Professional Documents

Culture Documents

Expl Notes ECIya2012

Uploaded by

ksoskOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expl Notes ECIya2012

Uploaded by

ksoskCopyright:

Available Formats

Explanatory Notes to Estimated Chargeable Income (ECI) Form (YA2012) 1 2 3 4 5 Fill in the estimated chargeable income (ECI) in the

boxes corresponding to the appropriate tax rates. If the ECI is to be taxed at a rate other than the normal corporate tax rate of 17% or the concessionary tax rate of 10%, fill in the appropriate tax rate(s) in the boxes provided. Fill in the ECI, rounded off to the nearest dollar, and not the estimated tax payable in the boxes provided. The ECI should be the gross amount before deducting the exempt amount under the partial tax exemption scheme or tax b exemption scheme for new companies . If you are claiming the tax exemption for new companies , complete the relevant sections in the ECI Form to declare that the company has met all qualifying conditions and indicate its first Year of Assessment (YA). The basis period for the first YA cannot be more than 12 months. Take for example a company that was incorporated on 15 April 2010, has a financial year end of 30 June and had its first set of accounts prepared up to 30 June 2011. As the accounts covered more than 12 months, the company will st nd have to apportion its income to 2 YAs. The 1 YA would be YA 2011 (basis period is 15 April 2010 to 30 June 2010) and 2 YA would be YA 2012 (basis period is 1 July 2010 to 30 June 2011). For further details, please refer to the Tax exemption scheme for new start- up companies on our website http://www.iras.gov.sg. Fill in "0" in the box of the first row if the ECI is NIL. If you are a property developer, your ECI should be reported based on the Completed Contracts Method. Enter the Revenue amount (i.e. the main income source of a company as reflected in its profit and loss account). For instance, the revenue of a trading company would be its gross sales and an investment holding company would be its investment income. Claim for relief If there is a claim for relief, the ECI is computed using one of the following formulas: - For companies under the partial tax exemption scheme Estimated net tax payable (ENTP) < $425.00 $425.00 < Estimated net tax payable (ENTP) < $25,075.00 Estimated net tax payable (ENTP) > $25,075.00

*

6 7 8 9

ECI = ( ECI = ( ECI = (

b

200 x ENTP 8.5 100 x ENTP 8.5 50 x ENTP 8.5

) ) + $5,000 ) + $152,500

- For companies under the tax exemption scheme for new companies $0.00 < Estimated net tax payable (ENTP) < $17,000.00 Estimated net tax payable (ENTP) > $17,000.00

ECI = ( ECI = (

a

100 x ENTP 8.5 50 x ENTP 8.5

) + $100,000 ) + $200,000 S$ $392,500 392,500 152,500 240,000 40,800.00 1,280.00 39,520.00

Example (for companies under the partial tax exemption scheme ): Trade (including an amount of $12,800 which was subject to foreign withholding tax of $1,280) ECI (before deducting exempt amount) a Less: Exempt amount [(75% x $10,000) + (50% x $290,000)] ECI (after deducting exempt amount) Estimated tax thereon @ 17% Less: Double taxation relief (lower of foreign tax paid or Singapore tax payable) Estimated net tax payable (ENTP) Using the formula, ECI =( =(

50 x ENTP 8.5 50 x $39,520 8.5

) + $152,500 ) + $152,500

= $384,970 Fill in the ECI to be taxed at 17% as 384970. Example (for companies under the tax exemption scheme for new companies ): Trade (including an amount of $12,800 which was subject to foreign withholding tax of $640) ECI (before deducting exempt amount) b Less: Exempt amount [(100% x $100,000) + (50% x $200,000)] ECI (after deducting exempt amount) Estimated tax thereon @ 17% Less: Double taxation relief (lower of foreign tax paid or Singapore tax payable) Estimated net tax payable (ENTP) Using the formula, ECI =( =(

50 x ENTP 8.5 50 x $41,860 8.5

b

S$ 450,000 450,000 200,000 250,000 42,500.00 640.00 41,860.00

) + $200,000 ) + $200,000

= $446,235 Fill in the ECI to be taxed at 17% as 446235.

55 Newton Road, Revenue House, Singapore 307987 Telephone: 1800-356 8622 Facsimile: 6351 4360 http://www.iras.gov.sg

IRIN320/321/2012

10

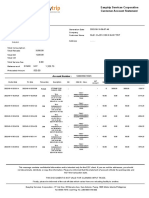

Claim for Group Relief If there is a transfer/ claim of loss items under the Group Relief System, the ECI should be the amount after taking into account the a loss items transferred/ claimed but before deducting the exempt amount under the partial tax exemption scheme or tax exemption b scheme for new companies . Example: Transferor company X Interest income Less: Unutilised capital allowances b/f Current year capital allowance Less: Current year loss Current year unutilised loss Less: Loss items transferred to claimant company Y ECI Fill in the ECI to be taxed at 17% as 0. Claimant company Y Trade income Interest income Less: Loss items transferred from transferor company X ECI (before deducting exempt amount) a Less: Exempt amount [(75% x $10,000) + (50% x $187,000)] ECI (after deducting exempt amount) Fill in the ECI to be taxed at 17% as 197000. Note: If claimant company Y is under the tax exemption scheme for new companies, its ECI after deducting the exempt amount of $148,500 [i.e. {(100% x $100,000) + (50% x $97,000)}] would be $48,500. However, please fill in the ECI to be taxed at 17% as "197000". S$ 215,000 20,000 235,000 38,000 197,000 101,000 96,000 S$ 8,000 10,000 S$ 80,000 18,000 62,000 100,000 38,000 38,000 NIL

11 Please ensure that the ECI Form is duly completed and signed. completing the Form.

th

Also, please provide the name and designation of the person

12 To encourage you to e-file, the number of instalments you get for e-filing your company's ECI is more than that for paper-filing. For e-filers, e-file by the 26 of each qualifying month to enjoy the maximum number of instalments allowable for that month. th For paper-filers, your ECI Form should reach us by the 24 of each qualifying month to enjoy the maximum number of instalments allowable for that month. Example: December year-end company E-file by Number of instalments th 26 January 10 th 26 February 8 th 26 March 6 th After 26 March No instalments Paper-file by th 24 January th 24 February th 24 March th After 24 March Number of instalments 5 4 3 No instalments

If your company qualifies for instalments and has previously paid its tax by instalments, the instalment plan will be sent to your company together with your Notice of Assessment. However, if your company has not paid its tax by instalments previously and would like to do so, please let us know your preference to pay the tax by instalments before you file your ECI. You can email us at ctpayment@iras.gov.sg or contact us on 1800 356 8622. If you are paying by GIRO for the first time, you must complete and submit the GIRO Application Form. For more information, please refer to our website http://www.iras.gov.sg under <Businesses - For companies> <Filing Estimated Chargeable Income (ECI)> <How to file>.

a

A partial tax exemption is given on the first $300,000 of a company's chargeable income which is subject to tax at the normal corporate tax rate: 75% tax exemption for the first $10,000 chargeable income 50% tax exemption for the next $290,000 chargeable income For a qualifying new start-up company, the following exemption is given on the first $300,000 of its normal chargeable income, for any of its first 3 consecutive YAs: Full tax exemption for the first $100,000 chargeable income 50% tax exemption for the next $200,000 chargeable income To qualify for this exemption for each relevant YA, the company must satisfy all the following conditions: It must be incorporated in Singapore; It must be a tax resident in Singapore for that YA of claim; and It must not have more than 20 shareholders where: i) all of the shareholders are individuals throughout the basis period for that YA beneficially and directly holding the shares in their own names; or ii) at least one of the shareholders is an individual beneficially and directly holding at least 10% of the issued ordinary shares of the company throughout the basis period for that YA.

IRIN320/321/2012

55 Newton Road, Revenue House, Singapore 307987 Telephone: 1800-356 8622 Facsimile: 6351 4360 http://www.iras.gov.sg

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- MF15 formula listDocument8 pagesMF15 formula listniveumaNo ratings yet

- Indices and Logrithma PDF December 1 2008-3-16 PM 263kDocument27 pagesIndices and Logrithma PDF December 1 2008-3-16 PM 263kksoskNo ratings yet

- Additional Revision Questions 2 SolutionsDocument11 pagesAdditional Revision Questions 2 SolutionsNicholas TehNo ratings yet

- H2 CHEMISTRY SYLLABUS AND ASSESSMENTDocument48 pagesH2 CHEMISTRY SYLLABUS AND ASSESSMENTSherman HoNo ratings yet

- Indices and Logrithma PDF December 1 2008-3-16 PM 263kDocument27 pagesIndices and Logrithma PDF December 1 2008-3-16 PM 263kksoskNo ratings yet

- Related Rates Problems ExplainedDocument14 pagesRelated Rates Problems Explainedksosk100% (1)

- Make The Grade As and A2 Chemistry Chemistry Revision Guide Edexcel As A2 Modular Nelson Advanced ScienceDocument147 pagesMake The Grade As and A2 Chemistry Chemistry Revision Guide Edexcel As A2 Modular Nelson Advanced Scienceareyouthere92100% (3)

- 2009 Anderson Sec SCH Sec 4 A Maths Prelim Exam Paper 1 Worked SolutionsDocument4 pages2009 Anderson Sec SCH Sec 4 A Maths Prelim Exam Paper 1 Worked SolutionsksoskNo ratings yet

- Stopwatch: T N S N Science ObjectivesDocument7 pagesStopwatch: T N S N Science ObjectivesksoskNo ratings yet

- Hwa Lss2 Eoyexam2009Document23 pagesHwa Lss2 Eoyexam2009ksoskNo ratings yet

- Indices and Logrithma PDF December 1 2008-3-16 PM 263kDocument27 pagesIndices and Logrithma PDF December 1 2008-3-16 PM 263kksoskNo ratings yet

- Bonding How Atoms CombineDocument4 pagesBonding How Atoms CombineLauren HattonNo ratings yet

- SingaporeCitizen3rdyearSPR PTENPENSep2011Document1 pageSingaporeCitizen3rdyearSPR PTENPENSep2011ksoskNo ratings yet

- Citadels Card Game RulesDocument20 pagesCitadels Card Game RulesJohn NgNo ratings yet

- Citadels Card Game RulesDocument20 pagesCitadels Card Game RulesJohn NgNo ratings yet

- Understanding PSLE T-ScoresDocument12 pagesUnderstanding PSLE T-ScoresksoskNo ratings yet

- Ark Ham Horror Game Turn and ReferenceDocument1 pageArk Ham Horror Game Turn and ReferenceksoskNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

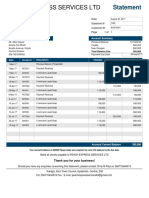

- CashDocument7 pagesCashhellohello100% (1)

- LTA Claim FormDocument1 pageLTA Claim FormSupratikNo ratings yet

- 02-2004 Vat Philippine Port Authority PpaDocument3 pages02-2004 Vat Philippine Port Authority Ppaapi-247793055No ratings yet

- July 2020 E-StatementDocument2 pagesJuly 2020 E-StatementDân TríNo ratings yet

- Mr. Kiran Kumar Midde's bank statement summaryDocument4 pagesMr. Kiran Kumar Midde's bank statement summaryKiran KumarNo ratings yet

- Manila Mandarin Hotels Vs CommissionerDocument2 pagesManila Mandarin Hotels Vs CommissionerEryl Yu100% (1)

- All AcDocument32 pagesAll AcVinod KumarNo ratings yet

- Online Tuition Fee Payment System for Philippine Christian UniversityDocument4 pagesOnline Tuition Fee Payment System for Philippine Christian UniversitydugongandmeNo ratings yet

- Muhammad Qaf Qayyum transaction historyDocument12 pagesMuhammad Qaf Qayyum transaction historyQaf QayyumNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370Ainnur ArifahNo ratings yet

- SAMDS012136Document1 pageSAMDS012136amitNo ratings yet

- What is Letter of Credit? Bank Payment Tool for ExportersDocument2 pagesWhat is Letter of Credit? Bank Payment Tool for ExportersCarlos KarmunNo ratings yet

- Wells Business StatementDocument5 pagesWells Business StatementViolet BowmanNo ratings yet

- Acacia Car Wash Account StatementDocument1 pageAcacia Car Wash Account StatementkajtheviroNo ratings yet

- Haryana CST Return Format Form - 1Document2 pagesHaryana CST Return Format Form - 1Virender SainiNo ratings yet

- Project On Pan Card and Its BenefitsDocument22 pagesProject On Pan Card and Its BenefitsShambhavi SharmaNo ratings yet

- HSBC V CIRDocument16 pagesHSBC V CIRMp CasNo ratings yet

- ESC Customer Account StatementDocument2 pagesESC Customer Account StatementJake CastañedaNo ratings yet

- e-StatementBRImo NEW 1Document3 pagese-StatementBRImo NEW 1dealut123456No ratings yet

- Case Digest of GR No 153204Document1 pageCase Digest of GR No 153204Ivan ChuaNo ratings yet

- Direct Tax Interview Questions For ArticleshipDocument15 pagesDirect Tax Interview Questions For ArticleshipAayush GamingNo ratings yet

- Boi MF Common Application FormDocument3 pagesBoi MF Common Application FormQUSI E. ABDNo ratings yet

- SharonDocument6 pagesSharonLucky LuckyNo ratings yet

- Beps 6.michael LangDocument11 pagesBeps 6.michael Langflordeliz12100% (1)

- Income Taxation - Win Ballada 19th EditionDocument11 pagesIncome Taxation - Win Ballada 19th EditionAshley GomezNo ratings yet

- Fauji Cement Manual Hoist QuoteDocument2 pagesFauji Cement Manual Hoist QuoteAdeeb ShahzadaNo ratings yet

- Solved Whaleco Acquired All of The Common Stock of Minnowco EarlyDocument1 pageSolved Whaleco Acquired All of The Common Stock of Minnowco EarlyAnbu jaromiaNo ratings yet

- The Equity Implications of Taxation: Tax IncidenceDocument36 pagesThe Equity Implications of Taxation: Tax IncidenceSatria Hadi LubisNo ratings yet

- Gida - Industrial Plot Allotment Scheme - 2020Document4 pagesGida - Industrial Plot Allotment Scheme - 2020VIJAY PAREEKNo ratings yet

- Inv 407306401237Document2 pagesInv 407306401237hesima4637 bodeem.comNo ratings yet