Professional Documents

Culture Documents

Estimating High Dimensional Covariance Matrices Using A Factor Model - Sun - 2013 - Slides

Uploaded by

Gallo SolarisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estimating High Dimensional Covariance Matrices Using A Factor Model - Sun - 2013 - Slides

Uploaded by

Gallo SolarisCopyright:

Available Formats

1

Estimating High Dimensional

Covariance Matrix and

Volatility Index by making

Use of Factor Models

Celine Sun

R/Finance 2013

2

Outline

Introduction

Proposed estimation of covariance matrix:

Estimator 1: Factor-Model Based

Estimator 2: SVD based

Empirical testing results

Proposed volatility estimation:

Cross-section volatility (CSV)

Empirical Results

Conclusion

3

Two new estimators are

proposed in this work:

We propose two new covariance matrix

estimators :

1. Allow non-parametrically time-varying:

Estimate the monthly realized covariance matrix using daily data

2. Allow full rank for N>T:

Using the factor model and SVD to estimate such that the

covariance estimator is full rank

The new estimators are different from the commonly used

estimators and approaches

E

4

Covariance matrix estimation

based on FM (factor models)

We propose an estimation of

covariance matrix, based on a statistical

factor model with k factors (k < N).

Here, { } are the loadings,

{ } are the regression errors.

Note: The estimator matrix is full rank.

(

(

(

(

(

+

(

(

(

(

(

(

=

=

T

t

Nt

T

t

it

Nk k

N

Nk N

k

FM

RCOV

1

2

1

2

1

1 11

1

1 11

0

0

c

c

| |

| |

| |

| |

ij

c

ij

|

FM

RCOV

FM

RCOV

5

Covariance matrix estimation

based on SVD method

I propose the 2nd estimation of

covariance matrix, based on SVD:

Here, { } and { } are from the usual eigen

decomposition of the NxN realized variance matrix, and

having , with k < N.

{ } = the remaining terms from reconstructing

the return matrix by { } and { }

SVD

RCOV

(

(

(

(

(

+

(

(

(

(

(

(

(

(

(

=

=

T

t

Nt

T

t

it

kN k

N

k kN N

k

SVD

d

d

e e

e e

e e

e e

RCOV

1

2

1

2

1

1 11

2

2

1

1

1 11

0

0

2

i

ij

e

0

1

> > >

k

it

d

i

ij

e

6

0

0.01

0.02

0.03

0.04

0.05

0.06

0.07

0.08

0.09

0.1

1

9

2

6

1

2

1

9

2

9

0

1

1

9

3

1

0

2

1

9

3

3

0

3

1

9

3

5

0

4

1

9

3

7

0

5

1

9

3

9

0

6

1

9

4

1

0

7

1

9

4

3

0

8

1

9

4

5

0

9

1

9

4

7

1

0

1

9

4

9

1

1

1

9

5

1

1

2

1

9

5

4

0

1

1

9

5

6

0

2

1

9

5

8

0

3

1

9

6

0

0

4

1

9

6

2

0

5

1

9

6

4

0

6

1

9

6

6

0

7

1

9

6

8

0

8

1

9

7

0

0

9

1

9

7

2

1

0

1

9

7

4

1

1

1

9

7

6

1

2

1

9

7

9

0

1

1

9

8

1

0

2

1

9

8

3

0

3

1

9

8

5

0

4

1

9

8

7

0

5

1

9

8

9

0

6

1

9

9

1

0

7

1

9

9

3

0

8

1

9

9

5

0

9

1

9

9

7

1

0

1

9

9

9

1

1

2

0

0

1

1

2

2

0

0

4

0

1

2

0

0

6

0

2

2

0

0

8

0

3

2

0

1

0

0

4

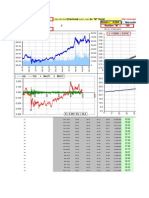

V

o

l

a

t

i

l

i

t

y

Global minimum portfolio

Shrinkage

FM

SVD

Empirical testing:

1 Year Rolling Volatility for S&P 500

7

Empirical testing:

1 Year Rolling Volatility for S&P 500

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

1

9

2

6

1

2

1

9

2

9

0

1

1

9

3

1

0

2

1

9

3

3

0

3

1

9

3

5

0

4

1

9

3

7

0

5

1

9

3

9

0

6

1

9

4

1

0

7

1

9

4

3

0

8

1

9

4

5

0

9

1

9

4

7

1

0

1

9

4

9

1

1

1

9

5

1

1

2

1

9

5

4

0

1

1

9

5

6

0

2

1

9

5

8

0

3

1

9

6

0

0

4

1

9

6

2

0

5

1

9

6

4

0

6

1

9

6

6

0

7

1

9

6

8

0

8

1

9

7

0

0

9

1

9

7

2

1

0

1

9

7

4

1

1

1

9

7

6

1

2

1

9

7

9

0

1

1

9

8

1

0

2

1

9

8

3

0

3

1

9

8

5

0

4

1

9

8

7

0

5

1

9

8

9

0

6

1

9

9

1

0

7

1

9

9

3

0

8

1

9

9

5

0

9

1

9

9

7

1

0

1

9

9

9

1

1

2

0

0

1

1

2

2

0

0

4

0

1

2

0

0

6

0

2

2

0

0

8

0

3

2

0

1

0

0

4

V

o

l

a

t

i

l

i

t

y

Mean variance efficient portfolio with mean=8%

Shrinkage

FM

SVD

Volatility Index

A number of drawbacks of current volatility index

Not based on actual stock returns

The index only available to liquid options

Only available at broad market level

Advantage of CSV

Observable at any frequency

Model-free

Available for every region, sector, and style of the

equity markets

Don't need to resort option market

8

9

Cross-sectional volatility

Cross-sectional volatility (CSV) is defined

as the standard deviation of a set of asset

returns over a period.

The relationship between cross-sectional

volatility, time-series volatility and average

correlation is given by:

( ) o o ~ 1

x

10

0

0.1

0.2

0.3

0.4

0.5

0.6

1

9

2

6

0

1

1

9

2

8

0

3

1

9

3

0

0

5

1

9

3

2

0

7

1

9

3

4

0

9

1

9

3

6

1

1

1

9

3

9

0

1

1

9

4

1

0

3

1

9

4

3

0

5

1

9

4

5

0

7

1

9

4

7

0

9

1

9

4

9

1

1

1

9

5

2

0

1

1

9

5

4

0

3

1

9

5

6

0

5

1

9

5

8

0

7

1

9

6

0

0

9

1

9

6

2

1

1

1

9

6

5

0

1

1

9

6

7

0

3

1

9

6

9

0

5

1

9

7

1

0

7

1

9

7

3

0

9

1

9

7

5

1

1

1

9

7

8

0

1

1

9

8

0

0

3

1

9

8

2

0

5

1

9

8

4

0

7

1

9

8

6

0

9

1

9

8

8

1

1

1

9

9

1

0

1

1

9

9

3

0

3

1

9

9

5

0

5

1

9

9

7

0

7

1

9

9

9

0

9

2

0

0

1

1

1

2

0

0

4

0

1

2

0

0

6

0

3

2

0

0

8

0

5

2

0

1

0

0

7

Monthly cross-sectional volatility vs.

average volatility & average correlation

cross-vol

vol*sqrt(1-corr)

Correlation: 0.85

Empirical testing:

1 Year Rolling Volatility for S&P 500

11

Decomposing Cross-Sectional

Volatility

Apply the factor model on return

The change of beta is more persistent

Cross-sectional volatility of the specific

return is a proxy for the future volatility

The correlation between VIX and CSV of

specific return is 0.62.

) ( ) ( ) (

i t i i

CSV f CSV R CSV c | + =

12

Conclusion

Constructed covariance matrix estimators

which are full rank

The portfolios constructed based on my

estimators have lower volatility

Applying factor model structure to CSV

gives us a good estimation of the volatility.

It could be used at any frequency and at

any set of stocks

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- DCF PrimerDocument30 pagesDCF PrimerAnkit_modi2000No ratings yet

- RusselJ. Fuller and Chi-Cheng Hsia A Simplified Common Stock Valuation ModelDocument9 pagesRusselJ. Fuller and Chi-Cheng Hsia A Simplified Common Stock Valuation ModelShivani RahejaNo ratings yet

- CPA Review Cost of CapitalDocument12 pagesCPA Review Cost of CapitalCarlito B. BancilNo ratings yet

- Stochastic Portfolio Theory - A Survey - SlidesDocument27 pagesStochastic Portfolio Theory - A Survey - SlidesTraderCat SolarisNo ratings yet

- R-QuantLib Integration Spanderen 2013 SlidesDocument20 pagesR-QuantLib Integration Spanderen 2013 SlidesGallo SolarisNo ratings yet

- The Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesDocument25 pagesThe Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesGallo SolarisNo ratings yet

- Community Futures Strathcona Loan Application PDFDocument4 pagesCommunity Futures Strathcona Loan Application PDFGallo SolarisNo ratings yet

- Time Varying Higher Moments and The Cost of GARCH - Ghalanos - 2013 - SlidesDocument19 pagesTime Varying Higher Moments and The Cost of GARCH - Ghalanos - 2013 - SlidesGallo SolarisNo ratings yet

- Business Name Request Form PDFDocument2 pagesBusiness Name Request Form PDFGallo SolarisNo ratings yet

- The Bible of The Good & Moral AtheistDocument109 pagesThe Bible of The Good & Moral Atheistnitagrl74100% (14)

- Deeper Kernels - Taylor - 2013 - Slides PDFDocument70 pagesDeeper Kernels - Taylor - 2013 - Slides PDFGallo SolarisNo ratings yet

- How To Choose The Right Business StructureDocument4 pagesHow To Choose The Right Business StructureAnu AnushaNo ratings yet

- The Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesDocument25 pagesThe Scidb Package - An R Interface To SciDB - Lewis - 2013 - SlidesGallo SolarisNo ratings yet

- The Impact of Computational Error On The Volatility Smile - Chance and Hanson Et Al - 2013 - SlidesDocument19 pagesThe Impact of Computational Error On The Volatility Smile - Chance and Hanson Et Al - 2013 - SlidesGallo SolarisNo ratings yet

- Using Markov Models in R To Understand The Lifecycle of Exchange-Traded Derivatives - Cavanaugh - 2013 - SlidesDocument37 pagesUsing Markov Models in R To Understand The Lifecycle of Exchange-Traded Derivatives - Cavanaugh - 2013 - SlidesGallo SolarisNo ratings yet

- Understanding Moving Averages Strategies With The Help of Toy Models Using R - Silva - 2013 - SlidesDocument9 pagesUnderstanding Moving Averages Strategies With The Help of Toy Models Using R - Silva - 2013 - SlidesGallo SolarisNo ratings yet

- California tenants guide rights responsibilitiesDocument122 pagesCalifornia tenants guide rights responsibilitieskingsaratNo ratings yet

- OneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesDocument8 pagesOneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesGallo SolarisNo ratings yet

- 30 Stock KurtosisDocument60 pages30 Stock KurtosisGallo SolarisNo ratings yet

- Using Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesDocument78 pagesUsing Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesGallo Solaris100% (1)

- 4 Stock RegressionsDocument16 pages4 Stock RegressionsGallo SolarisNo ratings yet

- 4 Stock RegressionsDocument16 pages4 Stock RegressionsGallo SolarisNo ratings yet

- Download: Fill in The Then Click The ButtonDocument101 pagesDownload: Fill in The Then Click The ButtonGallo SolarisNo ratings yet

- 3 Stock Correlations2Document162 pages3 Stock Correlations2Gallo SolarisNo ratings yet

- Ito OptionsDocument5 pagesIto OptionsGallo SolarisNo ratings yet

- 2 Stock CorrelationDocument118 pages2 Stock CorrelationGallo SolarisNo ratings yet

- Ito PredictDocument79 pagesIto PredictGallo SolarisNo ratings yet

- GARCHDocument125 pagesGARCHGallo SolarisNo ratings yet

- 5 Year AnalysisDocument100 pages5 Year AnalysisGallo SolarisNo ratings yet

- Hurst ExponentDocument148 pagesHurst ExponentGallo SolarisNo ratings yet

- Golden RatiosDocument7 pagesGolden RatiosGallo SolarisNo ratings yet

- Fama French 92Document19 pagesFama French 92Cobra PrsjNo ratings yet

- The Cost of Capital: All Rights ReservedDocument56 pagesThe Cost of Capital: All Rights ReservedANISA RABANIANo ratings yet

- Fin33 2nd NewDocument2 pagesFin33 2nd NewRonieOlarteNo ratings yet

- Full download book Advances In Active Portfolio Management New Developments In Quantitative Investing Pdf pdfDocument41 pagesFull download book Advances In Active Portfolio Management New Developments In Quantitative Investing Pdf pdftonja.oneal380100% (18)

- 2008 Financial Market Anomalies - New Palgrave Dictionary of Economics (Keim)Document14 pages2008 Financial Market Anomalies - New Palgrave Dictionary of Economics (Keim)jude55No ratings yet

- Cash Flow EstimationDocument38 pagesCash Flow EstimationMuhammad Mohsin Shahzad KahloonNo ratings yet

- Risk and Rates of Return: Stand-Alone Risk Portfolio Risk Risk & Return: CAPM/SMLDocument55 pagesRisk and Rates of Return: Stand-Alone Risk Portfolio Risk Risk & Return: CAPM/SMLeyraNo ratings yet

- Mutual Fund Valuation and AccountingDocument72 pagesMutual Fund Valuation and Accountingsiclsicl100% (1)

- Investments Ch.9 QuizDocument3 pagesInvestments Ch.9 Quizmh_jusbreal0% (1)

- Cost of DebtDocument3 pagesCost of DebtGonzalo De CorralNo ratings yet

- IAPM AssignmentDocument14 pagesIAPM AssignmentAssignment GuideNo ratings yet

- Chapter 9 SolutionsDocument5 pagesChapter 9 SolutionsRivaldi SembiringNo ratings yet

- Marriot CorpDocument7 pagesMarriot Corpamith88100% (1)

- CamelDocument43 pagesCamelsuyashbhatt1980100% (1)

- Investmment Chapter TwoDocument10 pagesInvestmment Chapter Twosamuel debebeNo ratings yet

- Securitization of IPDocument8 pagesSecuritization of IPKirthi Srinivas GNo ratings yet

- Assignment Sampa VideoDocument7 pagesAssignment Sampa Videohernandezc_joseNo ratings yet

- SFM Equity Additional Practice QuestionsDocument23 pagesSFM Equity Additional Practice QuestionsSuhag PatelNo ratings yet

- AEW Global Focused Real Estate Fund: Fund Highlights Morningstar RatingDocument2 pagesAEW Global Focused Real Estate Fund: Fund Highlights Morningstar RatingBob MilisNo ratings yet

- Capital Budgeting MethodsDocument7 pagesCapital Budgeting MethodsCarl Angelo Lopez100% (1)

- Stock StrategiesDocument29 pagesStock StrategiesHans CNo ratings yet

- Performance Attribution - Ossiam ResearchDocument8 pagesPerformance Attribution - Ossiam ResearchLuis VelardeNo ratings yet

- DuhaDocument26 pagesDuhaKhánh LyNo ratings yet

- Alpha InvestingDocument4 pagesAlpha Investingapi-3700769No ratings yet

- Calculation of Beta in Stock MarketsDocument35 pagesCalculation of Beta in Stock Marketsneha_baid_1No ratings yet

- Assignment: 1 Security Market Line:: Arun Anantha Raman, Roll No: 86, PGDM - Finance (2012 - 14)Document5 pagesAssignment: 1 Security Market Line:: Arun Anantha Raman, Roll No: 86, PGDM - Finance (2012 - 14)Pratik Dilip DudaniNo ratings yet

- FIN622 Online Quiz - PdfaDocument531 pagesFIN622 Online Quiz - Pdfazahidwahla1100% (3)