Professional Documents

Culture Documents

Apple Inc - Case Study

Uploaded by

Ahsan ShahidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apple Inc - Case Study

Uploaded by

Ahsan ShahidCopyright:

Available Formats

STRATEGIC MARKETING & PLANNING

Apple pioneered in personal computing, IBM brought PCs into the mainstream in the 1980s. Dell & many other manufacturers built PCs that came to be known as Wintel PCs. Growth in PCs was driven by lower prices & expanding capabilities, Internet demand & emerging markets like China. Early estimates suggested 2 billion PCs would be used in the world by 2015.

Despite declining prices demand fell from 8-9% in the1990s to 2% by 2011. Reason: the IT bubble burst. Contract manufacturing moved to Taiwan & China (lower cost). Demand for laptop computers grew as prices (ASP) dropped below $1,000 to $746 (2011). Mini notebooks arrived after 2009 (ASP $400).

Initial demand for mini notebooks was high: 40 million sold in 2009. Introduction of iPad in 2010 led to a sharp decline in demand for mini notebooks. Ultra-thin, lightweight, Windows-based notebooks introduced in 2011 as high performance PCs, in the hope that demand would go back up as prices came down.

Market divided into five categories: 1. Home consumers (50% of PC users), 2. Small & medium-sized business (SMB), 3. Corporate sector, 4. Education, & 5. Government. Price important for all; home consumers also wanted design, mobility, & Wi-Fi connectivity, business also wanted service & support, education sector wanted software.

Early 1990s PC more knowledgeable customers moved away from full-service dealers; Larger enterprises bought directly from the manufacturer; Home & SMB customers started buying PCs from superstores (Wal-Mart, Costco), electronics retailers, (Best Buy), & online retailers. Generic (white-box) computer sales grew to 30% - small company buyers.

53.6%

Top 4 PC companies HP, Dell, Lenovo, & Acer 53.6% of worldwide shipments in 2011; Leadership shifting with time HP on top in 2011 despite higher price; Dell evolved from build-to-order to retail also; Lenovo to the fore in 2005 taking over business from IBM big domestic market; Acer in US & Europe after acquiring Packard-Bell.

Suppliers of two types: 1. Memory chips, disk drives, keyboard suppliers (Many); 2. Microprocessor & OS suppliers (Microsoft & Intel). Intel share 80% of microprocessor market. Microsoft share of Windows OS >90%. [Windows XP/ Windows 7 successful Vista unsuccessful. Windows 8 due in 2012 now in market].

Since 1990s, large variety of PC applications available; average prices of software declining. Microsoft largest supplier of software for Wintel PCs & Macs as well. Google in market with free productivity software/ Google Apps. In recent years, demand for PC apps on the decline (phones & tablets the reason).

Since early 2000s cell phones, TV set-top boxes, game consoles delivering functionality of PCs e.g. Sony PlayStation used to play DVDs, surf the Web, or play games online. Smartphones have become handheld computers: used for emails, websites visit, other online functions. Tablet computers, in market since 1980s failed to make any impact until iPad arrived in 2010.

60 million tablets sold in 2011.

While many industry insiders worried about impact of digital devices on PC industry, Jobs viewed these devices as part of an integrated strategy to deliver breakthrough user experiences.

In 2001, Apples 25th anniversary, Jobs presented his vision for the Macintosh as the digital hub ideal for modern life built around digital cameras, portable music players, digital camcorders, & mobile phones. Jobs viewed Apples control of both hardware & software, as a means of creating strong competitive advantage.

Apple revamped product line to offer machines that could deliver cutting-edge, tightly integrated user experience. Apple catered to education market, but new PC products focused on home consumers lifestyle. Innovative computer products, like the ultra-thin Mac Air grew rapidly making Apple the third-largest PC vendor in U.S. with 11% unit share in Q4 2011.

The companys main strength remained in the premium-priced PC category with 91% share of PCs sold above $1,000 in the U.S. Overall Apples share grew since 2004, but remained below 5% at the end of 2011.

New OS in 2001 - first fully overhauled platform since 1984, based on UNIX. Upgrades every 12-18 months. Switched to new chip architecture; Invested in new suite of proprietary applications; &

Bet on the Apple Store.

RESULT: Apple convergence towards a single OS for computers, iPhone & other devices.

Since early 1990s, Apple used IBM CPU, PowerPC in Macs. In 2006, Jobs decided to shift Apple on to Intel chips. By the following year, entire Macintosh line ran on Intel. Cost: $1 billion. Apple laptops became faster, used less power. By 2011, notebooks 72% of all Macintosh sales (38% nine years earlier). With Intel Inside, Mac also run Microsoft Windows & applications.

Apple developed new proprietary iLife suite (iPhoto, iTunes, iWeb), while maintaining relations with Microsoft & other key vendors. In 2003, Apple developed its Web browser Safari, replacing Internet Explorer for Mac. Microsoft continued to develop Office suite for Macintosh. Job knew interoperability with Office was critical for Macintosh, but developed iWork productivity apps: Pages, Keynote, & Numbers.

Final piece of Jobs strategy was to open its own retail stores first in McLean, Virginia, in 2001. Apple wanted closer customer interaction: help them appreciate Macintoshs eyecatching designs, & experience Apples software. By 2011, more than half of all Mac retail sales were to new Mac customers. 300 stores in 13 countries, accounted for 13% of total sales revenue.

Apples shift to a digital hub strategy: iPod in 2001, iPhone in 2007 & iPad in 2010. Focus of iPod on simplicity: iPod could sync with Windows & Mac. Available in all price segments (but ASP $50 to $100 higher than competition). Fashion accessories also quite affordable.

With iTunes software & iPod device, consumers could make the computer & iPod work together. iPod thus became the icon of the Digital Age.

Many MP3 digital music players in market but iPod only one with sleek design, simple user interface, large storage capacity (1,000 songs). Apple share of U.S. MP3 market grew to 70% (2007-2012). Nano profit margin 40%. Flash memory 50% cost component of iPod - Apple invested in several memory producers to secure output at best prices.

iTunes store first legal site for music download from five major record labels & thousands of independent music labels, at 99 cents/ song. Downloaded songs could be played on computer, burned onto CD, transferred to iPod.

Within THREE days of launch, one million copies of free iTunes software downloaded; one million songs paid for. By October 2011, 16 billion songs sold.

iTunes store became worlds largest music catalog also offered audiobooks, podcasts, books, movies, & TV shows. After iTunes launch iPod sales quadrupled & multiplied thereafter but profit on iTunes negligible. Apple kept 10% of price 70% went to record label & 20% for card payment processing. Profit came from sales of iPods.

Online music stores Amazon.com, Napster, & Walmart.com offered song downloads at competitive/ discounted prices or had subscription plans with unlimited listening, at $5/ month. Most songs played on the iPod. Music streaming services - Internet radio sites - offered free streaming music, allowed users to create their own playlists, share them, and stream free music like a virtual MP3 player.

Apples worry: future demand for iPods could be impacted by music streaming services. Solution: 1. In June 2007, Apple introduced iPhone. 2. In 2009, Apple bought Lala.com, a music streaming service. Raised speculations that Apple could be exploring alternative model to store & play digital music. Jobs: If you dont cannibalize yourself, someone else will.

At the introduction Steve Jobs said: Every once in a while a revolutionary product comes along that changes everything. Today, were introducing three revolutionary products of this class. The first one is a widescreen iPod with touch controls. The second is a revolutionary mobile phone. And the third is a breakthrough Internet communications device...These are not three separate devices, this is one device, and we are calling it iPhone.

Time magazine called it Invention of the Year. Two & a half years of development efforts under intense secrecy, even from company employees. Estimated development cost $150 million. Entry into mobile phones might have been a risky move for Apple!!

Handsets dominated by Nokia, Motorola, & Samsung: 60% market share. Short product life cycles (6-9 months); Sophisticated technology, including radio technology, Apple had little experience of. Distribution challenges: T-Mobile & Vodafone controlled the networks & phones used on them. In the U.S., Verizon Wireless and AT&T controlled > 60% of the market.

Handset manufacturers depended on operator for subsidy, to lower handset purchase price by $250 or more, based on a two-year service contract. Users also had to access content from operators network. Price competition was severe in the world. In China & India, consumers bought phones for well under $100. Most users only needed a phone to make calls.

By mid-1990s, phones came in more attractive designs & with user-friendly interfaces & camera as well: Nokia the pioneer. Smartphones came in the next decade. High-end phones with multiple functions - mobile phone, Internet browser, email, work device & media player. The iPhone changed the rules in the industry.

A 3.5 inch touch-screen interface, placing commands at users fingertips without a physical keyboard. The iPhone system ran on specially adapted version of Apples OS X platform - iOS. First 8GB model priced at $499, when only 5% handsets sold for $300 or more. Apple initially gave iPhone only to AT&T. No subsidy provided by AT&T it shared revenue with Apple.

First generation iPhone sold 6 million units over five quarters & >1million in the grey market. (Apple revenue loss $1 billion in 3 years from the loss from grey market). Second iPhone model in 2008 designed for 3G network. Pricing model changed - carriers provided subsidy ($400) as revenue sharing dropped. Upgraded iPhones introduced every 12-15 months - 4s in October 2011 (with Siri voice- activated technology bought in 2010).

Apple appointed multiple carriers with tougher commitments (Sprint signed a four year, $15 billion deal, agreed to sell at least 24 million iPhones). With each new generation introduced, Apple dropped price of older models. Big subsidies, low prices on older models, expanded distribution increased revenue & sales to match Samsung smart phones (the leader). Apple made > 50% of cell phone industrys total profit with <4% unit market share.

Steve Jobs wanted control over critical technologies that drove Apples differentiation. Bought two (ARM) microprocessor design companies for between 2008 & 2010. iPhone 4 series was Apples first phone powered by its own processor, called the A4. iPhones wholesale ASP $659 higher than competitors ASPs of $250 - $350. Lower component costs & design improvements reduced cost of manufacture.

Apple become largest customer of Foxconn in China. But after several suicides of Foxconn workers, Apple commissioned a study & discovered serious and pressing violations of the FLAs code of conduct & Chinese labor law. CEO Tim Cook promised quick action to bring Apple subcontractors into compliance.

Four years after launch, iPhone revenue 44% of Apples total revenue. In China, iPhone just taking off (2012): Chinese consumers willing to buy iPhones for up to US$1000. As countries including China & India move to 3G & 4G networks, demand for smartphones expected to rise sharply.

Apple App Store launched in 2008.

First outlet that made it easy to distribute, access, & download apps directly onto the mobile phone. Many apps free paid apps usually started at 99 cents. Software developers welcomed App Store: Apple kept 30% cut on developers app sales.

585,000 apps available: In first 18 months, 4 billion apps downloaded worldwide, to date 25 billion on to iPhones, iPods, & iPads. Apple generated $6.3 billion in revenues from the sale of music, books, & apps paid out >$4 billion to developers.

Apples competitors: horizontal and vertical. Manufacturers such as Samsung Electronics, HTC, LG Electronics, and Motorola followed a horizontal approach they licensed their OS & built own hardware.

iPhones greatest competitor Android phones built on Googles open & free platform. 84 handset makers, chips makers, & operators, back the platform.

Googles competitor to Apples app store, called Play Store, surged in 2010-2011. Developers as keen to develop apps for Androids (81%) as for iPhones (87%). Among handset manufacturers, Samsung most direct competitor.

Samsung volume leader in 2011: Android-based Galaxy S2 handset with Super Amoled screen the brightest in the industry.

Intense competition in smartphones reason for numerous IPR law suits;

Apple took Android manufacturers HTC & Samsung to court. Jobs: I will spend every penny of Apples $40 billion in the bank, to right this wrong. Im going to destroy Android, because its a stolen product. Some iPhone critics complain about its shortcomings: slow on 4G, low battery life. Yet iPhone exceeded all expectations.

Apples iPad launched in March 2010, defined a new device category.

Prior to the iPad, tablets sales accounted for a small share of PC market. More than 450,000 iPads sold in first week. Jobs called it a game changer. By February 2012, 55 million iPads had been sold, surpassing all estimates a $35 billion business for Apple.

iPad originally priced from $499 to $829 in the US. Contrary to smartphones, operators did not subsidize it.

Most tablet owners opted for a WiFionly connection & not go through a network.

Most popular use email, games, watching videos, & shopping online.

iPad could run nearly all iPhone apps. 1,000 new apps soon arrived (200,000 by March 2012) - made up for the deficit.

Early controversy over the iPad erupted when Apple sought to offer its own book store. Amazon most upset lowered prices to $9.99. Apple offered publishers to set their own prices ($12 to $15) for e-books & took 30% commission. Amazon forced by publishers to follow suit. By April 2012, Amazons market share in e-books had fallen to 60%.

Justice Department investigated Apples strategy accusing it of price fixing. Three companies settled - Apple & two other publishers chose to fight. Amazon almost immediately lowered prices back to $9.99 on some books.

Initial retail price of iPad, $499, lower than iPhone wholesale price. Apple still made 25% gross margin.

Its own CPU, lower trade margin, & lower component price (because of volume) reduced cost. Apple also had a third generation product, while competition dependent on Microsoft were a year late.

Android-based tablets introduced in late 2010, secured 38% share by 2011. Three potentially serious competitors: 1. Manufacturers using Googles Android e.g. Samsung (sold 5 million tablets in 2011); 2. Amazon, using open source Android (Kindle Fire at $199 seized 14% market share); & 3. Microsoft-based tablets rearing for entry based on Windows 8 & the Nook backed by Microsoft.

Jobs vision to make Apple a digital hub succeeded but the hub was moving into the cloud. Apple invested $500 million in a huge data center in North Carolina for iCloud that worked with Apple products for free. Google & Microsoft offered their own cloud storage services others (HTC & Samsung) settled for Dropbox a crossplatform cloud storage solution also for free.

Two notable failures: 1. Mac Mini, Apples entry-level desktop, at $599- come without a keyboard or mouse. 2. Apple TV introduced in 2007: set-top box to bring digital video content directly into consumers living rooms over a WiFi connection. Before he died, Jobs claimed to have cracked the code for a next generation TV, expected to be launched in 2013 or 2014.

1. 2. 3. 4. 5. 6. 7.

Ease of use (user-friendly graphic interface; plug-n-play peripherals); Proprietary environments (own OS); Industrial design (clever, innovative design & packaging); Buyer loyalty/ Strong brand; Ecosystem (apps, music, videos, etc.) Economies of scale (low cost producer); Economies of scope (ability to cross-sell iPhones, iPads, & Macs) through Apple Stores

Between 1988 & 2001, Apple suffered in its PCs business - hit rock bottom in 1996. Reasons: 1. Declining differentiation: Although Macs & Wintel PCs not same they are substitutes. 2. Application software: While PC industry saw declining application software prices, Apple unable to benefits because of lower volumes. 3. Operating system: Apple OSX cost $1 billion to develop, not justified by sales volume.

Under John Sculley, Apple tried to: 1. Lower cost & increase volume to attract independent software vendors (ISVs) and amortize the costs of R&D; 2. Create hit products, such as the PowerBook, to drive up margins; & 3. Create a joint venture with IBM to share development costs. But the strategy failed as it was inconsistent. R&D cost for hit products was high.

Cons:

1.

Move was risky & expensive ($1 billion to re-write all their software & redesign hardware;

OS rewrite for Intel & creating software to emulate the old chip in order for the old software to work was difficult. Ultimately, all software had to be rewritten.

2.

Pros:

1.

Switch was critical. IBM did not have low-powered chips that Apple needed to offer thin & light laptops that were growing in popularity.

Intel CPUs were also more powerful than the latest generation Motorola & IBM. If Apple kept its existing suppliers, it risked losing to Wintel PCs.

2.

Timing of move to Intel was perfect booming iPod business provided cover for any issues that could have occurred with Macintosh business. Two years earlier, any hiccup could have killed the company. Two years later, Mac may have lost too much market share. Macintosh share was also no more than 5%.

1.

Points in favor:

App Store: an important strategic move creating an ecosystem around the iPhone; Economies of scope: sharing of marketing, distribution, brand, & codevelopment cost with Mac, iPod, & iPhone;

2.

3.

Economies of scale: Flash memory key component & Apple had strong bargaining power.

Points in favor:

4.

Buyer loyalty: Apple users very loyal introduction of iCloud would discourage switching of Apple-only customers. Increased usage of iPhone in corporate market once employees use them, IT departments would support them.

Declining prices on older models.

5.

6.

1.

2.

3.

Points against: Strong competition from Android OSbased handsets. 80 handset makers including Samsung, HTC, LG Electronics, & Motorola support the Open Handset Alliance. Carriers: Verizon & other carriers unhappy with Apple, & promote other products. Fashion/fad? Some argue iPhone is a fashion item, & fashions are fickle.

Points in favor: 1. Apples first-mover position in the tablet market also generic for tablet now; 2. Enough shelf space - sold online, in Apple stores, & at retailers like Best Buy & Staples. 3. Overall market is growing - tablets could displace some PCs. 4. 200,000 optimized apps for iPad vs. close to zero for Android. 5. Economies of scale.

Points against: 1. Copycat competition, tablets by Samsung, Windows 8, Google after acquisition of Motorola. 2. Alternative business models such as with Amazon - losing money on hardware & making on software & content. 3. Lack of room for more real innovation, e.g., new iPad little better than iPad 2.

1.

There is a big difference between a product advantage & competitive advantage. For competitive advantages, companies have to think about their entire value system: cost drivers, apps, operating system. Companies must have deep understanding of industry driving forces. Apples big mistakes in 1980s &1990s was that it was too inwardlooking.

2.

3.

Companies have to pay careful attention to timing & windows of opportunity. Apples successes & failures also depended on it.

4.

Given that innovation is also cyclical, managers should be looking out for iPod, iPhone, or iPad equivalent to drive the next wave of innovation.

You might also like

- Apple IncDocument49 pagesApple IncSaid Ezz EldinNo ratings yet

- SUMMARY Linking The Balanced Scorecard To Strategy SummaryDocument4 pagesSUMMARY Linking The Balanced Scorecard To Strategy SummaryCamilleNo ratings yet

- Inside Intel InsideDocument2 pagesInside Intel InsideVatsal GoelNo ratings yet

- AppleDocument11 pagesAppleKeerthana Raghu RamanNo ratings yet

- Entrepreneurship & Management of SME AssignmentDocument18 pagesEntrepreneurship & Management of SME AssignmentPratik LawanaNo ratings yet

- Nestle - The Nestle Boycott - Addressing A Wicked Problem, Strategic Solutions Through Financial AnalysisDocument27 pagesNestle - The Nestle Boycott - Addressing A Wicked Problem, Strategic Solutions Through Financial AnalysisLucas Alan BlausteinNo ratings yet

- Nokia Phones - From A Total Success To A Total FiascoDocument16 pagesNokia Phones - From A Total Success To A Total FiascoAbhishek NaugriayaNo ratings yet

- Apple SWOT Analysis and Emerging Tech IntegrationDocument4 pagesApple SWOT Analysis and Emerging Tech IntegrationNishan HamalNo ratings yet

- CP 1660 HTDocument8 pagesCP 1660 HTRahmat RaharjoNo ratings yet

- Unilever-Future Strategy - Sao ChépDocument3 pagesUnilever-Future Strategy - Sao ChépLan PhanNo ratings yet

- The Analysis of Apple Inc. Markeing Mix. 3...Document14 pagesThe Analysis of Apple Inc. Markeing Mix. 3...Sharath PanickerNo ratings yet

- Business Level StrategiesDocument6 pagesBusiness Level StrategiessmashaNo ratings yet

- Apple SWOT Analysis and CompetitorsDocument30 pagesApple SWOT Analysis and CompetitorsmarcosbiesaNo ratings yet

- AltaGas Ltd. - Financial and Strategic SWOT Analysis ReviewDocument7 pagesAltaGas Ltd. - Financial and Strategic SWOT Analysis ReviewCompany_ProfileNo ratings yet

- Qualitative Research Methods: Autumn 2008 Lecturer: Jukka PeltokoskiDocument43 pagesQualitative Research Methods: Autumn 2008 Lecturer: Jukka PeltokoskiNusrat Jahan Mitu100% (1)

- CS-2 Apple - What's NextDocument3 pagesCS-2 Apple - What's NextapapNo ratings yet

- BSE Case StudyDocument2 pagesBSE Case Studykowshik moyyaNo ratings yet

- Apple Case StudyDocument17 pagesApple Case StudyLeopoldo PerezNo ratings yet

- How To Play: Strategy Simulation: The Balanced ScorecardDocument10 pagesHow To Play: Strategy Simulation: The Balanced ScorecardSwati ChorariaNo ratings yet

- Case of HyfluxDocument6 pagesCase of HyfluxMai NganNo ratings yet

- Analyst Apple)Document3 pagesAnalyst Apple)Tapmi SGNo ratings yet

- Room & Board 100911Document6 pagesRoom & Board 100911postitmanNo ratings yet

- Elizabeth, Rizki, Talita - IE 5Document34 pagesElizabeth, Rizki, Talita - IE 5bontjelNo ratings yet

- Electrolux: (Case Example)Document3 pagesElectrolux: (Case Example)sadafmatinNo ratings yet

- Spurring Innovation Through Global Knowledge Management at ProcterDocument12 pagesSpurring Innovation Through Global Knowledge Management at ProcterDinushika Madhubhashini0% (1)

- Lenovo: Porter's Five Forces Model and Porter's Value ChainDocument28 pagesLenovo: Porter's Five Forces Model and Porter's Value ChainHoàng PhongNo ratings yet

- Apple Financial ReportDocument3 pagesApple Financial ReportBig ManNo ratings yet

- Steve Jobs of Apple Inc: Successful Entrepreneur Case StudyDocument4 pagesSteve Jobs of Apple Inc: Successful Entrepreneur Case StudyLâm Lê VănNo ratings yet

- Apple IncDocument7 pagesApple IncSinziana IonescuNo ratings yet

- STP Strategy, 4p's, Loophole, Recommendation On NokiaDocument19 pagesSTP Strategy, 4p's, Loophole, Recommendation On Nokiampx123No ratings yet

- University of Jaffna-Sri Lanka Faculty of Management Studies & CommerceDocument9 pagesUniversity of Jaffna-Sri Lanka Faculty of Management Studies & CommerceTina chackoNo ratings yet

- Final LeadershipDocument25 pagesFinal LeadershipHamayun Rasheed100% (1)

- Apple Inc. Financial Statements AnalysisDocument15 pagesApple Inc. Financial Statements AnalysisDOWLA KHANNo ratings yet

- SCM OF AppleDocument8 pagesSCM OF AppleSai VasudevanNo ratings yet

- Marketing Final Project Blackberry Vs IphoneDocument18 pagesMarketing Final Project Blackberry Vs IphoneSalman MughalNo ratings yet

- MM5012 - Business Strategy and Enterprise Modeling Case Analysis: AppleDocument5 pagesMM5012 - Business Strategy and Enterprise Modeling Case Analysis: AppleNadia Ayuning PutriNo ratings yet

- Profit Planning: Budget - A Quantitative Plan For Acquiring and Using Resources Over A Specified Time PeriodDocument24 pagesProfit Planning: Budget - A Quantitative Plan For Acquiring and Using Resources Over A Specified Time PeriodDahlia Abiera OritNo ratings yet

- Digital Marketing Channels for iPhone "Think DifferentDocument7 pagesDigital Marketing Channels for iPhone "Think DifferentKainatNo ratings yet

- Project Introduction: Chinook DatabaseDocument42 pagesProject Introduction: Chinook DatabaseFiveer FreelancerNo ratings yet

- Rondell Data Corporation - FinalDocument32 pagesRondell Data Corporation - FinalVineet Chauhan100% (1)

- Course: Strategy and Innovation Mini Case Study: AppleDocument9 pagesCourse: Strategy and Innovation Mini Case Study: AppleDavid WatakNo ratings yet

- RhytmDocument25 pagesRhytmJulia Ortiz0% (1)

- Business Strategy and Enterprise Modelling Individual AssignmentDocument7 pagesBusiness Strategy and Enterprise Modelling Individual AssignmentMuhammad RhezaNo ratings yet

- CH 05Document44 pagesCH 05Joan LauNo ratings yet

- Apple Case StudyDocument18 pagesApple Case StudyMohamed FouadNo ratings yet

- A Brief Tutorial On Mistake-Proofing, Poka-Yoke, and ZQCDocument6 pagesA Brief Tutorial On Mistake-Proofing, Poka-Yoke, and ZQCArun SaigalNo ratings yet

- Group 8 Mountain DewDocument4 pagesGroup 8 Mountain DewAnosh DoodhmalNo ratings yet

- Dell Case - Narmin MammadovaDocument12 pagesDell Case - Narmin MammadovaNarmin J. Mamedova100% (1)

- Ctoe Case Study: New Balance Athletic Shoe IncDocument12 pagesCtoe Case Study: New Balance Athletic Shoe IncSakshi ShardaNo ratings yet

- Balaji TelefilmsDocument11 pagesBalaji TelefilmsVedant KumarNo ratings yet

- Apple Inc.'s Global Business Operations and Trade TheoriesDocument5 pagesApple Inc.'s Global Business Operations and Trade TheoriesAmal AbdAllahNo ratings yet

- Louis Vuitton - Final SlidesDocument32 pagesLouis Vuitton - Final SlideszeeshanNo ratings yet

- Strategic ManagentDocument2 pagesStrategic Managentmurtaza259No ratings yet

- YouTube Brand Strategy: Leveraging Channels, Ads and ContentDocument6 pagesYouTube Brand Strategy: Leveraging Channels, Ads and ContentNadia Ayuning PutriNo ratings yet

- MC Case 1 - Mountain DewDocument1 pageMC Case 1 - Mountain DewkaranNo ratings yet

- Apple Inc: Productions & Operations ManagementDocument10 pagesApple Inc: Productions & Operations ManagementHaytham HalawaNo ratings yet

- (MM5012) 29111328 Individual Assignment EditDocument6 pages(MM5012) 29111328 Individual Assignment EdithendrawinataNo ratings yet

- Case Study: Apple's Profitable But Risky StrategyDocument5 pagesCase Study: Apple's Profitable But Risky StrategyYuwarani ShaminiNo ratings yet

- Case Study Apple's Profitable But Risky StrategyDocument3 pagesCase Study Apple's Profitable But Risky StrategyNisha NathaniNo ratings yet

- The Genius of Apple: How Tim Cook and Personal Computing Changed the WorldFrom EverandThe Genius of Apple: How Tim Cook and Personal Computing Changed the WorldNo ratings yet

- Global Work Force Diversity - CM 1 and 2Document37 pagesGlobal Work Force Diversity - CM 1 and 2Ahsan ShahidNo ratings yet

- Project CharterDocument2 pagesProject CharterAhsan ShahidNo ratings yet

- Sales Force, Direct Marketing & Internet SellingDocument29 pagesSales Force, Direct Marketing & Internet SellingAhsan ShahidNo ratings yet

- Strategic Marketing & PlanningDocument23 pagesStrategic Marketing & PlanningAhsan ShahidNo ratings yet

- Cash Flow TimingDocument2 pagesCash Flow TimingAhsan ShahidNo ratings yet

- Hyundai Card Case StudyDocument19 pagesHyundai Card Case StudyAhsan Shahid100% (1)

- Managing Value Chain RelationshipsDocument31 pagesManaging Value Chain RelationshipsAhsan ShahidNo ratings yet

- Project Management (BUDGET)Document2 pagesProject Management (BUDGET)Ahsan ShahidNo ratings yet

- Strategic Brand ManagementDocument31 pagesStrategic Brand ManagementAhsan ShahidNo ratings yet

- Innovation & New Product StrategyDocument41 pagesInnovation & New Product StrategyAhsan Shahid100% (2)

- Hyundai Cards (Case Study)Document40 pagesHyundai Cards (Case Study)Ahsan Shahid100% (1)

- Market Driven StrategyDocument43 pagesMarket Driven StrategyAhsan ShahidNo ratings yet

- Competitve Space (Marketing)Document28 pagesCompetitve Space (Marketing)Ahsan ShahidNo ratings yet

- Corporate, Business & Marketing StrategiesDocument43 pagesCorporate, Business & Marketing StrategiesAhsan ShahidNo ratings yet

- Hyundai Card Case StudyDocument19 pagesHyundai Card Case StudyAhsan Shahid100% (1)

- Strategic Market Segmentation: Prepared By: Ma. Anna Corina G. Kagaoan Instructor College of Business and AccountancyDocument33 pagesStrategic Market Segmentation: Prepared By: Ma. Anna Corina G. Kagaoan Instructor College of Business and AccountancyAhsan ShahidNo ratings yet

- CompensationDocument8 pagesCompensationAhsan ShahidNo ratings yet

- Google - Case StudyDocument53 pagesGoogle - Case StudyAhsan ShahidNo ratings yet

- Ellcot Spinning Mills PresentationDocument22 pagesEllcot Spinning Mills PresentationAhsan ShahidNo ratings yet

- Ellcot Spinning Mills RATIOS & AnalysisDocument3 pagesEllcot Spinning Mills RATIOS & AnalysisAhsan ShahidNo ratings yet

- Selling Process (Sales Management)Document43 pagesSelling Process (Sales Management)Ahsan Shahid100% (1)

- Samsung Electronics Case StudyDocument50 pagesSamsung Electronics Case StudyAhsan Shahid88% (16)

- Common Size Analysis 2009-2011: Balance Sheet Indexed (%)Document1 pageCommon Size Analysis 2009-2011: Balance Sheet Indexed (%)Ahsan ShahidNo ratings yet

- PM (Project Life Cycle)Document22 pagesPM (Project Life Cycle)Ahsan ShahidNo ratings yet

- How To Achieve Performance (HRM)Document13 pagesHow To Achieve Performance (HRM)Ahsan ShahidNo ratings yet

- Attock Annual Rep 2011Document78 pagesAttock Annual Rep 2011Ahsan ShahidNo ratings yet

- 2 Slides Sales CareerDocument14 pages2 Slides Sales CareerAhsan ShahidNo ratings yet

- 2HE Fall2011 SaturdayDocument1 page2HE Fall2011 SaturdayAhsan ShahidNo ratings yet

- Wika Type 111.11Document2 pagesWika Type 111.11warehouse cikalongNo ratings yet

- A Woman's Talent Is To Listen, Says The Vatican - Advanced PDFDocument6 pagesA Woman's Talent Is To Listen, Says The Vatican - Advanced PDFhahahapsuNo ratings yet

- AP Euro Unit 2 Study GuideDocument11 pagesAP Euro Unit 2 Study GuideexmordisNo ratings yet

- A.2.3. Passive Transport Systems MCQsDocument3 pagesA.2.3. Passive Transport Systems MCQsPalanisamy SelvamaniNo ratings yet

- The Graduation Commencement Speech You Will Never HearDocument4 pagesThe Graduation Commencement Speech You Will Never HearBernie Lutchman Jr.No ratings yet

- EE-434 Power Electronics: Engr. Dr. Hadeed Ahmed SherDocument23 pagesEE-434 Power Electronics: Engr. Dr. Hadeed Ahmed SherMirza Azhar HaseebNo ratings yet

- Panasonic TC-P42X5 Service ManualDocument74 pagesPanasonic TC-P42X5 Service ManualManager iDClaimNo ratings yet

- 4 - Complex IntegralsDocument89 pages4 - Complex IntegralsryuzackyNo ratings yet

- Voltaire's Candide and the Role of Free WillDocument3 pagesVoltaire's Candide and the Role of Free WillAngy ShoogzNo ratings yet

- Aquafine Optivenn Series Data SheetDocument8 pagesAquafine Optivenn Series Data SheetKenz ZhouNo ratings yet

- The Polynesians: Task1: ReadingDocument10 pagesThe Polynesians: Task1: ReadingHəşim MəmmədovNo ratings yet

- Trove Research Carbon Credit Demand Supply and Prices 1 June 2021Document51 pagesTrove Research Carbon Credit Demand Supply and Prices 1 June 2021Ceren ArkancanNo ratings yet

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument35 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDrMichelleHutchinsonegniq100% (15)

- Basic Calculus: Performance TaskDocument6 pagesBasic Calculus: Performance TasksammyNo ratings yet

- Where On Earth Can Go Next?: AppleDocument100 pagesWhere On Earth Can Go Next?: Applepetrushevski_designeNo ratings yet

- The Rich Hues of Purple Murex DyeDocument44 pagesThe Rich Hues of Purple Murex DyeYiğit KılıçNo ratings yet

- Biomechanics of Advanced Tennis: January 2003Document7 pagesBiomechanics of Advanced Tennis: January 2003Katrien BalNo ratings yet

- T23 Field Weld Guidelines Rev 01Document4 pagesT23 Field Weld Guidelines Rev 01tek_surinderNo ratings yet

- EMECH 2 MarksDocument18 pagesEMECH 2 MarkspavanraneNo ratings yet

- Tutorial 3Document2 pagesTutorial 3prasoon jhaNo ratings yet

- Write 10 Lines On My Favourite Subject EnglishDocument1 pageWrite 10 Lines On My Favourite Subject EnglishIrene ThebestNo ratings yet

- Digital Citizenship Initiative To Better Support The 21 Century Needs of StudentsDocument3 pagesDigital Citizenship Initiative To Better Support The 21 Century Needs of StudentsElewanya UnoguNo ratings yet

- Main Hoon Na - WikipediaDocument8 pagesMain Hoon Na - WikipediaHusain ChandNo ratings yet

- The Invisible Hero Final TNDocument8 pagesThe Invisible Hero Final TNKatherine ShenNo ratings yet

- Class 9th Chemistry Unit#4 Structure of MoleculesDocument8 pagesClass 9th Chemistry Unit#4 Structure of MoleculesIrfanullahNo ratings yet

- Mark Dean GR6211 Fall 2018 Columbia University: - Choice Theory'Document5 pagesMark Dean GR6211 Fall 2018 Columbia University: - Choice Theory'bhaskkarNo ratings yet

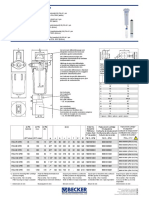

- Medical filter performance specificationsDocument1 pageMedical filter performance specificationsPT.Intidaya Dinamika SejatiNo ratings yet

- Global 6000 SystemsDocument157 pagesGlobal 6000 SystemsJosé Rezende100% (1)

- ChE 135 Peer Evaluation PagulongDocument3 pagesChE 135 Peer Evaluation PagulongJoshua Emmanuel PagulongNo ratings yet

- Bethany Getz ResumeDocument2 pagesBethany Getz Resumeapi-256325830No ratings yet