Professional Documents

Culture Documents

Multinational Business Finance 12th Edition Slides Chapter 16

Uploaded by

Alli Tobba0 ratings0% found this document useful (0 votes)

728 views24 pagesA firm has an optimal financial structure determined by that particular mix of debt and equity that minimizes the firm's cost of capital. Domestic theory of optimal financial structures must be modified to accommodate the case of the multinational firm. A multinational firm's marginal cost of capital is constant for considerable ranges of its capital budget.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA firm has an optimal financial structure determined by that particular mix of debt and equity that minimizes the firm's cost of capital. Domestic theory of optimal financial structures must be modified to accommodate the case of the multinational firm. A multinational firm's marginal cost of capital is constant for considerable ranges of its capital budget.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

728 views24 pagesMultinational Business Finance 12th Edition Slides Chapter 16

Uploaded by

Alli TobbaA firm has an optimal financial structure determined by that particular mix of debt and equity that minimizes the firm's cost of capital. Domestic theory of optimal financial structures must be modified to accommodate the case of the multinational firm. A multinational firm's marginal cost of capital is constant for considerable ranges of its capital budget.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

Chapter 16

Sourcing Debt Globally

Copyright 2010 Pearson Prentice Hall. All rights reserved.

Optimal Financial Structure

The domestic theory of optimal financial structure must be modified considerably to encompass the multinational firm. Most finance theorists are now in agreement about whether an optimal financial structure exists for a firm, and if so, how it can be determined. When taxes and bankruptcy costs are considered, a firm has an optimal financial structure determined by that particular mix of debt and equity that minimizes the firms cost of capital for a given level of business risk. As the business risk of new projects differs from the risk of existing projects, the optimal mix of debt and equity would change to recognize tradeoffs between business and financial risks.

16-2

Copyright 2010 Pearson Prentice Hall. All rights reserved.

Optimal Financial Structure

The following exhibit illustrates how the cost of capital varies with the amount of debt employed. As the debt ratio increases, the overall cost of capital (kWACC) decreases because of the heavier weight of low-cost (due to taxdeductibility) debt ([kd(1-t)] compared to high cost equity (ke).

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-3

Exhibit 16.1 The Cost of Capital and Financial Structure

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-4

Optimal Financial Structure and the MNE

The domestic theory of optimal financial structures needs to be modified by four more variables in order to accommodate the case of the MNE.

These variables include:

Availability of capital Diversification of cash flows

Foreign exchange risk

Expectations of international portfolio investors

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-5

Optimal Financial Structure and the MNE

Availability of capital:

A multinational firms marginal cost of capital is constant for considerable ranges of its capital budget

This statement is not true for most small domestic firms (as they do not have equal access to capital markets), nor for MNEs located in countries that have illiquid capital markets (unless they have gained a global cost and availability of capital)

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-6

Optimal Financial Structure and the MNE

Diversification of cash flows:

The theoretical possibility exists that multinational firms are in a better position than domestic firms to support higher debt ratios because their cash flows are diversified internationally

As returns are not perfectly correlated between countries, an MNE might be able to achieve a reduction in cash flow variability (much in the same way as portfolio investors who diversify their security holdings globally)

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-7

Optimal Financial Structure and the MNE

Foreign exchange risk:

When a firm issues foreign currency denominated debt, its effective cost equals the after-tax cost of repaying the principal and interest in terms of the firms own currency

This amount includes the nominal cost of principal and interest in foreign currency terms, adjusted for any foreign exchange gains or losses

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-8

Optimal Financial Structure and the MNE

Expectations of International Portfolio Investors:

The key to gaining a global cost and availability of capital is attracting and retaining international portfolio investors If a firm wants to raise capital in global markets, it must adopt global norms that are close to the US and UK norms as these markets represent the most liquid and unsegmented markets

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-9

Financial Structure of Foreign Subsidiaries

If the theory that minimizing the cost of capital for a given level of business risk and capital budget is an objective that should be implemented from the perspective of the consolidated MNE, then the financial structure of each subsidiary is relevant only to the extent that it affects this overall goal.

In other words, an individual subsidiary does not really have an independent cost of capital; therefore its financial structure should not be based on an objective of minimizing it.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-10

Financial Structure of Foreign Subsidiaries

Advantages to implementing a financing structure that conforms to local norms: Reduction in criticisms Improvement in the ability of management to evaluate ROE relative to local competitors Determination as to whether or not resources are being misallocated (cost of local debt financing versus returns generated by the assets financed)

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-11

Financial Structure of Foreign Subsidiaries

Disadvantages to localization:

MNEs are expected to have a competitive advantage over local firms in overcoming imperfections in national capital markets; there would then be no need to dispose of this competitive advantage and conform

Consolidated balance sheet structure may not conform t any countrys norm (increasing perceived financial risk and cost of capital to the parent) Local debt ratios are really only cosmetic as lenders will ultimately look to the parent, and its consolidated worldwide cash flow as the source of debt repayment

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-12

Financial Structure of Foreign Subsidiaries

In addition to choosing an appropriate financial structure for foreign subsidiaries, financial managers of MNEs must choose among alternative sources of funds to finance the foreign subsidiary. These funds can be either internal to the MNE or external to the MNE. Ideally the choice should minimize the cost of external funds (after adjusting for foreign exchange risk) and should choose internal sources in order to minimize worldwide taxes and political risk.

Simultaneously, the firm should ensure that managerial motivation in the foreign subsidiaries is geared toward minimizing the firms worldwide cost of capital

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-13

Exhibit 16.2 Internal Financing of the Foreign Subsidiary

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-14

Exhibit 16.3 External Financing of the Foreign Subsidiary

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-15

International Debt Markets

The international debt market offers the borrower a wide variety of different maturities, repayment structures, and currencies of denomination. The markets and their many different instruments vary by source of funding, pricing structure, maturity, and subordination or linkage to other debt and equity instruments. The three major sources of debt funding on the international markets are depicted in the following exhibit.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-16

Exhibit 16.4 International Debt Markets and Instruments

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-17

International Debt Markets

Bank loans and syndications:

International bank loans have traditionally been sourced in the Eurocurrency markets, there is a narrow interest rate spread between deposit and loan rates of less than 1%.

Eurocredits are bank loans to MNEs, sovereign governments, international institutions, and banks denominated in Eurocurrencies and extended by banks in countries other than the country in whose currency the loan is denominated. The syndication of loans has enabled banks to spread the risk of very large loans among a number of banks (this is significant for MNEs as they usually need credit in an amount larger than a single banks loan limit).

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-18

International Debt Markets

The Euronote market:

Euronotes and Euronote facilities are short to medium in term and are either underwritten and non-underwritten

Euro-commercial paper is a short-term debt obligation of a corporation or bank (usually denominated in US dollars) Euro medium-term notes is a new entrant to the worlds debt markets, which bridges the gap between Euro-commercial paper and a longerterm and less flexible international bond

16-19

Copyright 2010 Pearson Prentice Hall. All rights reserved.

International Debt Markets

The International Bond Market:

A Eurobond is underwritten by an international syndicate of banks and other securities firms and is sold exclusively in countries other than the country in whose currency the issue is denominated A foreign bond is underwritten by a syndicate composed of members from a single country, sold principally within that country, and denominated in the currency of that country The Eurobond markets differ from the Eurodollar markets in that there is an absence of regulatory interference, less stringent disclosure rules and favorable tax treatments for these bonds

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-20

International Debt Markets

Unique Characteristics of Eurobond Markets:

Absence of regulatory interference

National governments often impose tight controls on foreign issuers of securities denominated in local currencies. However, governments in general have less stringent limitations for securities denominated in foreign currencies and sold within their markets

Less stringent disclosure

Disclosure requirements less stringent than those of the SEC

Favorable tax status

Eurobonds offer tax anonymity and flexibility. Interest paid on Eurobonds is generally not subject to an income withholding tax

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-21

Mini-Case Questions: Tirstrup Biomechanics (Denmark)

Which of the many debt characteristics currency, maturity, cost, fixed versus floating rate do you believe are of the highest priority for Julie and Tirstrup? Does the currency of denomination depend on the currency of the parent or the currency of the business unit that will be responsible for servicing the debt? Exhibit 1 is Julies spreadsheet analysis of what she considers relevant choices. Using these, what would you recommend as a financing package?

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-22

Chapter 16

Additional Chapter Exhibits

Copyright 2010 Pearson Prentice Hall. All rights reserved.

Exhibit 1

Copyright 2010 Pearson Prentice Hall. All rights reserved.

16-24

You might also like

- Exchange Rate DeterminationDocument18 pagesExchange Rate DeterminationBini MathewNo ratings yet

- Libor Outlook - JPMorganDocument10 pagesLibor Outlook - JPMorganMichael A. McNicholasNo ratings yet

- Corporate Finance FinalsDocument66 pagesCorporate Finance FinalsRahul Patel50% (2)

- Types of SwapsDocument25 pagesTypes of SwapsBinal JasaniNo ratings yet

- Structural - Analysis - Skid A4401 PDFDocument94 pagesStructural - Analysis - Skid A4401 PDFMohammed Saleem Syed Khader100% (1)

- Swaps: Chapter SixDocument25 pagesSwaps: Chapter SixPavithra GowthamNo ratings yet

- Chapter 12 International Bond Markets Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument6 pagesChapter 12 International Bond Markets Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsMona AgarwallaNo ratings yet

- FIxed Income PresentationDocument277 pagesFIxed Income PresentationAlexisChevalier100% (1)

- 14 Interest Rate and Currency SwapsDocument28 pages14 Interest Rate and Currency SwapslalitjaatNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 12Document33 pagesMultinational Business Finance 12th Edition Slides Chapter 12Alli Tobba100% (1)

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Practice Questions - International FinanceDocument18 pagesPractice Questions - International Financekyle7377No ratings yet

- 2 Forward Rate AgreementDocument8 pages2 Forward Rate AgreementRicha Gupta100% (1)

- SwapsDocument44 pagesSwapsAditya Paul SharmaNo ratings yet

- Derivatives Individual AssignmentDocument24 pagesDerivatives Individual AssignmentCarine TeeNo ratings yet

- Introduction To Foreign Exchange Rates, Second EditionDocument32 pagesIntroduction To Foreign Exchange Rates, Second EditionCharleneKronstedt100% (1)

- FI - Overview of Cross Currency Swaps Via Swap PricerDocument59 pagesFI - Overview of Cross Currency Swaps Via Swap PricerDao QuynhNo ratings yet

- Riding The Yield Curve 1663880194Document81 pagesRiding The Yield Curve 1663880194Daniel PeñaNo ratings yet

- Multinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Document229 pagesMultinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Alli Tobba83% (12)

- Multinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Document229 pagesMultinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Alli Tobba83% (12)

- Interest Rate SwapsDocument12 pagesInterest Rate SwapsChris Armour100% (1)

- 1310 - LIBOR $OFR Transition WebinarDocument23 pages1310 - LIBOR $OFR Transition WebinarChuluunbaatar UurstaikhNo ratings yet

- International Finance CasesDocument20 pagesInternational Finance CasesCaesar ZTinuNo ratings yet

- IFS International BankingDocument39 pagesIFS International BankingVrinda GargNo ratings yet

- 14 Interest Rate and Currency SwapsDocument45 pages14 Interest Rate and Currency SwapsJogendra BeheraNo ratings yet

- Interest Rate Parity: by - Alpana Kaushal Deepak Verma Seshank Sarin Mba (Ib)Document14 pagesInterest Rate Parity: by - Alpana Kaushal Deepak Verma Seshank Sarin Mba (Ib)Deepak SharmaNo ratings yet

- Solutions Chapters 10 & 11 Transactions and Economic ExposureDocument46 pagesSolutions Chapters 10 & 11 Transactions and Economic ExposureJoão Côrte-Real Rodrigues50% (2)

- Interest Rate SwapDocument7 pagesInterest Rate SwapAnonymous UJWnCouYNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 11Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 11Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 11Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 11Alli TobbaNo ratings yet

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketFrom EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo ratings yet

- VISCOSITY CLASSIFICATION GUIDE FOR INDUSTRIAL LUBRICANTSDocument8 pagesVISCOSITY CLASSIFICATION GUIDE FOR INDUSTRIAL LUBRICANTSFrancisco TipanNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 18Document39 pagesMultinational Business Finance 12th Edition Slides Chapter 18Alli Tobba0% (1)

- Multinational Business Finance 12th Edition Slides Chapter 19Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 19Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 01Document25 pagesMultinational Business Finance 12th Edition Slides Chapter 01Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 08Document44 pagesMultinational Business Finance 12th Edition Slides Chapter 08Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 02Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 02Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 03Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 03Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 09Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 09Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 20Document32 pagesMultinational Business Finance 12th Edition Slides Chapter 20Alli Tobba100% (2)

- Multinational Business Finance 12th Edition Slides Chapter 21Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 21Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 07Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 07Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 13Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 13Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 06Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 06Alli Tobba100% (1)

- Multinational Business FinanceDocument95 pagesMultinational Business FinancebhargaviNo ratings yet

- Week 3 - Ch8 - Interest Rate Risk - The Repricing ModelDocument12 pagesWeek 3 - Ch8 - Interest Rate Risk - The Repricing ModelAlana Cunningham100% (1)

- Exchange Rates, Interest Rates, and Inflation RatesDocument19 pagesExchange Rates, Interest Rates, and Inflation RatesAnNa SouLsNo ratings yet

- SM Multinational Financial Management ch09Document5 pagesSM Multinational Financial Management ch09ariftanur100% (1)

- Euro Bond MarketDocument30 pagesEuro Bond MarketSharath PoojariNo ratings yet

- The Subsidiary As A PEDocument6 pagesThe Subsidiary As A PEJorish PaidestroNo ratings yet

- Currency OptionsDocument6 pagesCurrency OptionsDealCurry100% (1)

- Libor TransitionDocument20 pagesLibor TransitionViviana CV100% (1)

- Role of Financial Markets and InstitutionsDocument30 pagesRole of Financial Markets and InstitutionsĒsrar BalócNo ratings yet

- Eun8e CH 005 PPTDocument47 pagesEun8e CH 005 PPTannNo ratings yet

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- M07 MishkinEakins3427056 08 FMI C07Document58 pagesM07 MishkinEakins3427056 08 FMI C07Declan ShuitNo ratings yet

- Chapter 18 - Derivatives and Risk ManagementDocument85 pagesChapter 18 - Derivatives and Risk Managementliane_castañares0% (1)

- International Financial ManagementDocument23 pagesInternational Financial Managementsureshmooha100% (1)

- Interest Rate FuturesDocument22 pagesInterest Rate FuturesHerojianbuNo ratings yet

- Net Stable Funding Ratio (NSFR)Document12 pagesNet Stable Funding Ratio (NSFR)Salman EjazNo ratings yet

- Global Investments PPT PresentationDocument48 pagesGlobal Investments PPT Presentationgilli1trNo ratings yet

- Currency SwapDocument7 pagesCurrency SwaprethviNo ratings yet

- 3 LN14 EitemanDocument49 pages3 LN14 EitemanDevyanshu Singh RajputNo ratings yet

- Chapter 14 - Raising Debt and Equity GloballyDocument46 pagesChapter 14 - Raising Debt and Equity GloballyDuong TrinhNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 20Document32 pagesMultinational Business Finance 12th Edition Slides Chapter 20Alli Tobba100% (2)

- Multinational Business Finance 12th Edition Slides Chapter 21Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 21Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 17Document28 pagesMultinational Business Finance 12th Edition Slides Chapter 17Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 15Document24 pagesMultinational Business Finance 12th Edition Slides Chapter 15Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 09Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 09Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 13Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 13Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 10Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 10Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 05Document54 pagesMultinational Business Finance 12th Edition Slides Chapter 05Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 06Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 06Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 07Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 07Alli Tobba100% (1)

- Samsung Sustainability Report 2011Document94 pagesSamsung Sustainability Report 2011CSRmedia.ro NetworkNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 04Document46 pagesMultinational Business Finance 12th Edition Slides Chapter 04Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 03Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 03Alli TobbaNo ratings yet

- Samsung Sustainability Report 2011Document94 pagesSamsung Sustainability Report 2011CSRmedia.ro NetworkNo ratings yet

- Service: Audi A6 1998Document256 pagesService: Audi A6 1998Kovács EndreNo ratings yet

- UTC awarded contracts with low competitionDocument2 pagesUTC awarded contracts with low competitioncefuneslpezNo ratings yet

- Primary Homework Help Food ChainsDocument7 pagesPrimary Homework Help Food Chainsafnaxdxtloexll100% (1)

- LDocument32 pagesLDenNo ratings yet

- KS4 Higher Book 1 ContentsDocument2 pagesKS4 Higher Book 1 ContentsSonam KhuranaNo ratings yet

- TESTIS PHYSIOLOGY Spermatogenic Cell Syncytium Makela and Toppari 2018Document10 pagesTESTIS PHYSIOLOGY Spermatogenic Cell Syncytium Makela and Toppari 2018LudimilaNo ratings yet

- 2019 BioscienceJDocument14 pages2019 BioscienceJPatrícia Lima D'AbadiaNo ratings yet

- OV2640DSDocument43 pagesOV2640DSLuis Alberto MNo ratings yet

- Goes 300 S Service ManualDocument188 pagesGoes 300 S Service ManualШурик КамушкинNo ratings yet

- Team Dynamics and Behaviors for Global ExpansionDocument15 pagesTeam Dynamics and Behaviors for Global ExpansionNguyênNo ratings yet

- Robin Engine EH722 DS 7010Document29 pagesRobin Engine EH722 DS 7010yewlimNo ratings yet

- Data Sheet FC SIDocument2 pagesData Sheet FC SIAndrea AtzeniNo ratings yet

- Lending Tree PDFDocument14 pagesLending Tree PDFAlex OanonoNo ratings yet

- Government of The Punjab Primary & Secondary Healthcare DepartmentDocument3 pagesGovernment of The Punjab Primary & Secondary Healthcare DepartmentYasir GhafoorNo ratings yet

- VFD ManualDocument187 pagesVFD ManualgpradiptaNo ratings yet

- Conservation of Kuttichira SettlementDocument145 pagesConservation of Kuttichira SettlementSumayya Kareem100% (1)

- Performance of a Pelton WheelDocument17 pagesPerformance of a Pelton Wheellimakupang_matNo ratings yet

- Module-1 STSDocument35 pagesModule-1 STSMARYLIZA SAEZNo ratings yet

- Bargaining Power of SuppliersDocument9 pagesBargaining Power of SuppliersPiyumi VitharanaNo ratings yet

- Operation Manual TempoLink 551986 enDocument12 pagesOperation Manual TempoLink 551986 enBryan AndradeNo ratings yet

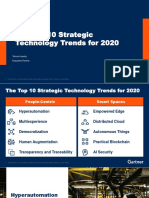

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDocument31 pagesThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloNo ratings yet

- Recent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4Document12 pagesRecent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4sebjangNo ratings yet

- Cypress Enable Basic Rer Erence ManualDocument2 pagesCypress Enable Basic Rer Erence ManualCarlos RodasNo ratings yet

- Funny Physics QuestionsDocument3 pagesFunny Physics Questionsnek tsilNo ratings yet

- Case Study On Vivekananda Flyover BridgeDocument8 pagesCase Study On Vivekananda Flyover BridgeHeta PanchalNo ratings yet

- Case 1 1 Starbucks Going Global FastDocument2 pagesCase 1 1 Starbucks Going Global FastBoycie TarcaNo ratings yet

- Microwave: Microwaves Are A Form ofDocument9 pagesMicrowave: Microwaves Are A Form ofDhanmeet KaurNo ratings yet

- Network Theory - BASICS - : By: Mr. Vinod SalunkheDocument17 pagesNetwork Theory - BASICS - : By: Mr. Vinod Salunkhevinod SALUNKHENo ratings yet