Professional Documents

Culture Documents

Full Feasibility Analysis

Uploaded by

Ricardo M Dukha JrOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Full Feasibility Analysis

Uploaded by

Ricardo M Dukha JrCopyright:

Available Formats

Full Feasibility Analysis

From Preparing Effective Business Plans by Bruce R. Barringer

Note: All fields can be expanded to provide additional space to respond to the questions. A copy of this template, along with each of the assessment tools, is also available in PDF format at the authors Web site at www.prenhall.com/entrepreneurship.

Introduction A. Name of the proposed business B. Name of the founder (or founders) C. One paragraph summary of the business Part 1: Product/Service Feasibility Issues Addressed in This Part A. Product/service desirability B. Product/service demand Assessment Tools Concept Statement Test Write a concept statement for your product/service idea. Show the concept statement to 5 to 10 people. Select people who will give you informed and candid feedback. Attached a blank sheet to the concept statement, and ask the people who read the statement to (1) tell you three things they like about your product/service idea, (2) provide three suggestions for making it better, (3) tell you whether they think the product or service idea is feasible (or will be successful), and (4) share any additional comments or suggestions. Summarize the information you obtain from the concept statement into the following three categories: * * * Strengths of the product or service ideathings people who evaluated your product or service concept said they liked about the idea Suggestions for strengthening the ideasuggestions made by people for strengthening or improving the idea Overall feasibility of the product or service conceptreport the number of people who thing the idea is feasible, the number of people who think it isnt feasible, and any additional comments that were made Other comments and suggestions

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Buying Intentions Survey Distribute the concept statement to 15 to 30 prospective customers (do not include any of the people who completed the concept statement test) with the following buying intentions survey attached. Ask each participant to read the concept statement and complete the buying intentions survey. Record the number of people who participated in the survey and the results of the survey here. Along with the raw data recorded here, report the percentage of the total number of people you surveyed that said they would probably buy or definitely would buy your product or service if offered. This percentage is the most important figure in gauging potential customer interest. One caveat is that people who say that they intend to purchase a product do not always follow through, so the numbers resulting from this activity are almost always optimistic. Still, the numbers provide you with a preliminary indication of how your most likely customers will respond to your potential product or service offering. How likely would you be to buy the product or service described above? ______ Definitely would buy ______ Probably would buy ______ Might or might not buy ______ Probably would not buy ______ Definitely would not buy Additional questions may be added to the buying intentions survey. Conclusion (expand fields and report findings, in discussion form, for each area) A. Product/service desirability B. Product/service demand C. Product/service feasibility (circle the correct response) Not Feasible Unsure Feasible D. Suggestions for improving product/service feasibility. Part 2: Industry/Market Feasibility Issues Addressed in This Part A. Industry attractiveness B. Target market attractiveness C. Timeliness of entry into the target market Assessment Tools Industry Attractiveness To the extent possible, assess the industry at the five-digit NAICS code level your potential business will be entering. Use a broader industry category (less NCICS digits) if appropriate (http://www.census.gov/epcd/www/naicstab.htm). Assess the attractiveness of the industry the potential business plans to enter on each of the following dimensions.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

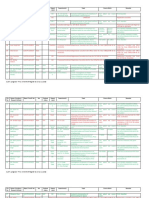

Industry Attractiveness Assessment Tool (used to assess the broad industry, rather than the specific target market, you plan to enter) Low Potential Moderate Potential High Potential 1. Number of competitors Many Few None 2. Age of industry Old Middle aged Young 3. Growth rate of industry Little or no Moderate growth Strong growth growth 4. Average net income for Low Medium High firms in the industry 5. Degree of industry Concentrated Neither Fragmented concentration concentrated nor fragmented 6. 7. Stage of industry life cycle Maturity phase or decline phase Ambivalent Growth phase Would like to have Medium Emergence phase Must have High

Importance of industrys products and/or services to customers 8. Extent to which business Low and environmental trends are moving in favor of the industry 9. Number of exciting new Low product and services emerging from the industry 10. Long-term prospects Weak

Medium

High

Neutral

Strong

Target Market Attractiveness Identify the portion or specific market within your broader industry that you plan to target. Assess the attractiveness of the target market on each of the following dimensions. Target Market Attractiveness Assessment Tool (used to assess the specific target market, rather than the broader industry, you plan to enter) Low Potential Moderate Potential High Potential 1. Number of competitors Many Few None in target market 2. Growth rate of firms in Little to no Slow growth Rapid growth the target market growth 3. Average net income for Low Medium High firms in the target market

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

4. 5. 6.

7.

8.

Methods for generating revenue in the industry Ability to create barriers to entry for potential competitors Degree to which customers feel satisfied by the current offerings in the target market Potential to employ low cost guerrilla and/or buzz marketing techniques to promote the firms product or services Excitement surrounding new product/service offerings in the target market

Low Potential Unclear Unable to create Satisfied

Moderate Potential Somewhat clear May or may not be able to create Neither satisfied or dissatisfied Moderate

High Potential Clear Can create Unsatisfied

Low

High

Low

Medium

High

Market Timeliness Determine the extent to which the window of opportunity for the proposed business is open or closed based on the following criteria. Determine the timeliness of entering a specific target market based on other criteria. Market Timeliness Assessment Tool Low Potential 1. Buying mood of Customers are customers not in a buying mood 2. Momentum of the market Stable to losing momentum 3. Need for a new firm in the Low market with your offerings or geographic location 4. Extent to which business Low and environmental trends are moving in favor of the target market 5. Recent or planned Large firms entrance of large firms entering the into the market market Moderate Potential Customers are in a moderate buying mood Slowly gaining momentum Moderate Medium High Potential Customers are in an aggressive buying mood Rapidly gaining momentum High High

Rumors that large firms may be entering the market

No larger firms entered the market or are rumored to be entering the market

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Conclusion (expand fields and report findings, in discussion form, for each area) A. Industry attractiveness B. Target market attractiveness C. Market timeliness D. Industry/market feasibility (circle the correct response) Not Feasible Unsure Feasible E. Suggestions for improving industry/market feasibility. Part 3: Organizational Feasibility Issues Addressed in This Part A. Management prowess B. Resource sufficiency Assessment Tools Management Prowess Use the following table to candidly and objectively rate the prowess of the founder or group of founders who will be starting the proposed venture. Management Prowess Assessment Tool Low Potential 1. Passion for the business Low idea 2. Relevant industry None experience 3. Prior entrepreneurial None experience 4. Depth of professional Weak and social networks 5. Creativity among Low management team members 6. Experience and expertise None in cash flow management 7. College graduate No college education Moderate Potential Moderate Moderate Moderate Moderate Moderate Moderate Some college education but not currently in college High Potential High Extensive Extensive Strong High High Graduated or are currently in college

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Resource Sufficiency The focus in this section is on nonfinancial resources. Use the following table to rate your resource sufficiency in each category. The list of resources is not meant to be exhaustive. A list of the 6 to 12 most critical nonfinancial resources for your proposed business is sufficient. An explanation of the rating system used in the first portion of the table is as follows: 1 Available 2 Likely to be available: will probably be available and will be within my budget 3 Unlikely to be available: will probably be hard to find or gain access to, and may exceed my budget 4 Unavailable 5 NA: not applicable for my business Resource Sufficiency Assessment Tool Ratings Resource Sufficiency 1 2 3 4 5 Office space 1 2 3 4 5 Lab space, manufacturing space, or space to launch a service business 1 2 3 4 5 Contract manufacturers or outsource providers 1 2 3 4 5 Key management employees (now and in the future) 1 2 3 4 5 Key support personnel (now and in the future) 1 2 3 4 5 Key equipment needed to operate the business (computers, machinery, delivery vehicles) 1 2 3 4 5 Ability to obtain intellectual property protection on key aspects of the business 1 2 3 4 5 Support of local and state government if applicable for business launch 1 2 3 4 5 Ability to form favorable business partnerships Ratings: Strong, Neutral, or Weak Proximity to similar firms (for the purpose of knowledge sharing) Proximity to suppliers Proximity to customers Proximity to a major research university (if applicable)

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Conclusion (expand fields and report findings, in discussion form, for each area) A. Management prowess B. Resource sufficiency C. Organizational feasibility (circle the correct response) Not Feasible Unsure Feasible D. Suggestions for improving organizational feasibility Part 4: Financial Feasibility Issues Addressed in This Part A. Total startup cash needed B. Financial performance of similar businesses C. Overall financial attractiveness of the proposed venture Assessment Tools Total Start-Up Cash Needed The startup costs (which include capital investments and operating expenses) should include all the costs necessary for the business to make its first sale. New firms typically need money for a host of purposes, including the hiring of personnel, office or manufacturing space, equipment, training, research and development, marketing, and the initial product rollout. At the feasibility analysis stage, it is not necessary for the number to be exact. However, the number should be fairly accurate to give an entrepreneur an idea of the dollar amount that will be needed to launch the firm. After the approximate dollar amount is known, the entrepreneur should determine specifically where the money will come from to cover the startup costs. The total startup cash needed can be estimate using the following table.

Total Startup Cash Needed (to Make First Sale) Capital Investments Property Furniture and fixtures Computer equipment Other equipment Vehicles Amount

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Operating Expenses Legal, accounting, and professional services Advertising and promotions Deposits for utilities Licenses and permits Prepaid insurance Lease payments Salary and wages Payroll taxes Travel Signs Tools and supplies Starting inventory Cash (working capital) Other expense 1 Other expense 2 Total Startup Cash Needed =

Amount

Comparison of the Financial Performance of Proposed Venture to Similar Firms Use the following tables to compare the proposed new venture to similar firms in regard to annual sales (Year 1 and Year 2) and profitability (Year 1 and Year 2). Comparison of the Financial Performance of Proposed Venture to Similar Firms Assessment Tool Annual Sales Estimate of Proposed Ventures Annual SalesYear 1 Estimate of Year 1 Sales __________ Summary: How proposed annual sales, on average, compares to similar firms (circle one) Below Average Average Above Average Explanation of How the Estimate Was Computed

Estimate of Year 2 Sales __________ Summary: How proposed annual sales, on average, compares to similar firms (circle one) Below Average Average Above Average

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Net Income Estimate of Proposed Ventures Net IncomeYear 1 Estimate of Year 1 Net Income __________ Summary: How proposed net income, on average, compares to similar firms (circle one) Below Average Average Above Average Explanation of How the Estimate was Computed

Estimate of Year 2 Net Income __________ Summary: How proposed net income, on average, compares to similar firms (circle one) Below Average Average Above Average

Overall Financial Attractiveness of the Proposed Venture The following factors are important in regard to the overall financial attractiveness of the proposed business. Assess the strength of each factor in the following table. Overall Financial Attractiveness of Proposed Venture Assessment Tool Low Potential Moderate Potential High Potential 1. Steady and rapid growth in Unlikely Moderately likely Highly likely sales during the first one to three years in a clearly defined target market 2. High percentage of Low Moderate Strong recurring incomemeaning that once you win a client, the client will provide recurring sources of revenue 3. Ability to forecast income Weak Moderate Strong and expenses with a reasonable degree of certainty 4. Likelihood that internally Unlikely Moderately likely Highly likely generated funds will be available within two years to finance growth 5. Availability of exit Unlikely to be May be available Likely to be opportunity for investor if unavailable available applicable

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Conclusion (report finding for each area) A. Total startup cash needed B. Financial performance of similar businesses C. Financial feasibility (circle the correct response) Not Feasible Unsure D. Suggestions for improving financial feasibility Overall Feasibility: Summary and Conclusion Overall Feasibility of the Business Idea Based on Each Part Product/Market Feasibility Not feasible Unsure Feasible Industry/Market Feasibility Not feasible Unsure Feasible Organizational Feasibility Not feasible Unsure Feasible Financial Feasibility Not feasible Unsure Feasible Overall Assessment Not feasible Unsure Feasible

Feasible

Suggestions for Improving the Feasibility

Conclusionbriefly summarize your justification for your overall assessment.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

You might also like

- The Silicon Valley Way (Review and Analysis of Sherwin Jr.'s Book)From EverandThe Silicon Valley Way (Review and Analysis of Sherwin Jr.'s Book)No ratings yet

- Appendix 3 1Document10 pagesAppendix 3 1Muhammad SaqibNo ratings yet

- Full Feasibility AnalysisDocument13 pagesFull Feasibility Analysisapi-288010181No ratings yet

- Full Feasibility AnalysisDocument15 pagesFull Feasibility Analysisapi-276987332No ratings yet

- Full Feasibility AnalysisDocument14 pagesFull Feasibility Analysisapi-289122077No ratings yet

- Busienss Plan TemplateDocument11 pagesBusienss Plan TemplateHafsa JehangirNo ratings yet

- Full Feasibility AnalysisDocument14 pagesFull Feasibility Analysiskasuri.bilal.donNo ratings yet

- Full Feasibility AnalysisDocument13 pagesFull Feasibility Analysisapi-338950517No ratings yet

- Full Feasibility AnalysisDocument14 pagesFull Feasibility Analysisapi-281781447No ratings yet

- Full Feasibility AnalysisDocument11 pagesFull Feasibility AnalysisJibran SheikhNo ratings yet

- ComfywifiDocument14 pagesComfywifiapi-335838196No ratings yet

- Full Feasibility AnalysisDocument14 pagesFull Feasibility Analysisapi-339252193No ratings yet

- Full Feasibility Analysis FinalDocument12 pagesFull Feasibility Analysis Finalapi-320112581No ratings yet

- Appendix - 3 - 1 Feasibility PDFDocument10 pagesAppendix - 3 - 1 Feasibility PDFsanjay.diddeeNo ratings yet

- Business Plan FormartDocument10 pagesBusiness Plan FormartPAMAJANo ratings yet

- Chp4 ConductingaFeasibilityAnalysisandCraftingaWinningBusinessPlan PDFDocument14 pagesChp4 ConductingaFeasibilityAnalysisandCraftingaWinningBusinessPlan PDFAar RageediNo ratings yet

- DocumentDocument16 pagesDocumentShivkant SinghNo ratings yet

- Full Feasibility AnalysisDocument13 pagesFull Feasibility Analysisapi-276998650No ratings yet

- Feasibility StudyDocument28 pagesFeasibility StudyEdnelle Joyce Leal AgusNo ratings yet

- 02 Idea Assessment Feasibility Analysis Business ModelDocument4 pages02 Idea Assessment Feasibility Analysis Business ModelImaan IqbalNo ratings yet

- The Business Plan FormatDocument9 pagesThe Business Plan FormatJoy CamaclangNo ratings yet

- Sample Contents of A Completed Feasibility StudyDocument4 pagesSample Contents of A Completed Feasibility StudyMatthew DasigNo ratings yet

- Mini Project Report Format GuideDocument16 pagesMini Project Report Format GuideAnamiNo ratings yet

- Feasibility Analysis TemplateDocument15 pagesFeasibility Analysis TemplateVanessa MirandaNo ratings yet

- CARLOS HILADO MEMORIAL STATE COLLEGE Feasibility StudyDocument5 pagesCARLOS HILADO MEMORIAL STATE COLLEGE Feasibility StudyJoshua de JesusNo ratings yet

- The Business Plan FormatDocument11 pagesThe Business Plan Formateun mun kangNo ratings yet

- Chapter 4 Oppotunity ScreeningDocument20 pagesChapter 4 Oppotunity ScreeningClarissNo ratings yet

- The Business Plan FormatDocument8 pagesThe Business Plan FormatImran RehmanNo ratings yet

- Conducting A Feasibility Analysis and Crafting A Winning Business PlanDocument12 pagesConducting A Feasibility Analysis and Crafting A Winning Business PlanAbdiyare Ali AhmedNo ratings yet

- Write A Marketing Plan: Name of Business Owner Name of Business Business AddressDocument24 pagesWrite A Marketing Plan: Name of Business Owner Name of Business Business AddressCamille Monae WhitlowNo ratings yet

- Market Potential by Ajay BansalDocument12 pagesMarket Potential by Ajay BansalajayNo ratings yet

- Screening of New Product IdeasDocument44 pagesScreening of New Product IdeasHitesh13161No ratings yet

- MiS Resource Sufficiency Assessment ToolDocument5 pagesMiS Resource Sufficiency Assessment ToolSheila Mae MalesidoNo ratings yet

- OAP Assignment OverviewDocument4 pagesOAP Assignment OverviewAnonymous UoyfjxDlNo ratings yet

- Feasibility Analysis in EntrepreneurshipDocument32 pagesFeasibility Analysis in EntrepreneurshipMahrukh Chohan100% (1)

- Arthur Andersen Tools and Techniques HandbookDocument42 pagesArthur Andersen Tools and Techniques HandbookZaki Al-TamimiNo ratings yet

- Ethics NotesDocument78 pagesEthics NotesMARVELLS ENTERTAINMENTNo ratings yet

- Preparing Effective Business Plans: An Entrepreneurial ApproachDocument21 pagesPreparing Effective Business Plans: An Entrepreneurial ApproachHafsah Ahmad najibNo ratings yet

- Chapter 3 - Feasibility AnalysisDocument24 pagesChapter 3 - Feasibility AnalysisUmar MasoodNo ratings yet

- Full Feasibility Analysis Latest 1Document8 pagesFull Feasibility Analysis Latest 1api-249683552No ratings yet

- Designing Successful Go To Market SrategiesDocument21 pagesDesigning Successful Go To Market Srategiessaurav_edu67% (3)

- C P: T B P: Ourse Roject HE Usiness LANDocument6 pagesC P: T B P: Ourse Roject HE Usiness LANTabinda KhanNo ratings yet

- FMS Case Book - Sept 2013Document33 pagesFMS Case Book - Sept 2013cizozenatoNo ratings yet

- Entrep 2.2Document24 pagesEntrep 2.2Shane Kimberly LubatNo ratings yet

- Every Business Needs To Have A Written Business PlanDocument6 pagesEvery Business Needs To Have A Written Business PlanRaymond Gregorio TrinidadNo ratings yet

- Case Interview GuideDocument35 pagesCase Interview GuideakrathiNo ratings yet

- Marketing Proposal ASSIGNMENTDocument5 pagesMarketing Proposal ASSIGNMENTNIRMALNo ratings yet

- Find the Right Business with Market ResearchDocument15 pagesFind the Right Business with Market ResearchDanica DimaculanganNo ratings yet

- R Business Plan in A Simple Forma1Document8 pagesR Business Plan in A Simple Forma1Mariel VillaNo ratings yet

- Exam CaballesDocument4 pagesExam CaballesJoshua de JesusNo ratings yet

- Academic Review - Basic ConceptsDocument16 pagesAcademic Review - Basic ConceptsDIVYANSHU SHEKHARNo ratings yet

- businessplan-231204072718-31132f0fDocument30 pagesbusinessplan-231204072718-31132f0florraine barrogaNo ratings yet

- Unit 3: Feasibility Analysis LH 8Document29 pagesUnit 3: Feasibility Analysis LH 8bibukar jung karkiNo ratings yet

- Chapter 2 - The Business Plan Road Map To SuccessDocument52 pagesChapter 2 - The Business Plan Road Map To SuccessFanie SaphiraNo ratings yet

- Writing Business Plan Company HistoryDocument8 pagesWriting Business Plan Company Historyজয় সোমNo ratings yet

- Feasibility Study Analysis for Computer Repair Shop BusinessDocument5 pagesFeasibility Study Analysis for Computer Repair Shop BusinessJoshua de JesusNo ratings yet

- Growth Strategy 2Document8 pagesGrowth Strategy 2Urzin PardiwallaNo ratings yet

- Writing A Feasibility Study: de Villa, John Paul D. CDocument13 pagesWriting A Feasibility Study: de Villa, John Paul D. CJohn Paul de VillaNo ratings yet

- Assessment Task 1Document23 pagesAssessment Task 1revathiNo ratings yet

- NetFax Leadnet Org PDFDocument143 pagesNetFax Leadnet Org PDFzogooNo ratings yet

- Cognitive and Metacognitive ProcessesDocument45 pagesCognitive and Metacognitive ProcessesjhenNo ratings yet

- CIB - PEC Healthy - EN-1Document16 pagesCIB - PEC Healthy - EN-1Lisa GonçalvesNo ratings yet

- Rethinking German IdealismDocument355 pagesRethinking German IdealismNeserina Rengin100% (1)

- Guidebook For All 2020 - 2021 PDFDocument125 pagesGuidebook For All 2020 - 2021 PDFZegera MgendiNo ratings yet

- My Dream CountryDocument7 pagesMy Dream CountryNazhif SetyaNo ratings yet

- Ateneo Zamboanga Nursing FormsDocument17 pagesAteneo Zamboanga Nursing FormsRyan MirandaNo ratings yet

- Math Patterns: Determining Missing Terms in Repeating SequencesDocument5 pagesMath Patterns: Determining Missing Terms in Repeating SequencesFranchescaLoisa Fuga100% (1)

- Cover Letter: Subha Rajagopal 8248274315Document7 pagesCover Letter: Subha Rajagopal 8248274315Yasi HanifNo ratings yet

- Resume of Sahed AhamedDocument2 pagesResume of Sahed AhamedSahed AhamedNo ratings yet

- Universe in Nutshell Hawking ReviewDocument3 pagesUniverse in Nutshell Hawking ReviewVladica Barjaktarovic100% (1)

- Opio Godfree RubangakeneDocument4 pagesOpio Godfree RubangakeneOcaka RonnieNo ratings yet

- MTO Drivers Handbook For Ontario, CanadaDocument145 pagesMTO Drivers Handbook For Ontario, CanadaJo PantulaNo ratings yet

- Commercial Arithmetics PDFDocument2 pagesCommercial Arithmetics PDFDawn50% (2)

- Are To Many People Going To CollegeDocument2 pagesAre To Many People Going To Collegektrout919No ratings yet

- Start Up Guide - How To Become A Truck Dispatcher eDocument12 pagesStart Up Guide - How To Become A Truck Dispatcher eDragan LovricNo ratings yet

- Trifles DiscussionDocument11 pagesTrifles Discussionapi-242602081No ratings yet

- Study Guide: IGCSE and AS/A2 Level 2017 - 2018Document45 pagesStudy Guide: IGCSE and AS/A2 Level 2017 - 2018Shakila ShakiNo ratings yet

- Climate Change Education at Nature-Based MuseumsDocument19 pagesClimate Change Education at Nature-Based MuseumsMaria Emilia del CastilloNo ratings yet

- Analysis and Design of A Multi Storied Residential Building of (Ung-2+G+10) by Using Most Economical Column MethodDocument8 pagesAnalysis and Design of A Multi Storied Residential Building of (Ung-2+G+10) by Using Most Economical Column MethoddhanashekarVNo ratings yet

- Guidelines For The USC Vol CorpsDocument3 pagesGuidelines For The USC Vol CorpsAngeli GuadalupeNo ratings yet

- Media Influence & Potential SolutionsDocument5 pagesMedia Influence & Potential SolutionsHìnhxămNơigóckhuấtTimAnhNo ratings yet

- Summer Class 2022 Grammar MaterialsDocument12 pagesSummer Class 2022 Grammar MaterialsRuffa Coletoy AceroNo ratings yet

- IntIntellectual Property Rightsellectual Property RightsDocument3 pagesIntIntellectual Property Rightsellectual Property RightsJosephine TorresNo ratings yet

- 5-Paragraph Essay "The Quote To Chew and Digest"Document2 pages5-Paragraph Essay "The Quote To Chew and Digest"ElennardeNo ratings yet

- ANA StandardsDocument1 pageANA Standardsointeriano100% (1)

- Ph.D. Enrolment Register As On 22.11.2016Document35 pagesPh.D. Enrolment Register As On 22.11.2016ragvshahNo ratings yet

- Eddie Black VitaeDocument5 pagesEddie Black VitaeEddie BlackNo ratings yet

- Frei Universitat PDFDocument167 pagesFrei Universitat PDFalnaturamilkaNo ratings yet

- Sesotho HL P3 May-June 2023Document5 pagesSesotho HL P3 May-June 2023bohlale.mosalaNo ratings yet