Professional Documents

Culture Documents

Chapter 2

Uploaded by

Lleiram Bulotano BolanioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2

Uploaded by

Lleiram Bulotano BolanioCopyright:

Available Formats

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Learning Objectives 1. Define and identify the basic elements of accounting-assets, liabilities, and owners equity. 2. Determine the net income through operation 3. Define and identify revenue, expense, net income, and net loss 4. Define and know the components of financial statements 5. Prepare properly classified financial statements Types of Financial Statements 1. Balance Sheet- shows the financial condition/position of a business as of a given period. It consists of the Assets, Liabilities, and Capital. 2. Income Statement- shows the result of operations for a given period. It consists of the Revenue, Cost, and Expenses. 3. Owners Equity Statement- shows the changes in the Capital or Owners Equity as a result of additional investment or withdrawals by the owner, plus or minus the net income or net loss for the year. 4. Cash Flow Statement- summarizes the cash receipts and cash disbursements for the accounting period ( to be fully discussed in higher accounting). Typical Account Titles Used Balance Sheet Assets- these are economic resources owned by the business expected for future gain. They are property and rights of value owned by the business. Liabilities- these include debts, obligations to pay, and claims of the creditors on the assets of the business. Owners Equity or Capital- this includes the interest of the owners on the business; claims of the owners on the assets of the business; and the investment of the owner plus or minus the results of operations. Owners equity or capital comes from two main sources- investment of owners and earnings of the business. The Fundamental Accounting Equation Assets= Liabilities + Owners Equity Illustration: 1. Assets = Liabilities + Owners Equity P? = P 40,000 + P 60,000 Answer: P 100,000

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Simply add liabilities of P 40,000 and owners equity of P 60,000 to get assets of P 100,000. 2. Assets = Liabilities +Owners Equity P 150,000 = P? + P 70,000 Answer: P 80,000 Simply deduct owners equity of P70,000 from the assets of P150,000 to get liabilities of P80,000. 3. Assets = Liabilities + Owners Equity P200,000 = P 110,000 + P? Answer: P90,000 Simply deduct liabilities of P110,000 from the assets of P200,000 to get owners equity P90,000. DEBITS AND CREDITS- THE DOUBLE-ENTRY SYSTEM Accounting is based on a double-entry system which means that the dual effects of a business transaction is recorded. A debit side entry must have a corresponding credit side entry. For every transaction, there must be one or more accounts debited and one or more accounts credited. Each transaction affects at least two accounts. The total debits for a transaction must always equal the total credits. An account is debited when an amount is entered on the left side of the account and credited when an amount is entered on the right side. The abbreviations for debit and credit are Dr. and Cr., respectively. The account type determines how increases or decreases in it are recorded. Increases in assets are recorded as debits (on the left side of the account) while decreases in assets are recorded as credits (on the right side). Conversely, increase in liabilities and owners equity are recorded by credits and decreases are entered as debits. The rules of debit and credit for income and expense accounts are based on the relationship of theses accounts to owners equity. Income increase owners equity and expense decreases owners equity. Hence, increase in income are recorded as credits and decreases as debits. Increases in expenses are recorded as debits and decreases as credits. These are the rules of debit and credit.

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

The following summarizes the rules: Balance Sheet Accounts Assets Debit (+) Increases Credit (-) Decreases Liabilities and Owners Equity Debit (-) Decreases Credit (+) Increases

Income Statement Accounts Debit for decreases in owners equity Expenses Debit (+) Increases Credit (-) Decreases Credit for increases in owners equity Income Debit (-) Decreases Credit (+) Increases

TYPES AND EFFECTS OF TRANSACTIONS 1. Increase in Assets = Increase in Liabilities a) Purchase of equipment on account Dr Machinery and Equipment xxxx Cr Accounts Payable xxxx b) Advance payment received for services to be rendered next year Dr Cash xxxx Cr Unearned Income xxxx 2. Increase in Assets = Increase in Owners Equity a) Cash contribution of an owner or of a partner Dr Cash xxxx Cr A, Capital b) Property contribution an owner or of a partner Dr Property and Equipment xxxx Cr A, Capital 3. Increase in one Asset = Decrease in another Asset a) Cash purchase of company equipment Dr Property and Equipment xxxx Cr Cash

xxxx

xxxx

xxxx

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

4. Decrease in Assets = Decrease in Liabilities a) Payment of accounts payable Dr Accounts Payable Cr Cash 5. Decrease in Assets = Decrease in Owners Equity a) Capital drawings Dr A, Capital Cr Cash

xxxx xxxx

xxxx xxxx

6. Increase in Liabilities = Decrease in Owners Equity a) Dividends payable Dr Retained Earnings xxxx Cr Dividends Payable 7. Increase in Owners Equity = Decrease in Liabilities a) Capitalization of dividends payable Dr Dividends Payable xxxx Cr A, Capital 8. Increase in one Liability = Decrease in another Liability a) From long term liability to short term liability (reclassification based on due dates of liabilities)

xxxx

xxxx

9. Increase in one Owners Equity = Decrease in another Owners Equity b) Capitalization of net income Dr Net Income xxxx Cr A, Capital xxxx

Assets Classification of Assets 1. Current Assets Improvements to International Accounting Standards 1 (December 2003) classifies assets as current assets when it is: a) Expected to be realized in, or is intended for sale or consumption in, the entitys normal operating cycle; b) Held primarily for the purpose of being traded; c) Expected to be realized within twelve months of the balance sheet date; or d) Cash or a cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the balance sheet date.

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Classification of Current Assets Cash includes coins, currencies, checks, bank deposits, and other cash items readily available for use in the operations of the business. Cash Equivalents are short-term investments that are readily convertible to known amounts of cash which are subject to an insignificant risk to changes in value Marketable Securities are stocks and bonds purchased by the enterprise and are to be held for only a short span of time or short duration. They are usually purchased when a business has excess cash. Accounts Receivable is the amount collectible from the customer to whom sales have been made or services have been rendered on account or credit. Notes Receivable is a promissory note issued by the client or the customer in exchange for services or goods received as evidence of his/her obligation to pay. Inventories represent the unsold goods at the end of the accounting period. This is applicable only to merchandising business. Prepaid Expenses are items that will be used in the operations of the business that have been paid in advance. Classification of Non-Current Assets Long-Term Investments are assets held by an enterprise for the accretion of wealth through capital distribution such as interest, royalties, dividends and rentals, for capital appreciation or for other benefits to the investing enterprise such as those obtained through trading relationships. Investments are classified as long-term when they are intended to be held for an extended period of time. Property, Plant, and Equipment are tangible assets that are held by an enterprise for use in the production or supply of goods or services, or for administrative purposes and which are expected to be used for more than one period. Examples of Plant, Property, and Equipment Land is a piece of lot or real estate owned by the enterprise on which a building can be constructed for business purposes. Building is an edifice or structure used to accommodate the office, store or factory of a business enterprise in the conduct of its operations.

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Equipment includes typewriter, air-conditioner, calculator, filing cabinet, computer, electric fan, trucks, cars used by the business in its office, store or factory. Specific account titles may be used such as Office Equipment, Store Equipment, Delivery Equipment, Transportation Equipment, Machinery and Equipment. Furniture and Fixtures includes tables, chairs, carpets, curtains, lamp and lighting fixtures, and wall decors. Specific account titles maybe used such as Office Furniture and Fixtures and Store Furniture and Fixtures. Accumulated Depreciation is a contra-asset account representing expired cost of plant, property and equipment as a result of usage and passage of time. This is deducted from the cost of the related asset account. Intangible Assets are identifiable, non-monetary assets without physical substance held for use in the production or supply of goods or services, for rental to others, or for administrative purposes. These include goodwill, patents, copyrights, licenses, franchises, trademarks, brand names, secret processes, subscription lists and non-competition agreements.

Liabilities Improvements to International Accounting Standards (December 2003) classifies a liability as current liability when it is: a) Expected to be settle in the entitys normal operating cycle; b) Held primarily for the purpose of being traded; c) Due to be settle within twelve months after the balance sheet date; or the entity does not have an unconditional right to defer settlement of the liability for at least twelve months after the balance sheet date. Classification of Current Liabilities Accounts Payable includes debts arising from purchase of an asset or acquisition of services on account. Notes Payable includes debts arising from purchase of an asset or acquisition of services on account evidenced by a promissory note. Loan Payable is a liability to pay the bank or other financing institution arising from funds borrowed by the business from these institutions. Utilities Payable is an obligation to pay utility companies for services received from them. Examples of this are telephone services to PLDT, electricity to Meralco, and water services to Maynilad.

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Unearned Revenues represent obligations of the business arising from advance payments received before goods or services are provided to the customer. This will be settled when certain goods or services are delivered or rendered. Accrued Liabilities include amounts owed to others for expenses already incurred but not yet paid. Examples of these are salaries payable, utilities payable, taxes payable, and interest payable. Classification of Non-Current Liabilities Non-Current Liabilities are long term liabilities or obligations which are payable for a period longer than one year. Examples of Non-Current Liabilities are as follows: Mortgage Payable is a long-term debt of the business with security or collateral in the form of real properties. In case the business fails to pay the obligation, the creditor can foreclose or cause the mortgaged asset to be sold and the proceeds of the sale be used to settle the obligation. Bonds Payable is s certificate of indebtedness under the seal of a corporation, specifying the terms of repayment and the rate of interest to be charged. Owners Equity Capital is an account bearing the name of the owner representing the original and additional investment of the owner of the business increased by the amount of net income earned during the year. It is decreased by the cash or other assets withdrawn by the owner as well as the net loss incurred during the year. Drawing represents the withdrawals made by the owner of the business either in cash or other assets. Income Summary is a temporary account used at the end of the accounting period to close income and expense accounts. The balance of this account shows the net income or net loss for the period before it is closed to the capital account. Income Statement Service Income includes revenues earned or generated by the business in performing services for a customer or client. Examples: Laundry Services by a laundry shop Medical Services by a doctor Dental Services by a dentist

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Sales revenues earned as a result of sale of merchandise; for example, sale of building materials by a construction supplies firm. Cost of Sales the cost incurred to purchase or to produce the products sold to customers during the period; also called cost of good sold. Salaries or Wages Expense includes all payments made to employees or workers for rendering services to the company. Examples are salaries or wages, 13th month pay, cost of living allowances, and other related benefits given to them. Utilities Expense is an expense related to the use of electricity, fuel, water, and telecommunications facilities. Supplies Expense covers office supplies used by the business in the conduct of its daily operations. Insurance Expense is the expired portion of premiums paid on insurance coverage such as premiums paid for health or life insurance, motor vehicles or other properties. Depreciation Expense is the annual portion of the cost of a tangible asset such as buildings, machineries, and equipment charged as expense for the year. Uncollectible Account Expense/Doubtful Accounts Expense/Bad Debts Expense means the amount of receivables charged as expense for the period because they are estimated to be doubtful of collection. Interest Expense is the amount of money charged to the borrower for the use of borrowed funds.

Forms of Balance Sheet 1. Account Form follows the accounting equation where assets are listed on the lefthand column of the report with the liabilities and owners equity listed on the righthand column. 2. Report Form shows in one straight column the assets, followed by the liabilities and owners equity. Classification Items in the balance sheet are classified, with assets and liabilities separated into two or more categories. Subclassification is as follows: 1. Assets are subclassified as current assets and non-current assets.

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

2. Liabilities are either current liabilities or non-current liabilities. Current assets are classified and presented according to liquidity with the most liquid first followed by those with lesser liquidity. Since cash is the most liquid, it is always listed first followed by other current assets according to their proximity to cash. Liabilities are classified and presented based on their maturity. Obligations presently due for payment are listed first. Examples of the four statement, namely 1) Balance Sheet (Report Form); 2) Balance Sheet (Account Form); 3) Income Statement; and 4) Statement of Owners Equity

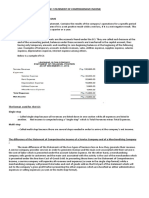

REPORT FORM BALANCE SHEET

ABC Fresh Laundry Services Balance Sheet December 31, 2010

Current Assets Cash Accounts Receivable Supplies Prepaid Insurance Total Current Assets Non-Current Assets Plan, Property, and Equipment Land Equipment Less: Accumulated Depreciation Total Non-Current Assets Total Assets

Assets P450,000 31,000 27,000 37,000 P545,000

P200,000 P560,000 67,000 493,000 693,000 P1,238,000 Liabilities

Current Liabilities Accounts Payable Notes Payable Unearned Laundry Revenue Total Current Liabilities Owners Equity A, Capital Total Liabilities and Capital

P75,000 190,000 39,000 P304,000

934,000 P1,238,000

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

ACCOUNT FORM BALANCE SHEET

ABC Fresh Laundry Services Balance Sheet December 31, 2010

Assets Current Assets Cash Accounts Receivable Supplies Prepaid Insurance Total Current Assets Non-Current Assets Plant, Property, and Equipment Land Equipment P560,000 Less: Accumulated 67,000 Depreciation Total Non-Current Assets Total Assets

Liabilities Current Liabilities Accounts Payable Notes payable Unearned Laundry Revenue P545,000 Total Current Liabilities

P450,000 31,000 27,000 37,000

P 75,000 190,000 39,000 P304,000

Owners Equity P200,000 A, Capital 493,000 693,000 P1,238,000 _______ P1,238,000 934,000

Total Liabilities and Capital

10

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

ABC Fresh Laundry Services Income Statement For Year Ended December 31, 2010

Service Revenue Less: Operating Expenses Salaries Expense Depreciation Expense Supplies Expense Rent Expense Insurance Expense Total Operating Expenses Net Income

P312,000 P125,000 13,000 10,000 7,000 2,000 157,000 P155,000

ABC Fresh Laundry Services Statement of Owners Equity For Year Ended December 31, 2010 A, Capital Add: Additional Investment Net Income Total Less: Drawings Total Owners Equity P759,000 P50,000 155,000 205,000 P964,000 30,000 P934,000

11

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 1 Write the letter of the correct answer on the blank A. B. C. D. E. F. Balance Sheet Income Statement Owners Equity Statement Assets Liabilities Owners Equity

________1. Shows the results of operations for a given period ________2. Economic resources owned by the business expected for future gain ________3. Shows the financial condition/position of a business as of a given period ________4. Interest of the owners on the business ________5. Shows the changes in the Capital or Owners Equity as a result of additional investment, withdrawals, net income or net loss for the year. ________6. Debts, obligations to pay, claims of the creditors on the assets of the business

Exercise 2 Write the letter of the correct answer on the blank. A. B. C. D. Cash Cash Equivalents Marketable Securities Accounts Receivable E. Notes Receivable F. Inventories G. Prepaid Expenses

________1. Promissory note issued by the client for goods received. ________2. Items that will be used in the operations of the business that have been paid in advance. ________3. Stocks purchased by the business to be held for a short time ________4. Unsold goods at the end of the accounting period. ________5. Amount collectible from customer to whom sales have been made or services have been rendered on account or credit. ________6. Includes coins, currencies, checks, and bank deposits ________7. Shot-term investments readily convertible to known amounts of cash subject to an insignificant risk to changes in value

12

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 3 Write the letter of the correct answer on the blank. A. Land B. Building C. Equipment E. Furniture and Fixtures F. Accumulated Depreciation G. Intangible Assets

________1. Contra-asset account representing expired cost of plant, property, and equipment as a result of usage and passage of time ________2. Lot used by the business on which a building can be constructed ________3. Non-monetary assets without physical substance held for use in the production or supply of goods, for rental to others, or for administrative purposes e.g., goodwill, patents, copyrights ________4.tables, chairs, curtains, lighting fixtures, and wall decors ________5. Edifice, structure used to house the office, store or factory ________6. Typewriter, air-conditioner, calculator, filing cabinet, computer, electric fan, trucks, cars used in business

Exercise 4 Write the letter of the correct answer on the blank A. Accounts Payable B. Notes Payable C. Loan Payable D. Utilities Payable E. Unearned Revenues F. Accrued Liabilities G. Interest Expense

________1. Debts arising from purchase of an asset on account evidenced by a promissory note ________2. An obligation to pay utility companies for services received from them ________3. Amounts owed to others for expenses already incurred but not yet paid ________4. Liability arising from amount of money borrowed by the business ________5. Debts arising from acquisition of services on account ________6. Obligations of the business arising from advance payments received before services are provided to the customer

13

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 5 Write the letter of the correct answer on the blank A. Mortgage Payable B. Bonds Payable C. Drawing D. Income Summary

________1. Temporary account used at the end of the accounting period to close income and expense accounts ________2. Certificate of indebtedness under the seal of a corporation ________3. Long-term debt of the business with security or collateral in the form of real properties ________4. Represents the withdrawals made by the owner of the business either in cash or other assets

Exercise 6 Write the letter of the correct answer on the blank A. Service Income B. Salaries Expense C. Utilities Expense D. Rent Expenses E. Supplies Expense F. Insurance Expense

________1. Amount paid for the used of space, equipment or other rentals ________2. Amount of supplies used in the conduct of daily business ________3. Revenues earned by performing services for a customer ________4. Expired portion of premiums paid on insurance coverage ________5. Payments made to employees for rendering services to the company ________6. Expenses related to the use of electricity, fuel, water, and telecommunications facilities

14

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 7 Find the missing amounts. ASSETS A. P4,902,400 B. _________ C. 1,141,000 D. 8,200,000 E. 25,000,000 Exercise 8 Find the missing amounts. ASSETS A. P___________ B. ____________ C. 1,141,000 D. 6,500,000 E. 10,000,000 LIABILITIES P 3,932,100 2,246,000 __________ 3,250,000 __________ OWNERS EQUITY P5,100,000 1,777,200 646,000 _________ 4,900,000 LIABILITIES P__________ 9,656,000 646,000 ___________ 14,600,000 OWNERS EQUITY P2,153,800 987,200 _________ 3,250,000 _________

Exercise 9 For each of the following, write I if it is an income statement item and B if it is a balance sheet item. _______1. Interest Expense _______2. Interest Receivable _______3. Mortgage Payable _______4. Interest Income _______5. Miscellaneous Expense _______6. Drawing Account _______7. Supplies Expense _______8. Supplies _______9. Equipment _______10. Building _______11. Salaries Expense _______12. Accounts Payable _______13. Prepaid Rent _______14. Insurance Expense _______15. Cash

15

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 10 Below are the classifications commonly found on a classified balance sheet. On the blank provided before each number, write the classification to where it belongs. A. B. C. D. E. F. Current Assets Plant, Property and Equipment Current Liabilities Non-Current Liabilities Owners Equity Not a Balance Sheet Item

________1. Land ________2. Rent Expense ________3. L, Capital ________4. Accounts Receivable ________5. Unearned Rent ________6. Supplies Used ________7. Supplies on Hand ________8. Prepaid Insurance

_______9. Accounts Payable _______10. Notes Payable _______11. Mortgage Payable _______12. Taxes Payable _______13. Truck _______14. Equipment _______15. Commissions Earned

16

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 11 Presented below are the income statement accounts for Willies Auto Repair Shop for the year ended December 31, 2010. Prepare a Single Step Income Statement for Willies Auto Repair Shop for year ended December 31, 2010 by completing the Income Statement. Supplies Expense Bad Debts Expense Taxes & Licenses Depreciation Expense Insurance Expense Salaries Expense Utilities Expense Rent Expense Repair Income P 400 4,900 7,250 9,750 10,000 45,000 46,750 55,000 275,000

Willies Auto Repair Shop Income Statement For Year Ended December 31, 2010

Repair Income Less: Operating Expenses Rent expense Utilities expense Salaries expense Insurance expense Depreciation expense Taxes & Licenses Bad Debts expense Supplies expense Total Operating Expenses Net Income

P P

400 __________ P 95,950

Exercise 12 Presented below are the income statement accounts for Carls Psychiatric Clinic. Prepare a Single Step Income Statement for Carls Psychiatric Clinic for year ended December 31, 2010 by completing the income statement. Insurance Expense Salaries Expense Utilities Expense P 20,000 90,000 92,000

17

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Rent Expense Professional Fees Supplies Expense Bad Debts Expense Taxes & Licenses Depreciation Expense

110,000 600,000 800 9,800 15,000 18,500

Carls Psychiatric Clinic Income Statement For Year Ended December 31, 2010

Professional Fees Less: Operating Expenses Rent Expense Utilities Expense Salaries Expense Insurance Expense Depreciation Expense Taxes & Licenses Bad Debts Expense Supplies Expense Total Operating Expenses Net Income

P P110,000 92,000 20,000

9,800 800 ________

356,100 P________

18

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION Exercise 13 Presented below are the balance sheet accounts of Galvez Consultancy Firm. Prepare a report form balance sheet for the year December 31, 2010 by completing the balance sheet. Land Building Furniture & Fixtures Accumulated Depreciation- Building Allowance for Bad Debts Cash Supplies Accounts Receivable Galvez, Capital Accounts Payable Loans Payable Utilities Payable Prepaid Insurance P 68,000 350,000 4,500 50,000 6,000 101,000 700 46,500 469,200 5,000 50,000 500 10,000

Galvez Consultancy Firm Balance Sheet December 31, 2010 Assets Current Assets Cash Accounts Receivable Less: Allowance for Bad Debts Supplies Prepaid Insurance Total Current Assets Non-Current Assets Plant, Property and Equipment Land Equipment Less: Accumulated Depreciation Furniture & Fixtures Total Non-Current Assets Total Assets Current Liabilities Accounts Payable Loans Payable Utilities Payable Total Current Liabilities Owners Equity Galvez, Capital Total Liabilities and Capital 469,200 P524,700 P P 46,500 6,000 700 10,000 P

P P350,000 50,000 300,000 4,500 _________ P 524,700 Liabilities P 500 P 55,500

19

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 14 Presented below are the balance sheet accounts of Forever Bridal Consultancy. Prepare an account form balance sheet for the year December 31, 2010 by completing the balance sheet. Supplies Equipment Building Furniture & Fixtures Accumulated Depreciation-Building Cash P 1,000 20,000 384,000 4,500 50,000 111,500 Notes Receivable F, Capital Accounts Payable Loan Payable Notes Payable Prepaid Rent P 35,000 421,000 5,000 39,000 45,000 4,000

Forever Bridal Consultancy Balance Sheet December 31, 2010 Assets Current Assets Cash Notes Receivable Supplies Prepaid Rent Total Current Assets Non-Current Assets Plant, Property and Equipment Building Less: Accumulated Depreciation Equipment Furniture & Fixtures Total Non-Current Assets Total Assets P

4,000 P

P 50,000

P 334,000 4,500 358,500 P 510,000

Liabilities Current Liabilities Accounts Payable Notes Payable Loan Payable Total Current Liabilities Owners Equity F, Capital Total Liabilities and Capital ________ P 510,000

P 5,000 39,000 P 89,000

20

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 15 From the information given from the records of Gracias Consultancy Services, prepare a statement of owners equity for year ended December 31, 2010. G, Capital G, Drawing P400,000 40,000

The company generated a P150,000 net income. Gracia made an additional investment of P80,000.

Exercise 16 Using the same information from exercise 13, except that, instead of a net income, the company incurred a net loss of P 55,000. Complete the statement of owners equity of Gracias Consultancy Services. Gracias Consultancy Services Statement of Owners Equity For Year Ended December 31, 2010 G, Capital Add: Additional Investment Net Income Total Less: Drawings Total Owners Equity P P 150,000 ___________ P630,000 ___________ P590,000___

Gracias Consultancy Services Statement of Owners Equity For Year Ended December 31, 2010 G, Capital Add: Additional Investment Total Less: Drawings Net Loss Total Owners Equity P400,000 80,000 P 40,000 ________

__95,000 P_________

21

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Exercise 17- Comprehensive Problem Presented is the trial balance of Niko Ong Art Gallery. From the information given, prepare the following by completing the incomplete statements: 1. Income Statement 2. Balance Sheet 3. Statement of Owners Equity

Niko Ong Art Gallery Trial Balance Dec. 31, 2010 Cash Accounts Receivable Art Supplies Prepaid Rent Prepaid Insurance Transportation Equipment Office Equipment Accounts Payable Notes Payable Utilities Payable Unearned Painting Revenue Ong, Capital Ong, Drawing Painting Revenue Salaries Expense Utilities Expense Total P 840,500 50,000 12,000 30,000 18,000 300,000 50,000 P 37,000 200,000 900 250,000 500,000 30,000 350,000 2,500 4,900 P1,337,900 _________ P1,337,900

Nikos Ong Art Gallery Income Statement For Year Ended December 31, 2010 Painting Revenue Less: Operating Expense Utilities Expense Salaries Expense Total Operating Expenses Net Income P P __2,500 __________ P 342,600__

22

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

Niko Ong Art Gallery Balance Sheet December 31, 2010 Assets Current Assets Cash Accounts Receivable Art Supplies Prepaid Rent Prepaid Insurance Total Current Assets Non-Current Assets Plant, Property, and Equipment Transportation Equipment Office Equipment Total Non-Current Assets Total Assets Liabilities Current Liabilities Accounts Payable Notes Payable Utilities Payable Unearned Painting Revenue Total Current Liabilities Owners Equity Ong, Capital Total Liabilities and Capital _812,600 P________

P 840,500

18,000 P

P 50,000 350,000 P 1,300,500

P 37,000

250,000 P

Niko Ong Art Gallery Statement of Owners Equity For Year Ended December 31, 2010 Ong, Capital Add: Net Income Total Less: Drawings Total Owners Equity P _342,600 P 842,600 ________ P_______

23

BOOKKEEPING NC III FINANCIAL STATEMENTS FOR A SERVICE BUSINESS AND THE FUNDAMENTAL ACCOUNTING EQUATION

24

You might also like

- Cash Flow Statement Activities Transactions PreparationDocument1 pageCash Flow Statement Activities Transactions PreparationAdoree Ramos75% (4)

- Fabm-2 2Document33 pagesFabm-2 2KIRSTEN HENRYK CHINGNo ratings yet

- Chapter 4Document38 pagesChapter 4Haidee Sumampil67% (3)

- Drill ABMDocument1 pageDrill ABMGeorge Gonzales78% (23)

- Funda 2Document20 pagesFunda 2Lorraine Miralles67% (3)

- Topic: Accounting Cycle of A Service BusinessDocument5 pagesTopic: Accounting Cycle of A Service BusinessJohn Rey BusimeNo ratings yet

- Answers in Fundamentals of Accountancy, Business and Management 1Document14 pagesAnswers in Fundamentals of Accountancy, Business and Management 1Sherilyn Diaz0% (2)

- Tiga Laba Laundry Shop Trial BalanceDocument5 pagesTiga Laba Laundry Shop Trial BalanceMaureen FloresNo ratings yet

- JournalizingDocument47 pagesJournalizingCattleya67% (3)

- CashflowDocument6 pagesCashflowAizia Sarceda Guzman71% (7)

- Mr. Ong Performed Audit Service For Mr. Tan On AccountDocument3 pagesMr. Ong Performed Audit Service For Mr. Tan On AccountAdolph Christian Gonzales100% (2)

- Customer Relationship Report Demo RevisedDocument16 pagesCustomer Relationship Report Demo RevisedLaila Mae PiloneoNo ratings yet

- Statement of Comprehensive IncomeDocument26 pagesStatement of Comprehensive IncomerachelNo ratings yet

- 2QUIZ1Document3 pages2QUIZ1Marilyn Nelmida Tamayo100% (1)

- Special ExamDocument3 pagesSpecial ExamAdoree Ramos50% (2)

- Chapter 3statement of Changes in EquityDocument14 pagesChapter 3statement of Changes in EquityKyla DizonNo ratings yet

- Fabm2 Module Week 1Document8 pagesFabm2 Module Week 1Mylene Santiago100% (1)

- Mira's School Supplies Store Financial AnalysisDocument1 pageMira's School Supplies Store Financial AnalysisMiguel Lulab100% (1)

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- Chapter 3: Preparation Financial StatementDocument20 pagesChapter 3: Preparation Financial StatementIan BucoyaNo ratings yet

- Fundamentals of Accountancy Business and Management II 2nd QDocument14 pagesFundamentals of Accountancy Business and Management II 2nd QAnonymousNo ratings yet

- Fundamentals of Accountancy, Business, and Management 1: 2. Journal EntriesDocument15 pagesFundamentals of Accountancy, Business, and Management 1: 2. Journal EntriesVanessa Lou Torejas67% (3)

- Enclosure 1. Teacher-Made Learner's Home Task (Week 3)Document7 pagesEnclosure 1. Teacher-Made Learner's Home Task (Week 3)Kim FloresNo ratings yet

- Assignment November11 KylaAccountingDocument2 pagesAssignment November11 KylaAccountingADRIANO, Glecy C.No ratings yet

- Accounting Cycle and Trial BalanceDocument20 pagesAccounting Cycle and Trial BalanceJoseph Entera100% (2)

- Debit AccountancyDocument33 pagesDebit AccountancyJuancho Miguel0% (1)

- Accounting Fundamentals 1 Learning Activity SheetsDocument95 pagesAccounting Fundamentals 1 Learning Activity SheetsCHRISTINE JOY BONDOC100% (1)

- Lesson 9.4 Adjusting EntriesDocument36 pagesLesson 9.4 Adjusting EntriesDanica Medina50% (2)

- Module in Fabm 1: Department of Education Schools Division of Pasay CityDocument6 pagesModule in Fabm 1: Department of Education Schools Division of Pasay CityAngelica Mae SuñasNo ratings yet

- Introduction to Financial Management ConceptsDocument14 pagesIntroduction to Financial Management ConceptsAiron BendañaNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Abm General and Special JournalDocument63 pagesAbm General and Special JournalEstelle Gammad33% (3)

- Module 3 - Accounting For Business TransactionsDocument10 pagesModule 3 - Accounting For Business TransactionsMJ San PedroNo ratings yet

- Fundamentals of accounting final taskDocument2 pagesFundamentals of accounting final taskJohn Michael Zamoras100% (2)

- Accounting Cycle of a Service BusinessDocument46 pagesAccounting Cycle of a Service BusinesscjNo ratings yet

- Learn the Accounting Equation and Rules of Debit and CreditDocument21 pagesLearn the Accounting Equation and Rules of Debit and CreditJesseca JosafatNo ratings yet

- Time Value of Money: Abm5 - Business FinanceDocument34 pagesTime Value of Money: Abm5 - Business FinanceBarbie BleuNo ratings yet

- Review of Financial Statement PreparationDocument2 pagesReview of Financial Statement PreparationNiccaP100% (3)

- Far 1 - Activity 1 - Sept. 09, 2020 - Answer SheetDocument4 pagesFar 1 - Activity 1 - Sept. 09, 2020 - Answer SheetAnonn100% (1)

- WorksheetDocument7 pagesWorksheetCamelliaNo ratings yet

- Problem 3.2Document3 pagesProblem 3.2MedicareMinstun ProjectNo ratings yet

- Types of Account Titles UsedDocument48 pagesTypes of Account Titles UsedKrung KrungNo ratings yet

- Journalize the above transactions in the general journal of Bert PhotographyDocument24 pagesJournalize the above transactions in the general journal of Bert PhotographyManuel Panotes Reantazo50% (2)

- HULA MEDocument4 pagesHULA MEEnrique BongaisNo ratings yet

- Lesson 1 Abm 2Document35 pagesLesson 1 Abm 2Albert Gaddiel CobicoNo ratings yet

- JKL Company Comparative Balance Sheet and Income Statement AnalysisDocument4 pagesJKL Company Comparative Balance Sheet and Income Statement AnalysisChancellor RimuruNo ratings yet

- Principles of Accountability, Fairness and TransparencyDocument16 pagesPrinciples of Accountability, Fairness and TransparencyDina Valdez0% (1)

- Accounting Books - Journal, Ledger and Trial BalanceDocument35 pagesAccounting Books - Journal, Ledger and Trial BalanceGhie Ragat100% (3)

- SLM WK 1-2 Bus EthicsDocument22 pagesSLM WK 1-2 Bus Ethicsvincent viovicenteNo ratings yet

- Accounting Cycle of a Service BusinessDocument1 pageAccounting Cycle of a Service BusinessFlorante De Leon100% (1)

- Fundamentals of ABM 1 Accounting CycleDocument47 pagesFundamentals of ABM 1 Accounting CycleHarrold HarryNo ratings yet

- FABM2 Module 05 (Q1-W6)Document12 pagesFABM2 Module 05 (Q1-W6)Christian ZebuaNo ratings yet

- Act 110 Module 2Document28 pagesAct 110 Module 2Nashebah A. BatuganNo ratings yet

- Dr.-King AnswerDocument3 pagesDr.-King AnswerAdolph Christian Gonzales100% (1)

- Session 6-7 Debit and Credit Rule - MIDTERMDocument13 pagesSession 6-7 Debit and Credit Rule - MIDTERMAnge BoboNo ratings yet

- Statement of Changes in Equity - Practice ExercisesDocument2 pagesStatement of Changes in Equity - Practice ExercisesEvangeline Gicale25% (8)

- Problems Problem 1: True or FalseDocument11 pagesProblems Problem 1: True or FalseSarah SantosNo ratings yet

- Chapter 2-Accounting 101Document26 pagesChapter 2-Accounting 101Haidee SumampilNo ratings yet

- Accounting Basics for Non-AccountantsDocument129 pagesAccounting Basics for Non-Accountantsdesikan_r100% (7)

- Role of Financial Manager (WEEK 2)Document15 pagesRole of Financial Manager (WEEK 2)Aliza Urtal100% (1)

- 06 Activity 01Document2 pages06 Activity 01rebecca cruzNo ratings yet

- L1 Book-Keeping S2 2000Document21 pagesL1 Book-Keeping S2 2000Fung Hui YingNo ratings yet

- 12th Biology Important 235 Mark Questions English Medium PDF DownloadDocument6 pages12th Biology Important 235 Mark Questions English Medium PDF DownloadNandhakumarNo ratings yet

- CPA Income Tax QuizDocument15 pagesCPA Income Tax QuizApolinar Alvarez Jr.100% (4)

- March 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDocument10 pagesMarch 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDillon CollierNo ratings yet

- TNK BP RussiaDocument16 pagesTNK BP RussiapheeyonaNo ratings yet

- A Presentation On Special Economic Zones (SEZDocument29 pagesA Presentation On Special Economic Zones (SEZsvjiwaji96% (23)

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- Ch. 14 Payout PolicyDocument68 pagesCh. 14 Payout PolicyRiyan DarmawanNo ratings yet

- S Glass Limited: Working Capital Management INDocument34 pagesS Glass Limited: Working Capital Management INtanu srivastava50% (2)

- Chapter 14 - Bus. Combination Part 2Document16 pagesChapter 14 - Bus. Combination Part 2PutmehudgJasdNo ratings yet

- Engineering EconomicsDocument6 pagesEngineering EconomicsSisay AD100% (1)

- Nestle Financial Statements - Keystone BankDocument15 pagesNestle Financial Statements - Keystone Bankemmanuelleonard54No ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Philippine Income Tax Classification GuideDocument5 pagesPhilippine Income Tax Classification GuideLouNo ratings yet

- BHELDocument14 pagesBHELMayank Gupta100% (1)

- Assign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020Document6 pagesAssign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020mhikeedelantar50% (2)

- Pricol Limited - Broker Research - 2017 PDFDocument25 pagesPricol Limited - Broker Research - 2017 PDFnishthaNo ratings yet

- Cost Sheet: Practical Problems 05-08-20Document14 pagesCost Sheet: Practical Problems 05-08-20Shubham Saurav SSNo ratings yet

- LN04Brooks671956 02 LN04Document57 pagesLN04Brooks671956 02 LN04nightdazeNo ratings yet

- Contract of Employment & Types of OrganisationsDocument16 pagesContract of Employment & Types of OrganisationsKomborero MagurwaNo ratings yet

- Youth Face an Uncertain Future as Demographics ShiftDocument28 pagesYouth Face an Uncertain Future as Demographics ShiftIcoliveira VascoNo ratings yet

- Pricing PolicyDocument50 pagesPricing PolicyTeaching ExcellenceNo ratings yet

- Munjal Showa 31st Annual Report 2015 16Document112 pagesMunjal Showa 31st Annual Report 2015 16maayan21No ratings yet

- Asian Paints Limited Consolidated Balance SheetDocument40 pagesAsian Paints Limited Consolidated Balance SheetSehajpal SanghuNo ratings yet

- Strategy and National DevelopmentDocument35 pagesStrategy and National DevelopmentelmarcomonalNo ratings yet

- Mcqs ST MGTDocument51 pagesMcqs ST MGTWasama WaqarNo ratings yet

- Industrial SicknessDocument4 pagesIndustrial SicknessPoonam RajpootNo ratings yet

- Financial ManagementDocument238 pagesFinancial ManagementJherzy Henry Elijorde FloresNo ratings yet