Professional Documents

Culture Documents

Final ME-1 On Euro Crisis

Uploaded by

shiv029Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final ME-1 On Euro Crisis

Uploaded by

shiv029Copyright:

Available Formats

EURO CRISIS

PRESENTED BY: SAMBIT MOHANTY DHYANANANDA MOHANTY SANKALP PATTANAIK SHREYANSH AGRAWAL SAURABH RAJ SHIV KUMAR SINGH VISHAKHA PANCHBHAI (12202152) (12202134) (12202155) (12202160) (12202156) (12202159) (12202175)

WHAT IS EURO ZONE ?

The Eurozone is the nickname commonly used to describe the member states that use the EUs single currency, the Euro. The idea was first mentioned in the 1970, which led to the establishing of the European Monetary System (EMS), the forerunner of the Economic and Monetary Union (EMU). Established certain budgetary and monetary rules for countries wishing to join the EMU (known

as the convergence criteria).

1. Keep the budget deficit below 3% of GDP; 2. Keep public debt below 60% of GDP 3. Demonstrate long-term price stability 4. Ensure interest rates remain within certain limits for at least 2 years.

Currently there are 17 member states (Germany, France, Italy, Belgium, Luxembourg, the

Netherlands, Spain, Portugal, Ireland, Austria, Finland, Cyprus, Estonia, Greece, Malta, Slovakia,

Slovenia) adopted a single exchange rate, which was set by the European Central Bank . The new Euro notes and coins were launched on 1 January 2002

WHAT IS EUROZONE CRISIS ?

From 2007, the international financial crisis caused a global economic downturn. Within the European Union, some states were particularly badly hit. The debt crisis of Greece which put a question on the stability of the Euro zone's single currency,

the Euro, and the future of the EUs Economic and Monetary Union (EMU).

In April 2010, Euro-zone unemployment reached ,an all-time high of 15.86 million (10.1% of the Euro-zone population). There was a big build-up of debts in Spain and Italy before 2008 but related to private sector i.e. companies and mortgage borrowers who were taking out loans due to which interest rates had

fallen to really low levels in the Southern European countries when they joined the Euro which

acted as fuel to the fire to the debt-fuelled boom.

Germany became an export power house after the euro zone was setup in 1999,

exporting far more to the rest of the world than it was importing. It was earning a lot of

surplus cash on its exports and giving most of the cash as lent to the Southern European countries. During the economic boom unlike other Southern European countries the wages rate kept on increasing, the German kept the wage rate static. As a result Spain and the Italian workers had huge competitive price disadvantage. It became very difficult for the Southern European countries to export and earn. The government borrowings has increased since the 2008 global financial crisis, so it played a small part in creating the Euro-zone crisis.

For countries in the Southern Europe specially SPAIN & ITALY where due to recession

no one wants to spend their hard-earned money . Exports are not up to the mark and not

globally competitive enough to pull the country out of the recession. So in order to control down the overall debt govt. decided to cut down borrowing in order to revive

their economies.

This cost cutting cause many other problems like Unemployment (more than 20% in SPAIN) which decrease the wages making it very hard for general people to pay their debt, spending decrease, it create a huge number of arrears in the already savaged economy of the country.

Secondly, coming to the situation where the governments keep on injecting into the economy then the countries might be on the brink of an financial collapse as there is a limitation on the fund available with the Governments.

Effect of Eurozone Crisis on the Global

The global economy is interrelated, so if major trading blocks like the Eurozone or countries like the US or China go into recession, its likely to affect economic growth around the world. The Eurozone is a massive market for businesses for the United States, China, India, Japan, Russia and the other major world economic powers and if the Euros value gets depreciated it will eventually affect them.

China has considered lending money to Europe, they are that concerned that the Euro may

collapse. The International Monetary Fund (IMF), which was set up to help countries in economic difficulty, set aside hundreds of billions of dollars for a bailout of some of the Eurozone countries.

Effect of Eurozone Crisis on the Global Contd.

The wider world is so keen to see the Euro survive for the following reasons.

To preserve the Eurozones massive consumer market :: Euro is the currency of seventeen nations. 322 millions people uses it for buying goods and services from overseas and if there was a collapse in its value, then they would be unable to buy imports. To prevent a global recession :: By collapse of the Euro some European governments would be unable to repay their huge debt, which will have a negative impact on the world economy and eventually will lead to a global recession with no business investment, no new

hiring, cost cuts, job cuts etc.

To protect the world financial system :: Banks around the globe who have given debt to Eurozone countries also hold large amounts of Euros. If the Euro will fall in value, which could affect them. It could be like the 2007 and 2008 financial crash again, and will put global banking system under threat. This would be bad news for everyone. There are 150 million people in African countries whose currencies are pegged to value the Euro. If the value of the Euro collapses, these African countries will see the value of their

currency collapse too.

GREEK DEBT CRISIS

In the first quarter of 2010 , the national debt of Greece was put at 300 billion euro($413.6 billion) , which is bigger than the countries economy. The Greek debt crisis is an expensive lesson in the importance of fiscal discipline - that comes with a multi-billion-dollar price tag.

Greece has the worst combination, large budget deficit and on of high debt level and

large external debt . Due to decades of overspending, Greece is currently receiving a bailout package of $159 billion (110 billion Euros) from European governments and the International Monetary Fund (IMF) to meet payment obligations.

IMPACT OF GREEK CRISIS

Greek crisis has made investors nervous about lending money to government, through buying government bonds. The bonds & securities of PIIGS country was not bought by any other country as the credit worthiness of these PIIGS countries got eroded .

Big U.S. banks have been lending generously to banks across Europe. Close to 29% of

their lending books during the past two years have gone to their heavyweight European counterparts. There was a impact on private individuals Now Germany and France are demanding for independent monetary & fiscal policy.

THE EUROPEAN BANKS LOANS TO GREECE

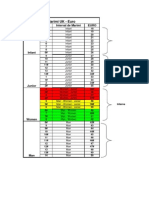

CREDIT RATING DEVELOPMENT OF THE GREEK BONDS (1997-2010)

MAJOR FACTORS THAT CAUSED EURO-ZONE CRISIS

1) Excessive borrowing can make government debt dangerously large (a lack of growth makes

it harder for borrowers to pay back loans and interest). 2) Conflict over who is responsible for bank bail-outs. In a sovereign state, this responsibility clearly lies with the national government that controls the central bank. However, no such clear line of responsibility exists in the Eurozone. 3) Problems when separate countries pursue different macroeconomic policies. Some countries may want to promote growth by lowering interest rates and, in doing so, increasing inflation.

However, other countries may want to keep inflation low to consolidate growth.

4) National economic growth occurring at a faster rate in one country than in other countries. If a countrys economy grows and demand increases, prices will rise and supply will be encouraged, which will reduce demand. This process may be accompanied by an appreciation of the countrys currency. Imports from countries with weaker economies - whose currency has not appreciated at the same rate - will be more attractive. This would allow weaker countries to increase their output, which would appreciate their currency. However, this

process cannot occur in the Eurozone because there is a single currency rate .

MAJOR FACTORS THAT CAUSED EURO-ZONE CRISIS (Contd)

5. Trade imbalances, A trade deficit occurs when the value of a countrys imports exceeds the

value of its exports. A trade surplus is when the opposite occurs.

6. Stabilizing elements of the EMU were not rigorously enforced or followed. 7. The role of the ECB. By issuing loans to countries those are unable to pay them back, setting interest rates low, to encourage investment and job creation, the ECB encouraged excessive borrowing. 8. The global financial crisis. It is also important to remember that some of the problems faced by the Eurozone were caused by problems in the wider global economy and financial system. 9. Countries borrowed too heavily and invested the borrowed money unwisely.

IMPACT OF THE EUROZONE CRISIS ON INDIA

As Euro value fell, the value of dollar against the Indian Rupee increases in a drastic way. As a result of this inflow of money in the economy will be less as Foreign investors would be very conservative in investing their money. One of the biggest outcomes of this would be the rise in price of the fuels, as India primarily depends for fuels in the form of imports. Euro-zone crisis was the result of encouraging high-risk lending and borrowing practices, international trade imbalances and slow economic growth. If the right lessons

are not taken from this INDIA might be the epicenter of another GLOBAL

FINANCIAL CRISIS.

SOME MEASURE TO TACKLE

Cleaning up banks Reducing the public debt in Greece, the only Euro zone country which has likely become insolvent Fostering adjustment and growth in peripheral countries.

Increasing the production in own country so that export and employability can be

increased. Decreasing the wages rate. Investing funds to improve infrastructure and other elements of the economy that could improve growth and competitiveness of the country.

CONCLUSION

The Eurozone is the most adventurous economic Endeavour the world has seen; never before have so many diverse and large economies been integrated both monetarily and economically. The Euro zone's future has huge implications for economic theory and practice. It is perhaps safe to say that the Eurozone is at a crossroads, where European economic integration is set to increase or perhaps fatally stall.

There seem to be a number of paths that the Eurozone could take. First, Estonias impending accession to the Eurozone (in 2011) could prove to be the last for a while if Eurozone leaders lose the stomach for greater integration in the face of continuing economic problems.

CONTINUED

Secondly, the current economic problems could encourage the EU to push for further political and economic integration, tying the political structures of the EU with the economic system of the EMU. This could happen if national governments see it as a way to shift responsibility away from themselves in the event of future economic problems (including trade imbalances, dangerous levels of debt and lack of competitiveness). Thirdly, if member states cannot agree on a suitable reform program, or if the economic conditions proposed by some members are unworkable for others, the Eurozone could disband or devolve into separate, smaller Euro zones (e.g. a Mediterranean, a Central European, and a Baltic version). Those who support the ekstablishing of smaller sub-zones argue that each zone might be more suitable for the economies that comprise it, and therefore could ease the tensions that arise in the bigger, single Eurozone. This advantage, however, would depend on the competitiveness of states within each sub-zone being more comparable

CONTINUED

Another observation was made about the leaders in some countries. These leaders were supposed to understand the situation and bring desired solutions to the crisis. Germany, Netherlands and France never explained the importance of the situation to their people. The reason behind not taking this seriousness to public was the fear for losing the votes and so they acted slowly and didn't take any urgent measures . Thus without any further delays, countries with high debt ratios and macroeconomic disproportions such as Portugal, Spain, Ireland, Greece and Italy should be accommodated with fast and sufficient debt restructuring and macroeconomic and political factors should be made cooperative. If these measures do not take place, then some countries will go through the spiral of the crisis and will be forced to see the negative results of this case.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EN 12208-1999 Windows and Doors - Watertightness - ClassificationDocument6 pagesEN 12208-1999 Windows and Doors - Watertightness - ClassificationSelda KozanogluNo ratings yet

- Реквизиты Для Перевода (На Английском)Document1 pageРеквизиты Для Перевода (На Английском)vanminNo ratings yet

- OB Presentation-Theories of Motivation PresentationDocument7 pagesOB Presentation-Theories of Motivation Presentationshiv029No ratings yet

- Consumer Court Timeframes for Complaints and AppealsDocument2 pagesConsumer Court Timeframes for Complaints and Appealsshiv029No ratings yet

- A LAB Presentation On Consumer RightsDocument14 pagesA LAB Presentation On Consumer Rightsshiv029No ratings yet

- CF Final (1) On PTR Restaurant Mini CaseDocument23 pagesCF Final (1) On PTR Restaurant Mini Caseshiv029No ratings yet

- Debt Crisis of Greece: Lessons For Stable EconomyDocument11 pagesDebt Crisis of Greece: Lessons For Stable EconomyShubham ThakurNo ratings yet

- GDP breakdown by country and currencyDocument1,340 pagesGDP breakdown by country and currencyAlbert LópezNo ratings yet

- QSA Easa Part 145Document1 pageQSA Easa Part 145QSANo ratings yet

- Tabel Marimi UK-EURDocument2 pagesTabel Marimi UK-EURmariela2mNo ratings yet

- Country InfoDocument12 pagesCountry InfoEko YuliantoNo ratings yet

- Greek Debt CrisisDocument12 pagesGreek Debt Crisisjimmy_bhavanaNo ratings yet

- Materjalet ElektrikeDocument2 pagesMaterjalet ElektrikeKlajdi LikcaniNo ratings yet

- List of Important Country Capital and Their CurrencyDocument3 pagesList of Important Country Capital and Their CurrencyAlbus SeverusNo ratings yet

- Is there a future for the EU after the crisisDocument14 pagesIs there a future for the EU after the crisisVishal JainNo ratings yet

- History of Foreign Exchange RatesDocument2 pagesHistory of Foreign Exchange RatesDustin PlaasNo ratings yet

- T24 System Build - Core V1.0Document30 pagesT24 System Build - Core V1.0Quoc Dat TranNo ratings yet

- Country Capital Currency Embassy WebsiteDocument5 pagesCountry Capital Currency Embassy WebsiteMallappaNo ratings yet

- Names of Countries, Capital Cities, Nationalities and Currencies Country Capital Nationality CurrencyDocument2 pagesNames of Countries, Capital Cities, Nationalities and Currencies Country Capital Nationality CurrencyTalhaNo ratings yet

- Euro Coins Catalogue 2012 PDFDocument1 pageEuro Coins Catalogue 2012 PDFPhucNo ratings yet

- Banco Central de Chile - Indicadores Diarios - Euro (Pesos Por Euro) - Año 2017Document9 pagesBanco Central de Chile - Indicadores Diarios - Euro (Pesos Por Euro) - Año 2017Lorena MutizábalNo ratings yet

- Euro To Indian Rupee Exchange Rate History - 21 June 2018 (21!06!2018)Document6 pagesEuro To Indian Rupee Exchange Rate History - 21 June 2018 (21!06!2018)clionpoorNo ratings yet

- EquitiesDocument3 pagesEquitiesnarendermbaNo ratings yet

- Members of NASDAQ OMX Nordic: Member Name Trading ID Member In: Trading IDDocument20 pagesMembers of NASDAQ OMX Nordic: Member Name Trading ID Member In: Trading IDEmmaTgNo ratings yet

- Euro Area Annual Inflation Up To 8.6%: Flash Estimate - June 2022Document2 pagesEuro Area Annual Inflation Up To 8.6%: Flash Estimate - June 2022Milan PetrikNo ratings yet

- Infographic 1 - The Nordic Market Feb19 PDFDocument1 pageInfographic 1 - The Nordic Market Feb19 PDFIggNo ratings yet

- Live Iranian Rial (IRR) Exchange Rates in Iran's Free MarketDocument1 pageLive Iranian Rial (IRR) Exchange Rates in Iran's Free Marketerhan karadenizNo ratings yet

- Conversor de Divisas Online Con FormulasDocument11 pagesConversor de Divisas Online Con FormulasnoeNo ratings yet

- Countries Capitals CurrenciesDocument10 pagesCountries Capitals CurrenciesMuhammad Hassan KhanNo ratings yet

- Cyprus ... A Test Case For Future European Banking Policy: John BrutonDocument2 pagesCyprus ... A Test Case For Future European Banking Policy: John BrutonNasef MohdNo ratings yet

- DOLLAR SPOT FORWARD RATES AGAINST CURRENCIESDocument1 pageDOLLAR SPOT FORWARD RATES AGAINST CURRENCIESAlina IliseiNo ratings yet

- Salary Survey Entry 64 Richard - SteblesDocument498 pagesSalary Survey Entry 64 Richard - SteblesClerenda McgradyNo ratings yet

- French Currency: History of The French FrancDocument2 pagesFrench Currency: History of The French FrancGoutham ShineNo ratings yet

- ID Number Full Name Phone Number Date of BirthDocument6 pagesID Number Full Name Phone Number Date of BirthThái TranNo ratings yet