Professional Documents

Culture Documents

Intro To Econometrics

Uploaded by

Oisín Ó CionaoithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intro To Econometrics

Uploaded by

Oisín Ó CionaoithCopyright:

Available Formats

EC564 Financial Econometrics I (Time Series Analysis)

Stephen ONeill Department of Economics

St Anthonys Email: Stepheno_neill_1999@yahoo.com

What is Econometrics?

The study of methods that enables us to quantify economic relationships using actual data It includes all those statistical and mathematical techniques that are utilized in the analysis of economic data

A Stylisation of Econometrics Methodology (KP: 10-12)

Theory model

Observation of empirical regularities Assessment of past empirical and theoretical research Data instigated ideas/discovery

Outline formulation of a model to be estimated

Problems of matching theory and observable variables Empirical definitions of variables Collection of data and choice of sample period

Estimation of the empirical model

Choice of estimation method Estimation

A Stylisation of Econometrics Methodology (KP: 10-12)

Specification testing and diagnostic checking

Is the model statistically adequate? Does it pass diagnostic tests? Is respecification necessary? Is the model tentatively adequate?

Does the model improve upon previous models? Is the model able to encompass competing models?

Progressive evaluation of the empirical model

Asteriou and Hall Page 3

Economic Data

Economic data sets come in various forms which will influence the econometric methods applied Cross sectional Data [the focus for first few weeks!]

Consists of a sample of individuals, households, firms, countries, regions, cities or any other type of units at a specific point in time For each unit we have only one set of observation! Cross-sectional variables are denoted with the subscript i, taking values from 1,2,3,,N; for N number of cross sections, e.g. Y is national income for N number of individual countries. Yi for i = 1,2,3,..N

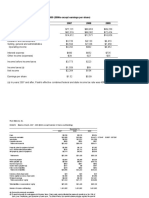

Example of cross section data (using made-up data)

Here we have 1 observation per country, for 3 variables GDP, population and some measure of natural resources. We can control for variation between countries but not for variation across time (since the data is for the same period)

Economic Data

Time Series Data [the main focus of this course!]

A time series data set consists of observations on one or more variables over time. We have multiple observations of the same unit Data are arranged in chronological order Data can take on different time frequencies annual/quarterly/weekly/hourly/ Examples include GDP, Stock prices, public expenditure etc. Time series data are denoted with the subscript t. So for example if Y denotes GDP of a country from 1995 to 2007 Yt for t = 1,2,3,,T. Where t = 1 for 1995 and t = T = 13 for 2002.

Example of Time series data

Here we have observations for only one country but we have an observation each year for 10 years. Here we can control for variation within a country but not for variation across countries (since we have only 1 countries data)

Economic Data

Panel Data

Panel data consists of a time series for each cross sectional member in the data set, e.g. Money supply data for a set of 20 countries over a 20 year periods. Panal data are denoted by the use of both the i and t subscripts. Hence money supply for a set of countries and for a specific time period is denoted by Yit for t = 1,2,3,,T and i = 1,2,3,..N

Example of Panel data

Here we have data for two countries for 5 years each. We can control for differences across countries but also for differences across time This is the most useful data to have, but not that common and estimation techniques may be more complex

Choosing between data types

Often the choice is made for you by unavailability of data! Otherwise, may be useful to think in terms of what you want from your results:

To predict for different individuals in the same time period => cross section To predict for a particular individual (e.g. country) in different time periods => time series To predict for different individuals in different time periods => panel data

For this course:

Although the focus of the course will be on time-series techniques, some knowledge of cross-section techniques/considerations is extremely important. We will spend some time on cross-section models. Unfortunately since this isnt the focus of the course it is your responsibility to get to grips with this part. Basic Econometrics by Gujarati gives a good (non-technical) intro to this stuff and I will give readings from this as we go. Please be sure to read them - particularly if you havent taken a course in econometrics before. Each year there is a clear difference between the marks of those who had done econometrics before and those that hadnt

For this course:

If you have any problems keeping up with the course e-mail me - I am happy to meet with any students that are struggling. If you do have problems:

Try to identify the specific area that is causing you difficulty:

Dont be general I dont understand ANY of it Be able to say I understood as far as . But where does come from?

There is a lot of terminology in econometrics but often the ideas arent as complicated as they appear. Try not to be daunted by it.

For this course:

After each class I will put up a list of questions similar to what tends to appear on the exam. I strongly recommend that people try to make sample answers to them

It saves time when it comes to the exam and makes you less likely to confuse topics More importantly it will help you to see whether you understand the topic.

I may make one question per lecture compulsory not as a hint that they will be on the exam - just so I can see if people understand what we cover

For the remainder of todays class:

We will look at some time series graphs Then well consider some definitions and commonly used data transformations

Time Series Graphs

A sequence of time series observations for a single (or several) variables recorded on a two dimensional graph with time on the horizontal and values of the observations on the vertical axis Why time series graphs are useful

Naturally order observations Provides a visual impression of the time series Observe tendencies to increase or decrease (trend) Observe tendencies to fluctuate more widely at different periods

Observe patterns

Time Series Graphs: Some Examples

From observing the time series graphs we see that economic observations are commonly dependent across time. Additionally time series data display clear trends over time. Time series data follow certain frequencies and might exhibit a seasonal pattern particularly in weekly, monthly and quarterly time series. We also observe structural breaks in series and also changes in the volatility of series. With structural breaks the time period of observation may matter. The frequency of observation also matters. Some series revert to a mean level while others demonstrate a random walk

Time Series Graphs: Some Examples

A time series typically consists of four components

Trend A smooth long term consistent upward or downward movement Cycle A rise and fall over periods, typically longer than a year Seasonal - within year patterns Irregular random component

Note: Not all time series have all components

See KP, Chapter 2 for further examples and discussion

Some Examples of Time Series Graphs [see excel sheets]

Irelands Nominal GDP 1970 - 1994

Ireland's GDP 1970-1994

50000

45000 40000

GDP in EUR, Current Prices

35000 30000 25000 20000

Irel

15000

10000 5000 De De De De De De De De De De De De De De De De De De De De De De De De De Year 0

We see a fairly smooth increase over the period If we look instead at the growth rate.

Growth rate of Irelands Nominal GDP

0.3

Ireland's Nominal GDP Growth Rate 1970-2006

0.25 0.2 0.15 % GDP Growth 0.1 0.05

Ireland

0 Dec-00 Dec-02

Dec-70 Dec-72 Dec-74 Dec-76 Dec-78 Dec-80 Dec-82 Dec-84 Dec-86 Dec-88 Dec-90 Dec-92 Dec-94 Dec-96 Dec-98 Dec-04 Dec-06

We see more variation. Nominal GDP includes the effects of prices Suppose we hold prices constant and look at Real GDP

Year

Irelands Real GDP 1960-2004

Irish Real GDP 1960-2004

120 100 80 Real GDP, 60 40 20 0

GDP

We see that there was a pretty smooth increase until 1994 and then it increased much more rapidly (but this was hidden by in the Nominal GDP series by lower price)

Year

12 10 8 % Growth 6 4 2 0 -2

Growth in Irish Real GDP 1960-2004

Year

We can see this also when we look at the growth of Real GDP growth is higher in the 1990s Also easier to see here that growth drops in the 2000s =>Important to know whats going on with your data -> is it telling you what you are interested in. If we are interested in productivity, its better to use Real GDP that to use Nominal GDP

Sometimes we observe periods where theres a lot of change (volatility), while at other times we see less change

ISEQ Daily level

ISEQ Daily Level May 2006- June 2007

10000 9500 9000 Index level 8500 8000 7500 7000

25.10

11.10

22.11

20.12

6500 10.5.06 24.5.06 21.6.06 19.7.06 16.8.06 30.8.06 13.9.06 27.9.06 7.6.06 5.7.06 2.8.06

28.3.07

8.11.06

6.12.06

17.1.07

31.1.07

14.2.07

28.2.07

14.3.07

11.4.07

25.4.07

Date

We see that at the start of the sample and towards the end, volatility is higher This is much easier to see when we look at growth rates.

23.5.07

3.1.07

9.5.07

Growth rate for Daily ISEQ

ISEQ Daily % Change 2006- June 2007

3.5 2.5 1.5 Index level 0.5 -0.5 -1.5 -2.5 -3.5 -4.5

So when you first work with a data series, its often a good idea to look at a few transformations of it to get an impression of whats going on!

Date

The importance of frequency of data.

Annual Tourism Revenue for Ireland

Annual Tourism Revenues in Ireland

1400 1200 1000 Tourism Revenue in 800 600 400 200 0

Dec-91

Dec-92

Dec-85

Dec-86

Dec-87

Dec-88

Dec-89

Dec-90

Dec-93

Dec-94

Dec-95

Dec-96

Dec-97

Dec-98

Dec-99

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Year

We see a fairly smooth increase over time But if we instead obtain quarterly data

Dec-06

Quarterly Tourism Revenue

Quarterly Tourism Revenues in Ireland 1985-2007 2000 1800 1600 1400 Tourism Revenue in 1200 1000

800

600 400 200 0

Mar86

Mar03

Mar85

Mar87

Mar88

Mar89

Mar90

Mar91

Mar92

Mar93

Mar94

Mar95

Mar96

Mar97

Mar98

Mar99

Mar00

Mar01

Mar02

Mar04

Mar05

Mar06

Quarter

we see that although the overall trend is similar, there is much more variation, which may be important Whats causing this?

Mar07

Often our models work better when the data is less changeable, one way to achieve this is to take the log of the variable

Irish Real GDP 1960-2004

120 100 80 Real GDP, 60 40 20 0 Year

GDP

Natural Log Irish Real GDP 1960-2004

5 4.5 Change in Real GDP, 4

G

3.5 3

2.5

2

Year

Logs

Taking logs, just rescales the data However, we must remember that the results now relate to the log of the variable rather than the variable itself. => Important for interpretation

Summary Statistics and Definitions

A variable is something that can take on a number of values A discrete variable can take on a finite number of values [e.g. No. of rooms in a house] A continuous variable can take on an infinite number of values [e.g. Height] A random variable can take on a number of values each of which has a known probability [e.g. first number drawn in the lottery]

Summary Statistics and Definitions

Mean (average). This is a measure of central tendency 1 T

Mean:

x T

i 1

Variance: This is a measure of the extent to which a variable varies around its mean (A Measure of variability) T

Variance :

1 ( x x) T 1

2 x i 1 i

Standard Deviation:

2 x

Data Transformations

When using data to estimate an economic model a choice must be made as to how to apply the data. The frequency of the data series monthly/quarterly/annual

Annual data may obscure seasonal fluctuations Nominal series contain a price component which can obscure the fundamental features you are interested in

Nominal or Real values

Data Transformations

Logs

Linearizes an exponential trend which will reveal other features of the data series

Logs may be used to linearize a model which is non linear in the parameters. This is to enable the estimation of the model using standard techniques.

Consider the Cobb-Douglas production function.

Q AX Y log(Q) log( A) log( X ) log(Y )

Data Transformations

Differencing

Removes a trend component from a series entirely

Yt Yt Yt 1

(The change in Yt)

Although less common, we may difference a second time:

2Yt (Yt Yt 1 ) Yt Yt 1

(Yt Yt 1 ) (Yt 1 Yt 2 )

(The change in the change in Yt)

Growth Rates

Sometimes economists are more interested in the growth rate of a series rather than the level e.g Inflation Rate versus the Price Level Growth rate of Yt = (Yt-Yt-1)/ Yt-1

Lagging and Leading Time Series Data

A variable lagged s periods is denoted Yt-s

(I.e The value of Y, s periods ago.)

A variable leading k periods will be denoted Yt+k

(I.e The value of Y, k periods in the future.)

Time Series Econometrics

In time series econometrics the starting point is to obtain information from the variable itself Can analyse a single time series (univariate time series analysis) or multiple time series (multivariate time series analysis) In general the purpose of time series analysis is to capture and examine the dynamics of the data

Extract as much information as possible from the history of the data series

The Greek Alphabet:

From: http://www.cs.cmu.edu/~christos/christina/greece-project/alphabet.html

My lecture notes will be available on blackboard before class so you can print them out [set it to handouts rather than slides]

You might also like

- Time Series with Python: How to Implement Time Series Analysis and Forecasting Using PythonFrom EverandTime Series with Python: How to Implement Time Series Analysis and Forecasting Using PythonRating: 3 out of 5 stars3/5 (1)

- Time Series000Document58 pagesTime Series000Paritosh Kesarwani100% (1)

- Statistics For Management - Assignments SolvedDocument9 pagesStatistics For Management - Assignments Solvednitin_bslNo ratings yet

- Unit 2 BsaDocument53 pagesUnit 2 Bsasinghsaurabhh91No ratings yet

- Forecasting MethodsDocument14 pagesForecasting MethodsSiddiqullah IhsasNo ratings yet

- BSA Unit-II Topic - Time Series & Index No.Document55 pagesBSA Unit-II Topic - Time Series & Index No.singhsaurabhh91No ratings yet

- Understanding Economic Data StructuresDocument2 pagesUnderstanding Economic Data StructuresRustamzad GulNo ratings yet

- R Time Series AnalysisDocument6 pagesR Time Series Analysisprasenjit kunduNo ratings yet

- Module 02.1 Time Series Analysis and Forecasting AccuracyDocument11 pagesModule 02.1 Time Series Analysis and Forecasting AccuracyJunmirMalicVillanuevaNo ratings yet

- Module 6: Introduction To Time Series Forecasting: Titus Awokuse and Tom IlventoDocument26 pagesModule 6: Introduction To Time Series Forecasting: Titus Awokuse and Tom IlventoAshutoshSrivastavaNo ratings yet

- Time Series Analysis and ForecastingDocument23 pagesTime Series Analysis and ForecastingArnab DeyNo ratings yet

- Mca4020 SLM Unit 10Document45 pagesMca4020 SLM Unit 10AppTest PINo ratings yet

- 18bst6el U4Document18 pages18bst6el U4hardikpadhyNo ratings yet

- BBA Time Series Analysis Trend SeasonalDocument11 pagesBBA Time Series Analysis Trend SeasonalDeepanshu RajawatNo ratings yet

- Time Series.Document97 pagesTime Series.Pranav Khanna100% (1)

- Powerful Forecasting With MS Excel SampleDocument257 pagesPowerful Forecasting With MS Excel SampleBiwesh NeupaneNo ratings yet

- Mb0040 - Statistics For Management: Mba Semester 1Document16 pagesMb0040 - Statistics For Management: Mba Semester 1sphebbarNo ratings yet

- Mb0040 - Statistics For Management: Mba Semester 1Document16 pagesMb0040 - Statistics For Management: Mba Semester 1PushhpaNo ratings yet

- Time Series 11Document97 pagesTime Series 11Sachin KumarNo ratings yet

- Econometrics - Basic 1-8Document58 pagesEconometrics - Basic 1-8Saket RathiNo ratings yet

- Chapter 5 Exponential Smoothing Methods L 2015Document19 pagesChapter 5 Exponential Smoothing Methods L 2015sadyehclenNo ratings yet

- Times Series Analysis NotesDocument5 pagesTimes Series Analysis NotesDr Swati RajNo ratings yet

- IME602 Notes 01Document65 pagesIME602 Notes 01Tanmay KulshresthaNo ratings yet

- Time SeriesDocument44 pagesTime SeriesSahauddin ShaNo ratings yet

- Ecotrics (PR) Panel Data ReferenceDocument22 pagesEcotrics (PR) Panel Data ReferenceArka DasNo ratings yet

- Timeseries - AnalysisDocument37 pagesTimeseries - AnalysisGrace YinNo ratings yet

- StatisticsDocument138 pagesStatisticsalemayehu sewagegnNo ratings yet

- Components of Time Series Analysis Trends and MaDocument1 pageComponents of Time Series Analysis Trends and MabhupeshjwgarwalNo ratings yet

- Forecasting SKDocument20 pagesForecasting SKNirmay Mufc ShahNo ratings yet

- Econometrics AioDocument12 pagesEconometrics AioavnidtuNo ratings yet

- Powerful Forecasting With MS Excel SampleDocument257 pagesPowerful Forecasting With MS Excel SamplelpachasmNo ratings yet

- Year 1990 1991 1992 1993 1994 1995: Wheat Production (In Tons) 260 270 300 320 305 400Document9 pagesYear 1990 1991 1992 1993 1994 1995: Wheat Production (In Tons) 260 270 300 320 305 400Retd. NK S P RAJASHEKARANo ratings yet

- Applied Statistics Chapter 2 Time SeriesDocument82 pagesApplied Statistics Chapter 2 Time Seriescris lu salemNo ratings yet

- TIME SERIES ANALYSIS AND FORECASTINGDocument7 pagesTIME SERIES ANALYSIS AND FORECASTINGRUHDRANo ratings yet

- Econometrics CH01Document41 pagesEconometrics CH01sd7nq4r7mrNo ratings yet

- The Complete Guide to Time Series Analysis and ForecastingDocument20 pagesThe Complete Guide to Time Series Analysis and ForecastingacNo ratings yet

- Econometrics for Finance Lecture Notes Introduction (40Document21 pagesEconometrics for Finance Lecture Notes Introduction (40achal_premiNo ratings yet

- Research Methodology - Lokendra OjhaDocument46 pagesResearch Methodology - Lokendra OjhaojhalokendraNo ratings yet

- Chapter 3 - ForecastingDocument28 pagesChapter 3 - ForecastingDahlia Abiera OritNo ratings yet

- Time Series AnalysisDocument23 pagesTime Series AnalysisSandeep BadoniNo ratings yet

- Unit IDocument9 pagesUnit IAbhay KNo ratings yet

- Decomposition MethodDocument73 pagesDecomposition MethodAbdirahman DeereNo ratings yet

- Powerful Forecasting With MS Excel Sample PDFDocument257 pagesPowerful Forecasting With MS Excel Sample PDFn_gireesh5468No ratings yet

- Demand Forecasting Demand Forecasting and Its ImportanceDocument7 pagesDemand Forecasting Demand Forecasting and Its ImportanceameenaNo ratings yet

- MB0040 Statistics For Management Sem 1 Aug Spring AssignmentDocument17 pagesMB0040 Statistics For Management Sem 1 Aug Spring AssignmentNeelam AswalNo ratings yet

- Chapter 9 - Forecasting TechniquesDocument50 pagesChapter 9 - Forecasting TechniquesPankaj MaryeNo ratings yet

- Econometrics in Managerial EconomicsDocument160 pagesEconometrics in Managerial EconomicsMayank ChaturvediNo ratings yet

- Demand Forecasting: Prof. Ravikesh SrivastavaDocument29 pagesDemand Forecasting: Prof. Ravikesh SrivastavaShrey DattaNo ratings yet

- Study Material For Final ExamDocument11 pagesStudy Material For Final ExamBHUMI VYASNo ratings yet

- Time Series: - Kirthi Nair BE (Biotech), MBADocument34 pagesTime Series: - Kirthi Nair BE (Biotech), MBAkirthi nairNo ratings yet

- Unit 10Document36 pagesUnit 10Pramendra Kumar SinghNo ratings yet

- Time Series Analysis in EconomicsDocument397 pagesTime Series Analysis in Economicsbbelcarla100% (1)

- Powerful Forecasting With MS Excel SampleDocument257 pagesPowerful Forecasting With MS Excel SampleHarsa WaraNo ratings yet

- Time Series PDFDocument34 pagesTime Series PDFkirthi nairNo ratings yet

- Forecasting Summary NotesDocument9 pagesForecasting Summary NotesJennybabe PetaNo ratings yet

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesFrom EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNo ratings yet

- Statistical Analysis and Decision Making Using Microsoft ExcelFrom EverandStatistical Analysis and Decision Making Using Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Balance of Payments Recap Key RelationshipsDocument14 pagesBalance of Payments Recap Key RelationshipsOisín Ó CionaoithNo ratings yet

- GARCHDocument20 pagesGARCHOisín Ó Cionaoith100% (1)

- EC563 Lecture 2 - International FinanceDocument15 pagesEC563 Lecture 2 - International FinanceOisín Ó CionaoithNo ratings yet

- EC563 Lecture 1 - International FinanceDocument30 pagesEC563 Lecture 1 - International FinanceOisín Ó CionaoithNo ratings yet

- VaR and Causality TestsDocument34 pagesVaR and Causality TestsOisín Ó CionaoithNo ratings yet

- Violations of OLSDocument64 pagesViolations of OLSOisín Ó CionaoithNo ratings yet

- Non-Stationarity and Unit RootsDocument25 pagesNon-Stationarity and Unit RootsOisín Ó CionaoithNo ratings yet

- CointegrationDocument39 pagesCointegrationOisín Ó CionaoithNo ratings yet

- ARIMA AR MA ARMA ModelsDocument46 pagesARIMA AR MA ARMA ModelsOisín Ó CionaoithNo ratings yet

- Multiple RegressionDocument49 pagesMultiple RegressionOisín Ó CionaoithNo ratings yet

- Stationarity and Unit RootsDocument64 pagesStationarity and Unit RootsOisín Ó CionaoithNo ratings yet

- Effects of Supervision On Tax ComplianceDocument5 pagesEffects of Supervision On Tax ComplianceSyehabudin ZmNo ratings yet

- Astro TalkDocument24 pagesAstro TalkAteet RaiNo ratings yet

- Latihan Soal Chapter 22Document9 pagesLatihan Soal Chapter 22JulyaniNo ratings yet

- Acl 2017Document136 pagesAcl 2017RiyasNo ratings yet

- WEEK 4 Finance and Strategic Management UU MBA 710 ZM 22033Document10 pagesWEEK 4 Finance and Strategic Management UU MBA 710 ZM 22033Obiamaka UzoechinaNo ratings yet

- Accounting BasicsDocument4 pagesAccounting BasicsHazel Mae LasayNo ratings yet

- Pre-Feasibility Study on UPS and Stabilizer Assembling UnitDocument23 pagesPre-Feasibility Study on UPS and Stabilizer Assembling UnitRaza Un NabiNo ratings yet

- SSSSSSSSMMMMMMMMDocument12 pagesSSSSSSSSMMMMMMMMAjay TahilramaniNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationSamiksha MoreNo ratings yet

- Working Capital Management at Raymond Ltd.Document92 pagesWorking Capital Management at Raymond Ltd.Bhagyesh R Shah67% (6)

- BA 99.1 Rodriguez LE 1 SamplexDocument6 pagesBA 99.1 Rodriguez LE 1 SamplexYsabella Beatriz SamsonNo ratings yet

- Corporate Governance IntroductionDocument34 pagesCorporate Governance IntroductionIndira Thayil100% (2)

- Financial Management in Hospitality - Hotel Industries Like TAJ, LeelaDocument56 pagesFinancial Management in Hospitality - Hotel Industries Like TAJ, Leelakris_sone85% (20)

- Individual Tax ReturnDocument4 pagesIndividual Tax ReturnmacNo ratings yet

- MABE Syllabus 2016-17 NewDocument91 pagesMABE Syllabus 2016-17 Newamir755No ratings yet

- Final Income Taxation Lesson 5: Passive Income and Withholding Tax RatesDocument28 pagesFinal Income Taxation Lesson 5: Passive Income and Withholding Tax Rateslc50% (4)

- Personal Cash-Flow Statement: Monthly AmountDocument2 pagesPersonal Cash-Flow Statement: Monthly AmountDũng HoàngNo ratings yet

- Flash Memory Income Statements 2007-2009Document10 pagesFlash Memory Income Statements 2007-2009sahilkuNo ratings yet

- Monthly Sales: PriceDocument5 pagesMonthly Sales: PriceChicken NoodlesNo ratings yet

- Gesco Kabab: Worksheet For The Month Ended in December 31, 2021Document20 pagesGesco Kabab: Worksheet For The Month Ended in December 31, 2021TanjinNo ratings yet

- Chapter 5 PowerpointDocument37 pagesChapter 5 Powerpointapi-248607804No ratings yet

- CH 09 SMDocument54 pagesCH 09 SMapi-234680678100% (2)

- NPI Introduction W Energy AdvisoryDocument3 pagesNPI Introduction W Energy AdvisoryDev DuttNo ratings yet

- Plant Business PlanDocument9 pagesPlant Business PlanramsekherNo ratings yet

- Reviewer - Cash & Cash EquivalentsDocument5 pagesReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- Section - A: Statutory Update: Part - I: Direct Tax LawsDocument47 pagesSection - A: Statutory Update: Part - I: Direct Tax LawsmdfkjadsjkNo ratings yet

- Tax On IndividualsDocument9 pagesTax On IndividualsshakiraNo ratings yet

- ADM 3349 MidtermDocument15 pagesADM 3349 MidtermfishzeeNo ratings yet

- 3415 Corporate Finance Assignment 2: Dean CulliganDocument13 pages3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersNo ratings yet

- Chapter - 3 - Entrepreneurship, Franchising and Small Business Part-1Document17 pagesChapter - 3 - Entrepreneurship, Franchising and Small Business Part-1anon_952991112No ratings yet