Professional Documents

Culture Documents

Accounts Receivables

Uploaded by

Shafiq KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Receivables

Uploaded by

Shafiq KhanCopyright:

Available Formats

ACCOUNTING FOR RECEIVABLES P#1.

The following balances have been taken from the books of Fiazan stores for

the year ended on 30 the April 1999. Accounts Receivable Allowance for bad debts Net sales REQUIRED:

(i) (ii) P#2.

Rs.76,000 500 100,000

Pass an adjusting entry if the allowance for bad debts is estimated 6% of accounts receivables. If allowance for bad debts is estimated 2-1/2 % of sales.

The following balances have been taken from the books of Fiazan stores for the year ended on 30 the April 1999. Accounts Receivable Rs.80,000 Allowance for bad debts (debit) 500 Net sales 100,000 REQUIRED: (i) Pass an adjusting entry if the allowance for bad debts is estimated 5% of accounts receivables. (ii) If allowance for bad debts is estimated 2-1/2 % of sales. (iii) Prepare a partial balance sheet. 1st January 1996 the ledger of Noreen LTD. Showed a balance of Rs.1,12,800 in Accounts receivable and CR balance of allowance for bad debts of Rs.3,625. 1. Total sales Rs.250,000(including cash sales of Rs.117,500). 2. Sales returns and allowance Rs.15,000. 3. Sales discount Rs.6,000. 4. Customers account written off Rs.4,000. 5. Cash collected from customer Rs.175,000. 6. Previously written off accounts receivable recover Rs.1,800. REQUIRED: (i) Compute allowance for bad debts if it is estimated 3% of net credit sales. (ii) If it is estimated 5% of accounts receivables. (iii) Pass the adjusting and closing entries and also journal entries. (iv) Prepare a partial balance sheet.

P#3.On P#4. Mujahid company reports the balances for the period ended June 30,1999. Accounts Receivable Rs.50,000 Allowance for bad debts 500 (a) Credit sales Rs.430,000. (b) Sales return and allowance Rs.15,000. (c) Sales discount Rs.5,000. (d) Accounts receivables written off. Rs.12,000. (e) Accounts receivable recovered Rs.4000. (f) Collection from customer Rs.10,000. (g) Advance by customer as known through subsidiary ledgers Rs.6,000.

REQUIRED: (i) Compute allowance for bad debts if it is estimated 3% of net credit sales. (ii) If it is estimated 5% of accounts receivables. (iii) Pass the adjusting and closing entries and also journal entries. (iv) Prepare a partial balance sheet. P#5. Raheel & sons provide allowance for bad debts at 5% of a/c receivables at year end their balances were as follows. Accounts Receivable Rs10,500 Allowance for bad debts 2,000 1. Credit sales Rs.45,000. 2. Sales return and allowance Rs.400. 3. Sales discount Rs.200. 4. Accounts receivables written off. Rs.1,000. 5. Accounts receivable recovered Rs.400. 6. Over payment by customer Rs.800 including in accounts receivables. REQUIRED: (i) Pass the adjusting and closing entries and also journal entries. (ii) Prepare a partial balance sheet. P#6. Atif & 1999. 1. 2. 3. 4. co. presented the following selected information for the year ended December 31 st

Accounts receivable (31-12-98) Rs.200,000 Allowance for bad debts (31-12-98) 5,000 A customer account is written off 6,000 A previously written off account of Rs.7,000 was subsequently recovered to the extent of 5,000 On December 31,1999 the accounts receivable (control) showed a debit balance of Rs.80,000. Analysis of accounts receivable subsidiary ledger revealed a credit balance of Rs.4,000 in customer account. On this date the co. estimates bad debts at 10% of accounts receivables. REQUIRED: (a) Record the entries including adjusting. (b) Prepare a partial balance sheet as on December 31,1999. P#7.on December 31,1996 Sabiha co. accounts receivable account showed a debit balance of Rs.36,000 and allowance for doubtful debts a credit balance of Rs.1,100. on this date the co. estimated bad debts at 10% of accounts receivable. Summary of transactions for the year 1997 is as follows: 1. Sales (all on credit) 170,000 2. Sales returns 2,500 3. Cash received from customer 1,69,000 4. Total account written off as uncollectible 4,700 5. Previously written off account recovered 1,800 On December 31 19997 the co. estimated bad debts at 10% of the year-end balance of accounts receivables. REQUIRED: (a) Entries in general journal. (i) To record the bad debts on December 31,1996. (ii) For transactions 1 to 5. (iii) To record the bad debts on December 31,1997. (b) Set up T-accounts for accounts receivable and allowance for bad debts and show all postings therein. Balance these accounts. P#8. The following accounts among others, appear in the trial balance of SALMAN ass of December 31,1990. DEBIT CREDIT Accounts receivable Rs.98,000

Sales 350,000 Sales returns 22,500 On December 31,1990 an allowance for bad debts was 2 % of net credit sales. During 1991 the following uncollectble accounts were written off. April 4 Riaz 1200 September 20 Mateen 1090 On December 10 1991 a chque of Rs.190 was received from Riaz as the first and final amount. Net sales for 1991 were 394,000. the allowance for bad debts on December 31,1991 was adjusted to be 8 % of accounts receivables as policy has changed. And accounts receivable which has a debit balance of Rs.92,000 on this date. REQUIRED: a. Give general entries including adjusting entries for 1990 and 1991. b. Show allowance for bad debts account as it would appear on given date. c. Prepare a partial balance sheet as on December 31,1991. P#9.Baber & co. sell merchandise to their customers on credit. The terms in all cases are thirty days. The companys accounting year ends june 30 each. The company provides an allowance for doubtful debts equal to: 10% to all balances not due. 20% to all balances which are 1-30 days past due. 30% to all balances which are 31-60 days past due. 50% to all balances which are 60 days and above past due. The following customers accounts appear in the subsidiary ledger during 1994. Jamal Naeem Jan 15 (a) 400 Feb. 12 (a) 400 March 3 (a) 180 Jun 18 (b) 380 Akbar Akram April 16 (a) 990 May 14 (a) 990 Dec. 8 (a) 270 Jan 6 (a) 270 28 (b) 600 May 20 (b) 460 REQUIRED: (a) Prepare a schedule showing analysis of the above accounts by age group as given above. (b) Compute the account for doubtful debts applying the percentage given above. (c) Give the necessary adjusting journal entry in proper form to record the bad debts expense assuming that the allowance for bad debts account has a credit balance of Rs.95 before adjustment. P#10.The accounts receivable ledger of the Munna shows that the following data on December 31,1995. the general ledger showed Rs.200 credit balance in allowance for bad debts before adjustment. NAME OF CUSTOMERS INVOICE DATE AMOUNT Matin co. May 2, 1995 Rs.9,600 Naseem co. August 15 , 1995 5,368 Nadeem co. October 2, 1995 11,518 Faheem co. December 8, 1995 4,400 Waseem co. March 3, 1995 7,120 Rashid co. November 11, 1995 13,160 Nasir co. July 10, 1995 14,752 Others December 5, 1995 320,000 Terms of sales are n/30. Required: (i) Prepare an analysis of accounts receivable by age. (ii) Compute the estimated bad debts on the following percentages. Amounts not due Amounts past due Estimated % 0.5 1.0 3.0

01 30 days 31 60 days

(iii)

61 90 days 91 120 days 121 365 days pass the adjusting and closing entries.

10 25 50

P#11.The general ledger of Asad & co. is showing a debit balance of accounts receivable control Rs.18,000 of 50 customers. The subsidiary ledger is showing debit balance of 49 customers account and credit balance of Rs.2,000 of one customer. Compute the debit balance of 49 customers. REQUIRED: 1. Give the journal entry of the customers credit balance assuming that no other transaction takes place. 2. Prepare a partial balance sheet showing the above information only. P#12.Delta co. furnishes the following account balances at year ended June 30. Balances : Accounts receivable Rs.250,000 (including past due accounts 50,000) Allowance for bad debts (dr) 2,500. Sales Rs.580,000 (including cash sales Rs.180,000) REQUIRED: (i) Calculate bad debts expense using balance sheet approach @ 2% on not due accounts and 5% on past due accounts. (ii) Calculate bad debts expense @1- % of credit sales. P#13 accounts receivable for the common co. were reported on the balance sheet prepared at the end of 1998 as follow: Accounts receivable $46,000 Less: allowance for doubtful accounts (2,780) $43,820 The company sales good on term of 2/10 e.o.m, n/ 30 at the end of the year accounts receivable are aged and the following percentages are applied in arriving at an estimate of the charged for doubtful accounts: Accounts not more than two months overdue 5% Accounts more than two month but not more than six month overdue 20% Accounts more than six month but not more than one year overdue 50% Accounts more than one year overdue 100% At the end of the year the company also anticipates sales discount on all receivable not year due for payment. In 1999 the following transaction took place: Sales on account $412,405 Cash collected on account 395,615 Cash discounts allowed 5,540 Sales return an allowances 2,320 Bad debts written off 1,280 Bad debts previously written off but recovered 125 At the end of the year overdue accounts are as follow: Accounts not more than two month overdue $5,200 Accounts more than two months but not more than six month overdue 1,520 Accounts more than six months but not more than one year overdue 1,050 Accounts more than one year overdue 1,500 REQUIRED: 1. Give the entries required to record the transactions listed above and also adjust the accounts. 2. Calculate the balances for accounts receivable and the amount of allowance for bad debts as of December 31,1999 and prepare a partial balance sheet. P#14.The balance sheet prepared by Ahsan at December 31st,1993 included accounts receivable of Rs.380,640 and an allowance for bad debts accounts of Rs.9,720 . The companys sales in 1994 amounted to rs.2,562,000 and cash collection amounted to Rs.2,478,768. Among

these collections was the recovery of Rs.4,680 receivable from Akbar, a customer whose account had been written off as worthless in 1993. During 1994 it was necessary to write off as uncollectable customers accounts totaling Rs.10,098. On December 1,1994 Ahsan sold for Rs.2,16,000 a tract of land acquired as a building site several years ago at a cost of Rs.1,44,000. the land now considered unsuitable as a building site . Terms of sales were Rs.60,000 cash and a 6% six month note for Rs.1,56,000. The buyer of the land is a sound party and the note was regarded as fully collectible. At December 31,1994 the accounts receivable included Rs.60,174 of past due accounts. After careful study of all past due accounts the management estimated that the probable loss contained therein was 20% and that in addition 2% of the current accounts receivable might prove uncollectible. REQUIRED: a) Prepare journal entries in proper form including adjusting entry. b) Prepare a partial balance sheet.

P#15 GIVEN: The following information related to Saeed co.

Accounts receivable on December 31,2000 -------------------------------------Rs.100,000. Allowance for doubtful debts ---------------------------------------------------------10,000. Total sales (including cash sales Rs.15,000) -----------------------------------150,000. Discount allowed -----------------------------------------------------------------------5,000. Sales return & allowance ------------------------------------------------------------5,000. A credit balance of a customer not included in cash above -----------------10,000. Write off a customer account --------------------------------------------------------5,000. Bill received from customer ---------------------------------------------------------50,000. Bill received dishonored -------------------------------------------------------------5,000. Cheque received from customer(including recovery of Rs.3,000) ---------20,000. The cheque received from customer ( other then written off )dishonored --5,000. Credit balance in customers account- end of the year advance 23,00 payments not included in cash above. -------------------------------------------0 REQUIRED: a) Post the above transactions into general ledgers of accounts receivable and allowance for doubtful debts. b) Give the adjusting entry of doubtful debts assuming that company has the policy of charging 10% on accounts receivable. c) Several accounts are involved in above problem, some of which will be shown on the balance sheet. Prepare a partial balance sheet. P#16. The following information is available in respect of three different companies. Company 1 Company 2 Company 3 1. Balance of a/c receivable as on June 30,1998 100,000 87,500 187,500 2. Balance of doubtful debts as on July 1,1997 7,500 10,000 7,500 3. Accounts receivable written off during the year 5,000 12,500 5,000 4. Application rate of doubtful debts 2.5% 3.0% 2.0% REQUIRED: (i) Compute the amounts of doubtful debts for each of the above three companies. (ii) Give necessary adjusting entries for each of the above companies separately. (iii) Assumed that the amount written off is recovered of company 3 give necessary general entry. P#17. On January 1 2004 the accounts receivable account balance was Rs.72,000 and the allowance for bad debts account showed a credit balance of Rs.3,600. During the year following transactions took place. i. Sales on account Rs.325,000. ii. Cash collected from customers Rs.260,000. iii. Worthless customer account were written off Rs.4,000. iv. A previously written off customer account of Rs.2,000 was subsequently recovered to the extent of Rs.1,500.

REQUIRED: a. Record the above transactions in general journal. b. Prepare accounts receivable and allowance for bad debts T accounts. c. Estimate the allowance for bad debt @ 5% of accounts receivable year end balance and give adjusting and closing entry. d. Prepare a partial balance sheet as on December 31, 2004.

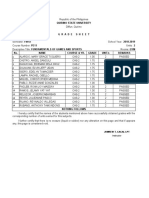

P#18.Nagina company has 420 accounts receivable in its subsidiary ledger. due in 30 days. On December 31, an aging schedule was prepared. summarized below: 31-60 61 90 Customer Not yet 1-30 days days past days past (418 names) Total due past due due due Subtotal 863,125 458,975 236,700 108,350 22,500

All accounts are The results are Over 90 days past due 36,600

Two accounts receivable were accidentally omitted from this schedule. The following data is available regarding these accounts: 1) Junaid owes Rs.10,825 from two invoices; invoice no. 218, dated Sept. 14 in the amount of 7,450; and invoice no. 568 dated November 9, in the amount of Rs.3,375. 2) Saleem owes Rs.9,400 from two invoices; invoice no 574, dated November 19, in the account of Rs.3,375; and invoice no 641, dated December 5, in the amount of Rs.6,250. REQUIRED: a) Complete the aging schedule as of December 31 by adding to the column subtotal an aging of the accounts of Junaid and Saleem. b) Prepare a schedule to compute the amounts of estimated bad debts by applying the following percentages. Not yet 1-30 days 31-60 days 61 90 days Over 90 days due past due past due past due past due 1% 4% 1% 30% 50% c) Prepare the adjusting entry assuming that allowance for bad debts has an unadjusted credit balance of Rs.34,500. d) Show how accounts receivable would appear in the companys balance sheet at December 31. P#19. Furqan Associates uses the balance sheet approach to estimate bad debts and maintains an allowance account to reduce accounts receivable to realizable value. An analysis of the accounts receivable at year end produced the following age groups: Not yet due .. Rs.348,000 1 30 days past due 180,000 31 60 days past due . 78,000 61 90 days past due . 18,000 Over 90 days past due . 30,000 Total accounts receivable 654,000 In reliance upon past experience with collections, the company estimated the percentages probably uncollectible for the five age groups to be as follows: Group 1, 1%; Group 2, 4%; Group 3, 10%; Group 4, 30%; and Group 5, 50%. Prior to adjustment at December 31st, the allowance for bad debts showed a credit balance of Rs.12,600. REQUIRED: i. Compute the estimated bad debts based on the classification by age group. ii. Prepare the adjusting entry needed to bring the allowance for bad debts accounts to the proper amount. iii. Prepare a partial balance sheet. iv. Assume that a customer Javed account Rs.7,200 worthless written off. Prepare the journal entry.

Winning is not every thing but waiting for win is.

You might also like

- Practical AccountingDocument13 pagesPractical AccountingDecereen Pineda RodriguezaNo ratings yet

- Accounting Mid TermDocument9 pagesAccounting Mid TermSaad MaqboolNo ratings yet

- UP Prof's lost luggage caseDocument2 pagesUP Prof's lost luggage caseeun hee kimNo ratings yet

- Investment PropertyDocument3 pagesInvestment PropertyacyNo ratings yet

- Financial Accounting Problems: Problem I (Current Assets)Document21 pagesFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNo ratings yet

- ILPA - Case Study Auditing - 062017 - FinalDocument20 pagesILPA - Case Study Auditing - 062017 - FinalDany DanielNo ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- 6809 Accounts ReceivableDocument2 pages6809 Accounts ReceivableEsse Valdez0% (1)

- PartnershipDocument27 pagesPartnershipkrys_elleNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Handout ReceivablesDocument4 pagesHandout ReceivablesTsukishima KeiNo ratings yet

- Cash and Cash Equivalents Multiple Choice QuestionsDocument11 pagesCash and Cash Equivalents Multiple Choice Questionsjhela18No ratings yet

- Accounting for Debt InstrumentsDocument4 pagesAccounting for Debt InstrumentsKeahlyn Boticario CapinaNo ratings yet

- Receivable Part 1Document22 pagesReceivable Part 1Rose Marie Anne ReyesNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- The Unadjusted Trial Balance of Fashion Centre LTD Contained TheDocument2 pagesThe Unadjusted Trial Balance of Fashion Centre LTD Contained TheBube KachevskaNo ratings yet

- D. None of These.: 1 - Page DR/ Magdy Kamel Tel/ 01273949660Document10 pagesD. None of These.: 1 - Page DR/ Magdy Kamel Tel/ 01273949660magdy kamelNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit Practice ExamDocument17 pagesAudit Practice ExamNoel CaingletNo ratings yet

- Computation For Formation of PartnershipDocument10 pagesComputation For Formation of PartnershipErille Julianne (Rielianne)No ratings yet

- Accounting ReportDocument19 pagesAccounting ReportEdward Glenn BaguiNo ratings yet

- Standard Unmodified Auditor ReportDocument3 pagesStandard Unmodified Auditor ReportRiz WanNo ratings yet

- 25781306Document19 pages25781306GuinevereNo ratings yet

- FARAP-4516Document10 pagesFARAP-4516Accounting StuffNo ratings yet

- Accounting For Income Taxes ExercisessDocument5 pagesAccounting For Income Taxes ExercisessdorothyannvillamoraaNo ratings yet

- ADFINA 1 - Home Office - Quiz - 2016NDocument2 pagesADFINA 1 - Home Office - Quiz - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- Adv2 QUIZ3Document3 pagesAdv2 QUIZ3husney botawanNo ratings yet

- Father's Retirement Savings GoalDocument2 pagesFather's Retirement Savings GoalEngr Fizza AkbarNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- DLSU CPA Cash and Cash EquivalentsDocument3 pagesDLSU CPA Cash and Cash EquivalentsEuniceChungNo ratings yet

- Practice Set - Audit of Sales and ReceivablesDocument2 pagesPractice Set - Audit of Sales and ReceivablesnikkaNo ratings yet

- Bonds PayableDocument39 pagesBonds PayableRuiz, CherryjaneNo ratings yet

- P2 BautistaDocument8 pagesP2 BautistaMedalla NikkoNo ratings yet

- 2007-05-25 050934 QuizDocument15 pages2007-05-25 050934 QuizRohith Kumar VennaNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Heats Corporation Current and Noncurrent LiabilitiesDocument1 pageHeats Corporation Current and Noncurrent LiabilitiesjhobsNo ratings yet

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- Basic accounting for defined benefit plansDocument23 pagesBasic accounting for defined benefit plansKristine Diane CABAnASNo ratings yet

- AdjustmentDocument5 pagesAdjustmentBeta TesterNo ratings yet

- Activity 1.1Document2 pagesActivity 1.1kathie alegarmeNo ratings yet

- Seatwork-Hedging of A Net Investment in Foreign OperationDocument1 pageSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacNo ratings yet

- 1.2 Assignment Audit of Cash and Cash Equivalents 2Document3 pages1.2 Assignment Audit of Cash and Cash Equivalents 2ORIEL RICKY IGNACIO GALLARDONo ratings yet

- Activity 2Document3 pagesActivity 2kathie alegarmeNo ratings yet

- Financial-Management 345Document1 pageFinancial-Management 345khurramNo ratings yet

- SimexDocument3 pagesSimexRoland Ron BantilanNo ratings yet

- Audit of Receivables AdjustmentsDocument5 pagesAudit of Receivables AdjustmentsandreamrieNo ratings yet

- Chapter 2 Nca Held For Sale and Discontinued OperationsDocument14 pagesChapter 2 Nca Held For Sale and Discontinued Operationslady gwaeyngNo ratings yet

- Which of The Following Would Indicate That A Note Receivable or Other Loan Is ImpairedDocument1 pageWhich of The Following Would Indicate That A Note Receivable or Other Loan Is ImpairedJAHNHANNALEI MARTICIONo ratings yet

- Auditing and Assurance Principles Pre-Test ReviewDocument9 pagesAuditing and Assurance Principles Pre-Test ReviewKryzzel Anne JonNo ratings yet

- Partnership QuestionsDocument2 pagesPartnership Questionslachimolaluv chimNo ratings yet

- AudprobDocument3 pagesAudprobJonalyn MoralesNo ratings yet

- ValixDocument12 pagesValixJESTONI RAMOSNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocument12 pagesLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- Adjusting EntiresDocument9 pagesAdjusting EntiresIqra MughalNo ratings yet

- Assessment Part 1Document5 pagesAssessment Part 1RoNnie RonNieNo ratings yet

- Process Modeling by ZADocument2 pagesProcess Modeling by ZAShafiq KhanNo ratings yet

- The Importance of Report Writing ShafiqDocument18 pagesThe Importance of Report Writing ShafiqShafiq Khan100% (5)

- The Importance of Report Writing ShafiqDocument18 pagesThe Importance of Report Writing ShafiqShafiq Khan100% (5)

- The Importance of Report Writing ShafiqDocument18 pagesThe Importance of Report Writing ShafiqShafiq Khan100% (5)

- Shares PresentationDocument3 pagesShares PresentationShafiq KhanNo ratings yet

- Seven Barriers To Great CommunicationDocument4 pagesSeven Barriers To Great CommunicationShafiq Khan100% (3)

- Non Verbal CommunicationDocument5 pagesNon Verbal CommunicationShafiq KhanNo ratings yet

- Promoting Malaysia's MICE IndustryDocument8 pagesPromoting Malaysia's MICE IndustrySuboh BeladingNo ratings yet

- AIA Report QQ 2177 FinalDocument17 pagesAIA Report QQ 2177 FinalHrithik WaghmareNo ratings yet

- Main References: Process SkidsDocument37 pagesMain References: Process SkidslaquetengoNo ratings yet

- 1ST Sem PeDocument60 pages1ST Sem PeJumreih CacalNo ratings yet

- Filene's Basement Customer Strategy CaseDocument3 pagesFilene's Basement Customer Strategy CaseDeepikaNo ratings yet

- Agricultural Productivity in IndiaDocument27 pagesAgricultural Productivity in IndiaAnkit LatharNo ratings yet

- Grand Review Packet Ap ExamDocument22 pagesGrand Review Packet Ap Examapi-41164603No ratings yet

- Gear Pump4.2LDocument1 pageGear Pump4.2LKhabib MasrokhanNo ratings yet

- Basoliben WoredaDocument39 pagesBasoliben WoredaShegaw BalambarasNo ratings yet

- Mahrukh Sher Ali 62202 (Assignment 04)Document4 pagesMahrukh Sher Ali 62202 (Assignment 04)wahajNo ratings yet

- Sabre NotesDocument11 pagesSabre NotesTasbeehNo ratings yet

- Docslide - Us Grade 9 Learning Module in Technology and Livelihood Education SelectedDocument325 pagesDocslide - Us Grade 9 Learning Module in Technology and Livelihood Education Selectedtyeharold85% (182)

- Trade Data On China and Medical SuppliesDocument4 pagesTrade Data On China and Medical SuppliesYahoo NewsNo ratings yet

- Sachin GIDC Company List SuratDocument5 pagesSachin GIDC Company List SuratCedric KerkettaNo ratings yet

- Changing Modes of Production in Indian AgricultureDocument2 pagesChanging Modes of Production in Indian Agricultureabhijit488No ratings yet

- Industrial/Sectoral Scenario: 1. History / Evolution of The SectorDocument15 pagesIndustrial/Sectoral Scenario: 1. History / Evolution of The SectorRahul YadavNo ratings yet

- The Impact of GATT and Globalization on Filipino FarmersDocument3 pagesThe Impact of GATT and Globalization on Filipino FarmersChrisun CabalquintoNo ratings yet

- Contribution of Hospitality Industry in The National DevelopmentDocument12 pagesContribution of Hospitality Industry in The National Developmentvandv printsNo ratings yet

- Aabradiant Systems: Company InformationDocument4 pagesAabradiant Systems: Company Informationneha_time2workNo ratings yet

- Indian MNCsDocument35 pagesIndian MNCsShweta ShrivastavaNo ratings yet

- Kashmir Avenue ChallanDocument1 pageKashmir Avenue ChallanDr Kashif's Cosmetic Laser ClinicNo ratings yet

- Gulfood18 Exhibitor List 02-12-2018Document134 pagesGulfood18 Exhibitor List 02-12-2018sonia87100% (4)

- Geographical and Ecological or Natural FactorsDocument11 pagesGeographical and Ecological or Natural FactorsharishsharmaNo ratings yet

- Barrett Kirwan's Academic Curriculum VitaeDocument5 pagesBarrett Kirwan's Academic Curriculum VitaeBarrett KirwanNo ratings yet

- Transformation of Agricultural Market and Its Impact On Agricultural DevelopmentDocument3 pagesTransformation of Agricultural Market and Its Impact On Agricultural Developmentsubhanka_roychoudhurNo ratings yet

- Working Group Presentation Collaboration Between Sme Corp-Hdc-Nestle 21 JULY 2010Document7 pagesWorking Group Presentation Collaboration Between Sme Corp-Hdc-Nestle 21 JULY 2010Jason KhooNo ratings yet

- Deal Drivers: EMEA FY 2021: A Spotlight On Mergers and Acquisitions Trends inDocument44 pagesDeal Drivers: EMEA FY 2021: A Spotlight On Mergers and Acquisitions Trends inBAGESNo ratings yet

- Management Consulting - FinalDocument2 pagesManagement Consulting - FinalShiv MehtaNo ratings yet

- Elektrim EMM Catalogue 20150916 Trang 1,3 4,6 7Document5 pagesElektrim EMM Catalogue 20150916 Trang 1,3 4,6 7Quang SinhNo ratings yet

- Top35 - 2020 Judging Pack PDFDocument689 pagesTop35 - 2020 Judging Pack PDFTheSAICANo ratings yet