Professional Documents

Culture Documents

Chp06 T-Bond Futures

Uploaded by

Amsalu WalelignCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chp06 T-Bond Futures

Uploaded by

Amsalu WalelignCopyright:

Available Formats

K.Cuthbertson, D.

Nitzsche 1

Version 1/9/2001

FINANCIAL ENGINEERING:

DERIVATIVES AND RISK MANAGEMENT

(J. Wiley, 2001)

K. Cuthbertson and D. Nitzsche

LECTURE

T-Bond Futures

K.Cuthbertson, D. Nitzsche 2

Details of Contracts and Terminology

Hedging with T-Bond Futures

Pricing T-Bond Futures

Market Timing

Topics

K.Cuthbertson, D. Nitzsche 3

Details of Contracts and Terminology

K.Cuthbertson, D. Nitzsche 4

Long T-bond futures position

Holder can take delivery of a long maturity T-bond at

expiration, at a price F

0

agreed at t=0.

Speculation

Think long rates will fall in the future, then buy a T-Bond

future

If rates do fall, then F increases and close out at profit

Hedging

Lock in a price today, for delivery or sale of the underlying

T-Bonds

Arbitrage

Keeps the cash market T-bond price (S) and the futures

price,F broadly moving together

Contract and its Uses

K.Cuthbertson, D. Nitzsche 5

27

th

July 2000s

Settlement price(CBT), Sept. delivery

= 98-14 (= 98

14/32

) =$98.4375 per $100 nominal

Contract size, z = $100,000

Face value one contract:

FVF

0

=z(F

0

/100)=z ($98.4375 / $100) = $98,437.50.

Tick size = 1/32 of 1%

Tick value = $31.25 per contract

US, T-Bond Futures Contract

K.Cuthbertson, D. Nitzsche 6

.

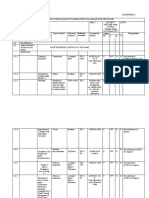

Table 6.2 : US T-Bond Future (CBOT)

Contract Size $ 100,000 nominal, notional US Treasury Bond with

8% coupon

Delivery Months March, June, September, December

Quotation Per $ 100 nominal

Tick Size (Value) 1/32 ($ 31.25)

Last trading day 7 working days prior to last business day in expiry

month

Delivery day Any business day in delivery month (sellers choice)

Settlement Any US Treasury Bond maturing at least 15 years

from the contract month (or not callable for 15 years)

Margins $ 5,000 initial; $ 4,000 maintenance

Trading Hours 8 am 2 pm Central Time

Daily Price Limit 96/30 pnts $ 3,000

K.Cuthbertson, D. Nitzsche 7

Adjusts price of actual bond to be delivered by assuming

it has an 8% yield to maturity, , which then matches that

of the notional bond in the futures contract.

(also with maturity > 15yrs)

If the coupon on the bond actually delivered > 8%

then CF > 1

If the coupon on the bond actually delivered < 8%

then CF < 1

Conversion Factor, CF

K.Cuthbertson, D. Nitzsche 8

CTD bond is one with smallest raw basis:

[6.1] Raw Basis = B

T

F

T

CF

T

B

T

= spot (clean) price of eligible bond for delivery

F

T

= settlement futures price

CF

T

= conversion factor of a deliverable bond.

Cheapest to Deliver

K.Cuthbertson, D. Nitzsche 9

Hedging

with

T-Bond Futures

K.Cuthbertson, D. Nitzsche 10

Hedging an Existing Bond Position

Spot Position: 1st May Futures : 1st May (September delivery)

10%, 2005 Treasury Bond (YTM = 10.12%) CF of CTD bond = 1.12

Nominal Bond holding NB

0

= $1m

Size of one contract z = $100,000

Current Price S

0

= $101 ($101 per $100) Price of futures F

0

= 110-16 ($110.50)

Market Value, Spot = TVS

0

= NB

0

(S

0

/100) = $1,010,00

Duration D

s

= 6.9

Number of futures contracts

10

0

0

=

|

|

.

|

\

|

=

CTD

f

s

f

CF

D

D

FVF

TVS

N

Face Value FVF

0

= z F

0

=$110,500

Duration D

F

= 7.2

Tick value of 1/32 equals $31.25

K.Cuthbertson, D. Nitzsche 11

FINANCIAL ENGINEERING:

Outcome of the Hedge : 1st August

Spot Market (On 1st August) September Futures (On 1

st

August)

S

1

= 98-16 ($98.5)

Value of spot position TVS

1

= (S

1

/100)B

= (98.5/100)$1m

= $985,000

F

0

= 110-16 ($110.5)

F

1

= 108-16 ($108.5 per $100)

Loss on spot position = ((S

0

S

1

)/ 100) B

= (101 98.5)/100)$1m = $25,000

Gain on short futures

= N

f

z (F

0

F

1

)/100

= 10 ($100,000) (2/100) = $20,000

or

= (2 x 32) ticks x $31.25 x 10 = $20,000

NET RESULT

Net loss

Hedged = $20,000 $25,000 = $5,000

Unhedged = $25,000

K.Cuthbertson, D. Nitzsche 12

-the hedge period (eg. 3 months from May to August)

may not correspond to the maturity of the futures contract

(eg. September contract)

-the exact bond to be delivered in the futures contract is

not known, neither is the precise delivery date

-all of the methods for calculating the relative price

response in the spot and futures markets are subject to

some error, in part because it is difficult to ascertain the

CTD bond (and hence its duration)

-shifts in the yield curve may not be parallel, so we

cannot always assume, Ay

s

= Ay

F.

Risks in the Hedge

K.Cuthbertson, D. Nitzsche 13

Position Day :

The short notifies the Clearing House of intention to deliver, two

business days later

Notice of Intention Day :

The Clearing House assigns a trader who is long to accept delivery.

The short is now obligated to deliver the next business day.

Delivery Day

Bonds are delivered (with the last possible delivery day being the

business day prior to the last 7 days in the delivery month).

Wild Card Play

K.Cuthbertson, D. Nitzsche 14

On any 'position day'.

If the spot price of bonds falls between 3pm and 5pm, the short buys

the low price CTD bond in the cash market and issues a notice of

intention to deliver knowing that upon delivery she will receive the

high futures settlement price determined as of 3pm that day.

However, if the spot (bond) price does not decline, she can wait until

the next day and repeat this strategy (until the final business day

before the final delivery day in the month).

the short has an implicit option that is exercisable during the delivery

month, while the long has increased risk because she does not know

the exact price (ie. value) of the bond that will be delivered.

Wild Card Play by the short

K.Cuthbertson, D. Nitzsche 15

Pricing T-Bond Futures

K.Cuthbertson, D. Nitzsche

Figure 6.2 : Pricing a T-bond future

Deliverable bond is 10% coupon which matures 15th February 2020.

Deliverable bond pays semi-annual coupons of $(10/2) on 15th Feb. and 15th Aug.

C/2 C/2 C/2

15th Feb.

1999

1st July

1999 (= t)

15th Aug.

1999

Buy Spot Bond

AI

t

= (136/181)(10/2)

= 3.76

11th Sept.

1999 (= T)

15th Feb.

2000

Delivery of Bond in Futures

AI

T

= (27/184)(10/2) = 0.73

Arbitrage Period = 72 days

181 days 184 days

136 days 45 27 157 days

K.Cuthbertson, D. Nitzsche 17

Zero Coupon Bond

[13c] F = S exp( r (T-t) )

Coupon Paying Bond

Synthetic bond future

[6.14] Net cost (at T) of carry in cash market = (S

t

e

r(T-t)

FVC

T

)

FVC

T

applies to the coupon payments which occur between t = 1

st

of

July and T = 11

th

of September

[6.15] Invoice Price of Futures (at T): IPF = F

t

CF

t

+ AI

T

Actual futures contract and the synthetic futures both deliver one

bond at T then their cost must be equal, otherwise riskless arbitrage

profits would be possible. Equating [6.14] and [6.15] :

[6.16a] F

t

(CF

t

)

+ AI

t

= S

t

e

r(T-t)

FVC

T

[6.16b] F = (1/CF

t

) (S

t

e

r(T-t)

FVC

T

- AI

T

)

Pricing T-Bond Futures

K.Cuthbertson, D. Nitzsche 18

[6.18] S

t

= B

t

+ AI

t

[6.19b] S

t

= $130 + $4.14 = $134.14

Net cost of carry in the cash market at T, is :

[6.20] (S

t

e

r(T-t)

FVC

T

) = $134.14 e

0.03(58/365)

$5.022 = $129.76

AI

T

because of the next coupon payment on 15

th

of Feb 2000 is :

[6.21a] AI

T

= (27/184) (10/2) = 0.73

[6.21b] F = (1/CF

t

) (S

t

e

r(T-t)

FVC

T

- AI

T

)

= (1/1.22) ($129.76 $0.73) = $105.76

Pricing T-Bond Futures

K.Cuthbertson, D. Nitzsche 19

Market Timing

K.Cuthbertson, D. Nitzsche 20

Sell futures if you expect a rise in yields and therefore

require a lower duration for your existing bond portfolio

Buy futures if you expect a fall in yields and therefore

require an increased duration for your bond portfolio.

Market Timing

K.Cuthbertson, D. Nitzsche 21

END OF SLIDES

You might also like

- Achieving High Returns Safely: Use Safe Money Market InstrumentsFrom EverandAchieving High Returns Safely: Use Safe Money Market InstrumentsNo ratings yet

- Figures For Chapter 2: Futures MarketsDocument10 pagesFigures For Chapter 2: Futures MarketsUmar Ali KhanNo ratings yet

- BB - 6 - Futures & Options - Hull - Chap - 6Document23 pagesBB - 6 - Futures & Options - Hull - Chap - 6Ibrahim KhatatbehNo ratings yet

- Session 2 - BP Background Reading - 2011s2Document14 pagesSession 2 - BP Background Reading - 2011s2Stay Liangnan WeiNo ratings yet

- T-Bond and T-Note Futures: - Futures Contracts On U.S. Treasury Securities Have Been Immensely SuccessfulDocument37 pagesT-Bond and T-Note Futures: - Futures Contracts On U.S. Treasury Securities Have Been Immensely SuccessfulBen Salah MounaNo ratings yet

- Chp04 Currency Forwards and FuturesDocument26 pagesChp04 Currency Forwards and FuturesRohtash Singh RathoreNo ratings yet

- Futures and forwards for interest rate risk managementDocument16 pagesFutures and forwards for interest rate risk managementDennis HurtadoNo ratings yet

- Lecture Slides Forwards 2Document26 pagesLecture Slides Forwards 2Praveen Kumar DusiNo ratings yet

- Lecture-1, Section 16, Reading 58, Forward Markets and ContractsDocument33 pagesLecture-1, Section 16, Reading 58, Forward Markets and ContractsAnkit Gupta100% (1)

- FuturesDocument102 pagesFuturesSon LamNo ratings yet

- Calculate Forward and Futures Contract ValuationDocument7 pagesCalculate Forward and Futures Contract ValuationMurtaza ParekhNo ratings yet

- Fixed Income Basics: Understanding Bonds and Interest RatesDocument21 pagesFixed Income Basics: Understanding Bonds and Interest RatestheromeooNo ratings yet

- Determinants of Interest RatesDocument27 pagesDeterminants of Interest RatesraviNo ratings yet

- Tutorial 13Document3 pagesTutorial 13Henry Ng Yong KangNo ratings yet

- FWD and Future PricingDocument11 pagesFWD and Future PricingJatin SirsikarNo ratings yet

- InflationDocument11 pagesInflationZakaria ZrigNo ratings yet

- Interest Rates and Bond Valuation: DefaultDocument23 pagesInterest Rates and Bond Valuation: DefaultrytnmmNo ratings yet

- Sample TestDocument9 pagesSample Teststudunt100% (2)

- Futures Market and Prices: 2.1 Warming UpDocument15 pagesFutures Market and Prices: 2.1 Warming Upcharles luisNo ratings yet

- BOND VALUATION With SolutionsDocument30 pagesBOND VALUATION With Solutionschiaraferragni75% (8)

- FM Unit 6Document9 pagesFM Unit 6bookabdi1No ratings yet

- Forward and Future Pricing 2 FinalDocument24 pagesForward and Future Pricing 2 FinalRahul Singh100% (1)

- Chapter 15 The Term Structure of Interest Rates A. Yield-To-MaturityDocument6 pagesChapter 15 The Term Structure of Interest Rates A. Yield-To-MaturityGauravNo ratings yet

- Bonds Exam Cheat SheetDocument2 pagesBonds Exam Cheat SheetSergi Iglesias CostaNo ratings yet

- Section2 2013Document7 pagesSection2 2013gogogogoNo ratings yet

- End of Chapter Exercises - AnswersDocument3 pagesEnd of Chapter Exercises - AnswersYvonneNo ratings yet

- Lecture 4 ForwardsPrDocument29 pagesLecture 4 ForwardsPrKessellie T MulbahNo ratings yet

- 04 Forward and Future Exchange RateDocument12 pages04 Forward and Future Exchange RateAdnan KamalNo ratings yet

- Hedging Strategies Using Futures (MFFINTECH 6003Document29 pagesHedging Strategies Using Futures (MFFINTECH 6003Jessie DengNo ratings yet

- Pricing Model For An Inflation SwapDocument4 pagesPricing Model For An Inflation SwapchertokNo ratings yet

- Actuarial Investigations Slides 1Document102 pagesActuarial Investigations Slides 1implus112No ratings yet

- Bonds and Their ValuationDocument36 pagesBonds and Their ValuationRubab BabarNo ratings yet

- Interest Rate DerivativesDocument17 pagesInterest Rate Derivativescharles luisNo ratings yet

- Basis Trading BasicsDocument51 pagesBasis Trading BasicsTajinder SinghNo ratings yet

- Notes On Forward PricingDocument12 pagesNotes On Forward PricingWei Liang Ho100% (1)

- Chapter06 6th PDFDocument36 pagesChapter06 6th PDFClaudine AbesamisNo ratings yet

- Final Examination: Group - Iii Paper-11: Capital Market Analysis & Corporate LawsDocument51 pagesFinal Examination: Group - Iii Paper-11: Capital Market Analysis & Corporate LawsANSHUL BHATIANo ratings yet

- Lecture 4 Int Rate Derivatives Presentation2Document215 pagesLecture 4 Int Rate Derivatives Presentation2gghthtrhtNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument49 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskfahadaijazNo ratings yet

- S2-3 FisDocument37 pagesS2-3 FisMayank SinghNo ratings yet

- Derivatives Contracts, Including Forwards and Futures Have Become A Huge Market With Over $100 Trillion in ValueDocument19 pagesDerivatives Contracts, Including Forwards and Futures Have Become A Huge Market With Over $100 Trillion in ValueAbhi JainNo ratings yet

- What Characteristics Define The Money Markets?Document8 pagesWhat Characteristics Define The Money Markets?habiba ahmedNo ratings yet

- Answers To Chapter 6 QuestionsDocument4 pagesAnswers To Chapter 6 QuestionsLe QuangNo ratings yet

- Mafs5030 Topic 1Document168 pagesMafs5030 Topic 1nyj martinNo ratings yet

- Please Read & Follow The Instructions Carefully Instructions Note Carefully The Units in Which The Choices Are Given and AskedDocument5 pagesPlease Read & Follow The Instructions Carefully Instructions Note Carefully The Units in Which The Choices Are Given and AskedRohit Kumar PandeyNo ratings yet

- FINA 3780 Chapter 6Document33 pagesFINA 3780 Chapter 6roBinNo ratings yet

- Immunization With FuturesDocument18 pagesImmunization With FuturesNiyati ShahNo ratings yet

- Forward ContractsDocument11 pagesForward ContractsLangat LangsNo ratings yet

- Stocks and Bonds ValuationDocument82 pagesStocks and Bonds ValuationRonald MendozaNo ratings yet

- Interest Rate FutureDocument25 pagesInterest Rate FutureRitika KhareNo ratings yet

- Answers On Financial ManagementDocument4 pagesAnswers On Financial ManagementArjunSharmaNo ratings yet

- Commodities Futures Basis RiskDocument13 pagesCommodities Futures Basis RiskhahulaniNo ratings yet

- Bond ValuationDocument45 pagesBond ValuationSudeep ChinnabathiniNo ratings yet

- Sapm Compre Partb QPDocument15 pagesSapm Compre Partb QPXavier CharlesNo ratings yet

- 5021 Solutions 7Document7 pages5021 Solutions 7karsten_fdsNo ratings yet

- MPRA Paper 1449Document38 pagesMPRA Paper 1449arnaudNo ratings yet

- U6018+Practice+Midterm+Exam Spring+2022 SolsDocument6 pagesU6018+Practice+Midterm+Exam Spring+2022 SolsKaren QNo ratings yet

- Hedging With Futures ContractsDocument33 pagesHedging With Futures ContractsLiam HarrisNo ratings yet

- Payment: USD 2,277.03: Bank DetailsDocument1 pagePayment: USD 2,277.03: Bank DetailsAmsalu WalelignNo ratings yet

- PpaDocument4 pagesPpaAmsalu WalelignNo ratings yet

- Address List of Major Ethiopian ExportersDocument18 pagesAddress List of Major Ethiopian ExportersSami Tsedeke50% (6)

- NETSANETDocument1 pageNETSANETAmsalu WalelignNo ratings yet

- Applying for a position as a statisticianDocument1 pageApplying for a position as a statisticianAmsalu WalelignNo ratings yet

- Applying Statistical Tools To Improve Quality in The Service SectorDocument13 pagesApplying Statistical Tools To Improve Quality in The Service SectorabelendaleNo ratings yet

- CH1 2011Document44 pagesCH1 2011Amsalu WalelignNo ratings yet

- Chapter 23Document21 pagesChapter 23Amsalu WalelignNo ratings yet

- DuraDocument47 pagesDuraAmsalu WalelignNo ratings yet

- SPSS For BeginnersDocument429 pagesSPSS For BeginnersBehrooz Saghafi99% (198)

- Mathemtian and Astronomer - The Strategy of Discovering Laplace Transform Was To SolveDocument2 pagesMathemtian and Astronomer - The Strategy of Discovering Laplace Transform Was To SolveAmsalu WalelignNo ratings yet

- DestaDocument19 pagesDestaAmsalu WalelignNo ratings yet

- Chapter 15 of GlobeDocument26 pagesChapter 15 of GlobeSyed Zakir Hussain ZaidiNo ratings yet

- RCA Mini Guide PDFDocument15 pagesRCA Mini Guide PDFIldzamar Haifa WardhaniNo ratings yet

- CH 3Document16 pagesCH 3Amsalu WalelignNo ratings yet

- Simple Linear Regression and Correlation Analysis: Chapter FiveDocument5 pagesSimple Linear Regression and Correlation Analysis: Chapter FiveAmsalu WalelignNo ratings yet

- Introduction To Statistical Quality ControlDocument29 pagesIntroduction To Statistical Quality ControlmivranesNo ratings yet

- 6&7Document17 pages6&7Amsalu WalelignNo ratings yet

- MSc Statistics Program Needs Assessment SurveyDocument2 pagesMSc Statistics Program Needs Assessment SurveyAmsalu WalelignNo ratings yet

- Chapter 2Document4 pagesChapter 2Amsalu WalelignNo ratings yet

- SDFGSDSDFDocument14 pagesSDFGSDSDFAmsalu WalelignNo ratings yet

- VCN CVNDocument9 pagesVCN CVNAmsalu WalelignNo ratings yet

- SPSS For BeginnersDocument429 pagesSPSS For BeginnersBehrooz Saghafi99% (198)

- LRTEST Using Stata for Logistic RegressionDocument13 pagesLRTEST Using Stata for Logistic RegressionAmsalu WalelignNo ratings yet

- Population. Usually, We Cannot Ask Everyone in Our Population (Like All ISU Students) So SampleDocument2 pagesPopulation. Usually, We Cannot Ask Everyone in Our Population (Like All ISU Students) So SampleAmsalu WalelignNo ratings yet

- Stat10010 Tutorial 5 Insecticide Volume vs Dead Insects Scatter PlotDocument1 pageStat10010 Tutorial 5 Insecticide Volume vs Dead Insects Scatter PlotAmsalu WalelignNo ratings yet

- Interactive Scatter Plots in SPSSDocument4 pagesInteractive Scatter Plots in SPSSAmsalu WalelignNo ratings yet

- IOE 265 Probability and Statistics For Engineers - Winter 2004 Section 200Document5 pagesIOE 265 Probability and Statistics For Engineers - Winter 2004 Section 200Amsalu WalelignNo ratings yet

- Generalized Ordered Logit Models: April 2, 2010 Richard Williams, Notre Dame Sociology, Gologit2 Support PageDocument6 pagesGeneralized Ordered Logit Models: April 2, 2010 Richard Williams, Notre Dame Sociology, Gologit2 Support PageAmsalu WalelignNo ratings yet

- Reliability Analysis-SpssDocument5 pagesReliability Analysis-SpssJamie GuanNo ratings yet

- Some Thoughts On The Failure of Silicon Valley Bank 3-12-2023Document4 pagesSome Thoughts On The Failure of Silicon Valley Bank 3-12-2023Subash NehruNo ratings yet

- MB21012 Saurabh BhotmangeDocument15 pagesMB21012 Saurabh BhotmangeDont knowNo ratings yet

- Crec Masterlist Format v8Document83 pagesCrec Masterlist Format v8Jojie HugoNo ratings yet

- T MedicalDocument223 pagesT MedicalAssam JobNo ratings yet

- Breathes: Entrepreneurship and Innovation Strategy ProjectDocument26 pagesBreathes: Entrepreneurship and Innovation Strategy ProjectSaqib NaeemNo ratings yet

- Diecastcollectorissue 295 May 2022Document82 pagesDiecastcollectorissue 295 May 2022Martijn HinfelaarNo ratings yet

- Extractives, Environmental & Human Rights in AfricaDocument16 pagesExtractives, Environmental & Human Rights in AfricaNjokiNo ratings yet

- Busm4696 Political Economy of International Business Cover SheetDocument14 pagesBusm4696 Political Economy of International Business Cover SheetThuỳ Dung0% (1)

- 1-2 Math at Home Game TimeDocument1 page1-2 Math at Home Game TimeKarla Panganiban TanNo ratings yet

- Blue BankDocument3 pagesBlue BankDream SquareNo ratings yet

- Axe Deodorant Marketing-2Document10 pagesAxe Deodorant Marketing-2moshin qureshiNo ratings yet

- Sdoc 02 10 SiDocument5 pagesSdoc 02 10 Siمحي الدين محمدNo ratings yet

- Productivity, Efficiency and Economic Growth in Asia PacificDocument335 pagesProductivity, Efficiency and Economic Growth in Asia PacificZainudin Mohamed100% (1)

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- Digital Marketing Freelance OpportunitiesDocument1 pageDigital Marketing Freelance OpportunitiesSandeep JainNo ratings yet

- Portfolio Activity 7Document5 pagesPortfolio Activity 7Aidah Bunoro0% (1)

- The Waldorf Hilton Hotel Job Offered Contract LetterDocument3 pagesThe Waldorf Hilton Hotel Job Offered Contract LetterHIsham Ali100% (2)

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- ANNE-A MQAP for PenstockDocument3 pagesANNE-A MQAP for Penstocktarun kaushalNo ratings yet

- Marketing Research: Term Report OnDocument38 pagesMarketing Research: Term Report OnUrooj Khan50% (2)

- Man Wah v. Raffel - Fourth Amended ComplaintDocument55 pagesMan Wah v. Raffel - Fourth Amended ComplaintSarah BursteinNo ratings yet

- CrosbyDocument19 pagesCrosbyDr. Sanjay Mahalingam, Asst. Professor, Management & Commerce, SSSIHLNo ratings yet

- Foundations of Operations Management Canadian 4th Edition Ritzman Solutions ManualDocument26 pagesFoundations of Operations Management Canadian 4th Edition Ritzman Solutions ManualMaryMurphyatqb100% (51)

- DevOps Project 101: Complete Source Code and DeploymentDocument22 pagesDevOps Project 101: Complete Source Code and Deploymentvivek reddyNo ratings yet

- Organizing Your Website's Layout in Scapple and ScrivenerDocument10 pagesOrganizing Your Website's Layout in Scapple and ScrivenertallerzamyraNo ratings yet

- Frischanita - 2018 - A Comparative Study of The Effect of Institutional Ownership, Audit Committee, and Gender On Audit Report Lag in In-AnnotatedDocument13 pagesFrischanita - 2018 - A Comparative Study of The Effect of Institutional Ownership, Audit Committee, and Gender On Audit Report Lag in In-Annotatedahmad lutfieNo ratings yet

- Expert System Recommends Localized Products in Vending MachinesDocument10 pagesExpert System Recommends Localized Products in Vending Machines翁慈君No ratings yet

- The Barcelona Traction, Light and Power Company Case Icj Reports, 1970Document2 pagesThe Barcelona Traction, Light and Power Company Case Icj Reports, 1970reyna amor condesNo ratings yet

- RBI DataDocument86 pagesRBI DatarumiNo ratings yet

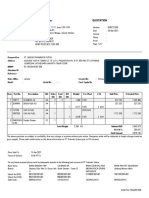

- PT Trakindo Utama Quotation for PT Basuki Rahmanta PutraDocument2 pagesPT Trakindo Utama Quotation for PT Basuki Rahmanta PutraDeden PramikaNo ratings yet