExamDocument17 pagesPce ExamPravin Vjai Aiyanakavandan100% (4)

- PCE Sample Questions - SET 3 (ENG)Document17 pagesPCE Sample Questions - SET 3 (ENG)Goh Koon Loong75% (4)

- PCE Trial Exam 1Document55 pagesPCE Trial Exam 1Kenny Chen68% (22)

- PCE Sample Questions Set 2Document20 pagesPCE Sample Questions Set 2Raja Mohan86% (7)

- PCE Practice Questions 1Document31 pagesPCE Practice Questions 1De ZulNo ratings yet

- Pre-Contract Study Guide for Insurance ExamDocument36 pagesPre-Contract Study Guide for Insurance Exammohdhafizmdali0% (2)

- PCE English Set ADocument28 pagesPCE English Set Aronasso7100% (1)

- PCE SET 3 Version August 2015Document11 pagesPCE SET 3 Version August 2015Kalai Arasen PerumalNo ratings yet

- PCE Sample Questions - SET 6 (ENG)Document15 pagesPCE Sample Questions - SET 6 (ENG)Raja Mohan100% (1)

- PCE Life Past QuestionsDocument42 pagesPCE Life Past QuestionsJo Yong60% (5)

- Understanding Takaful Principles and BenefitsDocument6 pagesUnderstanding Takaful Principles and BenefitsEileen WongNo ratings yet

- PCEIA Exam PaperDocument20 pagesPCEIA Exam PaperShiharu Comil0% (1)

- Tbe C - Mock - Exam - 100Document22 pagesTbe C - Mock - Exam - 100Sharania Udhaya Kumar100% (4)

- PCEIA New Edition Questions (English - Set 6Document26 pagesPCEIA New Edition Questions (English - Set 6Hema100% (3)

- Pre Contract Examination For Insurance AgentsDocument14 pagesPre Contract Examination For Insurance Agentsmiormaria6514No ratings yet

- Mock Exam - Set 4: Compiled by FSA As at April 2008Document14 pagesMock Exam - Set 4: Compiled by FSA As at April 2008Farah S Noshirwani67% (3)

- 2 Ceilli Set A (Eng)Document24 pages2 Ceilli Set A (Eng)chiewteck0% (1)

- Ceilli Sample Questions (Eng) – Set 1Document13 pagesCeilli Sample Questions (Eng) – Set 1Premkumar NadarajanNo ratings yet

- Ceilli1 SQ en Eah PDFDocument24 pagesCeilli1 SQ en Eah PDFLeevya GeethanjaliNo ratings yet

- PCEIA Sample Questions Set 2Document19 pagesPCEIA Sample Questions Set 2kenny sanNo ratings yet

- Pceia - Bi Full NotesDocument407 pagesPceia - Bi Full Notesmohdhafizmdali100% (3)

- Ceili Sample Questions Set 1Document14 pagesCeili Sample Questions Set 1jsdawson29% (7)

- PCE A & C Insurance Basics and PrinciplesDocument35 pagesPCE A & C Insurance Basics and Principlescarollim1008100% (1)

- Ceilli PresentationDocument197 pagesCeilli PresentationjsdawsonNo ratings yet

- Pceia BiDocument407 pagesPceia BiWenny Khoo100% (1)

- Soalan Pce ExamDocument8 pagesSoalan Pce Examsukahati0% (1)

- Tbe Part Ac Set 1 100qa 2019 With AnswerDocument23 pagesTbe Part Ac Set 1 100qa 2019 With AnswerMuhammad Haziq Ilham Bin Roslan100% (1)

- CEILLI New Edition Questions (English - Set 1)Document19 pagesCEILLI New Edition Questions (English - Set 1)Gary Teong75% (8)

- Ceili Sample Questions Set 2Document26 pagesCeili Sample Questions Set 2jsdawson67% (3)

- Ceilli EnglishDocument84 pagesCeilli EnglishKanna Nayagam100% (1)

- PCE Part B 2000 Sample QuestionsDocument14 pagesPCE Part B 2000 Sample QuestionszaraNo ratings yet

- Ceilli 8Document18 pagesCeilli 8HemaNo ratings yet

- CEILLI Sample Questions - Set 3 (ENG)Document11 pagesCEILLI Sample Questions - Set 3 (ENG)Raja Mohan83% (6)

- CEILLI Training Slide PDFDocument221 pagesCEILLI Training Slide PDFtharan100% (1)

- PCIL SET 1 Questions 2021Document18 pagesPCIL SET 1 Questions 2021renugaNo ratings yet

- Final English 2015 PCE PDFDocument192 pagesFinal English 2015 PCE PDFCheong Weng ChoyNo ratings yet

- PCE Part B 2000 QuestionsDocument13 pagesPCE Part B 2000 Questionszara100% (1)

- PCIL Study Material English PDFDocument123 pagesPCIL Study Material English PDFIsaac Wong100% (1)

- PCE Slides 2019 (English)Document192 pagesPCE Slides 2019 (English)Hema100% (2)

- ADIB YAZID - Nota Ringkas PCEIA Study Guide (Bahasa Inggeris)Document36 pagesADIB YAZID - Nota Ringkas PCEIA Study Guide (Bahasa Inggeris)Hanis Ahmad Badri50% (2)

- INVESTMENT-LINKED INSURANCE EXAMDocument18 pagesINVESTMENT-LINKED INSURANCE EXAMDivyaa Krishnan40% (5)

- Insurance CFPDocument166 pagesInsurance CFPAbhinav MandlechaNo ratings yet

- FPA Insurance Planning ModuleDocument166 pagesFPA Insurance Planning Modulesantosh0025No ratings yet

- Insurance Objective Qtn&AnsDocument26 pagesInsurance Objective Qtn&AnsSsengondo100% (1)

- Understanding Takaful FundamentalsDocument9 pagesUnderstanding Takaful FundamentalsChaerry MeanieNo ratings yet

- Personal Insurance Individual Risk Examination Simulator - Card ADocument13 pagesPersonal Insurance Individual Risk Examination Simulator - Card AScribdTranslationsNo ratings yet

- Risk Analysis Insurance PlanningDocument10 pagesRisk Analysis Insurance PlanningAbhinav Mandlecha0% (1)

- Legal Requirements in Food IndustryDocument42 pagesLegal Requirements in Food IndustryHazel Joy Balberan-AgustinNo ratings yet

- SAP T CodesDocument49 pagesSAP T Codesanilks27No ratings yet

- Ibs Equine Park 1 31/10/23Document6 pagesIbs Equine Park 1 31/10/23alvinlun.cbsmyNo ratings yet

- Ivd STF 2Document2 pagesIvd STF 2ChakriNo ratings yet

- Terms & Conditions - Smartemi (Dial An Emi) : Please Note ThatDocument2 pagesTerms & Conditions - Smartemi (Dial An Emi) : Please Note ThatSaurabh SharmaNo ratings yet

- Central Institute of Technology Private Iti: Question Code - A Total Time: 1 Hrs Total Marks: 30Document1 pageCentral Institute of Technology Private Iti: Question Code - A Total Time: 1 Hrs Total Marks: 30Cit SasthamcottaNo ratings yet

- M1 King of Kings God-Sky-EarthDocument8 pagesM1 King of Kings God-Sky-EarthKarin E. J. KollandNo ratings yet

- Estmt - 2019 08 26Document8 pagesEstmt - 2019 08 26Sandra RíosNo ratings yet

- Accidental Damage and Breakdown Insurance Insurance Product Information DocumentDocument3 pagesAccidental Damage and Breakdown Insurance Insurance Product Information DocumentMoosaa Bin-SuhaylNo ratings yet

- Deutsche Bank Research Container Shipping ReportDocument8 pagesDeutsche Bank Research Container Shipping ReportbenlauhhNo ratings yet

- ACT Nomination Guidelines for Skilled VisasDocument15 pagesACT Nomination Guidelines for Skilled VisasKhairul AlamNo ratings yet

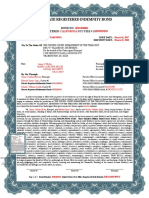

- 3 2 Registered Private Indemnity Bond 20090819 PDFDocument5 pages3 2 Registered Private Indemnity Bond 20090819 PDFCraig Stein100% (7)

- Work Life BalanceDocument69 pagesWork Life BalanceSagar Paul'gNo ratings yet

- Mutual Funds in ICICI Bank: Bachelor of Management StudiesDocument19 pagesMutual Funds in ICICI Bank: Bachelor of Management StudiesGanganiya GauravNo ratings yet

- Payflowgateway GuideDocument262 pagesPayflowgateway GuideAshok OrugantiNo ratings yet

- Bord of DirectorsDocument2 pagesBord of DirectorsWajid KhanNo ratings yet

- RTC Jurisdiction Over Housing Loan DisputeDocument11 pagesRTC Jurisdiction Over Housing Loan DisputeEmary GutierrezNo ratings yet

- ICICI ProjectDocument90 pagesICICI ProjectSrusti ParekhNo ratings yet

- NISM Certifications List All SerisesDocument3 pagesNISM Certifications List All SerisesSayantan Munna PaulNo ratings yet

- Comaprative Financial Statment Analysis of HBL & MCBDocument28 pagesComaprative Financial Statment Analysis of HBL & MCBIfzal Ahmad86% (7)

- Reksadana SahamDocument25 pagesReksadana SahamAbdul RahmanNo ratings yet

- Scheme of Examination and Course Structure B. Voc. in Banking Financial Services and Insurance (BFSI)Document3 pagesScheme of Examination and Course Structure B. Voc. in Banking Financial Services and Insurance (BFSI)sainipreetpalNo ratings yet

- HDFC BankDocument16 pagesHDFC Bankpeketisantosh3011No ratings yet

- Venmo Carding Method by DsDocument2 pagesVenmo Carding Method by DsKwaku RicoNo ratings yet

- Satyam ScamDocument30 pagesSatyam Scamvikrant9147No ratings yet

- AGENCY COURSE SYLLABUSDocument109 pagesAGENCY COURSE SYLLABUSAshAngeLNo ratings yet

- Cebu International Financing Corp. v. CA G.R. No. 107554. February 13, 1997 FactsDocument2 pagesCebu International Financing Corp. v. CA G.R. No. 107554. February 13, 1997 FactsRap SantosNo ratings yet

- Wisdom of Great InvestorsDocument16 pagesWisdom of Great Investorsdmoo10No ratings yet

- Incoterms Chart 073109Document1 pageIncoterms Chart 073109Sumit SharmaNo ratings yet

- Case Study On Green MarketingDocument7 pagesCase Study On Green MarketingAnonymous WucWqwNo ratings yet