Professional Documents

Culture Documents

Yankees Fact Sheet 4-12-12

Uploaded by

Nick ReismanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yankees Fact Sheet 4-12-12

Uploaded by

Nick ReismanCopyright:

Available Formats

THE CASE FOR FAIR ELECTIONS How the Yankees deal still leaves New Yorkers paying big

bucks for peanuts What does the richest major league baseball team do when it wants public dollars for a new stadium in one of the poorest counties in the nation? The answer: Dole out hundreds of thousands of dollars in contributions to elected officials and hire politically connected consultants to win more than $600 million in public subsidies. In this report, the Center for Working Families, an independent, unaffiliated research and advocacy group, reviews what the Yankees spent and the generous hand-outs they received. We also review how New Yorkers still are paying for the stadium because of broken promises and the extraordinary cost of replacing public parkland. These new broken promises and costs include: A loss of six jobs rather than 55 new jobs at parking garages built after the Yankees demanded the new structures as part of the stadium deal1 Likely default on tax-exempt bonds held by the Bronx Parking Development Co., which built and manages the garages. Private shareholders will be on the hook, but the public may shoulder maintenance costs and the construction of any new buildings. Only three public ball fields replace the five that Bronx residents could use before the Yankees took over their parkland, and players lost six seasons before they opened. Pick-up games will be heavily restricted. No additional dedicated funding has been allocated for the maintenance of the replacement park facilities. The new stadium also has failed to create the thousands of jobs that government leaders claimed justified the enormous subsidies. If we had Fair Elections with public financing, itd be a major stop toward ending expensive giveaways to undeserving private entities. Heres the whole story: What they gave: Yankee contributions to New York political campaigns To build its new stadium in the Bronx, the Yankeesthe most valuable team in baseball with a value pegged at $950 millionneeded the support of state and city elected officials. (The teams value is now at least $1.7 billion, the third highest valued sports team in the world.2) In particular, the state legislature had to approve the seizure of 22 acres of heavily used public parkland. The Yankees were able to secure that support in record time over the vociferous opposition of local residents, community organizations and parks advocates. How did the Yankees pull it off? Our review of the teams contributions to New York political campaigns

Center for Working Families 1133 Broadway, Suite 332, New York, NY 10010 (212) 206-9168 www.cwfny.org

shows how campaign cash heavily influenced legislative decision-making: The Yankees contributed $50,000 to the Bronx Democratic County Committee from 2005 to 2010.3 Top Yankee officials contributed a total of $25,600 to the campaigns of city and state politicians key to the stadiums development.4 They made these gifts from 2003 to 2006. Assembly Member Jose Rivera, former head of the Bronx Democratic County Committee, and his children received $8,850 in campaign contributions from the Yankees between 2006 and 2008. Republican Senator Joseph Bruno, then majority leader, received $18,000 from the Yankees between 2006 and 2008. The Yankees paid more than $300,000 in the first quarter of 2006 to the Mirram Group, a firm run by Roberto Ramirez, a former Bronx Assembly member and chair of the Bronx Democratic Party who had long-term relationships with Bronx elected officials. This was the single largest lobbying fee registered in the city in 2006.5

What the Yankees got in return: State, city and other government subsidies As the Yankees spread the wealth to politicians, New York City and New York State each faced multibillion dollar budget gaps, and the Bronx Bombers home borough remained the poorest urban county in the nation, with 43 percent of Bronx children living below poverty line. But this did not faze elected officials. In June 2005, a member of the Bronx County Democratic Committee, Assembly Member Carmen Arroyo, and Senator Frank Padavan introduced bills authorizing the seizure of the Bronx parkland. The legislation was supported by the New York City Council and other city officials. Within eight days, the state legislature passed both bills. Government Subsidies to the Yankees6 Taxpayer Subsidies New York City subsidies

Direct subsidies for land/infrastructure Forgone property taxes, sales taxes, and income taxes on bond interest Rent rebates

Amount

$203.9 million $166.8 $13.4

City TOTAL State Subsidies

Direct subsidies for garage construction and stadium maintenance Forgone sales taxes and income taxes on bond interest

$384.1 million

$74.7 $33.3

State TOTAL MTA Subsidies

Metro-North station

$108 million

$51.2

MTA TOTAL Federal Subsidies

Forgone income taxes on bond interest (for stadium and garages)

$51.2 million $120.2 $120.2 million $663.5 million

Federal total TOTAL

The legislation passed in 2005 and the takeover of public parkland began in early in 2006. Tax breaks, subsidies and other benefits, secured through the New York City Economic Development Corporation and other entities, continued to roll in. Replacement of much the public parkland was finally completed in 2011, two years behind schedule. The new stadium has failed to create the thousands of jobs that government leaders offered as justification for the enormous subsidies. Meanwhile, local business owners now report that the new stadium has depressed commercial activity in the surrounding area, though no economic impact study has been conducted. The Solution: Fair Elections with Public Financing Fair elections involve strict contribution limits, public financing for candidates who adhere to those limits and aggressive enforcement. The results? Increased voter participation, limitations on the influence of big money, and even better laws and policies. With sweetheart deals like the one described here, we cant afford not to have fair elections with public financing.

EDC Subsidizes Empty Job Promises, news release, Office of the NYC Comptroller (March 19,2012) Retrieved on April 12, 2012 at http://www.comptroller.nyc.gov/press/2012_releases/pr12-03-025.shtm NYC comptroller report.

2

Badenhausen, Kurt, The Worlds 50 Most Valuable Sports Teams, Forbes (July 12, 2011). Retrieved on April 12, 2012 at http://www.forbes.com/sites/kurtbadenhausen/2011/07/12/the-worlds-50-most-valuable-sports-teams/.

3

All New York State campaign contribution and lobbying data in this report was analyzed by NYPIRG unless otherwise indicated.

4

Insider Baseball: How Current & Former Public Officials Pitched a Community Shutout for the New York Yankees, Report, Good Jobs New York (July 2007). Retrieved on March 12, 2012 at http://goodjobsny.org/sites/default/files/docs/insider_baseball_report.pdf.

5

Brodsky, Richard. (n.d.) The House That You Built. An Interim Report Into the Decision By New York City To Subsidize the New York Stadium.

6

A version of this table appeared in the 2007 report by Good Jobs New York, Insider Baseball: How Current & Former Public Officials Pitched a Community Shutout for the New York Yankees.

You might also like

- IG LetterDocument3 pagesIG Letterjspector100% (1)

- Joseph Ruggiero Employment AgreementDocument6 pagesJoseph Ruggiero Employment AgreementjspectorNo ratings yet

- Cornell ComplaintDocument41 pagesCornell Complaintjspector100% (1)

- NYSCrimeReport2016 PrelimDocument14 pagesNYSCrimeReport2016 PrelimjspectorNo ratings yet

- State Health CoverageDocument26 pagesState Health CoveragejspectorNo ratings yet

- Federal Budget Fiscal Year 2017 Web VersionDocument36 pagesFederal Budget Fiscal Year 2017 Web VersionjspectorNo ratings yet

- Pennies For Charity 2018Document12 pagesPennies For Charity 2018ZacharyEJWilliamsNo ratings yet

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocument8 pagesFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorNo ratings yet

- Opiods 2017-04-20-By Numbers Brief No8Document17 pagesOpiods 2017-04-20-By Numbers Brief No8rkarlinNo ratings yet

- SNY0517 Crosstabs 052417Document4 pagesSNY0517 Crosstabs 052417Nick ReismanNo ratings yet

- Inflation AllowablegrowthfactorsDocument1 pageInflation AllowablegrowthfactorsjspectorNo ratings yet

- Teacher Shortage Report 05232017 PDFDocument16 pagesTeacher Shortage Report 05232017 PDFjspectorNo ratings yet

- Abo 2017 Annual ReportDocument65 pagesAbo 2017 Annual ReportrkarlinNo ratings yet

- 2017 08 18 Constitution OrderDocument27 pages2017 08 18 Constitution OrderjspectorNo ratings yet

- Class of 2022Document1 pageClass of 2022jspectorNo ratings yet

- Siena Poll March 27, 2017Document7 pagesSiena Poll March 27, 2017jspectorNo ratings yet

- Darweesh Cities AmicusDocument32 pagesDarweesh Cities AmicusjspectorNo ratings yet

- Review of Executive Budget 2017Document102 pagesReview of Executive Budget 2017Nick ReismanNo ratings yet

- Youth Cigarette and E-Cigs UseDocument1 pageYouth Cigarette and E-Cigs UsejspectorNo ratings yet

- 2017 School Bfast Report Online Version 3-7-17 0Document29 pages2017 School Bfast Report Online Version 3-7-17 0jspectorNo ratings yet

- Pub Auth Num 2017Document54 pagesPub Auth Num 2017jspectorNo ratings yet

- Oag Sed Letter Ice 2-27-17Document3 pagesOag Sed Letter Ice 2-27-17BethanyNo ratings yet

- Schneiderman Voter Fraud Letter 022217Document2 pagesSchneiderman Voter Fraud Letter 022217Matthew HamiltonNo ratings yet

- Hiffa Settlement Agreement ExecutedDocument5 pagesHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocument55 pages16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorNo ratings yet

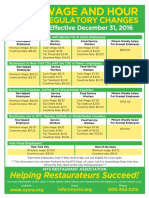

- Wage and Hour Regulatory Changes 2016Document2 pagesWage and Hour Regulatory Changes 2016jspectorNo ratings yet

- 2016 Local Sales Tax CollectionsDocument4 pages2016 Local Sales Tax CollectionsjspectorNo ratings yet

- Voting Report CardDocument1 pageVoting Report CardjspectorNo ratings yet

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Document4 pagesActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorNo ratings yet

- p12 Budget Testimony 2-14-17Document31 pagesp12 Budget Testimony 2-14-17jspectorNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)