Professional Documents

Culture Documents

VAT Carousels

Uploaded by

Anna TyshchenkoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT Carousels

Uploaded by

Anna TyshchenkoCopyright:

Available Formats

IN RE

VAT Carousels

B

by Anna F. Tyshchenko

eing a subject of utmost interest in Europe, VAT carousels remain almost unknown to Ukrainian criminal law practice, lawyers and business. The attention of national legislation and tax authorities is concentrated mostly on identification of so-called tax holes and effective elimination of possible negative consequences of their use. There is no such term as VAT carousel in Ukrainian legislation, no articles and investigations on this topic. At the same time, it can not be left without close attention and consideration.

Since the beginning of the 1980s economies of various countries have suffered billions of dollars losses from the fraud commonly known as VAT carousel. According to Eurasian Group of the FATF 2005 Typologies research Use of fraudulent VAT pay-back schemes in the export of goods and services for the purpose of obtaining proceeds from crime and their laundering, cross border schemes of VAT carousels were discovered in Ukraine as well, though in our country this issue continues to be a terra nova, except for specialists who practice international white collar criminal law.

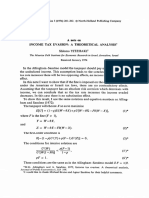

Initial Supplier (EU Country-1)

Invoices (goods)

I believe at this stage it is necessary to increase public awareness of such crime. National criminals are well-known for their successful implementation of world experience and achievements to national realities. Therefore, the public should be guarded in cases when some sharp-witted fraudsters decide to use progressive achievements of the Western criminal mind in the sphere of creation of VAT carousels. So what is a classic VAT carousel? In simple words a VAT carousel is an organized criminal activity that involves a number

Invoices (goods)

110, no VAT

Missing trader (EU Country-2)

Invoices (goods)

Broker (EU Country-2)

110, no VAT

100, VAT

18,55

Invoices (goods)

Unpaid VAT = 17,5

Buffer-1 (EU Country-2)

Invoices (goods)

106, VAT

Buffer-3 (EU Country-2)

Invoices (goods)

102, VAT

104, VAT Buffer-2 (EU Country-2) 0,35 0,35

EU Country-2

Key to the scheme:

Anna F. Tyshchenko is a counsel with ILF Integrites

The amount of VAT due and unpaid by the Missing trader (in coins of account) The amount of VAT received by EU country-2 from Bu ers and the Broker (di erence between output and input VAT (in coins of account) The amount of VAT reimbursed by EU country-2 (in coins of account)

22

May 2012 | The Ukrainian Journal of Business Law | www.ujbl.info

0,35

VAT

IN RE

of legal entities registered as taxpayers in different jurisdictions forming complicated scheme of transactions aimed at attacking the tax system of a State to generate substantial profit. Profit received by fraudsters is formed on the basis of a tax refund. Below there is a figure reflecting a classic scheme of the VAT carousel. It reflects the main principles used in VAT carousels in the countries of European Union. The first transaction is made between companies registered in two countries members of the European Union. During this transaction goods are purchased at zero VAT rate. For convenience let us take the cost of this purchase as 110 coins of account. The second transaction in this particular scheme has some distinctive features: pricedrop made by Missing trader (goods will be sold to Buffer-1 by lowered price 100 coins of account); goods are sold to the company registered in the same country as the Missing trader is; as a consequence of the second transaction an obligation to pay VAT arises for the Missing trader; Missing trader does not pay VAT to the budget of EU Country-2 (it is the reason why this member of the chain is called Missing trader). The third, fourth and fifth transactions are made with the participation of so-called buffer

companies. Their main purpose is to create a distance between the broker and a missing trader who are actually the main figures in the entire scheme. It is not necessary for the missing trader to appear during the second transaction. It may as well occur between two buffers. All the buffers do their accounts correctly and pay VAT (which is actually the difference between output and input VAT) in EU Country-2. At the same time, analysis of complete carousels has shown that the profit of all the Buffers and the Broker in the carousel equals the price drop made by the Missing trader. So those who organized the whole chain do not lose any money, only receive profit at the expense of EU Country-2, which reimburses the full amount of VAT to the Broker after the latter sells goods to another country member of European Union (in this scheme it is the EU Country-1). For the calculations see the table taken from the report of the Financial Action Task Force (FATF). The sixth transaction (and in this scheme the last link) is selling the goods from a broker who will then claim VAT reimbursement in the EU Country-2. The scheme described is of a rather simple nature. In reality VAT carousels are much more complicated. Practice shows that criminals are becoming more and more creative, and today it is usual for the carousel to in-

clude companies from different countries and jurisdictions. Use of third countries and companies registered in off-shore jurisdictions becomes frequent due to the complexity of information exchange with such countries. In some cases the Missing trader and Broker could be registered as taxpayers in different counties. In the last decade there were criminal investigations of VAT carousels, where Ukraine and its taxation system were not jeopardized, but Ukrainian citizens were involved in organization and receiving profits from carousels in other countries (e.g. UK, members of EU). In some cases Ukrainians were found guilty and sentenced for this crime. In this regard it is important to say that at present the Criminal Code of Ukraine does not contain a description of such a crime as VAT carousel or its analogue (this aspect will be analyzed further). And, according to Article 2 of the Criminal Code of Ukraine, the only basis for criminal liability is committing an act that contains corpus delicti, which is specified in this Code. If a persons actions do not meet this requirement, he/ she can not be criminally liable. Part 3 Article 3 of the Code provides that criminal nature of the deed and criminal punishment can be determined exclusively by the Criminal Code of Ukraine. This corresponds to general principle of law, according to which anything that is not specifically forbidden by law is allowed, and

At present the CRImINAl CodE of Ukraine doEs NoT CoNTAIN a dEsCRIpTIoN of sUCh a CRImE as VAT CARoUsEl or its analogue

Table: Laundering the proceeds of VAT carousel fraud, 2007 Profit in a carousel fraud Cost Missing trader Buffer-1 Buffer-2 Buffer-3 Broker Net profit Net profit % 110 100 102 104 106 Sales price 100 102 104 106 110 Profit -10 2 2 2 4 0 0 Input VAT 0 17.5 17.85 18.2 18.55 Output VAT 17.5 17.85 18.2 18.55 0 Net VAT Due to Customs 17.5 0.35 0.35 0.35 -18.55 Net VAT paid/(repaid) per m 0 3500 3500 3500 -185500 -175500 17.5

www.ujbl.info | The Ukrainian Journal of Business Law | May 2012

23

IN RE

VAT

IT Is highly UNlIkEly that a pERsoN dEAlINg with VAT CARoUsEl will bE bRoUghT to CRImINAl lIAbIlITy in Ukraine

also with the provisions of Article 29 of The Universal Declaration of Human Rights: In the exercise of his rights and freedoms, everyone shall be subject only to such limitations as are determined by law solely for the purpose of securing due recognition and respect for the rights and freedoms of others and of meeting the just requirements of morality, public order and the general welfare in a democratic society. So let us examine provisions of Ukrainian criminal law more closely. Among the articles on tax crimes that potentially may be applied to those who organized VAT carousel, it is possible to indicate evasion of taxes, fees or other mandatory payments (Article 212 of the Criminal Code of Ukraine) and Fraudulent actions with financial resources (Article 222 of the Criminal Code of Ukraine). Article 212 provides that evasion of taxes, fees and other mandatory payments means a willful evasion of taxes, fees or other mandatory payments which are the part of the tax system established by law, by an officer of an enterprise, institution or organization of any ownership status, or by any person conducting entrepreneurial activity without establishment of a legal entity, or by any other person liable to pay such taxes, fees or other mandatory payments, where

such actions resulted in actual non-receipt of funds by budgets or special state funds. Article 222 provides that fraudulent actions with financial resources means deliberate providing state authorities, state authorities of Autonomous Republic of Crimea, local government, banks or other creditors with fortiori untruthful information with the aim of receiving subsidies, subventions, grants, credits or tax privileges in cases where there is no evidence of a crime against property. Analysis of the above-mentioned provisions brings one to the conclusion that it is highly unlikely that a person dealing with a VAT carousel will be brought to criminal liability under Article 222 of the Criminal Code of Ukraine as far as the nature of VAT carousels presupposes that the broker provides tax authorities with truthful information. At first glance, Article 212 of the Criminal Code of Ukraine can not be used for this purpose either, as it envisages liability for willful tax evasion only and not for use of unlawful schemes aimed at receiving VAT reimbursement. According to this in the scheme of the VAT carousel only the Missing traders officials can be liable for deliberate tax evasion. However, on deeper consideration the tax authorities can use their experience gained in the fight against tax holes. The position of tax authorities

on this topic is contained in the Letter of the State Tax Administration of Ukraine No.2012/7/101017 of 3 February 2009. Namely, as a result of a tax check, the tax authorities should prepare the appropriate On Check Act, in which the fact of existence of null and void agreements is reflected. Ukrainian legislation contains two different types of null and void agreements. An agreement of the first type can be acknowledged as null and void by a court. Agreements of the second type are considered as null and void according to legislation (in cases when such legal consequence is directly provided by effective legislation) and there is no need to acknowledge them as invalid in court proceedings. According to Articles 215, 228 of the Civil Code of Ukraine agreements concluded with the aim of unlawful taking possession of state property violate public order of Ukraine and such agreements are considered as null and void without any court decisions. Therefore, upon the results of a tax check the null and void nature of agreements concluded in the measures of a VAT carousels chain should be reflected in the Act. This results in further conclusions about unlawful increase of tax credit/amounts due to budget reimbursement which, in turn, mean an unlawful decrease in a taxpayers tax obligations.

END

advertisement

UKRAINIAN LAW FIRMS

Reliable market guide to top law rms and practitioners in Ukraine

Annual market trends and developments Top law rms and vivid practitioners Legislative background update And more

2012

Published

since 2003

Is available on-line: www.ukrainianlawfirms.com

24

May 2012 | The Ukrainian Journal of Business Law | www.ujbl.info

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Misuse of A Right For Contestation (Ukraine)Document1 pageMisuse of A Right For Contestation (Ukraine)Anna TyshchenkoNo ratings yet

- Contract Law 2009 (Deposit Contracts - Peculiarities of Termination in The Light of The Current Financial DepressionDocument2 pagesContract Law 2009 (Deposit Contracts - Peculiarities of Termination in The Light of The Current Financial DepressionAnna TyshchenkoNo ratings yet

- Yurpraktika Tyshchenko Pylypenko Zaochnaya RuletkaDocument1 pageYurpraktika Tyshchenko Pylypenko Zaochnaya RuletkaAnna TyshchenkoNo ratings yet

- ULF 2008 - Written Word RemainsDocument2 pagesULF 2008 - Written Word RemainsAnna TyshchenkoNo ratings yet

- Loan Agreements in UkraineDocument2 pagesLoan Agreements in UkraineAnna TyshchenkoNo ratings yet

- Loan Agreements in UkraineDocument2 pagesLoan Agreements in UkraineAnna TyshchenkoNo ratings yet

- Yurpraktika Tyshchenko Pylypenko Zaochnaya RuletkaDocument1 pageYurpraktika Tyshchenko Pylypenko Zaochnaya RuletkaAnna TyshchenkoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tax Avoidance and Tax EvasionDocument11 pagesTax Avoidance and Tax EvasionYashVardhan100% (1)

- PRINCIPLES OF TAXATIONDocument220 pagesPRINCIPLES OF TAXATIONChristine Gorospe100% (1)

- CIR V GonzalesDocument20 pagesCIR V GonzalesPatatas SayoteNo ratings yet

- A Theoretical Analysis On Tax Auditing-Tax Compliance Determinants and Bomb Crater EffectDocument23 pagesA Theoretical Analysis On Tax Auditing-Tax Compliance Determinants and Bomb Crater EffectmeisyafitriNo ratings yet

- Assessing VAT Collection Performance of Ethiopia's LTODocument89 pagesAssessing VAT Collection Performance of Ethiopia's LTOALEMU BERIENo ratings yet

- A Note On Income Tax Evasion: A Theoretical AnalysisDocument2 pagesA Note On Income Tax Evasion: A Theoretical AnalysisnalaNo ratings yet

- Corruption in IndiaDocument172 pagesCorruption in IndiabobNo ratings yet

- 28 CIR Vs TodaDocument17 pages28 CIR Vs TodaYaz CarlomanNo ratings yet

- Guide To MVATDocument452 pagesGuide To MVATSagar TeliNo ratings yet

- Detecting High Risk Taxpayers Using Data Mining Techniques: Mehdi Samee Rad Asadollah ShahbahramiDocument5 pagesDetecting High Risk Taxpayers Using Data Mining Techniques: Mehdi Samee Rad Asadollah ShahbahramiamanualNo ratings yet

- Tax PalnningDocument25 pagesTax PalnningVish Nu VichuNo ratings yet

- Financial Crimes - ACC 404 Fraud Examination - 19 October 2021Document98 pagesFinancial Crimes - ACC 404 Fraud Examination - 19 October 2021Bernadette Ruiz AlbinoNo ratings yet

- Tax Effects on Production and EmploymentDocument10 pagesTax Effects on Production and EmploymentTony LithimbiNo ratings yet

- B53 CIR V Pascor Realty and DevelopmentDocument1 pageB53 CIR V Pascor Realty and DevelopmentMiguelNo ratings yet

- Final Report RohiniDocument31 pagesFinal Report RohiniSagar BitlaNo ratings yet

- US Department of Justice Official Release - 02062-06 Tax 802Document2 pagesUS Department of Justice Official Release - 02062-06 Tax 802legalmattersNo ratings yet

- Test 1Document5 pagesTest 1nesrineNo ratings yet

- CIR Vs TransfieldDocument12 pagesCIR Vs TransfieldMiley LangNo ratings yet

- Asefu AdugnaDocument89 pagesAsefu Adugnasintayehu sirahbizuNo ratings yet

- Republic vs. Intermediate Appellate Court 196 SCRA 335Document8 pagesRepublic vs. Intermediate Appellate Court 196 SCRA 335BernsNo ratings yet

- How Successful Is Presumptive Tax in Bringing Informal Operators Into The Tax Net in Zimbabwe? A Study of Transport Operators in BulawayoDocument10 pagesHow Successful Is Presumptive Tax in Bringing Informal Operators Into The Tax Net in Zimbabwe? A Study of Transport Operators in BulawayoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cir vs. CaDocument31 pagesCir vs. CaRodesa AbogadoNo ratings yet

- Abdulsemed Shafi Selected by TayeDocument94 pagesAbdulsemed Shafi Selected by TayeHabtamu YosephNo ratings yet

- Black Market and The Indian EconomyDocument6 pagesBlack Market and The Indian EconomyMehak LIfez TrailingNo ratings yet

- Tax Amnesty, Condonation, Recoupment & CompromiseDocument3 pagesTax Amnesty, Condonation, Recoupment & CompromiseCaliboso DaysieNo ratings yet

- Academy Course NotesDocument208 pagesAcademy Course NotesPhebin PhilipNo ratings yet

- 2014 Validated Status of Governance Cluster InitiativesDocument41 pages2014 Validated Status of Governance Cluster InitiativesGov_Cluster_SecretariatNo ratings yet

- Paddu Main ProjectDocument18 pagesPaddu Main ProjectnagarajanNo ratings yet

- Research 2Document36 pagesResearch 2Hilario Domingo ChicanoNo ratings yet