Professional Documents

Culture Documents

Mobile Technology Adoption in Europe: Is It The End of Mobile

Uploaded by

Sumit RoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mobile Technology Adoption in Europe: Is It The End of Mobile

Uploaded by

Sumit RoyCopyright:

Available Formats

2012 . EMEA Mobile Research Paper .

iProspect

The Mobile Landscape.

Western Europe

An Overview of Local T rends & Global Strategies.

App

Foreward

2012 . EMEA Mobile Research Paper. iProspect

Contents

2012 . EMEA Mobile Research Paper. iProspect

Director Of Mobile, Google EMEA, Ian Carrington

02

Contents Mobile is Huge in EMEA.

Over the last 12 months we have moved to a state where all advertisers understand they need to build and integrate their mobile strategy. There is still a long way to go, many businesses still need to build mobile friendly sites, they need to test engaging mobile formats, they need fully understand the impact of mobile in driving users to retail sites and whether they buy a product whilst there after comparing it on their phone. The days of people debating the value of mobile are over. Advertisers now know without a doubt that the mobile web is the next generation of the web. Introduction About this eBook Data Shaping Y our Approach T actics References About the Studies 04 14 18 34 42 68 72

About TNS NIPO

About iProspect

76

78

03

2012 . EMEA Mobile Research Paper. iProspect

Introduction

04 05

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Global

double by

most of these users will be

internet usage will more than

&

06

2015

mobile

07 5

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Once referred to as the third screen (behind television and desktop computers), mobile devices are fast becoming the first screen for many users.

Experts Say ThatW e Are at the Mobile Inflection Point

The penetration of mobile devices has reached critical mass in most markets. 1 Smartphone shipments in 2012 will account for almost 40 percent of total worldwide handset shipments. 2 Based on recent research, Marin Software predicts that smart mobile devices will account for 25 percent of all paid search ad clicks in Googles network by December 2012. 3 Adults spend more media time on mobile than on newspapers and magazines combined.

4

The on-demand and highly targeted nature of the mobile channel gives brands a seamless way to get in front of the right consumers at the right time with the right advertising content.

08

09

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Are you connecting with and serving your consumers in the mobile marketplace?

Connect: 127.6 million mobile users in the U.S. and 108 million users in Europe consumed mobile media

through their mobile browser or application in 2011, about a 30 percent increase over 2010.

5

30% increase

in mobile media

6

2011

Serve: Sixty-one percent of customers who visit a mobile unfriendly site are likely to go to a competitors site.

As the mobile landscape has matured, consumer expectations have risen. High-quality, fully functional mobile access to brands is no longer a nice-to-have. Its a required element for brands that want to compete. Fortunately, the breadth and depth of mobile marketing opportunities is expanding to meet the growing need for creative and relevant executions.

2010

2010

Bottom line: Businesses with a strong mobile presence have a critical edge over their non-mobile competition.

10

11

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Introduction Section 01

2012 . EMEA Mobile Research Paper. iProspect

Seventy-one percent of smartphone users that see a TV, press or online ad do a mobile search for more information.

7

It s Time to Make Mobile an Integral Part of Y our Marketing Strategy

Googles Mobile Playbook refers to the channel as the connective tissue across marketing channels from outdoor to TV to print.8 In the same way that our mobile devices connect us to each other and all the resources of the Internet, the mobile channel provides a central point-of-contact for all the elements of your marketing campaigns. Integrating mobile provides incremental and extremely relevant opportunities for consumer awareness, engagement and conversion. It puts your brand at consumers fingertips whenever and wherever they are.

Smartphone penetration in Western Europe reaches maturity: +/- 50%

Netherlands: 45% Germany: 47% Spain: 49% UK: 51% Ireland: 51%

Switzerland: 56% Sweden: 58% Norway: 59% UAE: 64% Saudi Arabia: 82%

The global mobile ad market will grow from $3.4 billion in 2010 to $22.0 billion in 2016. 9 Mobile ad revenue will reach an estimated $11.6 billion this year, up 85.4 percent over last year. 10

So, are you connecting with and serving your consumers in the mobile marketplace?

12

13

2012 . EMEA Mobile Research Paper. iProspect

About this eBook

14 15

About this eBook Section 02

2012 . EMEA Mobile Research Paper. iProspect

About this eBook Section 02

2012 . EMEA Mobile Research Paper. iProspect

This eBook is Divided into Three Distinct Sections:

The burgeoning needs of iProspects clients were the genesis for this eBook and the market-specific research behind it. Though the growth of the mobile market is a vast and global reality, there are important, countryspecific nuances in usage patterns, search behaviours, and activity preferences. As iProspect worked with European clients to build and execute effective mobile campaigns, it was discovered there was a lack of relevant data to inform country-specific strategies. To better serve iProspects existing clients and bring state of the art data to bear on some key markets, iProspect partnered with TNS NIPO, one of the worlds largest insight, information, and consultancy groups.

1 United Kingdom

Data

iProspects findings from the research with TNS NIPO

Sweden

Getting StartedWith Mobile Marketing

iProspects insight-driven approach to mobile strategy and execution

Germany

Spain Netherlands

Mobile Tactics Overview

What they are, when to use them, and how to get the best results

To start,lets take a look at the data

16 17

2012 . EMEA Mobile Research Paper. iProspect

Data

18 19

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Use by Location:the iProspect survey looked at location by use across four distinct segments

Indoor

Smartphone

20

Outdoor

Indoor

Tablet

Outdoor

21

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Smartphone

Key Findings: While recent U.S. data shows that the desktop PC is the primary device used to access the Internet during what most people consider working hours, the five European markets we surveyed all showed a sustained pattern of smartphone usage throughout the day. Most countries demonstrated a preference for smartphones over the runner-up desktop PC during working hours, with Germany showing the highest difference (51% vs. 38%). In Sweden, however, users marginally preferred desktops over smartphones at work (50% vs. 49%). All countries surveyed showed that even tablet owners are at least twice as likely to use their smartphone than their tablet for personal tasks at work indoors. In the Netherlands, respondents were nearly five times as likely to use their smartphone over their tablet in a work environment (56% vs. 12%).

Takeaway

Consumers are using their smartphones as a primary device for personal tasks during work hours meaning brands have more mobile air time than they may have previously assumed.

Tablet

Tablet owners show a substantial preference for tablets over smartphones when at home in general or while watching TV.

indicated tablet usage (65%) that was roughly equal to smart- phone usage (60%).

For outdoor locations (e.g., travel via public transport or car, walking), there was a clear preference for the smartphone from survey respondents in all countries.

Takeaway

The tablet is the most popular multi-tasking device and provides an opportunity for brands to integrate traditional (TV) and digital (tablet/PC) strategies for a 360-degree approach that boosts engagement.

Takeaway

Smartphones are the device of choice for users who are running errands. A strong mobile presence helps local businesses maximize foot traffic and gain a competitive edge over less mobile-accessible brands. It also gives brands the opportunity to remain connected to consumers, right up to the point of conversion.

There were, however, fairly consistent spikes in tablet usage among tablet owners across all outdoor locations. Most notably, tablet owners show a marked preference for tablets when on vacation. Respondents from all countries surveyed

Local Insight: Survey responses from the Netherlands indicate that tablet use while on vacation is particularly popular with this group. The percentage of Dutch mobile users indicating a preference for tablets while on vacation was 11 percent higher than the next closest country response. Also in the Netherlands, tablet usage on vacation outpaced smartphone usage by fifteen percentage points (68% vs. 53%).

22

23

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Use by

time

64%

of survey respondents feel they are always connected to the Internet Internet on the mobile phone is used at an almost constant level

of day

When commuting by public transport the UK prefers accessing the Internet on their smartphone at

during the day

Tablet use

shows a peak during the evening

64%

accessed the Internet during commuting hours via smartphones

Takeaway

Mobile devices expand consumer access to the Internet, providing new advertising opportunities. However, its important to look carefully at the usage of your specific audience to help you determine optimal bid strategies and day-parting tactics.

68% vs 19%

on their tablet

24

25

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Advertising Preferences

Eighty-nine percent of respondents clicked on a regular or natural link at least once for every ten sessions they were browsing and shopping online via their smartphones. Approximately four out of 10 consumers who clicked on a regular link bought at least one product or service on their smartphone as a result of that click in the past 12 months.

Clicks & Conversions on Mobile

49%

Integration is Key

Between Online & Offline Advertising

Mobile searches triggered by

Clicks

Natural link in a search engine

Sponsored link in a search engine Banner

OFFLINE

89% 64% 41%

Takeaway

Integrated campaigns that incorporate both offline and online 26 elements make mobile campaigns more effective and drive incremental engagement.

Conversions

Mobile searches triggered by

36%

Natural link in a search engine Sponsored link in a search engine Banner

39% 22% 23%

ONLINE

26

27

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Advertising Preferences,Cont.

Overwhelmingly, respondents from all countries indicated that the most common action that follows clicking on any kind of mobile ad (paid, organic or banner) on their smartphone was searching for more details, followed by purchasing the product in either online or offline.

Local Insight: Engagement with mobile ads varied from country to country with Spanish respondents being the most likely to interact with online ads and Dutch respondents being the least likely.

Netherlands

Takeaway 1

Mobile offers higher engagement rates than PC for all ad types, and they are converting into sales.

Spain

Takeaway 2

Take advantage of analytics platforms to evaluate consumer click paths and optimise the experiences they are finding to be most relevant.

At least half of mobile shoppers make purchases monthly on their smartphones.

11

28

29

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Mobile Search Behaviour

Non-brand search queries are the most common type of query across all countries and all vertical categories except one online gambling.

Smartphone Usage

Purchase a product or service online via their smartphone Search for products/services via search engine on their smartphones

Takeaway

Mobile keyword lists skewed towards non-branded terms are appropriate for most verticals. Shorter keywords should be considered for inclusion on mobile keyword lists to accommodate ease of use on these devices.

Non-brand search performance is especially important for retail, food-related, and finance verticals. The automotive vertical sees a more balanced split between branded and non-branded search behaviours. An average of 70 percent visit fewer search results pages on their smartphone than they would on their PC.

A strong majority report always selecting one of the first three results displayed on their smartphone search results page (36%+).

Takeaway

Brand loyalty is not typically a factor in mobile search where consumers are often looking for the fastest solution to an immediate need. The non-branded searches that are driven by this type of need are an opportunity to attract and engage new customers.

51% 20%

U K

30

55% 19%

Sweden

51% 19%

Germany

50% 21%

44% 10%

Takeaway

The smaller mobile screen particularly on smartphones makes top placement (within the first three results) critical. Though the bidding for mobile ads can get very competitive, its imperative to invest in winning bids for these key placements.

Spain

Netherlands

31

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Data 03

2012 . EMEA Mobile Research Paper. iProspect

Tablet Usage

Up to 52 percent of respondents anticipate spending more time on their tablets Up to 21 percent of respondents who do not yet own a tablet anticipate spending time on one in the coming year, indicating an intention to purchase a tablet device. When asked to anticipate how much time they will spend on each device one year from the time of the survey, the vast majority of respondents from all countries indicated that they plan on spending the same or more time on their mobile devices. The gain in time spent with mobile appears to be at the expense of time spent on PCs. Up to 43 percent of respondents anticipate spending more time on their smartphones Up to 56 percent of respondents anticipate spending LESS time on their PCs

Micro Study: T ablet Out Performs T raditional Mobile Vertical: Apparel Retail

Goal: Expand tablet-targeted search campaigns to meet brand demand. Strategy: Created iPad-specific campaigns modeled after desktop campaigns and included an expanded keyword set. Results: 153:1 ROI (vs. 60:1 in traditional mobile), 28 percent higher AOV (average order value) than traditional mobile, 34 percent year-over-year increase on combined mobile ROI (114:1)

Tablets are amazing when it comes to shopping and an amazing platform for brand building. The reach might be small now, but the consumer is valuable and its worth paying attention to the tablet. - Jesse Haines, Head of Marketing, Google Mobile Ads 12

32

33

2012 . EMEA Mobile Research Paper. iProspect

ShapingYour Approach

34

35

Shaping Your Approach Section 04

2012 . EMEA Mobile Research Paper. iProspect

Shapping Your Approach Section 04

2012 . EMEA Mobile Research Paper. iProspect

Mobile

Mindset. Before you get started with

mobile, you need to know the

lay of the land

Solid strategy and flawless execution are important elements for success, but starting with a mobile mindset will help you get the most out of your mobile campaigns.

36 37

Shaping Your Approach Section 04

2012 . EMEA Mobile Research Paper. iProspect

Shaping Your Approach Section 04

2012 . EMEA Mobile Research Paper. iProspect

Mobile Mindset

There are four BIG ideas that will help you think mobile...

1 2

38

Mobile works best when it is integrated. One of the biggest mistakes brands make with mobile is handling it as an afterthought or a stand-alone channel. Look at ways to blend traditional, online, and mobile tactics to create a 360-degree immersion campaign.

3 4

Think beyond branding. Many companies assume that mobile is only good for brand awareness campaigns, but it can also be used to effectively generate sales, leads, and produce a positive ROI.

More than other channels, you need to relate to your consumer. People use mobile differently than they use other online devices and that usage changes based on a number of variables including demographics, location, and cultural behaviour patterns.

Recognize the importance of device targeting. Users of each device (PC, smartphone, tablet) and each OS (iOS, Android, Symbian) display varying behaviours. These insights will help you understand how your consumers are interacting with your brand and provide additional levels of optimisation.

3 9 3 9

Shaping Your Approach Section 04

2012 . EMEA Mobile Research Paper. iProspect

Shaping Your Approach Section 04

2012 . EMEA Mobile Research Paper. iProspect

Mobile Mindset,Cont.

The importance of mobile-specific metrics & measurement

Applying traditional, one-to-one measurement to a mobile campaign can lead to incomplete, inaccurate, or misleading data. Your campaign goals and metrics need to be defined within the context of the mobile channel, considering device and consumer preferences and behaviours. In addition to sales conversion, evaluate the relevance of nontraditional responses such as app downloads, calls, store locator actions, etc. While these responses may not directly produce revenue, they have a very real relevance to the consumers ultimate purchase decision.

Micro Study: Understanding the T rue Value of Mobile

Vertical: T ravel Goal: Determine the ROI for click-to-call actions.

Strategy: Worked with the client to understand the user flow within their call centre and what data was available from those interactions. Results: Developed a customized equation to help measure the likelihood of a conversion: Six minute call duration = an interested consumer Agents convert 30 percent of interested consumers Interested Consumers * 30% = # of conversions

App

40

41

2012 . EMEA Mobile Research Paper. iProspect

Tactics

42 43

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Mobile Tactics Overview

The mobile landscape is rich with a wide variety of tactics that help deliver against many different brand goals. In this section, were going to look at some of the most widely used and effective mobile campaign tactics in the context of three stages of mobile engagement.

44

Be There

SEO PPC Landing Pages

Be Smart

Device T argeting Click-to-Call Location Based Mobile App Extensions Couponing

Be More

Display SMS

45

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be There:SEO

Benefit

Discoverability Be consistently visible to both loyal customers and new prospects.

Best Practices

57%of users

say

they wont recommend a business with a poorly designed mobile site 13

A place on consumers radar. To consumers, mobile is just another point of access, not a channel for brand engagement. A strong mobile presence puts you in front of more consumers in a variety of situations and generally improves the perception of your brand. A competitive edge. More and more, consumers are using mobile for pre-purchase research and browsing. If youre not showing up when your consumers are searching for you, you risk losing sales opportunities to your competitors. Whether consumers are connecting in-store or from home, a well-designed mobile experience is the best tool for making a good impression and encouraging additional engagement or even conversion. A more strategic and controlled consumer experience. A well-optimised mobile experience allows brands to focus on the most effective elements of the brand experience landing pages, forms, etc. so that they can move prospects through the decision process more smoothly and efficiently.

1. Understand your audience. Think strategically about how a mobile user engages with your brand. Look at analytics to see which content mobile users access most frequently and which pages show a high mobile bounce rate. Optimally, solicit direct consumer feedback to define what website features should be prioritized in the mobile space.

2. Pay attention to the boring details. Traditional best practices apply still. Make sure URLs, title tags, meta data and images are optimized for your priority keywords. 3. Build for mobile. Take care to work within the constraints of the mobile device. Create a mobilespecific site map to increase the visibility of your site to search engines. Improve page load times with image optimization, caching, and compression. Avoid flash and large image files.

4. Simplify your content. Mobile content should be more concise and easier to navigate than desktop content. Pare your mobile site down to the content elements that make sense for mobile users and then organize the critical content with clear and streamlined navigation. 5. Mobile-ize your content. Take advantage of mobile features like clickable phone numbers, location-based maps, and photo sharing to improve the consumer experience and increase engagement.

Local Insight: Of all five countries surveyed, Spain exhibited the highest rate of retail searches conducted (63%). Conducted in general via a search engine. Based on this finding, Spanish retailers should consider focusing SEO efforts on non-brand indexes to appeal to a large and potentially new audience.

46

47

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be There:PPC

Benefit

A good place to start. A good place to build.

Best Practices

1. Focus efforts on The Big 3: Google, Bing/Yahoo, and Yandex. If budget is a concern, Google is the best option with European market share that is consistently at or higher than 93 percent. 14

2. Launch with broad (for scale & new keyword trends), broad match modifier, and exact match (for lower CPCs and increased relevancy), but hold off on phrase match type. Most mobile searches contain three words or less and including phrase match in the mix may not yield any volume when broad match types are already employed. 3. Maintain a consistent presence with trademark (branded) terms. If budget allows, test all branded, top converting non-brand, and top volume keywords first with the goal of identifying differences in performance across the device types (desktop, smartphone, and tablet).

A low-friction entry into the mobile landscape. Although there are mobile-specific considerations, mobile search is very similar to desktop search in terms of both execution and evaluated metrics, making it a familiar space. When getting started, consider a mobile search strategy that focuses on driving performance and will validate the value of the channel for the brand. A strong foundation for future mobile efforts. PPC campaigns deliver critical insights into consumer affinities in this channel. These learnings help you build better-targeted campaigns based on the preferences and behaviours of your particular audience.

4. Separate campaigns by device type and OS (operating systems) to identify performance trends and facilitate efficient scale. Paying attention to these details will make optimization more targeted and effective. 5. Include contextual device/mobile call outs (such as on your smartphone) to assure the consumer that the user experience has been designed with mobile in mind.

46

38

48

49

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be There:Landing Pages

Benefit

More focused experience and results.

Best Practices:

1. Test landing page destinations. Driving mobile traffic to an un-optimised, desktop site can create a frustrating consumer experience. However, some desktop sites perform admirably on mobile devices. Bottom line: dont assume anything. Test different destinations to see which yields the best engagement and conversion results. 2. Consider task-specific landing pages. If a mobile optimised destination proves to be your best option, but the resources arent yet available to develop a full mobile site, do some testing to determine exactly which pages will be most useful to your mobile audience (e.g., store locator, contact form, sale information, etc.) and then direct mobile traffic to those specific pages rather than a generic homepage.

3. Keep things clear and simple. Keep landing page headlines and content brief and straightforward. Include a prominent CTA (call-to-action) so visitors are clear on next steps.

Micro Study: Landing Page T esting Vertical: Apparel Retail Goal: Understand the best user experience for tablet users.

Strategy: Swapped keyword landing pages from desktop site to mobile site landing pages during test period. Results: Strong preference for desktop site over mobile site: CPCs 89 percent less, conversation rate 52 percent higher, ROAS 228 percent higher

Improved performance: Land mobile prospects and consumers on highly-relevant, needs-focused pages and you will: -Reduce bounce rate -Increase conversion rate -Create opportunities for higher AOV (average order value) Stronger strategy: Use landing pages to determine which tasks consumers want to perform via mobile devices. What you learn will help you make smarter decisions about the type of mobile presence that will be most effective for your brand unique landing pages, a full mobile site, an app, etc.

Local Insight: Landing page optimization is even more critical in countries like Germany where 38 percent of respondents said they visit websites on their smartphones to help make purchasing decisions. The smaller screen requires a greater focus and clarity of messaging and presentation.

50

51

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be Smart:Understand Device Targeting

What is it? In addition to breaking mobile campaigns out from desktop campaigns, its beneficial to segment mobile campaigns by both device type (smartphone vs. tablet) and OS (iOS, Android, and Symbian). Running separate campaigns allows brands to identify performance affinities trends by device and OS and allow for efficient scale. The variety of devices available make mobile a more complex channel, but also provides opportunities for much more granular, and therefore efficient optimisations.

How can it benefit an integrated campaign? Device-specific insights - whether behaviour or performance-related inform the strategic and tactical approach for future campaigns. They also provide clarity of need and scope for any potential mobile site development. Different devices also serve different needs. Desktop and tablet devices, for instance, are typically used for research and purchasing, effectively bookending the conversion funnel. Smartphones fill in the gaps between the two ends, satisfying immediate and on-the-go needs for information (e.g., comparison shopping, calling for information, finding a location, etc.). Making sure your brand has a relevant presence on each device delivers a holistic and comprehensive consumer experience.

When is it a good fit? As shown in the data from our research with TNS, there are nuances in device usage that brands can use to craft more effective, device-specific campaigns. Applying device and OS preferences to your strategic approach ultimately improves engagement and conversion results. Local Insight: Eighteen percent of tablet owners in Germany and more than 27 percent in Spain and the UK reported shopping daily from these devices. Managing separate campaigns for each device allows marketers to evaluate independent KPIs to capitalize on trends like these.

52

53

Tactics 03

2012 . EMEA Mobile Research Paper. iProspect

Tactics 03

2012 . EMEA Mobile Research Paper. iProspect

Be Smart:Click-to-Call

What is it? Click-to-call ad functionality allows consumers to click on a phone number within an advertisement and instantly place a call. When is it a good fit? When campaign goals are focused on driving calls When you want to avoid driving consumers to a less-than-optimal mobile experience When consumers are close to a purchase decision and a person-to-person dialogue is the most cost-effective way to influence the conversion When the target audience is unable to browse the mobile web, but able to talk on the phone When you want to offer multiple ways for consumers to engage with your brand.

Recommended especially for: Travel, B2B, weight loss/diet, restaurant and recruitment brands How can it benefit an integrated campaign? When other campaign elements (e.g., billboards, print ads, television, or radio) drive to mobile, the addition of the click-to-call extension makes contact by phone easier, faster, and more reliable.

How do you measure performance? Metrics that can be tracked include call start and end time, duration, status (missed vs. received), as well as the area code of the caller. More detailed data can be obtained through Googles Advanced Call Metrics tracking, or other, third party providers. Dedicated phone numbers can be obtained for use with a click-to-call campaign, isolating calls that come through that channel. Although click-to-call has proven effective, it can be challenging to track conversions accurately since the conversion may take place offline. In the best circumstances, brands and agencies collaborate to develop an equation to evaluate the likelihood of conversion. For instance, if a brand can identify the average call length that indicates a viable level of interest, that information can be combined with the average conversion rate and average order value to quantify a return when one-to-one measurement is not possible.

Local Insight: Enabling consumers to call for more information in countries like the Netherlands where mobile search volume is plentiful (44 percent), but mobile browsing behaviours are minimal (<25 percent) helps brands influence purchase decisions by offering consumers a more familiar method of engagement.

54

55

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be Smart:Location-Based Services

What is it? Location-based tactics tailor ad content based on the users proximity to a real world location. When is it a good fit? When a brand wants to drive traffic to brick-and-mortar locations When the target audience may be more comfortable making an in-store vs. online purchase When the consumer query shows an intent to buy instore (typically by searching on location or store-related terms) Recommended especially for: Retail and hotel brands

brick-and-mortar locations provides critical insights that will help you make more strategic marketing decisions. To evaluate ROI, leverage brand data to identify offline conversion modifiers and in-store AOV to more accurately attribute revenue. How do you measure performance? Click share (user clicks on location info vs. the site URL) Store locator searches & corresponding foot traffic Apply offline conversion multipliers to estimate ROI

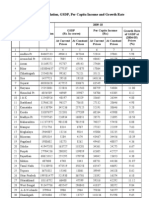

Country

% users seeking local information

% of local information seekers who take action*

UK France

Spain

84% 83% 88%

80% 81% 80%

* Action defined as placing a call to the business, making a 85% 86% or inGermany purchase (online or in-store), visiting the business (online store), or looking up the business location on a map 15

How can it benefit an integrated campaign? One effective way to tie location-based tactics into a larger campaign is to measure the intent behind these interactions. Understanding how location-based tactics influence traffic to

56

57

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be Smart:Mobile App Extensions in Search

What is it? Mobile app extensions serve a click-to-download ad that allows the promotion of apps directly in Google search results by linking to a brands Android Marketplace or Apple App Store page.

When is it a good fit?

Micro Study: Drive Incremental ROI Vertical: Big Box Retailer

How do you measure performance? App downloads Duration of time spent in app Number and frequency of app opens Evaluate lifetime value of these consumers

Goal: Assign accurate value to an app download.

Strategy: Obtained white-listed status for Googles Mobile App Extension Beta, separated campaign to target Android Marketplace and iTunes appropriately, disabled all non-app links for duration of campaign, and associated a $200 value to each app download. Results: 92 downloads, ROAS of 89:1, 334 percent incremental ROI

When app downloads are a campaign priority When you want to facilitate easy and immediate app downloads for no additional media cost When the targeted audience may be more comfortable interacting with the brand via an app Note: app extensions trump mobile site links, so if your PPC campaign goals are based on conversions or revenue (vs. downloads), the mobile app extension is not the right choice.

58

59

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Mobile site or a mobile app? If most people are going to find you through search then you should optimise your site for the mobile Web, but if you think you have a big enough fan base and you can cut through the clutter of getting people to download your app, then you can have a more immersive experience by creating an app. - Chet Fenster, MEC Entertainment, November 2011 7

Use an App if...

Y ou require ongoing interactivity

Your target consumers will be interacting via personalized access (e.g., login) You are displaying data and need to manipulate it with complex calculations, charts, etc. (e.g., banking) You want to engage the consumers native phone functions (e.g., camera)

Y ou need to provide offline access

Use a Mobile Site if...

App

60

Y ou want to provide instant access Y ou want to be easily found via search and directories

You require compatibility across multiple devices and operating systems

Y ou make frequent content updates

Y oure looking for fast, more cost-efficient deployment

16

61

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be Smart:Couponing

Benefit

Coupon-driven campaigns are an effective way to influence purchase decisions and attract new consumers. They also provide a way to track the effect of online efforts on offline sales.

Best Practices:

1. Offer should be mobile-specific to reinforce the value of acquiring customers in that space, either an offer that converts via mobile, or one that converts offline but can be tracked back to a mobile source via a unique code. 2. Take care to leverage one-time use codes if your brand is concerned with giving away too many dollars. 3. Apply a consumers purchase history whenever possible to

tier offers. For instance, if the consumer has never purchased before you may want to promote a more competitivethem offer to to buy from your brand. Conversely, if encourage the consumer is returning you may want to promote a smaller savings to encourage their loyalty without giving away many too dollars.

Micro Study: Geo-T argeted Couponing Vertical: High-end Athletic Footwear Goal: Increase store traffic via cross-channel promotion.

Strategy: Duplicated and then tailored desktop brand search campaign for mobile, implemented Google Mobile Offer beta (mobile coupons), increased relevancy by displaying only to users within twentymile radius of store location.

store traffic

via cross-channel promotion

Increase

When is it a good fit? When you want to include special offers in mobile ads to influence conversion When you want to track in-store traffic When you want to drive offer-specific online traffic

Results: CTR up 28 percent, CPC down 32 percent, average of 12 incremental orders per week in store

Local Insight: In the UK, 21 percent of mobile searchers interested in financial services visit price comparison websites. Leveraging mobile offers here could help attract priceconscious

62

63

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be More:Display

Benefit

Maximize scalability, create brand awareness to increase visibility and drive traffic, acquire new customers and create cost effective opportunities for incremental conversions.

Sample display benefits: Micro Study: Geo-T argeted Display Three things you may not know about mobile display:

1. Static banners are the better choice for driving ROI while rich media are more effective for reaching branding and engagement goals.

Vertical: High-end Athletic Footwear

Goal: Drive high school students from mobile to retail to redeem offer. Strategy: Mobile display banners featuring giveaway offer targeted by device, demographics, and geographic location (increased relevancy by only serving banners to consumers within limited radius to store), directed consumers to mobile-friendly landing page with store info and directions. Results: Over 96K clicks to landing page, 0.89 percent CTR (740 percent higher than desktop), $0.77 average CPC (66 percent lower than desktop)

Mobile banners see exponentially higher CTRs than desktop banners, 770 percent 17 Fifty-four percent of marketing decision-makers list cost effectiveness as a high importance & leading benefit of mobile ads 18

When is it a good fit?

When you want to increase awareness and reach with shoppers that arent already familiar with your brand When you want to attract new consumers by taking advantage of the fact that mobile browsers do not typically exhibit a high level of brand loyalty When you want to focus on qualified shoppers (those who have been exposed to the brand, are potentially interested, but have not yet purchased) When you want to reach shoppers who are familiar with the brand and ready to purchase.

2. True geo-targeting can only be enabled by the consumers consent. Confirm scalability of GPS enabled inventory with media partners. 3. Conversion tracking Conversion tracking is only available for mobile web inventory at this time. In-app banners can track other app downloads, but no other type of conversion.

Local Insight: Advertisers can find highly engaged consumers in mobile where they wouldnt normally on the PC. For example, within gaming channels which overindex in popularity in countries like Germany and the Netherlands.

64

65

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Tactics 05

2012 . EMEA Mobile Research Paper. iProspect

Be More:SMS

When is it a good fit? When you want to create dialogue with consumers When you want to build CRM When you want to increase consumer loyalty

The impact of SMS:

Best Practices:

1. Be consistent. SMS alerts should be sent every seven to ten days. The most efficient approach is to plan your message sequence in advance to ensure consistent delivery. 2. Be strategic. Make each text count. Structure your messages so that each response provides you with consumer insights. Dont ask yes/no questions. For example, instead of asking, Would you like to receive store alerts? ask, If youd like to receive store alerts, please reply with your city.

In Western Europe, seven in 10 or more say they send text messages on their cell phones 19 Expect an open rate in excess of 95 percent for text messages 20 Ninety-five percent of text messages are read within the first 4 minutes 21 Up to 35 percent average response rates depending on message type 22

Benefit

SMS, or text messaging, is an excellent way to extend the dialogue with your consumers. The mediums brevity and immediacy are often catalysts for consumer action.

3. Be tuned in. Stay on top of the message logs and pay attention to any unsolicited feedback from consumers.

66

67

2012 . EMEA Mobile Research Paper. iProspect

References

68 69

References Section 06

2012 . EMEA Mobile Research Paper. iProspect

References Section 06

2012 . EMEA Mobile Research Paper. iProspect

References

1 Boston Consulting Group, Mary Meeker, Kleiner Perkins, Mor- gan Stanley Research, Berg Insight via Business Insider 2 Portio Research, Worldwide Mobile Industry Handbook 2012 - 2016, http://www.portioresearch.com/en/reports/currentportfo- lio/worldwide-mobile-industry-handbook-20122016.aspx 3 The State of Mobile Search Advertising in the U.S., Marin Software, March 2012. 4 eMarketer, TV, Mobile See Gains in Viewing Time, December 2011 http://www.emarketer.com/Article.aspx?R=1008728 5 2012 Mobile Future in Focus (white paper), ComScore, 2012 http://www.comscore.com/Press_Events/Presentations_ Whitepapers/2012/2012_Mobile_Future_in_Focus 6 Temsamani, Karim (at IABALM 2012) via @IAB, February 2012 https://twitter.com/iab/status/174225109165424640

7 mobiThinking Stats Corner, http://mobithinking.com/ mobile-marketingtools/latest-mobile-stats 8 Google Mobile Playbook http://www.themobileplaybook. com/ 9 Hosford, Christopher, Mobile marketing seeks a foothold Uncertainties about mobiles advantages plague b2b marketers March 2012 http://www.btobonline.com/article/20120312/ WEB02/303129948/mobile-marketing-seeks-a-foothold 10 BtoB The Magazine for Marketing Strategists, Mobile ad revenue to reach $11.6 billion this year, April 2012 11 Google, Ipsos, Mobile Marketing Association, and iab, Our Mobile Planet, March 2011 March 2012 http:// www.thinkwithgoogle.com/mobileplanet/en/ 12 Johnson, Lauren, Mobile Marketer, Google exec: Mobile changes a brands value proposition http://www.mobilemarketer. com/cms/news/content/13063.html

13 Compuware, What Users Want From Mobile, http://www. gomez.com/resources/whitepapers/survey-report-whatusers- want-from-mobile/

19 Pew Research Center, Global Digital Communication: Texting, Social Networking Popular Worldwide, February 2012 http://www.pewglobal.org/2011/12/20/global-digitalcommuni- cation-texting-social-networking-popular-worldwide/ 20 Business Wired, Top 5 Reasons You Need to Be Delivering News to Stakeholders Via Mobile Alerts, January 2012 http:// blog.businesswire.com/2012/01/24/mobile-alerts/ 21 Value Leaf, Mobile Marketing Trends In 2012 | SMS Marketing, [slidedeck] December 2011 http://www.slideshare. net/23Anand/mobilemarketingtrendsin2012 22 comScore, Mobile Usage Behaviors and Trends The who, what, when, where, why, and how of mobile consumers, January 2012 http://www.slideshare.net/tessierv/comscoremobile-mar- keting

14 Stat Counter Global Stats http://gs.statcounter.com/ #search_engine-eu-monthly-201106-201206

15 Google and Ipsos, Our Mobile Planet: Understanding the Mobile Consumer, May 2012 http://www.ourmobileplanet.com 16 Human Service Solutions, Mobile Website vs. Mobile App (Application): Which is Best for Your Organization? http://hswso- lutions.com/services/mobile-webdevelopment/mobile-website- vs-apps/

17 Media Mind, TinyScreen, Huge Results: Maximizing Mobile Advertising Performance, July 2011 http://www2.mediamind. com/data/uploads/resourcelibrary/mediamind_mobile_advertis - ing_2011.pdf 18 IAN and Ovum, Marketer Perceptions of Mobile Advertising, July 2011 http://www.iab.net/CMO_Mobile

70

71

2012 . EMEA Mobile Research Paper. iProspect

About the Studies

72

73

About the Studies Section 07

2012 . EMEA Mobile Research Paper. iProspect

About the Studies Section 07

2012 . EMEA Mobile Research Paper. iProspect

About the Studies

TNS NIPO: Digital Life Digital Life provides recommendations on how to use digital channels to grow your business through a precise understanding of human behaviours and attitudes online. Based on conversations with over 72,000 people in 60 countries, Digital Lifes size, scale and detail make it the most comprehensive view of consumer attitudes and behaviour online, on a global and local level. Across countries and product categories, Digital Life pinpoints the range of growth opportunities available to brands in the online world. Digital Life also introduces the Digital Growth Index, a single number score defining the opportunity across product categories and countries for growth through digital channels, and showing the diversity of opportunities available in the online world. TNS NIPO: Mobile Life Mobile Life is an annual investigation from TNS NIPO designed to provide a deep understanding of todays global mobile device consumers and the future impact mobile will have on our digital landscape. 34,000* interviews with mobile users across over 43 countries (including the BRIC countries, Indonesia and several key African markets) provides real insight into how consumers across the world are using and interacting with mobile technology and delivers a holistic understanding of the end-to-end consumer experience and how this will change in the future. iProspect: This study is executed in cooperation with TNS NIPO and is a deep dive on extensive research performed by this experienced agency. Both the Digital Life (based on conversations with over 72,000 people in 60 countries) and the Mobile Life (based on 34,000 interviews with mobile users across over 43 countries) researches are used as a strong fundament to build further on. During the iProspect research, over 2600 respondents in Germany, the Netherlands, Spain, Sweden and the UK were questioned through an online questionnaire. All respondents were smartphone users between the ages of 16 and 60 who were making use of the mobile Internet.

For more information and access to additional data, please visit http://www.tnsdigitallife.com/.

For more information and access to additional data, please visit http://discovermobilelife.com/.

74

75

About the Studies Section 07

2012 . EMEA Mobile Research Paper. iProspect

About the Studies Section 07

2012 . EMEA Mobile Research Paper. iProspect

But our greatest asset is the quality and commitment of our people. They meet the growing need for insight, interpretation and advice on a daily basis. We view market research not as a goal, but as a tool for making optimum decisions. That is why at TNS NIPO you deal with professionals who are either experts in a particular sector such as FMCG, Automotive, Telecom, Finance or Non-Profit, or have a specific expertise in areas such as branding, stakeholder management and effectiveness of communication.

About TNS NIPO

TNS NIPO has occupied a leading position in the market for marketing research for many years. We are constantly able to respond successfully to our clients changing needs. Product development plays an important role in this. Hence we have successfully launched products in areas of innovation, online shopper behaviour, CSR, positioning and qualitative research in recent years.

Our professionals feel personally involved with the clients and organisations that they serve, share their vision and advise on the strategy to pursue. TNS NIPO is part of the international TNS group alongside the labels TNS Consult, NIPO Software and Veldkamp. TNS is the worlds largest supplier of customised research and has offices in more than eighty countries. TNS in turn is part of the international WPP group.

For information visit: www.tns-nipo.com and www.tnsglobal.com.

76

1 1 7 7

About the Studies Section 07

2012 . EMEA Mobile Research Paper. iProspect

About the Studies Section 07

2012 . EMEA Mobile Research Paper. iProspect

About iProspect

R

iProspect, part of Aegis Media, is a global digital performance agency helping to grow the worlds most sought-after brands, by targeting audiences that are ready to act and find inventive ways to turn intention into action. Clients include companies and leaders across multiple industries, including adidas, Kelloggs, GM, Nokia, Johnson & Johnson. iProspect was recently awarded a 2012 MIXX Award for Best LocationBased Advertising and was noted to represent more retailers on Internet Retailers Top 500 List than any other agency (2009-2012). iProspect has 51 offices globally, in 39 countries. Questions regarding this study should be directed to:

Amanda DuBois - Sr. Marketing and Brand Manager, iProspect Global t. +001 817 665 0058 e. amanda.dubois@iprospect.com Judith Nissen - Marketing & Communications Adviser, iProspect Netherlands t. +31 (0)24 359 37 70 e. Judith.nissen@iprospect.com Kerri Smith - Director of Mobillity, iProspect USA t. +001 917 326 7064 e. kerri.smith@iprospect.com

About iProspects Research: iProspect has a long legacy of research and thought leadership in the digital marketing industry. Findings from iProspect research are regularly used to enhance our service offerings and to educate clients on digital marketing best practices and industry trends. iProspect studies are frequently quoted by speakers at marketing industry events, and by both business and trade press. Proper attribution requires that any references to the study be clearly identified as coming from:

The Mobile Landscape: Western Europe

78

79

2012 . EMEA Mobile Research Paper . iProspect

The Mobile Landscape.

11

You might also like

- Unlocking The Power of MobileDocument13 pagesUnlocking The Power of MobileErsilia BaraganNo ratings yet

- SUDHDocument7 pagesSUDHheenaNo ratings yet

- Transformers: Case StudyDocument5 pagesTransformers: Case StudyNaveed Taj GhouriNo ratings yet

- How Mobile Raises The Bar For Brand Communications: Key InsightsDocument20 pagesHow Mobile Raises The Bar For Brand Communications: Key InsightsEdward RDNo ratings yet

- Mobile App Popularity and Revenue ModelsDocument51 pagesMobile App Popularity and Revenue Modelsalen.paul.88No ratings yet

- ST - Joseph'S College of Business Administration: Research ProjectDocument20 pagesST - Joseph'S College of Business Administration: Research ProjectTony JoseNo ratings yet

- Iphone Research PaperDocument9 pagesIphone Research Paperfvjebmpk100% (1)

- Mobile MarketingDocument9 pagesMobile MarketingGianiCristeaNo ratings yet

- Mobile Marketing StrategiesDocument13 pagesMobile Marketing Strategiesrahul_tarNo ratings yet

- MEF GCS2013 ExecutiveSummaryDocument4 pagesMEF GCS2013 ExecutiveSummaryNhan Trong DinhNo ratings yet

- Adobe Mobile Experience Survey: What Users Want From Media, Finance, Travel & ShoppingDocument33 pagesAdobe Mobile Experience Survey: What Users Want From Media, Finance, Travel & ShoppingAndrew John PerryNo ratings yet

- Consumer Buying Behaviour Towards SmartphoneDocument36 pagesConsumer Buying Behaviour Towards SmartphoneAbhijeet MahapureNo ratings yet

- Mobile Marketing and AdvertisingDocument26 pagesMobile Marketing and AdvertisingClarice PopescuNo ratings yet

- The Utilization of Mobile Technology and Approaches in Commercial Market ResearchDocument10 pagesThe Utilization of Mobile Technology and Approaches in Commercial Market ResearchscribdjicNo ratings yet

- To Know The Customer Responce Towards Advertising byDocument25 pagesTo Know The Customer Responce Towards Advertising byChintan DesaiNo ratings yet

- 2011 Advanced Global Mobile TrendsDocument37 pages2011 Advanced Global Mobile TrendsShane ShahNo ratings yet

- Hello, Are You There?: Marketing in A Smartphone WorldDocument15 pagesHello, Are You There?: Marketing in A Smartphone WorldChris FrewNo ratings yet

- Metia Insights 2012Document27 pagesMetia Insights 2012Deborah HanamuraNo ratings yet

- The Mobile Maze: Navigating Consumer Usage of Mobile DataDocument36 pagesThe Mobile Maze: Navigating Consumer Usage of Mobile Datadryn_sNo ratings yet

- GFK TechTrends 2015Document13 pagesGFK TechTrends 2015Guillermo DampierNo ratings yet

- A Pharma Marketer’s Guide to Getting Started in Mobile MarketingDocument20 pagesA Pharma Marketer’s Guide to Getting Started in Mobile MarketingambitiousamitNo ratings yet

- Mobile Report 2015Document16 pagesMobile Report 2015Amardeep KaushalNo ratings yet

- The Power of Connected Consumers: How Mobile is Impacting Retail Marketing in 5 WaysDocument3 pagesThe Power of Connected Consumers: How Mobile is Impacting Retail Marketing in 5 WaysSanjiv KhullarNo ratings yet

- Recent Mobile TrendsDocument13 pagesRecent Mobile TrendsAnshul SrivastavaNo ratings yet

- Literature Review On Brand Preference of Mobile Phones PDFDocument6 pagesLiterature Review On Brand Preference of Mobile Phones PDFc5qvf1q1No ratings yet

- Mobile MarketingDocument21 pagesMobile MarketingSyeda SaniNo ratings yet

- Chapter 8 Trends in Information SystemsDocument10 pagesChapter 8 Trends in Information Systemsrandy ccsitNo ratings yet

- AssignmentDocument14 pagesAssignmentShahzad KhanNo ratings yet

- JETIRTHE206Document47 pagesJETIRTHE206hansabandiya1No ratings yet

- THesis Chapter 2Document7 pagesTHesis Chapter 2Renzo Ravien MercadoNo ratings yet

- Consumer Buying Behaviour Towards SmartphoneDocument36 pagesConsumer Buying Behaviour Towards Smartphonevikrant_ghs80% (30)

- Mobile Marketing Three Principles For SuccessDocument19 pagesMobile Marketing Three Principles For SuccessBilal SununuNo ratings yet

- Q3 2011 - InMobi Network Research EuropeDocument10 pagesQ3 2011 - InMobi Network Research EuropeInMobiNo ratings yet

- "Popularity and Usage of Smartphones": A Project Report ONDocument42 pages"Popularity and Usage of Smartphones": A Project Report ONdjpatel10No ratings yet

- Literature Review On Brand Preference of Mobile PhonesDocument6 pagesLiterature Review On Brand Preference of Mobile PhonesaflsbbesqNo ratings yet

- Iphone Marketing Research PaperDocument5 pagesIphone Marketing Research Papereghkq0wf100% (1)

- Mobile Marketing Whitepaper For Brands and Agencies: The Tipping Point Is NowDocument14 pagesMobile Marketing Whitepaper For Brands and Agencies: The Tipping Point Is NowTy BraswellNo ratings yet

- 6 Mobile Ad: Trends FromDocument4 pages6 Mobile Ad: Trends Fromspam.recycler1048No ratings yet

- Kantar Worldpanel ComTech Smartphone OS Barometer 11-7-12Document4 pagesKantar Worldpanel ComTech Smartphone OS Barometer 11-7-12Sumit RoyNo ratings yet

- Factors Affecting The Demand of Smartphone Among Young AdultDocument17 pagesFactors Affecting The Demand of Smartphone Among Young AdultKimberly A. S. SmithNo ratings yet

- Smart Phones 1. Chih-Hsuan Wang. (Incorporating The Concept of Systematic Innovation Into QualityDocument11 pagesSmart Phones 1. Chih-Hsuan Wang. (Incorporating The Concept of Systematic Innovation Into QualityRenzo Ravien MercadoNo ratings yet

- 2011 Advanced Global Mobile TrendsDocument36 pages2011 Advanced Global Mobile TrendsSarah BastienNo ratings yet

- Study of Consumer Buying Behaviour Towards Smart PhoneDocument36 pagesStudy of Consumer Buying Behaviour Towards Smart PhoneAnish JohnNo ratings yet

- Fairphone SWOTDocument15 pagesFairphone SWOTjackNo ratings yet

- Research Paper On Mobile ServicesDocument6 pagesResearch Paper On Mobile Servicesd1fytyt1man3100% (1)

- Why OOH Media Is Central To SEADocument11 pagesWhy OOH Media Is Central To SEAEli DesenderNo ratings yet

- ORM Mobile Marketing WP 0213Document10 pagesORM Mobile Marketing WP 0213Rog DonNo ratings yet

- Mobile Applications in Life Insurance and PensionsDocument16 pagesMobile Applications in Life Insurance and PensionsPetra BalintNo ratings yet

- Smart PhoneDocument24 pagesSmart PhoneArun KarishankariNo ratings yet

- Q3.Information Communication TechnologyDocument11 pagesQ3.Information Communication TechnologyHanessyNo ratings yet

- Mobile IQ: January 11, 2012Document40 pagesMobile IQ: January 11, 2012Eric FarkasNo ratings yet

- Key Digital Trends 2011Document50 pagesKey Digital Trends 2011Richard KocherspergerNo ratings yet

- Púca Releases Irish Smartphone Market ResearchDocument2 pagesPúca Releases Irish Smartphone Market Researchapi-102693783No ratings yet

- E-C Midterm PaperDocument9 pagesE-C Midterm PaperTú GaruNo ratings yet

- Final Project RamyaDocument92 pagesFinal Project RamyaStr YovaNo ratings yet

- Thesis IphoneDocument5 pagesThesis Iphoneafbtegwly100% (2)

- Factors influencing young female adults' smartphone purchase intentionsDocument105 pagesFactors influencing young female adults' smartphone purchase intentionsAnish John100% (1)

- Wereldleiders Op TwitterDocument24 pagesWereldleiders Op TwitterHerman CouwenberghNo ratings yet

- TRAI Data Till 31st March, 2014Document19 pagesTRAI Data Till 31st March, 2014Tamanna Bavishi ShahNo ratings yet

- World Health Days 2014: JanuaryDocument2 pagesWorld Health Days 2014: JanuaryIvy Jorene Roman RodriguezNo ratings yet

- Hepatitis A eDocument1 pageHepatitis A eSumit RoyNo ratings yet

- FINAL - Mobile Advertising DeckDocument73 pagesFINAL - Mobile Advertising DecksumitkroyNo ratings yet

- Calendário de Jogos Do Mundial de Futebol-Brasil 2014Document0 pagesCalendário de Jogos Do Mundial de Futebol-Brasil 2014Miguel RodriguesNo ratings yet

- The State of Mobile Advertising in Emerging Countries TLS EmergingMarketsDocument8 pagesThe State of Mobile Advertising in Emerging Countries TLS EmergingMarketsSumit RoyNo ratings yet

- Nightingales - Philips Healthcare Tie UpDocument3 pagesNightingales - Philips Healthcare Tie UpSumit RoyNo ratings yet

- Risk Factors From Hepatitis BCDDocument1 pageRisk Factors From Hepatitis BCDSumit RoyNo ratings yet

- Hepatitis A eDocument1 pageHepatitis A eSumit RoyNo ratings yet

- Mobile Advertising Research Trends and InsightsDocument15 pagesMobile Advertising Research Trends and InsightsSumit RoyNo ratings yet

- Mediamind Comscore Research Dwelling On EntertainmentDocument20 pagesMediamind Comscore Research Dwelling On EntertainmentSumit RoyNo ratings yet

- NokiaDocument1 pageNokiaSumit RoyNo ratings yet

- Global Top 100 Most Valueable Brands Brandz2014 - Infographic PDFDocument1 pageGlobal Top 100 Most Valueable Brands Brandz2014 - Infographic PDFSumit RoyNo ratings yet

- The State of Airline Marketing Airlinetrends Simpliflying April2013Document21 pagesThe State of Airline Marketing Airlinetrends Simpliflying April2013Sumit RoyNo ratings yet

- The State of Maternal Health, D Nutrition in Asia " World Vision DataDocument4 pagesThe State of Maternal Health, D Nutrition in Asia " World Vision DataSumit RoyNo ratings yet

- MGI China E-Tailing Executive Summary March 2013Document18 pagesMGI China E-Tailing Executive Summary March 2013Sumit RoyNo ratings yet

- World Health Statisitics FullDocument180 pagesWorld Health Statisitics FullClarice SalidoNo ratings yet

- Calendar 14Document57 pagesCalendar 14Hanan AhmedNo ratings yet

- 10 Historical Speeches Nobody Ever HeardDocument20 pages10 Historical Speeches Nobody Ever HeardSumit Roy100% (1)

- The 5 Free Alternatives To Microsoft WordDocument60 pagesThe 5 Free Alternatives To Microsoft WordSumit RoyNo ratings yet

- The 5 Free Alternatives To Microsoft WordDocument60 pagesThe 5 Free Alternatives To Microsoft WordSumit RoyNo ratings yet

- CEO Survey On Hiring, Profitability and PeopleDocument36 pagesCEO Survey On Hiring, Profitability and PeopleSumit RoyNo ratings yet

- CVD Atlas 16 Death From Stroke PDFDocument1 pageCVD Atlas 16 Death From Stroke PDFRisti KhafidahNo ratings yet

- The Evolution of Digital Advertising 3.0: Adobe Research InsightsDocument1 pageThe Evolution of Digital Advertising 3.0: Adobe Research InsightsSumit RoyNo ratings yet

- 2014 Bill and Melinda Gates Foundation Report On Global PovertyDocument28 pages2014 Bill and Melinda Gates Foundation Report On Global PovertySumit RoyNo ratings yet

- Gender and Social Networking Activity :facebook Vs OthersDocument18 pagesGender and Social Networking Activity :facebook Vs OthersSumit RoyNo ratings yet

- Statewise GSDP PCI and G.RDocument3 pagesStatewise GSDP PCI and G.RArchit SingalNo ratings yet

- India InfographicsDocument3 pagesIndia InfographicsSumit RoyNo ratings yet

- Himalaya Herbal Toothpaste Case Study - g2 - Sec FDocument6 pagesHimalaya Herbal Toothpaste Case Study - g2 - Sec FIsha Dwivedi100% (1)

- 2009 UCLA Anderson MCA Casebook PDFDocument42 pages2009 UCLA Anderson MCA Casebook PDFJohn SnowmanNo ratings yet

- Mgt212 Final Assignment - E2100233 - Pham Vu Hoang LamDocument25 pagesMgt212 Final Assignment - E2100233 - Pham Vu Hoang LamNhat Mai Hoang AnhNo ratings yet

- The Content CodeDocument182 pagesThe Content CodeWan Seung100% (1)

- The Center For Entrepreneurship Qatar UniversityDocument13 pagesThe Center For Entrepreneurship Qatar UniversityTalha Iftekhar KhanNo ratings yet

- Modern tobacco marketing fundamentalsDocument6 pagesModern tobacco marketing fundamentalsAbdus SalamNo ratings yet

- Advertising of Vicco Turmeric Ayurvedic CreamDocument40 pagesAdvertising of Vicco Turmeric Ayurvedic CreamChandan Parsad80% (5)

- MARK333 Assignment NikeAd Yap.J12jan11Document11 pagesMARK333 Assignment NikeAd Yap.J12jan11Jonathan YapNo ratings yet

- The Ultimate Lead Magnet Examples List PDFDocument67 pagesThe Ultimate Lead Magnet Examples List PDFVeken Bakrad100% (1)

- Harley Davidson Marketing Plan Targets Young RidersDocument24 pagesHarley Davidson Marketing Plan Targets Young RidersGarvit KumarNo ratings yet

- Tracking MagicDocument45 pagesTracking MagicTeraNo ratings yet

- Marketing StrategiesDocument15 pagesMarketing StrategiesWilma BundangNo ratings yet

- Organising A Conference Checklist PDFDocument14 pagesOrganising A Conference Checklist PDFInter 4DMNo ratings yet

- THUNDERSTORM Dynamic Ad Insertion - AmagiDocument5 pagesTHUNDERSTORM Dynamic Ad Insertion - AmagiArpit MalaniNo ratings yet

- 1case StudyDocument17 pages1case StudyJoyluxxiNo ratings yet

- Marketing Mix Modeling For The Tourism Industry-A Best Practices ApproachDocument15 pagesMarketing Mix Modeling For The Tourism Industry-A Best Practices ApproachOmkar VedpathakNo ratings yet

- 1822 Further.c n06Document6 pages1822 Further.c n06Nghĩa Nguyễn HữuNo ratings yet

- Kaisa Farm Business PlanDocument46 pagesKaisa Farm Business PlanSyed Aki100% (7)

- Measuring Impact of Social Marketing CampaignDocument65 pagesMeasuring Impact of Social Marketing CampaignPreethu GowdaNo ratings yet

- Role of Advertising in Marketing Strategy ofDocument19 pagesRole of Advertising in Marketing Strategy ofmegh9No ratings yet

- Module Vi: Media and Information LanguagesDocument6 pagesModule Vi: Media and Information LanguagesJoenetha Ann ApariciNo ratings yet

- Chapter 2 Integrated Marketing Communication PlanningDocument7 pagesChapter 2 Integrated Marketing Communication PlanningSao Nguyễn ToànNo ratings yet

- AdRoll Full Funnel MarketingDocument12 pagesAdRoll Full Funnel MarketingGarrett ChanNo ratings yet

- Investment ThesisDocument3 pagesInvestment Thesisapi-16270486No ratings yet

- MIL English - 4.1 Poster - Captions and SlogansDocument6 pagesMIL English - 4.1 Poster - Captions and SlogansChiragNo ratings yet

- Media and EthicsDocument6 pagesMedia and EthicsZara UsmaniNo ratings yet

- (Developments in Marketing Science_ Proceedings of the Academy of Marketing Science) Krzysztof Kubacki (Eds.)-Ideas in Marketing_ Finding the New and Polishing the Old_ Proceedings of the 2013 AcademyDocument908 pages(Developments in Marketing Science_ Proceedings of the Academy of Marketing Science) Krzysztof Kubacki (Eds.)-Ideas in Marketing_ Finding the New and Polishing the Old_ Proceedings of the 2013 AcademyTheodor CarducciNo ratings yet

- The Role of Public Relations in Branding: SciencedirectDocument9 pagesThe Role of Public Relations in Branding: Sciencedirectjoel joyNo ratings yet

- Bulats Writing Practice No. 2Document2 pagesBulats Writing Practice No. 2Julius CandelarioNo ratings yet

- ChocniqDocument89 pagesChocniqfathinNo ratings yet