Professional Documents

Culture Documents

Changes in CRR and SLR in Recent Past and Their Impact

Uploaded by

jj20thomsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Changes in CRR and SLR in Recent Past and Their Impact

Uploaded by

jj20thomsonCopyright:

Available Formats

CHANGES IN CRR AND SLR IN RECENT PAST AND THEIR IMPACT

MEMBERS IN GROUP:

Jitesh Sethi -127 Amit -128 Avinash Kapil -129 Bhavya Malhotra -130 Pinki Rana -131 Sakshi Jaiswal -132 Nitish Yadav -133 Durgesh Kumar -201 Seenu Bansal-202 Neha Sharma -203

Cash Reserve Ratio

Cash Reserve Ratio (CRR) is a specified minimum fraction of the total deposits of customers, which commercial banks have to hold as reserves either in cash or as deposits with the central bank. CRR is set according to the guidelines of the central bank of a country.

ADVANTAGES OF MAINTAINING CRR:1) To ensure liquidity and solvency position of scheduled commercial banks . 2) To monitor and regulate the flow of credit given by commercial banks. 3) To ensure a stable flow of credit in the economy. 4) When RBI increases CRR the SCB restrict the flow of credit to the public which sucks the money from the general public . 5) When RBI decreases CRR the SCB grant more credit loans and other facilities to the general public which increase the flow of money in the hands of many.

DRAWBACKS OF MAINTAINING CRR :1) Affects industrial growth ,when commercil banks have to maintain high rate of crr with rbi the restrict the credit to general public who are none other that business developers ,entrepreneurs and other industrialists who seek pre and post shipment finance. 2) Reduces the standard of living of people when crr is increased. 3)Banks loose their valuable customers when they are in a situation not to provide credit to general public.

CHANGES IN CRR:-

Cash Reserve Ratio (CRR)

4.00% (wef 09/02/2013) announced on 29/01/2013

Decreased from 4.25%which was continuing since 30/10/2012

ADVANTAGES OF MAINTAINING SLR

The SLR is commonly used to contain inflation and fuel growth, by increasing or decreasing it respectively This counter acts by decreasing or increasing the money supply in the system respectively. To control the expansion of bank credit- By changing the level of SLR, the Reserve Bank of India can increase or decrease bank credit expansion.

CHANGES IN SLR:Statutory Liquidity Ratio (SLR) 23%(w.e.f. 11/08/2012) (announced on 31/07/2012) Decreased from 24% which was continuing since 18/12/2010

IMPACT OF CRR:-

IMPACT OF CRR:

CRR Hike Help In Lowering Inflation Impact on Interest rates Reduces credit expansion

IMPACT OF SLR:

Increase credit availability SLR, A CUSHION FOR SAFETY

CRR VS. SLR:CRR SLR

CRR, is the portion of deposits that SLR restricts the banks leverage in the banks have to maintain with the pumping more money into the Central Bank to reduce liquidity in economy banking system. CRR controls liquidity in banking system CRR it has to be only cash CRR is maintained in cash form with central bank SLR regulates credit growth in the country To meet SLR, banks can use cash, gold or approved securities SLR is money deposited in govt. securities

You might also like

- Significant of CRR and Slr.Document20 pagesSignificant of CRR and Slr.Devesh VermaNo ratings yet

- Cash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) : Presented by Bhavana BDocument9 pagesCash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) : Presented by Bhavana BDhivyaNo ratings yet

- RBI's Development and Regulatory Policy: CA Divakar VijayasarathyDocument29 pagesRBI's Development and Regulatory Policy: CA Divakar Vijayasarathyaditya kothekarNo ratings yet

- Significant of CRR and Slr.Document13 pagesSignificant of CRR and Slr.Devesh VermaNo ratings yet

- Monetary PolicyDocument34 pagesMonetary PolicyYogesh Kende89% (9)

- Monetary Policy - Eco ProjectDocument8 pagesMonetary Policy - Eco Projectnandanaa06No ratings yet

- Notes On Monetary & Credit Policy of RBIDocument5 pagesNotes On Monetary & Credit Policy of RBIjophythomasNo ratings yet

- Economics Project - Docx 2Document7 pagesEconomics Project - Docx 2Gurpreet Singh100% (1)

- Should CRR Be AbolishedDocument12 pagesShould CRR Be AbolishedNimisha JainNo ratings yet

- Chapter 3: Public Sector Banks: An Overview and Identification of Weak BanksDocument10 pagesChapter 3: Public Sector Banks: An Overview and Identification of Weak BanksAnindita Biswas RoyNo ratings yet

- Economic policies for StabilizationDocument23 pagesEconomic policies for StabilizationMayurRawoolNo ratings yet

- Investor Presentation Q3 FY2012-13 (15-January-2013) PDFDocument33 pagesInvestor Presentation Q3 FY2012-13 (15-January-2013) PDFRohit ShawNo ratings yet

- Banking Sector Reforms in IndiaDocument8 pagesBanking Sector Reforms in IndiaJashan Singh GillNo ratings yet

- Reprt SoneriDocument23 pagesReprt SoneriMuqaddas IsrarNo ratings yet

- Monetary Policy RBI Mid Quarter Review of Dec.2010 VRK100 17122010Document5 pagesMonetary Policy RBI Mid Quarter Review of Dec.2010 VRK100 17122010RamaKrishna Vadlamudi, CFANo ratings yet

- RBI Credit Creation GuideDocument24 pagesRBI Credit Creation GuideABIGAIL SHIJU 20213116No ratings yet

- 56 - Banking - Sector Thematic 24mar14Document37 pages56 - Banking - Sector Thematic 24mar14girishrajsNo ratings yet

- Monetary PolicyDocument18 pagesMonetary PolicySarada NagNo ratings yet

- Ruhi Agrawal Assignment (Banking)Document32 pagesRuhi Agrawal Assignment (Banking)Shraddha GawadeNo ratings yet

- Cash Reserve RatioDocument40 pagesCash Reserve RatioMinal DalviNo ratings yet

- RBI Monetary Policy Explained in 40 CharactersDocument21 pagesRBI Monetary Policy Explained in 40 CharactersRahulNo ratings yet

- Monetary Policy of RBIDocument22 pagesMonetary Policy of RBIBindu MadhaviNo ratings yet

- Value and Formula: Statutory Liquidity Ratio Is The Amount of Liquid Assets Such As Precious Metals (Gold) or OtherDocument4 pagesValue and Formula: Statutory Liquidity Ratio Is The Amount of Liquid Assets Such As Precious Metals (Gold) or OthernandiniNo ratings yet

- Monetary Policy: Presentation byDocument31 pagesMonetary Policy: Presentation bySumant AlagawadiNo ratings yet

- Assets & Liabilities Management at Union Co-op BankDocument21 pagesAssets & Liabilities Management at Union Co-op BankapluNo ratings yet

- CRRDocument7 pagesCRRAyush Agrawal0% (1)

- Instruments of Monetary Policy: Presented by Vinita Kumari PGDM-1Document7 pagesInstruments of Monetary Policy: Presented by Vinita Kumari PGDM-1hgaur90No ratings yet

- Finance Current Affairs November Day 1Document19 pagesFinance Current Affairs November Day 1Ayesha SNo ratings yet

- Financial Institutions: 2013 Outlook: Major Indian Non-Bank Finance CompaniesDocument10 pagesFinancial Institutions: 2013 Outlook: Major Indian Non-Bank Finance Companiess_suraiyaNo ratings yet

- Monetary-PolicyDocument23 pagesMonetary-Policyrahulm6538No ratings yet

- Financial sector reforms in India since 1991Document17 pagesFinancial sector reforms in India since 1991Palash BairagiNo ratings yet

- Banking Industry in India: Presented By: Samrat BanerjeeDocument23 pagesBanking Industry in India: Presented By: Samrat BanerjeeSohini KarNo ratings yet

- Financial IndicatorsDocument20 pagesFinancial Indicatorsmajid_khan_4No ratings yet

- Co-Operative Banking: Competitive Business EnvironmentDocument14 pagesCo-Operative Banking: Competitive Business EnvironmentfdjsgjdgNo ratings yet

- A Study of Management of Non-Performing Assets (Npas) in Credit CooperativesDocument33 pagesA Study of Management of Non-Performing Assets (Npas) in Credit Cooperativesm.c.madhan kumarNo ratings yet

- Central BankDocument17 pagesCentral BankWishy KhanNo ratings yet

- Central BankDocument17 pagesCentral BankGaurav KumarNo ratings yet

- How RBI Controls Money Supply Through CRR and SLRDocument24 pagesHow RBI Controls Money Supply Through CRR and SLRyash bhushanNo ratings yet

- Mrunal Economics 02Document70 pagesMrunal Economics 02haroon nazirNo ratings yet

- The Taxing Problem Future of The Cash Reserve RatioDocument7 pagesThe Taxing Problem Future of The Cash Reserve RatioShay WaxenNo ratings yet

- CRISIL Ratings - Report - Pandemic To Weigh On India Inc Credit Quality - 03april2020 PDFDocument32 pagesCRISIL Ratings - Report - Pandemic To Weigh On India Inc Credit Quality - 03april2020 PDFmurthyeNo ratings yet

- How Is CRR Used As A Tool of Credit ControlDocument14 pagesHow Is CRR Used As A Tool of Credit ControlHimangini SinghNo ratings yet

- Financial Sector Reforms in India Since 1991Document11 pagesFinancial Sector Reforms in India Since 1991AMAN KUMAR SINGHNo ratings yet

- What Ails Indian Banking SectorDocument9 pagesWhat Ails Indian Banking SectorparthiNo ratings yet

- Central Bank of India PresentationDocument23 pagesCentral Bank of India PresentationNikita NisarNo ratings yet

- DCB Bank Buy Emkay ResearchDocument23 pagesDCB Bank Buy Emkay ResearchGreyFoolNo ratings yet

- Credit ControlDocument19 pagesCredit ControlPramil AnandNo ratings yet

- CRR & SLR and Computation - PPTX BVB 204Document20 pagesCRR & SLR and Computation - PPTX BVB 204679shrishti SinghNo ratings yet

- Concept Monetary and Fiscal PolicyDocument17 pagesConcept Monetary and Fiscal Policycluadine dinerosNo ratings yet

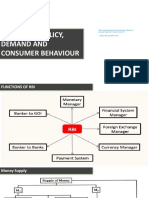

- Monetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreDocument23 pagesMonetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreBhavya NarangNo ratings yet

- What Is Monetary PolicyDocument5 pagesWhat Is Monetary PolicyBhagat DeepakNo ratings yet

- Cash Reserve Ratio: Economics Project by Ayush Dadawala and Suradnya PatilDocument14 pagesCash Reserve Ratio: Economics Project by Ayush Dadawala and Suradnya PatilSuradnya PatilNo ratings yet

- Presentation UCBs PDFDocument20 pagesPresentation UCBs PDFaneesh_nith8965No ratings yet

- Statutory Liquidity RatioDocument2 pagesStatutory Liquidity RatioRamNo ratings yet

- Banking and Financial Awareness PDFDocument62 pagesBanking and Financial Awareness PDFkumarsanjeev.net9511No ratings yet

- Impact of Credit Policy On The Indian Capital Markets: PortfoliotalkDocument5 pagesImpact of Credit Policy On The Indian Capital Markets: PortfoliotalkWELLS_BETSNo ratings yet

- Role of CRR and SLRDocument9 pagesRole of CRR and SLRVineeta Malan50% (2)

- L-33 & 34, Fiscal Policy and Monetary PolicyDocument25 pagesL-33 & 34, Fiscal Policy and Monetary PolicyDhruv MinochaNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- A Study On The Customers Awareness and Perception Level Towards Green CarsDocument8 pagesA Study On The Customers Awareness and Perception Level Towards Green Carsjj20thomsonNo ratings yet

- A Study On The Customers Awareness and Perception Level Towards Green Cars PDFDocument4 pagesA Study On The Customers Awareness and Perception Level Towards Green Cars PDFAmruth Charan KNo ratings yet

- Srinivasa Aiyangar RamanujanDocument8 pagesSrinivasa Aiyangar Ramanujanjj20thomsonNo ratings yet

- JJ RetirementDocument1 pageJJ Retirementjj20thomsonNo ratings yet

- BLE Research AssignmentDocument10 pagesBLE Research Assignmentjj20thomsonNo ratings yet

- FireDocument35 pagesFirejj20thomsonNo ratings yet

- Assignment OnDocument37 pagesAssignment Onjj20thomsonNo ratings yet

- BC Assignment Shubham PuriDocument2 pagesBC Assignment Shubham Purijj20thomsonNo ratings yet

- Delhi-Goa Itinery RevisedDocument2 pagesDelhi-Goa Itinery Revisedjj20thomsonNo ratings yet

- AssignmentDocument4 pagesAssignmentjj20thomsonNo ratings yet

- Cultural DiversityDocument5 pagesCultural Diversityjj20thomsonNo ratings yet

- Jitesh Business CommunicationDocument2 pagesJitesh Business Communicationjj20thomsonNo ratings yet

- Hardware Requirements For UnixDocument42 pagesHardware Requirements For Unixjj20thomsonNo ratings yet

- BLE Research AssignmentDocument10 pagesBLE Research Assignmentjj20thomsonNo ratings yet

- Summer Training Report - RitikaDocument69 pagesSummer Training Report - Ritikaritika_honey2377% (30)

- Foundations of Education Case StudiesDocument2 pagesFoundations of Education Case Studiesapi-316041090No ratings yet

- UKLSR Volume 2 Issue 1 Article 3 PDFDocument34 pagesUKLSR Volume 2 Issue 1 Article 3 PDFIbrahim SalahudinNo ratings yet

- SITHKOP004 Develop Menus For Special Dietary RequirementsDocument14 pagesSITHKOP004 Develop Menus For Special Dietary RequirementsArmughan Bukhari100% (2)

- Combination Resume SampleDocument2 pagesCombination Resume SampleDavid SavelaNo ratings yet

- Kashmir Highway sports club membership formDocument2 pagesKashmir Highway sports club membership formSarah HafeezNo ratings yet

- 69-343-093 NFP2000 ManualDocument56 pages69-343-093 NFP2000 ManualYoga Darmansyah100% (1)

- Nuclear Power in The United KingdomDocument188 pagesNuclear Power in The United KingdomRita CahillNo ratings yet

- Tanveer SethiDocument13 pagesTanveer SethiRoshni SethiNo ratings yet

- AHMEDABAD-380 014.: Office of The Ombudsman Name of The Ombudsmen Contact Details AhmedabadDocument8 pagesAHMEDABAD-380 014.: Office of The Ombudsman Name of The Ombudsmen Contact Details AhmedabadPatrick AdamsNo ratings yet

- The Elite and EugenicsDocument16 pagesThe Elite and EugenicsTheDetailerNo ratings yet

- Digbeth Residents Association - ConstitutionDocument3 pagesDigbeth Residents Association - ConstitutionNicky GetgoodNo ratings yet

- MIHU Saga (Redacted)Document83 pagesMIHU Saga (Redacted)Trevor PetersonNo ratings yet

- Tuanda vs. SandiganbayanDocument2 pagesTuanda vs. SandiganbayanJelena SebastianNo ratings yet

- Central Banking: What Is Central Bank?Document6 pagesCentral Banking: What Is Central Bank?Arif Mahmud MuktaNo ratings yet

- The Workmen's Compensation ActDocument23 pagesThe Workmen's Compensation ActMonika ShindeyNo ratings yet

- Project Management of World Bank ProjectsDocument25 pagesProject Management of World Bank ProjectsDenisa PopescuNo ratings yet

- PPSC Announces Candidates Cleared for Statistical Officer InterviewDocument3 pagesPPSC Announces Candidates Cleared for Statistical Officer InterviewYasir SultanNo ratings yet

- 232 Sumifru (Phils.) Corp. v. Spouses CerenoDocument2 pages232 Sumifru (Phils.) Corp. v. Spouses CerenoHBNo ratings yet

- Final Merit List of KU For LaptopDocument31 pagesFinal Merit List of KU For LaptopAli Raza ShahNo ratings yet

- Gorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockDocument1 pageGorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockLorena Sanchez 3No ratings yet

- Family Law Dissertation TopicsDocument5 pagesFamily Law Dissertation TopicsWriteMyEnglishPaperForMeSterlingHeights100% (1)

- Caterpillar Cat 301.8C Mini Hydraulic Excavator (Prefix JBB) Service Repair Manual (JBB00001 and Up) PDFDocument22 pagesCaterpillar Cat 301.8C Mini Hydraulic Excavator (Prefix JBB) Service Repair Manual (JBB00001 and Up) PDFfkdmma33% (3)

- SALAZAR WrittenDocument3 pagesSALAZAR WrittenJustin SalazarNo ratings yet

- 1.1 Simple Interest: StarterDocument37 pages1.1 Simple Interest: Starterzhu qingNo ratings yet

- Newstead v. London Express Newspaper, LimiteDocument16 pagesNewstead v. London Express Newspaper, Limitesaifullah_100% (1)

- PowerFlex 750 Series AC Drive - Custom V - HZ and Fan - Pump DifferencesDocument5 pagesPowerFlex 750 Series AC Drive - Custom V - HZ and Fan - Pump DifferencesAndrii AverianovNo ratings yet

- Lumbini Grade 9 Test 2 PhysDocument8 pagesLumbini Grade 9 Test 2 PhysSnow WhiteNo ratings yet

- Major League Baseball v. CristDocument1 pageMajor League Baseball v. CristReid MurtaughNo ratings yet

- Amalgmation, Absorbtion, External ReconstructionDocument9 pagesAmalgmation, Absorbtion, External Reconstructionpijiyo78No ratings yet

- Anti-Communist Myths DebunkedDocument168 pagesAnti-Communist Myths DebunkedSouthern Futurist100% (1)