Professional Documents

Culture Documents

Act Companies 1965 s167

Uploaded by

Masni Maidin0 ratings0% found this document useful (0 votes)

68 views1 pageACT 125 COMPANIES ACT 1965 PART VI - ACCOUNTS AND AUDIT DIVISION 1 - ACCORDS. Every company and the directors and managers thereof shall cause to be kept such accounting and other records as will sufficiently explain the transactions and financial position of the company. Records shall be kept at the registered office of the company or at such other place in Malaysia as the directors think fit and shall at all times be open to inspection by the directors.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACT 125 COMPANIES ACT 1965 PART VI - ACCOUNTS AND AUDIT DIVISION 1 - ACCORDS. Every company and the directors and managers thereof shall cause to be kept such accounting and other records as will sufficiently explain the transactions and financial position of the company. Records shall be kept at the registered office of the company or at such other place in Malaysia as the directors think fit and shall at all times be open to inspection by the directors.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

68 views1 pageAct Companies 1965 s167

Uploaded by

Masni MaidinACT 125 COMPANIES ACT 1965 PART VI - ACCOUNTS AND AUDIT DIVISION 1 - ACCORDS. Every company and the directors and managers thereof shall cause to be kept such accounting and other records as will sufficiently explain the transactions and financial position of the company. Records shall be kept at the registered office of the company or at such other place in Malaysia as the directors think fit and shall at all times be open to inspection by the directors.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

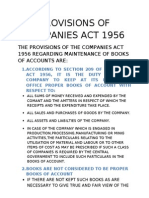

ACT 125 COMPANIES ACT 1965 PART VI - ACCOUNTS AND AUDIT DIVISION 1 - ACCOUNTS

Section 167. Accounts to be kept.

(1) Every company and the directors and managers thereof shall cause to be kept such accounting and other records as will sufficiently explain the transactions and financial position of the company and enable true and fair profit and loss accounts and balance sheets and any documents required to be attached thereto to be prepared from time to time, and shall cause those records to be kept in such manner as to enable them to be conveniently and properly audited. (1A) Every company and the directors and managers thereof shall cause appropriate entries to be made in the accounting and other records within sixty days of the completion of the transactions to which they relate. [Am. Act A21: s.17] (2) The company shall retain the records referred to in subsection (1) for seven years after the completion of the transactions or operations to which they respectively relate. (3) The records referred to in subsection (1) shall be kept at the registered office of the company or at such other place in Malaysia as the directors think fit and shall at all times be open to inspection by the directors. (4) Notwithstanding the provisions in subsection (3), the accounting and other records of operations outside Malaysia may be kept by the company at a place outside Malaysia and there shall be sent to and kept at a place in Malaysia and be at all times open to inspection by the directors, such statements and returns with respect to the business dealt with in the records so kept as will enable to be prepared true and fair profit and loss accounts and balance sheets and any documents required to be attached thereto. (5) If any accounting and other records are kept at a place outside Malaysia pursuant to subsection (4), the company shall, if required by the Registrar to produce those records at a place in Malaysia, comply with the requirements. (6) The Court may in any particular case order that the accounting and other records of a company be open to inspection by an approved company auditor acting for a director, but only upon an undertaking in writing given to the Court that information acquired by the auditor during his inspection shall not be disclosed by him except to that director. [Am.Act A616: s.41] (7) If default is made in complying with this section the company and every officer of the company who is in default shall be guilty of an offence against this Act. Penalty: Imprisonment of six months or five thousand ringgit or both.

Copyright 2003 PNMB-LawNet. All rights reserved.

You might also like

- AUDITOR RIGHTSDocument6 pagesAUDITOR RIGHTSMohamad Arif Bin ShamsuddinNo ratings yet

- Rules of Appointment & RemovalDocument16 pagesRules of Appointment & RemovalHendry TupaiNo ratings yet

- Edited DiscussionDocument3 pagesEdited DiscussionAnonymous 7pUNKoFrLNo ratings yet

- Accounts of Company: by Haneef Ahmed BhattiDocument30 pagesAccounts of Company: by Haneef Ahmed BhattiZubair AsifNo ratings yet

- Audit and Accounts in CompaniesDocument23 pagesAudit and Accounts in CompaniesAmishaNo ratings yet

- Company Act PART VI Accounts AuditDocument21 pagesCompany Act PART VI Accounts Auditsam zhongNo ratings yet

- Registers and RecordsDocument90 pagesRegisters and RecordsVikram DasNo ratings yet

- Accounts and AuditDocument31 pagesAccounts and AuditexclusiverammyNo ratings yet

- Chapter 6 A4Document122 pagesChapter 6 A4Dhiraj JaiswalNo ratings yet

- Audit Group 2 Rules & Case StudyDocument26 pagesAudit Group 2 Rules & Case StudyHendry TupaiNo ratings yet

- Auditing BAC2664 (New), BAC2287 (Old) : Topic 2 The Requirements of Companies Act, 1965Document17 pagesAuditing BAC2664 (New), BAC2287 (Old) : Topic 2 The Requirements of Companies Act, 1965sueernNo ratings yet

- Companies ActDocument7 pagesCompanies ActSagarmakodeNo ratings yet

- Company Law 11Document16 pagesCompany Law 11ebenezerqusnsahNo ratings yet

- Auditors' Statutory Rights and DutiesDocument4 pagesAuditors' Statutory Rights and DutiesAshi AgarwalNo ratings yet

- Co Accounts & Audit Pedia by CA Ravi AgrawalDocument28 pagesCo Accounts & Audit Pedia by CA Ravi AgrawalSri PavanNo ratings yet

- Accounts and Audit L 18Document10 pagesAccounts and Audit L 18Everything NewNo ratings yet

- Auditors and ReportingDocument6 pagesAuditors and ReportingAnonymous br29lnPbNo ratings yet

- Auditors' Role and ResponsibilitiesDocument4 pagesAuditors' Role and ResponsibilitiesAreej AJNo ratings yet

- Preparation of Balance Sheet and Profit and Loss Account: TotalDocument7 pagesPreparation of Balance Sheet and Profit and Loss Account: TotalAnil ChauhanNo ratings yet

- Accounts of CompaniesDocument43 pagesAccounts of CompaniesSaurabh KumarNo ratings yet

- CRG PresentationDocument18 pagesCRG Presentationchris_yvonneNo ratings yet

- Accounts and Audit RequirementsDocument17 pagesAccounts and Audit RequirementsPriyanshu RaiNo ratings yet

- Chapter One Companies and Allied Matters Act 1990 - B Meetings and Proceedings of CompaniesDocument22 pagesChapter One Companies and Allied Matters Act 1990 - B Meetings and Proceedings of CompaniesAnfield FaithfulNo ratings yet

- Provisions of Companies Act 1956 FinalDocument9 pagesProvisions of Companies Act 1956 FinalDiwahar Sunder100% (1)

- Company Accounts Statutory BooksDocument21 pagesCompany Accounts Statutory BooksChandru SivaNo ratings yet

- CompanyDocument1 pageCompanyEthan HuntNo ratings yet

- Auditing and Internal Review AssignmentDocument13 pagesAuditing and Internal Review AssignmentStefan S. AdjeiNo ratings yet

- Independent Auditors' ReportDocument14 pagesIndependent Auditors' ReportNikhil KasatNo ratings yet

- BOOKS OF ACCOUNTS UNDER COMPANIES ACTDocument8 pagesBOOKS OF ACCOUNTS UNDER COMPANIES ACTKomal NandanNo ratings yet

- CRG 660 Past Year Question CollectionsDocument5 pagesCRG 660 Past Year Question CollectionsZulaikha HananiNo ratings yet

- Filing Annual Returns is Mandatory for All CompaniesDocument4 pagesFiling Annual Returns is Mandatory for All CompaniesRaphael ClementNo ratings yet

- Corporate Social ResponsibilityDocument4 pagesCorporate Social ResponsibilitySurabhi PandeyNo ratings yet

- Company Law: Mandatory Books of Accounts, Audit and Financial StatementsDocument18 pagesCompany Law: Mandatory Books of Accounts, Audit and Financial StatementsPratima SrivastavaNo ratings yet

- OhadaDocument24 pagesOhadaDesmond NsohNo ratings yet

- Law of Chartered AccountantsDocument52 pagesLaw of Chartered AccountantsRiyazi FarookNo ratings yet

- Lecture 28A - Company Audit (Accounts of Companies and LLP Audit)Document10 pagesLecture 28A - Company Audit (Accounts of Companies and LLP Audit)Harshit JainNo ratings yet

- Companies (Audit and Auditors) Rules, 2014 - MCA - 31-03-2014Document10 pagesCompanies (Audit and Auditors) Rules, 2014 - MCA - 31-03-2014dhuvadpratikNo ratings yet

- Jebel Ali Free Zone Company RegulationsDocument13 pagesJebel Ali Free Zone Company Regulationsseshuv2No ratings yet

- ChargesDocument2 pagesChargesitsrahulmaheshwariNo ratings yet

- Auditors and Their RoleDocument10 pagesAuditors and Their RoleKeshav DograNo ratings yet

- Books of Account Under The Company ACT, 2013: Book of Accounts (Section 128)Document4 pagesBooks of Account Under The Company ACT, 2013: Book of Accounts (Section 128)VikasDoshiNo ratings yet

- Dutch Lady Milk Industries Annual Report 2013Document88 pagesDutch Lady Milk Industries Annual Report 2013humairaemilyNo ratings yet

- SEBI RegistrationDocument4 pagesSEBI RegistrationpiyushNo ratings yet

- Books of Account and Companies Act, 2013Document16 pagesBooks of Account and Companies Act, 2013Jayshree ChoudharyNo ratings yet

- Akta PerniagaanDocument26 pagesAkta PerniagaanKai GustavNo ratings yet

- 2019 BUSINESS LAW EXAMINABLE SUPPLEMENTDocument21 pages2019 BUSINESS LAW EXAMINABLE SUPPLEMENTQwerty19oNo ratings yet

- BPT Regulation EnglishDocument30 pagesBPT Regulation EnglishsamaanNo ratings yet

- Circular 36-2011 07jun2011Document12 pagesCircular 36-2011 07jun2011CA Harish GargNo ratings yet

- 209A. (1) (I) (Ii)Document29 pages209A. (1) (I) (Ii)Manoj NamdevNo ratings yet

- Legal LiabilityDocument29 pagesLegal LiabilityMei Chien YapNo ratings yet

- Register Rules for CompaniesDocument5 pagesRegister Rules for CompaniesKumar MangalamNo ratings yet

- BP 68 Corporation Code ForeignDocument7 pagesBP 68 Corporation Code ForeignmmeeeowwNo ratings yet

- Rules for foreign and other company typesDocument3 pagesRules for foreign and other company typesSharad BhorNo ratings yet

- Who Is An Auditor?Document15 pagesWho Is An Auditor?Aman ChauhanNo ratings yet

- Sec. 14. Contents of The Articles of Incorporation. - All Corporations Organized Under This Code Shall FileDocument1 pageSec. 14. Contents of The Articles of Incorporation. - All Corporations Organized Under This Code Shall FileKrisha Marie CarlosNo ratings yet

- Brief Note On Annual Report PDFDocument4 pagesBrief Note On Annual Report PDFMaruko ChanNo ratings yet

- Lesson 7 FOREIGN CORPDocument14 pagesLesson 7 FOREIGN CORPVanessa Evans CruzNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Legal English Word List Unit 1. The Practice of LawDocument4 pagesLegal English Word List Unit 1. The Practice of LawViktorijaNo ratings yet

- G.R. No. 128016 - Spouses Raet v. Court of AppealsDocument11 pagesG.R. No. 128016 - Spouses Raet v. Court of AppealsMaying Dadula RaymundoNo ratings yet

- Citizenship Case of Sagun vs RepublicDocument1 pageCitizenship Case of Sagun vs RepublicAlexis CatuNo ratings yet

- 003 Cantos vs. PeopleDocument7 pages003 Cantos vs. Peoplest3ll4_my8No ratings yet

- Dishonest AcquisitionDocument7 pagesDishonest AcquisitionmaustroNo ratings yet

- Secretary Leila De Lima vs Magtanggol GatdulaDocument2 pagesSecretary Leila De Lima vs Magtanggol GatdulaShane Fulgueras100% (1)

- Tuf-Tite v. Federal Package NetworksDocument4 pagesTuf-Tite v. Federal Package NetworksPriorSmartNo ratings yet

- Troherro Ketih BatisteDocument20 pagesTroherro Ketih BatisteThe Town TalkNo ratings yet

- Jurisdiction in General: The 1997 Rules of Civil Procedure 2002 EditionDocument10 pagesJurisdiction in General: The 1997 Rules of Civil Procedure 2002 EditionChelissaRojasNo ratings yet

- People v. EchegarayDocument2 pagesPeople v. EchegarayMaria Beth100% (1)

- 039 NLR NLR V 65 E. P. Seneviratne Appellant and Thaha RespondentDocument2 pages039 NLR NLR V 65 E. P. Seneviratne Appellant and Thaha RespondentDinesh Kumara0% (1)

- Remedial Law, City Government of Makati v. OdenaDocument4 pagesRemedial Law, City Government of Makati v. Odenagailacd100% (1)

- Pelayo vs. Lauron DigestDocument2 pagesPelayo vs. Lauron DigestFairyssa Bianca SagotNo ratings yet

- Sample Remission PetitionDocument5 pagesSample Remission PetitionANY2LDONo ratings yet

- Resume of Shelley A Ajax - 2020Document2 pagesResume of Shelley A Ajax - 2020api-277818853No ratings yet

- Svoma v. Clarendon National Insurance Company - Document No. 4Document4 pagesSvoma v. Clarendon National Insurance Company - Document No. 4Justia.comNo ratings yet

- 2023 Pre-Week Notes - Criminal LawDocument92 pages2023 Pre-Week Notes - Criminal LawCarrotman IsintheHouseNo ratings yet

- Moot CourtDocument20 pagesMoot CourtJer RyNo ratings yet

- United States v. Angela Dee Isley, 11th Cir. (2010)Document28 pagesUnited States v. Angela Dee Isley, 11th Cir. (2010)Scribd Government DocsNo ratings yet

- Ejectment Case LawDocument29 pagesEjectment Case LawMEL JUN DIASANTA100% (1)

- Report On Crimes Against Women (MLAs and MPS) V3Document32 pagesReport On Crimes Against Women (MLAs and MPS) V3Prem PanickerNo ratings yet

- Preventing human traffickingDocument3 pagesPreventing human traffickingdanielaNo ratings yet

- Fe B. Yabut and Norberto Yabut, Substituted by His Heirs Represented by Catherine Y. Castillo, Petitioners, vs. Romeo AlcantaraDocument11 pagesFe B. Yabut and Norberto Yabut, Substituted by His Heirs Represented by Catherine Y. Castillo, Petitioners, vs. Romeo AlcantaraNympa VillanuevaNo ratings yet

- Ss Alvarez Vs CiDocument13 pagesSs Alvarez Vs CiKat PinedaNo ratings yet

- Jurisdictional Issues in International ArbitrationDocument23 pagesJurisdictional Issues in International ArbitrationMAHANTESH GNo ratings yet

- United States of America Ex Rel. Shaykh Muhammad Ali Hasan A/K/A Abyssinia Hayes v. Paul J. Gernert, Chairman Pennsylvania State Board of Probation and Parole, 395 F.2d 193, 3rd Cir. (1968)Document3 pagesUnited States of America Ex Rel. Shaykh Muhammad Ali Hasan A/K/A Abyssinia Hayes v. Paul J. Gernert, Chairman Pennsylvania State Board of Probation and Parole, 395 F.2d 193, 3rd Cir. (1968)Scribd Government DocsNo ratings yet

- Fundamental Powers of the StateDocument15 pagesFundamental Powers of the StateDanica ConcepcionNo ratings yet

- Filamer Full CaseDocument2 pagesFilamer Full CaseMark Voltaire LazaroNo ratings yet

- ACAS Disciplinary and Grievance GuideDocument7 pagesACAS Disciplinary and Grievance Guidehamba0007No ratings yet

- MDE Letter To Cros-LexDocument3 pagesMDE Letter To Cros-LexLiz ShepardNo ratings yet